Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Manila Standard Today - Business Daily Stock Review (July 24, 2012)

Caricato da

Manila Standard TodayTitolo originale

Copyright

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Manila Standard Today - Business Daily Stock Review (July 24, 2012)

Caricato da

Manila Standard TodayCopyright:

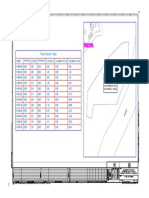

B2 WEDNESDAY

Business

ManilaStandardToday

JULY 25, 2012

extrastory2000@gmail.com

MST BUSINESS DAILY STOCKS REVIEW

M

S

T

TUESDAY, JULY 24, 2012

52 Weeks

High

Low

STOCKS

Previous

Low

Close Change Volume

High

61.00

71.85

0.71

476.00

28.50

22.20

18.54

10.20

71.00

452.00

37.00

92.10

1.96

70.05

83.10

354.20

44.00

135.00

900.00

98.95

1.72

61.25

72.00

0.71

477.00

28.50

22.75

18.70

10.20

78.00

452.00

37.00

95.30

1.96

71.50

86.00

355.00

44.00

136.30

920.00

98.95

1.74

(0.49)

(0.69)

0.00

(0.63)

1.79

0.00

0.86

(0.39)

4.00

0.18

0.00

2.47

(0.51)

(2.05)

0.00

0.00

0.00

(1.23)

1.10

(0.55)

(0.57)

5,745,550

1,540,240

41,000

94,980

3,600

75,600

1,498,900

600

3,070

10

5,000

3,617,190

40,000

170,730

560

17,550

135,900.00

727,540

410

91,520

3,100,000

(188,784,127.50)

(9,343,040.50)

34.00

8.54

19.50

1.39

1.40

27.40

2.30

150.10

2.53

9.45

5.99

6.75

18.08

76.20

19.80

0.0130

11.60

4.07

0.630

104.00

8.30

42.50

1.96

1.46

25.10

15.98

256.00

2.87

9.94

10.46

8.69

3.25

5.20

33.80

112.00

1.90

1.82

0.140

4.49

1.17

57.50

1.15

0.600

0.94

34.10

8.54

19.70

1.42

1.40

28.40

2.43

156.00

2.53

9.45

6.10

6.86

18.46

78.90

20.00

0.0140

11.60

4.10

0.630

106.00

8.30

42.50

1.99

1.46

25.25

16.00

260.00

2.90

10.00

10.46

8.80

3.28

5.20

33.90

112.00

1.92

1.82

0.140

4.50

1.18

58.10

1.18

0.600

0.94

(0.29)

(0.70)

(1.50)

0.00

(2.10)

1.43

0.00

(13.33)

(0.39)

5.59

1.16

0.88

1.99

3.61

(2.44)

0.00

0.00

0.74

(1.56)

(0.47)

(5.68)

(2.30)

(1.00)

(2.01)

0.60

(1.23)

0.78

0.35

0.00

(4.91)

0.00

0.00

(1.89)

0.00

(0.88)

(1.03)

(0.55)

0.00

0.00

(3.28)

0.61

1.72

(1.64)

1.08

2,792,800

43,000

3,800

29,000

966,000

122,900

17,000

240

180,000

100

18,721,300

1,580,900

8,457,800

1,603,330

99,000

40,000,000

100,000

78,000

135,000

875,500

20,000

300

837,000

38,000

1,201,400

2,389,400

319,060

1,652,000

1,895,700

3,000

28,000

420,000

11,000

211,000

500,860

3,101,000

34,000

300,000

785,000

8,696,000

1,846,760

1,165,000

51,000

80,000

37,692,670.00

70.50

76.80

1.82

595.00

28.50

23.90

20.70

22.00

89.00

681.00

39.20

98.00

3.06

77.80

95.00

500.00

45.50

155.20

1240.00

140.00

2.06

46.00

50.00

0.68

370.00

27.80

12.98

18.50

7.56

50.00

450.00

3.00

60.00

1.30

41.00

63.50

204.80

25.45

77.00

890.00

58.00

1.43

Banco de Oro Unibank Inc.

Bank of PI

Bankard, Inc.

China Bank

Citystate Savings

COL Financial

Eastwest Bank

Filipino Fund Inc.

First Metro Inv.

Manulife Fin. Corp.

Maybank ATR KE

Metrobank

Natl Reinsurance Corp.

