Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Gulfpub HP 201204

Caricato da

BacteriamanDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Gulfpub HP 201204

Caricato da

BacteriamanCopyright:

Formati disponibili

RENTECH breaks new trails in the

boiler industry with its focus on custom

engineering and design.

Theres no on the shelf inventory at RENTECH because we design and build each and every

boiler to operate at peak effciency in its own unique conditions. As an industry leader, RENTECH

provides solutions to your most demanding specifcations for safe, reliable boilers. From design and

manufacture to installation and service, we are breaking new trails.

APRIL 2012

HPIMPACT SPECIALREPORT BONUSREPORT

PETROCHEMICAL

DEVELOPMENTS

Innovative chemistry

and catalysts improve

profitability

Energy for economic

growth

Canadian oil sands

alliance

ROTATING EQUIPMENT

New seal designs

enhance operations

and reliability

www.HydrocarbonProcessing.com

Unlike a phony cowboy who is all hat with no

cattle, a boiler from RENTECH will pass muster.

Each boiler is designed and built to meet its demanding specications and operate in its unique

conditions in a variety of industries, including rening, petro-chemical and power generation.

Our quality control system assures you that RENTECH boilers are safe, reliable and efcient.

For a real, genuine, original boiler, you can depend on RENTECH. Honestly.

WWW.RENTECHBOILERS.COM

Select 51 at www.HydrocarbonProcessing.com/RS

SPECIAL REPORT: PETROCHEMICAL DEVELOPMENTS

41

Optimize olefin operations

This operating company used process models to find solutions

to poor separation performance

K. Romero

47

Alternate feedstock options for petrochemicals: A roadmap

New hydrocarbons will be needed to meet future demand

S. K. Ganguly, S. Sen and M. O. Garg

55

Improve catalyst management at the FCC unit

System revamp reduces unloading time, boosts refinery operations

M. L. Sargenti, N. Ergonul, M. Scherer, H. Upadhyay,

R. McClung and T. S. W. Al Rawahi

59

Operational optimization for mixed-refrigerant systems

Use rigorous simulation to improve process efficiency

J. Zhang, Q. Xu and K. Li

67

Consider new economics for purification on a small scale

For smaller methanol units, new designs balance energy cost

against capital cost for long-term profitability

K. Patwardhan, G. Satishbabu, S. Rajyalakshmi and P. Balaramkrishna

Cover Night view of 25,000-metric-

tpy ethylene plant built in Texas

circa 1948. Project awarded to The

Lummus Co. (now CB&I) in 1945.

Photo courtesy of CB&I.

HPIMPACT

19 Energy for economic

growth

20 Medium-voltage AC

drives surge, thanks

to energy market

22 Canadian oil sands

alliance

23 Polyurethane news

from Riyadh

COLUMNS

9 HPINSIGHT

All hydrocarbons

have a place in

the global market;

timing depends on

economics

13 HPIN RELIABILITY

Pump alignment

saves power

17 HPINTEGRATION

STRATEGIES

The journey to supply-

chain excellence

in the refining

and petrochemical

industries

126 HPIN AUTOMATION

SAFETY

The imaginary hacker

DEPARTMENTS

7 HPIN BRIEF 25 HPINNOVATIONS

29 HPIN CONTRUCTION 37 HPIN CONSTRUCTION PROFILE

38 HPINCONSTRUCTION BOXSCORE UPDATE

122 HPI MARKETPLACE 125 ADVERTISER INDEX

BONUS REPORT: ROTATING EQUIPMENT

73

Use better designed turboexpanders to handle flashing fluids

New models eliminate vibration problems and improve reliability

K. Kaupert

79

Understand multi-stage pumps and sealing options: Part 2

Designing for dirty service involves many factors

L. Gooch

CATALYST 2012SUPPLEMENT

C-84

Perspectives on the 2012 energy industry

Here are several thoughts on how companies can adapt to

and profit fromthe uncertain environment

V. Doshi, A. Clyde and C. Click

ENVIRONMENT AND SAFETY

103

Venting vapor streams: Predicting the outcome

Laminar and turbulent jet theories provide strong support

when addressing cold venting situations

R. Benintendi

109

Apply audits to reexamine safety procedures

Recognizing distinctive vulnerabilities in various refinery units

S. L. Chakravorty

CLEAN FUELS

117

Methanol contamination of naphtha: A case study

Creative problem solving was used to upgrade off-spec export products

while minimizing tank storage

F. Ovaici

www.HydrocarbonProcessing.com

APRIL 2012 VOL. 91 NO. 4

4

I

APRIL 2012 HydrocarbonProcessing.com

EDITORIAL

Editor Stephany Romanow

Reliability/Equipment Editor Heinz P. Bloch

Process Editor Adrienne Blume

Technical Editor Billy Thinnes

Online Editor Ben DuBose

Associate Editor Helen Meche

Contributing Editor Loraine A. Huchler

Contributing Editor William M. Goble

Contributing Editor ARC Advisory Group

MAGAZINE PRODUCTION

DirectorProduction and Operations

Sheryl Stone

Manager Editorial Production Angela Bathe

Artist/Illustrator David Weeks

ManagerAdvertising Production

Cheryl Willis

ADVERTISING SALES

See Sales Offices page 124.

CIRCULATION +1 (713) 520-4440

DirectorCirculation Suzanne McGehee

E-mail Circulation@GulfPub.com

SUBSCRIPTIONS

Subscription price (includes both print and

digital versions): United States and Canada,

one year $199, two years $359, three years

$469. Outside USA and Canada, one year

$239, two years $419, three years $539, digi-

tal format one year $199. Airmail rate outside

North America $175 additional a year. Single

copies $25, prepaid.

Because Hydrocarbon Processing is edited spe-

cifically to be of greatest value to people work-

ing in this specialized business, subscriptions

are restricted to those engaged in the hydro-

carbon processing industry, or service and sup-

ply company personnel connected thereto.

Hydrocarbon Processing is indexed by Applied

Science & Tech nology Index, by Chemical

Abstracts and by Engineering Index Inc.

Microfilm copies available through University

Microfilms, International, Ann Arbor, Mich.

The full text of Hydrocarbon Processing is also

available in electronic versions of the Business

Periodicals Index.

ARTICLE REPRINTS

If you would like to have a recent article reprint-

ed for an upcoming conference or for use as a

marketing tool, contact Foster Printing Company

for a price quote. Articles are reprinted on qual-

ity stock with advertisements removed; options

are available for covers and turnaround times.

Our minimum order is a quantity of 100.

For more information about article reprints,

call Rhonda Brown with Foster Printing

Company at +1 (866) 879-9144 ext 194

or e-mail rhondab@FosterPrinting.com.

HYDROCARBON PROCESSING (ISSN 0018-8190) is published monthly by

Gulf Publishing Co., 2 Greenway Plaza, Suite 1020, Houston, Texas 77046.

Periodicals postage paid at Houston, Texas, and at additional mailing office.

POSTMASTER: Send address changes to Hydrocarbon Processing, P.O. Box

2608, Houston, Texas 77252.

Copyright 2012 by Gulf Publishing Co. All rights reserved.

Permission is granted by the copyright owner to libraries and others regis-

tered with the Copyright Clearance Center (CCC) to photocopy any articles

herein for the base fee of $3 per copy per page. Payment should be sent

directly to the CCC, 21 Congress St., Salem, Mass. 01970. Copying for other

than personal or internal reference use without express permission is prohib-

ited. Requests for special permission or bulk orders should be addressed to

the Editor. ISSN 0018-8190/01.

www.HydrocarbonProcessing.com

GULF PUBLISHING COMPANY

John Royall, President/CEO

Ron Higgins, Vice President

Bill Wageneck, Vice President

Pamela Harvey, Business Finance Manager

Part of Euromoney Institutional Investor PLC.

