Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Franklin Budget Revenues FY2013

Caricato da

Steve SherlockCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Franklin Budget Revenues FY2013

Caricato da

Steve SherlockCopyright:

Formati disponibili

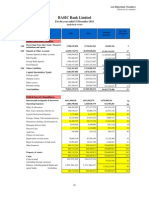

Fiscal Year 2013 Budget Funding

Final

FY 2010

I.

Final

FY 2011

Final

FY 12

Projected

FY 13

AVAILABLE RESOURCES:

TAX LEVY

1

Prior Year Levy Limit plus 2 1/2%

New Growth

50,303,727

52,266,278

54,099,089

56,327,438

687,763

513,322

854,509

600,000

50,991,490

52,779,600

54,953,598

56,927,438

Prop 2 1/2 override

3

Unused Levy

4

5

Debt Exclusions:

Elementary School(Net of SBA)

178,886

340,462

Horace Mann (2,000,000)

158,900

154,650

8

10

Lincoln Street (bond)

611,375

599,513

Horace Mann (bond)/FY 06 premium

461,634

451,508

11

1,410,795

1,546,133

1,468,947

1,375,682

12

52,402,285

54,325,733

56,422,545

58,303,120

28,152,172

26,714,222

26,857,636

26,857,636

727,543

801,929

712,745

574,028

2,177,055

2,089,973

1,938,859

1,938,859

344,298

297,744

310,747

329,647

31,401,068

29,903,868

29,819,987

29,700,170

1,040,348

825,934

825,934

825,934

32,441,416

30,729,802

30,645,921

30,526,104

6,360,000

6,410,000

340,000

340,000

13

STATE REVENUE (Net of Offsets)

14

Chapter 70 School Aid (Net)

15

Charter Tuition/Captial Assessment Reimb

16

School - Other

17

Lottery

18

All Other (net of offsets)

19

Prior Year Overestimates

20

21

School Building Assistance

22

23

24

OTHER REVENUES

Local Receipts - General Fund (+ ambulance receipts 2004) 6,694,305

meals tax

260,000

Medway library shared director revenue

28

hotel/motel FY 12

29

indirects wtr/swr/sw

45,000

400,000

30

31

32

33

Other Available Funds

34

Small Cities Program (Senior Center Debt)

6,999,305

7,192,000

20,000

11,000

7,100,000

6,750,000

Parking Meter Receipts Reserved

Affordabel Housing Gift

Enterpirse Fund (Indirects)

15,000

15,000

955,000

956,000

966,000

350,000

350,000

975,000

982,000

1,331,000

1,343,000

200,000

200,000

200,000

200,000

93,018,006

93,429,535

Free Cash

43

44

Stabilization Fund (Capital Debt)

45

Stabilization Fund (O&M)

46

Overlay Surplus

47

993,000

48

49

TOTAL REVENUES & OTHER FIN SOURCES

95,499,466

96,922,224

52

53 LESS AMOUNTS TO BE RAISED:

54

School Choice (Est.) - Deduction from CH 70

182,742

149,754

159,056

124,941

55

State Assessments (Est.)

358,423

354,973

340,254

366,542

56

County Assessment (Est.)

57

Charter School Assessment

Court Judgement

59

Provision for Abatements & Exemptions (Overlay)

60

Prior year funds to be raised

61

Tax Title

208,100

213,315

213,429

218,765

3,422,629

3,732,262

3,992,883

4,025,050

560,568

513,449

679,478

650,000

4,963,753

5,385,100

5,385,298

4,944

4,737,406

61

63

64 TOTAL AVAILABLE FUNDING FOR BUDGETS

88,280,600

88,266,045

1

88,465,781

90,114,366

91,536,926

65

66 TOTAL

BUDGETS(Recovered).xls

RECOMMENDED

budget

13 REVENUES

88,430,285

90,105,026

91,534,529

4/4/2012

Fiscal Year 2013 Budget Funding

Final

FY 2010

69

70

surplus/unused levy

budget 13 REVENUES (Recovered).xls

Final

FY 2011

14,555

35,496

Final

FY 12

$

Projected

FY 13

9,340

2,397

4/4/2012

Potrebbero piacerti anche

- Investment Analysis Polar Sports ADocumento9 pagineInvestment Analysis Polar Sports AtalabreNessuna valutazione finora

- Division of Lipa City MRDDocumento18 pagineDivision of Lipa City MRDJeremiah TrinidadNessuna valutazione finora

- Disbursements (2013)Documento1 paginaDisbursements (2013)visayasstateuNessuna valutazione finora

- Consolidated SummaryDocumento19 pagineConsolidated SummaryOsahon OsemwengieNessuna valutazione finora

- Barclayloan Loan Repayment Schedule For:: Amount Interest Rate Period (Years)Documento2 pagineBarclayloan Loan Repayment Schedule For:: Amount Interest Rate Period (Years)ddambaNessuna valutazione finora

