Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Role of Commercial Banks in Developing The Economy of Pakistan

Caricato da

Ishtiaq AhmedTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Role of Commercial Banks in Developing The Economy of Pakistan

Caricato da

Ishtiaq AhmedCopyright:

Formati disponibili

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

ALLAMA IQBAL OPEN UNIVERSITY

(Department of Business Administration) Assignment # 2 Banking Law and Practice (5548)

TOPIC: ROLE OF COMMERCIAL BANKS IN

DEVELOPING THE ECONOMY OF PAKISTAN

Submitted to: Sir Kamran Mehmood Submitted by: Ishtiaq Ahmed

AH-526270

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Acknowledgement

All praises to Almighty Allah, the most Gracious, the most Beneficent and the most Merciful, who enabled me to complete this assignment. I feel great pleasure in expressing my since gratitude to my teacher, for his guidance and support for providing me an opportunity to complete my Project. My special thanks and acknowledgments to Mr. Zeeshan for providing me all relative information, guidance and support to compile the practical study at MCB. I will keep my hopes alive for the success of given task to submit this report to my honorable teacher Sir Kamran Mehmood, whose guidance; support and encouragement enable me to complete this assignment.

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Executive Summary

A bank is a financial institution and a financial intermediary that accepts deposits and channels those deposits into lending activities, either directly or through capital markets The word bank was borrowed in Middle English from Middle French banque, from Old Italian banca, from Old High German banc, bank "bench, counter". A commercial bank (or business bank) is a type of financial institution and intermediary. It is a bank that provides transactional, savings, and money market accounts and that accepts time deposits. Commercial Bank is a back bone for any country. They play important role in the development of that country. Commercial banks perform a lot of function and provide many services for their customers. MCB is one of the largest banks of Pakistan, founded in 1947. It is supported by a strong Mian Mansha group. Muslim commercial Bank is playing an important role in the developing economy of Pakistan. But there are still some weaknesses in its system that can be taking some strong Steps.

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Table of Contents

Contents Page No

01 02 03 04 05 22

1. Title page 2. Acknowledgement 3. Executive Summary 4. Table of contents 5. Introduction to the topic 6. Practical study of organization

7. Practical study of organization with respect 25 to the issue 8. SWOT analysis 9. Recommendations 10. 11. Conclusion References 14 35 36 37

4

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Introduction to Topic

Bank

A bank is a financial institution and a financial intermediary that accepts deposits and channels those deposits into lending activities, either directly or through capital markets Due to their critical status within the financial system and the economy generally, banks are highly regulated in most countries. Most banks operate under a system known as fractional reserve banking where they hold only a small reserve of the funds deposited and lend out the rest for profit. They are generally subject to minimum capital requirements which are based on an international set of capital standards, known as the Basel Accords.

Origin of the word:

The word bank was borrowed in Middle English from Middle French banque, from Old Italian banca, from Old High German banc, bank "bench, counter". Benches were used as desks or exchange counters during the Renaissance by Florentine bankers, who used to make their transactions atop desks covered by green tablecloths.

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

One of the oldest items found showing money-changing activity is a silver Greek drachm coin from ancient Hellenic colony Trapezus on the Black Sea, modern Trabzon, c. 350325 BC, presented in the British Museum in London. The coin shows a banker's table (trapeza) laden with coins, a pun on the name of the city. In fact, even today in Modern Greek the word Trapeza () means both a table and a bank.

History:

Banking in the modern sense of the word can be traced to medieval and early Renaissance Italy, to the rich cities in the north like Florence, Venice and Genoa. The Bardi and Peruzzi families dominated banking in 14th century Florence, establishing branches in many other parts of Europe. Perhaps the most famous Italian bank was the Medici bank, set up by Giovanni Medici in 1397. The earliest known state deposit bank, Banco di San Giorgio (Bank of St. George), was founded in 1407 at Genoa, Italy.

Types of banks

Banks' activities can be divided into retail banking, dealing directly with individuals and small businesses; business banking, providing services to mid-market business; corporate banking, directed at large business entities; private banking, providing wealth management services to high net worth individuals and families; and investment banking, relating to activities on the financial markets. Most banks are profit-making, private enterprises.

6

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

However, some are owned by government, or are non-profit organizations.

Types of retail banks

1.Commercial bank: the term used for a normal bank to

distinguish it from an investment bank. After the Great Depression, the U.S. Congress required that banks only engage in banking activities, whereas investment banks were limited to capital market activities. Since the two no longer have to be under separate ownership, some use the term "commercial bank" to refer to a bank or a division of a bank that mostly deals with deposits and loans from corporations or large businesses.

2.Community banks: locally operated financial institutions

that empower employees to make local decisions to serve their customers and the partners.

3.Community development banks: regulated banks that

provide financial services and credit to under-served markets or populations.

4.Credit unions: not-for-profit cooperatives owned by the

depositors and often offering rates more favorable than forprofit banks. Typically, membership is restricted to employees of a particular company, residents of a defined neighborhood, members of a certain labor union or religious organizations, and their immediate families.

5.Postal savings banks: savings banks associated with

national postal systems.

7

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

6.Private Banks: banks that manage the assets of high net

worth individuals. Historically a minimum of USD 1 million was required to open an account; however, over the last years many private banks have lowered their entry hurdles to USD 250,000 for private investors.

7.Offshore banks: banks located in jurisdictions with low

taxation and regulation. Many offshore banks are essentially private banks.

8.Savings bank: in Europe, savings banks took their roots in

the 19th or sometimes even in the 18th century. Their original objective was to provide easily accessible savings products to all strata of the population. In some countries, savings banks were created on public initiative; in others, socially committed individuals created foundations to put in place the necessary infrastructure. Nowadays, European savings banks have kept their focus on retail banking: payments, savings products, credits and insurances for individuals or small and mediumsized enterprises. Apart from this retail focus, they also differ from commercial banks by their broadly decentralized distribution network, providing local and regional outreach and by their socially responsible approach to business and society.

9.Building societies and Landesbanks: institutions that

conduct retail banking.

10.

Ethical banks: banks that prioritize the transparency of

all operations and make only what they consider to be sociallyresponsible investments.

