Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

I Pay Statements Serv 08 Jun

Caricato da

No'o Riccardo Ahio0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

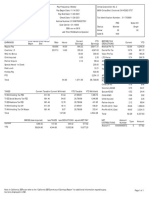

67 visualizzazioni1 paginaRate hours XXX-XX-5556 this period year to date Other Benefits and this period total to date Regular Overtime Holiday Pay Misc Earnings Shift Premium Gross Pay Statutory Federal Income Tax Social Security Tax Medicare Tax UT State Income Tax Holiday Hrs Misc Hrs Ytd Prem Accru Ddchk 2 Health Insuranc Uniform Clean Un Dues Bct Net Pay Excluded from federal taxable wages this period are $905 24 Advice number:

Descrizione originale:

Titolo originale

i Pay Statements Serv 08 Jun

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoRate hours XXX-XX-5556 this period year to date Other Benefits and this period total to date Regular Overtime Holiday Pay Misc Earnings Shift Premium Gross Pay Statutory Federal Income Tax Social Security Tax Medicare Tax UT State Income Tax Holiday Hrs Misc Hrs Ytd Prem Accru Ddchk 2 Health Insuranc Uniform Clean Un Dues Bct Net Pay Excluded from federal taxable wages this period are $905 24 Advice number:

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

67 visualizzazioni1 paginaI Pay Statements Serv 08 Jun

Caricato da

No'o Riccardo AhioRate hours XXX-XX-5556 this period year to date Other Benefits and this period total to date Regular Overtime Holiday Pay Misc Earnings Shift Premium Gross Pay Statutory Federal Income Tax Social Security Tax Medicare Tax UT State Income Tax Holiday Hrs Misc Hrs Ytd Prem Accru Ddchk 2 Health Insuranc Uniform Clean Un Dues Bct Net Pay Excluded from federal taxable wages this period are $905 24 Advice number:

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

CO.

FILE

DEPT.

CLOCK

VCHR. NO.

8LR

305486

LR1890

11 AT

0000230174 197-0002

Earnings Statement

Period Ending: Pay Date: 06/02/2012 06/08/2012

3301 RIDER TRAIL SUITE 100 EARTH CITY, MO 63045

Taxable Marital Status: Exemptions/Allowances: Federal: 4 UT: 4

Married

KALOLO AHIO 4470 S GOLDENARROW COVE WEST VALLEY CITY, UT 84128

Social Security Number: rate hours

XXX-XX-5556 this period year to date

Other Benefits and

this period total to date

Regular Overtime Holiday Pay Misc Earnings Shift Premium

21 32 21 21 0

4150 1225 4150 4150 4000

27 75 1 50 12 00 50 25

594 48 256 10 0

27 18 98 71 10

Gross Pay Statutory

Federal Income Tax Social Security Tax Medicare Tax UT State Income Tax

910 24

18 778 04 7 020 23 591 62 63 01 6 20 26 459 10

Holiday Hrs Misc Hrs Shift Prem Hrs Ytd Prem Accru

28 3 15 12

00 00 50 00

51 38 13 35

84 02 13 72

2 066 15 1 106 45 381 99 1 161 55

Ddchk 2 Health Insuranc Uniform Clean Un Dues Bct

763 61 5 00* 2 92

21 355 115 65 207

25 00 09 62

Net Pay

0 00

* Excluded from federal taxable wages

Your federal taxable wages this period are $905 24

2000 A DP, Inc

Advice number:

Pay date:

00000230174

06/08/2012

Deposited

to the account of

account number

transit

ABA

amount

KALOLO AHIO

xxxxxxxx0619

xxxx xxxx

$763 61

NON-NEGOTIABLE

Potrebbero piacerti anche

- 2 BXooo 006610620000 R 969253 A0 FFC521Documento1 pagina2 BXooo 006610620000 R 969253 A0 FFC521Pily AguilarNessuna valutazione finora

- CheckStub - 2020-11-06 v3.6Documento1 paginaCheckStub - 2020-11-06 v3.6dijaje865Nessuna valutazione finora

