Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Mutual Fund 200: Chap. 1

Caricato da

Megha Jain BhandariDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Mutual Fund 200: Chap. 1

Caricato da

Megha Jain BhandariCopyright:

Formati disponibili

MUTUAL FUND 200 9

Chap. 1

INTRODUCTION

The one investment vehicle that has truly come of age in India in the past decade is Mutual Funds. Today, the Mutual Fund industry in the country manages around Rs 329,162 crore (As of Dec, 2006) of assets, a large part of which comes from retail investors. And this amount is invested not just in equities, but also in the entire gamut of debt instruments. Mutual Funds have emerged as a proxy for investing in avenues that are out of reach of most retail investors, particularly government securities and money market instruments. Specialization is the order of the day, be it with regard to a schemes investment objective or its targeted investment universe. Given the plethora of options on hand and the hard-sell adopted by Mutual Funds vying for a piece of your savings, finding the right scheme can sometimes seem a bit daunting. Mind you, its not just about going with the fund that gives you the highest returns. Its also about managing risk finding funds that suit your risk appetite and investment needs. So, how can you, the retail investor, create wealth for yourself by investing through Mutual Funds? To answer that, we need to get down to brass tackswhat exactly is a Mutual Fund?

1

MUTUAL FUND 200 9

What is Mutual Fund? To state in simple words, a Mutual Fund collects the saving from small

investors, invest in Government and other corporate securities and earn income through interest and dividends, besides capital gain. It works on the principle of small drops of water make a big ocean.

For instance, if one has Rs.1000 to invest, it may not fetch very much on its own. But, when it is pooled with Rs.1000 each from a lot of other people, then, one could create a big fund large enough to invest in a wide varieties of shares and debentures on a commanding scale and thus, to enjoy the economies of large scale operation. Hence, a Mutual Fund is nothing but a form of collective investment. It is formed by the coming together of a number of investors who transfer their surplus funds to a professionally qualified organization to manage it. To get the surplus funds from the investors, the fund adopts a simple technique, each fund is divided into a small fraction called unit of equal value.

2

MUTUAL FUND 200 9

Each investors is allocated units in proportion to the size of his investment. Thus, every investors, whether big or small, will have a stake in the fund and can enjoy the wide portfolio of the investment held by the fund. Hence, Mutual Funds enable millions of small and large investors to participate in and derive the benefit of the capital market growth. It has emerged as a popular vehicle of creation of wealth due to high return, lower cost and diversified risk.

DEFINITION: The Securities and Exchange Board of India (SEBI) (Mutual Fund) Regulation,

1993 defines a Mutual Fund as a fund established in the form of a trust by sponsor, to raise monies by the trustees through the sale of units to public, under one or more schemes, for investing in securities in accordance with these regulations.

These Mutual Fund are referred to as Unit Trust in the U.K. and as open end investment companies in the U.S.A. therefore, Kamm, J.O. defines an open end investment company as an organization formed for the investment of funds obtained from individual and institutional investors who in exchange for the funds receive shares which can be redeemed at any time at their underlying asset values.

MUTUAL FUND 200 9

Fund Unit vs. Share: Just like share, the price of units of a

fund is also quoted in the market. This price is governed basically by the value of underlying investment held by that fund. At this juncture, one should not confuse a Mutual Fund investment on units with that of an investment on equity shares. Investment on equity share represents investment in a particular company alone. On the other hand, investment on an unit of a fund represents investment in the parts of shares of a large number of companies. This itself gives an idea how safe the units are. If a particular company fails, the shareholder of that company are affected very much whereas the unit holders of that company are able to withstand that risk by means of their profitable holdings in other companies shares. Again, investment on equity shares can be used as a tool by speculators and inveterate stock market enthusiasts with a view to gaining abnormal profits. These people play an investment game in the stock market on the basis of daily movement of prices. But, Mutual Fund cannot be invested for such purposes and the Mutual Fund is not at all concerned with the daily ebbs and flows of the market. In short, Mutual Fund is not the right investment vehicle for speculators. Mutual Funds are, therefore, suitable only to genuine investors whereas shares are suitable to both the genuine investors and the speculators.

MUTUAL FUND 200 9

ORIGIN OF MUTUAL FUND: The origin of the concept of Mutual Fund dates back to the very dawn of

commercial history. It is said that Egyptians and Phoenicians sold their shares in vessels and caravans with a view to spreading the risk attached with these risky ventures. However, the real credit of introducing the modern concept of Mutual Fund goes to the Foreign and Colonial Government Trust of London established in 1868. Thereafter, a large number of close-ended Mutual Funds were formed in the U.S.A. in 1930s followed by many countries in Europe, the Far East and Latin America. In most of the countries, both open and close-ended types were popular. In India, it gained momentum only in 1980, through it began in the year 1964 with the Unit Trust of India launching its first fund, the Unit Scheme 1964. ADVANTAGES OF MUTUAL FUND: 1. Professional Management: Mutual Funds provide the services of experienced and skilled professionals, that analyses the performance and prospects of companies and selects suitable investments to achieve the objectives of the scheme. This risk of default by any company, can be minimized by investing in Mutual Funds as the fund managers analyze the companies financials more minutely than an individual can do as they have the expertise to do so. They can manage the maturity of their portfolio by investing in instruments of varied maturity profiles.

MUTUAL FUND 200 9

2. Diversification: Mutual Funds invest in a number of companies across a broad crosssection of industries and sectors. This diversification reduces the risk because seldom do all stocks decline at the same time and in the same proportion. It is less expensive. 3. Convenient Administration: Investing in a Mutual Fund reduces paperwork and helps you avoid many problems such as bad deliveries, delayed payments and follow up with brokers and companies. Mutual Funds save your time and make investing easy and convenient. 4. Return Potential: Over a medium to long-term, Mutual Funds have the potential to provide a higher return as they invest in a diversified basket of selected securities. Apart from liquidity, these funds have also provided very good post-tax returns on year to year basis. Even historically, we find that some of the debt funds have generated superior returns at relatively low level of risks. On an average debt funds have posted returns over 10 percent over one-year horizon. The best performing funds have given returns of around 14 percent in the last one-year period. In nutshell we can say that these funds have delivered more than what one expects of debt avenues such as post office schemes or bank fixed deposits.

5.

Liquidity:

6

MUTUAL FUND 200 9

In open-end schemes, the investor gets the money back promptly at net asset value related prices from the Mutual Fund. In closed-end schemes, the units can be sold on a stock exchange at the prevailing market price or the investor can avail of the facility of direct repurchase at NAV related prices by the Mutual Fund. Moreover, Mutual Funds are better placed to absorb the fluctuations in the prices of the securities as a result of interest rate variation and one can benefits from any such price movement. 6. Transparency: Investors get regular information on the value of your investment in addition to disclosure on the specific investments made by your scheme, the proportion invested in each class of assets and the fund manager's investment strategy and outlook. 7. Flexibility: Through features such as regular investment plans, regular withdrawal plans and dividend reinvestment plans; you can systematically invest or withdraw funds according to your needs and convenience. 8. Affordability: Investing through MF route enables an investor to invest in many good stocks and reap benefits even through a small investment. Investors individually may lack sufficient funds to invest in high-grade stocks. A Mutual Fund because of its large corpus allows even a small investor to take the benefit of its investment strategy. 9. Well Regulated:

7

MUTUAL FUND 200 9

All Mutual Funds are registered with SEBI and they function within the provisions of strict regulations designed to protect the interests of investors. The operations of Mutual Funds are regularly monitored by SEBI. 10. Tax Benefits: Last but not the least, Mutual Funds offer significant tax advantages. Dividends distributed by them are tax-free in the hands of the investor. They also give you the advantages of capital gains taxation. If you hold units beyond one year, you get the benefits of indexation. This reduces your tax liability. Whats more, tax-saving schemes and pension schemes give you the added advantage of benefits under Section 88. You can avail of a 20 per cent tax exemption on an investment of up to Rs 10,000 in the scheme in a year. DISADVATAGES OF MUTUAL FUND: Even Mutual Funds have some inherent drawbacks. Understand these before you commit your money to a Mutual Fund.

1. No assured returns and no protection of capital:

If you are planning to go with a Mutual Fund, this must be your mantra: Mutual Funds do not offer assured returns and carry risk. For instance, unlike bank deposits, your investment in a Mutual Fund can fall in value. In addition, Mutual Funds are not insured or guaranteed by any government body (unlike a bank deposit, where up to Rs 1 lakh per bank is insured by the Deposit and Credit Insurance Corporation, a subsidiary of the Reserve Bank of India).