8

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Types of investment banks

Investment banks "underwrite" (guarantee the sale of) stock and bond issues, trade for their own accounts, make markets, and advise corporations on capital market activities such as mergers and acquisitions. Merchant banks were traditionally banks which engaged in trade finance. The modern definition, however, refers to banks which provide capital to firms in the form of shares rather than loans. Unlike venture capital firms, they tend not to invest in new companies.

Both combined

Universal banks, more commonly known as financial services companies, engage in several of these activities. These big banks are very diversified groups that, among other services, also distribute insurance hence the term bancassurance, a portmanteau word combining "banque or bank" and "assurance", signifying that both banking and insurance are provided by the same corporate entity.

Other types of banks

Central banks are normally government-owned and charged with quasi-regulatory responsibilities, such as supervising commercial banks, or controlling the cash interest rate. They generally provide

9

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

liquidity to the banking system and act as the lender of last resort in event of a crisis. Islamic banks adhere to the concepts of Islamic law. This form of banking revolves around several well-established principles based on Islamic canons. All banking activities must avoid interest, a concept that is forbidden in Islam. Instead, the bank earns profit (markup) and fees on the financing facilities that it extends to customers.

Commercial bank

A commercial bank (or business bank) is a type of financial institution and intermediary. It is a bank that provides transactional, savings, and money market accounts and that accepts time deposits.

Origin of the word:

The name bank derives from the Italian word banco "desk/bench", used during the Renaissance by Florentine bankers, who used to make their transactions above a desk covered by a green tablecloth. However, traces of banking activity can be found even in ancient times. In fact, the word traces its origins back to the Ancient Roman Empire, where moneylenders would set up their stalls in the middle of enclosed courtyards called macella on a long bench called a bancu, from which the words banco and bank are derived. As a

10

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

moneychanger, the merchant at the bancu did not so much invest money as merely convert the foreign currency into the only legal tender in Rome that of the Imperial Mint.

The role of commercial banks

Commercial banks engage in the following activities:

Processing

of payments by way of telegraphic transfer,

EFTPOS, internet banking, or other means.

Issuing bank drafts and bank cheques. Accepting money on term deposit. Lending money by overdraft, installment loan, or other means. Providing

documentary performance

and

standby

letter

of

credit,

guarantees,

bonds,

securities

underwriting

commitments and other forms of off balance sheet exposures.

Safekeeping of documents and other items in safe deposit

boxes.

Sales/distribution or brokerage, with or without advice, of

insurance, unit trusts and similar financial products as a financial supermarket.

Cash management and treasury. Merchant banking and private equity financing.

Traditionally, large commercial banks also underwrite bonds, and make markets in currency, interest rates, and credit-related securities, but today large commercial banks usually have an investment bank arm that is involved in the mentioned activities.

11

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Types of loans granted by commercial banks

Secured loan

A secured loan is a loan in which the borrower pledges some asset (e.g. a car or property) as collateral for the loan, which then becomes a secured debt owed to the creditor who gives the loan. The debt is thus secured against the collateral in the event that the borrower defaults, the creditor takes possession of the asset used as collateral and may sell it to regain some or all of the amount originally lent to the borrower, for example, foreclosure of a home. From the creditor's perspective this is a category of debt in which a lender has been granted a portion of the bundle of rights to specified property. If the sale of the collateral does not raise enough money to pay off the debt, the creditor can often obtain a deficiency judgment against the borrower for the remaining amount. The opposite of secured debt/loan is unsecured debt, which is not connected to any specific piece of property and instead the creditor may only satisfy the debt against the borrower rather than the borrower's collateral and the borrower.

Mortgage loan

A mortgage loan is a very common type of debt instrument, used to purchase real estate. Under this arrangement, the money is used to purchase the property. Commercial banks, however, are given security - a lien on the title to the house - until the mortgage is paid

12

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

off in full. If the borrower defaults on the loan, the bank would have the legal right to repossess the house and sell it, to recover sums owing to it. In the past, commercial banks have not been greatly interested in real estate loans and have placed only a relatively small percentage of assets in mortgages. As their name implies, such financial institutions secured their earning primarily from commercial and consumer loans and left the major task of home financing to others. However, due to changes in banking laws and policies, commercial banks are increasingly active in home financing. Changes in banking laws now allow commercial banks to make home mortgage loans on a more liberal basis than ever before. In acquiring mortgages on real estate, these institutions follow two main practices. First, some of the banks maintain active and wellorganized departments whose primary function is to compete actively for real estate loans. In areas lacking specialized real estate financial institutions, these banks become the source for residential and farm mortgage loans. Second, the banks acquire mortgages by simply purchasing them from mortgage bankers or dealers. In addition, dealer service companies, which were originally used to obtain car loans for permanent lenders such as commercial banks, wanted to broaden their activity beyond their local area. In recent years, however, such companies have concentrated on acquiring mobile home loans in volume for both commercial banks and savings and loan associations. Service companies obtain these loans

13

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

from retail dealers, usually on a nonrecourse basis. Almost all bank/service company agreements contain a credit insurance policy that protects the lender if the consumer defaults.

Unsecured loan

[Unsecured Loans] are monetary loans that are not secured against the borrower's assets (i.e., no collateral is involved). These may be available from financial institutions under many different guises or marketing packages:

Bank overdrafts:

An overdraft occurs when money is withdrawn from a bank account and the available balance goes below zero. In this situation the account is said to be "overdrawn". If there is a prior agreement with the account provider for an overdraft, and the amount overdrawn is within the authorized overdraft limit, then interest is normally charged at the agreed rate. If the POSITIVE balance exceeds the agreed terms, then additional fees may be charged and higher interest rates may apply on;

Corporate bonds Credit card debt Credit facilities or lines of credit Personal loans

Operations of Commercial Banks:

14

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Commercial banks are authorized to engage in only the following types of activities:

Receiving interest-bearing and interest-free deposits (time,

demand and other) and other returnable means of payment;

Extending consumer loans, mortgage loans other credits both

secured and unsecured credits and engaging in factoring operations with and without the right of recourse, trade finance including the granting of guaranties, letters of credit, acceptance finance, and forfeiting.

