Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Limitations On The Power of Taxation

Caricato da

April Anne CostalesDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Limitations On The Power of Taxation

Caricato da

April Anne CostalesCopyright:

Formati disponibili

Limitations on The Power of Taxation The power of taxation, is however, subject to constitutional and inherent limitations.

Constitutional limitations are those provided for in the constitution or implied from its provisions, while inherent limitations are restrictions to the power to tax attached to its nature. The following are the inherent limitations. 1. 2. 3. 4. 5. Purpose. Taxes may be levied only for public purpose; Territoriality. The State may tax persons and properties under its jurisdiction; International Comity. the property of a foreign State may not be taxed by another. Exemption. Government agencies performing governmental functions are exempt from taxation Non-delegation. The power to tax being legislative in nature may not be delegated. (subject to exceptions)

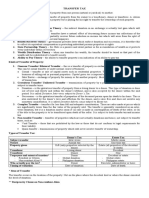

Constitutional limitations. 1. Observance of due process of law and equal protection of the laws. (sec, 1, Art. 3) Any deprivation of life , liberty or property is with due process if it is done under the authority of a valid law and after compliance with fair and reasonable methods or procedure prescribed. The power to tax, can be exercised only for a constitutionally valid public purpose and the subject of taxation must be within the taxing jurisdiction of the state. The government may not utilize any form of assessment or review which is arbitrary, unjust and which denies the taxpayer a fair opportunity to assert his rights before a competent tribunal. All persons subject to legislation shall be treated alike under like circumstances and conditions, both in the privileges conferred in liabilities imposed. Persons and properties to be taxed shall be group, and all the same class shall be subject to the same rate and the tax shall be administered impartially upon them. Rule of uniformity and equity in taxation (sec 28(1)Art VI) All taxable articles or properties of the same class shall be taxed at the same rate. Uniformity implies equality in burden not in amount. Equity requires that the apportionment of the tax burden be more or less just in the light of the taxpayers ability to bear the tax burden. No imprisonment for non-payment of poll tax (sec. 20, Art III) A person cannot be imprisoned for nonpayment of community tax, but may be imprisoned for other violations of the community tax law, such as falsification of the community tax certificate, or for failure to pay other taxes. Non-impairment of obligations and contracts, sec 10, Art III . the obligation of a contract is impaired when its terms and conditions are changed by law or by a party without the consent of the other, thereby weakening the position or the rights of the latter. IF a tax exemption granted by law and of the nature of a contract between the taxpayer and the government is revoked by a later taxing law, the said law shall not be valid, because it will impair the obligation of contract. Prohibition against infringement of religious freedom Sec 5, Art III, it has been said that the constitutional guarantee of the free exercise and enjoyment of religious profession and worship, which carries the right to disseminate religious belief and information, is violated by the imposition of a license fee on the distribution and sale of bibles and other religious literatures not for profit by a non-stock, non-profit religious corporation. Prohibition against appropriations for religious purposes, sec 29, (2) Art. VI, Congress cannot appropriate funds for a private purpose, or for the benefit of any priest, preacher or minister or for the support of any sect, church except when such priest, preacher, is assigned to the armed forces or to any penal institutions, orphanage or leprosarium. exemption of all revenues and assets of non-stock, non-profit educational institutions used actually, directly, and exclusively for educational purposes from income, property and donors taxes and custom duties (sec. 4 (3 and 4) art. XIV. Concurrence by a majority of all members of Congress in the passage of a law granting tax exemptions. Sec. 28 (4) Art. VI. Congress may not deprive the Supreme Court of its jurisdiction to review, revise, reverse, modify or affirm on appeal or certiorari, final judgments and orders of lower courts in all cases involving the legality of any tax, impost, assessment or any penalty imposed in the relation thereto.

2.

3.

4.

5.

6.

7.

8. 9.

