Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Five Different Types of Foreign Direct Investment (FDI)

Caricato da

meet22591Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Five Different Types of Foreign Direct Investment (FDI)

Caricato da

meet22591Copyright:

Formati disponibili

Five Different Types of Foreign Direct Investment (FDI)

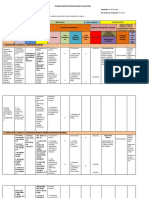

According to Chryssochoidis, Millar & Clegg, 1997 there are five different types of foreign direct investment (FDI). The first type of FDI is taken to gain access to specific factors of production, e.g. resources, technical knowledge, material know-how, patent or brand names, owned by a company in the host country. If such factors of production are not available in the home economy of the foreign company, and are not easy to transfer, then the foreign firm must invest locally in order to secure access. The second type of FDI is developed by Raymond Vernon in his product cycle hypothesis. According to this model the company shall invest in order to gain access to cheaper factors of production, e.g. low-cost labour. The government of the host country may encourage this type of FDI if it is pursuing an export-oriented development strategy. Since it may provide some form of investment incentive to the foreign company, in form of subsidies, grants and tax concessions. If the government is using an import-substitution policy instead, foreign companies may only be allowed to participate in the host economy if they possess technical or managerial know-how that is not available to domestic industry. Such know-how may be transferred through licensing. It can also result in a joint venture with a local partner. The third type of FDI involves international competitors undertaking mutual investment in one another, e.g. through cross-shareholdings or through establishment of joint venture, in order to gain access to each other's product ranges. As a result of increased competition among similar products and R&D-induced specialisation this type of FDI emerged. Both companies often find it difficult to compete in each other's home market or in third-country markets for each other's products. If none of the products gain the dominant advantage, the two companies can invest in each other's area of knowledge and promote sub-product specialisation in production. The fourth type of FDI concerns the access to customers in the host country market. In this type of FDI there are not observed any underlying shift in comparative advantage either to or from the host country. Export from the companies' home base may be impossible, e.g. certain services, or the capability to request immediate design modifications. The limited tradability of many services has been an important factor explaining the growth of FDI in these sectors. The fifth type of FDI relates to the trade diversionary aspect of regional integration. This type occurs when there are location advantages for foreign companies in their home country but the existence of tariffs or other barriers of trade prevent the companies from exporting to the host country. The foreign companies therefore jump the barriers by establishing a local presence within the host economy in order to gain access to the local market. The local manufacturing presence need only be sufficient to circumvent the trade barriers, since the foreign company wants to maintain as much of the value-added in its home economy.

ENTRY ROUTES FOR FDI 1 Investments can be made by non-residents in the equity shares/fully, compulsorily and Mandatorily convertible debentures/ fully, compulsorily and mandatorily convertible preference shares of an Indian company, through two routes; 1. The Automatic Route: under the Automatic Route, the non-resident investor or the Indian company does not require any approval from the RBI or Government of India for the investment. 2. The Government Route: under the Government Route, prior approval of the Government of India through Foreign Investment Promotion Board (FIPB) is required. Proposals for foreign investment under Government route as laid down in the FDI policy from time to time, are considered by the Foreign Investment Promotion Board (FIPB) in Department of Economic Affairs (DEA), Ministry of Finance.

Advantages

Increase economic growth by dealing with different international products 1 million (1 Crore) employment will create in three years - UPA Government Billion dollars will be invested in Indian market Spread import and export business in different countries Agriculture related people will get good price of their goods

Disadvantages

Will affect 50 million merchants in India Profit distribution, investment ratios are not fixed An economically backward class person suffers from price raise Retailer faces loss in business Market places are situated too far which increases traveling expenses Workers safety and policies are not mentioned clearly Inflation may be increased Again India become slaves because of FDI in retail sector

Why India is a good destination to Invest your money

Innovation and India go together with the latter known worldwide for the former. Post the British and licence raj era, when Indias innovative ability was hampered, India has bounced back strongly. Software, aerospace, telecommunications, medicine, pharmacy etc. are just some of the many fields that have benefited from Indias innovation and creativity. Zero was born in India! And today it is perhaps the most sought after number after all the number of zeroes behind a digit makes a huge difference! Creativity in India can be seen in its Ajanta and Ellora caves, various art forms (including literature, music and dance), and diverse religions. India is home to five major classical dance forms; two forms of classical music, and four major religions were born in this country. India is also home to 25 languages Kannada and Telugu being the most advanced of all and innumerable dialects. Unfortunately, the spirit of innovation and creativity slacked during the British reign in India. Our traditional (and ancient) educational system of Gurukul was completely destroyed. But now this spirit is reviving. Indians are known for their creativity and innovativeness. And innovation stands on the pillars of capital, in terms of both human and money. And fortunately, India is the second most densely inhabited country, and the flow of money has increased dramatically in the past 10-15 years. Since independence, India has strived to achieve unexplored heights in scientific and engineering education. And today millions of students not only from India but also abroad graduate from these institutions every year.

