Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Communique t2 2012 Uk Last

Caricato da

Kavudham ASDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Communique t2 2012 Uk Last

Caricato da

Kavudham ASCopyright:

Formati disponibili

Q2 2012 Sales inc.

VAT

12 July 2012

H1 2012 sales (inc. VAT) up 0.9% to 43.7 bn Q2 2012 sales (inc. VAT) down 0.3% at 21.7 bn Sustained growth in emerging markets, stabilization of sales trends in France and Europe

H1 2012 sales: 43.7 bn, +0.9%, driven by growth in emerging markets, notably in Latin America, where sales rose 5.3% (+8.3% at constant exchange rates) Q2 2012 sales: 21.7 bn, broadly stable at -0.3%, supported by sustained growth in emerging markets. Sales trends stabilized in France and Europe.

France: Sales down 2.1%, supported by improving food sales but impacted by a fall in non-food sales, notably for seasonal

goods. Sales trends at hypermarkets and supermarkets are in line with the expected effects of the action plan. Significant improvement of sales in convenience. Acceleration of Drive roll-out with 125 outlets at end-June.

Europe (ex. France): Sales down 3.5% (-2.4% at constant exchange rates), impacted by a depressed consumption

environment in Southern Europe. Growth in sales in Belgium.

Latin America: Sales up 2.7% (+7.4% at constant exchange rates). In Brazil, Atacadao continued its growth. Asia: Sales up 14% (+1.8% at constant exchange rates), an improvement over the previous quarter. Sales growth in China,

driven by expansion.

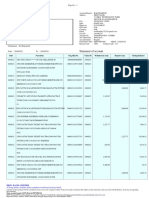

First Half 2012 sales inc. VAT1

Change at constant exch. rates inc. petrol LFL France Europe (excl. France) Latin America Asia Group 19,010 11,422 8,700 4,552 43,684 -0.7% -2.6% +5.3% +9.4% +0.9% +0.3% -2.6% +6.8% -3.4% +0.4% Total -0.7% -1.5% +8.3% +0.6% +0.9% Change at constant exch. rates ex. petrol LFL -1.8% -3.1% +7.8% -3.4% -0.5% Total -2.1% -1.9% +9.4% +0.6% +0.5%

Change

Second quarter 2012 sales inc. VAT1

Change at constant exch. rates inc. petrol LFL France Europe (excl. France) Latin America Asia Group 9,656 5,764 4,279 2,016 21,715 -2.1% -3.5% +2.7% +14.0% -0.3% -1.2% -3.3% +5.7% -2.3% -0.5% Total -2.1% -2.4% +7.4% +1.8% -0.1% Change at constant exch. rates ex. petrol LFL -3.3% -3.7% +6.9% -2.3% -1.3% Total -3.6% -2.7% +8.8% +1.8% -0.4%

Change

Operations in Greece have been reclassified as Discontinued Activities as of January 1, 2012. Figures are pro-forma, ex. Greece.

PAGE 1

Q2 2012 Sales inc. VAT

12 July 2012

FRANCE

Second quarter 2012 sales inc. VAT

Change ex. petrol LFL Hypermarkets Supermarkets Other formats France 5,228 3,325 1,102 9,656 -4.4% -0.8% +5.7% -2.1% -3.5% +0.8% +4.9% -1.2% -5.7% -1.4% +3.4% -3.3% Total -6.2% -1.8% +4.3% -3.6%

Change

LFL

The first half was marked by three changes in scope: End of the franchise agreement with Coop Atlantique effective January 1, 2012 End of the franchise agreement with Altis effective April 6, 2012 Integration of Guyenne & Gascogne on June 1, 2012, after the success of the cash tender offer, with a secondary option in shares, followed by a compulsory buyout offer The calendar effect in France is estimated at -0.6% in the second quarter. Sales in France fell by 2.1%. The petrol effect is +1.5%, boosted by the success of the "Low Price Guarantee" on petrol launched in May in hypermarkets. LFL sales at Hypermarkets recorded a drop of 3.5% (-5.7% excluding petrol). Food sales trends improved for the second consecutive quarter. Non-food sales declined, impacted by unfavorable weather conditions that affected apparel and seasonal goods (gardening, camping). LFL sales at Supermarkets were up 0.8% (-1.4% excluding petrol), with improved food sales. Franchise store activity is up in spite of a high comparable level in the previous year. The roll-out of Drive accelerated, with the number of outlets rising to 125 at the end of Q2: 67 Drives were opened during the quarter, including 19 in hypermarkets and 48 in supermarkets. Other formats (especially convenience and cash & carry) recorded sales growth of 4.9%. Excluding petrol, sales grew 3.4% driven by renovated stores. At end-June, the convenience format included 413 City, 348 Contact, 143 Express and 15 Montagne.

