Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Dublin Café Merger Analysis

Caricato da

superclickmktgincDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Dublin Café Merger Analysis

Caricato da

superclickmktgincCopyright:

Formati disponibili

Dublin Caf

Submitted by: Castaneda, Mary Cheryl Duenas, Erwin Lim, Alexander Allen Wongchuking, Lizsa

FINANCIAL MANAGEMENT (FNC 5110)

Submitted to: Professor Edgardo C. Grey Jr. Graduate School of Business De La Salle University March 19, 2011

I.

CASE BACKGROUND

Bob Radliff, Globals vice president for restaurant operations, is considering the acquisition of Dublin Cafe, a chain of eight restaurants that operates in the Boston area. The brew pub atmosphere, which is growing in popularity, has allowed Dublin to charge premium prices for its food, and in each of its locations, Dublin has been able to compete successfully with nearby national chains. Dublin was founded in 1990 by Tom and Ed OBrien with the initial capital coming from their father. In early 1997 the company went public to raise additional capital. The offering was for 3 million shares at $1 per share, but the offering was not well received and only 1.4 million shares were actually sold. The company currently has 2,000,000 shares outstanding. The OBrien brothers own 400,000 shares, others in management own 200,000 shares, and 1.4 million shares are held by outside (public) investors. The stock is traded infrequently and in small amounts. The last trade was at a new all-time high price of $1.97, but the stock is volatile, and its beta coefficient is 1.7. Radliff has tentatively decided to try to acquire the company after a thorough analysis of Dublins situation. The primary issues he now faces are (1) how much to offer for Dublins stock, (2) how to approach Dublins management, and (3) how to expand the business if and when the acquisition has been completed. The projections assume that Global would make a number of changes in Dublins operations, including the following (All of these changes are tentative and speculative): o o o With Globals financial support and pool of managerial talent, Dublins rate of new store openings would be increased significantly, dramatically increasing the growth rate. With Globals stable, diversified operations providing a backup, Dublin could employ a higher debt ratio. Even with more debt, Globals better access to capital markets and improved coverages would result in a lower cost of debt. Also, Dublins beta should decline somewhat after the acquisition, thus lowering the CAPM cost of equity. Radliffs analysts forecast that Dublins post-merger beta will be 1.4886 versus a pre-merger beta of 1.7. Global has both more knowledge about purchasing and more clout with suppliers than Dublin. Also, its faster growth and larger size would lead to economies of scale. As a result, both the operating cost/sales and the depreciation/sales ratios should decline. Dublins tax rate is expected to increase in 2001 because tax loss carry forwards and other tax shelters derived in its first few years of operations would be used up. The merger would not affect the tax rate, which would be 40% with or without the merger. Dublin currently pays no dividends, and if it remains independent, this situation would continue on into the future. Under Global, Dublin would pass any excess earnings (i.e., earnings not needed for operations) on to Global in the form of dividends.

o o o

Radliff thinks that the OBriens, with their strong entrepreneurial instincts, might help him expand Globals overall restaurant operation. His own staff is competent at managing existing operations, but less so in creating new opportunities. So, Radliff thinks a Dublin acquisition might bring with it management talent as well as a good business.

The offer price is a critical issue. Below is a list of the steps Radliff plans to go through to establish the offer price:

1. Perform a DCF analysis to determine just how much Dublin is worth to Global. This would set an upper limit on the offer price. 2. Hire a consulting firm or an investment banking firm to do an independent evaluation of Dublin. This would serve as a check on Globals own appraisal, and it would also be used as a Fairness Opinion which would be presented first to Dublins managers and then to its shareholders when they are asked to vote to approve the merger. In very large mergers, a highly-regarded firm such as Goldman Sachs or Morgan Stanley will be asked to make the fairness opinion. Generally, both the acquiring firm (Global) and the target firm (Dublin) will hire their own consultants or bankers to get independent opinions.

3. The fairness opinion would undoubtedly begin with Dublins current market value. The last stock price was $1.97 per share, and there are 2 million shares outstanding. Thus, the current market value of Dublins common stock is just under $4 million. Radliff would probably conclude that he must offer a minimum of $1.97 per share, or $4 million in total, to get Dublins stockholders to agree to the acquisition. In all likelihood, he would have to offer a premium of 25 to 30 percent, or about $2.50, to get stockholder approval. 4. While the current market price tells us what The Market thinks the stock is worth, and Globals DCF analysis gives an estimate of what Dublin is worth to it, analysts always consider other data when appraising the value of a stock such as Dublin. Stock prices are volatile, and the current stock price probably does not reflect the effects of a merger, so the current market value is flawed as a measure of Dublins value when merger possibilities are considered. Moreover, any DCF value is extremely sensitive to cash flow estimates and the cost of capital used as the discount rate, and those inputs are just educated guesses. Thus, it is dangerous to place a great deal of confidence on DCF values. 5. Therefore, analysts typically supplement their DCF valuations with valuations based on a multiples approach. 6. The final valuation is generally determined as a weighted average of the current market value, the DCF valuation, and the different multiple valuations. The weights used are judgmental.