While the power does not emanate from a grant, as the same is necessarily inherent upon the existence of the state, exercise of the power is subject to those limitations inherent upon it and those expressly provided for by the Constitution as follows: Inherent limitations. These limitations are those limitations that emanates from the very nature of the power of taxation. They are very basic and are built-in with the power. Some may be similar to the constitutional limitation but the constitutional limitation seems to be supreme as they are the most specific, thus, specifically intended to rule the application or exercise of the power of taxation. Hereunder are the INHERENT LIMITATIONS: Levy for public purpose. To levy a tax means to impose or to charge or to collect a tax from those to whom it is addressed. Technically however, to levy is to pass on laws or ordinances imposing a tax or duty upon specific group of taxpayers. Under this concept, the impelling reason for the imposition of the tax must be the welfare of the public, in general. This follows that the proceeds from such imposition shall inure to the benefit of the public. In one case, a certain imposition was successfully passed for the purpose of upholding the welfare of the sugar industry. It was questioned on the ground that there is no PUBLIC purpose since the sugar industry does not allegedly represent the public. The issue was resolved in favor of the validity of the imposition. While sugar industry does not represent the entire public as the proceeds would not add to the general budget of the national government, nevertheless, the industry itself admits of a public nature whose circumstances and effects directly affect the public. The requirement of direct purpose does not admit of a direct public benefit from the imposition. Non-delegation of legislative power to tax. To delegate is to pass on or to entrust to another a certain duty or obligation. Power to tax is lodged with the legislative department. To my mind, this is because the legislative branch is theoretically the representative of the people and they are directly aware and in common contact with the instances and situations of their districts making them the ones knowledgeable of how best their district could be affected by the new taxes imposed. Likewise, this is premised on the legal maxim delegate potestas, non delegari potest which means, what has been delegated cannot be re-delegated so as not to hamper the objective of the delegation. However, there are at least two (2) instances where delegation is possible (a) delegation to the President of some tariff powers, and (b) Local government units fiscal autonomy for their self serving needs. Exemption of government entities. Government is the people, by (not BUY) the people, for (not POOR) the people. Government exists for the people and whatever amount it makes, came from the people and such amount it use to finance its various activities to address the general welfare of its inhabitants. It is not constituted to engage in any trade or business but to deliver basic services and serve everyone within. Analytically, taxing the government itself will not generate more revenue. The money will only rotate and so no effect, at all, would be made. Suffice it to say however, there exist no express prohibition International comity has something to do with the friendly interaction and participation of different estates. This adheres to some amount of submission and compliance of certain international rules and covenants for mutual benefits and enjoyment of the states and its inhabitants. Bilateral agreements, conventions and international treaties fall under this category. Territorial jurisdiction relates to the area of jurisdiction and responsibility of a particular estate. Independent states power of taxation is generally confined only within its jurisdiction to give due respect and as courtesy to other states. A state, as a rule, can only impose and implement tax laws and rules within its jurisdiction in accordance with its wishes. Outside its jurisdiction, it is without power to do so. But then, it can tax on citizens or entities of other states doing a trade or business or deriving income within the jurisdiction of its state. See the case of Spratley islands for better picture. Issue on who owns spratley had long been outstanding for each party claims jurisdiction in accordance with its of the parties belief that it rightfully belongs to it.

Potrebbero piacerti anche

- TAX FinalsDocumento26 pagineTAX FinalsApple Grace LalicanNessuna valutazione finora

- Constitutional LimitationsDocumento3 pagineConstitutional LimitationsPete BasNessuna valutazione finora

- Taxation - Constitutional Limitations PDFDocumento1 paginaTaxation - Constitutional Limitations PDFVicson Mabanglo100% (3)

- General Principles of Taxation ExplainedDocumento12 pagineGeneral Principles of Taxation ExplainedMatt Marqueses PanganibanNessuna valutazione finora

- Negotiable instruments and corporate law essentialsDocumento14 pagineNegotiable instruments and corporate law essentialsMark MartinezNessuna valutazione finora

- Limitations on Taxing PowerDocumento8 pagineLimitations on Taxing PowerFranco David BaratetaNessuna valutazione finora

- CHAPTER-TWO PUBLIC REVENUEDocumento76 pagineCHAPTER-TWO PUBLIC REVENUEyebegashetNessuna valutazione finora

- Bar Exam Taxation Q&A (Source: chanroblesbar.comDocumento7 pagineBar Exam Taxation Q&A (Source: chanroblesbar.comフィリピン 愛100% (2)

- What Is Public Utility - Compiled - GRP1Documento77 pagineWhat Is Public Utility - Compiled - GRP1Chloe Sile Dela CruzNessuna valutazione finora

- Law On Negotiable Instruments Sec 1Documento43 pagineLaw On Negotiable Instruments Sec 1suigeneris28Nessuna valutazione finora

- Constitutional LimitationsDocumento66 pagineConstitutional LimitationsDev LitaNessuna valutazione finora