Other energy group titles include:

World Oil

Petroleum Economist

Publication Agreement Number 40034765

Printed in U.S.A

Houston Office: 2 Greenway Plaza, Suite 1020, Houston, Texas, 77046 USA

Mailing Address: P. O. Box 2608, Houston, Texas 77252-2608, USA

Phone: +1 (713) 529-4301, Fax: +1 (713) 520-4433

E-mail: editorial@HydrocarbonProcessing.com

www.HydrocarbonProcessing.com

Publisher Bill Wageneck

E-mail Bill.Wageneck@GulfPub.com

www.HydrocarbonProcessing.com

Creating Value.

Carver Pump Company

2415 Park Avenue

Muscatine, IA 52761

563.263.3410

Fax: 563.262.0510

www.carverpump.com

Designed specifically to meet the

requirement of API 610, the API Maxum

Series is available in 35 sizes to handle

flows up to 9,900 GPM and 720 feet of

head. Standard materials include S-4,

S-6, C-6 and D-1. A wide range of

options makes this the API 610 pump

for you!

Select 151 at www.HydrocarbonProcessing.com/RS

lntrcduolng a gasket

that`s even better than curs.

we lnvented the splral wcund gasket ln 1912. Sc lt`s flttlng that

we oelebrate cur oentennlal wlth ancther new prcduot. lt`s a metalwcund

heat exohanger gasket that dellvers a mcre dynamlo seal than curs

cr anycne else`s. we oall lt Change. ^nd lt`s ocmlng sccn.

Detalls, applloatlcn questlcns?

1-8??-668-?006 | changef|ex|ta|||c.cem | www.f|ex|ta|||c.cem

Deer lark, TX 77536 US^ > f|ex|ta|||c.cem

Select 93 at www.HydrocarbonProcessing.com/RS

ThyssenKrupp Uhde

www.uhde.eu

Get more out of your coal.

Only too often do we fail to see the treasures that are right in front of us.

With our solids gasification technology you can make more out of any

feedstock. Why not contact us: you might just be surprised!

As a leading EPC contractor, we also have a proprietary portfolio of

technologies. And we network intelligently within the ThyssenKrupp Uhde

group based on our business philosophy Engineering with ideas.

Visit us at

Frankfurt a.M., June 18 - 22, 2012

Hall 9.1, Stand B4

Select 88 at www.HydrocarbonProcessing.com/RS

HPIN BRIEF

BILLY THINNES, TECHNICAL EDITOR

BT@HydrocarbonProcessing.com

HYDROCARBON PROCESSING APRIL 2012

I

7

The international availability of

massive US shale gas resources could

determine the fate of global gas pric-

es over the next decade, said Paolo

Scaroni, CEO of Italian oil and gas

major Eni. Mr. Scaroni delivered the

keynote address at the annual IHS

CERAWeek energy conference, held

March 59 in downtown Houston.

Mr. Scaroni bemoaned the global

differences in sales prices for the same

stupid molecule of natural gas, citing

values of less than $3/MMBtu in the US

compared with about $9 in European

spot markets, $11 on European oil-

linked contracts and $13 in Asia. The US

is an island in gas terms, he explained,

noting that the nation was set for at

least the next decade.

With recoverable gas resources and

stronger gas markets across the ocean,

there are many who think that the US

might become a major exporter over

the next decade, Mr. Scaroni said. But

this is more complex than it sounds.

For example, it remains to be

seen whether US citizens, who slowly

accepted the rationale of shale gas

exploration for their own energy secu-

rity, would be willing to export the

gas, thereby benefiting the financial

position of other countries.

On the whole, global gas demand

is expected to grow by 2020. But the

outlook on prices is murky, because

supply remains unclear, given US mar-

ketplace uncertainties. As such, Mr.

Scaroni said it can be difficult for com-

panies to gauge the viability of large-

scale gas projects.

Other key questions include the

fate of nuclear power following the

Japan disaster and whether gas-based

fuels can gain traction within the trans-

portation sector. On the other hand,

growth in LNG trade should allow for

at least some rebalancing in global

prices. Over the next decade, the key

to the market is LNG, Mr. Scaroni said.

In addition, the gap between US

gas and oil prices should narrow, he

observed. Scaroni noted that, based

on calorific power, US gas trades at

roughly

1

6 the price of oildown from

1

2 in 2008. HP

Ben DuBose

ExxonMobil plans to invest approximately $185 billion over the next

five years to develop new supplies of energy to meet expected growth in demand, CEO

Rex W. Tillerson said in a recent presentation at the New York Stock Exchange. During

challenging times for the global economy, ExxonMobil continues to invest to deliver

the energy needed to underpin economic recovery and growth, Mr. Tillerson told

investment analysts. He said that, even with significant efficiency gains, ExxonMobil

expects global energy demand to increase by 30% by 2040, compared to 2010 levels.

Demand for electricity will make natural gas the fastest-growing major energy source,

and oil and natural gas are expected to meet 60% of energy needs over the next three

decades. To help meet that demand, ExxonMobil is anticipating an investment profile

of approximately $37 billion per year through 2016. A total of 21 major oil and gas

projects will begin production between 2012 and 2014, he said.

Motiva Enterprises plans to convert all of its high-sulfur diesel heating

oil (2,000 ppm) storage to ultra-low-sulfur diesel (ULSD) (15 ppm) at its Sewaren

terminal in New Jersey. Motivas conversion aims to meet its customers needs under a

new New York state mandate that all heating oil sold in the state be no more than 15

ppm sulfur by July 1, 2012. It will also allow the Motiva Sewaren refined products ter-

minal with a capacity of more than 5 million bbl, to take deliveries of ULSD for New

York Mercantile Exchange-based contracts via marine and pipeline. In addition to the

conversion to ULSD heating oil, Motiva is undertaking a project to convert two tanks

of heating oil storage to B100 biodiesel at the Sewaren terminal. With the addition of

biodiesel tankage and improved rail logistics, Motiva Sewaren will be able to supply mul-

tiple blends of biodiesel to the Northeast over the truck rack, as well as via marine vessel.

Metso has acquired South Korean global valve technology and

service company Valstone Controls Inc. The acquisition enables Metso to expand its

offering for the oil and gas and power industries with globe valve technology that

plays a key role in most critical processes with extreme pressures and temperatures,

the company said. Valstone is a privately owned globe valve and service specialist com-

pany. Valstone has an established customer base in Korean engineering, procurement

and construction (EPC) companies and in domestic South Korean petrochemical and

power-generation industries. Metso said it further plans to develop partnerships with

leading South Korean engineering, procurement and construction companies.

Petronas and BASF have taken the next steps in the development

of the previously announced 1 billion investment that will expand their partnership in

Malaysia, involving projects at their existing venture in Kuantan and at a new site with-

in Petronas proposed refinery and petrochemical integrated development (RAPID)

complex in Pengerang, Johor. These projects are to be implemented between 2015 and

2018. Under the terms of the recently signed agreement, the partners have agreed to

form a new entity (BASF, 60%; Petronas, 40%) to jointly own, develop, construct and

operate production facilities for isononanol, highly reactive polyisobutylene, non-ionic

surfactants, and methanesulfonic acid, as well as plants for precursor materials. These

world-scale facilities will become an integral part of Petronas RAPID project.

Oil trading and logistics company Gunvor Group has reached an

agreement to buy the 107,500-bpd refinery that insolvent Swiss oil refiner Petroplus

shut down in Antwerp, Belgium. Gunvor said in a statement that it expects the deal to

close in the next month. Gunvor will retain all current workers, and will operate the

refinery on a long-term basis. The company plans to restart the refinery immediately

after the deal closes in late April. Petroplus began shutting down the Antwerp refinery

in late December amid mounting credit woes. The Antwerp site also has a storage

capacity of more than 1.2 million cubic meters. HP

Postcard from

CERAWeek

The Emerson logo is a trademark and a service mark of Emerson Electric Co. 2012 Emerson Electric Co.