PAGE 2

Q2 2012 Sales inc. VAT

12 July 2012

EUROPE (excluding France)

Second quarter 2012 sales inc. VAT1

Change

Change at constant exch. rates inc. petrol LFL Total -5.3% -5.5% +1.2% +4.3% -2.4%

Change at constant exch. rates ex. petrol LFL -7.4% -4.3% +0.8% +0.0% -3.7% Total -6.8% -5.4% +1.2% +4.7% -2.7%

Spain Italy Belgium Other countries Europe (excl. France)

2,142 1,456 1,060 1,106 5,764

-5.3% -5.5% +1.2% -1.6% -3.5%

-5.9% -4.5% +0.8% -0.3% -3.3%

On June 15, 2012, Carrefour announced the sale to Marinopoulos of its stake in the Carrefour Marinoupolos joint venture, leading to the Groups operations in Greece being reclassified as discontinued operations. To facilitate comparison, the Q2 2011 figures have been restated pro-forma ex. Greece. The calendar effect in Europe (excluding France) is estimated at -0.8% in the second quarter. Currencies had a negative impact of 1.1%, mainly explained by the depreciation of currencies in Poland and Romania.

Sales in Europe (excluding France) fell by 3.5%, an improvement in trends over the previous quarter. All countries posted a satisfactory performance given the increased pressure on consumption and discretionary spending, particularly in Southern Europe. This consumption environment is particularly true of Spain, but the downward trend of sales slowed in Q2 vs. Q1 2012. In Italy, LFL sales excluding petrol were down 4.3%, with non-food sales in hypermarkets recovering. Belgium recorded 0.8% growth in LFL sales, building on the +7.1% growth recorded in Q2 2011. All formats contributed to this performance. Combined sales in Poland, Turkey and Romania excluding petrol rose 4.7% at constant exchange rates and were flat on a LFL basis.

Operations in Greece have been reclassified as Discontinued Activities as of January 1, 2012. Figures are pro-forma, ex. Greece.

PAGE 3

Q2 2012 Sales inc. VAT

12 July 2012

LATIN AMERICA

Second quarter 2012 sales inc. VAT

Change at constant exch. rates inc. petrol LFL Brazil Other countries Latin America 2,979 1,301 4,279 -3.0% +18.4% +2.7% +4.9% +7.8% +5.7% Total +5.9% +11.5% +7.4% Change at constant exch. rates ex. petrol LFL +6.2% +8.7% +6.9% Total +7.4% +12.5% +8.8%

Change

The calendar effect in Latin America is not significant in the second quarter. Currencies had a negative impact of -4.7%, mainly explained by the depreciation of the Brazilian Real, while the Peso in Argentina and Colombia appreciated. Sales in Latin America rose 2.7%. Excluding the impact of foreign exchange, sales rose by 7.4%, in line with the previous quarter, driven by LFL sales growth and expansion. In Brazil, sales excluding petrol and at constant exchange rates rose by 7.4%, of which +6.2% LFL. Atacadao continued its growth in Q2 in spite of an already strong Q2 2011. Hypermarket LFL sales also grew. Supported by Argentina, sales of other countries grew by 12.5%, of which +8.7% LFL (excluding petrol and at constant exchange rates).

ASIA

Second quarter 2012 sales inc. VAT

Change at constant exch. rates +2.1% +1.3% +1.8% Change at constant exch. rates LFL China Other countries Asia 1,247 769 2,016 +17.7% +8.5% +14.0% -3.6% -0.4% -2.3%

Change

The calendar effect in Asia is estimated at +0.4% in the second quarter. The 15.7% appreciation of the Chinese currency contributed to a positive foreign exchange effect of 12.3% in Asia. Sales in Asia grew by 14%. Excluding currency effects, sales rose by 1.8%. Sales in China grew by 2.1%, driven by a recovery in non-food and sustained expansion (-3.6% LFL). LFL sales of Other countries were broadly stable. Sales in Taiwan and Indonesia continued to grow.