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

Vantage Equities

61.55

72.50

0.71

480.00

28.00

22.75

18.54

10.24

75.00

451.20

37.00

93.00

1.97

73.00

86.00

355.00

44.00

138.00

910.00

99.50

1.75

FINANCIAL

61.50

72.50

0.71

481.00

28.50

22.75

18.72

10.20

79.50

452.00

37.00

95.40

1.96

72.00

86.00

355.00

44.00

136.30

920.00

99.50

1.74

35.50

13.58

23.90

1.70

1.65

26.50

8.00

11.98

0.97

1.08

2.96

250.00

3.07

9.70

7.00

6.75

18.00

78.55

30.90

0.02

12.36

7.40

2.35

120.00

2.12

41.00

2.30

7.41

4.83

2.80

12.50

51.50

22.50

0.0099

7.80

3.80

0.74

80.00

91.25

8.40

1.90

26.00

15.30

295.00

3.00

17.40

13.70

14.94

3.78

6.50

33.00

132.60

1.90

2.44

0.250

5.30

1.41

69.20

5.50

1.12

1.22

25.00

1.04

1.11

18.10

8.12

215.00

1.96

9.70

10.20

8.05

1.01

2.90

26.50

110.20

1.25

1.80

0.112

3.30

0.90

37.00

1.05

0.310

0.70

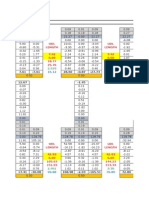

Aboitiz Power Corp.

Agrinurture Inc.

Alaska Milk Corp.

Alliance Tuna Intl Inc.

Alsons Cons.

Asiabest Group

Calapan Venture

Chemphil

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Energy Devt. Corp. (EDC)

EEI

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Ionics Inc

Jollibee Foods Corp.

Lafarge Rep

Liberty Flour

LMG Chemicals

Mabuhay Vinyl Corp.

Manila Water Co. Inc.

Megawide

Mla. Elect. Co `A

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

RFM Corporation

Salcon Power Corp.

San Miguel Brewery Inc.

San Miguel Corp `A

Seacem

Splash Corporation

Swift Foods, Inc.

Tanduay Holdings

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vulcan Indl.

34.20

8.60

20.00

1.42

1.43

28.00

2.43

180.00

2.54

8.95

6.03

6.80

18.10

76.15

20.50

0.0140

11.60

4.07

0.640

106.50

8.80

43.50

2.01

1.49

25.10

16.20

258.00

2.89

10.00

11.00

8.80

3.28

5.30

33.90

113.00

1.94

1.83

0.140

4.50

1.22

57.75

1.16

0.610

0.93

INDUSTRIAL

34.55

8.60

19.70

1.42

1.43

28.85

2.43

179.00

2.53

9.45

6.12

6.86

18.80

79.15

20.20

0.0140

11.60

4.10

0.640

107.00

8.30

42.50

2.03

1.46

25.30

16.10

268.00

2.90

10.00

10.46

8.80

3.30

5.20

34.00

113.00

1.92

1.82

0.140

4.53

1.21

59.00

1.23

0.600

0.94

1.18

59.90

0.019

13.70

2.97

5.02

6.98

3.15

4.16

485.20

64.80

5.20

0.98

520.00

5.22

36.20

4.19

6.21

1.54

3.82

4.65

6.24

7.50

0.0770

2.20

0.82

4.10

0.490

750.00

1.78

0.420

0.620

1.370

0.65

35.50

0.014

8.00

1.80

3.00

0.260

1.49

2.30

272.00

30.50

3.30

0.10

455.40

2.94

19.00

2.27

4.00

0.61

1.790

2.56

2.55

1.22

0.045

1.20

0.44

1.56

0.285

450.00

1.00

0.101

0.620

0.185

Abacus Cons. `A

Aboitiz Equity

Alcorn Gold Res.

Alliance Global Inc.

Anglo Holdings A

Anscor `A

Asia Amalgamated A

ATN Holdings A

ATN Holdings B

Ayala Corp `A

DMCI Holdings

Filinvest Dev. Corp.

Forum Pacific

GT Capital

House of Inv.

JG Summit Holdings

Jolliville Holdings

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

Marcventures Hldgs., Inc.

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

MJCI Investments Inc.

Pacifica `A

Prime Media Hldg

Prime Orion

Republic Glass A

Sinophil Corp.

SM Investments Inc.

Solid Group Inc.

Unioil Res. & Hldgs

Wellex Industries

Zeus Holdings

1.00

48.40

0.0160

11.40

1.99

4.60

5.00

2.32

2.72

410.20

56.30

4.08

0.270

530.00

5.06

31.80

2.85

5.83

1.09

2.45

4.16

5.38

6.20

0.0560

1.600

0.460

2.12

0.335

715.00

1.49

0.2260

0.3200

0.450

HOLDING FIRMS

1.03

0.94

48.95

47.30

0.0180

0.0170

11.60

11.40

2.00

1.98

4.71

4.70

5.14

4.90

2.45

2.32

2.70

2.34

421.00

405.00

57.50

55.20

4.09

4.06

0.275

0.250

530.00

525.00

4.98

4.70

31.95

31.75

2.99

2.87

6.00

5.79

1.14

1.08

2.47

2.42

4.17

4.12

5.40

5.20

6.15

5.40

0.0560

0.0560

1.520

1.520

0.480

0.460

2.12

2.12

0.335

0.335

740.00

712.50

1.50

1.49

0.2300

0.2260

0.3300

0.3100

0.450

0.440

0.94

47.30

0.0180

11.52

1.99

4.70

5.14

2.43

2.34

415.00

57.05

4.09

0.265

527.00

4.98

31.80

2.95

5.90

1.09

2.42

4.12

5.31

6.15

0.0560

1.520

0.480

2.12

0.335

740.00

1.50

0.2300

0.3100

0.440

(6.00)