- TAX SITUS-It Is The Place or Authority That Has The Right To Impose and Collect TaxesDocumento58 pagineTAX SITUS-It Is The Place or Authority That Has The Right To Impose and Collect TaxesTJ Julian BaltazarNessuna valutazione finora

- Tax Vs TollDocumento4 pagineTax Vs TollKris Joseph LasayNessuna valutazione finora

- INCOME TAX HANDOUT FOR FINALS - SorianoDocumento77 pagineINCOME TAX HANDOUT FOR FINALS - SorianoPoPo MillanNessuna valutazione finora

- Chapter 2 Taxes Tax Law and Tax AdministrationDocumento37 pagineChapter 2 Taxes Tax Law and Tax AdministrationJohn Galleno100% (1)

- Income Taxation (General Principles of Taxation)Documento10 pagineIncome Taxation (General Principles of Taxation)Isabelle HanNessuna valutazione finora

- 2 General Principles of Income TaxationDocumento9 pagine2 General Principles of Income TaxationDenise ZurbanoNessuna valutazione finora

- TAX RULES FOR CORPORATIONSDocumento10 pagineTAX RULES FOR CORPORATIONSeinel dcNessuna valutazione finora

- General Principles in Taxation PDFDocumento15 pagineGeneral Principles in Taxation PDFJewel Francine PUDESNessuna valutazione finora

- Taxation Law I: Key Allowable Deductions and Standard Deduction RulesDocumento51 pagineTaxation Law I: Key Allowable Deductions and Standard Deduction RulesJansen OuanoNessuna valutazione finora

- Inherent Limitations of TaxationDocumento1 paginaInherent Limitations of TaxationVicson Mabanglo100% (2)

- INTERNATIONAL ACADEMY OF MANAGEMENT v. LITTONDocumento3 pagineINTERNATIONAL ACADEMY OF MANAGEMENT v. LITTONAinna Rose NaldaNessuna valutazione finora

- Remedies of The GovernmentDocumento9 pagineRemedies of The GovernmentRod Floriven MarianoNessuna valutazione finora

- General Principles: Answer: CDocumento13 pagineGeneral Principles: Answer: CReno PhillipNessuna valutazione finora

- Income Taxation01Documento7 pagineIncome Taxation01Ailene MendozaNessuna valutazione finora

- Income Taxation ReviewerDocumento17 pagineIncome Taxation ReviewerheheNessuna valutazione finora

- Chapter 3 Concept of IncomeDocumento6 pagineChapter 3 Concept of IncomeChesca Marie Arenal Peñaranda100% (1)

- BPI Vs Sps YuDocumento2 pagineBPI Vs Sps YuArahbellsNessuna valutazione finora

- The Fundamental Powers of The StateDocumento12 pagineThe Fundamental Powers of The Statedaphnie lorraine ramosNessuna valutazione finora

- Memory Aid TAXATIONDocumento35 pagineMemory Aid TAXATIONMary Christine Formiloza MacalinaoNessuna valutazione finora

- Tax - Vat GuidenotesDocumento13 pagineTax - Vat GuidenotesNardz AndananNessuna valutazione finora

- Understanding Taxation FundamentalsDocumento34 pagineUnderstanding Taxation FundamentalsKaren DammogNessuna valutazione finora

- I. Payment/performance: Ii. Loss of The Thing DueDocumento15 pagineI. Payment/performance: Ii. Loss of The Thing Duelemonjuice rileyNessuna valutazione finora

- Tax Notes Under Atty GaleraDocumento18 pagineTax Notes Under Atty GaleraArahbellsNessuna valutazione finora

- Art. 6 Sec. 28 Limitation On The Power of Taxation - Uniform and EquitableDocumento2 pagineArt. 6 Sec. 28 Limitation On The Power of Taxation - Uniform and EquitableMadeliniaNessuna valutazione finora

- Impact, Incidence and Shifting of TaxesDocumento26 pagineImpact, Incidence and Shifting of TaxesRiya RoyNessuna valutazione finora

- Taxation On Estates and Trusts - REVISED 2022Documento16 pagineTaxation On Estates and Trusts - REVISED 2022rav danoNessuna valutazione finora

- Tax - Procter & Gamble VS Municipality of JagnaDocumento2 pagineTax - Procter & Gamble VS Municipality of JagnaKath LimNessuna valutazione finora

- Discussion QuestionsDocumento7 pagineDiscussion QuestionsPoison IvyNessuna valutazione finora