2. Restrictive gains:

8

MUTUAL FUND 200 9

Diversification helps, if risk minimization is your objective. However, the lack of investment focus also means you gain less than if you had invested directly in a single security.

3. Management risk:

When you invest in a Mutual Fund, you depend on the fund's manager to make the right decisions regarding the fund's portfolio. If the manager does not perform as well as you had hoped, you might not make as much money on your investment as you expected. Of course, if you invest in Index Funds, you forego management risk, because these funds do not employ managers.

4. Fees and commissions:

All funds charge administrative fees to cover their day-to-day expenses. Some funds also charge sales commissions or "loads" to compensate brokers, financial consultants, or financial planners. Even if you don't use a broker or other financial adviser, you will pay a sales commission if you buy shares in a Load Fund.

5. Cash, cash and more cash:

As you know already, Mutual Funds pool money from thousands of investors, so everyday investors are putting money into the fund as well as withdrawing investments. To maintain liquidity and the capacity to accommodate withdrawals, funds typically have to keep a large portion of their portfolios as cash. Having ample cash is great for liquidity, but money sitting around as cash is not working for you and thus is not very advantageous.

9

MUTUAL FUND 200 9

6. Misleading advertisement:

The misleading advertisements of different funds can guide investors down the wrong path. Some funds may be incorrectly labeled as growth funds, while others are classified as small cap or income funds. The Securities and Exchange Commission (SEC) requires that funds have at least 80% of assets in the particular type of investment implied in their names. How the remaining assets are invested is up to the fund manager.

7. Evaluating Funds:

Another disadvantage of Mutual Funds is the difficulty they pose for investors interested in researching and evaluating the different funds. Unlike stocks, Mutual Funds do not offer investors the opportunity to compare the P/E ratio, sales growth, earnings per share, etc. A Mutual Fund's net asset value gives investors the total value of the fund's portfolio less liabilities. Always note that Mutual Fund descriptions/advertisements always include the tagline "past results are not indicative of future returns". Be sure not to pick funds only because they have performed well in the past - yesterday's big winners may be today's big losers.

8. Dilution:

It's possible to have too much diversification. Because funds have small holdings in so many different companies, high returns from a few investments often don't make much difference on the overall return. Dilution is also the result of a successful fund getting too big. When money pours into funds that have had

10

MUTUAL FUND 200 9

strong success, the manager often has trouble finding a good investment for all the new money.

CHAP. 2

HISTORY OF MUTUAL FUND

The origin of Mutual Fund industry in India is with the introduction of the concept of Mutual Fund by UTI in the year 1963. Though the growth was slow, but it accelerated from the year 1987 when non-UTI players entered the industry. In the past decade, Indian Mutual Fund industry had seen dramatic improvements, both quality wise as well as quantity wise. The main reason of its poor growth is that the Mutual Fund industry in India is new in the country. Large sections of Indian investors are yet to be intellectuated with the concept. Hence, it is the prime responsibility of all Mutual Fund companies, to market the product correctly atleast of selling. The Mutual Fund industry can be broadly put into four phases according to the development of the sector. Each phase is briefly described as under.

First Phase - 1964-87

11

MUTUAL FUND 200 9

Unit Trust of India (UTI) was established on 1963 by an Act of Parliament. It was set up by the Reserve Bank of India and functioned under the Regulatory and administrative control of the Reserve Bank of India. In 1978 UTI was de-linked from the RBI and the Industrial Development Bank of India (IDBI) took over the regulatory and administrative control in place of RBI. The first scheme launched by UTI was Unit Scheme 1964. At the end of 1988 UTI had Rs.6,700 crores of assets under management.

Second Phase - 1987-1993 (Entry of Public Sector Funds) Entry of non-UTI Mutual Funds. SBI Mutual Fund was the first followed by Canbank Mutual Fund (Dec 87), Punjab National Bank Mutual Fund (Aug 89), Indian Bank Mutual Fund (Nov 89), Bank of India (Jun 90), Bank of Baroda Mutual Fund (Oct 92). LIC in 1989 and GIC in 1990. The end of 1993 marked Rs.47,004 as assets under management.

Third Phase - 1993-2003 (Entry of Private Sector Funds) With the entry of private sector funds in 1993, a new era started in the Indian Mutual Fund industry, giving the Indian investors a wider choice of fund families. Also, 1993 was the year in which the first Mutual Fund Regulations came into being, under which all Mutual Funds, except UTI were to be registered and governed. The erstwhile Kothari Pioneer (now merged with Franklin Templeton) was the first private sector Mutual Fund registered in July 1993.

12

MUTUAL FUND 200 9

The 1993 SEBI (Mutual Fund) Regulations were substituted by a more comprehensive and revised Mutual Fund Regulations in 1996. The industry now functions under the SEBI (Mutual Fund) Regulations 1996. The number of Mutual Fund houses went on increasing, with many foreign Mutual Funds setting up funds in India and also the industry has witnessed several mergers and acquisitions. As at the end of January 2003, there were 33 Mutual Funds with total assets of Rs. 1,21,805 crores. The Unit Trust of India with Rs.44,541 crores of assets under management was way ahead of other Mutual Funds.

Fourth Phase - since February 2003 This phase had bitter experience for UTI. It was bifurcated into two separate entities. One is the Specified Undertaking of the Unit Trust of India with AUM of Rs.29,835 crores (as on January 2003). The Specified Undertaking of Unit Trust of India, functioning under an administrator and under the rules framed by Government of India and does not come under the purview of the Mutual Fund Regulations. The second is the UTI Mutual Fund Ltd, sponsored by SBI, PNB, BOB and LIC. It is registered with SEBI and functions under the Mutual Fund Regulations. With the bifurcation of the erstwhile UTI which had in March 2000 more than Rs.76,000 crores of AUM and with the setting up of a UTI Mutual Fund, conforming to the SEBI Mutual Fund Regulations, and with recent mergers taking place among different private sector funds, the Mutual Fund industry has entered its current phase of consolidation and growth. As at the end of September, 2004, there were 29 funds, which manage assets of Rs.153108 crores under 421 schemes.

13

MUTUAL FUND 200 9

The graph indicates the growth over the years.

14

MUTUAL FUND 200 9

CHAP. 3

Mutual Fund Companies in India

The concept of mutual funds in India dates back to the year 1963. The era between 1963 and 1987 marked the existance of only one mutual fund company in India with Rs. 67bn assets under management (AUM), by the end of its monopoly era, the Unit Trust of India (UTI). By the end of the 80s decade, few other mutual fund companies in India took their position in mutual fund market. The new entries of mutual fund companies in India were SBI Mutual Fund, Canbank Mutual Fund, Punjab National Bank Mutual Fund, Indian Bank Mutual Fund, Bank of India Mutual Fund. The succeeding decade showed a new horizon in indian mutual fund industry. By the end of 1993, the total AUM of the industry was Rs. 470.04 bn. The private sector funds started penetrating the fund families. In the same year the first Mutual Fund Regulations came into existance with re-registering all mutual funds except UTI. The regulations were further given a revised shape in 1996.

15

MUTUAL FUND 200 9

Kothari Pioneer was the first private sector mutual fund company in India which has now merged with Franklin Templeton. Just after ten years with private sector players penetration, the total assets rose up to Rs. 1218.05 bn. Today there are 33 mutual fund companies in India.

Major Mutual Fund Companies in India:

ABN AMRO Mutual Fund ABN AMRO Mutual Fund was setup on April 15,

2004 with ABN AMRO Trustee (India) Pvt. Ltd. as the Trustee Company. The AMC, ABN AMRO Asset Management (India) Ltd. was incorporated on November 4, 2003. Deutsche Bank A G is the custodian of ABN AMRO Mutual Fund. Birla Sun Life Mutual Fund Birla Sun Life Mutual Fund is the joint venture of Aditya Birla Group and Sun Life Financial. Sun Life Financial is a golbal organisation evolved in 1871 and is being represented in Canada, the US, the Philippines, Japan, Indonesia and Bermuda apart from India. Birla Sun Life Mutual Fund follows a conservative long-term approach to investment. Recently it crossed AUM of Rs. 10,000 crores. Bank of Baroda Mutual Fund (BOB Mutual Fund)

16

MUTUAL FUND 200 9

Bank of Baroda Mutual Fund or BOB Mutual Fund was setup on October 30, 1992 under the sponsorship of Bank of Baroda. BOB Asset Management Company Limited is the AMC of BOB Mutual Fund and was incorporated on November 5, 1992. HDFC Mutual Fund HDFC Mutual Fund was setup on June 30, 2000 with two sponsorers nemely Housing Development Finance Corporation Limited and Standard Life Investments Limited.