Potrebbero piacerti anche

- Sample Opposition To Motion To Strike Portions of Complaint in United States District CourtDocumento2 pagineSample Opposition To Motion To Strike Portions of Complaint in United States District CourtStan Burman100% (1)

- International InvestmentDocumento27 pagineInternational InvestmentYash Dave100% (1)

- Foreign Direct InvestmentDocumento45 pagineForeign Direct InvestmentRamya GowdaNessuna valutazione finora

- Lecture & Seminar 4: Foreign Direct InvestmentDocumento35 pagineLecture & Seminar 4: Foreign Direct InvestmenttapiwaNessuna valutazione finora

- State Immunity Cases With Case DigestsDocumento37 pagineState Immunity Cases With Case DigestsStephanie Dawn Sibi Gok-ong100% (4)

- FDI in India Case Study WalmartDocumento32 pagineFDI in India Case Study WalmartDhawal Khandelwal33% (3)

- FDI in India Case Study WalmartDocumento32 pagineFDI in India Case Study WalmartSaad KhanNessuna valutazione finora

- International Trade and Finance Law: Globalisation and Fdi in IndiaDocumento34 pagineInternational Trade and Finance Law: Globalisation and Fdi in IndiaAnonymous qFWInco8cNessuna valutazione finora

- FDI in India Advantages and DisadvantagesDocumento3 pagineFDI in India Advantages and DisadvantagesBharat TaraparaNessuna valutazione finora

- Project Onforeign Direct InvestmentDocumento20 pagineProject Onforeign Direct InvestmentNimesh MokaniNessuna valutazione finora

- Fdi in IndiaDocumento21 pagineFdi in Indiabestowedart8905Nessuna valutazione finora

- Finanace International Equity MarketsDocumento8 pagineFinanace International Equity Marketsguptasoniya247Nessuna valutazione finora

- Types of Foreign Direct Investment: An Overview: Outward FDIDocumento7 pagineTypes of Foreign Direct Investment: An Overview: Outward FDIRitu MakkarNessuna valutazione finora

- Give Ten Reasons Why FDI Is Beneficial To Developing Economy? AnsDocumento19 pagineGive Ten Reasons Why FDI Is Beneficial To Developing Economy? AnsFaisal MohdNessuna valutazione finora

- Assignment OF Business Envirnment ON Fii in India: Submitted To:-Submitted ByDocumento13 pagineAssignment OF Business Envirnment ON Fii in India: Submitted To:-Submitted BySachin Kumar BassiNessuna valutazione finora

- Fdi in Indian Retail Sector: Opportunities and Challenges: Ritika, Neha DangiDocumento6 pagineFdi in Indian Retail Sector: Opportunities and Challenges: Ritika, Neha DangiArvind NayakaNessuna valutazione finora

- Foreign Direct Investment Is Investment Made by A Foreign Individual or Company inDocumento6 pagineForeign Direct Investment Is Investment Made by A Foreign Individual or Company invelmurugantextileNessuna valutazione finora

- Unit 5 Role of Multinational Companies in IndiaDocumento12 pagineUnit 5 Role of Multinational Companies in IndianikhilnamburiNessuna valutazione finora

- Foreign Direct InvestmentDocumento7 pagineForeign Direct InvestmentSaviusNessuna valutazione finora

- Ugc Net: CommerceDocumento20 pagineUgc Net: CommerceAyan AhmadNessuna valutazione finora

- FDI Inflows Up 36% in Jan-Oct: Foreign Direct Investment (FDI) IsDocumento4 pagineFDI Inflows Up 36% in Jan-Oct: Foreign Direct Investment (FDI) Islubnashaikh266245Nessuna valutazione finora

- Foreign Direct Investment (Fdi) : Jaipur National UniversityDocumento9 pagineForeign Direct Investment (Fdi) : Jaipur National UniversityManthan Ashutosh MehtaNessuna valutazione finora

- Chapter 6 - FOREIGN DIRECT INVESTMENTDocumento13 pagineChapter 6 - FOREIGN DIRECT INVESTMENTAriel A. YusonNessuna valutazione finora