- Unaudited Half Year Result As at June 30 2011Documento5 pagineUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulNessuna valutazione finora

- Uttara Bank LimitedDocumento1 paginaUttara Bank LimitedHasan Imam FaisalNessuna valutazione finora

- Financial Report of Operation 2012Documento6 pagineFinancial Report of Operation 2012visayasstateuNessuna valutazione finora

- Quarterly Acc 3rd 2011 12Documento10 pagineQuarterly Acc 3rd 2011 12Asif Al AminNessuna valutazione finora

- Income Statement: Assets Non-Current AssetsDocumento213 pagineIncome Statement: Assets Non-Current AssetsAhmed_Raza_ShahNessuna valutazione finora

- Karnataka State Co-Operative Apex Bank Limited: Balance Sheet As On 31st March, 2008Documento6 pagineKarnataka State Co-Operative Apex Bank Limited: Balance Sheet As On 31st March, 2008ಲೋಕೇಶ್ ಎಂ ಗೌಡNessuna valutazione finora

- LAUSDFirstInterimFinancial2011 12 OcrDocumento77 pagineLAUSDFirstInterimFinancial2011 12 OcrSaveAdultEdNessuna valutazione finora

- BASIC Bank Limited: Analytical ReviewDocumento6 pagineBASIC Bank Limited: Analytical ReviewGazi Ahsan RubbyNessuna valutazione finora

- Roxas ZDN ES2010Documento7 pagineRoxas ZDN ES2010J JaNessuna valutazione finora

- KilimoDocumento51 pagineKilimomomo177sasaNessuna valutazione finora

- Salary ScheduleDocumento27 pagineSalary ScheduleDanSedigoNessuna valutazione finora

- MSD 2011/12 Preliminary BudgetDocumento123 pagineMSD 2011/12 Preliminary BudgetDebra KolrudNessuna valutazione finora

- Pak Elektron Limited: Condensed Interim FinancialDocumento16 paginePak Elektron Limited: Condensed Interim FinancialImran ArshadNessuna valutazione finora

- Financial Report of Operation 2011Documento8 pagineFinancial Report of Operation 2011ppadojNessuna valutazione finora

- SN Current Year Previous Year: (Amount in RS)Documento1 paginaSN Current Year Previous Year: (Amount in RS)Louis SebNessuna valutazione finora

- As of December 31, 2011 Department/Agency: Deped Division of Cavite City Fund CodeDocumento28 pagineAs of December 31, 2011 Department/Agency: Deped Division of Cavite City Fund CodeJeremiah TrinidadNessuna valutazione finora

- Desco Final Account AnalysisDocumento26 pagineDesco Final Account AnalysiskmsakibNessuna valutazione finora

- General Fund Expenditures by Object and StaffingDocumento15 pagineGeneral Fund Expenditures by Object and StaffingStatesman JournalNessuna valutazione finora

- 2Documento15 pagine2Charo Santos LeyvaNessuna valutazione finora

- Financials at A GlanceDocumento2 pagineFinancials at A GlanceAmol MahajanNessuna valutazione finora

- Square Textiles Limited: Balance Sheet As of 31st March, 2010Documento4 pagineSquare Textiles Limited: Balance Sheet As of 31st March, 2010SUBMERINNessuna valutazione finora

- Bangladesh Autocars Limited Balance Sheet As at 30 June, 2010. 2009-2010 (TAKA)Documento4 pagineBangladesh Autocars Limited Balance Sheet As at 30 June, 2010. 2009-2010 (TAKA)crownair11Nessuna valutazione finora

- Gen - Fund SRE 2011-2013Documento1 paginaGen - Fund SRE 2011-2013bunso2012Nessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Daily Trade Journal - 03.07.2013Documento6 pagineDaily Trade Journal - 03.07.2013Randora LkNessuna valutazione finora

- Fcmdata 0110Documento6 pagineFcmdata 0110Rahmat TaufiqNessuna valutazione finora

- Public Sec Banks 1Documento8 paginePublic Sec Banks 1ajsharma8Nessuna valutazione finora

- Gross Working Capital: Current Assets: Ratio Analysis Liquidity RatiosDocumento2 pagineGross Working Capital: Current Assets: Ratio Analysis Liquidity RatiosMuhammad AfzalNessuna valutazione finora

- SB51: 2012 Education AppropriationDocumento18 pagineSB51: 2012 Education AppropriationFactBasedNessuna valutazione finora

- Kingsbury AR - 2012 PDFDocumento52 pagineKingsbury AR - 2012 PDFSanath FernandoNessuna valutazione finora

- 2013-14 PTA BudgetDocumento2 pagine2013-14 PTA BudgetpazchannelsNessuna valutazione finora