Buying, selling, paying and receiving monetary instruments,

such as notes, drafts and checks, certificates of deposit, as well as securities, futures, options and swaps on debt instruments, and interest rates, currencies, foreign exchange, precious metals and precious stones.

Cash and non-cash settlement operations and the provision of

collection services.

Issuing

money

orders

and

managing

money

circulation

(including tax cards, checks and bills of exchange).

Securities brokerage services; Trust operations on behalf of clients and funds management Safekeeping and registration of valuables including securities; Credit-information services; Activities incidental to each of the above types of services.

Banking in Pakistan

15

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Banking in Pakistan first formally started in Pakistan during the period of British colonialisation in the South Asia. After independence from British Raj in 1947, and the emergence of Pakistan as a country in the globe, the scope of banking in Pakistan has been increasing and expanding continuously. Pakistan's oldest bank is the State Bank of Pakistan, which is also the central bank of the nation. Before independence on August 14, 1947, the Reserve Bank of India was the central bank of what is now Pakistan. After independence, Muhammad Ali Jinnah took actions to establish a central bank in Pakistan which resulted in the new founding of the State bank of Pakistan, with its headquarters to be based in Karachi. Only 7% of the population uses the banks, has tremendous potential but this needs to be pushed a little further The banking sector in Pakistan has been going through a

comprehensive but complex and painful process of restructuring since 1997. It is aimed at making these institutions financially sound and forging their links firmly with the real sector for promotion of savings, investment and growth. Although a complete turnaround in banking sector performance is not expected till the completion of reforms, signs of improvement are visible. The almost simultaneous nature of various factors makes it difficult to disentangle signs of improvement and deterioration.

Pakistans Banking Sector can be classified under the following broad categories:

16

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Category

State Bank Pakistan

Description

Central Bank and the Autonomous of and Governing Body for all banking operations in the country These deal primarily in industries of banking and capital markets. They offer a host of unique policies, banking training, services and products which include loans, credit cards, savings and consumer banking

Nationalized Scheduled Banks

Private Banks

Banks engage in channeling funds Scheduled from depositors to lenders against the primary objective of acquiring profit i.e. Bank Spread These concentrate primarily on International Trade Finance, Innovative Credit Orientation and Plastic Money Investment Banks act as underwriter or agent serving as intermediary between an issuer of securities and the investing public These banks are created with specific interest thus specializing and catering to a particular sector industry.

17

Foreign Banks

Development/ Cooperative/ Investment Banks

Specialized Banks

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Categorical Listing of Operating Banks

Central Bank Nationalized Scheduled Banks State Bank of Pakistan First Woman Bank Ltd. National Bank of Pakistan Zari Taraqiati Bank (ZTBL) Industrial Development Bank of Specialized Banks Pakistan Punjab Provincial Cooperative Bank Ltd Askari Commercial Bank Limited Bank Al-Falah Limited Bolan Bank Limited Faysal Bank Limited Bank Al-Habib Limited Metropolitan Bank Limited KASB Commercial Bank Limited Prime Commercial Bank Limited PICIC Commercial Bank Limited Soneri Bank Limited Private ScheduledUnion Bank Limited Meezan Bank Limited Banks Saudi-Pak Commercial Bank Limited Crescent Commercial Bank Limited Dawood Bank Limited NDLC-IFIC Bank Limited (NIB) Allied Bank of Pakistan Limited United Bank Limited Habib Bank Limited SME Banks Foreign Banks ABN Amro Bank N.V Albaraka Islamic Bank BSC (EC) American Expresss Bank Limited Bank of Tokyo Mitsubishi Limited Citibank N.A Deutsche Bank A.G. Habib Bank A.G. Zurich Hongkong & Shanghai Banking

18

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Investment Banks

Corp Limited Oman International Bank S.O.A.G Rupali Bank Limited Standard Chartered Bank Limited Crescent Investment Bank Limited First International Investment Bank Limited Atlas Investment Bank Limited Security Investment Bank Limited Fidelity Investment Bank Limited Prudential Investment Bank Limited Islamic Investment Bank Limited Asset Investment Bank Limited Al-Towfeek Investment Bank Limited Jahangir Siddiqui Investment Bank Limited Franklin Investment Bank Limited Orix Investment Bank (Pak) Limited

Role of Commercial Banks in the Economic Development of Pakistan

Banks play an important role in the economic development of a country. It the banking system is unorganized and inefficient, it creates maladjustments In and impediments banking in the is process very of development. Pakistan, the system well

organized. The State Bank of Pakistan established on July 1, 1948 stands at the apex and is responsible for the operation of the banking system in Pakistan. The other banks which form the banking structure in Pakistan are playing an active role in the economic development of the Country.

19

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

The role of the commercial banks in the growth and development of sound and healthy economy of the Pakistan is briefly discussed as under:

1. Saving mobilization. The commercial banks namely National

Bank of Pakistan, Habib Bank, Allied Bank, United Bank and Muslim Commercial Bank has opened up branches in urban and rural areas to mobilize savings of the people.

2. Financing development project. The banks and other

development finance institutions like IDBP, Zarai Taraqiati Bank Limited, PICIC etc. advance short and medium term loans for financing of the development projects both in the private and public sectors and thus help in accelerating the rate of economic development in the country.

3. Facilitating trade activities. The credit institutions collect

the savings of the people arid make them available for facilitating trade activities both inside and outside the country.

4. Creating climate for capital formation. A developed

banking system is a stimulant to growth and is creating favorable climate for capital formation in the country.

5. Helping SBP in achieving monetary policies. The

commercial banks under the supervision and guidance of the State Bank of Pakistan help in implementing and achieving the objectives of the monetary policy which vary from time to time.

6. Assisting in the development. The commercial banks are

profit seeking enterprises. In order to maximize the profits, they have the incentive to maximize the loans. An organized banking

20

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

system keeps a balance between liquidity and profitability and thus assists in the planned development of the economy.

7. Provision of agency services. The commercial banks

provide agency services to the clients. They receive and pay cheques. They collect dividends and pay interest and premium on behalf of the clients. They keep their valuables in safe custody. They help in the mobility of capital and thus stimulate capital in the country.