- Chapter 8 Foreign Direct InvestmentDocumento23 pagineChapter 8 Foreign Direct InvestmentMd. Mehedi HasanNessuna valutazione finora

- Mod 4 BeDocumento25 pagineMod 4 BePratha JainNessuna valutazione finora

- Ib Module 5Documento64 pagineIb Module 5AncyNessuna valutazione finora

- FDI, Foreign Direct InvestmentDocumento20 pagineFDI, Foreign Direct InvestmentBhargesh VedNessuna valutazione finora

- Project 1Documento71 pagineProject 1vipulNessuna valutazione finora

- Foreign Direct InvestmentDocumento11 pagineForeign Direct InvestmentshubhangiNessuna valutazione finora

- Unit 5 BEDocumento11 pagineUnit 5 BESharwan SinghNessuna valutazione finora

- International Marketing Dec 2022 Vz6g3dDocumento11 pagineInternational Marketing Dec 2022 Vz6g3dRajni KumariNessuna valutazione finora

- Project Report On FdiDocumento15 pagineProject Report On FdiAkshata ZopayNessuna valutazione finora

- Advantages of Foreign Direct InvestmentDocumento3 pagineAdvantages of Foreign Direct InvestmentPrasanna VenkateshNessuna valutazione finora

- Bep 5Documento12 pagineBep 5Kajal singhNessuna valutazione finora

- Fdi in Retail: Click To Edit Master Subtitle StyleDocumento11 pagineFdi in Retail: Click To Edit Master Subtitle StyleT Sree Hima BinduNessuna valutazione finora

- Foreign Direct InvestmentDocumento8 pagineForeign Direct InvestmentpratikpawarNessuna valutazione finora

- International Trade and Foreign Direct InvestmentDocumento3 pagineInternational Trade and Foreign Direct InvestmentrhannemacoyNessuna valutazione finora

- Foreign Direct InvestmentDocumento4 pagineForeign Direct InvestmentRajiv RanjanNessuna valutazione finora

- Updated FC QB AnsDocumento41 pagineUpdated FC QB AnsMr.Nessuna valutazione finora

- Foreign Institutional Investments and Its Influence On Equity Stock Market in IndiaDocumento14 pagineForeign Institutional Investments and Its Influence On Equity Stock Market in IndiaNeha KumariNessuna valutazione finora

- 20bbah005 A1dwdvDocumento18 pagine20bbah005 A1dwdvUtkarsh AryanNessuna valutazione finora

- Foreign Direct InvestmentDocumento5 pagineForeign Direct InvestmentHARIKIRAN PRNessuna valutazione finora

- Foreign Direct Investment: Learning ObjectivesDocumento4 pagineForeign Direct Investment: Learning ObjectivesLia Rhuu 温明玲 LingNessuna valutazione finora

- Eco 2016 FiiDocumento29 pagineEco 2016 FiiishanNessuna valutazione finora

- Hand Out Chap 7Documento34 pagineHand Out Chap 7Anirvaan GhoshNessuna valutazione finora

- Foreign Direct InvestmentDocumento23 pagineForeign Direct InvestmentLalsivaraj SangamNessuna valutazione finora

- Foreign Direct InvestmentDocumento13 pagineForeign Direct InvestmentGaurav GuptaNessuna valutazione finora

- Hot ItDocumento26 pagineHot ItTanoj PandeyNessuna valutazione finora

- Foreign Invesment in IndiaDocumento19 pagineForeign Invesment in IndiaZaina ParveenNessuna valutazione finora

- Topic 7: Foreign Direct InvestmentDocumento19 pagineTopic 7: Foreign Direct InvestmentSozia TanNessuna valutazione finora

- IB Chapter 7Documento17 pagineIB Chapter 7Noor Asma ZakariaNessuna valutazione finora

- Need For Liberalisation in Indian EconomyDocumento12 pagineNeed For Liberalisation in Indian EconomysandeepNessuna valutazione finora

- Chapter 7 COMM 211Documento12 pagineChapter 7 COMM 211madison dworskyNessuna valutazione finora

- Foreign Market Entry and International Production SCRIPTDocumento5 pagineForeign Market Entry and International Production SCRIPTGabrielle CustodioNessuna valutazione finora

- Final Project On FDI and FIIDocumento39 pagineFinal Project On FDI and FIIReetika BhatiaNessuna valutazione finora

- Fiiiii Impactt Over IniaDocumento22 pagineFiiiii Impactt Over IniakanishkNessuna valutazione finora