With low-cost implementation and easy integration, Emerson Pump Health Monitoring means

big savings now and in the long run. Our real-time predictive technology tells you what to pay

attention to and when, so you stop wasting time, money and manpower. Automated asset monitoring

also helps you avoid risks to operation, safety and environment, thereby increasing the reliability of

your refinery. And with the advantage of Smart Wireless, installation is quick and painless. See how

to unleash your plants and your peoples potential at EmersonProcess.com/PumpHealth

When pumps go down, so does my production.

To see which pumps are in danger, I need real-time monitoring.

But how can I afford the upgrade?

HPINSIGHT

HYDROCARBON PROCESSING APRIL 2012

I

9

All hydrocarbons have a place in the global market;

timing depends on economics

Remaining profitable continues to be a critical issue for hydro-

carbon processing facilities. Balancing new technology with gov-

ernment mandates is a thorny problem. Environmental issues add

more cost to refined products. Changes in transportation fuels

continue as vehicle manufacturers update engine designs. R&D

and innovative inventors continue to find solutions to old and

new challenges of the hydrocarbon processing industry (HPI).

Headlines from Hydrocarbon Processing,

April 2002:

Clean fuels: Estimated $7 billion in US refining capital

spending. In 1999, The Environmental Protection Agency

(EPA) released Tier II sulfur mandates, as part of the Clean Fuels

Program. These rules require lowering sulfur concentrations in

gasoline to 30 ppm by 2006. Compliance with the low-sulfur

guidelines for gasoline and diesel is deemed to be complicated.

Most refiners have studied two possible options: revamping die-

sel hydrotreaters or constructing new desulfurization units. A

study of the 162 US refineries identified construction of 96 new

desulfurization units, representing $6.6 billion in total spending.

OPEC recommends output freeze; group will meet again in

June. OPEC continues to maintain its crude oil output until the

global economy and/or demand improves. The group also hopes

to improve crude oil contributions from non-OPEC producers.

Controversy swirls around renewable fuel standard. The

American Petroleum Institute (API) and the Renewable Fuels

Association (RFA) have joined forces against pending legisla-

tion to ban methyl tertiary butyl ether (MTBE) and to create a

renewable fuel standard. The new mandate would require use

of approximately 5 billion gallons of ethanol in gasoline before

2012. By providing liability protection to ethanol but not for

MTBE, refiners will have significant incentives to abandon

MTBE blending before the four-year ban takes effect.

Headlines from Hydrocarbon Processing,

April 1992:

Crude oil to remain inexpensive for two years, said the

renowned energy economist, P. K. Verleger. OPEC cut nearly

2 million bpd of production to attain a $21/bbl minimum refer-

ence set in July 1990. However, curtailment wont hold prices at

current levels, Verleger said.

City diesel curtails emissions. Year-long trials are underway

in Helsinki, Finland, with a new diesel fuel that promises to

cut both sulfur and particulate emissions from public transport

vehicles. City diesel was developed by Neste Oil, based on

surveys with engine manufacturers. The new diesel has a low

sulfur content (0.005 wt% as compared to 0.1 wt% to 0.2 wt%

of present diesel) and is also less aromatic.

Synthetic rubber demand on the rise. Recovery in the global

synthetic rubber (SR) market is anticipated. Worldwide con-

sumption of SR and natural rubber will increase over the next

five years (19911996) to 15.8 million tons, thus having an aver-

age annual 2.1% demand growth rate. All geographical regions

should experience new growth. However, demand in Central

Europe and the Commonwealth of Independent States (CIS) is

expected to decline 17% over the same period.

OSHA issues final rule for chemicals PSM. The US Occupa-

tional Safety and Health Administration (OSHA) issued a final

rule entitled, Process Safety Management of Highly Hazardous

Chemicals in the Federal Register on Feb. 24, 1992. This rule

requires employers to manage hazards associated with processes

using materials identified as highly hazardous. It will affect any

industry that produces, uses, stores, transports or handles any of

these materials in amounts equal to or greater than the specified

quantity. As part of the rule, employers must compile written

process safety information, conduct hazard analyses, develop and

implement written operating procedures, train employees on the

written procedures, and more. Twelve criteria are included under

the new rule.

Headlines from Hydrocarbon Processing,

April 1982:

LPG emerging as the motor fuel for fleet vehicles. Once again,

motor vehicles powered with liquefied petroleum gas (LPG) are

under consideration, especially for fleet applications. Industry

statistics indicate that more than 500,000 vehicles per year will

be converted to propane during the 1980s. Most of the converted

LPG vehicles will be part of municipal fleets, such as police cars

and other emergency vehicles.

Get jet fuel from shale oil in single step? Amoco Oils new

experimental catalyst moved closer to the reality of converting

shale oil into aviation fuel.

Operations at Marathon Oil Co.s 200,000-bpd Garyville, Louisiana,

refinery are automatically and remotely controlled from four control

centers. This main process control center oversees all process

operations electronically. It is linked by radio and telephone to other

centers monitoring and controlling the boiler area, tank farm and

water treatment facilities. Hydrocarbon Processing.

HPINSIGHT

10

I

APRIL 2012 HydrocarbonProcessing.com

Synfuels viability boils down to economics. A coal gasification

plants product would have to net $17/MMBtu in 1988 (as com-

pared to $100/bbl of crude oil). At present, the most expensive

category of natural gas is about $9/MMBtu. Capital cost for a

synfuels facility is another huge factor; construction costs for coal

gasification units continue to rise. The present oil glut, temporary

or not, is another factor.

Natural gas price decontrol? Decontrol of the US natural gas

(NG) market remains a controversial subject. As a major con-

sumer, the US chemical industry remains vulnerable to NG supply

shortages. Shortfalls are attributed to inadequate incentives under

the Natural Gas Policy Act (NGPA), passed in 1978. NGPA has

contributed to significant disruption in the NG market.

Headlines from Hydrocarbon Processing,

April 1972:

Heavy-oil cracking process developed. Kellogg International

and Phillips Petroleum have developed a new heavy-oil cracking

(HOC) process that can convert residuals from the atmospheric

or vacuum towers directly into high-octane gasoline. The Kellogg-

Phillips HOC Process disposes of high-sulfur residuals by extend-

ing the feedstock range for fluid catalytic cracking. The first unit

was constructed at Phillips Borger, Texas, refinery, and it has an

operating capacity of 25,000 bpd.

Anti-pollution control will cost billions by 1976. Over the next

four years, petrochemical/chemical companies will invest $1.43

billion on capital equipment alone for environmental projects.

Total estimated costs for water, air and solid-waste pollution-

control projects will bump $12.7 billion by 1976.

Lead drops, but US octane holds up. Despite a drop in the

average lead content, the octane of regular and premium gasoline

at US service stations remains at a high level. Octane levels were

maintained by altering the proportions of fuel additives, and by

incorporating new blending methods, to compensate for the lower

lead content. In 1972, lead content in gasoline dropped from 2.43

g/gal to 2.22g/gal.

New desulfurization process available. Chisso Engineering of

Japan has developed a new desulfurization process that can com-

pete with conventional hydrogenation processes. The new process

uses water at 250C to melt and extract undesirable compounds

from petroleum at a fifth of the cost of other methods.

Takahax process recovers sulfur dioxide directly from gases

with very low hydrogen sulfide (H

2

S) content. The process

was originally developed in Japan. Nissan Engineering has

constructed 40 units, and has issued an exclusive license to

Ford, Bacon & Davis to design and construct Takahax units in

the Western Hemisphere. The process uses a caustic solution

with an oxidation-reduction catalyst to remove nearly 100%

of the H

2

S.

Alaska pipeline seems far offand expensive. The Alyeska

Pipeline Service Co. says the cost of the pipeline from Prudhoe

Bay to Valdez would be about $3 billion. Putting this pipeline

through Canada would double construction costs. There is still

no (US) government approval on the construction project, but the

approval is expected no later than mid-June (1972).

To see more headlines from 1962 to 1922,

visit HydrocarbonProcessing.com.