8. Making capital available for investment. The organized

banking system helps in directing physical resources into productive channels. It also keeps a balance between the availability and requirements of the capital in the country.

9. Less reliance on foreign capital. A planned banking

system by launching a vigorous campaign of mobilizing idle saving in the country can meet the capital development requirements from within the country. The country will thus have to rely less on foreign capital for financing the development projects

10. Profit, sharing scheme. The commercial banks receive

surplus balances of households and business and pay interest on the deposits of the clients. The banks have now introduced interest free banking in Pakistan. The depositors instead of having a fixed return on the deposits will share in the profit and loss of the banks. The Profit and Loss Sharing (PLS) arrangement which is an alternative to interest under an Islamic Economic System is now operating in Pakistan.

11. Provision of Qarze Hasna. Qarz-e-Hasna Scheme has

been prepared and launched by Pakistan Banking Council through

21

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

nationalized commercial banks. Under the Qarz-e-Hasria Scheme, financial assistance is provided to the students of in sufficient means and of outstanding caliber who are unable to pursue their studies due to financial difficulties. Loans are provided for pursuing studies both within and outside Pakistan.

12. Export promotion cell. In order to boost the exports of the

country, the banks have established Export Promotion Cell for the information and guidance of the exporters.

22

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Practical Study of the Organization

Vision Statement:

TO BE THE LEADING FINANCIAL SERVICES PROVIDER, PARTNERING WITH OUR CUSTOMERS FOR A MORE PROSPEROUS AND SECURE FUTURE

Mission Statement:

WE ARE A TEAM OF COMMITTED PROFESSIONALS, PROVIDING INNOVATIVE AND EFFICIENT FINANCIAL SOLUTIONS TO CREATE AND NURTURE LONG-TERM RELATIONSHIPS WITH OUR CUSTOMERS. IN DOING SO, WE ENSURE THAT OUR SHAREHOLDERS CAN INVEST WITH CONFIDENCE IN US

History of the Organization:

23

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

MCB

Bank

Limited (Formerly

Muslim

Commercial

Bank)

was incorporated by the Adamjee Group on July 9, 1947, under the Indian Companies Act, VII of 1913 as a limited company. The bank was established with a view to provide banking facilities to the business community of the South Asia. The bank was nationalized in 1974 during the government of Zulfikar Ali Bhutto. This was the first bank to be privatized in 1991 and the bank was purchased by a consortium of Pakistani corporate groups led by Nishat Group. As of June 2008, the Nishat Group owns a majority stake in the bank. The president of the bank is M.U.A Usmani. Founded in 1948, Nishat Group is one of the leading and most diversified business groups in Pakistan. The group has strong presence in the most important business sectors of the country such as banking, textile, cement and insurance. Mian Mohammad Mansha is the Chairman of the group (and also MCB). MCB is Pakistans largest bank by market share 18% its assets are of PKR 605 bln (apprx.)(US$ 7.02 billion) in 2011, and the largest by market capitalization having a market capitalization of US$ 1.8 billion. The Bank has a customer base of approximately 4.5 million and a nationwide distribution network of 1,130 branches, including 8 Islamic banking branches, and over 600 ATMs, in a market with a population of over 160 million. (July 2011 record) In 2011, MCB reported a profit after tax of PKR 15.5 billion (appx. US$183 million) and generated a return on average equity of

24

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

27.35% and a return on assets of 3.25%. The Banks asset quality is strong with a gross NPL ratio of 8.62%. Office in Dubai, UAE. The Bank has also formed a private company in Hong Kong (fully owned subsidiary of MCB) in partnership with Standard Chartered Bank, handling trade transactions of select countries in the Asia-Pacific region.

MCB Bank Ltd

Type Industry Founded Headquart ers Key people Products Revenue

Public (KSE:[2]) Banking Capital Markets 1947 Registered Office: Islamabad, Principal Office: Karachi Pakistan Mian Mohammad Mansha(Chairman) Loans, Credit Cards, Savings, Consumer Banking etc. PKR 35.782 Billion (2011)

25

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Net income Total assets Website

PKR 26.753 Billion (2011) USD 6.02 Billion www.mcb.com.pk

CORPORATE PROFILE

Board of Directors

Mian Mohammad Mansha Mr. S. M. Muneer Mr. Tariq Rafi Mr. Saleem Shahzad Chairman

Vice Chairman Director Director Director Director

Mr. Sarmad Amin Mr. Mian Mansha Mr. Mian Mansha Mr. Aftab Khan Mr. Mushtaq Raza

Umer

Director

Ahmad

Director

Manzar Director

26

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Mr. Ahmad Alman Director Aslam Dato' Seri Ismail Shahudin Director

Mr. Abdul Farid Bin Director Alias Mr. M.U.A. Usmani President / CEO

Practical Study of the Organization with respect to the Issue

Role of Muslim Commercial Bank in the Economic Development of Pakistan

Muslim Commercial banks playing an important role in the process of economic development of Pakistan, which is clear from the following points:

Capital Accumulation or Formation:

Capital formation refers to the increase in the existing stock of capital goods in an economy. Muslim Commercial banks remove the capital deficiency by encouraging saving and investment. The Muslim commercial bank is promoting capital formation in the country by moving the resources to the productive uses. Rate of capital formation is 5 % in Pakistan.

27

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Mobilization of Savings:

There operates vicious circle of poverty in developing countries like Pakistan. So, savings remain at the lowest level. Savings of people are very low due to international demonstration effect in Pakistan. Muslim Commercial Bank is playing important role in the mobilization of saving by introducing a variety of saving schemes. Banks induce the people to earn interest through saving and it provides various facilities in a country to create a will and power to save. Domestic savings are 9.5 % of GDP.

Availability of Funds:

An additional point of role of banks is more availability of funds. Poor population has poor resources for the economic development in poor countries like Pakistan. The activities like inventions and innovations, research and development and initiatives (effectiveness in responding to challenges) are impossible due to insufficiency of funds in these countries. Banks remove the deficiency of capital by providing different types of funds that leads to economic development.