HSBC Mutual Fund HSBC Mutual Fund was setup on May 27, 2002 with

HSBC Securities and Capital Markets (India) Private Limited as the sponsor. Board of Trustees, HSBC Mutual Fund acts as the Trustee Company of HSBC Mutual Fund. ING Vysya Mutual Fund ING Vysya Mutual Fund was setup on February 11, 1999 with the same named Trustee Company. It is a joint venture of Vysya and ING. The AMC, ING Investment Management (India) Pvt. Ltd. was incorporated on April 6, 1998. Prudential ICICI Mutual Fund The mutual fund of ICICI is a joint venture with Prudential Plc. of America, one of the largest life insurance companies in the US of A. Prudential ICICI Mutual Fund

17

MUTUAL FUND 200 9

was setup on 13th of October, 1993 with two sponsorers, Prudential Plc. and ICICI Ltd. The Trustee Company formed is Prudential ICICI Trust Ltd. and the AMC is Prudential ICICI Asset Management Company Limited incorporated on 22nd of June, 1993.

Sahara Mutual Fund Sahara Mutual Fund was set up on July 18, 1996 with Sahara India Financial

Corporation Ltd. as the sponsor. Sahara Asset Management Company Private Limited incorporated on August 31, 1995 works as the AMC of Sahara Mutual Fund. The paid-up capital of the AMC stands at Rs 25.8 crore. State Bank of India Mutual Fund State Bank of India Mutual Fund is the first Bank sponsored Mutual Fund to launch offshor fund, the India Magnum Fund with a corpus of Rs. 225 cr. approximately. Today it is the largest Bank sponsored Mutual Fund in India. They have already launched 35 Schemes out of which 15 have already yielded handsome returns to investors. State Bank of India Mutual Fund has more than Rs. 5,500 Crores as AUM. Now it has an investor base of over 8 Lakhs spread over 18 schemes.

18

MUTUAL FUND 200 9

Tata Mutual Fund Tata Mutual Fund (TMF) is a Trust under the Indian

Trust Act, 1882. The sponsorers for Tata Mutual Fund are Tata Sons Ltd., and Tata Investment Corporation Ltd. The investment manager is Tata Asset Management Limited and its Tata Trustee Company Pvt. Limited. Tata Asset Management Limited's is one of the fastest in the country with more than Rs. 7,703 crores (as on April 30, 2005) of AUM.

Kotak Mahindra Mutual Fund Kotak Mahindra Asset Management Company (KMAMC) is a subsidiary of KMBL. It is presently having more than 1,99,818 investors in its various schemes. KMAMC started its operations in December 1998. Kotak Mahindra Mutual Fund offers schemes catering to investors with varying risk - return profiles. It was the first company to launch dedicated gilt scheme investing only in government securities. Unit Trust of India Mutual Fund UTI Asset Management Company Private Limited, established in Jan 14, 2003, manages the UTI Mutual Fund with the support of UTI Trustee Company Privete Limited. UTI Asset Management Company presently manages a corpus of over Rs.20000 Crore. The sponsorers of UTI Mutual Fund are Bank of Baroda (BOB), Punjab National Bank (PNB), State Bank of India (SBI), and Life Insurance Corporation of India (LIC). The schemes of UTI Mutual Fund are Liquid Funds, Income Funds, Asset Management Funds, Index Funds, Equity Funds and Balance Funds.

19

MUTUAL FUND 200 9

Reliance Mutual Fund Reliance Mutual Fund (RMF) was established as trust under Indian Trusts Act, 1882. The sponsor of RMF is Reliance Capital Limited and Reliance Capital Trustee Co. Limited is the Trustee. It was registered on June 30, 1995 as Reliance Capital Mutual Fund which was changed on March 11, 2004. Standard Chartered Mutual Fund Standard Chartered Mutual Fund was set up on March 13, 2000 sponsored by Standard Chartered Bank. The Trustee is Standard Chartered Trustee Company Pvt. Ltd. Standard Chartered Asset Management Company Pvt. Ltd. is the AMC which was incorporated with SEBI on December 20,1999. Franklin Templeton India Mutual Fund The group, Franklin Templeton Investments is a California (USA) based company with a global AUM of US$ 409.2 bn. (as of April 30, 2005). It is one of the largest financial services groups in the world. Investors can buy or sell the Mutual Fund through their financial advisor or through mail or through their website. They have Open end Diversified Equity schemes, Open end Sector Equity schemes, Open end Hybrid schemes, Open end Tax Saving schemes, Open end Income and Liquid schemes, Closed end Income schemes and Open end Fund of Funds schemes to offer.

20

MUTUAL FUND 200 9

LIC Mutual Fund Life Insurance Corporation of India set up LIC Mutual Fund on 19th June 1989. It contributed Rs. 2 Crores towards the corpus of the Fund. LIC Mutual Fund was constituted as a Trust in accordance with the provisions of the Indian Trust Act, 1882. . The Company started its business on 29th April 1994. The Trustees of LIC Mutual Fund have appointed Jeevan Bima Sahayog Asset Management Company Ltd as the Investment Managers for LIC Mutual Fund. GIC Mutual Fund GIC Mutual Fund, sponsored by General Insurance Corporation of India (GIC), a Government of India undertaking and the four Public Sector General Insurance Companies, viz. National Insurance Co. Ltd (NIC), The New India Assurance Co. Ltd. (NIA), The Oriental Insurance Co. Ltd (OIC) and United India Insurance Co. Ltd. (UII) and is constituted as a Trust in accordance with the provisions of the Indian Trusts Act, 1882.

21

MUTUAL FUND 200 9

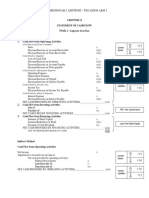

TOP 10 MUTUAL FUND COMPANIES IN INDIA

NO. NAME OF MUTUAL 1. FUND HDFC Mutual Fund INCEPTIO N DATE June 30th 2000 HDFC Trustee Company Ltd.

TRUSTEE

Top Performing Schemes AUM as on

30th April 09 HDFC Top 200 (2338 cr) HDFC Equity (2759.30 cr) HDFC MIP Longterm (887.90 cr) Tata Pure Equity (269.95 cr) Tata Index Nifty (6.77 cr) Tata Short-term Bond (292.08 cr) Magnum Contra (1,958.50 cr) Magnum Balanced

2.

Tata Mutual Fund June 30th 1995

Tata Trustee Company Pvt. Ltd

3.

SBI Mutual Fund

June 29th 1987

SBI Mutual Fund Trustee Company Pvt.

22

MUTUAL FUND 200 9

Ltd

(333.11 cr) Magnum Multiplier Plus (687.15 cr)

4.

Reliance Mutual Fund

June 30th 1995

Reliance Capital Trustee Company Ltd.

Reliance MIP (168.52 cr) Reliance Banking Retail (681.25 cr) Reliance Diversified Power Sector Fund (3809.57 cr) DSPBR top 100 Equity (1167.08 cr) DSPBR Equity (919.77 cr) DSPBR GSF Longer Duration (425.67 cr) Kotak Bond Reular (445.69 cr) Kotak 30 (688.14 cr) Kotak opportunities (658.50 cr) Principal Child Benefit (19.81 cr) Principal Index (21.88 cr) Principal Personal

5.

DSP BlackRock Mutual Fund

December 16th 1996

DSP Merrill Lynch Trustee Company Pvt. Ltd

6.

Kotak Mutual Fund

June 23rd 1998

Kotak Mahindra Trustee Company Ltd

7.

Principal Mutual Fund

November 25th 1994

Principal Trustee Co. Pvt. Ltd

23

MUTUAL FUND 200 9

Tax Saver (332.53 cr)

8.