- FDI Mcom PRDocumento9 pagineFDI Mcom PRVinitmhatre143Nessuna valutazione finora

- Foreign Direct Investment in The Retail Sector in IndiaDocumento5 pagineForeign Direct Investment in The Retail Sector in IndiaKashaf ShaikhNessuna valutazione finora

- A Comparative Analysis of Foreign Direct Investment in China and IndiaDocumento10 pagineA Comparative Analysis of Foreign Direct Investment in China and IndiaAlexander DeckerNessuna valutazione finora

- Foreign Direct InvestmentDocumento16 pagineForeign Direct Investmentchhavi nahataNessuna valutazione finora

- UntitledDocumento7 pagineUntitledAna KatulićNessuna valutazione finora

- Labstan 1Documento2 pagineLabstan 1Samuel WalshNessuna valutazione finora

- SILABO 29-MT247-Sensors-and-Signal-ConditioningDocumento2 pagineSILABO 29-MT247-Sensors-and-Signal-ConditioningDiego CastilloNessuna valutazione finora

- Reference Template For Feasibility Study of PLTS (English)Documento4 pagineReference Template For Feasibility Study of PLTS (English)Herikson TambunanNessuna valutazione finora

- Cryo EnginesDocumento6 pagineCryo EnginesgdoninaNessuna valutazione finora

- Water Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Documento160 pagineWater Hookup Kit User Manual (For L20 Ultra - General (Except EU&US)Aldrian PradanaNessuna valutazione finora

- CodebreakerDocumento3 pagineCodebreakerwarrenNessuna valutazione finora

- MORIGINADocumento7 pagineMORIGINAatishNessuna valutazione finora

- Fidp ResearchDocumento3 pagineFidp ResearchIn SanityNessuna valutazione finora

- Use of EnglishDocumento4 pagineUse of EnglishBelén SalituriNessuna valutazione finora

- HRD DilemmaDocumento4 pagineHRD DilemmaAjay KumarNessuna valutazione finora

- What Caused The Slave Trade Ruth LingardDocumento17 pagineWhat Caused The Slave Trade Ruth LingardmahaNessuna valutazione finora

- Appendix - 5 (Under The Bye-Law No. 19 (B) )Documento3 pagineAppendix - 5 (Under The Bye-Law No. 19 (B) )jytj1Nessuna valutazione finora

- CoDocumento80 pagineCogdayanand4uNessuna valutazione finora

- ADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementDocumento33 pagineADS 460 Management Principles and Practices: Topic 1: Introduction To ManagementNURATIKAH BINTI ZAINOL100% (1)

- Brochure Ref 670Documento4 pagineBrochure Ref 670veerabossNessuna valutazione finora

- Sophia Program For Sustainable FuturesDocumento128 pagineSophia Program For Sustainable FuturesfraspaNessuna valutazione finora

- Apm p5 Course NotesDocumento267 pagineApm p5 Course NotesMusumbulwe Sue MambweNessuna valutazione finora

- Aircraftdesigngroup PDFDocumento1 paginaAircraftdesigngroup PDFsugiNessuna valutazione finora

- Business Environment Analysis - Saudi ArabiaDocumento24 pagineBusiness Environment Analysis - Saudi ArabiaAmlan JenaNessuna valutazione finora

- Financial Derivatives: Prof. Scott JoslinDocumento44 pagineFinancial Derivatives: Prof. Scott JoslinarnavNessuna valutazione finora

- Maths PDFDocumento3 pagineMaths PDFChristina HemsworthNessuna valutazione finora

- Anaphylaxis Wallchart 2022Documento1 paginaAnaphylaxis Wallchart 2022Aymane El KandoussiNessuna valutazione finora

- Rating SheetDocumento3 pagineRating SheetShirwin OliverioNessuna valutazione finora

- SBL - The Event - QuestionDocumento9 pagineSBL - The Event - QuestionLucio Indiana WalazaNessuna valutazione finora

- TAS5431-Q1EVM User's GuideDocumento23 pagineTAS5431-Q1EVM User's GuideAlissonNessuna valutazione finora

- TSB 120Documento7 pagineTSB 120patelpiyushbNessuna valutazione finora

- Microsoft Word - Claimants Referral (Correct Dates)Documento15 pagineMicrosoft Word - Claimants Referral (Correct Dates)Michael FourieNessuna valutazione finora

- Innovations in Land AdministrationDocumento66 pagineInnovations in Land AdministrationSanjawe KbNessuna valutazione finora