Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Kingfisher Tops Rivals in India

Caricato da

khemlataDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Kingfisher Tops Rivals in India

Caricato da

khemlataCopyright:

Formati disponibili

Kingfisher tops rivals in India's beer market

Bloomberg / New Delhi Mar 03, 2012, 00:40 IST

Ads by Google

SBP-Breweries : high tech brewery plants reasonable prices, made in EC

www.sbp-breweries.com Indians sip only two litres of beer a year, just one-twentieth the amount consumed by Chinese and less than onefortieth by Americans. SABMiller Plc, Anheuser- Busch InBev and Carlsberg see that as an opportunity. The global brewers are forming partnerships, introducing new products and marketing milder, pricier brews to young Indians. They have yet to overcome a maze of regulations and United Breweries Ltd, owner of top local brand Kingfisher, in a market expected by Euromonitor International to almost double to $9 billion by 2016. United Breweries so far has beaten back the challenges. It started selling Heineken in India over the past seven months to offer more options against foreign rivals. Changing state regulations have already eaten into Londonbased SABMillers market share and all of the brewers still face some Indian taboos on alcohol consumption. Everyone fantasises: Imagine if you had a billion Indian people drinking 50 litres of beer per capita, said Trevor Stirling, analyst at Sanford C Bernstein Ltd in London. Its going to be many decades, if ever, before Indian per capita consumption reaches 50 litres. Emerging markets such as India are important to global brewers as growth slows in the developed world and brands like Budweiser fight competition from craft beers in the US.(Click here for FROTHY RETURNS) At the same time, the experiences of foreign brewers show how regulations or entrenched competitors are holding back many of the worlds largest companies in the second most populous nation. Retailers such as WalMart Stores Inc faced a setback in December when the government reversed a decision to allow their entry into a market dominated by local mom-and-pop stores. India also bans advertising of alcoholic drinks, which can make it harder for brewers to introduce consumers to new names. Supplying British troops United Breweries traces its roots to British soldiers love for beer. In 1915, a Scotsman named Thomas Leishman bought five breweries in southern India to form United Breweries. The company transported its beer in barrels on bullock carts, serving British troops. Vittal Mallya, father of present chairman Vijay Mallya, bought United Breweries in 1947, and snapped up distillers and brewers on the cheap when the Indian government briefly threatened prohibition in the 1970s. The sale and distribution of alcohol in India is controlled by state governments, which impose taxes on imports and exports, forcing companies to open distilleries and breweries in each state where they want to sell their products cost-effectively. The biggest challenge is, in India, every state has their own system in terms of taxation, labor requirement, said Joergen Buhl Rasmussen, COE of Copenhagen- based Carlsberg, which entered the country in 2007. That does make India not very efficient to operate. United Breweries benefits from 28 breweries spread across the countrys 28 states. That tops the 13 that SABMiller uses and Carlsbergs five. New beers United Breweries, based in Bangalore, increased its beer market share to 57 per cent in 2011 from 43 per cent in 2006, according to London-based Euromonitor. In the same period, SABMillers share dropped to 24 per cent from 37 per cent. The success of the brewing business contrasts with United Breweries parent UB Groups money-losing Kingfisher Airlines The airline, which has reported more than 10 straight quarterly losses, is seeking new funds after grounding planes and cutting flights because of a cash shortage. Kingfisher has held its own in the beer market helped by the introduction of new products, including milder, higher- priced varieties like Kingfisher Ultra.