(2.27)

12.50

1.05

0.00

2.17

2.80

4.74

(13.97)

1.17

1.33

0.25

(1.85)

(0.57)

(1.58)

0.00

3.51

1.20

0.00

(1.22)

(0.96)

(1.30)

(0.81)

0.00

(5.00)

4.35

0.00

0.00

3.50

0.67

1.77

(3.13)

(2.22)

78,029,000

2,694,000

36,800,000

11,677,600

150,000

130,000

12,200

876,000

5,000

1,196,240

1,784,180

36,000

230,000

99,200

41,100

1,636,500

211,000

736,100

1,492,000

1,169,000

11,055,000

86,500

200

500,000

16,000

40,000

4,000

40,000

267,320

70,000

110,000

670,000

790,000

48.00

0.83

0.218

22.85

5.62

9.00

5.66

2.90

0.127

1.11

0.90

0.310

3.06

1.44

3.80

4.50

2.33

0.42

0.990

18.86

7.71

2.70

8.95

18.20

1.03

4.55

0.80

4.50

18.00

0.38

0.150

13.36

3.08

2.26

0.80

1.20

0.060

0.67

0.54

0.10

1.63

0.98

1.21

1.50

1.51

0.168

0.080

10.00

2.51

1.80

6.00

10.94

0.64

1.80

0.45

2.60

Anchor Land Holdings Inc.

Araneta Prop `A

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Century Property

City & Land Dev.

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Highlands Prime

Keppel Properties

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Development `A

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

21.40

0.600

0.175

19.90

4.99

5.80

1.42

2.50

0.077

0.83

0.870

0.185

1.98

1.29

1.72

1.94

2.12

0.1620

0.6500

18.12

3.09

2.58

6.18

13.48

0.70

4.03

0.520

4.220

PROPERTY

21.35

20.00

0.570

0.570

0.175

0.175

20.20

19.70

4.98

4.91

5.80

5.63

1.43

1.42

2.50

2.50

0.077

0.077

0.85

0.83

0.930

0.870

0.167

0.162

2.00

1.96

1.30

1.27

1.79

1.68

2.00

1.94

2.17

2.10

0.1630

0.1610

0.6500

0.6400

18.92

18.14

3.15

3.05

2.57

2.52

6.15

6.12

13.60

13.14

0.70

0.69

4.05

4.02

0.540

0.510

4.250

4.180

21.30

0.570

0.175

19.94

4.96

5.64

1.43

2.50

0.077

0.83

0.910

0.162

1.99

1.30

1.79

1.94

2.13

0.1610

0.6400

18.80

3.09

2.57

6.14

13.26

0.69

4.05

0.540

4.220

(0.47)

(5.00)

0.00

0.20

(0.60)

(2.76)

0.70

0.00

0.00

0.00

4.60

(12.43)

0.51

0.78

4.07

0.00

0.47

(0.62)

(1.54)

3.75

0.00

(0.39)

(0.65)

(1.63)

(1.43)

0.50

3.85

0.00

2,300

18,000

200,000

13,929,700

1,318,000

10,900

182,000

16,000

20,000

1,272,000

100,539,000

730,000

677,000

3,474,000

51,000

175,000

45,400,000

3,120,000

2,141,000

3,490,500

134,000

31,000

3,286,600

7,000,100

755,000

43,000

1,100,000

3,942,000

36.60

1.55

0.630

9.00

9.58

0.1280

8.35

67.60

5.89

2.54

1149.00

10.28

70.70

0.440

6.60

2.44

0.039

1.05

0.0470

2.8500

8.50

2.74

2.80

0.75

2.46

7.28

3.00

60.00

14.60

2688.00

0.320

26.05

3.70

2.73

0.430

SERVICES

36.40

35.20

1.65

1.48

0.630

0.630

9.00

9.00

9.98

9.56

0.1320

0.1250

8.35

8.08

67.75

67.40

5.87

5.85

2.54

2.54

1192.00

1127.00

10.30

10.26

71.20

70.50

0.435

0.415

6.60

6.60

2.43

2.25

0.039

0.038

1.05

1.05

0.0500

0.0500

2.8500

2.8100

8.57

8.30

2.76

2.73

2.80

2.80

0.75

0.75

2.49

2.45

7.29

7.25

3.02

3.00

60.00

57.10

14.80

14.02

2690.00

2672.00

0.330

0.320

26.05

25.75

3.60

3.60

2.75

2.42

0.435

0.430

35.20 (3.83)