Sundaram BNP Paribas Mutual Fund

August 24th 1996

Sundaram BNP Paribas Trustee Company Limited

Sundaram BNP Paribas taxsaver (703.54 cr) Sundaram BNP Paribas Select Focus Fund (880.78 cr) Sundaram BNP Paribas Bond Saver (59.12 cr) Franklin India Blue Chip Fund (1642.87 cr) Templeton IGSF PF (32.68 cr) Franklin India Prima Plus (1153.20 cr) Birla GSF Long Term (10.48 cr.) Birla Frontline Equity (481.14 cr) Birla'95 (127.12 cr)

9.

Franklin Templeton Mutual Fund

February 19th Franklin 1996 Templeton Trustee Services Pvt. Ltd

10.

Birla Sun Life Mutual Fund

December 24th 1994

Birla Sun Life Trustee Co. Ltd

24

MUTUAL FUND 200 9

CHAP. 4

IMPORTANCE OF MUTUAL FUND

Mutual Funds have come as a much needed help to these investors. It is a special type of Institutional device or an investment vehicle through which the investors Pool their savings which are to be invested under the guidance of a team of Experts in wide variety of portfolios of Corporate securities in such a way, So as to minimize risk, while ensuring safety and steady return on investment. It forms an important part of the capital market, providing the benefits of a diversified portfolio and expert fund management to a large number, particularly small investors. Now a day, Mutual Fund is gaining its popularity due to the following reasons: With the emphasis on increase in domestic savings and improvement in

1.

deployment of investment through markets, the need and scope for Mutual Fund operation has increased tremendously. The basic purpose of reforms in the financial sector was to enhance the generation of domestic Tripathy, Mutual Fund in India: This calls for a market based institution which can tap the vast potential of domestic

25

MUTUAL FUND 200 9

savings and chanalise them for profitable investments. Mutual Funds are not only best suited for the purpose but also capable of meeting this challenge. As Mutual Funds are managed by professionals, they are considered to

2.

have a better knowledge of market behaviors. Besides, they bring a certain competence to their job. They also maximize gains by proper selection and timing of investment. Another important thing is that the dividends and capital gains are

3.

reinvested automatically in Mutual Funds and hence are not fritted away. The automatic reinvestment feature of a Mutual Fund is a form of forced saving and can make a big difference in the long run. The Mutual Fund operation provides a reasonable protection to investors.

4.

Besides, presently all Schemes of Mutual Funds provide tax relief under Section 80 L of the Income Tax Act and in addition, some schemes provide tax relief under Section 88 of the Income Tax Act lead to the growth of importance of Mutual Fund in the minds of the investors.

5.

As Mutual Funds creates awareness among urban and rural middle class

people about the benefits of investment in capital market, through profitable and safe avenues, Mutual Fund could be able to make up a large amount of the surplus funds available with these people.

26

MUTUAL FUND 200 9

6.

The Mutual Fund attracts foreign capital flow in the country and secures

profitable investment avenues abroad for domestic savings through the opening of off shore funds in various foreign investors. Lastly another notable thing is that Mutual Funds are controlled and regulated by S E B I and hence are considered safe. Due to all these benefits the importance of Mutual Fund has been increasing.

CHAP. 5

TYPES OF MUTUAL FUND

A wide variety of Mutual Fund Schemes exist to cater to the needs such as financial position, risk tolerance and return expectations etc. The table below gives an overview into the existing types of schemes in the Industry. By structure: a) open-ended schemes b) close-ended schemes c) interval schemes By investment objective: a) growth schemes b) income schemes c) Balanced schemes d) money market schemes Other schemes: a) Tax saving schemes b) special schemes

27

MUTUAL FUND 200 9

c) index schemes d) sector specific schemes

By Structure

i)

Open-ended schemes: Under this scheme, the size of the fund and/or the period of the fund is not pre-

determined. The investors are free to buy and sell any number of units at any point of time. For instance, the unit scheme (1964) of the Unit Trust of India is an open ended one, both in terms of period and target amount. Anybody can buy this unit at any time and sell it also at any time at his direction. The main Features of the Open-Ended Funds are: i) There is complete flexibility with regard to ones investment or disinvestment. In other words, there is free entry and exit of investors in an open-ended fund. There is no time limit. The investor can join in and come out from the Fund as and when he desire. ii) These units are not publicly traded but, the fund is ready to repurchase them and resell them at any time. iii) The investor is offered instant liquidity in the sense that the units can be sold on nay working day to the fund. In fact, the fund operates just like a bank account wherein one can get cash across the counter for any number of units sold.

iv)

The main objective of this fund is income generation. The investor gets dividend, rights or bonuses as rewards for their investment.

28

MUTUAL FUND 200 9

v)

Since the units are not listed on the stock market, their prices are linked to the Net Asset Value (NAV) of the units. The NAV is determined by the fund and it varies from time to time.

vi) The fund manager has to be very careful in managing the investment because he has to meet the redemption demands at any time made during the life time of the scheme. To put it in a nutshell, the open ended funds have a perpetual existence and their corpus is ever-changing depending upon the entry and exit of members.

ii) Close-ended schemes Under this scheme, the corpus of the fund and its duration are prefixed. In other words, the corpus of the fund and the number of units are determined in advance. Once the subscription reaches the predetermined level, the entry of investors is closed. After the expiry of the fixed period, the entire corpus is disinvested and the proceeds are distributed to the various unit holders in proportion to their holdings. Thus, the fund ceases to be a fund, after the final distribution. The main Features of Close-Ended Funds are:

i)

The period and/or the target amount of the funds are definite and fixed beforehand.Once the period is over and/or the target is reached, the door is closed for the investors. They cannot, purchase anymore units.

ii) These units are publicly traded through stock exchange and generally, there is no repurchase facility by the fund. iii) The main objective of this fund is capital appreciation.

iv)

The fund manager can manage the investment efficiently and profitably without the necessity of maintaining and liquidity.

29

MUTUAL FUND 200 9

v)

At the time of redemption, the entire investment pertaining to a closed-ended scheme is liquidated and the proceeds are distributed among the unit holders. From the investors point of view, it may attract more tax since the entire capital appreciation is realized in to at one stage itself.

vi)

vii) If the market condition is not favorable, it may also affect the investor since he may not get the full benefit of capital appreciation in the value of the investment. viii) Generally, the prices of closed-ended scheme units are quoted at a discount of upto 40% below their Net Asset Value (NAV). Interval Funds Interval funds combine the features of open-ended and close-ended schemes. They are open for sale or redemption during pre-determined intervals at NAV related prices. By investment objective: A scheme can also be classified as growth scheme, income scheme, or balanced scheme considering its investment objective. Such schemes may be open-ended or close-ended schemes as described earlier. Such schemes may be classified mainly as follows: a) Income Funds: As the very name suggests, this fund aims at generating and distributing regular income to the members on a periodical basis. It concentrates more on the distribution of regular income and it also sees that the average return is higher than that of the income from bank deposits. The main Features of the Income Funds are:

30

iii)

MUTUAL FUND 200 9

i)

ii)

The investor is assured of regular income at periodic intervals, say half-yearly or yearly and so on. The main objective of this type of fund is to declare regular dividend. securities like debentures, bond etc.

iii) The pattern of investment is oriented towards high and fixed income yielding iv) This is best suited to the old and retired people who may not have any regular income. v) It concerns itself with short run gains only.

b) Pure Growth Fund (Growth Oriented Schemes) :

Unlike the Income Funds, Growth Funds concentrate mainly on long run gains, i.e., capital appreciation. They do not offer regular income and they aim at capital appreciation in the long run. Hence, they have been described as Nest Eggs investment. The main Features of the Growth Funds are: i) The Growth Oriented Fund aims at meeting the investors need for capital appreciation. ii) The Fund tries to get capital appreciation by taking much risks and investing on risk bearing equities and high growth equity shares. iii) The fund may declare dividend, but its principal objective is only capital appreciation. iv) This is best suited to salaried and business people who have high risk bearing capacity and ability to defer liquidity. They can accumulate wealth for future needs.