When we were going to launch Kingfisher Ultra two years ago, we used to wonder who would buy a Rs 100 ($2) beer, Samar Singh Sheikhawat, vice-president of marketing at United Breweries, said in an interview in August when the company introduced Heineken in India. But today, Kingfisher or the mainstream beers are close to Rs 90-95. What was considered a barrier for beer doesnt exist anymore. Regulatory disputes SABMiller also added brands, such as Miller High Life, to reach young, urban consumers. Its market share was still hurt by regulatory disputes in the states of Andhra Pradesh and Uttar Pradesh, and excise duty increases in other states, the company said in its 2010 annual report. The single greatest challenge that any brewer faces is regulation, Derek Hugh Jones, marketing director of SABMiller India, said in an email. The movement of beer across state borders is inefficient, eliminating any scale efficiency. Still, consumers greater affluence and increasing social acceptance of beer will ensure sustained growth for the industry in India, he said. Religious taboos Per capita consumption of beer in India at 1.6 litres is a fraction of 35.5 in China, 75.6 in the US and 105.6 in Germany, based on Euromonitor estimates. You have a reasonably high proportion of a Muslim population who wont drink alcohol, said Stirling. Also, if youre a devout Hindu, you wont drink alcohol. Social norms are changing and beer consumption picking up as Indias young adults have more money to spend and travel around the world. The economy has grown at an average annual pace of more than eight per cent for the last four years. Euromonitor estimates Indias beer market will grow to Rs 4,47.9 billion ($9 billion) from Rs 257 billion in 2011. Carlsbergs Rasmussen said the potential to raise per capita purchases makes the country a very attractive market to be in over time. Carlsberg, which entered India in 2007, had a 4.4 per cent share in 2011. AnheuserBusch InBev, the Leuven, Belgium-based company that sells its Budweiser beer, held 1.1 per cent. Stronger tastes One factor in the new brew battles: the strength of the beer. Indian drinkers are largely still partial to stronger beers like Kingfisher Strong, with an alcohol content that can go as high as eight per cent. As much as 80 per cent of the beer sold in Indias beer industry is strong, with alcohol content of six to eight per cent, by Sheikhawats estimate. United Breweries stable of brands includes Kingfisher Strong and Draught as well as milder variants such as Ultra. Carlsberg has introduced stronger brews, including Carlsberg Elephant and Tuborg Strong. Microbreweries are springing up in India as well. The New Delhi suburb of Gurgaon has several. One of the largest, called Rockmans Beer Island, has raised prices as many as four times since starting in 2009 and still has customers flying to its brewery, on the top floor of an upscale mall, from other cities.

Beer Industry In India

Posted: August 3, 2010 in ASSIGNMENTS

9

INTRODUCTION Beer is the worlds most consumed alcoholic beverage and the third most popular drink overall after water and tea. It is produced by the brewing and fermentation of starches, mainly derived from cereal grainsmost commonly malted barley, although wheat, maize (corn), and rice are widely used. Most beer is flavoured with hops, which add bitterness and act as a natural preservative, though other flavourings such as herbs or fruit may occasionally be included. THE INDIAN BEER MARKET The Indian beer market has seen huge growth since the liberalization of economy in the 1990s. due to the flow of western culture through media and workforce, the culturally existing intolerance towards alcohol has relaxed significantly and the new generation in the age group of 18-35, which is around 65% of the countries population, have become the ideal market for the industry. Given below are some features of the current scenario of the Indian beer industry: 1) BRAND LAUNCHES 2009 was highly dynamic in terms of new brand launches, with United Breweries Ltd and Carlsberg India Pvt Ltd expanding their domestic premium lager portfolios by launching Kingfisher Ultra and Tuborg, respectively. Brands such as Tenants, Kingfisher Blue and Indus Pride, which were launched in late 2008, became available in outlets nationwide in early 2009. Moreover, brands such as Tiger, Carlsberg and Budweiser saw lower prices and greater availability in India, as their new domestically-produced stock replaced imported SKUs in 2009. Niche products, such as dark beer, also saw greater availability, with the launch of ales from the Little Devils and Coopers portfolios in 2009. 2) VOLUME GROWTH 2009 total volume growth was two percentage points lower than the total volume CAGR recorded over the review period. Although 2009 volume growth was higher than that in 2008, growth rates did not bounce back to the highs seen in 2006 and 2007. While the long summer in 2009 buoyed the beer market in North and West India, sales growth in the key southern states, such as Karnataka, Andhra Pradesh and Tamil Nadu, was adversely affected due to taxation-related price rises in Karnataka and the withdrawal of United Breweries Ltds and SABMiller India Ltds brands from Andhra Pradesh in first half of 2009.