PAGE 4

Q2 2012 Sales inc. VAT

12 July 2012

First Half 2012 sales inc. VAT1

Change at constant exch. rates inc. petrol LFL Hypermarkets Supermarkets Other formats France Spain Italy Belgium Other countries Europe (excl. France) Brazil Other countries Latin America China Other countries Asia Group 10,389 6,522 2,099 19,010 4,279 2,896 2,070 2,177 11,422 6,151 2,549 8,700 2,908 1,644 4,552 43,684 -3.1% +0.9% +7.0% -0.7% -4.2% -3.3% +1.6% -2.4% -2.6% +1.3% +16.5% +5.3% +11.3% +6.2% +9.4% +0.9% -2.4% +2.8% +7.1% +0.3% -5.0% -2.8% +1.3% -0.8% -2.6% +6.0% +9.0% +6.8% -5.5% +0.1% -3.4% +0.4% Total -3.1% +0.9% +7.0% -0.7% -4.2% -3.3% +1.6% +3.6% -1.5% +6.7% +12.9% +8.3% +0.0% +1.6% +0.6% +0.9% Change at constant exch. rates ex. petrol LFL -4.4% +0.2% +6.3% -1.8% -6.8% -2.8% +1.3% -0.5% -3.1% +7.0% +9.8% +7.8% -5.5% +0.1% -3.4% -0.5% Total -4.8% -0.1% +6.3% -2.1% -5.9% -3.4% +1.6% +4.2% -1.9% +7.7% +13.8% +9.4% +0.0% +1.6% +0.6% +0.5%

Change

Calendar impact in the first half is estimated at +0.7% for the Group (+1.0% in France, +0.8% in Europe, +0.7% in Latin America, -0.5% in Asia).

Operations in Greece have been reclassified as Discontinued Activities as of January 1, 2012. Figures are pro-forma, ex. Greece.

PAGE 5

Q2 2012 Sales inc. VAT

12 July 2012

EXPANSION UNDER BANNERS Q2 2012

In the second quarter, we opened or acquired 163,000 gross sq. m, bringing to 237,000 sq. m the total of new space since the beginning of 2012. Net of disposals or closures, the network added 86,000 sq. m in the second quarter (-24,000 sq. m since the beginning of the year)

31 Dec. 2011 Thousands of sq. m France Europe (ex. Fr) Latin America Asia Total Group 5 078 6 241 2 340 2 636 16 296 4 975 6 215 2 356 2 640 16 187 31 March 2012 Openings/ Store enlargement 15 69 10 33 128 Acquisitions Closures Transfers Disposals 30 June 2012

0 0 35 0 35

-7 -26 0 0 -32

0 0 0 0 0

-45 0 0 0 -45

4 939 6 260 2 401 2 673 16 273

STORE NETWORK UNDER BANNERS Q2 2012

In the second quarter, we opened or acquired 287 stores for a total of 419 new stores since the beginning of 2012 on a gross basis. Net of disposals or closures, the network grew by 192 stores in the second quarter (101 since the beginning of the year).

No. of stores Hypermarkets France Europe (ex Fr) Latin America Asia Supermarkets France Europe (ex Fr) Latin America Asia Convenience France Europe (ex Fr) Latin America Asia Cash & carry France Europe (ex Fr) Asia Total France Europe (ex Fr) Latin America Asia 31 Dec. 2011 1,437 232 509 335 361 3,010 977 1,866 150 17 5,170 3,285 1,787 98 0 154 137 15 2 9,771 4,631 4,177 583 380 31 March 2012 1,434 225 509 338 362 2,966 942 1,858 149 17 5,126 3,283 1,746 97 0 154 137 15 2 9,680 4,587 4,128 584 381 Openings 15 1 8 2 4 19 0 19 0 0 120 47 63 10 0 4 2 2 0 158 50 92 12 381 Acquisitions 0 0 0 0 0 19 0 0 19 0 110 0 0 110 0 0 0 0 0 129 0 0 129 4 Closures 0 0 0 0 0 14 2 12 0 0 69 29 40 0 0 0 0 0 0 83 31 52 0 0 Transfers 0 0 0 0 0 1 0 1 0 0 -1 0 -1 0 0 0 0 0 0 0 0 0 0 0 Disposals 6 6 0 0 0 6 6 0 0 0 0 0 0 0 0 0 0 0 0 12 12 0 0 0 30 June 2012 1,443 220 517 340 366 2,985 934 1,866 168 17 5,286 3,301 1,768 217 0 158 139 17 2 9,872 4,594 4,168 725 385

AGENDA August 30: First Half 2012 results October 11: Q3 2012 sales

Investor relations: Rginald Gillet, Alessandra Girolami, Matthew Mellin Shareholder relations: Cline Blandineau Group Communication

Tel: +33 (1) 41 04 26 00 Tel:+33 (0) 0805 902 902(toll free in France) Tel : +33 (1) 41 04 27 63

PAGE 6

Potrebbero piacerti anche

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Preparation & Practice General & C7Documento1 paginaPreparation & Practice General & C7JáskáránNessuna valutazione finora