Construction continues for the largest catalytic cracking and gas

recovery unit, with 63,000 bpd of crude oil capacity. The cracker was

designed and built by The M.W. Kellogg Co. for Gulf Oils Philadelphia

refinery. Petroleum Refiner, 1954.

The new 360-ft tall Houdriflow cat cracker dwarfs the fixed-bed

catalytic refining units at Sun Oils Marcus Hook, refinery. The new

18,000-bpd Houdriformer will increase the refinerys capacity to

produce high-quality gasoline. Petroleum Refiner, 1955.

1-800-95-SPRAY

|

spray.com

|

Specify and order standard nozzles spray.com/ispray

Why Leading Refineries

and Engineering Firms Rely

on Us for Injectors and Quills

Manufacturing quality and flexibility.

Need a simple quill or multi-nozzle injector? Insertion length of a

few inches or several feet? 150# or 2500# class flange? High-pressure,

high-temperature and/or corrosion-resistant construction? Special

design features like a water-jacket, air purge or easy retraction for

maintenance? Tell us what you need and well design and manufacture

to your specifications and meet B31.1, B31.3 and CRN (Canadian

Registration Number) requirements.

Design validation with process modeling.

Let us simulate the injection environment to identify potential

problems. We can model gas flow, droplet trajectory and velocity,

atomization, heat transfer, thermal stresses, vibration and more

to ensure optimal performance.

Proven track record.

Weve manufactured hundreds of injectors for water wash, slurry

backflush, LNG processing, feed and additive injection, SNCR and SCR

NOx control, desuperheating and more. Customers include Jacobs

Engineering, Bechtel, Foster Wheeler Corp., Shaw Group, Conoco Phillips

Co., Shell, Valero and dozens more.

Learn More at spray.com/injectors

Visit our web site for helpful literature on key considerations in

injector and quill design and guidelines for optimizing performance.

Spray

Nozzles

Spray

Control

Spray

Analysis

Spray

Fabrication

D

32

(m)

220

165

110

55

0

CFD shows the change in drop size based

on nozzle placement in the duct.

Nozzle spraying

in-line with duct

Nozzle spraying

at 45 in duct

Computational Fluid

Dynamics (CFD)

Dual Nozzle

Injector

Retractable Injector, Slurry

Backflush Quill, Water

Wash Quill (bottom to top)

Z = 0.6 m

Select 66 at www.HydrocarbonProcessing.com/RS

Good night.

Rest easy, your operation is running

smoothly, efficiently, safely.

Thats because you manage your operation

successfully, without the worry of persistent

lubrication issues that divert attention away

from the core business. You turned to Total

Lubrication Management from Colfax Fluid Handling.

They gave you the on-site team of specialists, the

long-term commitment, the customized program

of products, services and expertise, the sustainable,

continuous improvement to take one heavy load

off your shoulders. Dedicated to keep you Up and

Running, so that you have many more good nights.

And good days too.

Total Lubrication Management

Up and Running

COLFAX is a registered trademark of the Colfax Corporation and TOTAL LUBRICATION MANAGEMENT is a service mark

of Total Lubrication Management Company. 2012 Total Lubrication Management Company. All rights reserved.

COT-PURITECH is now part of Total Lubrication Management,

bringing even more support for you in flushing, reclamation

and lubrication maintenance.

New from Total Lubrication Management

SM

Call 888.478.6996 for more information

Select 94 at www.HydrocarbonProcessing.com/RS

HEINZ P. BLOCH, RELIABILITY/EQUIPMENT EDITOR

HPIN RELIABILITY

HB@HydrocarbonProcessing.com

HYDROCARBON PROCESSING APRIL 2012

I

13

Awareness of energy efficiency is one

of the minimum job qualifications for

reliability engineers. In the summer of

1994, Jack Lambley, then an intern at the

Imperial Chemical Industries (ICI) Rock-

savage site in the UK, was assigned the

task of quantifying the effects on power

consumption for misaligned process

pumps. A surplus pump was overhauled,

and new bearings were fitted. This pump

was reinstalled, and water was recircu-

lated in a suitably instrumented closed-

loop arrangement. Prueftechnik GmbH

loaned Lambley a modern laser-optic

alignment instrument.

Background. As an undergraduate

student, Lambley had learned how mis-

alignment affected bearing load, and how

bearing load increases caused exponential

decreases in bearing service life. Following

instructions from his supervisor, Lambley

reviewed the engineering sections of SKFs

general catalog, which stated that a 25%

increase in bearing load caused the rated

bearing life to be halved.

Lambley investigated the alignment

accuracy and the methods in use at that

time. He discovered that straight-edge

methods were inappropriate for refinery

pumps. Rim-and-face alignment methods

were judged difficult and unreliable. Prop-

erly executed, reverse-dial-indicator meth-

ods required consideration of the bracket

sag, and they would require more time to

apply than modern laser techniques.

From data available at the Rocksavage

site, he calculated that the typical misalign-

ment consisted of 0.02 in./0.5 mm vertical

and horizontal offset and 0.002 in./in. verti-

cal and horizontal angularity. In 1994, lasers

were known to be inherently more accurate

than the best competing techniques.

Proof. Lambley constructed several

graphs and tabulations, as shown in Figs

Pump alignment saves power

0

0

2

4

6

8

10 20 30 40

Horizontal offset, thousandth

P

o

w

e

r

c

o

n

s

u

m

p

t

i

o

n

,

%

Accuracy +/ 3% of value

Source: ICI

50 60 70

Effect of parallel offset on power consumption of a pin

coupling at 3,000 rpm.

FIG. 1

0 5 10 15 20

0

2

4

6

8

10

Gap, thou./in.

P

o

w

e

r

c

o

n

s

u

m

p

t

i

o

n

,

%

Accuracy +/ 3% of value

Source: ICI

Effect of angular misalignment on power consumption of a

pin coupling at 3,000 rpm.

FIG. 2

0 10 20 30 40 50 60

0

1

2

3

4

5

6

7

8

9

Horizontal offset, thousandth

P

o

w

e

r

c

o

n

s

u

m

p

t

i

o

n

,

%

Accuracy +/ 3% of value

Source: ICI

Effect of parallel offset on power consumption of a

toroidal (tire-type) coupling at 3,000 rpm.

FIG. 3

0 5 10 15 20 25 30 35

0

1

2

3

4

5

6

Gap, thou./in.

P

o

w

e

r

c

o

n

s

u

m

p

t

i

o

n

,

%

Accuracy +/ 3% of value

Source: ICI

Effect of angular misalignment on power consumption of a

toroidal (tire-type) coupling at 3,000 rpm.

FIG. 4

HPIN RELIABILITY

14

14. The resulting recommendations

were to align machinery to within 0.005

in./0.12 mm shaft offsets and to limit

deviations in the hub gap to 0.0005 in./

in. of hub diameter. Lambley further doc-

umented that adhering to these recom-

mendations would reduce ICIs power con-

sumption by about 1%. He confirmed that

laser alignment was faster and superbly

more accurate. Lambley determined that

laser alignment technology was bottom-

line more cost-effective; he deserves credit

for establishing these facts instead of

repeating the opinions of others.

Using data from a mid-size refinery:

Average demand: 27 kW/pump

8,760 hr/yr $0.1/kWh 1,000 pumps

0.01 = $236,520/yr. And, with 1,000

pumps operating at any given time, this

location could annually save approximately

$250,000 in avoided power consumption.

Total cost. The total cost for laser

alignment instruments includes equip-

ment costs plus training costs. The ben-

efit is 8 man-hours of time-saving credit

per alignment job. For gathering more

data, thermography and infrared moni-

toring techniques are possible options.

These methods have been used to quan-

tify significant temperature increases in

a coupling located between misaligned

pump and driver shafts. You could com-

pare the energy wasted by the rising

temperature of a coupling to the energy

loss, as described by Lambley. Regardless

of calculation method, laser alignment

will result in surprisingly rapid payback.

