Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Orgb Ch13 Molsoncoors Casehmwk JPF

Caricato da

Муслим муслимDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Orgb Ch13 Molsoncoors Casehmwk JPF

Caricato da

Муслим муслимCopyright:

Formati disponibili

Molson Coors Brewing Company: Conflict Resolution in the Aftermath of a Merger In the mid-1990s a dispute began developing between

rival factions of the Molson family for control of the Molson empire, including the Molson brewing business. Eric Molson and Ian Molson were pitted against one another in this struggle for control. Eric and Ian clashed at board meetings, with their differences becoming increasingly intense and embittered. At a January 2003 board meeting, Eric announced a review of Molsons corporate governance. While a surprise to the board, the review was nonetheless conducted. The governance report recommended eliminating Ians position as deputy chairman. Ian confronted Eric but nothing was resolved. At the following November board meeting, the recommendation to eliminate Ians position was defeated. At the May 2004 meeting three board members, including Ian, resigned in protest over Erics leadership of the company. The remainder of the board chose to reaffirm Erics status as chairman. At the companys annual meeting the following month, Ian and four other members of the family-controlled board refused to stand for reelection. Meanwhile, Molson Inc. and Adolph Coors Co. initiated merger talks. The two companies had been working together since 1998, with each company distributing the others products in its home territory. The major hurdle to the proposed merger was the feud between the two factions of the Molson family. Eric, who along with allied family members controlled more than half the voting shares, favored the merger. Ian, with

approximately 10 percent of the voting shares, was against the merger. A shareholder agreement between Ian and Eric prevented either one from transferring or selling his voting shares without the consent of the other. Eric maintained that he had found a legal way to circumvent the agreement. Ian, on the other hand, was preparing to offer as much as $4 billion to acquire Molson Inc. in order to prevent the merger with Coors. On July 22, 2004, the two companies jointly announced the merger of Molson and Coors. As a result of the merger, Molson Coors became the third largest brewer in the United States and the fifth largest in the world, operating primarily in three mature markets Canada, the United States, and the United Kingdom. At the time of the merger, bringing together the Molson and Coors families seemed like a recipe for disaster. One was Canadian. One was American. One was east. One was west. And they both built their businesses in different ways. Even nearly three years afterwards, the merger is still a sore point with some, including Erics cousin Ian Molson, who saw the merger of equals as an outright takeover and not an advantageous one for shareholders at that. Nonetheless, just[t]wo years after the highly publicized merger between U.S. brewer Adolph Coors Co. and Canadian brewer Molson, the management problems anticipated by many analysts most notably a power struggle between two longstanding brewing families have yet to come to pass. In fact, Molson Coors Brewing Co. is leveraging the strength of its family-based culture to strategically focus on brand building and growing its domestic and international beer business.

How has Molson Coors Brewing avoided being decimated by conflict? Molson Coors CEO Leo Kiely, in describing how they were able to successfully merge two companies with strong cultures and traditions, cited two key factors. One factor involved investing local teams with the responsibility for their markets since the markets of the pre-merger Molson and Coors did not overlap much. The second factor was celebrating the two companies common features a strong family heritage and a passion for brewing beer. According to Kiely, the first priority after the merger was to get a good balanced team in place. After the merger of Molson and Coors, the senior management team was reorganized by drawing in people from both companies and both families and by establishing executive headquarters in both Denver, Colorado and Montreal, Canada. Eric Molson serves as chairman of the board and Peter Coors serves as vice chairman. Eric Molson works from Montreal, Canada, and CEO Leo Kiely, from the Coors side, runs the merged company from Denver, Colorado. Other members of both the Molson and Coors families play active roles in the business. Another major factor in avoiding debilitating conflict was the similar business interests and heritage of the two companies. Geoff Molson, a seventh-generation family member working in the business, says the thing outsiders dont understand is that the families passion for brewing was really the essential ingredient in getting the deal done. Geoff Molson continues, In the past two years, weve had differences, identified them and figured out a way to address them together with the interests of building the beer business at the same time. Although the merged company reflects 21st century globalization and