II.

STATEMENT OF THE PROBLEM Should Dublin Caf agree to a merger or remain independent?

III.

OBJECTIVES a. To evaluate the current financial status of Dublin Caf. b. To compare the projected financial status of Dublin Caf if they merge with Global or remain independent c. To determine the advantages and disadvantages of a merger

IV.

AREAS FOR CONSIDERATION

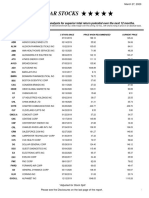

Input Data: Independent Company Model

Input Data for Model of Dublin if Acquired By Global

V.

ALTERNATIVE COURSES OF ACTIONS a. ACA # 1: Dublin Caf to merge with Global

Sensitivity Analysis: DCF Value/Share as Function of Various Inputs Operating Cost Ratio in 2002 83% 84% 85% 86% 87% 88% 89% 90% DCF Value/Share Sales Growth Rate in 2002 15% 10% 5% $10.70 $5.27 $2.94 $9.22 $4.44 $2.44 $7.70 $3.59 $1.93 $6.11 $2.73 $1.42 $4.42 $1.84 $0.89 $2.57 $0.90 $0.35 $0.43 ($0.10) ($0.21) ($2.32) ($1.23) ($0.81)

Output:

$5.34

Effect of discount rate on post-merger DCF value WACC 12.0% 14.0% 16.0% 18.0% DCF Value $21.39 5.41 2.74 1.64

Advantages of a Merger

Increased market share Lower cost of operation and/or production Higher competitiveness Industry know how and positioning Financial leverage Improved profitability and EPS stability as a corporate entity provide for higher political influence and industry leadership Benefits on account of tax sheilds like carried forward losses or unclaimed depreciation Restructuring and strengthening the balance sheet Investment of surplus cash Easy to acfquire economies of scale .

b. ACA # 2: Deublin Caf to remain independent

Sensitivity Analysis: DCF Value/Share as Function of Various Inputs Operating Cost Ratio in 2002 85% 86% 87% 88% 89% 90% DCF Value/Share Sales Growth Rate in 2002 15% 10% 5% $6.95 $3.70 $2.11 $5.93 $3.06 $1.70 $4.88 $2.41 $1.29 $3.79 $1.74 $0.86 $2.60 $1.04 $0.43 $1.23 $0.27 ($0.03)

Output:

$1.70

Disadvantages of a Merger

Legal expenses Short-term opportunity cost Cost of takeover Potential devaluation of equity Intangible costs Increase in cost to consumers Decreased corporate performance and/or services Potentially lowered industry innovation Suppression of competing businesses Decline in equity pricing and investment value Diseconomies of scale if business becomes too large, which leads to higher unit costs. Clashes of culture between different types of businesses can occur, reducing the effectiveness of the integration. May need to make some workers redundant, especially at management levels - this may have an effect on motivation. May be a conflict of objectives between different businesses, meaning decisions are more difficult to make and causing disruption in the running of the business.

VI.

CONCLUSION & RECOMMENDATION

Based on the above given, computations (as attached) and information, the group concludes that Dublin Caf should consider a merger with Global.

VII.

SOURCES

1) http://www.nvca.org/index.php? option=com_docman&task=doc_download&gid=368&Itemid=93 2) http://www.economicshelp.org/m icroessays/competition/benefit s-mergers.html 3) http://www.economicshelp.org/m icroessays/competition/uk-merg ers.html 4) http://www.investopedia.com/un iversity/mergers/mergers5.asp 5) http://www.gbata.com/docs/jgba t/v1n2/v1n2p1.pdf

Potrebbero piacerti anche

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterDa EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNessuna valutazione finora

- Cost & Managerial Accounting II EssentialsDa EverandCost & Managerial Accounting II EssentialsValutazione: 4 su 5 stelle4/5 (1)

- KFC Mission and ObjectivesDocumento30 pagineKFC Mission and ObjectivesSmriti ThapaNessuna valutazione finora

- BarrierDocumento5 pagineBarrierMa Jean Baluyo CastanedaNessuna valutazione finora