- Statement Showing The Changes in Working Capital (In Rupees 000)Documento9 pagineStatement Showing The Changes in Working Capital (In Rupees 000)Ranbir SinghNessuna valutazione finora

- Itr - 1Q13Documento75 pagineItr - 1Q13Usiminas_RINessuna valutazione finora

- Bs 2009 BergerDocumento1 paginaBs 2009 BergerSanoj NairNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento5 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Mayor's Office Budget - Jan-Jul 2012Documento4 pagineMayor's Office Budget - Jan-Jul 2012dlebrayNessuna valutazione finora

- Consolidated Balance Sheet: Annual Report 2013 - 2014Documento2 pagineConsolidated Balance Sheet: Annual Report 2013 - 2014mgajenNessuna valutazione finora

- Daily Trade Journal - 26.06.2013Documento7 pagineDaily Trade Journal - 26.06.2013Randora LkNessuna valutazione finora

- Appendix Table IV.1 (A) : Consolidated Balance Sheet of Public Sector BanksDocumento2 pagineAppendix Table IV.1 (A) : Consolidated Balance Sheet of Public Sector Banksnisarg_Nessuna valutazione finora

- OCH FoundationDocumento4 pagineOCH FoundationDCHS FriendsNessuna valutazione finora

- Brunswick School Dept: Budgets, Revenues, Expenditures, EtcDocumento1 paginaBrunswick School Dept: Budgets, Revenues, Expenditures, Etcpemster4062Nessuna valutazione finora

- Final Budget Edition: Estimated Impacts of 2009-11 Proposed Budget(s) On State RevenuesDocumento4 pagineFinal Budget Edition: Estimated Impacts of 2009-11 Proposed Budget(s) On State RevenuesJay WebsterNessuna valutazione finora

- City of Windsor Capital Budget Documents For 2013.Documento362 pagineCity of Windsor Capital Budget Documents For 2013.windsorstarNessuna valutazione finora

- India External Debt March 2013Documento7 pagineIndia External Debt March 2013Jhunjhunwalas Digital Finance & Business Info LibraryNessuna valutazione finora

- Monthly Report of Disbursement For The Month of January 2012 in Pesos (Absolute Figures)Documento12 pagineMonthly Report of Disbursement For The Month of January 2012 in Pesos (Absolute Figures)Jeremiah TrinidadNessuna valutazione finora

- Dividen & Dividen Payout by Year Dividen Dalam RP 000.000 Dan DP % Dividen Net Income Before Tax DP 2010Documento10 pagineDividen & Dividen Payout by Year Dividen Dalam RP 000.000 Dan DP % Dividen Net Income Before Tax DP 2010Sabar Andriko SianturiNessuna valutazione finora

- Gs Base Without Locality 2011Documento1 paginaGs Base Without Locality 2011Darrell AugustaNessuna valutazione finora

- LuckDocumento1 paginaLuckzubairkhan08Nessuna valutazione finora

- Financial: Six Years Review at A GlanceDocumento4 pagineFinancial: Six Years Review at A GlanceMisha SaeedNessuna valutazione finora

- Bharti Airtel: Concerns Due To Currency VolatilityDocumento7 pagineBharti Airtel: Concerns Due To Currency VolatilityAngel BrokingNessuna valutazione finora

- Banking Management: Sneha Maskara 2/21/2013Documento4 pagineBanking Management: Sneha Maskara 2/21/2013Piyush ChitlangiaNessuna valutazione finora

- Monthly Report of Disbursement For The Month of January 2013 in Pesos (Absolute Figures)Documento22 pagineMonthly Report of Disbursement For The Month of January 2013 in Pesos (Absolute Figures)Jeremiah TrinidadNessuna valutazione finora

- Franklin, MA: Master Plan Draft For ReviewDocumento59 pagineFranklin, MA: Master Plan Draft For ReviewSteve SherlockNessuna valutazione finora

- Congratulations FUSF For: 1 Year of Solar Production!Documento15 pagineCongratulations FUSF For: 1 Year of Solar Production!Steve SherlockNessuna valutazione finora

- Franklin FY2013 TaxRateInfoDocumento10 pagineFranklin FY2013 TaxRateInfoSteve SherlockNessuna valutazione finora

- Franklin Public Schools K-Registration As of 4-2-12Documento1 paginaFranklin Public Schools K-Registration As of 4-2-12Steve SherlockNessuna valutazione finora

- Weight Watchers FranklinDocumento1 paginaWeight Watchers FranklinSteve SherlockNessuna valutazione finora

- Health & Physical EducationDocumento9 pagineHealth & Physical EducationSteve SherlockNessuna valutazione finora

- New Franklin High School: Educational Design Features - RevisedDocumento28 pagineNew Franklin High School: Educational Design Features - RevisedSteve SherlockNessuna valutazione finora

- FPS SPED Update 20120207Documento11 pagineFPS SPED Update 20120207Steve SherlockNessuna valutazione finora