1.54 (0.65)

0.630 0.00

9.00 0.00

9.95 3.86

0.1250 (2.34)

8.21 (1.68)

67.60 0.00

5.87 (0.34)

2.54 0.00

1180.00 2.70

10.28 0.00

70.65 (0.07)

0.435 (1.14)

6.60 0.00

2.43 (0.41)

0.038 (2.56)

1.05 0.00

0.0500 6.38

2.8500 0.00

8.50 0.00

2.76 0.73

2.80 0.00

0.75 0.00

2.49 1.22

7.26

(0.27)

3.02 0.67

60.00 0.00

14.80 1.37

2680.00 (0.30)

0.320 0.00

25.90 (0.58)

3.60 (2.70)

2.74 0.37

0.435 1.16

700

2,256,000

30,000

50,000

3,875,900

8,000,000

517,800

322,490

26,000

5,000

46,595

529,600

1,637,510

350,000

2,000

37,000

64,800,000

50,000

100,000

5,000

810,900

44,000

9,000

256,000

1,180,000

14,600

381,000

4,050

2,000,500

131,215

2,250,000

4,140,000

1,000

85,000

320,000

0.0042

5.25

5.29

17.60

0.255

23.05

23.05

1.28

31.50

0.60

1.270

1.330

0.0680

0.0680

28.50

9.88

0.7000

5.000

0.0180

0.0180

6.00

21.60

37.75

0.051

39.00

221.00

0.0170

MINING & OIL

0.0042

0.0041

5.25

5.15

5.28

5.19

17.50

17.48

0.255

0.250

25.00

23.10

23.80

23.00

1.28

1.27

32.00

31.20

0.61

0.59

1.260

1.230

1.330

1.290

0.0680

0.0660

0.0670

0.0660

28.50

28.00

9.98

9.72

0.7000

0.7000

4.990

4.890

0.0180

0.0170

0.0190

0.0190

6.02

5.95

21.85

21.50

38.65

35.50

0.051

0.050

40.00

40.00

226.20

220.00

0.0170

0.0160

0.0042

5.25

5.25

17.48

0.255

24.95

23.80

1.27

31.60

0.60

1.230

1.320

0.0670

0.0670

28.35

9.88

0.7000

4.890

0.0180

0.0190

6.02

21.65

37.70

0.051

40.00

226.00

0.0160

25,000,000

46,400

213,700

172,800

3,070,000

35,100

10,000

132,000

71,300

4,004,000

13,901,000

5,259,000

60,410,000

62,920,000

481,200

397,200

10,000

735,200

6,900,000

200,000

43,000

846,700

1,335,300

176,190,000

900

259,140

91,200,000

42.00

18.98

0.78

10.92

102.80

0.5300

24.00

86.90

9.70

5.90

1270.00

11.00

77.00

0.98

6.80

4.70

34.50

3.87

0.0760

5.1900

11.12

3.85

3.96

0.84

3.15

8.58

3.32

60.00

17.88

2886.00

0.48

30.10

4.75

3.30

0.79

28.60

1.60

0.45

7.30

4.12

10.2000

6.66

62.00

5.40

1.45

831.00

6.18

43.40

0.36

4.30

2.00

0.036

1.00

0.042

2.550

5.90

2.60

2.70

0.57

1.10

4.60

1.05

18.00

12.10

2096.00

0.25

10.68

3.30

2.40

0.27

0.0083

6.20

6.22

25.20

0.380

30.35

34.00

2.51

61.80

1.21

1.82

2.070

0.085

0.087

36.50

12.84

1.100

8.40

0.032

0.033

7.05

28.95

48.00

0.062

69.00

257.80

0.029

0.0038

3.01

3.00

14.50

0.148

19.98

14.50

1.62

5.68

0.50

0.9000

1.0200

0.042

0.042

15.04

2.13

0.008

2.99

0.012

0.014

5.10

18.50

3.00

0.017

46.00

161.10

0.014

47.90

27.30

11.02

116.70

80.00

1050.00

ABS-CBN

Acesite Hotel

APC Group, Inc.

Asian Terminals Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

DFNN Inc.

Easy Call Common

Globe Telecom

GMA Network Inc.

I.C.T.S.I.

Information Capital Tech.

IPeople Inc. `A

IP Converge

IP E-Game Ventures Inc.

IPVG Corp.

Island Info

ISM Communications

Leisure & Resorts

Liberty Telecom

Macroasia Corp.

Manila Bulletin

Manila Jockey

PAL Holdings Inc.

Paxys Inc.

Phil. Seven Corp.

Philweb.Com Inc.