- Dwnload Full Corporate Finance The Core 4th Edition Berk Solutions Manual PDFDocumento36 pagineDwnload Full Corporate Finance The Core 4th Edition Berk Solutions Manual PDFdesidapawangl100% (16)

- KFCDocumento8 pagineKFCsadaffadasNessuna valutazione finora

- Green Zebra Finance Case StudyDocumento23 pagineGreen Zebra Finance Case StudyJessie Franz100% (10)

- Revised HD Equity Research ReportDocumento18 pagineRevised HD Equity Research Reportapi-312977476Nessuna valutazione finora

- Dwnload Full Corporate Finance 3rd Edition Berk Solutions Manual PDFDocumento26 pagineDwnload Full Corporate Finance 3rd Edition Berk Solutions Manual PDFlief.tanrec.culjd100% (10)

- Full Download Corporate Finance 3rd Edition Berk Solutions ManualDocumento35 pagineFull Download Corporate Finance 3rd Edition Berk Solutions Manualetalibelmi2100% (24)

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Documento38 pagineSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683verawarnerq5cl100% (13)

- Solutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683Documento38 pagineSolutions Manual To Accompany Corporate Finance The Core 2nd Edition 9780132153683auntyprosperim1ru100% (15)

- Part 1: Multiple Choice 2 Points Each /140 Points 5 Points Deduction For Every 5 Items Answered IncorectlyDocumento22 paginePart 1: Multiple Choice 2 Points Each /140 Points 5 Points Deduction For Every 5 Items Answered IncorectlyDanna Karen MallariNessuna valutazione finora

- Full Download Corporate Finance The Core 3rd Edition Berk Solutions ManualDocumento35 pagineFull Download Corporate Finance The Core 3rd Edition Berk Solutions Manualslodgeghidinc100% (32)

- Dwnload Full Corporate Finance The Core 3rd Edition Berk Solutions Manual PDFDocumento22 pagineDwnload Full Corporate Finance The Core 3rd Edition Berk Solutions Manual PDFdesidapawangl100% (14)

- Management Accounting p2Documento26 pagineManagement Accounting p2Abegail DazoNessuna valutazione finora

- Solutions Manual Fundamentals of Corporate Finance (Asia Global EditionDocumento15 pagineSolutions Manual Fundamentals of Corporate Finance (Asia Global EditionKinglam Tse100% (1)

- CPK CaseDocumento12 pagineCPK Casejohncaleb100% (5)

- JollibeeDocumento12 pagineJollibeePankaj Sahu67% (3)

- Financial ManagementDocumento9 pagineFinancial ManagementRabbaniya Aisyah Firdauzy100% (1)

- Chapter 3 Solution ManualDocumento14 pagineChapter 3 Solution ManualAhmed FathelbabNessuna valutazione finora

- Fae3e SM ch04 060914Documento23 pagineFae3e SM ch04 060914JarkeeNessuna valutazione finora

- ISP583 Assesment 2 - Individual AssignmentDocumento14 pagineISP583 Assesment 2 - Individual AssignmentBella LeeNessuna valutazione finora

- GCC 2021 Investor Presentation 1Documento32 pagineGCC 2021 Investor Presentation 1artsan3Nessuna valutazione finora

- Auction of Burger King ADocumento6 pagineAuction of Burger King ASanjeet Walia0% (2)

- IIM RANCHI Nestle and Alcon Mergers, Acquisitions and Corporate RestructuringDocumento9 pagineIIM RANCHI Nestle and Alcon Mergers, Acquisitions and Corporate RestructuringAnkur Saurabh100% (2)

- What Are The Advantages and Disadvantages of GoingDocumento2 pagineWhat Are The Advantages and Disadvantages of GoingGenevieve AbuyonNessuna valutazione finora

- Mergers and AcquistionsDocumento29 pagineMergers and AcquistionsAli HussainNessuna valutazione finora

- Optimize capital budgeting decisions with NPV analysisDocumento15 pagineOptimize capital budgeting decisions with NPV analysisBrenda JohnsonNessuna valutazione finora

- General Mills' Acquisition of PillsburyDocumento14 pagineGeneral Mills' Acquisition of Pillsburyswapnil tyagiNessuna valutazione finora

- Chapter One: Introducing The Firm and Its Goals: QuestionsDocumento4 pagineChapter One: Introducing The Firm and Its Goals: QuestionsRavineahNessuna valutazione finora

- 3 Case Study Brunswick Distribution IncDocumento18 pagine3 Case Study Brunswick Distribution Incapi-313247205100% (1)