- PM Reyes Tax Audit Assessment Primer PDFDocumento6 paginePM Reyes Tax Audit Assessment Primer PDFAnge Buenaventura SalazarNessuna valutazione finora

- Income Taxation ReviewerDocumento84 pagineIncome Taxation ReviewerCharmaine Mejia100% (1)

- Principles of Taxation: Nature, Scope, Classification, and Essential CharacteristicsDocumento14 paginePrinciples of Taxation: Nature, Scope, Classification, and Essential CharacteristicsClariña VirataNessuna valutazione finora

- Gaston v. RepublicDocumento10 pagineGaston v. RepublicBliz100% (1)

- General Principles of TaxationDocumento38 pagineGeneral Principles of TaxationAntonette Miranda80% (5)

- 1995Documento17 pagine1995Gelo MVNessuna valutazione finora

- FYCE BM1804 - Income Taxation HandoutDocumento17 pagineFYCE BM1804 - Income Taxation HandoutLisanna DragneelNessuna valutazione finora

- Actions and Damages - Digest Transpo LawDocumento42 pagineActions and Damages - Digest Transpo LawDennis Aran Tupaz AbrilNessuna valutazione finora

- General Principles: Theory and Basis of TaxationDocumento15 pagineGeneral Principles: Theory and Basis of TaxationRicarr ChiongNessuna valutazione finora

- Deductions From Gross IncomeDocumento66 pagineDeductions From Gross IncomeGet BurnNessuna valutazione finora

- Income Taxation - NotesDocumento10 pagineIncome Taxation - NotesMarie TNessuna valutazione finora

- Partnership Reviewer: University of The PhilippinesDocumento31 paginePartnership Reviewer: University of The PhilippinesKenneth Irvin D. NgNessuna valutazione finora

- CIR vs CA, CTA and A. Soriano CorpDocumento1 paginaCIR vs CA, CTA and A. Soriano CorpJerickson A. ReyesNessuna valutazione finora

- Tax Reviewer 3 TRANSFER TAXDocumento6 pagineTax Reviewer 3 TRANSFER TAXAlliahDataNessuna valutazione finora

- Note 1 Joint AccountsDocumento3 pagineNote 1 Joint AccountsJudith AlisuagNessuna valutazione finora

- Sources of Tax Laws Page 8Documento16 pagineSources of Tax Laws Page 8nazhNessuna valutazione finora

- Nature and Scope of The Power of TaxationDocumento4 pagineNature and Scope of The Power of Taxationwiggie2782% (17)

- Limitations on the Power of TaxationDocumento14 pagineLimitations on the Power of TaxationAlexander FutalanNessuna valutazione finora

- CONSTITUTIONAL LIMITATIONS - Those Limitations On The State's Exercise of TheDocumento6 pagineCONSTITUTIONAL LIMITATIONS - Those Limitations On The State's Exercise of TheMaybielynDavidNessuna valutazione finora

- Sources of Tax LawDocumento3 pagineSources of Tax Lawlarry tierraNessuna valutazione finora

- A Means by Which Governments Finance Their Expenditure by Imposing Charges On Citizens and Corporate EntitiesDocumento5 pagineA Means by Which Governments Finance Their Expenditure by Imposing Charges On Citizens and Corporate EntitiesLieanne EspinosaNessuna valutazione finora

- Drugs and NCPDocumento4 pagineDrugs and NCPApril Anne CostalesNessuna valutazione finora

- Prompt ListDocumento1 paginaPrompt ListApril Anne CostalesNessuna valutazione finora

- 708125A Dialog Kurzanleitung GB 08 08Documento20 pagine708125A Dialog Kurzanleitung GB 08 08Maxence KouessiNessuna valutazione finora

- Final Output PDFDocumento43 pagineFinal Output PDFApril Anne CostalesNessuna valutazione finora

- EngineeringDocumento1 paginaEngineeringApril Anne CostalesNessuna valutazione finora

- Global StratificationDocumento4 pagineGlobal StratificationApril Anne CostalesNessuna valutazione finora

- Drug StudyDocumento9 pagineDrug StudyApril Anne CostalesNessuna valutazione finora

- Philippine Patient's Bill of RightsDocumento6 paginePhilippine Patient's Bill of Rightsplethoraldork98% (49)

- 59521267Documento12 pagine59521267April Anne CostalesNessuna valutazione finora

- Coca-Cola Bottlers Philippines, Inc.Documento5 pagineCoca-Cola Bottlers Philippines, Inc.anneasfsdNessuna valutazione finora