PLDT Common

PremiereHorizon

Puregold

Touch Solutions

Transpacific Broadcast

Waterfront Phils.

Abra Mining

Apex `A

Apex `B

Atlas Cons. `A

Basic Energy Corp.

Benguet Corp `A

Benguet Corp `B

Century Peak Metals Hldgs

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Nickelasia

Nihao Mineral Resources

Omico

Oriental Peninsula Res.

Oriental Pet. `A

Oriental Pet. `B

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

PNOC Expls `B

Semirara Corp.

United Paragon

ABS-CBN Holdings Corp.

First Gen G

6.00

GMA Holdings Inc.

107.00 PCOR-Preferred

74.50

SMC Preferred 1

1000.00 SMPFC Preferred

Net Foreign

Close

32.50

102.00

10.22

110.00

74.90

1016.00

PREFERRED

33.80

102.00

10.22

110.30

75.25

1020.00

32.40

102.00

10.12

110.20

74.90

1020.00

0.00

0.00

(0.76)

(0.68)

0.00

8.24

3.25

(0.78)

0.32

0.00

(3.15)

(0.75)

(1.47)

(1.47)

(0.53)

0.00

0.00

(2.20)

0.00

5.56

0.33

0.23

(0.13)

0.00

2.56

2.26

(5.88)

33.80 4.00

102.00 0.00

10.16 (0.59)

110.30 0.27

74.90 0.00

1020.00

4,800

4,850

91,100

13,000

1,000

0.39

Trade/Buying

(502,290.00)

(3,535,060.00)

7,209,830.00

(4,574,934.00)

2,861,300.00

3,718,000.00

(56,118,728.00)

(61,730.00)

40,961,012.00

99,280.00

39,076,666.00

6,849,255.50

23,800.00

770,240.00

5,430,121.00

(19,700.00)

13,496,895.00

44,800.00

28,247,618.00

1,066,790.00

199,300.00

3,297,206.00

(139,530.00)

(45,086,789.50)

(94,920.00)

555,300.00

(2,243,660.00)

(35,418,116.00)

(174,607,074.00)

(27,268,265.00)

(354,130.00)

(37,182.00)

2,982,080.00

(3,408,600.00)

(21,857,470.00)

26,250.00

(3,329,015.00)

4,260.00

(61,881,671.00)

257,900.00

166,000.00

(1,002,420.00)

(183,100.00)

4,282,090.00

(243,950.00)

(21,711,600.00)

(36,786,518.00)

6,200.00

(2,152,500.00)

13,109,170.00

1,218,410.00

32,960.00

(1,195,874.00)

(602,607.00)

(3,884,888.00)

25,919,850.00

(16,131,170.00)

156,000.00

(67,000.00)

(30,030.00)

(2,483,000.00)

(15,979,992.00)

41,233,370.00

(29,725,820.00)

8,600.00

(1,478,808.00)

(76,500.00)

(161,220.00)

(31,500.00)

(36,000.00)

(264,810.00)

(998,755.00)

(23,616.00)

(3,869,720.00)

132,750.00

255,000.00

(8,842,316.00)

(400,000.00)

(23,120.00)

318,650.00

500

Potrebbero piacerti anche

- Manila Standard Today - Business Daily Stock Review (October 23, 2012)Documento1 paginaManila Standard Today - Business Daily Stock Review (October 23, 2012)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Business Daily Stock Review (July 31, 2012)Documento1 paginaManila Standard Today - Business Daily Stock Review (July 31, 2012)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Business Daily Stock Review (August 15, 2012)Documento1 paginaManila Standard Today - Business Daily Stock Review (August 15, 2012)Manila Standard TodayNessuna valutazione finora

- S7, S6Documento2 pagineS7, S6Brian Jaciel Alvarado IbarraNessuna valutazione finora

- Manila Standard Today - Business Daily Stocks Review (July 17, 2012)Documento1 paginaManila Standard Today - Business Daily Stocks Review (July 17, 2012)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Business Daily Stock Review (October 25, 2012)Documento1 paginaManila Standard Today - Business Daily Stock Review (October 25, 2012)Manila Standard TodayNessuna valutazione finora

- Debt FundsDocumento36 pagineDebt FundsArmstrong CapitalNessuna valutazione finora

- Manila Standard Today - Business Daily Stock Review (September 20, 2012)Documento1 paginaManila Standard Today - Business Daily Stock Review (September 20, 2012)Manila Standard TodayNessuna valutazione finora

- Practica 2 EstadisticaDocumento18 paginePractica 2 EstadisticaJesvScitooh Arcaya EscobarNessuna valutazione finora

- Ra Proy Am 0001 04Documento1 paginaRa Proy Am 0001 04Milagros AbarcaNessuna valutazione finora