31

MUTUAL FUND 200 9

c)

Balanced Fund: This is otherwise called income-cum-growth fund. It is nothing but a

combination of both income and growth funds. It aims at distributing regular income as well as capital appreciation. This is achieved by balancing the investment between the high growth equity shares and also the fixed income earning securities.

d) Specialized Funds: Besides the above, a large number of specialized funds are in existence abroad. They offer special schemes so as to meet the specific needs of specific categories of people like pensioners, window etc. there are also Fund for investments in securities of specified areas. For instance, Japan Fund, South Korea Fund etc. In fact, these funds open the door for foreign investors to invest on the domestic securities of these countries. These funds carry heavy risks since the entire investment is in one industry. But, there are high risk taking investors who prefer this type of fund.

e)

Money Market or Liquid Fund These funds are also income funds and their aim is to provide easy liquidity,

preservation of capital and moderate income. These schemes invest exclusively in safer short-term instruments such as treasury bills, certificates of deposit, commercial paper and inter-bank call money, government securities, etc. Returns on these schemes fluctuate much less compared to other funds. These funds are appropriate for

32

MUTUAL FUND 200 9

corporate and individual investors as a means to park their surplus funds for short periods. f) Taxation Fund: A taxation fund is basically a growth oriented fund. But, it offers tax rebates to the investors either in the domestic or foreign capital market. It is suitable to salaried people who want to enjoy tax rebates particularly during the month of February and March. In India, at present the law relating to tax rebates is covered under Sec. 88 of the Income Tax Act, 1961. An investor is entitled to get 20% rebate in Income Tax for investment made under this fund subject to a maximum investment of Rs.10,000/- per annum.. Other types of funds Index Fund : Index fund refers to those funds where the portfolios are designed in such a way that they reflect the composition of some broad based market index. This is done by holding securities in the same proportion as the index itself. The value of these index goes up and vice versa.

Sector Funds: The riskiest among equity funds, sector funds invest only in stocks of a specific

industry, say IT or FMCG. A sector funds NAV will zoom if the sector performs well; however, if the sector languishes, the schemes NAV too will stay depressed.

33

MUTUAL FUND 200 9

Gilt Funds They invest only in government securities and T-billsinstruments on which

repayment of principal and periodic payment of interest is assured by the government. So, unlike income funds, they dont face the specter of default on their investments. This element of safety is why, in normal market conditions, gilt funds tend to give marginally lower returns than income funds.

Fund-Of-Funds: A fund of funds scheme is a Mutual Fund scheme that invests in other Mutual

Fund schemes. The concept is widely prevalent abroad. Mutual Funds in India are being allowed to launch fund of funds.

34

MUTUAL FUND 200 9

RISK:

Mutual

Funds

are not free from risks. It is so because basically the Mutual Funds market also on invest shares

RISK

their funds in stock which are volatile in nature and are not risk free. Factors effecting variability of the investment performance: 1. The kind of stocks in the portfolio. 2. The degree to which a fund diversifies. 3. The degree to which a manager uses leverage or borrowing. 4. The extent, if any, to which the manager tries to time the market or hedge. Hence, the following risks are inherent in their dealings: i) Market risk: In general, there are certain risks associated with every kind of investment on shares. They are called market risks. These market risks can be reduced, but cannot be completely eliminated even by a good investment management. The prices of shares are subject to wide price fluctuations depending upon market condition over which nobody has a control. Moreover, every economy has to pass through a cycleBoom, Recession, Slump, Recovery. The phase of the business cycle affects the market condition to a larger extent.

35

MUTUAL FUND 200 9

ii) Scheme Risks:

There are certain risks inherent in the scheme itself. It all depends upon the nature of the scheme. For instance, in a pure growth scheme, risks are greater. It is obvious because if one expects more returns as in the case of a growth scheme, one has to take more risks. iii) Investment Risk: Whether the Mutual Fund makes money in shares or loses depends upon the investment expertise of the Asset Management Company (AMC). If the investment advice goes wrong, the fund has to suffer a lot. The investment expertises of various funds are different and it is reflected on the returns which they offer to investors. iv) Business Risk: The corpus of a Mutual Fund might have been invested in a companys shares. If the business of that company suffers any set back, it cannot declare any dividend. It may even go to extent of winding up its business. Though the Mutual Fund can withstand such a risk, its income paying capacity is affected.

v)

Political Risk: Successive Government bring with them fancy new economic ideologies and

policies. It is often said that many economic decisions are politically motivated. Changes in Government bring in the risk of uncertainty which every player in the financial service industry has to face. So Mutual Funds are no exception to it.

36

MUTUAL FUND 200 9

CHAP. 6

ORGANISATION OF MUTUAL FUND

The structure of Mutual Funds in India is governed by SEBI (Mutual Fund) Regulations, 1996. In India, is mandatory to have a three tier structure of Trustee-Asset Management Company. Sponsor-

Sponsor Sponsor is the person who acting alone or in combination with another body corporate establishes a Mutual Fund. The sponsor establishes the Mutual Fund and registers the same with SEBI. Sponsor appoints the Trustees, custodians and the AMC with prior approval of SEBI and in accordance with SEBI Regulations.

37

MUTUAL FUND 200 9

Sponsor must have a 5-year track record of business interest in the financial markets. Sponsor must have been profit making in at least 3 of the above 5 years. Sponsor must contribute at least 40% of the net worth of the Investment Managed and meet the eligibility criteria prescribed under the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996.The Sponsor is not responsible or liable for any loss or shortfall resulting from the operation of the Schemes beyond the initial contribution made by it towards setting up of the Mutual Fund.

Trust The Mutual Fund is constituted as a trust in accordance with the provisions of the Indian Trusts Act, 1882 by the Sponsor. The trust deed is registered under the Indian Registration Act, 1908.

Trustee Trustee is usually a company (corporate body) or a Board of Trustees (body of individuals). The main responsibility of the Trustee is to safeguard the interest of the unit holders and inter alia ensure that the AMC functions in the interest of investors and in accordance with the Securities and Exchange Board of India (Mutual Funds) Regulations, 1996, the provisions of the Trust Deed and the Offer Documents of the respective Schemes. At least 2/3rd directors of the Trustee are independent directors who are not associated with the Sponsor in any manner.

38

MUTUAL FUND 200 9

Asset Management Company (AMC) The AMC is appointed by the Trustee as the Investment Manager of the Mutual Fund. The AMC is required to be approved by the Securities and Exchange Board of India (SEBI) to act as an asset management company of the Mutual Fund. At least 50% of the directors of the AMC are independent directors who are not associated with the Sponsor in any manner. The AMC must have a net worth of at least 10 crore at all times.

Registrar and Transfer Agent The AMC if so authorized by the Trust Deed appoints the Registrar and Transfer Agent to the Mutual Fund. The Registrar processes the application form, redemption requests and dispatches account statements to the unit holders. The Registrar and Transfer agent also handles communications with investors and updates investor records.

Custodian A custodian is an agent, bank, trust company, or other organization which holds and safeguards an individual's, Mutual Funds, or investment company's assets for them.

39

MUTUAL FUND 200 9

CHAP. 7

SECURITIES AND EXCHANGE BOARD OF INDIA (SEBI) REGULATION

REGULATION OF MUTUAL FUNDS: The primary authority for regulating Mutual Funds in India is SEBI. SEBI

requires all Mutual Funds to be registered with it. The SEBI (Mutual Funds) Regulations, 1996 outlined the broad framework of authorization process and selection criteria. Accordingly, the authorization for the Mutual Fund will be granted in two steps. The first step will involve approval and eligibility of each of the constituents of the Mutual Fund viz. sponsors, trustees, asset management company (AMC) and custodian. For this purpose the interested parties would be required to submit necessary information only in on prescribed formats). The second stage will involve formal authorization of the Mutual Funds for business. For this purpose the sponsor or the AMC would be required to apply to SEBI in an application form for authorization along with an application fee to be specified later.

40

MUTUAL FUND 200 9

The authorisation shall be granted subject to conditions as may be considered necessary by SEBI and payment of authorisation fee as may be specified. It shall be SEBI's endeavor to advise an applicant within 10 to 15 working days of receipt of his letter / application form regarding status of his application. The eligibility of the sponsor will be examined with respect to the following: Sponsor could be a registered company, scheduled bank or all India or State level financial institution;

More than one registered company can also act as sponsor for a Mutual Fund;

Joint sponsorship with any of the entities in (a) above will also be eligible, and Sponsoring registered companies could be private or public limited companies either listed or unlisted. Sponsor and where there is more than one sponsor, each of the sponsoring entities, must have a sound track record as evidenced by Audited balance sheet and profit and loss .account for last five years; A positive net worth and consistent record of profitability and a good financial standing during the last five years; Good credit record with banks and financial institutions; General reputation in the market; Organization and management, and Fairness in business transactions. Sponsor or more than one sponsor put together should have at least a 40 per cent stake in the paid-up equity of the AMC.