Remember: In all reliability improve-

ment endeavors, never let somebodys

opinion get in the way of sound science

and facts.

Knowledge update. If you are like

the majority of hydrocarbon process-

ing industry facilities in the industrial-

ized world, your worker and technician

resources are probably stretched to the

limit. Understandably, you may be look-

ing for ways to simplify some of your tra-

ditional work processes and procedures.

You may have had an experience that rein-

forces the contention in which high-tech

tools are not always the answer. And hold

the view that the back-to-basics thinking

has considerable merit. However, decades

of well-documented observation attest

to the fact that misalignment has been

responsible for huge economic losses. The

more misalignment of the rotating unit

permitted, the greater the rate of wear,

likelihood of premature failure, and loss

of efficiency of the machine.

As an inquisitive Lambley proved, mis-

aligned machines absorb more energy than

they consume more power. So, its always

advantageous to update ones knowledge

of shaft alignment and alignment toler-

ances. Competent vendors will assist you

in illuminating the roadway to becoming

reliability-focused. And indications are

that only the reliability-focused facilities

will be around in the future. HP

The author is Hydrocarbon Processings Reliability/

Equipment Editor. A practicing consulting engineer

with now 50 years of applicable experience, he advises

process plants worldwide on failure analysis, reliability

improvement and maintenance cost avoidance top-

ics. He has authored or co-authored 18 textbooks on

machinery reliability improvement and over 490 papers

or articles dealing with related subjects. For more on

alignment, refer to Bloch, H. P., Pump Wisdom: Problem

Solving for Operators and Specialists, John Wiley &

Sons, Hoboken, 2011, pp. 153162.

Select 152 at www.HydrocarbonProcessing.com/RS

OFFSHORE DESIGN FOR YOUR

LNGC, FSRU, LNG FPSO AND LNG RV

No vibrations due to elimination

of unbalanced forces and moments

caused by oscillating masses

Simple compressor system for easy

operation, maintenance and control

Extremely exible solution for a

wide range of discharge pressures

(6 to 350 bar / 87 to 5070 psi)

and ows

Fuel gas system for ME-GI with vari-

ous reliquefaction options

Unique piston sealing technology for

maximum reliability and availability

www.recip.com/laby-gi

LNG BOG . BALANCED

LABY

-GI

YOUR BENEFIT:

LOWEST LIFE CYCLE COSTS

Select 79 at www.HydrocarbonProcessing.com/RS

power

your

performance

WR525 high-temperature thermoplastic composites

Greene, Tweed & Co. | PetroChem & Power | Tel: +1.281.765.4500 | www.gtweed.com

0

3

/

1

2

A

D

-

U

S

-

P

P

-

0

1

4

Utilize innovative thermoplastic composites from Greene, Tweed.

Demanding environments wear critical componentsespecially metallic ones

decreasing functionality and slowing delivery. But WR525 actually improves

efficiency and MTBF, powering performance so you can finish faster, stronger

and more efficiently.

WR525 is a thermoplastic composite that offers exceptional strength, excellent

nongalling and nonseizing properties and unique thermal expansion characteristics

not found in metallic or graphite materials. WR525 delivers reduced friction and

vibration and increased stability and efficiencymaking it an ideal thermoplastic

composite for wear rings, bushings and bearings for centrifugal pumps.

WR composites are powered by Greene, Tweeds innovative technology. Contact us

to learn more about our complete portfolio of Friction & Wear products.

Select 82 at www.HydrocarbonProcessing.com/RS

HPINTEGRATION STRATEGIES

HYDROCARBON PROCESSING APRIL 2012

I

17

preynolds@arcweb.com

PETER REYNOLDS, CONTRIBUTING EDITOR

The journey to supply-chain excellence

in the refining and petrochemical industries

In downstream refining and marketing, the handoff between

manufacturing operations and product distribution and market-

ing is often performed in a sub-optimal manner. Most process

manufacturing companies claim supply chain as a core compe-

tency, yet many still attempt to manage the workflow from end to

end. In many cases, the production operations and supply-chain

groups operate in silos. Refinery production groups typically make

superb products, using the manufacturing assets available to them.

However, since the logistics and supply-chain groups in refining

and petrochemical businesses usually handle product distribu-

tion and sales independently from production, their journey to

supply-chain excellence clearly lags behind many other industries.

With this understanding, leaders in process manufacturing

periodically peer into other industriessuch as discrete manu-

facturing and specialty chemicalsto learn ways to improve

supply-chain operational excellence. When they do, they often

learn that manufacturers must look at the entire supply chain

through multiple lenses and develop business processes based on

industry standards, best practices and appropriate use of technol-

ogy. All often offer opportunities to streamline business opera-

tions. In the downstream refining and petrochemicals industry,

one of the last levers left to improve profitability, is to streamline

the liquids supply chain.

Its often difficult to attain clear visibility into liquid-product

inventories due to inefficient or disconnected business processes

and technologies across primary and secondary distribution. Ter-

minal inventories are not reconciled in a timely fashion because

businesses often dont have the time to deal with spreadsheets and

complex IT applications.

Organizations implement supply-chain improvement projects

routinely, but with sub-optimal overall benefit. Successful IT proj-

ects for supply-chain integration need the business leaders to get

involved early in the project definition. However, these leaders are

usually busy running various marketing, distribution and trading

activities, and they seldom have adequate staff to support IT proj-

ects. Many business end users use a host of manual business pro-

cesses that involve e-mail, Microsoft Excel and hard-copy reports

to manage the complicated supply chains in the process industries.

Enter the Supply Chain Council. In 1996, the Supply

Chain Council (SCC) was formed to create and evolve an indus-

try-standard process reference model to help companies improve

supply-chain operations. The SCC created the Supply Chain

Operations Reference (SCOR) model; now companies can evalu-

ate and compare overall supply-chain activities and evaluate their

own performance.

The SCC is made up of over 800 members from worldwide

organizations. Owner-operatorssuch as Shell, DuPont, Irving

Oil, ExxonMobil and Chevroncomprise 40% of the mem-

bership. North American and European companies comprise

approximately 70% of the total membership. Most manufacturers

reported that the supply chain accounts for 60% to 90% of the

total company costs, while oil companies like ConocoPhillips and

Chevron disclosed spending 90% and 88%, respectively.

The SCOR model and framework. As the industry-stan-

dard supply chain business process reference model, the SCOR

contains over 200 high-level business processes; 550 supply-chain

metrics; and 200 skills classifications, including risk manage-

ment. The SCOR reference model includes five key management

process categories of activity. These provide a framework to link

suppliers, enterprise supply chains and customers. The SCOR

model is arranged with the fundamental business processes of

plan, source, make and deliver.

SCOR project toolkit. Initially, executing a supply-chain

project looks like a traditional project in which teams are devel-

oped, roles and responsibilities are aligned, and the standard

project charter is written. With the SCOR model, the competitive

SCORcard benchmark and analysis are introduced at an early

stage. SCOR metrics included in the benchmark are reliability,

responsiveness, agility, costs and assets. This process allows com-

panies to determine a supply-chain strategy and to analyze current

performance against competitors.

The SCOR project toolkit includes a number of tools that have

been used successfully to define a long-range plan to fix a supply

chain. Process mapping tools, like Aris, can be used in addition

to external benchmarking, logical and geographical maps, and

defect analysis tools. The SCOR model has several hundred best

practices that are easily identifiable with a given business process.

Organizations must execute IT projects in the correct order.

People, business process and technology are fully intertwined. At

the beginning of a project, it may be good practice to envision

the technology that will transform an organizations supply chain.

But technology cannot be implemented successfully on broken

business processes. Successful manufacturing companies look to

similar manufacturing companies and adapt standards when they

exist. These companies use the SCOR model to support tech-

nology procurement activities and the requirement documents

that are released to IT suppliers for bidding. The SCOR project

provides a proven methodology to transform the supply chain. It

includes the tools to define, analyze and benchmark supply-chain

performance and to choose the right supply-chain projects. HP

The author has more than 19 years of professional experience in process

control, advanced automation applications, information technology, enterprise

and supply chain in the downstream oil refining and petroleum product marketing

industry. Prior to joining ARC in 2011, Mr. Reynolds served as the strategic planning

manager for automation and IT at Irving Oil in Saint John, New Brunswick, Canada.