- Reacciones x (m) ϕ (rad) tg (ϕ)Documento5 pagineReacciones x (m) ϕ (rad) tg (ϕ)Gonzalo Emmanuel TettaNessuna valutazione finora

- Soportes y ReaccionesDocumento6 pagineSoportes y ReaccionesJohanMirandaNessuna valutazione finora

- Debit Rencana (1) FormatDocumento18 pagineDebit Rencana (1) FormatRully Eka P Yusuf RullyNessuna valutazione finora

- Example LOSS RateDocumento17 pagineExample LOSS Ratetjiendradjaja yaminNessuna valutazione finora

- Manila Standard Today - Business Daily Stock Review (July 26, 2012)Documento1 paginaManila Standard Today - Business Daily Stock Review (July 26, 2012)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Business Daily Stocks Review (June 14, 2012)Documento1 paginaManila Standard Today - Business Daily Stocks Review (June 14, 2012)Manila Standard TodayNessuna valutazione finora

- Planilha para Calcular Um Diagrama T-X-Y Usando A Lei de RaoultDocumento4 paginePlanilha para Calcular Um Diagrama T-X-Y Usando A Lei de RaoultPaulo GustavoNessuna valutazione finora

- BHP Group LimitedDocumento197 pagineBHP Group LimitedVasu PothunuruNessuna valutazione finora

- Tabelat Thermal Comfort IndexDocumento17 pagineTabelat Thermal Comfort IndexoutmatchNessuna valutazione finora

- Manila Standard Today - Business Daily Stocks Review (December 4, 2012)Documento1 paginaManila Standard Today - Business Daily Stocks Review (December 4, 2012)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Business Daily Stock Review (October 18, 2012)Documento1 paginaManila Standard Today - Business Daily Stock Review (October 18, 2012)Manila Standard TodayNessuna valutazione finora

- Lot Sizing - Medium RiskDocumento10 pagineLot Sizing - Medium RiskDhanil LangkersNessuna valutazione finora

- Debt FundsDocumento38 pagineDebt FundsArmstrong CapitalNessuna valutazione finora

- RESULTS LIST (KN, M)Documento1 paginaRESULTS LIST (KN, M)K KARTHIKNessuna valutazione finora

- Earthwork VolumeDocumento12 pagineEarthwork VolumeDaniel AnuchaNessuna valutazione finora

- Factor de Grupo en PernosDocumento1 paginaFactor de Grupo en PernosandresNessuna valutazione finora

- Phase of Voltage, Current, and Power, by Power FactorDocumento3 paginePhase of Voltage, Current, and Power, by Power FactorChezy DewanggaNessuna valutazione finora

- Tablas de ResumenDocumento4 pagineTablas de ResumenEliza MartinezNessuna valutazione finora

- Payroll Time Conversion ChartDocumento1 paginaPayroll Time Conversion ChartRONALYN SANTOSNessuna valutazione finora

- Kalkulus 1 CDocumento3 pagineKalkulus 1 CRendy SetiawanNessuna valutazione finora

- Manila Standard Today - Business Daily Stocks Review (May 30, 2012)Documento1 paginaManila Standard Today - Business Daily Stocks Review (May 30, 2012)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Business Daily Stocks Review (November 20, 2012)Documento1 paginaManila Standard Today - Business Daily Stocks Review (November 20, 2012)Manila Standard TodayNessuna valutazione finora

- Calif Icac I OnesDocumento3 pagineCalif Icac I OnesIsrael Osuna CabreraNessuna valutazione finora

- Movimiento de TierrasDocumento8 pagineMovimiento de TierrasWilson Ever Irigoin BustamanteNessuna valutazione finora

- Eje28 3Documento2 pagineEje28 3YeferHernanPlazasMartinezNessuna valutazione finora

- Maria Camila Diaz Carrillo Enith Lizbeth Pardo Merino Karen Valentina Villalba GalindoDocumento6 pagineMaria Camila Diaz Carrillo Enith Lizbeth Pardo Merino Karen Valentina Villalba GalindoEnith PardoNessuna valutazione finora

- Kimia Anorganik: Rekapitulasi Perbandingan Nilai Antar Waktu Data Hasil Pemantauan Kualitas Sungai Batang LembangDocumento12 pagineKimia Anorganik: Rekapitulasi Perbandingan Nilai Antar Waktu Data Hasil Pemantauan Kualitas Sungai Batang LembangSusilawati SusiNessuna valutazione finora

- Regression StatisticsDocumento4 pagineRegression StatisticsAmanNessuna valutazione finora

- Sheet Job Number Job Title Client Calcs by Checked by Date Software Consultants (Pty) LTDDocumento9 pagineSheet Job Number Job Title Client Calcs by Checked by Date Software Consultants (Pty) LTDraheemNessuna valutazione finora

- Gestao de BancaDocumento27 pagineGestao de BancazwierzykowskiadrianoNessuna valutazione finora