Attaining Self Sufficiency:

debts and dependence on other countries. Muslim

A major problem faced by the developing countries is burden of foreign Commercial bank provides incentive for the entrepreneurs to take risks and to use idle resources for more and better production. So, banks are helpful in attaining self-sufficiency. Banks provide loan to develop the various economic sectors. It results in reduction in

28

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

imports and increase in exports. Accordingly, banks are very important to achieve the self-sufficiency.

Implementation of Modern Technology:

Economic development without use of advanced and the most upto-date technology is impossible. Almost in all the economic sectors backward techniques of productions are used due to poverty in third world countries like Pakistan. Muslim Commercial bank provides more funds to people to make it possible to use the modern techniques of production. Due to implementation of modern technology, there is increase in production level, decrease in cost and save in time.

Development of Agriculture Sector:

All the regions and all the sectors of the economy are not equally efficient and developed in an economy. There is big need to develop the backward regions and sectors for the economic development. Rural areas and agricultural sector is still backward n Pakistan. Muslim Commercial Bank is playing an important role in the development of rural and agriculture sector. Growth rate of agricultural sector is 1.2 %.

Development of Industrial Sector:

Industrial sector is the backbone of their economies in rich nations. It is still backward in Pakistan and other poor countries. Muslim Commercial bank provides different types of loans for the development of industrial sector. Industrial development leads to agricultural development and it results in economic development. Growth rate of industries is 1.7%.

29

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Expansion of Market:

Muslim Commercial banks help in the expansion of market. They help in the formation of sound economic infrastructure in order to raise living standards and to expand trade and commerce of an economy. Muslim Commercial bank causes development of industrial as well as agriculture sector. Accordingly, there is expansion of market that results in economic development.

Essential for Foreign Trade:

Foreign trade is one of the most important needs of all the countries of the world. Today international trade, without involving banks, is so difficult. International trade is necessary for the economic development. Muslim Commercials bank is helpful in increasing international trade through following ways: Provision of credit facilities Low rate of interest for the exporters Opening of letter of credit (L/C) Arrangement of foreign exchange Opening of foreign currency accounts

Muslim

Commercial bank have $ 2.2571 billion of foreign

exchange reserves

Remove Budget Deficits:

The Muslim commercial bank is very helpful for the government. Now a day, the government has to face the budget deficits because of increased expenditures and falling revenues. In this situation, government has to depend upon deficit financing to meet the budget deficits. To cover the gap between the expenditures and

30

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

revenues, government borrows from the banks. As a result, the development process can be started through borrowed money from banks.

Optimum Utilization of Resources:

Muslim Commercial bank helps in the just and optimum allocation of resources. Some mega projects cannot be started due to the lack of capital. Muslim Commercial bank provides loans and removes the problem of deficiency of capital. Due to use of resources in an economy, there is increase in production, income and employment etc. Increase in these things leads to economic development.

Creators and Distributors of Money:

Creation of money and distribution of money are the two main objectives of Muslim commercial bank. Muslim Commercial banks move the finances toward productive uses. There are a lot of problems in the way of economic development like inflation, deflation, low investment and saving etc. All these problems are possible to remove through creation and distribution of money by Muslim commercial bank. So, fluctuation in the supply of money can attain the economic development.

Provision of Valuable Services:

The Muslim commercial bank is providing a lot of valuable services for the economic development. Some of the most important services provided by Muslim commercial bank are as under: Due to use of credit instruments like cheques, drafts and bills of exchange, banks have reduced the use of currency at the cheapest costs and in the safest manner.

31

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Banks serve as business and commercial agents of their customers. Banks provide locker facility. Banks accept the various utility bills. They guide the investors while making investment decisions. Banks advance loans for education in foreign countries.

Modern Facilities:

Now Muslim commercial bank is providing various modern facilities like:

PC & Internet banking since 2003, PC banking available to all

MCB customers in 14 cities. ATM & Online facilities & Balance ready cash etc.

Mobile Banking and Call Centers, Smart Card and Debit Card.

DD issuance, Statement inquiry and credit cards.

SWOT analysis

The acronym SWOT stands for a firm is internal Strengths and Weaknesses and its external Opportunities and Threats. The purpose of such analysis is to build on companys strengths in

32

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

order to exploit opportunities and counter threats and to correct companys weaknesses. SWOT analysis is based on the assumption that if managers carefully review such strengths, weaknesses, opportunities, and threats, a useful strategy for ensuring organizational success will become evident. Strengths and weaknesses typically relate to the internal

environment of an organization, whereas opportunities and threats are brought about by the external environment of an organization. In the following section both internal and external analyses of MCB are outlined:

Strength:

Strength can be defined as an area where a company is best at doing something or a feature that puts the company at an advantage in comparison to its competitors. MCB enjoys the following strengths: MCB is a well established bank enjoying long history of over 55 years of experience and profitable operation. MCB is the largest private bank in Pakistan and third largest bank among all banks. It has the largest branch network among private banks of Pakistan. MCB is the market leader in introduction of e-banking and it has the largest ATM network in the country.

33

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

MCB has the ability to bring innovative products and services like personalized service, electronic funds transfer, sophisticated financial products such as electronic banking, auto-teller machines and evening banking. Excellent branches appearance gives an edge to MCB over other banks. The branches are well furnished even in less developed areas where other banks branches give a poor view.

Weakness:

A weakness is defined as an area in an organization where the organization is not as good at doing something as its competitors or a thing which an organization lacks thus putting the organization at disadvantage in comparison to its competitors. Based on the above definition, MCB has the following weaknesses. Though MCB is third largest bank in Pakistan, yet the fact remains that it is not market leader as HBL and NBP. The overseas branch network of MCB is limited. It has only four overseas branches, branches three whereas subsidiaries, HBL two has twenty overseas and one affiliates,

representative office. Similarly NBP has fifteen overseas branches, one subsidiary, and four representative offices. Employees at branch level are not properly motivated to work by heart. They take the all routine activities as a boring job. Most of the employees lack managerial training as they are not properly educated. Due to seniority, they have moved up on the hierarchy line to Grade-I, II or III positions having hardly bachelor degrees. This type of senior staff cannot apply the

34

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

modern and innovative techniques of management in decision making.