3) PRODUCTION The domestic production of beer is on the rise, with official statistics reporting an 11% increase in domestic beer production in 2008, which is in line with the 12% growth in volume sales of domestic lager in 2008. In October 2009, Carlsberg India Pvt Ltd started work on its new Greenfield brewery in Medak (Andhra Pradesh), which is expected to have a production

capacity of 4 million litres per month and start operations in late 2010. 4) CONSUMPTION TREND Apparent consumption levels grew by 24% in 2007 over the previous year, to reach 390 million litres. This is less than one third of the reported market size of 1,193 million litres in the year. This discrepancy between the calculated apparent consumption and total market size is chiefly due to problems associated with data collection by government bodies. Companies often underreport actual production figures. In addition, many units will be sold via both official and unofficial channels, such as with the illegal imports of beer into prohibition states.

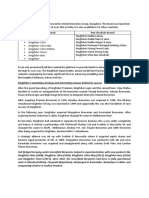

MARKET OVERVIEW UB (United Breweries Ltd.) is the market leader in the Indian beer market with a 40% market share. Its flagship Kingfisher brand alone commands 25% market share. The company has however been focussing on strong beer, which has driven growth. The company introduced its strong beer, Kingfisher Strong during the year 2000 in the selected market of Maharashtra and Karnataka. The move came as a reactive move following increasing shift of consumers towards strong beer, a trend started by Shaw Wallace. While the overall market grew marginally by 2%, the strong beer market grew at 8-10% during the year at the expense of lager beer. The market is now skewed towards strong beer with more than 60% of the market being strong beer market. COMPETITORS Financial metrics FY2008 Name Market Capitalization in Rs Cr Sales Turnover in Rs Cr Operating Margin Net Profit in Rs Cr United Breweries Limited[40] 1,695.94 1,340.80 12.57% 62.47 SABMiller[41] 7560 7272 16.10% 909 Mt Shivalik[42] 19.08 93.66 10.1% 5.43 Mohan Meakin[43] N.A 278.92 1.92% 0.46

Fig: market share of different brewing industry PEST ANALYSIS PEST analysis stands for Political, Economic, Social, and Technological analysis and describes a framework of macro-

environmental factors used in the environmental scanning component of strategic management. Beer industry is highly regulated and controlled by the government in India. Moreover, there are many social and cultural barriers that a Beer Industry should be aware of. For that reason we here look up on the PEST Analysis of the Beer Industry.

POLITICAL Market liberalization Legal Policies

Change in world wide supply and demand which will open for the firms crossing the national boarders. Government campaigning against drinking and driving hard-hitting campaigns and stiffer penalties have helped to reduce the number of roads accidents, deaths, injuries and damage. Campaigns have aimed to raise awareness of the legal situation and the dangers of driving while intoxicated. In most international jurisdictions, anyone who is convicted of injuring or killing someone while under the influence of alcohol or drugs can be heavily fined, as in France, in addition to being given a lengthy prison sentence. Sometimes those campaigns make the brewery industry looking very bad since usually the blame is laid exclusively on them for making alcohol so easily available. Threat, with the government heavily expending money in such campaigns the consumption of alcohol tends to decrease with people scare

ECONOMICAL

Change in exchange rate Slow down of the developed economies and evolution of emerging economies.

Breweries will move towards the emerging market Per capita consumption in India is hovering around a measly 0.5 litres per annum. These figures pale into insignificance if one compares them with those of Czech Republic that has the highest per capita consumption of 156.9 litres per annum (see box) Per capita consumption is directly related to the taxation, according to an industry observer. For instance, in Maharashtra there is a direct 100% excise duty on Beer. An equivalent 650 ml bottle is available for approximately Rs 8 in China. Which is the per capita consumption in China is a high 16 litres per annum. Reduction in beer prices: The Indian consumer typically values an alcoholic beverage on the basis of its kick factor versus its price. The following two factors therefore, affect the market for beer. Firstly, as most states do not have a differential tax structure based on the alcohol content, strong beer

SOCIAL Change in consumption pattern Rise in middle class Increase trend of urbanization

Market sixe of beer consumers will increase Rising income levels: India is home to nearly one-sixth of the global population and is one of the most attractive consumer markets in the world today. Various research studies have shown that a rise in the income levels has a direct positive effect on beer consumption. The National Council for Applied Economic Research (NCAER) projects Indias very rich, consuming and climbers classes to grow at a CAGR of 15 per cent, 10 per cent and 2 per cent respectively. With this growth in income levels, Indian beer consumption is expected to continue growing, at the very minimum, at the growth rates witnessed in the last decade. Changing lifestyles: Urban consumers become more exposed to western lifestyles, through overseas travel and the media, their attitude towards alcohol is relaxing. Social habits are undergoing a transformation as mixed drinks are becoming more popular. The greatest evidence of this trend is the increase in beer consumption among women. With increasing urbanisation, this acceptance is only going to rise.