- Ref PVC Schedule80 IPS PlasticPipeDocumento1 paginaRef PVC Schedule80 IPS PlasticPipesirajuddin khowajaNessuna valutazione finora

- Single-Span Support: Trapez Load Tables Positive PositionDocumento1 paginaSingle-Span Support: Trapez Load Tables Positive PositionmikeshiiNessuna valutazione finora

- InvestingDocumento2 pagineInvestingDonnie PutinyNessuna valutazione finora

- Manila Standard Today - Business Daily Stocks Review (November 22, 2012)Documento1 paginaManila Standard Today - Business Daily Stocks Review (November 22, 2012)Manila Standard TodayNessuna valutazione finora

- Kreatinin Kinase MB1Documento8 pagineKreatinin Kinase MB1dmandatari7327Nessuna valutazione finora

- Compare Decimals WorksheetDocumento2 pagineCompare Decimals WorksheetAiza ConchadaNessuna valutazione finora

- Relacion Del Comité de Usuarios de Agua Ccochapata-Tupac Amaru-Canas Cód. de Parcela Areas (Ha)Documento4 pagineRelacion Del Comité de Usuarios de Agua Ccochapata-Tupac Amaru-Canas Cód. de Parcela Areas (Ha)Mijail Candia ArmutoNessuna valutazione finora

- Deposit - AlumnosDocumento7 pagineDeposit - AlumnosGabriel Inostroza MedinaNessuna valutazione finora

- Single-Span Support: Negative PositionDocumento1 paginaSingle-Span Support: Negative PositionmikeshiiNessuna valutazione finora

- MDM 9 Span 4 LayersDocumento48 pagineMDM 9 Span 4 LayersChristian BaldoNessuna valutazione finora

- Cemargos Cemargos Colcap: Varianza Desviación Estandar Coeficiente de VariaciónDocumento15 pagineCemargos Cemargos Colcap: Varianza Desviación Estandar Coeficiente de VariaciónE. Nova ONessuna valutazione finora

- Metodos de LicuacionDocumento1 paginaMetodos de LicuacionJesús MeraNessuna valutazione finora

- EJERCICIOSDocumento14 pagineEJERCICIOSapi-3712810Nessuna valutazione finora

- Aula de Geoestatica 1Documento3 pagineAula de Geoestatica 1Maria Dorcas Massa MassaNessuna valutazione finora

- Tabla IIIDocumento1 paginaTabla IIILuis Alberto Mozombite GonzalesNessuna valutazione finora

- Tabla IIIDocumento1 paginaTabla IIILuis Alberto Mozombite GonzalesNessuna valutazione finora

- Tabla #VII Valores de X Y (1+X) para Suelos No CohesivosDocumento1 paginaTabla #VII Valores de X Y (1+X) para Suelos No CohesivosLuis Alberto Mozombite GonzalesNessuna valutazione finora

- Hourly Climatic Data Eto Summary: My Weather Station-1Documento1 paginaHourly Climatic Data Eto Summary: My Weather Station-1M ArsalanNessuna valutazione finora

- Manila Standard Today - Business Daily Stock Review (October 24, 2012)Documento1 paginaManila Standard Today - Business Daily Stock Review (October 24, 2012)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (June 3, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 26, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (June 5, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (June 8, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (June 2, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (June 4, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Documento1 paginaManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 25, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 20, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 13, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 4, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 4, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 18, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Documento1 paginaManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 7, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 22, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 11, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 5, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (May 6, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (April 28, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (April 28, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (April 29, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (April 29, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (April 30, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (April 30, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (April 24, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (April 24, 2015)Manila Standard TodayNessuna valutazione finora

- Manila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Documento1 paginaManila Standard Today - Business Weekly Stock Review (April 20 - 24, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (April 22, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (April 22, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (April 23, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (April 23, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (April 16, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (April 16, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Weekly Stocks Review (April 19, 2015)Documento1 paginaThe Standard - Business Weekly Stocks Review (April 19, 2015)Manila Standard TodayNessuna valutazione finora

- The Standard - Business Daily Stocks Review (April 17, 2015)Documento1 paginaThe Standard - Business Daily Stocks Review (April 17, 2015)Manila Standard TodayNessuna valutazione finora

- Data Sheet: Permanent Magnet GeneratorDocumento2 pagineData Sheet: Permanent Magnet Generatordiegoadjgt100% (1)

- UNIT 6 - Dr. Cemre Erciyes PDFDocumento24 pagineUNIT 6 - Dr. Cemre Erciyes PDFMaries San PedroNessuna valutazione finora

- Hyster Forklift Class 5 Internal Combustion Engine Trucks g019 h13xm h12xm 12ec Service ManualsDocumento23 pagineHyster Forklift Class 5 Internal Combustion Engine Trucks g019 h13xm h12xm 12ec Service Manualsedwinodom070882sad100% (71)