Opportunities:

An opportunity can be defined as a change in external environment which if properly exploited with the organizational strengths will result in enhanced sales market share or income. Using its strengths MCB can avail the following opportunities. It can introduce debit card system or may convert the existing ATM cards into a complete debit card. New products like personal loans mortgage and auto leasing and each management which diversify credit risk and add to revenue generating products are currently provided in big cities like Lahore, Islamabad, Karachi and Rawalpindi, these products may be tested for success in other areas like Peshawar, Quetta and Sargodha.

Developing network for electronic transaction require huge

investment which cant be made all at once, there exists an opportunity for MCB to enter into agreement with other banks to use each others ATMs which will result in an increased convenience to MCB customers and customers of other banks. As all around the world remittances of money are strictly monitored so as the money remitted may not fall in hands of so called terrorists for that all conventional money laundering through Hundies have been stopped there is an opportunity for MCB to extend its branch network to various countries

35

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

emphasizing mainly on introducing electronic fund transfer facilities.

Threats:

Threat can define as a change in external environment which if not met with proper strategies will result in loss of revenues market share or income. In the context of MCBs external environment the following potential threats exist: Change in interest rate from SBP. The frequent reduction on 6-month and 12-month Treasury Bills discount rates by SBP may create pressure on the banks profitability. The low discount rates are also negatively influencing the advances rates which may affect the banks profits from the other side.

36

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

Recommendation

First of all, the management needs to overlook the major problems that the organization is currently facing and then develop strategies to solve them. Some of the suggestions that I would like to give at the end are:

MCB does not offer any chances of chances of social gathering

for staff. There should be some informal meeting arrangements to restore the atmosphere of mutual trust and confidence and to give them respect. Job rotation for employees. MCB is not currently giving owner ship to employees. It should give certain percentage of shares to employees to develop a feeling of belonging in them. When employees own the on. They own its strengths and weal nesses also. So they readily start working for its progress.

In

MCB, there is no culture of encouraging new ideas.

Employees should not be considered on Robots. They have brains of their own. They should be thought to use the brains on well on hand. Because they won the night people who are as possible for operations and can give best suggestion.

37

Role of Commercial Banks in Developing the Economy of Pakistan MCB has not built any connection with its customers. For

2nd Assignment

knowing their suggestions about you services. There should be a proper channel for them.

Conclusion

I have concluded that.

A bank is a financial institution and a financial intermediary

that accepts deposits and channels those deposits into lending activities, either directly or through capital markets The word bank was borrowed in Middle English from Middle French banque, from Old Italian banca, from Old High German banc, bank "bench, counter".

A commercial

bank (or business bank) is a type of

financial institution and intermediary. It is a bank that provides transactional, savings, and money market accounts and that accepts time deposits. Commercial Bank is a back bone for any country. They play important role in the development of that country. Commercial banks perform a lot of function and provide many services for their customers.

38

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

MCB is one of the largest banks of Pakistan, founded in 1947. It is supported by a strong Mian Mansha group. Muslim commercial Bank is playing an important role in the developing economy of Pakistan. But there are still some weaknesses in its system that can be taking some strong Steps.

Reference

Project report Role of Commercial Banks in developing the Economy of Pakistan www.slideshare.com http://www.mcb.com.pk/ http://www.mcb.com.pk//whyMCB.php http://en.wikipedia.org/wiki/MCB_Pakistan

39

Role of Commercial Banks in Developing the Economy of Pakistan

2nd Assignment

http://www.scribd.com/doc/24651033/HR-REPORT-culturalcompatible-practices-inMCB

40

Potrebbero piacerti anche

- BOA Statement PDFDocumento10 pagineBOA Statement PDFN N100% (1)

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDocumento5 pagineYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodLao TruongNessuna valutazione finora

- Smart MetersDocumento14 pagineSmart MetersMilon Mahmud25% (4)

- Money Market Concept, MeaningDocumento4 pagineMoney Market Concept, MeaningAbhishek ChauhanNessuna valutazione finora

- Role of Banks in Indian Economy ReportDocumento28 pagineRole of Banks in Indian Economy Reportsouravsaha8694% (34)

- Human Rights in The Light of Khuta HujjaDocumento4 pagineHuman Rights in The Light of Khuta HujjaasadNessuna valutazione finora

- Allied Banking Corp V Spouses Macam G.R. No. 200635, (February 1, 2021)Documento12 pagineAllied Banking Corp V Spouses Macam G.R. No. 200635, (February 1, 2021)RLAMMNessuna valutazione finora

- CurrentAccountStatement 07112023Documento4 pagineCurrentAccountStatement 07112023caraleighjaneNessuna valutazione finora

- How Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Documento28 pagineHow Time Value of Money Affects Investments and Financial Decisions in Financial Minagement.Ishtiaq Ahmed82% (11)

- BudgetDocumento95 pagineBudgetAbdu Mohammed100% (1)

- Advantage and Disadvantage of Mutual Funds. 10 Reasons Why To Invest in Mutual FundsDocumento5 pagineAdvantage and Disadvantage of Mutual Funds. 10 Reasons Why To Invest in Mutual FundssushantgawaliNessuna valutazione finora

- Organizing and Staffing Project Office and TeamDocumento21 pagineOrganizing and Staffing Project Office and TeamIshtiaq Ahmed100% (4)

- Ultimate Reward Current Account GuideDocumento112 pagineUltimate Reward Current Account GuideRyan BucuNessuna valutazione finora

- How To Authorize ACHDocumento12 pagineHow To Authorize ACHPete Ng100% (1)

- Business-Bank-Account MetroDocumento3 pagineBusiness-Bank-Account Metroussef oblivion0% (1)

- Data Analysis in ResearchDocumento29 pagineData Analysis in ResearchIshtiaq Ahmed100% (1)

- The Role of Financial Institutions in THDocumento41 pagineThe Role of Financial Institutions in THRex KingsleyNessuna valutazione finora

- Banking Law Anu AroraDocumento765 pagineBanking Law Anu AroraГога100% (3)

- SANTANDER STATEMENtDocumento1 paginaSANTANDER STATEMENtАнечка Бужинская100% (1)