- Netflix Equity Debt Convertible Investment Banking Pitch BookDocumento15 pagineNetflix Equity Debt Convertible Investment Banking Pitch BookphuNessuna valutazione finora

- COBFSDS - Group 1 - Jollibee Case StudyDocumento7 pagineCOBFSDS - Group 1 - Jollibee Case Studylyniel siclotNessuna valutazione finora

- Dokumen - Tips CPK CaseDocumento11 pagineDokumen - Tips CPK CaseHarke Revo Leonard PoliiNessuna valutazione finora

- Fundamental Financial Analysis and ReportingDocumento6 pagineFundamental Financial Analysis and Reportinggilli1trNessuna valutazione finora

- Exhibit 4-5 Chan Audio Company: Current RatioDocumento35 pagineExhibit 4-5 Chan Audio Company: Current Ratiofokica840% (1)

- Unit 33 - Small Business EnterpriseDocumento14 pagineUnit 33 - Small Business EnterpriseNayeem H Khan94% (16)

- Financial Analysis and Valuation PICAVET ValentinDocumento26 pagineFinancial Analysis and Valuation PICAVET ValentinValentin PicavetNessuna valutazione finora

- Analysis of Financial Statements 1-10-19Documento28 pagineAnalysis of Financial Statements 1-10-19Shehzad QureshiNessuna valutazione finora

- Jollibee Case - Global StrategyDocumento27 pagineJollibee Case - Global StrategyJedidiah Danae AlvarezNessuna valutazione finora

- Dominos PizzaDocumento32 pagineDominos Pizzaapi-555390406Nessuna valutazione finora

- Financial Engineering Playbook Explains Value Creation TechniquesDocumento18 pagineFinancial Engineering Playbook Explains Value Creation TechniquesAyush AggarwalNessuna valutazione finora

- Resource ArchiveDocumento109 pagineResource ArchivemshadzNessuna valutazione finora

- Jefferies Presentation 06-24-2015Documento28 pagineJefferies Presentation 06-24-2015Ankur MittalNessuna valutazione finora

- BBBY Case ExerciseDocumento7 pagineBBBY Case ExerciseSue McGinnisNessuna valutazione finora

- Case Analysis Kuok 5-2Documento28 pagineCase Analysis Kuok 5-2Levi Lazareno Eugenio89% (9)

- Leveraged Buyouts Explained: Types, Process and ExamplesDocumento24 pagineLeveraged Buyouts Explained: Types, Process and ExamplesNIDHI SAROANessuna valutazione finora

- Credit Analysis and Commercial Lending: November 8, 2011, DUFEDocumento11 pagineCredit Analysis and Commercial Lending: November 8, 2011, DUFEHạnh LêNessuna valutazione finora

- Coors SolutionDocumento4 pagineCoors Solutiongoratim100% (1)

- Questions For Critical Thinking 1Documento6 pagineQuestions For Critical Thinking 1chilltime100% (2)

- McDonalds Competitive Analysis PresentationDocumento58 pagineMcDonalds Competitive Analysis PresentationTalha Muhammad100% (1)

- Greenwald Class Notes 5 - Liz Claiborne & Valuing GrowthDocumento17 pagineGreenwald Class Notes 5 - Liz Claiborne & Valuing GrowthJohn Aldridge Chew100% (2)

- Chap 011Documento21 pagineChap 011kianhuei50% (2)

- Target Case GuidelinesDocumento2 pagineTarget Case Guidelinesdktravels85Nessuna valutazione finora

- Linear Technology Dividend Policy and Shareholder ValueDocumento4 pagineLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNessuna valutazione finora

- HR Om11 Ism ch02Documento7 pagineHR Om11 Ism ch02143mc14Nessuna valutazione finora

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)Da EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)Nessuna valutazione finora

- Lean Distribution: Applying Lean Manufacturing to Distribution, Logistics, and Supply ChainDa EverandLean Distribution: Applying Lean Manufacturing to Distribution, Logistics, and Supply ChainValutazione: 2.5 su 5 stelle2.5/5 (2)

- Venture Capital Valuation, + Website: Case Studies and MethodologyDa EverandVenture Capital Valuation, + Website: Case Studies and MethodologyNessuna valutazione finora

- Five Star StocksDocumento5 pagineFive Star StocksJeff SturgeonNessuna valutazione finora

- Chapter-1-Marketing-ChannelDocumento43 pagineChapter-1-Marketing-ChannelSrushti GadgeNessuna valutazione finora

- Cost Management Processes and TechniquesDocumento16 pagineCost Management Processes and Techniquespriyanshu shrivastavaNessuna valutazione finora