consolidation within the brewing industry, each of the two companies is fighting to keep its identity, which is rooted in the past. Regarding the Canadian side of the merger, Eric Molson says, Since 1786, playing a part in the community has been the Molson tradition a tradition that is woven into the cultural fabric of Molson and our family, and continues to thrive today. We are very proud to be part of this country, from coast to coast. A similar perspective applies to the Coors traditions. Indeed, the family aspect and community involvement of both Molson and Coors define the separate histories of Molson and Coors as well as the present times of the merged Molson Coors Brewing. Will the two families of Molson Coors Brewing be able to continue working together amiably as they grapple with the challenges of an increasingly globalized and consolidated brewing industry? Addressing this dilemma became increasing more complicated on October 9, 2007 when Molson Coors and SABMiller PLC announced plans to merge their United States operations. The Molson and Coors families did not want to sell the entire brewing company to SABMiller, and consequently the companys operations in Canada and the United Kingdom will remain independent of SABMiller.

SOURCE: Frank R., and Cheney, E. (2004) Canadian Club: A Brewing Family Feud Poses Risks for Molson Beer Empire, The Wall Street Journal, eastern edition (June 29), p. A1; Cheney, E., and Frank, R. (2004) Molson Chairman Resists Calls for Ouster Amid a Family Feud, The Wall Street Journal, Eastern edition (June 23), p. B46; Frank, R., and Berman, D.K.

(2004) Molson, Coors Talks Heat Up, But a Deal Faces Several Hurdles, The Wall Street Journal, Eastern edition (July 19), p. B2; Molson Press Release. (2004) Molson and Coors Announce Merger of Equals to Create Worlds Fifth largest Brewer. http://micro.newswire.ca/release.cgi?rkey=1207225107&view=534540&Start=0 (accessed July 22, 2004); Kesmodel, D. (2007) Boss Talk: How Chief Beer Taster Blended Molson, Coors, The Wall Street Journal, Eastern edition (October 1), p. B1; Landi, H. (2007) Go Global, Think Local: With a strong foundation in North America, the worlds fifth largest brewer is on the move, Beverage World (July), p. 46; Holloway, A. (2007) The Molson Way, Canadian Business (April 9), Vol. 80, No. 8, p. 36 (4 pages); Holloway, A. (2007) Eric Molson, Canadian Business (May 21), Vol. 80, No. 11, p. 94; Kesmodel, D., and Ball, D. (2007) Miller, Coors to Shake Up U.S. Beer Market, The Wall Street Journal, Online edition (October 10), pp. A1+. This case was written by Michael K. McCuddy, The Louis S. and Mary L. Morgal Chair of Christian Business Ethics and Professor of Management, College of Business Administration, Valparaiso University. Discussion Questions 1. From your perspective, were the consequences of the conflict between Eric Molson and Ian Molson positive or negative? 2. What ineffective techniques for managing conflict are evident in the case? 3. What effective techniques for managing conflict are evident in the case?

Potrebbero piacerti anche

- Beer Porter Five ForcesDocumento17 pagineBeer Porter Five ForcesGopesh Meena67% (3)

- Coors Case StudyDocumento3 pagineCoors Case StudyJohn Aldridge Chew0% (1)

- 31212CA Breweries in Canada Industry ReportDocumento35 pagine31212CA Breweries in Canada Industry ReportmaryNessuna valutazione finora

- Aleph Farms Case Analysis Highlights Company's Focus on SustainabilityDocumento7 pagineAleph Farms Case Analysis Highlights Company's Focus on SustainabilityOlivia HorvathNessuna valutazione finora

- Hausser Foods SCDocumento6 pagineHausser Foods SCHumphrey OsaigbeNessuna valutazione finora

- Chrysler Unseats Its Competition With Supplier PartnershipsDocumento6 pagineChrysler Unseats Its Competition With Supplier PartnershipsGopi KhuntNessuna valutazione finora

- Economics of Strategy: Sixth EditionDocumento63 pagineEconomics of Strategy: Sixth EditionRichardNicoArdyantoNessuna valutazione finora

- Marvel Case SolutionsDocumento3 pagineMarvel Case Solutionsmayur7894Nessuna valutazione finora