- Sample California Mutual Release and Settlement AgreementDocumento4 pagineSample California Mutual Release and Settlement AgreementSteve Vondran IP Lawyer67% (3)

- Labor StandardDocumento6 pagineLabor StandardClarito LopezNessuna valutazione finora

- Republic of the Philippines Supreme Court rules on prescription period for subdivision development obligationsDocumento10 pagineRepublic of the Philippines Supreme Court rules on prescription period for subdivision development obligationsKiko AguilarNessuna valutazione finora

- Union Manufacturing vs. Philippine GuarantyDocumento3 pagineUnion Manufacturing vs. Philippine GuarantyAnonymous 33LIOv6LNessuna valutazione finora

- Sales Cases 01Documento74 pagineSales Cases 01PaulineNessuna valutazione finora

- Transpo Chapter 2 Contract of Common CarriageDocumento4 pagineTranspo Chapter 2 Contract of Common CarriageDarla GreyNessuna valutazione finora

- Case Digests Political LawDocumento39 pagineCase Digests Political LawMinerva LopezNessuna valutazione finora

- Sales Cir Vs CA and AteneoDocumento1 paginaSales Cir Vs CA and AteneoMariaAyraCelinaBatacan0% (1)

- Assam Hydro Power ConsultancyDocumento32 pagineAssam Hydro Power ConsultancySaurabh SharmaNessuna valutazione finora

- Proforma Invoice - MINI 12PSBDocumento2 pagineProforma Invoice - MINI 12PSBmkdiesel30Nessuna valutazione finora

- Republic Vs Ca, 236 Scra 257Documento3 pagineRepublic Vs Ca, 236 Scra 257Junior DaveNessuna valutazione finora

- UNIT 1 InsuranceDocumento9 pagineUNIT 1 InsuranceHarleenNessuna valutazione finora

- QP Company Law KsluDocumento3 pagineQP Company Law KsluSunil ChoudhariNessuna valutazione finora

- 2011 Feb17 - Howard Griswold Conference CallDocumento11 pagine2011 Feb17 - Howard Griswold Conference CallGemini ResearchNessuna valutazione finora

- Lim V Sunlife G.R. No. L-15774 November 29, 1920: I. PolicyDocumento5 pagineLim V Sunlife G.R. No. L-15774 November 29, 1920: I. PolicyNFNLNessuna valutazione finora

- !01192008 ITTs Memo For Record - Report of Fraud To ITTDocumento4 pagine!01192008 ITTs Memo For Record - Report of Fraud To ITTTrafficked_by_ITTNessuna valutazione finora

- Defective Incorporation - de Facto Corporations Corporations by EDocumento29 pagineDefective Incorporation - de Facto Corporations Corporations by EEl-Seti Anu Ali ElNessuna valutazione finora

- UntitledDocumento526 pagineUntitledJes CantuNessuna valutazione finora

- May Security Guards Form A Labor Organization?Documento28 pagineMay Security Guards Form A Labor Organization?Chari BelleNessuna valutazione finora

- PERSONS & FAM ILY RELATIONS CASE DIGESTSDocumento15 paginePERSONS & FAM ILY RELATIONS CASE DIGESTSyannie11Nessuna valutazione finora

- Posting WorkersDocumento15 paginePosting WorkersAuguste MartinelyteNessuna valutazione finora

- GR 136913 - Buce V CADocumento2 pagineGR 136913 - Buce V CALexNessuna valutazione finora

- 00-10-001 - F - Nov.2000Documento0 pagine00-10-001 - F - Nov.2000Levi MurdokNessuna valutazione finora

- Letter of IntentDocumento2 pagineLetter of Intentpierololli75% (4)

- Speed Control with S7-1200 and SINAMICS V90 via PROFINETDocumento23 pagineSpeed Control with S7-1200 and SINAMICS V90 via PROFINETDavid LucioNessuna valutazione finora

- Extension of Contract Till Dec 2022Documento2 pagineExtension of Contract Till Dec 2022pritam kumar chatterjeeNessuna valutazione finora

- Cosio vs. PalileoDocumento12 pagineCosio vs. PalileojieNessuna valutazione finora

- Letter of Intend JVDocumento7 pagineLetter of Intend JVRedefine SpacesNessuna valutazione finora

- Santiago vs. CF Sharp Crew ManagementDocumento3 pagineSantiago vs. CF Sharp Crew ManagementLance Lagman100% (1)