- Dewitt Gibson: This Is Not A CheckDocumento1 paginaDewitt Gibson: This Is Not A CheckDewitr GibsonNessuna valutazione finora

- Paystub 1Documento1 paginaPaystub 1Lori JohnsonNessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-NegotiableAyanna Sellers100% (5)

- Employee Pay StubDocumento2 pagineEmployee Pay StubTasnim jamil100% (1)

- Adp Pay Stub Template 1Documento1 paginaAdp Pay Stub Template 1Candy ValentineNessuna valutazione finora

- Wal-Mart Statement of Earnings and Deductions.: 77 Green Acres RD S, Valley Stream, NY 11581Documento1 paginaWal-Mart Statement of Earnings and Deductions.: 77 Green Acres RD S, Valley Stream, NY 11581Sharon JonesNessuna valutazione finora

- Pete's Salary For A Week PDFDocumento1 paginaPete's Salary For A Week PDFCarmen KuhneNessuna valutazione finora

- Non-Negotiable: 1033 Massachusetts Avenue 2nd Floor Cambridge, MA 02138Documento1 paginaNon-Negotiable: 1033 Massachusetts Avenue 2nd Floor Cambridge, MA 02138DearNoodlesNessuna valutazione finora

- Earnings Statement Earnings Statement Earnings Statement Earnings StatementDocumento1 paginaEarnings Statement Earnings Statement Earnings Statement Earnings StatementAbu Mohammad Omar Shehab Uddin AyubNessuna valutazione finora

- Scott Luman 5929 FM 711 CENTER, TX 75935-000Documento6 pagineScott Luman 5929 FM 711 CENTER, TX 75935-000dolapo BalogunNessuna valutazione finora

- Earnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Documento1 paginaEarnings Current YTD Amount Current Units YTD Units: Town of Guttenberg 6808 Park Avenue Guttenberg, NJ 07093Alfredo MurrugarraNessuna valutazione finora

- Paystub 1Documento1 paginaPaystub 1PeterJamesNessuna valutazione finora

- Pay Stub - 1 PDFDocumento1 paginaPay Stub - 1 PDFPankaj DesaiNessuna valutazione finora

- Pay StubsDocumento2 paginePay StubsmatthewmerricksNessuna valutazione finora

- PaystubDocumento1 paginaPaystubOrbarsNessuna valutazione finora

- Liska PaystubDocumento1 paginaLiska PaystubCreative Puppy100% (1)

- View PDF Form Paycheck MonthDocumento1 paginaView PDF Form Paycheck Monthnodropcarwash100% (1)

- Get Payslip by OffsetDocumento1 paginaGet Payslip by OffsetDarryl WhiteheadNessuna valutazione finora

- Els 10 29 2016 PDFDocumento1 paginaEls 10 29 2016 PDFRebeca LedezmaNessuna valutazione finora

- Wal-Mart Statement of Earnings and Deductions.: 702 S.W. 8th St.,Bentonville, Arkansas 72716Documento1 paginaWal-Mart Statement of Earnings and Deductions.: 702 S.W. 8th St.,Bentonville, Arkansas 72716osce1349Nessuna valutazione finora

- PayStubDocumento1 paginaPayStubhaideegracebordadorNessuna valutazione finora

- Paystub Golden Limousine, Inc 20210906 20210919Documento2 paginePaystub Golden Limousine, Inc 20210906 20210919Alexander Weir-WitmerNessuna valutazione finora

- Earnings Statement PAY STUBDocumento1 paginaEarnings Statement PAY STUBAtonye Nyingifa100% (1)

- View - Weekly Paystub - JanDocumento1 paginaView - Weekly Paystub - JannodropcarwashNessuna valutazione finora

- Employee PaystubDocumento1 paginaEmployee PaystubBrittney WhiteNessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-Negotiablesivajyothi1973Nessuna valutazione finora

- Gina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursDocumento4 pagineGina L Eggleton 22965 NE Albertson RD Gaston, OR 97119: Company: Check No. Group: Loc. Dept: Check Date: HoursGigi EggletonNessuna valutazione finora