- Indian Newspapers' Digital Transition PDFDocumento50 pagineIndian Newspapers' Digital Transition PDFNajmus SajeebNessuna valutazione finora

- Going With The Flow: Agile Development at DellDocumento16 pagineGoing With The Flow: Agile Development at DellgautamNessuna valutazione finora

- Case Study Analysis Coors Brewing CompanyDocumento64 pagineCase Study Analysis Coors Brewing Companyipsa2582% (11)

- DryGoods CaseDocumento8 pagineDryGoods CasemanasrmohantyNessuna valutazione finora

- Boeing Vs Airbus - Game TheoryDocumento3 pagineBoeing Vs Airbus - Game Theoryaatifkamal100% (1)

- Under ArmourDocumento26 pagineUnder ArmourThiên Quốc TrầnNessuna valutazione finora

- PepsiCo Submitted Report on History, Brands, Financials and Growth StrategyDocumento15 paginePepsiCo Submitted Report on History, Brands, Financials and Growth StrategyVishnu Chevli100% (1)

- Assignment No.4 Millennium Case StudyDocumento6 pagineAssignment No.4 Millennium Case StudyRitwik KumarNessuna valutazione finora

- CaseDocumento23 pagineCaseNguyễnVũHoàngTấnNessuna valutazione finora

- Case Memo #3Documento3 pagineCase Memo #3Iris WangNessuna valutazione finora

- BIG Rock International Expansion PlanDocumento20 pagineBIG Rock International Expansion PlanAly Ihab GoharNessuna valutazione finora

- Anne Mulcahy's Leadership in Resurrecting Xerox from CrisisDocumento3 pagineAnne Mulcahy's Leadership in Resurrecting Xerox from Crisisrissa pramitaNessuna valutazione finora

- Harley Davidson Motor Company Enterprise PDFDocumento2 pagineHarley Davidson Motor Company Enterprise PDFPetter PNessuna valutazione finora

- Fall 2006 Chemco Case Study Page 1 of 5Documento5 pagineFall 2006 Chemco Case Study Page 1 of 5Byron Galáctico RodríguezNessuna valutazione finora

- Group 10 Poletown DilemmaDocumento3 pagineGroup 10 Poletown DilemmaNaveen Choudhury100% (1)

- MBC Corporation PDFDocumento3 pagineMBC Corporation PDFMuhammad SaadNessuna valutazione finora

- Nucor ADocumento15 pagineNucor Adharma_1001Nessuna valutazione finora

- Canadian Blood ServicesDocumento5 pagineCanadian Blood ServicesAbhinav ChaudharyNessuna valutazione finora

- Morgan StanleyDocumento9 pagineMorgan StanleyNikita MaskaraNessuna valutazione finora

- Taqa Co 100305Documento3 pagineTaqa Co 100305Yue XiangNessuna valutazione finora

- AB Inbev TipsDocumento1 paginaAB Inbev TipsLuis KasNessuna valutazione finora

- Colgate Palmolive India SWOT AnalysisDocumento3 pagineColgate Palmolive India SWOT AnalysisSrinivas NandikantiNessuna valutazione finora

- STOCKHOLDER VS STAKEHOLDER MODELSDocumento3 pagineSTOCKHOLDER VS STAKEHOLDER MODELSNrityam NundlallNessuna valutazione finora

- Kingfisher Vs Fosters With Porters Five ForcesDocumento32 pagineKingfisher Vs Fosters With Porters Five Forcesvenkataswamynath channa100% (5)

- FIAT and Cristler Case Study.Documento6 pagineFIAT and Cristler Case Study.mbiradar85Nessuna valutazione finora

- Growing Zarr Tech Faces Competition and Seeks New Revenue StreamsDocumento8 pagineGrowing Zarr Tech Faces Competition and Seeks New Revenue StreamsSaksham DhamaNessuna valutazione finora

- Implementing Self Directed Teams - Case StudyDocumento2 pagineImplementing Self Directed Teams - Case StudySam854413% (8)

- Cineplex's Loyalty Program: Boosting Moviegoing & ConcessionsDocumento1 paginaCineplex's Loyalty Program: Boosting Moviegoing & ConcessionsAjeng Kartika0% (1)