TECHNOLOGICAL Innovation and Development of new products State of the art of brewery technique

Try to achieve economies of scale through leverage of global scale operation In accordance with the world, the Indian breweries are keeping up their pace with state of the art technology.

PORTERS FIVE FORCE MODEL

Fig: Porters five Industry Analyses

Highly weakened threat by the new entrants Entry and exit of the new competitor is easy in this sector. Economies of scale in manufacturing, distributing, and marketing to create barriers to the national and global markets. The capital needs to build beer manufacturing facilities and the cost associated with this highly controversial industry seek

high level of sales, thus making the industry more and more prohibitive for new comers . There is strict rules and regulation from the government to control this sector which makes this industry quite unattractive. Tax rate is high in this industry. Moderately strong bargaining power of buyers Buyers switching cost of the brand is very low. That makes buyers in the higher position and gives advantage in bargaining power. A decline in disposable income shifts the consumer preferences away from premium priced brand name products in favour of lower priced brands i.e. switching cost is low. The quantity of alcoholic beverages that a nation consumes tends to be unaffected through recession and prosperity while the quality of the products purchased is directly related to the disposable income. Buyers are in advantage when they are buying in bulk especially in peak season and time of celebration and occasions.

A moderately strong threat of substitutes Threat from the other substitute like cold drinks or other hard drinks as whiskey, rum, wine, gin etc always prevails. There is low product differentiation and high competition in this industry. This makes an intense cut throat competition within the industry itself. The advertising restriction placed on alcoholic beverage industry in recent years make it harder to achieve brand loyalty.

Weak bargaining power of suppliers Products used to brew beer are inexpensive and suppliers are numerous. Because of this suppliers are in disadvantage in terms of bargaining power. If there is no scope of backward integration or forward integration from the manufacturer, the bargaining power of the supplier increases. But in the beer industry manufactures may opt for the backward integration as manufacturing their own facility for packaging.

A strong force from the intensity of rivalry amongst competitors There is slightly higher than moderate kind of competition because industry is refrained from advertising there product publicly. Because of the high legal and regulatory burdens, manufacturers tend to merge in order to lower the competition. As there is much competition among the competitors and high intensity of the substitute product the level of competition and survival of the company is tough. There are few big brands like Kingfisher, Budweiser, Hayward, Tuborg etc that control the market has enjoys larger market

share. Though the competition is tuff, the Kingfisher brand is the one of the largest supplier of beer and the third largest producer of distilled spirits.

CRITICAL SUCCESS FACTORS In order to remain competitive, brewers in this industry must make their product readily available or easily accessible to the customer. Brewers must create a sense of brand loyalty in customer in order to get an competitive advantage. India has an emerging middle class-India has a healthy urban workforce with 7.2% unemployment. Indias emerging middle class is relatively young. 63% of the country population is between the ages of 15-64. India has an active domestic brewing industry that includes many local firms and a growing increase in foreign investment Beer sale in India are forecast to grow at a compound annual growth rate of 17.2%. Indias climate is favourable for the harvesting of hops and barley, the primary natural ingredients in beer. Utilization of brewing capacity to keep manufacturing costs low. Developing a strong network of wholesale distributors to gain access to retail outlets. Clever advertising to induce beer drinkers to buy a particular brand and stick to that brand.