41

MUTUAL FUND 200 9

Guidelines for Mutual Funds as per SEBI : The AMC will be authorized by SEBI on the basis of the criteria indicated in

the guidelines. , SEBI regulations clearly state that all funds and schemes operational under them would be bound by their regulations. SEBI has recently taken following steps for the regulation of Mutual Funds:

Formation: Certain structural changes have also been made in the Mutual Fund industry, as

part of which, Mutual Funds are required to set up asset management companies with fifty percent independent directors, separate board of trustee companies, consisting of a minimum fifty percent of independent trustees and to appoint independent custodians. This is to ensure an arm's length relationship between trustees, fund managers and custodians, and is in contrast with the situation prevailing earlier in which all three functions were often performed by one body which was usually the sponsor of the fund or a subsidiary of the sponsor . SEBI guidelines provide for the trustees to maintain an arm's length relationship with the AMCs and do all those things that would secure the right of investors. With funds being managed by AMCs and custody of assets remaining with trustees, an element of counter-balancing of risks exists as both can keep tabs on each other.

42

MUTUAL FUND 200 9

Registration: In January 1993, SEBI prescribed registration of Mutual Funds taking into

account track record of a sponsor, integrity in business transactions and financial soundness while granting permission. This will curb excessive growth of the Mutual Funds and protect investor's interest by registering only the sound promoters with a proven track record and financial strength. In February 1993, SEBI cleared six private sector Mutual Funds viz. 20th Century Finance Corporation, Industrial Credit& Investment Corporation of India, Tata Sons, Credit Capital Finance Corporation, Ceat Financial Services and Apple Industries.

Documents: The offer documents of schemes launched by Mutual Funds and the scheme

particulars are required to be vetted by SEBI. A standard format for Mutual Fund prospectuses is being formulated.

Assurance on returns: SEBI has introduced a change in the Securities Control and Regulations Act

governing the Mutual Funds. Now the Mutual Funds were prevented from giving any assurance on the land of returns they would be providing. However, under pressure from the Mutual Funds, SEBI revised the guidelines allowing assurances on return subject to certain conditions.

43

MUTUAL FUND 200 9

Hence, only those Mutual Funds which have been in the market for at least five years are allowed to assure a maximum return of 12 per cent only, for one year. With this, SEBI, by default, allowed public sector Mutual Funds an advantage against the newly set up private Mutual Funds.

Minimum corpus: The current SEBI guidelines on Mutual Funds prescribe a minimum start-up

corpus of Rs.50 crore for an open-ended scheme, and Rs.20 crore corpuses: or closedended scheme, failing which application money has to be refunded.

Institutionalization: The efforts of SEBI have, in the last few years, been to institutionalise the

market by introducing proportionate allotment and increasing the minimum deposit amount to Rs.5000 etc. These efforts are to channel the investment of individual investors into the Mutual Funds.

Investment of funds mobilised: In November 1992, SEBI increased the time limit from six months to nine

months within which the Mutual Funds have to invest resources raised from the latest tax saving schemes.

44

MUTUAL FUND 200 9

Investment in money market: SEBI guidelines say that Mutual Funds can invest a maximum of 25 per cent of

resources mobilized into money-market instruments in the first six months after closing the funds and a maximum of 15 per cent of the corpus after six months to meet short term liquidity requirements. Private sector Mutual Funds, for the first time, were allowed to invest in the call money market after this year's budget. As SEBI regulations limit their exposure to money markets, Mutual Funds are not major players in the call money market. Thus, Mutual Funds do not have a significant impact on the call money market. SEBI also conclude that Mutual Funds were not responsible for the unprecedented shooting up of call money rates.

Valuation of investment: SEBI should work in tandem with the Institute of Chartered Accountants of

India (ICAI) to take up a fresh look at Mutual Fund regulations enacted in 1993. The valuation of investments, a key aspect of fund accounting, as on balance sheet date, needs review, SEBI regulations 1993, give discretionary powers to the fund managers as far as the valuation of the investment portfolio on the balance sheet date is concerned. There are no accounting standards or guidelines prescribed by the ICAI for the valuation of a Mutual Fund's investment portfolio.

Inspection: SEBI inspect Mutual Funds every year. A full SEBI inspection of all f the 27

Mutual Funds were proposed to be done by the March 1996 to streamline their

45

MUTUAL FUND 200 9

operations and protect the investor's interests. Mutual Funds are monitored and inspected by SEBI to ensure compliance with the regulations.

Underwriting: In July 1994, SEBI permitted Mutual Funds to take up underwriting of primary

issues as apart of their investment activity. This step may assist the Mutual Funds in diversifying the business.

Conduct: In September 1994, it was clarified by SEBI that Mutual Funds shall not offer

buy back schemes or assured returns to corporate investors. The Regulations governing Mutual Funds and Portfolio Managers ensure transparency in their functioning.

Voting rights: In September 1993, Mutual Funds were allowed to exercise their voting rights.

Department of Company Affairs has reportedly granted Mutual Funds the right to vote as full-fledged shareholders in companies where they have equity investments.

46

MUTUAL FUND 200 9

RECENT POLICY AND REGULATORY INITIATIVES

SEBI amended regulations to:

Permit investments by Mutual Funds in the mortgage-backed securities. These securities, however, must have a credit rating of not below investment grade and would represent investments in real estate mortgages (i.e., loans secured by real estate collateral) and not directly in real estate.

Allow Mutual Funds to invest in unlisted companies. A MF scheme could invest upto 5% of its net asset value (NAV) in the unlisted equity shares or equity related instruments in case of open-ended scheme and up to 10% of its NAV in case of closed-ended scheme. Within the investment limit of 15% of NAV in debt instruments issued by a single issuer, Mutual Funds could also invest in mortgagebacked securitised debt, which are rated not below investment grade by a credit rating agency registered with SEBI.

SEBI Regulations also stipulate that the asset management company (AMC) shall exercise due diligence and care in all its investment decisions. For effective implementation and bringing about transparency in the investment decisions, all the AMCs were advised to maintain records in support of each investment decisions which would indicate data, facts and opinion leading to that decision.

47

MUTUAL FUND 200 9

Specific attention may be given to investments in unlisted' and privately placed securities, unrated debt securities, non-performing assets (NP As), transactions where associates are involved and the instances where there is poor performance of the schemes. MF Distribution by NSCCL: In a move to encourage the MF industry, NSE and NSCCL have launched the Mutual Fund Service System (MFSS) to effectively cater to buying/redemption of units of Mutual Funds by individual investors, which presently takes place manually. The main objective of MFSS is to provide a one-stop shop to investors for transacting in financial products. NSE with its trading terminals across the country offers a mechanism for collection of orders from the market and NSCCL undertakes the clearing and settlement of the same. While a good number of closed-ended schemes are traded on the exchanges; Today the entire process of buying and redeeming openended MF scheme units takes place directly between the individual investor and the AMC.

MF Distribution through Post Offices: Post offices started distributing MF products. IDBI Principal Mutual Fund has

started distributing its index, balanced and income funds through select post offices branches. Other Mutual Funds like, SBI Mutual, ICICI Prudential, UTI and Zurich Mutual Fund are also tying up with Department of Posts to distribute their products.

48

MUTUAL FUND 200 9

The MF supplies application forms for their schemes to the post office for sale over the counter and any customer who wishes to invest in MF can take a form from the counter, fill it in and hand it back to the officials in the post office which in turn are handed over to the MF office, This system of distribution is presently operational only in selected post offices in the 4 cities of Delhi, Mumbai, Patna and Kolkatta.

CHAP. 8

FACILITIES AVAILABLEN TO INVESTORS

REPURCHASE FACILITIE: The units of closed ended schemes must be compulsorily listed in recognized stock exchanges. Such units can be sold or bought at market prices. But, units of open ended schemes are not at all listed and hence they have to be bought only from the fund. So, the fund reserves the right to buy back the units from its members. This process of buying back the units from the investors by the fund is called repurchase facility. This is available in both schemes so as to provide liquidity to investors. The price fixed for this purpose is called repurchase price.

REI-SSUE FACILITIES: In the case of open ended schemes, units can be bought only from the fund and not in the open market. The units bought from the investors are again

49

MUTUAL FUND 200 9

reissued to those who are interested in purchasing them. The price fixed for this purpose is called re-issue price.

ROLL OVER FACILITIES: At the time of redemption, the investor is given an option to reinvest his entire investment once again for another term. An investor can overcome an adverse market condition prevailing at the time of redemption by resorting to this roll over facility. This is applicable in the case of close ended funds.