- The New Years Eve CrisisDocumento6 pagineThe New Years Eve CrisisDipta Bhanu BakshiNessuna valutazione finora

- Arcor GroupDocumento3 pagineArcor GroupSonu Avinash Singh0% (1)

- Case Questions - HarleyDocumento6 pagineCase Questions - HarleyAlexis ChatzialexiouNessuna valutazione finora

- Marketing Research: Bay Madison IncDocumento12 pagineMarketing Research: Bay Madison IncpavanNessuna valutazione finora

- Section Cola WarsDocumento13 pagineSection Cola WarsShubham MehtaNessuna valutazione finora

- Haier Group: OEC ManagementDocumento10 pagineHaier Group: OEC ManagementNitinchandan KumarNessuna valutazione finora

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Documento6 pagineQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607Nessuna valutazione finora

- Facebook Acquires WhatsAppDocumento7 pagineFacebook Acquires WhatsAppJoel DavisNessuna valutazione finora

- Becton DickinsonDocumento3 pagineBecton Dickinsonanirudh_860% (2)

- Apple Harvesting in IndiaDocumento38 pagineApple Harvesting in Indiaphani_mtpNessuna valutazione finora

- Panera Bread Company SWOT Analysis and Strategic Plan for Franchise ExpansionDocumento6 paginePanera Bread Company SWOT Analysis and Strategic Plan for Franchise ExpansiontomNessuna valutazione finora

- This Study Resource Was: Global Strategy at LenovoDocumento3 pagineThis Study Resource Was: Global Strategy at LenovoAnukriti ShakyawarNessuna valutazione finora

- EMI's CT Scanner Diversification OpportunityDocumento4 pagineEMI's CT Scanner Diversification OpportunityMayuresh D PradhanNessuna valutazione finora

- Case Study Introducing New Coke Group C7Documento10 pagineCase Study Introducing New Coke Group C7atul boscoNessuna valutazione finora

- Elon Musk's Leadership Keeps Tesla Motors RunningDocumento5 pagineElon Musk's Leadership Keeps Tesla Motors RunningArjohn GeocalloNessuna valutazione finora

- Ebay CAGEDocumento1 paginaEbay CAGEPushkar SinhaNessuna valutazione finora

- United Beverage Case AnalysisDocumento5 pagineUnited Beverage Case AnalysisEric DiamondNessuna valutazione finora

- 03.McAfee. Mastering The Three Worlds of Information TechnologyDocumento10 pagine03.McAfee. Mastering The Three Worlds of Information Technology5oscilantesNessuna valutazione finora

- Policy Implications of Autonomous VehiclesDocumento16 paginePolicy Implications of Autonomous VehiclesCato InstituteNessuna valutazione finora

- Structural Analysis of Telecommunication and Tele Services IndustryDocumento6 pagineStructural Analysis of Telecommunication and Tele Services IndustryVigneshwarNessuna valutazione finora

- Levendary Cafe The China ChallengeDocumento13 pagineLevendary Cafe The China Challengeyogendra choukikerNessuna valutazione finora

- Canadian Blood ServicesDocumento1 paginaCanadian Blood Servicessheetal jaimalaniNessuna valutazione finora

- 1987 MayDocumento15 pagine1987 MayJaime VillonNessuna valutazione finora

- Coors CaseDocumento11 pagineCoors Casesree785Nessuna valutazione finora

- Coors Case Study AnalysisDocumento4 pagineCoors Case Study AnalysisHannah HurstNessuna valutazione finora

- Bill Koch: The Dirty Money Behind Cape Wind OppositionDocumento7 pagineBill Koch: The Dirty Money Behind Cape Wind OppositionGreenpeace100% (1)

- 2015 Case 1 MolsonCoors 2Documento19 pagine2015 Case 1 MolsonCoors 2Gautam GuptaNessuna valutazione finora

- Company Profile: J.M. Smucker Co.Documento5 pagineCompany Profile: J.M. Smucker Co.SplatteredWNessuna valutazione finora