CONCLUSIONS There is not enough variety in the market. Market has been controlled by few big players like Kingfisher and Corona. Indian market has great potential for the beer market but still demand lacks in comparison to other beer drinking nation. There is a vast price difference between the foreign brands and local national brands. eg: Kingfisher costs Rs.100/-but Corona costs Rs.250/- . They need to make the market more competitive in terms of pricing for foreign brands as well. This will enable the whole industry in general to improve and hence give a better offering to the consumer. This prevails because of the governments policy towards the foreign brands and strong rules and regulations imposed to the beer industry. In terms of advertising, since India has restrictions on Tobacco and Alcohol advertising, beer companies need to come up with other innovative ways to market. They can tow the same line as some of the other spirit companies (Bagpiper, Bacardi etc) have done by launching CDs, drinking soda, bottled water, events etc. The idea here is VISIBILITY. Just because Kingfisher is the most visible product there, does not mean it is the BEST beer. Any beer company needs to be able to market itself so that it is noticeable as a new/different brand. Financial Comparison of the competitors:

Financial metrics FY2008 Name Market Capitalization in Rs Cr Sales Turnover in Rs Cr Operating Margin Net Profit in Rs Cr United Breweries Limited[40] 1,695.94 1,340.80 12.57% 62.47 SABMiller[41] 7560 7272 16.10% 909 Mt Shivalik[42] 19.08 93.66 10.1% 5.43 Mohan Meakin[43] N.A 278.92 1.92% 0.46

Indian Breweries Industry

Scope eKnowledge Center Pvt Ltd, Jan 2001, Pages: 27

Description

Table of Contents

Enquire before Buying

Send to a Friend

In India, drinking has remained a bad word, clubbed with the other vices. While the beer and liquor market continues to grow at an impressive rate even against an economic recession, the social stigma remains in place, which manifests itself in anti-growth state policies. Domestic Industry However, the Rs. 60.0 Billion organized beer and liquor industry has been growing at an impressive rate. In sharp contrast to the trend the world over, beer is losing ground to hard liquor in India. Amidst beers, the current trend is that lager beer is giving way to strong beer. Even as the liquor manufacturers could hope to garner the people who are shifting from beer to liquor, there is a vast country liquor market and a sizable grey market to contend with. United Breweries (UB), Shaw Wallace and McDowell (part of the UB Group) presently dominate the liquor and beer market. The market on its part is set to undergo a sea change with the arrival of MNCs. The removal of quantitative restrictions (QRs) on the import of bottled alcoholic beverages only makes the competition tougher. The MNCs looked forward to good business after the removal of QRs but the Government nullified it by slapping new taxes. The foreign bottle, therefore, remains as costly as ever. Latest Trends To survive in the highly competitive environment, the MNCs as well as the domestic majors are coming up with various strategies. Acquisitions and alliances appear to be the order of the day. Several such deals are already underway while more are in the offing. The domestic majors are also reorganizing their operations so that they can forge a deal with an MNC if the need arises. For instance, UB, which recently took up a major revamp, has said it is willing to offer a 25.0 percent stake to multinational liquor major. Another trend that seem to be catching up is the consumption of Coolers by the discerning connoisseurs. Coolers is typically a cold drink (or cocktail), which is often a mixture of white wine and fruit juice. As of now there is no definitive data available on the consumption front for coolers either globally or locally. But the fact that this finds mention in most of the wine and recipe related sites helps us to arrive at the conclusion that the trend of consuming coolers in its various combinations is indeed catching up. Problem Areas

What plagues the industry most is a very complicated set of laws and taxes. Each state has a different excise duty structure, import and export levies and other regulations regarding licensing fees and sales of new brands. This puts tremendous pressure on the industry players. They cannot transport their products from a market that has excess capacity to one where there is a short supply. The taxes on alcoholic beverages are some of the highest in the world. In some states it works out to as high as 200%. The brewers argue that subjecting beer to the same level of taxing, as hard liquor is uncalled for, since the alcohol content in beer is very low. They are lobbying to have beer delinked from Imfl so that the taxes will fall, prices will plunge and consumption rise. Crystal Gazing Amidst all the competition and tough laws, the industry sees vast potential in the market. Consumption is set to rise with higher disposable incomes and standard of living. While the beer market is expected to expand rapidly, hard liquor is not seen losing much market share, either.