Irving Oil operates Canadas largest refinery.

The Emerson logo is a trademark and a service mark of Emerson Electric Co. 2011 Emerson Electric Co. D351992X012 MX11 (H:)

The life cycles of my critical service

valves are already pushed to the max.

And now they want to extend the time

between turnarounds?

Maximize uptime and reduce risk with superior valve technology and engineering.

Keeping competitive doesnt just mean having the right valves. Its also about the right partnership. And Emerson

delivers on both. Every Fisher

valve general and severe service applications is expertly selected to meet

your exact specifications. And our unmatched engineering and rigorous testing help ensure it will excel in even

your most demanding applications. Fisher valves its how you turn a risky situation into stable, reliable operation.

Go to Fisher.com/CriticalService

YOU CAN DO THAT

Select 76 at www.HydrocarbonProcessing.com/RS

HPIMPACT

BILLY THINNES, TECHNICAL EDITOR

BT@HydrocarbonProcessing.com

HYDROCARBON PROCESSING APRIL 2012

I

19

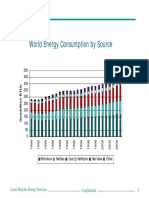

Energy for economic

growth

Having proved resilient throughout the

recent recession compared to other sectors,

the energy industry has the potential to be a

key engine of economic growth and recov-

ery, according to a new study by IHS CERA

and the World Economic Forum. The report

provides a framework for understanding the

larger economic role of the energy industry

at a time when issues of employment and

investment are so critical in a troubled global

economy, its authors said.

The report examines the industrys role

as a driver of investment and job creation, as

well as energys importance as the key input

for most goods and services in the econ-

omy. Fig. 1 shows the energy sectors share

of business-sector gross domestic product

(GDP) along with other industries in sev-

eral Organization for Economic Coopera-

tion and Development (OECD) countries.

The energy industry is unique in its

economic importance, said Daniel Yergin,

IHS CERA chairman. The energy sector

has the potential to be a tremendous eco-

nomic catalyst and source of innovation

in its own right, while it simultaneously

produces the very lifeblood that drives the

broader economy.

The energy industryby nature, capi-

tal intensive and requiring high levels of

investmenthas the ability to generate

outsized contributions to GDP growth,

the study says. In the US, the oil and gas

extraction sector grew at a rate of 4.5% in

2011 compared to an overall GDP growth

rate of 1.7%.

The highly skilled technical nature of

energy industry jobs is reflected in compen-

sation levels. As a result, employees of the

energy industry contribute more absolute

spending per capita to the economy than

the average worker, and contribute a larger

share of GDP per worker than most indus-

tries, the study says.

The energy industrys most important

immediate source of economic potential

is its high employment multiplier effect,

which is a result of its extensive supply

chain and relatively high worker pay. Every

direct job created in the oil, natural gas and

related industries in the US generates three

or more indirect and induced jobs across

the economy, the study says. For further

illumination, Fig. 2 shows energy sector

employment when compared to other

industries in select OECD countries.

In the US, this places oil and gas ahead

of the financial, telecommunications, soft-

ware and non-residential construction sec-

tors in terms of the additional employment

associated with each direct worker.

We always suspected that energy had a

vital role to play in the economic recovery,

said Roberto Bocca, senior director and

head of energy industries at the World Eco-

nomic Forum. But we were still surprised

when the data uncovered the magnitude of

the sectors multiplier effects.

Energy prices. As the key input for most

goods and services in the economy, lower

energy prices reduce expenses for consum-

ers and businesses and increase the dispos-

able income available to be spent elsewhere.

Many countries, such as China, India and

South Korea, are increasingly focusing on

renewable energy sources as potential growth

sectors for their economies, the report said.

Developed countries are also investing in

renewables in an effort to meet sustainability

goals and emerge at the forefront of this

Germany

Mexico

Norway

South Korea

United Kingdom

United States

Percent

0 5 10

10.4

21.2

5.9

4.5

2.8

3.5

8.5

3.2

24.4

8.8

6.5

22.3

2.5

11.8

19.1

28

6.3

18.2

15 20 25 30

Energy-related

industries

Manufacturing Health and

social work

Source: IHS CERA and OECD Structural Analysis Database.

Note: Data are 10-year averages of the most recent data available:

20002009 for the United States, 19932002 for Norway,

and 19942003 for all other countries.

Share of business-sector GDP and energy compared to

other industries.

FIG. 1

Source: IHS CERA and OECD Structural Analysis Database.

Note: Data are 10-year averages of the most recent data available:

20002009 for the United States, 19932002 for Norway and

19942003 for all other countries.

Energy-related

industries

Manufacturing Health and

social work

Germany

Mexico

Norway

South Korea

United Kingdom

United States

Percent

0 5 10 15 20 25 30

16.9

18

1.2

0.9

2.6

0.6

18.6

2.7

11.9

0.8

9.5

22.1

1.4

14.3

2.3

27.8

11.1

15.7

Share of business-sector employment and energy

compared to other industries.

FIG. 2

HPIMPACT

20

growing sector. However, the higher costs

of these technologies create tradeoffs that

must be considered, the study said.

One must look at energys contribution

to the overall economy, not just its direct

contribution, said Samantha Gross, IHS

CERA director of integrated research. Max-

imizing direct jobs in the energy sector may

not be the right goal if it reduces efficiency

and increases energy prices to the detriment

of the economys overall productivity.

The study also examines the role

of policy in maximizing the economic

benefits of energy production, promot-

ing steady and reasonable energy prices

through stable tax and fiscal schemes,

and encouraging of industrial diversifi-

cation through cluster development. It

points to the challenge for a resource-rich

country to transform oil and gas earnings

into the foundations of a wider, more

diversified economy.

Medium-voltage AC

drives surge, thanks

to energy market

While large project orders helped main-

tain the market size of medium-voltage

AC drives in 2009, it also resulted in low

growth in 2010 compared to other auto-

mation product markets. However, 2010

was still not a disappointing year for the

medium-voltage AC drives market. The

market expected to experience higher

growth in 2011 compared to sluggish

growth in 2010, according to an ARC

Advisory Group study.

The impact of the extraordinary amount

of policy stimulus in 2009 boded well for

the high-power AC drives market in 2009

and 2010. Monetary policy had been

highly expansionary, with interest rates

down to record lows in most advanced, and

in many emerging, economies.

Growth in power and automation

solutions for all regions of the world [was

seen continuing] in 2011 and beyond, with

increasing market demand for building

newand upgrading existingpower infra-

structure and improving industrial efficiency

and productivity, according to Himanshu

Shah, the principal author of ARCs study.

Demand from emerging markets.

While demand in mature markets for auto-

mation solutions and AC drives is expected

to improve, emerging markets will remain

significant drivers of growth as they build

up their electrical power-generation capac-

ity and expand industrial production with

a major focus on improving energy effi-

ciency and industrial process quality. These

dynamics directly impact market growth

for medium-voltage AC drives. Demand

for commodities fueled by the economic

growth of emerging countries and the need

to become more globally competitive in

product quality is also expected to propel

demand for industrial automation solu-

tions and medium-voltage AC drives in the

emerging markets.

Infrastructure investment. Glo-

balization has created a growing demand

for modern infrastructures, especially in

emerging economies. Major investments

are underway, and more are being planned

for airport facilities, railway and public

transportation expansions, and new road

construction. These projects are driving

demand for products from the metals and

mining, cement and glass, and oil and gas

A year ago Velan acquired

a majority share in ABV Energy

(since renamed Velan ABV).