- MCQs - Secondary MarketsDocumento8 pagineMCQs - Secondary Marketskazi A.R RafiNessuna valutazione finora

- RBI Master Circular on Risk Management and Inter-Bank DealingsDocumento95 pagineRBI Master Circular on Risk Management and Inter-Bank DealingsBathina Srinivasa RaoNessuna valutazione finora

- Bank and NBFC - MehalDocumento38 pagineBank and NBFC - Mehalsushrut pawaskarNessuna valutazione finora

- World Co. Supply Chain Management AssignmentDocumento1 paginaWorld Co. Supply Chain Management AssignmentmirrorNessuna valutazione finora

- Solved Question Rhodes CorporationDocumento4 pagineSolved Question Rhodes CorporationBilalTariqNessuna valutazione finora

- Adjusted Present ValueDocumento14 pagineAdjusted Present ValueGoGoJoJo100% (1)

- Capital Market InstrumentsDocumento33 pagineCapital Market InstrumentsMayankTayal100% (1)

- 1033. ტურიზმის-მარკეტინგი-სოფო-თევდორაძეDocumento120 pagine1033. ტურიზმის-მარკეტინგი-სოფო-თევდორაძეAnton SinatashviliNessuna valutazione finora

- FD Course OutlineDocumento8 pagineFD Course OutlineSudip ThakurNessuna valutazione finora

- Paper - Iii Commerce: Note: Attempt All The Questions. Each Question Carries Two (2) MarksDocumento26 paginePaper - Iii Commerce: Note: Attempt All The Questions. Each Question Carries Two (2) MarksashaNessuna valutazione finora

- Hotel Ms DiantiDocumento2 pagineHotel Ms DiantiUsman BisnisNessuna valutazione finora

- Supply Chain Management PPT Final EditedDocumento17 pagineSupply Chain Management PPT Final Editedimran khanNessuna valutazione finora

- Kieso17e ch13 Solutions ManualDocumento89 pagineKieso17e ch13 Solutions ManualMoheeb HaddadNessuna valutazione finora

- Ramo 1-2000Documento526 pagineRamo 1-2000Mary graceNessuna valutazione finora

- Accounting Terminology GuideDocumento125 pagineAccounting Terminology GuideRam Cherry VMNessuna valutazione finora

- Valuation of The Deal Between Vedanta and CairnDocumento8 pagineValuation of The Deal Between Vedanta and Cairndnss_007Nessuna valutazione finora

- Chapter 04 Test Bank - Static - Version1Documento45 pagineChapter 04 Test Bank - Static - Version1mahasalehl200Nessuna valutazione finora

- Findings: Mutual FundDocumento4 pagineFindings: Mutual FundAbdulRahman ElhamNessuna valutazione finora

- Corporate Level StrategyDocumento33 pagineCorporate Level StrategyDave NamakhwaNessuna valutazione finora

- Guide To Original Issue Discount (OID) Instruments: Publication 1212Documento17 pagineGuide To Original Issue Discount (OID) Instruments: Publication 1212ChaseF31ckzwhrNessuna valutazione finora

- Business Combination - TheoriesDocumento11 pagineBusiness Combination - TheoriesMILLARE, Teddy Glo B.Nessuna valutazione finora

- Module 4 Key Vocabulary - English For Business and Entrepreneurship Summer 2023Documento7 pagineModule 4 Key Vocabulary - English For Business and Entrepreneurship Summer 2023Yamir VelazcoNessuna valutazione finora

- Week 4 Topic 1 Aqad and Sources of FundsDocumento41 pagineWeek 4 Topic 1 Aqad and Sources of Funds2 Ashlih Al TsabatNessuna valutazione finora

- Igcse Business Studies Workbook AnswersDocumento51 pagineIgcse Business Studies Workbook AnswersMateo VegnaduzziNessuna valutazione finora

- Mergers & Acquisitions: Aldovino, Hansley Eud, Rizza Mae Magana, Geselle Rodil, Via NicoleDocumento27 pagineMergers & Acquisitions: Aldovino, Hansley Eud, Rizza Mae Magana, Geselle Rodil, Via NicoleRizza Mae EudNessuna valutazione finora

- Five Keys To Investing SuccessDocumento12 pagineFive Keys To Investing Successr.jeyashankar9550Nessuna valutazione finora

- Examination: Subject ST7 - General Insurance: Reserving and Capital Modelling Specialist TechnicalDocumento5 pagineExamination: Subject ST7 - General Insurance: Reserving and Capital Modelling Specialist Technicaldickson phiriNessuna valutazione finora