Potrebbero piacerti anche

- Bloomberg News UBDocumento3 pagineBloomberg News UBRaman RalhanNessuna valutazione finora

- Indian Beer MarketDocumento15 pagineIndian Beer MarketRajeev NairNessuna valutazione finora

- Ub Group - United Breweries Limited: Industry OverviewDocumento13 pagineUb Group - United Breweries Limited: Industry OverviewJinal SolankiNessuna valutazione finora

- Beer Industry in IndiaDocumento22 pagineBeer Industry in IndiaAmit Kumar Singh80% (5)

- Research ProposalDocumento3 pagineResearch ProposalDeepak Kataria0% (1)

- Beer Industry AnalysisDocumento177 pagineBeer Industry AnalysisMukul Attri100% (1)

- Beer IndustryDocumento10 pagineBeer IndustryEktaLalwaniNessuna valutazione finora

- Executive SummaryDocumento4 pagineExecutive SummaryvivekkodilkarNessuna valutazione finora

- Budweiser Final DeepaDocumento25 pagineBudweiser Final DeepaRosemary JohnNessuna valutazione finora

- Marketing Mix AnalysisDocumento12 pagineMarketing Mix AnalysisPrashant ShiralkarNessuna valutazione finora

- SynopsisDocumento11 pagineSynopsisYusuf MonafNessuna valutazione finora

- BCG MatrixDocumento18 pagineBCG MatrixAnuraaagNessuna valutazione finora

- Niir India Beer Market Industry Size Share Trends Analysis Forecasts Upto 2017Documento8 pagineNiir India Beer Market Industry Size Share Trends Analysis Forecasts Upto 2017Saras AgrawalNessuna valutazione finora

- United Breweries LTD.: International Management Anand Vaidya - M911012003Documento6 pagineUnited Breweries LTD.: International Management Anand Vaidya - M911012003Anand Vaidya0% (1)

- Final Report On Kingfisher BeerDocumento17 pagineFinal Report On Kingfisher Beerjitendrag9067% (3)

- Beer Industry IndiaDocumento33 pagineBeer Industry Indiaallen1191919Nessuna valutazione finora

- Product & Brand Management of Alcohol Indystry in IndiaDocumento27 pagineProduct & Brand Management of Alcohol Indystry in Indiadevara_srinuNessuna valutazione finora

- Indian Luquor ScenarioDocumento12 pagineIndian Luquor Scenariokumar bhanushaliNessuna valutazione finora

- BeerDocumento22 pagineBeerAditiNessuna valutazione finora

- Scandinavian Brewers Review - India PDFDocumento5 pagineScandinavian Brewers Review - India PDFSachinNessuna valutazione finora

- Cobra Beer StrategyDocumento11 pagineCobra Beer StrategyAshishTantubay100% (7)

- Kingfisher Soft DrinkDocumento26 pagineKingfisher Soft DrinkmarshalsonavaneNessuna valutazione finora

- High Hops With Market Opportunities Brewing For U.S. Beer Ingredient - New Delhi - India - 4!18!2018Documento12 pagineHigh Hops With Market Opportunities Brewing For U.S. Beer Ingredient - New Delhi - India - 4!18!2018Telugu TamilNessuna valutazione finora

- Kingfisher Premium Kingfisher Strong Kingfisher Ultra Kingfisher Ultra Max Kingfisher Ultra Witbier Kingfisher Storm Kingfisher Blue KingfisherDocumento3 pagineKingfisher Premium Kingfisher Strong Kingfisher Ultra Kingfisher Ultra Max Kingfisher Ultra Witbier Kingfisher Storm Kingfisher Blue Kingfishersarat krishnaNessuna valutazione finora

- Final CobraDocumento24 pagineFinal CobraAmit BharwadNessuna valutazione finora

- United Breweries LTD (Diya Hai Vo)Documento52 pagineUnited Breweries LTD (Diya Hai Vo)golu1timaNessuna valutazione finora

- Breweries - : Industry Structure Manufacturing Process MarketDocumento3 pagineBreweries - : Industry Structure Manufacturing Process MarketbadranagNessuna valutazione finora

- SKOL Breweries Limited: Annual Report 2008Documento60 pagineSKOL Breweries Limited: Annual Report 2008mohanngpNessuna valutazione finora

- About The Company:: "Probably The Best Beer in The World"Documento8 pagineAbout The Company:: "Probably The Best Beer in The World"krapanshu rathiNessuna valutazione finora

- Strategic Marketing Assignment: Kingfisher BeerDocumento8 pagineStrategic Marketing Assignment: Kingfisher BeerSharthak Shankar Bhagat100% (1)

- Bs AssignmentDocumento4 pagineBs AssignmentShweta SharmaNessuna valutazione finora