Together, we offer a wide range of

valves to meet any industrial application,

including our latest DTP (discrete tortuous

path) choke valves specically designed

for pressure control where high energy

dissipation is required.

So the next time youre in the

market for a valve suitable for

oil and gas wellhead control,

as well as all type of uids and

aggressive environments,

you can rely on Velan ABV.

When it comes to valves

that offer low emissions,

easy maintenance, and

long and reliable service,

Velan and Velan ABV

are the names to trust.

Velan. Quality that lasts.

+1 514 748 7743

www.velan.com

Velan ABV:

See us at

OTC, Houston, TX

April 30 May 3

2012

Booth #4853

Select 153 at www.HydrocarbonProcessing.com/RS

GAS TREATING EXCELLENCE

remoteness loves proximity

Gas treatment plants are often located in the loneliest corners of the planet.

We at BASF ensure that all plants working with our gas treatment technology

run smoothly, regardless of where they are. Under its new OASE

brand,

BASF provides gas treatment solutions consisting of technology, services and

products. We at BASF combine the experience of more than 40 years and about

300 distinct references with the latest innovations to provide you with your

unique solution. So if going to the ends of the earth results in us being your

best neighbor, its because at BASF we create chemistry. www.oase.basf.com

Select 100 at www.HydrocarbonProcessing.com/RS

HPIMPACT

22

industries. Emerging economies know that

their current infrastructures are a major

bottleneck for their continuing economic

growth. Medium-voltage AC drives are one

of the critical components for these infra-

structure investments, and they are used

extensively in these industries.

In spite of the unpredictable economic

conditions of some countries in Europe,

the globalization environment is expected

to resume over the next forecast period.

The beginnings of a modest recovery in the

global economy would present an excellent

backdrop for medium-voltage AC drives

market growth.

While every region will experience

growth in the medium-voltage AC drives

market over the forecast period, there are

significantly different factors affecting each

market. A brief description regarding the

economic scenarios for each region is cov-

ered in the report.

Canadian oil sands

alliance

Canadian oil sands producers have

formed a new alliance named Canadas

Oil Sands Innovation Alliance (COSIA),

seeking to accelerate the pace of improving

environmental performance in Canadas oil

sands. Companies involved in the alliance

include BP, Canadian Natural Resources,

Cenovus Energy, ConocoPhillips, Devon,

Imperial Oil, Nexen, Shell, Statoil Canada,

Suncor Energy, Teck Resources and Total.

CEOs from those companies signed the

alliances founding charter, committing to

COSIAs vision to enable responsible and

sustainable growth of Canadas oil sands

while delivering accelerated improvement

in environmental performance through col-

laborative action and innovation.

The creation of COSIA as an indepen-

dent alliance builds on work done over the

past several years by both oil sands industry

members and research and development

organizations, the group said. COSIA plans

to take these efforts to a much larger scale

and seeks to help the industry address envi-

ronmental challenges by breaking down

barriers in the areas of funding, intellectual

property enforcement, and human resources

that may otherwise impede progress.

The publics expectation of environ-

mental performance in the oil sands contin-

ues to evolve; we want to meet those expecta-

tions, and well work collaboratively to do so,

building on previous successes, said John C.

Abbott, executive vice president of heavy oil

for Shell Canada. Coming together today

to sign the charter is a significant and impor-

tant step for all our companies and marks a

pivotal point for our industry.

COSIA also announced Dr. Dan

Wicklum as CEO of the new alliance. Dr.

Wicklum has a background in environ-

mental science and was selected following

a national search. The organization said

that his scientific qualifications and leader-

ship experience position him well to lead

COSIA, a science-based alliance focused on

environmental technology and innovation.

I am confident COSIA will greatly

accelerate innovation and environmental

performance in priority areas that Cana-

dians care most about, Dr. Wicklum

said. Today is just the beginning, and I

am excited to be part of this new alliance.

We understand we have a lot of work to

do, and we are looking forward to working

with our stakeholders and reporting on our

progress along the way.

Select 154 at www.HydrocarbonProcessing.com/RS

HPIMPACT

COSIA will establish structures and

processes through which oil sands pro-

ducers and other stakeholders can work

together for the benefit of the environ-

ment. The alliance will identify, develop

and apply solutions-oriented innovations

around the most pressing oil sands envi-

ronmental challenges (specifically water,

land, greenhouse gases and tailings), and

will communicate COSIAs efforts and suc-

cesses in addressing those challenges.

Jean-Michel Gires, CEO of Total E&P

Canada, said that COSIA creates a new

dynamic for the oil sands industry, promot-

ing new approaches for intellectual property

management of environmental technology

and better working relationships with uni-

versities, research agencies, technology pro-

viders, regulators and oil sands stakeholders

in the communities where industry operates.

COSIA is a reflection of how the oil

sands have evolved into a global resource,

with companies committing to fostering

continuous innovation and the develop-

ment of new environmental solutions,

Mr. Gires said. We have seen what can be

achieved when we work together and multi-

ply our ideas and efforts. For example, work

done by the Oil Sands Leadership Initiative

and the Oil Sands Tailings Consortium is

already delivering technology that promises

to reduce our environmental footprint.

Companies participating in COSIA will

contribute at varying levels to the alliance,

based on their own areas of expertise, offi-

cials said. COSIA will rely on the input of

scientists and engineers from within the

ranks of the member companies, as well

as leading thinkers from government, aca-

demia and the wider public.

Polyurethane news

from Riyadh

Saudi Basic Industries Corp. (SABIC)

has signed a toluene di-isocyanate (TDI)

and methylene di-phenyl isocyanate (MDI)

technology license agreement with Mitsui

Chemicals, under which Mitsui will provide

manufacturing technology for producing

TDI and MDI. TDI and MDI are each raw

materials for producing polyurethane. The

agreement also provides for joint technology

development in TDI/MDI, officials said.

The official signing ceremony (Fig. 3) took

place at SABIC headquarters in Riyadh,

Saudi Arabia, and featured Mohamed Al-

Mady, SABIC vice chairman and chief exec-

utive officer, and Toshikazu Tanaka, Mitsui

Chemicals president and CEO.

Mr. Al-Mady said that the partnership

would spearhead a strategic collaboration

between the two companies to explore

future possibilities to collaborate in the

polyurethane business. The agreement

will spur our strategic business plan to

penetrate the global polyurethane market,

as well as to power the ambition and com-

petitive advantage of our customers for the

long term, he said. It will also enable a

fast development of polyurethane applica-

tion industries in Saudi Arabia, especially

with regard to thermal insulation, which

will contribute to employment creation in

addition to energy savings.

Mr. Al-Mady pointed out that Mit-

sui Chemicals has lengthy experience as

a manufacturer of TDI and MDI and has

developed pioneering manufacturing pro-

cesses. Through this technology license

agreement, we will strengthen our prod-

uct capabilities with high-quality TDI and

MDI, and expand into the polyurethane

business, he said.

For Mitsui Chemicals, this license

agreement will be the largest and most

extensive one we have ever made, Mr.

Tanaka said. We will support this project

full force on every front and are commit-

ted to its success. I hope that it will be just

the first step in a future business partner-

ship with SABIC, which may include the

establishment of a strategic supply base for

competitive TDI/MDI. HP

Executives from SABIC and Mitsui Chemicals ink a deal in Riyadh, Saudi Arabia. FIG. 3

To find out more, visit:

www.borsig.de

BORSIG GmbH

Phone: ++49 (30) 4301-01

Fax: ++49 (30) 4301-2236

E-mail: info@borsig.de

Egellsstrasse 21, D-13507

Berlin/Germany

BORSIG TRANSFER

LINE EXCHANGERS

FOR

ETHYLENE CRACKING

FURNACES

BORSIG is the worlds leading

manufacturer of quench coolers

for ethylene plants with more than

6,000 units installed worldwide.

- BORSIG Linear Quencher

(BLQ)

- BORSIG Tunnelflow Transfer

Line Exchanger (TLE)

A practical design, highly quali-

fied personnel and modern

manufacturing and testing

methods ensure the high quality

standards to meet all require-

ments with regard to stability,

operational reliability

and service life.