- Statement 30-DEC-22 AC 50882755 01045142 PDFDocumento5 pagineStatement 30-DEC-22 AC 50882755 01045142 PDFferuzbekNessuna valutazione finora

- Sutton Bank Statement Estmt - 2022-03-31Documento8 pagineSutton Bank Statement Estmt - 2022-03-31qkcv6dm8qgNessuna valutazione finora

- Comparison of Islamic and Conventional BanksDocumento57 pagineComparison of Islamic and Conventional BanksInam Ul Haq ShahNessuna valutazione finora

- New Non Banking Financial InstitutionsDocumento18 pagineNew Non Banking Financial InstitutionsGarima SinghNessuna valutazione finora

- Project On Banking Sector in IndiaDocumento32 pagineProject On Banking Sector in IndiaPatel SagarNessuna valutazione finora

- Commercial Banking MAYURDocumento86 pagineCommercial Banking MAYURShama Jain100% (1)

- A Study On International BankingDocumento36 pagineA Study On International Bankinganilpeddamalli0% (1)

- Role of Development Banking in NigeriaDocumento82 pagineRole of Development Banking in NigeriaGodwin ArigbonuNessuna valutazione finora

- FdI in Banking Sector in IndiaDocumento38 pagineFdI in Banking Sector in IndiaSumedhAmaneNessuna valutazione finora

- Bus 303 Asignment Group 6Documento28 pagineBus 303 Asignment Group 6Murgi kun :3Nessuna valutazione finora

- 16 Role of SME in Indian Economoy - Ruchika - FINC004Documento22 pagine16 Role of SME in Indian Economoy - Ruchika - FINC004Ajeet SinghNessuna valutazione finora

- The Economic Cooperation Organisation (Eco) A Short Note: Senior Economist at The SESRTCICDocumento8 pagineThe Economic Cooperation Organisation (Eco) A Short Note: Senior Economist at The SESRTCICFaiza GandapurNessuna valutazione finora

- Meaning of Exchange ControlDocumento2 pagineMeaning of Exchange ControlDinesh KumarNessuna valutazione finora

- Agriculture Credit... N Role of Commercial BanksDocumento7 pagineAgriculture Credit... N Role of Commercial BanksLearner84100% (2)

- Functions of RbiDocumento4 pagineFunctions of RbiMunish PathaniaNessuna valutazione finora

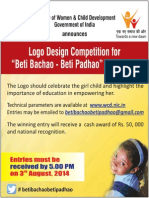

- Beti Bachao Beti Padhao Campaign 24072014Documento5 pagineBeti Bachao Beti Padhao Campaign 24072014huzaifa17iNessuna valutazione finora

- Types of Banks: BankingDocumento11 pagineTypes of Banks: BankingKaviya KaviNessuna valutazione finora

- Format of Project For 6th SemesterDocumento4 pagineFormat of Project For 6th SemesterShahjahan100% (1)

- Banking Sector Reforms in IndiaDocumento8 pagineBanking Sector Reforms in IndiaJashan Singh GillNessuna valutazione finora

- Challenges For Public Sector Banks in IndiaDocumento63 pagineChallenges For Public Sector Banks in IndiaKahkashan Anjum100% (8)

- Presentation Report On Loans and AdvancesDocumento20 paginePresentation Report On Loans and AdvancesHawk AujlaNessuna valutazione finora

- Uniform Civil CodeDocumento5 pagineUniform Civil Codemihir khannaNessuna valutazione finora

- Assignment in Banking SystemDocumento4 pagineAssignment in Banking Systemfakrul0% (1)

- A Research Project On Credit Risk and Liquidity RiskDocumento86 pagineA Research Project On Credit Risk and Liquidity RiskEkam JotNessuna valutazione finora

- Role of RBI in Indian EconomyDocumento4 pagineRole of RBI in Indian EconomySubhashit SinghNessuna valutazione finora

- Role of Banks in The Development of EconomyDocumento25 pagineRole of Banks in The Development of EconomyZabed HossenNessuna valutazione finora

- Economic Project On Banking Regulation Act 1949Documento45 pagineEconomic Project On Banking Regulation Act 1949ezekielNessuna valutazione finora

- An Evaluative Study of SecondaryDocumento97 pagineAn Evaluative Study of SecondaryMinecraft ServerNessuna valutazione finora

- Rbi Impact On Indian EconomyDocumento15 pagineRbi Impact On Indian EconomyJP MusicNessuna valutazione finora

- Economic DevelopmentDocumento83 pagineEconomic DevelopmentJimmi KhanNessuna valutazione finora

- Odisha Economic Survey 2014-15Documento575 pagineOdisha Economic Survey 2014-15Sabyasachi MohantyNessuna valutazione finora

- Ankita Final Report On RDCDocumento97 pagineAnkita Final Report On RDCMayank SarpadadiyaNessuna valutazione finora

- Subject: Entrepreneurship and Small Business Development: Course Code: MC-202Documento40 pagineSubject: Entrepreneurship and Small Business Development: Course Code: MC-202rajeeevaNessuna valutazione finora

- Harshit Manaktala (23) Soundararajan.R (59) Ananya Pratap Singh Ragini Anand TusharDocumento14 pagineHarshit Manaktala (23) Soundararajan.R (59) Ananya Pratap Singh Ragini Anand TusharAnanya Pratap SinghNessuna valutazione finora

- The Banking OmbudsmanDocumento101 pagineThe Banking Ombudsmanfrediz7970% (10)

- Project Report On Entrepreneurship in IndiaDocumento36 pagineProject Report On Entrepreneurship in IndiaShazi Naj100% (1)

- 6 Economics of International TradeDocumento29 pagine6 Economics of International TradeSenthil Kumar KNessuna valutazione finora

- Comparative Analysis of Public and Private Sector Steel Companies in IndiaDocumento47 pagineComparative Analysis of Public and Private Sector Steel Companies in IndiaGaurav TripathiNessuna valutazione finora

- Chapter 1 - History and Development of Islamic Banking and Finance Around The WorldDocumento54 pagineChapter 1 - History and Development of Islamic Banking and Finance Around The WorldKar NeeNessuna valutazione finora