- Kingfisher Ultra Max Repositioning HurdleDocumento11 pagineKingfisher Ultra Max Repositioning HurdleSushma MishraNessuna valutazione finora

- My ProjectDocumento56 pagineMy ProjectDeepak Mullassery100% (1)

- Beer Start-Up MarketingDocumento19 pagineBeer Start-Up MarketingSaloni MaheshwariNessuna valutazione finora

- PPTDocumento17 paginePPTSanta Kumar100% (1)

- MabdDocumento11 pagineMabdKishore RaghupathiNessuna valutazione finora

- UB Customer Oriented Marketing: The Consumer Orientation IsDocumento8 pagineUB Customer Oriented Marketing: The Consumer Orientation Issarat krishnaNessuna valutazione finora

- United Breweries: Kingfisher BeerDocumento34 pagineUnited Breweries: Kingfisher Beerajaygoyal84Nessuna valutazione finora

- Marketing ObjectiveDocumento1 paginaMarketing ObjectivePrakash SelvanNessuna valutazione finora

- Project - Bira Beer FinalDocumento18 pagineProject - Bira Beer FinalRajvi ChatwaniNessuna valutazione finora

- Indian Alcohol MarketDocumento23 pagineIndian Alcohol MarketPSYCHO RockstarNessuna valutazione finora

- 31212CA Breweries in Canada Industry ReportDocumento35 pagine31212CA Breweries in Canada Industry ReportmaryNessuna valutazione finora

- Premium Beer Market in IndiaDocumento8 paginePremium Beer Market in IndiaArpita Basu RayNessuna valutazione finora

- Report Description: Chapter 1 IntroductionDocumento28 pagineReport Description: Chapter 1 Introductionsidhujassi91Nessuna valutazione finora

- Future of Indian Beer IndustryDocumento63 pagineFuture of Indian Beer Industryrivi singhNessuna valutazione finora

- SAURYA SINGH RESEARCH PROJECt 2041103201Documento55 pagineSAURYA SINGH RESEARCH PROJECt 2041103201rivi singhNessuna valutazione finora

- Kingfisher MildDocumento5 pagineKingfisher MildRakesh BaduguNessuna valutazione finora

- Diego Vs UbDocumento2 pagineDiego Vs Ubmohitegaurv87Nessuna valutazione finora

- Indian Alcohol Brewaries Industry VCKDocumento29 pagineIndian Alcohol Brewaries Industry VCKSubrata Sarkar100% (1)

- Beer TsingtaoDocumento19 pagineBeer Tsingtaomanoj17188100% (1)

- To The CustomersDocumento31 pagineTo The CustomersSaranyaelangovan MargaretNessuna valutazione finora

- Presentation On Case Study "Cobra Beer" Marketing in India: Group No.-2Documento25 paginePresentation On Case Study "Cobra Beer" Marketing in India: Group No.-2Tarun ChopraNessuna valutazione finora

- Indian Liquor IndustryDocumento22 pagineIndian Liquor Industryabhi jagtapNessuna valutazione finora

- Coca-Cola FinalDocumento32 pagineCoca-Cola Finalkarthy1221Nessuna valutazione finora

- Beer Industry (Group 3)Documento22 pagineBeer Industry (Group 3)Vaibhav Kumar RanaNessuna valutazione finora

- True Beer: Inside the Small, Neighborhood Nanobreweries Changing the World of Craft BeerDa EverandTrue Beer: Inside the Small, Neighborhood Nanobreweries Changing the World of Craft BeerNessuna valutazione finora

- Wine Growing in Great Britain 2nd Edition - EbookDa EverandWine Growing in Great Britain 2nd Edition - EbookNessuna valutazione finora

- Start Your Own Microbrewery, Distillery, or Cidery: Your Step-By-Step Guide to SuccessDa EverandStart Your Own Microbrewery, Distillery, or Cidery: Your Step-By-Step Guide to SuccessValutazione: 4.5 su 5 stelle4.5/5 (2)

- Cho Gsas - Harvard 0084L 11462Documento503 pagineCho Gsas - Harvard 0084L 11462Claudemiro costaNessuna valutazione finora