BORSIG - Always

your first choice

Visit us at:

Ethylene Producers Conference

at the AIChE 2012 Spring Meeting

Select 155 at www.HydrocarbonProcessing.com/RS

Flexible H

2

S Removal

LO CATs fexible technologies and worldwide services are backed by over three decades of

reliability. Over 200 licensees in 29 countries are meeting todays compliance requirements by

turning nasty H

2

S into elemental sulfur with the use of LO CAT technologies. Efcient, efective

and environmentally sound, LO CAT is the technology of choice for H

2

S removal / recovery.

www.merichem.com

Sweet Solutions.

LO CAT

Select 84 at www.HydrocarbonProcessing.com/RS

HPINNOVATIONS

HYDROCARBON PROCESSING APRIL 2012

I

25

SELECTED BY HYDROCARBON PROCESSING EDITORS

Editorial@HydrocarbonProcessing.com

Vessel monitoring system

uses thermal cameras

The Critical Vessel Monitoring Sys-

tem from Land Instruments International

Ltd., a unit of AMETEK Inc., uses indus-

trial-strength thermal-imaging cameras

to provide higher measurement density

than traditional systems based on ther-

mocouples. The system measures surface

temperature once every 16 cm

2

, as com-

pared with one measurement every 250

cm

2

in thermocouple systems. Each cam-

era records over 110,000 individual mea-

surements, ensuring that even the smallest

degradation can be detected.

By measuring temperatures in more loca-

tions, the system allows for earlier detection

of refractory wear or breakdown. Measure-

ments from all cameras are reported using

graphical software that signals an alarm if a

potential breakout is detected. The software

also compiles temperature trends to sup-

port statistical analysis of refractory wear.

An integrated web interface allows for the

visualization of current vessel conditions

from all plant locations.

The system is optimized for use in

gasifiers and other critical vessels in pet-

rochemical production, power genera-

tion, chemical and coal processing, waste

management, and fertilizer and plastics

production. Benefits include greater pro-

tection against catastrophic vessel failure

and extension of refractory lifetime based

on actual data.

Select 1 at www.HydrocarbonProcessing.com/RS

New catalyst produces

high-performance polymers

Dow Chemical Co.s CONSISTA C601

polypropylene catalyst, which is included

in its Ziegler Natta catalyst family, is a

non-phthalate-based catalyst system for the

production of high-performance polymers.

The system requires no capital or upgrades

to existing facilities, and accommodates

drop-in technology for Dows UNIPOL

Polypropylene Process Technology.

CONSISTA C601 Catalyst was imple-

mented in production trials at Slovnaft

Petrochemicals in Bratislava, Slovakia.

There, the catalyst was used to produce

homopolymer and high melt flow impact

copolymers. CONSISTA C601 Catalyst

demonstrated high yield and the capability

to make a broad range of products with a

non-phthalate-based catalyst system.

Andrej Horak, polypropylene plant

manager for Slovnaft Petrochemicals, noted

that the trials confirmed expectations for

improved product properties, and resulted

in lower production costs ensured by

40% higher catalyst yield compared to our

current system. Slovnaft Petrochemicals

plans to install the CONSISTA C601 cata-

lyst system for its entire production portfolio

in the near future, enabling it to meet future

REACH (Registration, Evaluation and

Authorization of Chemicals) requirements.

Additionally, in a separate trial of CON-

SISTA C601, the catalyst demonstrated

excellent operability and process perfor-

mance with homopolymer production,

using a standard operation protocol, thereby

validating the drop-in technology concept.

Select 2 at www.HydrocarbonProcessing.com/RS

Pump shaft seal listed

as Shell best practice

Shell Global Solutions has listed IHC

Lagersmits LIQUIDYNE water-lubricated

pump shaft seal as best practice for use with

its cooling water pumps worldwide. The

seal is also included in Shells Technically

Accepted Manufacturers and Products

(TAMAP) list.

The LIQUIDYNE seal was originally

developed for dredging pumps and has

been adapted to fit cooling water pumps.

Since the condition of the heavily rein-

forced seal can be determined at any time,

it offers significant reliability and above-

average mean time between maintenance

(MTBM) for cooling water pumps. The

high MTBM improves grip on the pump-

ing process and prevents both unnecessary

maintenance and sudden pump failure,

thereby reducing maintenance costs.

Select 3 at www.HydrocarbonProcessing.com/RS

Wireless network solution

links remote field sites

The Wireless Network Module (WNM)

from Moore Industries is an accurate and

reliable solution for sending process signals

between remote field sites. The bidirectional

WNM provides a low-cost wireless commu-

nications link between field sites that are in

rugged or impassable terrain, with a single

unit transmitting for up to 30 miles. The

unit can also act as a repeater for a virtually

unlimited transmission range.

The WNM uses Spread Spectrum Fre-

quency Hopping technology to avoid inter-

As HP editors, we hear about new products,

patents, software, processes and services

that are true industry innovations

a cut above the typical product offerings.

This section enables us to highlight these

significant developments. For more

information from these companies,

please go to our website at

www.HydrocarbonProcessing.com/rs

and select the reader service number.

This vessel monitoring software shows the exact locations of imaging cameras. FIG. 1

26

I

APRIL 2012 HydrocarbonProcessing.com

HPINNOVATIONS

ference problems caused by crowded radio

spectrums. This technology allows multiple

radio networks to use the same band while

in close proximity. The WNM does not

require a regulatory license, and it typically

can be installed without performing costly

radio frequency site surveys.

The WNM is ideal for use with Moore

Industries NCS NET Concentrator Sys-

tem, as well as with other supervisory con-

trol and data acquisition (SCADA) and

distributed input/output systems. WNM

models are available for data communica-

tions networks that use Ethernet and serial

(RS-485) communications.

Select 4 at www.HydrocarbonProcessing.com/RS

Clean CCS process replaces

coal-mining steps

Refineries with delayed coker technol-

ogy and open-pit or pad solids handling

resemble a coal-mining operation. How-

ever, engineering firm TRIPLAN AGs

Closed Coke Slurry (CCS) system offers

a modern, state-of-the-art delayed coking

process with sound economic incentives

and low emissions. The CCS technology

significantly improves overall plant reli-

ability and reduces costs.

The CCS system is technically a closed

system, improving mechanical, environ-

mental and worker hygiene compared to an

open-pit or pad system. All coke-handling

stepsfrom coke drum outlet to discharge

of dry coke to load-out, and the separa-

tion and disposal of coke fineshave been

converted from solids handling into one

smooth, swift step.

CCS technology enables a reduction

in cycle time of up to four hours, allow-

ing for greater feed processing and clean

products output. Also, improvements in

the metallurgy have made the CCS process

very stable, unlike the pit and pad designs.

The instrumentation allows for fully con-

trolled operation, and it enables the con-

sole operator to view a complete status of

the process at any time.

The typical payout time for a CCS sys-

tem is one and a half years to two years

(for a two-drum unit processing 1,000

tons of coke per day), as long as down-

stream modifications do not dilute the

economics. Since each delayed coker and

overall refinery configuration are different,

careful investigation and review of the site

are recommended before the installation

of the CCS system.

Select 5 at www.HydrocarbonProcessing.com/RS

Linde buys Chorens

Carbo-V technology

Linde Engineering Dresden GmbH

recently acquired the Carbo-V multistage

biomass gasification technology of the

insolvent Choren Industries GmbH, for

an undisclosed sum. Linde plans to offer

the technology for commercial projects in

the future.

During the Carbo-V technologys first

process stage, the biomass reacting in a

low-temperature gasifier (LTG) is con-

verted to biocoke and carbonization gas.

The second process stage comprises the

partial oxidation of the carbonization gas

that takes place in a high-temperature gas-

ifier (HTG), and, during the third process

stage, the biocoke is blown into the hot gas