- Wage Earnings StatementDocumento1 paginaWage Earnings StatementDiana MartinezNessuna valutazione finora

- Pay Stub SummaryDocumento1 paginaPay Stub SummaryamandastarNessuna valutazione finora

- The Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PDocumento1 paginaThe Texas A&M University System: Statement of Earnings For: Jadhav, Sangramsinh PSangram JadhavNessuna valutazione finora

- Debit Account Transactions Date Description Type Amount AvailableDocumento3 pagineDebit Account Transactions Date Description Type Amount Availableb100% (2)

- PaystubDocumento1 paginaPaystubAlberto MoralesNessuna valutazione finora

- Payslip PDFDocumento1 paginaPayslip PDFTwilliams SavgeeNessuna valutazione finora

- Paystub - 2009 03 31Documento1 paginaPaystub - 2009 03 31jrodasc100% (1)

- Northside Independent School District Pay AdviceDocumento2 pagineNorthside Independent School District Pay AdviceJuan EnriqueNessuna valutazione finora

- Earnings Statement TitleDocumento1 paginaEarnings Statement TitleScott DoeNessuna valutazione finora

- View PDF Form PaycheckDocumento1 paginaView PDF Form Paychecknodropcarwash100% (1)

- DescărcareDocumento1 paginaDescărcareDina SpinuNessuna valutazione finora

- PayStubDocumento1 paginaPayStubwilson0514Nessuna valutazione finora

- Adp QUANIC MARTIN-converted (1st Try)Documento12 pagineAdp QUANIC MARTIN-converted (1st Try)Quanic Martin100% (1)

- How to identify a real check from a sample checkDocumento1 paginaHow to identify a real check from a sample checkfreeman p. donNessuna valutazione finora

- DJ L Pay Stubs 2Documento1 paginaDJ L Pay Stubs 2jase0% (1)

- Employee Earnings Statement DetailsDocumento1 paginaEmployee Earnings Statement DetailsArthur LottieNessuna valutazione finora

- Gil Rental Payroll - 105 - 022019Documento1 paginaGil Rental Payroll - 105 - 022019Steven LinNessuna valutazione finora

- J6Hooo009310710000r0313131DE64F521 PDFDocumento1 paginaJ6Hooo009310710000r0313131DE64F521 PDFRoll KingsNessuna valutazione finora

- Job PRC Contracting Inc Attn: Job PRC Contracting Inc Payroll 10610 Union Hall ST Jamaica Ny 11433 ToDocumento1 paginaJob PRC Contracting Inc Attn: Job PRC Contracting Inc Payroll 10610 Union Hall ST Jamaica Ny 11433 ToDevon JohnsonNessuna valutazione finora

- WAHPBC PayStub Lawanda GardinerDocumento1 paginaWAHPBC PayStub Lawanda GardinerwahpbcNessuna valutazione finora

- Img 20140203 0001Documento5 pagineImg 20140203 0001Brandon MooreNessuna valutazione finora

- Earnings Statement Title for Period Ending January 23, 2017Documento1 paginaEarnings Statement Title for Period Ending January 23, 2017Katrin Joyce PenaredondaNessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-NegotiableSam TracyNessuna valutazione finora

- Non-Negotiable: Nvidia CorporationDocumento1 paginaNon-Negotiable: Nvidia CorporationSteven LinNessuna valutazione finora

- Pay StatementDocumento1 paginaPay Statementjmatos_297262Nessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-NegotiableanandsoggyNessuna valutazione finora

- CTAooo 0043003100000710 CF7 E3548521Documento1 paginaCTAooo 0043003100000710 CF7 E3548521Manuel De Jesus Andrade PalacioNessuna valutazione finora

- Small Cell InformaDocumento1 paginaSmall Cell Informaskouti9Nessuna valutazione finora

- Earnings Statement: Non-NegotiableDocumento1 paginaEarnings Statement: Non-NegotiableSrilatha YagniNessuna valutazione finora