- Introduction: Science and Environment: Brgy - Pampang, Angeles City, PhilippinesDocumento65 pagineIntroduction: Science and Environment: Brgy - Pampang, Angeles City, PhilippinesLance AustriaNessuna valutazione finora

- Mid Lesson 1 Ethics & Moral PhiloDocumento13 pagineMid Lesson 1 Ethics & Moral PhiloKate EvangelistaNessuna valutazione finora

- Boyle's Law 2023Documento6 pagineBoyle's Law 2023Justin HuynhNessuna valutazione finora

- Lecture 8Documento22 pagineLecture 8Ramil Jr. EntanaNessuna valutazione finora

- Design of Cycle Rickshaw For School ChildrenDocumento23 pagineDesign of Cycle Rickshaw For School ChildrenAditya GuptaNessuna valutazione finora

- Farmhouse Style Plans - Farm & CountryDocumento6 pagineFarmhouse Style Plans - Farm & Countryhanif azriNessuna valutazione finora

- A Study On Customer Satisfaction With After Sales Services at BLUE STAR Air ConditionerDocumento99 pagineA Study On Customer Satisfaction With After Sales Services at BLUE STAR Air ConditionerVinay KashyapNessuna valutazione finora

- Types of WinesDocumento91 pagineTypes of Winesrajanrld19880% (1)

- Moisture and Total Solids AnalysisDocumento44 pagineMoisture and Total Solids AnalysisNicholas BoampongNessuna valutazione finora

- QIAGEN Price List 2017Documento62 pagineQIAGEN Price List 2017Dayakar Padmavathi Boddupally80% (5)

- Plaquette - PRECASEM - CIMEC 2019 English VersionDocumento18 paginePlaquette - PRECASEM - CIMEC 2019 English VersionFranck BertrandNessuna valutazione finora

- Astm D974-97Documento7 pagineAstm D974-97QcHeNessuna valutazione finora

- Sperm Count EvaluationDocumento3 pagineSperm Count EvaluationGarry Kin CamarilloNessuna valutazione finora

- Moldex Realty, Inc. (Linda Agustin) 2.0 (With Sound)Documento111 pagineMoldex Realty, Inc. (Linda Agustin) 2.0 (With Sound)Arwin AgustinNessuna valutazione finora

- TXN Alarms 18022014Documento12 pagineTXN Alarms 18022014Sid GrgNessuna valutazione finora

- ADC ManualDocumento47 pagineADC ManualRavi ShuklaNessuna valutazione finora

- SweetenersDocumento23 pagineSweetenersNur AfifahNessuna valutazione finora

- Practical Considerations in Modeling: Physical Interactions Taking Place Within A BodyDocumento35 paginePractical Considerations in Modeling: Physical Interactions Taking Place Within A BodyFábio1 GamaNessuna valutazione finora

- Case Study (Co2 Flooding)Documento10 pagineCase Study (Co2 Flooding)Jessica KingNessuna valutazione finora

- Section Thru A-A at S-1: Footing ScheduleDocumento1 paginaSection Thru A-A at S-1: Footing ScheduleJan GarciaNessuna valutazione finora

- Air System Sizing Summary For NIVEL PB - Zona 1Documento1 paginaAir System Sizing Summary For NIVEL PB - Zona 1Roger PandoNessuna valutazione finora

- BRASS Introduction 2012Documento23 pagineBRASS Introduction 20121234scr5678Nessuna valutazione finora

- Hyundai Forklift Catalog PTASDocumento15 pagineHyundai Forklift Catalog PTASjack comboNessuna valutazione finora

- AssignmentDocumento13 pagineAssignmentSwakshar DebNessuna valutazione finora

- 4 Pure BendingDocumento42 pagine4 Pure BendingOmarfirozNessuna valutazione finora

- Soccer Training DiaryDocumento1 paginaSoccer Training DiaryMark DeaconNessuna valutazione finora

- ReagentsDocumento12 pagineReagentsKimscey Yvan DZ SulitNessuna valutazione finora

- BCSL 058 Previous Year Question Papers by IgnouassignmentguruDocumento45 pagineBCSL 058 Previous Year Question Papers by IgnouassignmentguruSHIKHA JAINNessuna valutazione finora

- Conceptual FrameworkDocumento3 pagineConceptual Frameworkprodiejigs36Nessuna valutazione finora