NET ASSET VALUE The repurchase price is always linked to the Net Asset Value (NAV). The NAV is nothing but the market price of each unit of a particular scheme in relation to all the assets of the scheme. This value is a true indicator of the performance of the fund. If the NAV is more than face value of the unit, it clearly indicates that the money invested on that unit has appreciated and the fund has performed well.

ILLUSTRATION: For instance, Fortune Mutual Fund has introduced a scheme called Millionaire Scheme. The scheme size is 100 crores. The value of each unit is Rs. 10/-. It has invested all the funds in shares and debentures and the market value of the investment comes to Rs. 200 crores. Now NAV= 200 crores/ 100 crores x value of each unit =2 x 10 = 20

50

MUTUAL FUND 200 9

Thus, the value of each unit of Rs. 10/- is worth Rs. 20/-. Hence the NAV = Rs. 20 . This NAV forms the basis for fixing the repurchase price and reissue price. The investors can call up the Fund any time to find out the NAV. Some MFs publish the NAV weekly in two or three leading daily newspapers.

51

MUTUAL FUND 200 9

CHAP. 9

COMMERCIAL BANKS AND MUTUAL FUNDS

AND

With view

a to

providing wider choice to small investors, the Government of India has permitted the banks to launch Mutual Funds as subsidiaries. There has been an urgent need for the banks to enter into the field of Mutual Funds due to the following reasons:

i)

Banks are not able to provide better yields to the investing public with their savings and fixed deposit interest rates whereas many financial intermediaries, with innovative market instruments offering very attractive returns, have entered the financial market. So banks are not able to compete with them in tapping the savings. Hence there is a necessity to enter into the field of Mutual Funds.

ii) Since the banks have branches in rural as well as urban sectors, they can reach out to everyone in the country.

52

MUTUAL FUND 200 9

iii)

Hence, a Mutual Fund backed by a bank will be in a better position to tap the savings effectively and vigorously for the capital market.

iv)

Indian investors, particularly small and medium ones, are not very keen in investing any substantial amount directly in capital market instrument. They may also hesitate to invest in an indirect way through private financial intermediaries. On the other hand, if such intermediary has the backing of bank, investors may have confidence and come forward to invest. Thus, banks have the advantage of public confidence which is very essential for the success of Mutual Funds.

v) Earlier banks were not permitted to tap the capital market for funds or to invest their funds in the market. Now, a green signal has been given to them to enter into this market and reap the maximum benefits.

vi)

Banks can provide a wider range of product in Mutual Funds by introducing innovative schemes and extend their professionalism to the Mutual Funds industry.

vii)

Banks, as merchant banks have wide experience in the capital market and hence managing a Mutual Fund may not be a big problem for them.

53

MUTUAL FUND 200 9

viii) The

entry of books would provide much needed competition in the Mutual

Fund industry which has been hitherto monopolized by the UTI. This competition will improve customer service and widen customer choice also.

ix)

In the Indian economy, the Eighties witnessed the operation of both the process of intermediation and dis-intermediation. The dis-intermediation process can be easily harnessed by commercial banks through Mutual Funds. The process of dis-intermediation of time deposits into Mutual Funds would benefit the capital market because it would provide a sustainable domestic source of demand.

x)

Above all the, investor servicing can be effectively done by banks through their network of branches spread throughout the country. Hence, the commercial banks have entered into Mutual Fund market without any hesitancy.

xi)

Moreover, the profitability of banks has been very much affected due to too many restrictions on their lending policies. They have been compelled to seek some other alternatives to increase their profits by mean of diversifying their activities. Mutual Funds offer an excellent outlet for diversification.

54

MUTUAL FUND 200 9

CHAP. 10

MUTUAL FUND IN ABROAD & IN INDIA

IN ABROAD: The Mutual Funds have been growing at

an unprecedented pace throughout the world. In the USA, Mutual Funds have been labeled as the bank deposits of 1990s. Mutual Funds have changed the American financial landscape by offering a menu of investment choice and some companies like Fidelity Investment, Vanguard and Merrill Lynch are very popular among them. The Americans have been pouring in over $ 1 billion every day into these funds. According to a study, the industry was expected to have $ 2 trillion in assets by 1995 or 1996 and touch the $3 trillion mark by 2000. But, in 1993 itself the fund touched the $ 2 trillion mark. In the US today, nearly 83 million investors forming 27% of the households save in 4.558 funds. In fact the number of Mutual Funds outnumbers the number of listed companies on the New York Stock Exchange. This industry has an annual growth of about 20 to 25 per cent. The Funds in UK have already crossed the 1000 mark by the end of 1987. The top 25 funds in terms of performance come from Japan and the Far East growth

55

MUTUAL FUND 200 9

sectors. Some of them have doubled their money within a period of just one year. In Australia also, these funds have been very successful particularly on account of 46.8% rise to Australian All Shares Index. MFs are growing in size and importance in countries like Hong Kong, Singapore, Philippines, Thailand, South Korea etc.

IN INDIA: Mutual Funds le households an option for

portfolio diversification and relative risk-aversion through collection of funds from the households and make investments in the stock and debt markets. Resources mobilised by Mutual Fund (UTI was the only Mutual Fund until 1987-88) grew at a steady rate until 1992-93; since then they showed some variations. Resources mobilised by Mutual Funds which was just 0.04 per cent of GDP (at current market prices) during the period of 1970-71 to 1974-85 increased to 1.59 per cent during 1990-91 to 1992-93. Total resources mobilised as proportion of GDP declined to 1.12 per cent by 1994-95 but nevertheless remained positive. During the period from 1995-97, there was a net outflow of funds form Mutual Funds, especially UTI, as a result of which the ratio turned negative. From 1997-98 onwards, the ratio again turned positive and stood at 1.13 per cent during 1999-2000.

The Mutual Fund industry registered significant growth in the last few years. The investible resources of Mutual Funds rose form Rs. 68,200 crore in 1998-99 to Rs. 1,09,114 crore in 1999-2000. Net resource mobilisation by Mutual Funds declined to Rs. 6,846 crore in April-December, 2000 from Rs. 12,193 crore in the

56

MUTUAL FUND 200 9

corresponding previous period. This was on account of the steep increase in redemption/repurchase during this period.

The outflow of funds via repurchase/redemption constituted 88.7 per cent of gross resource mobilisation during April-December, 2000 compared with 66.0 per cent in the corresponding previous period. In the case of public sector Mutual Funds, redemption/repurchase exceeded gross resource mobilisation, thereby making their net resource mobilisation negative.

57

MUTUAL FUND 200 9

58

MUTUAL FUND 200 9

59

MUTUAL FUND 200 9

REASON FOR SLOW

GROWTH:

Of late, Mutual Funds find their going very tough. Most of the funds are not able to collect the targeted amount from small investors. Investors tend to keep out of the new issue Mutual Fund and they prefer to buy units from the secondary market even by paying a brokerage fee of 3%. The Mutual Fund industry has to face many problems also. Some of them are:

Disparity between NAV and listed price: Small investors are really bewildered at the lack of proper pricing for their units. Though the NAV seems to be good, the listed prices are awfully poor. Of course, the NAV is used as a parameter to rate the performance of the Mutual Funds. However, in practice, almost all the Mutual Fund schemes are deeply discounted to their NAV by as much as 30 to 40%. Thus, the real dilemma for the investors is this disparity between the NAV and the listed price. Due to this factor, investors are not able to dispose off their units in the market and hence there is no liquidity at all.

60

MUTUAL FUND 200 9

Lack of transparency: Mutual Funds in India are not providing adequate information and materials to the investors. It was expected that they would provide a detailed investment pattern of their various schemes. They would also have frequent and continuing communication with the unit-holders. Unfortunately, most of the funds are not able to send even quarterly report to their members. For the success of Mutual Funds it is very essential that they should create a good rapport with investors by declaring their entire holdings to them.

Too much dependence on outside agencies: In india, most of the funds depend upon outside agencies to collect data and to do research. There is no doubt that research-driven funds can ensure god returns to its members. But, one should not rely on borrowed research. Since research involves lot of money, Mutual Funds think that their overhead cost will go up and thereby their administrative expenses will go beyond the 3 % level fixed by the SEBI.