- Barnett V Chelsea and Kensington Hospital Management CommitteeDocumento3 pagineBarnett V Chelsea and Kensington Hospital Management CommitteeArpit Soni0% (1)

- Dominar 400 Spare Parts CatalogueDocumento82 pagineDominar 400 Spare Parts CatalogueAkshayaNessuna valutazione finora

- Successfully Allocating Risk and Negotiating A PPP ContractDocumento12 pagineSuccessfully Allocating Risk and Negotiating A PPP ContractWilliam Tong100% (1)

- Centurion Bank of PunjabDocumento7 pagineCenturion Bank of Punjabbaggamraasi1234Nessuna valutazione finora

- Sowk-625 Iq Tool 4Documento22 pagineSowk-625 Iq Tool 4api-405320544Nessuna valutazione finora

- KEC International Limited: Pile FoundationDocumento49 pagineKEC International Limited: Pile FoundationDinesh Kumar100% (1)

- Definition of Sustainable Packaging PDFDocumento10 pagineDefinition of Sustainable Packaging PDFProf C.S.PurushothamanNessuna valutazione finora

- County Project Name Cycle Project Address Proj City Proj Zip Applicant/Owner Name HDGP $ Home $ FHTF $ Lihtc9 $ Help $ Oahtc $ Ghap $ HPF $ Lihtc4 $Documento60 pagineCounty Project Name Cycle Project Address Proj City Proj Zip Applicant/Owner Name HDGP $ Home $ FHTF $ Lihtc9 $ Help $ Oahtc $ Ghap $ HPF $ Lihtc4 $Mamello PortiaNessuna valutazione finora

- Chapter 3 - A Top-Level View of Computer Function and InterconnectionDocumento8 pagineChapter 3 - A Top-Level View of Computer Function and InterconnectionChu Quang HuyNessuna valutazione finora

- 1 Introduction To Pharmaceutical Dosage Forms Part1Documento32 pagine1 Introduction To Pharmaceutical Dosage Forms Part1Joanna Carla Marmonejo Estorninos-Walker100% (1)

- VAT (Chapter 8 Compilation of Summary)Documento36 pagineVAT (Chapter 8 Compilation of Summary)Dianne LontacNessuna valutazione finora

- List of Approved Journals For Promoting Purposes at The University of JordanDocumento3 pagineList of Approved Journals For Promoting Purposes at The University of JordanZaid MarwanNessuna valutazione finora

- Baterías YuasaDocumento122 pagineBaterías YuasaLuisNessuna valutazione finora

- Network Protection Automation Guide Areva 1 PDFDocumento500 pagineNetwork Protection Automation Guide Areva 1 PDFEmeka N Obikwelu75% (4)

- Eletrical InstallationDocumento14 pagineEletrical InstallationRenato C. LorillaNessuna valutazione finora

- Ecb 3Documento17 pagineEcb 3chakradhar pmNessuna valutazione finora

- 2008 Reverse Logistics Strategies For End-Of-life ProductsDocumento22 pagine2008 Reverse Logistics Strategies For End-Of-life ProductsValen Ramirez HNessuna valutazione finora

- Cattle Feed Close Tenders in BikanerDocumento9 pagineCattle Feed Close Tenders in BikanerCodm DutyNessuna valutazione finora

- Fpga De0-Nano User Manual PDFDocumento155 pagineFpga De0-Nano User Manual PDFCesarNessuna valutazione finora

- Model: The Most Accepted and Respected Engine-Driven Cooler in The Gas Compression IndustryDocumento2 pagineModel: The Most Accepted and Respected Engine-Driven Cooler in The Gas Compression IndustryparathasiNessuna valutazione finora

- LIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - EngDocumento13 pagineLIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - Engnakka_rajeevNessuna valutazione finora

- Hydraulic Breakers in Mining ApplicationDocumento28 pagineHydraulic Breakers in Mining ApplicationdrmassterNessuna valutazione finora

- Andaman & Nicobar: Port BlairDocumento4 pagineAndaman & Nicobar: Port BlairDevan BhallaNessuna valutazione finora

- Consolidated Companies ListDocumento31 pagineConsolidated Companies ListSamir OberoiNessuna valutazione finora

- Tarlac - San Antonio - Business Permit - NewDocumento2 pagineTarlac - San Antonio - Business Permit - Newarjhay llave100% (1)

- ABES Engineering College, Ghaziabad Classroom Photograph: (Ramanujan Block, First Floor)Documento21 pagineABES Engineering College, Ghaziabad Classroom Photograph: (Ramanujan Block, First Floor)Avdhesh GuptaNessuna valutazione finora

- Soal TKM B. Inggris Kls XII Des. 2013Documento8 pagineSoal TKM B. Inggris Kls XII Des. 2013Sinta SilviaNessuna valutazione finora