- Describe How Budgets Guide The Decision Making Process in Financial Management? 2. Also Outline How The Markets Influence The Budget Making Process and Outcomes?Documento1 paginaDescribe How Budgets Guide The Decision Making Process in Financial Management? 2. Also Outline How The Markets Influence The Budget Making Process and Outcomes?Муслим муслимNessuna valutazione finora

- 22.02.12 CH 14Documento2 pagine22.02.12 CH 14Муслим муслимNessuna valutazione finora

- Orgb Ch13 Molsoncoors Casehmwk JPFDocumento5 pagineOrgb Ch13 Molsoncoors Casehmwk JPFМуслим муслимNessuna valutazione finora

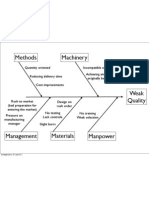

- Fishbone DiagramDocumento1 paginaFishbone DiagramМуслим муслимNessuna valutazione finora

- Buyers Guide 2010Documento12 pagineBuyers Guide 2010stvhollywoodNessuna valutazione finora

- Miller FinalDocumento20 pagineMiller FinalNikhil PalNessuna valutazione finora

- Five Forces - CoorsDocumento2 pagineFive Forces - Coorsnasr313Nessuna valutazione finora

- 01 Adolph CoorsDocumento16 pagine01 Adolph CoorsMahram Kalantari83% (6)

- Larry Brownlow Faces Career DecisionDocumento1 paginaLarry Brownlow Faces Career DecisionWl Wang100% (1)

- Haffmans Co: Recovery System Molson CoorsDocumento2 pagineHaffmans Co: Recovery System Molson CoorsPaulo SilvaNessuna valutazione finora

- Molson Brewing CompanyDocumento16 pagineMolson Brewing CompanyVictoria ColakicNessuna valutazione finora

- Moosehead Secondary Research AssignmentDocumento14 pagineMoosehead Secondary Research AssignmentMatt BeloNessuna valutazione finora

- Adolph Coors in The Brewing Industry: Take-AwaysDocumento9 pagineAdolph Coors in The Brewing Industry: Take-AwaysZANessuna valutazione finora

- Breweries in Canada: Industry ReportDocumento37 pagineBreweries in Canada: Industry ReportMatt WallNessuna valutazione finora

- Adolph Coors (1) Group 1Documento8 pagineAdolph Coors (1) Group 1HaroonNasirNessuna valutazione finora

- Adolph Coors in The Brewing IndustryDocumento12 pagineAdolph Coors in The Brewing Industryzchanna100% (3)

- TAP Molson Coors Boston Sept 2017 SlidesDocumento27 pagineTAP Molson Coors Boston Sept 2017 SlidesAla BasterNessuna valutazione finora

- Business Strategy Adolph Coors, Case StudyDocumento13 pagineBusiness Strategy Adolph Coors, Case StudyIrshad SondeNessuna valutazione finora

- Coors Assignment AnswerDocumento4 pagineCoors Assignment AnswerxebraNessuna valutazione finora

- Coors LightDocumento53 pagineCoors LightKaren NguyenNessuna valutazione finora

- ZimaDocumento8 pagineZimasoniaximenaNessuna valutazione finora

- Sabannual Report 2012Documento188 pagineSabannual Report 2012api-260265199Nessuna valutazione finora

- South Delaware Coors, IncDocumento10 pagineSouth Delaware Coors, Incagedark100% (1)

- 2015 Case 1 MolsonCoors 2Documento19 pagine2015 Case 1 MolsonCoors 2Gautam GuptaNessuna valutazione finora

- How Gay Consumers Cocreate Brand LegitimacyDocumento11 pagineHow Gay Consumers Cocreate Brand LegitimacyEstudanteSaxNessuna valutazione finora

- US Beer Market - Group 2 FinalDocumento11 pagineUS Beer Market - Group 2 FinalFrancisco Trigueiros100% (1)

- 2015 Freedom Conference ProgramDocumento24 pagine2015 Freedom Conference ProgramSteamboat InstituteNessuna valutazione finora

- Molson Canada - Evolution of Social Media MarketingDocumento16 pagineMolson Canada - Evolution of Social Media MarketingMoises VivancoNessuna valutazione finora