- Exim Bank of IndiaDocumento49 pagineExim Bank of IndiaShruti Vikram0% (1)

- BRICS 9 NewDocumento24 pagineBRICS 9 NewAYUSHI SHARMANessuna valutazione finora

- Capital StructureDocumento57 pagineCapital StructureRao ShekherNessuna valutazione finora

- Financial ServicesDocumento6 pagineFinancial ServicessadathnooriNessuna valutazione finora

- Role of Nationalised Banks in The EconomyDocumento5 pagineRole of Nationalised Banks in The EconomyAshis karmakar100% (1)

- Role and Importance of Capital Market in IndiaDocumento9 pagineRole and Importance of Capital Market in IndiaMukul Babbar50% (4)

- Role of Credit Rating Agencies in IndiaDocumento14 pagineRole of Credit Rating Agencies in IndiaPriyaranjan SinghNessuna valutazione finora

- Role of RBI in Financial InclusionDocumento12 pagineRole of RBI in Financial InclusionShannon Ford100% (3)

- Idbi ProjectDocumento86 pagineIdbi ProjectGodwin Morris67% (3)

- Role of Commercial Banks in Developing The Economy of PakistanDocumento36 pagineRole of Commercial Banks in Developing The Economy of PakistanAlok NayakNessuna valutazione finora

- Content (Kiran)Documento67 pagineContent (Kiran)Omkar ChavanNessuna valutazione finora

- Types of Bank: By: Second GroupDocumento15 pagineTypes of Bank: By: Second GroupDetira PutriNessuna valutazione finora

- Management of Banking OperationDocumento206 pagineManagement of Banking OperationAtul BharshankarNessuna valutazione finora

- Banking Awareness BasicsDocumento21 pagineBanking Awareness BasicsAbhijit WankhedeNessuna valutazione finora

- Management of Banking OperationDocumento208 pagineManagement of Banking OperationmanojNessuna valutazione finora

- Assignment - 2Documento4 pagineAssignment - 2VNessuna valutazione finora

- Internship Report of Askari BankDocumento111 pagineInternship Report of Askari BankAnonymous yYfTY1Nessuna valutazione finora

- Reasons For Issues Warrants and ConvertiblesDocumento23 pagineReasons For Issues Warrants and ConvertiblesIshtiaq Ahmed50% (2)

- Internal Control System of A Banking Organization Over Receipts and PaymentsDocumento21 pagineInternal Control System of A Banking Organization Over Receipts and PaymentsIshtiaq AhmedNessuna valutazione finora

- Need For Establishing Project OfficeDocumento19 pagineNeed For Establishing Project OfficeIshtiaq AhmedNessuna valutazione finora

- Financial Management StrategyDocumento23 pagineFinancial Management StrategyIshtiaq AhmedNessuna valutazione finora

- Strategy Evaluation ProcessDocumento38 pagineStrategy Evaluation ProcessIshtiaq Ahmed0% (1)

- Employees Recruitment and Selection ProcessDocumento26 pagineEmployees Recruitment and Selection ProcessIshtiaq Ahmed50% (2)

- Analysis and Application of Various Cost Concepts For Decision Making.Documento30 pagineAnalysis and Application of Various Cost Concepts For Decision Making.Ishtiaq Ahmed100% (2)

- Rtgs and Neft FormDocumento1 paginaRtgs and Neft FormAmruta patilNessuna valutazione finora

- An Analysis of Bank Overdraft Fees FinalDocumento10 pagineAn Analysis of Bank Overdraft Fees FinalSenator Cory Booker100% (3)

- Account Statement Greendot PDFDocumento4 pagineAccount Statement Greendot PDFBaris MironNessuna valutazione finora

- Chp1 Bank Bank Recon STMTDocumento16 pagineChp1 Bank Bank Recon STMTMichael AsieduNessuna valutazione finora

- Online Savings Account Statement: Goldman Sachs Bank USA PO Box 1978 Cranberry TWP., PA 16066Documento5 pagineOnline Savings Account Statement: Goldman Sachs Bank USA PO Box 1978 Cranberry TWP., PA 16066Rapid FinanceNessuna valutazione finora

- Overview of FinacleDocumento19 pagineOverview of FinaclenirmalyaratandeNessuna valutazione finora

- Chapter 6 Managing Your Money: Personal Finance, 6e (Madura)Documento22 pagineChapter 6 Managing Your Money: Personal Finance, 6e (Madura)Huỳnh Lữ Thị NhưNessuna valutazione finora

- 22 Beware of Banking Fees (B) - 703063Documento3 pagine22 Beware of Banking Fees (B) - 703063tryguy088Nessuna valutazione finora

- 剑桥雅思考官范文Documento50 pagine剑桥雅思考官范文雯茜桑Nessuna valutazione finora

- BRS TestDocumento2 pagineBRS TestMuhammad Ibrahim KhanNessuna valutazione finora

- FULL Personal Financing-I Application Form V10 Nov2018Documento20 pagineFULL Personal Financing-I Application Form V10 Nov2018Razidan AhmadNessuna valutazione finora

- Account Opening Form: Bank AL Habib LimitedDocumento4 pagineAccount Opening Form: Bank AL Habib LimitedaqsaNessuna valutazione finora

- Banking DicDocumento1.222 pagineBanking DicRehab Habiba Almuhajira100% (1)

- 12 - Fulton Iron Works Vs China BankingDocumento6 pagine12 - Fulton Iron Works Vs China BankingRaiden DalusagNessuna valutazione finora

- Bank Account GuideDocumento47 pagineBank Account Guidemayoo1986Nessuna valutazione finora

- BRS (Bank Reconciliation Statement)Documento23 pagineBRS (Bank Reconciliation Statement)Shruti KapoorNessuna valutazione finora

- Personal Finance Canadian 3rd Edition Madura Solutions Manual 1Documento36 paginePersonal Finance Canadian 3rd Edition Madura Solutions Manual 1karenhalesondbatxme100% (28)

- Services Provided by Commercial Bank in Nepal FinalDocumento5 pagineServices Provided by Commercial Bank in Nepal FinalRabindra RajbhandariNessuna valutazione finora