Other reasons:

61

MUTUAL FUND 200 9

Few funds which have not performed well have actually demoralized the investing public. Moreover, the listing of close ended funds on the stock exchanges has compelled the medium and small investors to go back to the stock market and face the Hassels and headaches of its dealing. Above all, there is lack of investor education in the country. Most of the investors are not aware of the Mutual Fund industry and the various products offered by it. Future of Mutual Fund industry: Inspite of the above bottlenecks, the Mutual Fund industry is having a good prospect in our country

CHAP. 11

RELIANCE MUTUAL FUND

Reliance Mutual Fund (RMF) is one of Indias leading Mutual Funds, with Average Assets Under Management (AAUM) of Rs. 90,938 Crores (AAUM for Mar 08 ) and an investor base of over 66.87 Lakhs.

62

MUTUAL FUND 200 9

Reliance Mutual Fund, a part of the Reliance - Anil Dhirubhai Ambani Group, is one of the fastest growing Mutual Funds in the country. RMF offers investors a well-rounded portfolio of products to meet varying investor requirements and has presence in 115 cities across the country. Reliance Mutual Fund constantly endeavors to launch innovative products and customer service initiatives to increase value to investors. "Reliance Mutual Fund schemes are managed by Reliance Capital Asset Management Limited., a subsidiary of Reliance Capital Limited, which holds 93.37% of the paid-up capital of RCAM, the balance paid up capital being held by minority shareholders."

About Reliance Mutual Fund: Reliance Mutual Fund (RMF) has been established as a trust under the Indian

Trusts Act, 1882 with Reliance Capital Limited (RCL), as the Settler /Sponsor and Reliance Capital Trustee Co. Limited (RCTCL), as the Trustee. RMF has been registered with the Securities & Exchange Board of India (SEBI) vide registration number MF/022/95/1 dated June 30, 1995. The name of Reliance Capital Mutual Fund has been changed to Reliance Mutual Fund effective 11th. March 2004 vide SEBI's letter no. IMD / PSP / 4958 / 2004 date 11th. March 2004. Reliance Mutual Fund was formed to launch various schemes under which units are issued to the Public with a view to contribute to the capital market and to provide investors the opportunities to make investments in diversified securities.

63

MUTUAL FUND 200 9

The main objectives of the Trust are: To carry on the activity of a Mutual Fund as may be permitted at law and

formulate and devise various collective Schemes of savings and investments for people in India and abroad and also ensure liquidity of investments for the Unit holders; To deploy Funds thus raised so as to help the Unit holders earn reasonable returns on their savings and, To take such steps as may be necessary from time to time to realize the effects without any limitation.

Social Responsibilities: Organizations, like individuals, depend for their survival, sustenance and growth on the support and goodwill of the communities of which they are an integral part, and must pay back this generosity in every way they can. This ethical standpoint, derived from the vision of the founder, lies at the heart of the CSR philosophy of the Reliance Group. While they strongly believe that their primary obligation or duty as corporate entities is to their shareholders they are just as mindful of the fact that this imperative does not exist in isolation; it is part of a much larger compact which they have with their entire body of stakeholders: From employees, customers and vendors to business partners, eco-system, local communities, NGO and society at large.

64

MUTUAL FUND 200 9

Reliance Mutual Fund : Asset under management:

AUM Month Average AUM Excluding Fund of Funds Average AUM Fund of Funds

Mar 2008

9093794.02

Vision Statement:

To be a globally respected wealth creator, with an emphasis on customer care and a culture of good corporate governance.

Mission Statement: To create and nurture a world-class, high performance environment aimed at delighting their customers.

Sponsors: Reliance Mutual Fund schemes are managed by Reliance Capital Asset

Management Limited., a subsidiary of Reliance Capital Limited, which holds 93.37%

65

MUTUAL FUND 200 9

of the paid-up capital of RCAM, the balance paid up capital being held by minority shareholders.", the sponsor. Reliance Mutual Fund (RMF) has been sponsored by Reliance Capital Ltd (RCL). The promoter of RCL is AAA Enterprises Private Limited. Reliance Capital Limited is a Non Banking Finance Company. Reliance Capital Limited is one of the Indias leading and fastest growing financial services companies, and ranks among the top three private sector financial services and banking companies, in terms of networth. Reliance Capital has interests in asset management and Mutual Funds, life and non-life insurance, private equity and proprietary investments, stock broking and other activities in the financial services sector. The net worth of RCL is Rs. 5,161.23 crores as on March 31, 2007.

The Schemes:

Equity/Growth Schemes:

The aim of growth funds is to provide capital appreciation over the medium to long- term. Such schemes normally invest a major part of their corpus in equities. Such funds have comparatively high risks. These schemes provide different options to the investors like dividend option, capital appreciation, etc. The investors must indicate the option in the application form. The Mutual Funds also allow the investors to change the options at a later date. Growth schemes are good for investors having a long-term outlook seeking appreciation over a period of time.

Debt/Income Schemes:

The aim of income funds is to provide regular and steady income to investors. Such schemes generally invest in fixed income securities such as bonds, corporate

66

MUTUAL FUND 200 9

debentures, Government securities and money market instruments. Such funds are less risky compared to equity schemes. These funds are not affected because of fluctuations in equity markets.

Sector Specific Schemes:

These are the funds/schemes which invest in the securities of only those sectors or industries as specified in the offer documents. E.g. Pharmaceuticals, Software, Fast Moving Consumer Goods (FMCG), Petroleum stocks, etc. The returns in these funds are dependent on the performance of the respective sectors/industries. While these funds may give higher returns, they are more risky compared to diversified funds. Investors need to keep a watch on the performance of those sectors/industries and must exit at an appropriate time. They may also seek advice of an expert. Product Profile:

Reliance Mutual Fund has launched thirty-two Schemes till date, namely:

Reliance Growth Fund (September 1995) Reliance Vision Fund (September 1995) Reliance Income Fund (December 1997) Reliance Liquid Fund (March 1998)

Reliance Medium Term Fund (AugustReliance Short Term Fund (December 2000) 2002)

Reliance Gilt Securities Fund (July 2003) Reliance Banking Fund (May 2003) Reliance Monthly Income Plan (DecemberReliance Diversified Power Sector Fund 2003) Reliance Pharma Fund ( May 2004) (March 2004) Reliance Floating Rate Fund (August

67

MUTUAL FUND 200 9

2004) Reliance Media & Entertainment FundReliance NRI Equity Fund (October (September 2004) 2004)

Reliance NRI Income Fund (October 2004) Reliance Index Fund (February 2005) Reliance Equity Opportunities FundReliance Regular Savings Fund (May 2005) Reliance Tax Saver (ELSS) Fund (July 2005)

(February 2005) Reliance Liquidity Fund (June 2005)

Reliance Fixed Tenor Fund (NovemberReliance Equity Fund (February 2006) 2005) Reliance Fixed Horizon Fund I (AugustReliance Fixed Horizon Fund (April 2006) 2006) Fixed Horizon Fund II

Reliance Fixed Horizon Fund III (MarchReliance 2007) Reliance Liquid Plus Fund (March 2007)

(November 2006) Reliance Long Term Equity Fund

(November 2006) Reliance Long Term Equity Fund (NovReliance Interval Fund (March 2007) 2006) Reliance Fixed Horizon Fund - IV (AugustReliance Fixed Horizon Fund - V 2007) (September 2007)

68

MUTUAL FUND 200 9

CHAP.12

CONCLUSION

Mutual Funds are funds that pool the money of several investors to invest in equity or debt markets. Mutual Funds could be Equity funds, Debt funds or balanced funds. With the structural liberalization policies no doubt Indian economy is likely to return to a high grow path in few years. Hence Mutual Fund organizations are needed to upgrade their skills and technology. Success of Mutual Fund however would bright depending upon the implementation of suggestion. Mutual Funds are a method for investors to diversify risk and to benefit from professional money management. The prospectus identifies key information about the fund including its operating boundaries and its costs. The fund manager operates within those boundaries and is a critical to achieving strong results within those boundaries. Fund critics correctly note that few fund boards put advisory contracts out for bid, but fail to acknowledge the defining legal feature of the Mutual Fund: that, by

69

MUTUAL FUND 200 9

contract, fund investors can, and do, rapidly discipline funds and fund advisers by redeeming fund shares at net asset value and investing the proceeds elsewhere; barriers to entry are low; actual entry and expansion of funds has been common and continuous over the past several decades; fees have, if anything, tended to trend down over time; and market shares of funds and fund complexes have shifted significantly over time.