- Effects On PPC Due To Various Govt PoliciesDocumento20 pagineEffects On PPC Due To Various Govt PoliciesDyno Plz100% (6)

- Graduate Thesis Topics in EconomicsDocumento6 pagineGraduate Thesis Topics in Economicslizbundrenwestminster100% (2)

- Fundamentals of Public Administration - Lecture 12 - NOTEDocumento10 pagineFundamentals of Public Administration - Lecture 12 - NOTEmuntasirulislam42Nessuna valutazione finora

- NETWOERTHSDocumento3 pagineNETWOERTHSVIJAY PAREEKNessuna valutazione finora

- International Cotton GradesDocumento5 pagineInternational Cotton GradesSamir AliyevNessuna valutazione finora

- GR8 Ems Nov Test P1 2022Documento12 pagineGR8 Ems Nov Test P1 2022melisizwenzimande32Nessuna valutazione finora

- Chapter - 14 (1) .PDF R.D SharmaDocumento79 pagineChapter - 14 (1) .PDF R.D Sharmaom2390057Nessuna valutazione finora

- Chapter 3 Project Identification and PPP Screening PDFDocumento58 pagineChapter 3 Project Identification and PPP Screening PDFThanasate Prasongsook50% (2)

- Assignment # 1 STUDENT ID: mc090201864 MKT 501 (Marketing Management) SolutionDocumento2 pagineAssignment # 1 STUDENT ID: mc090201864 MKT 501 (Marketing Management) SolutionImranNessuna valutazione finora

- AbgenixDocumento5 pagineAbgenixTuấn Dũng TrươngNessuna valutazione finora

- ACO StormBrixx ProjectReportDocumento7 pagineACO StormBrixx ProjectReportNguyễn Tiến ĐạtNessuna valutazione finora

- Mba 3 Sem Supply Chain and Logistics Management Kmbnom01 2022Documento1 paginaMba 3 Sem Supply Chain and Logistics Management Kmbnom01 2022kapa123Nessuna valutazione finora

- L3.3 - Comparative AdvantageDocumento1 paginaL3.3 - Comparative Advantage12A1-41- Nguyễn Cẩm VyNessuna valutazione finora

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocumento14 pagineMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionSoweirdNessuna valutazione finora

- Motor's Bearing DetailsDocumento9 pagineMotor's Bearing DetailsValipireddy NagarjunNessuna valutazione finora

- Sworn Statement of Assets, Liabilities and Net WorthDocumento3 pagineSworn Statement of Assets, Liabilities and Net WorthMj GarciaNessuna valutazione finora

- Annex 1-6-Cooperative Productive Society Fowa EnglishDocumento3 pagineAnnex 1-6-Cooperative Productive Society Fowa EnglishWikileaks2024Nessuna valutazione finora

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento8 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceKartikey SharmaNessuna valutazione finora

- Basic Statistics For BUSINESS - ECONOMICS Fifth Edition PDFDocumento580 pagineBasic Statistics For BUSINESS - ECONOMICS Fifth Edition PDFBiren75% (4)

- To, Crystal Metallurgical Services and SolutionsDocumento4 pagineTo, Crystal Metallurgical Services and SolutionsP NAVEEN KUMARNessuna valutazione finora

- Data Analysis and InterpretationDocumento7 pagineData Analysis and InterpretationATS PROJECT DEPARTMENTNessuna valutazione finora

- Using Logistic Regression For Cricket Analysis Predicting Match Outcomes and Player PerformancesDocumento4 pagineUsing Logistic Regression For Cricket Analysis Predicting Match Outcomes and Player PerformancesIJRASETPublicationsNessuna valutazione finora

- Module III Unit 1 Stadium ManagementDocumento4 pagineModule III Unit 1 Stadium Managementjince kappanNessuna valutazione finora

- 15 G Form (Pre-Filled)Documento3 pagine15 G Form (Pre-Filled)Ravi JammulaNessuna valutazione finora

- Homework Chap 25Documento2 pagineHomework Chap 25An leeNessuna valutazione finora

- Krugman EssayDocumento18 pagineKrugman EssaySonya PervezNessuna valutazione finora

- ECON - Ball Valve 1602 DSDocumento1 paginaECON - Ball Valve 1602 DSNoparit KittisatitNessuna valutazione finora

- Economies and DiseconomiesDocumento11 pagineEconomies and DiseconomiesChitra GangwaniNessuna valutazione finora

- Shipping Bill Format 02Documento1 paginaShipping Bill Format 02Arbaaz KhanNessuna valutazione finora