Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

ARCH Effect Explained (Excel)

Caricato da

NumXL ProCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

ARCH Effect Explained (Excel)

Caricato da

NumXL ProCopyright:

Formati disponibili

ARCHTesttutorial 1 SpiderFinancialCorp,2012

TheARCHEffectExplained

Intimeseriesandeconometricanalysis,summarystatisticsandresidualdiagnosisoftenleadustousea

somewhatmystifyingtestknownastheAutoRegressiveConditionalHeteroskedacity(ARCH)effecttest,

orARCHtestforshort.WhyexactlydoweusetheARCHtest?

YoumightthinkofofanARCHtestsimplyasameansofdetectingforthepresenceoffattailsinthe

underlyingdistribution;butifthatweretrue,whatwouldthetesttellusthatatestforexcesskurtosis

couldnot?

WeneedtoanswersomebasicquestionsabouttheARCHtest:Whatdoesitdo?Howisitrelatedtothe

whitenoisetest?Whenshouldweutilizewhatithastotellus?

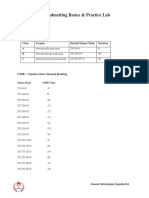

Note:Forillustration,weareusingtheIBMstockpricesdatasetfortheperiodbetweenMay17

th

1961

andNov2

nd

1962(SeriesBinBox,JenkinsandReinsellTimeseriesforecasttextbook(1976)).

Background

Letsassumewehaveadatasetofaunivariate{ }

t

x ,andwewishtodeterminewhetheritexhibitsan

ARCHeffect.

1. Constructanewtimeseries

t

y ,suchthat:

2

t t

y x =

2. Formaportmanteautypeoftestfor

t

y :

1 2

1

: ... 0

: 0

o m

k

H

H

= = = =

- =

ARCHTesttutorial 2 SpiderFinancialCorp,2012

Where

o

H =nullhypothesis

1

H =alternativehypothesis(autocorrelationissignificant)

m=maximumnumberoflagsincludedinthetest

i

=thepopulationautocorrelationfunctionofthesquaredtimeseries(

t

y )

1 k m s s

Inessence,theARCHeffecttestisawhitenoisetest,butforthesquaredtimeseries.Inotherwords,we

areinvestigatingahigherorder(nonlinear)ofautocorrelation.Howcanthisinformationbeuseful?

TheARCHeffecthasitsrootsintimevaryingconditionalvolatility,so:

2 2 2 2

( )

t t t t t

E x x E x x o ( ( = =

Where

2

t

o =conditionalvariance

t

x =conditionalmean

Assumingthetimeseriesdoesnothaveasignificantmean(typicalinfinancialtimeseries),thenthe

conditionalvarianceisexpressedas:

| |

2 2 2 2

( )

t t t t t t

E x x E x E y x o ( ( = = = ~

Assumingthesquaredtimeseries(

t

y )isseriallycorrelated,thenconditionalvolatility(

t

o )variesover

timeandexhibitsaclusteringphenomenon(e.g.periodsofswingsfollowedbyperiodsofrelativecalm).

Insum,theARCHtesthelpsustodetectatimevaryingphenomenonintheconditionalvolatility,and

thussuggestsdifferenttypesofmodels(e.g.ARCH/GARCH)tocapturethesedynamics.

WhitenoisetestconditionalmeanARMA/ARIMA

ARCHtestconditionalvolatilityARCH/GARCH

Q:Canwehaveasignificantserialcorrelationintheoriginaltimeseriesandaserialcorrelationinthe

squaredtimeseries?Ifso,howcanwemodelthat?A:Yes;weuseanARMAGARCHmixturemodel.

ARCHTesttutorial 3 SpiderFinancialCorp,2012

Analysis

Letstakeacloselookatthelogarithmicdailyreturnstimeseries:

Thedailyreturnplotsuggestsastationaryprocesswithzeromean,butthevolatilityexhibitsperiodsof

relativecalmfollowedbyswings(akavolatilityclustering).

Thewhitenoisetestidentifiesinsignificantserialcorrelationinthetimeseries,buttheARCHeffectis

significantandindicativeofatimevaryingvolatility.

1. DailyReturnsDistribution

Letsconstructtheempiricaldistributionofthesampletimeseries,andexaminethetailsincomparison

withthoseofaGaussiandistribution.

ARCHTesttutorial 4 SpiderFinancialCorp,2012

ARCHTesttutorial 5 SpiderFinancialCorp,2012

TheQQPlotshowsanasymmetricalviewofthedistributiontails;thedistributionslefttail(i.e.

extremenegativereturns)arefarmoredeviantfromwhattheGaussiandistributionsuggests.Thisisa

welldocumentedphenomenoninthefinancialtimeseries.

2. CorrelogramAnalysis

Bynow,weveestablishedthatthelogarithmicdailyreturnsdistributionhasfattails(andmaybefatter

ontheleftsidethanontheright),butwhereisthetimevaryingclaimcomingfrom?

Inthedescriptivestatisticstable,theARCHeffectsuggestsasignificantserialcorrelationinthesquared

timeseries.Letsdothefollowing:

1. Constructthesquaredtimeseries(

t

y ).

2. RunNumXLdescriptivestatisticwizard,andgeneratethesummarytable.Thewhitenoisetest

onthesquaredtimeseriesisequivalenttotheARCHtestontheoriginaltimeseries.

Notice:theARCHeffectforthesquaredtimeseriesissignificant,sodoesthismeanwehavea

timevaryingkurtosis(fourthmoment)?Letskeepthisquestioninmind,andrevisititina

separatetutorial!

ARCHTesttutorial 6 SpiderFinancialCorp,2012

3. UsingNumXLCorrelogramwizard,generatetheACF/PACFtableandplotforthesquaredtime

series.

TheACF/PACFPlotforthesquaredtimeseriesisshownbelow:

ARCHTesttutorial 7 SpiderFinancialCorp,2012

3. ARCHModeling

UsingtheACF/PACFtables/plot,wecanproceedtomodeltheconditionalvolatilityasanARMAmodel

(akaGARCH).AsinARMA,weneedtoidentifytheARandMAorderoftheconditionalvolatilitymodel.

Conclusion

TheARCHtestisavitaltoolforexaminingthetimedynamicsofthesecondmoments(i.e.conditional

variance).Thepresenceofasignificantexcesskurtosisisnotindicativeofatimevaryingvolatility,but

thereverseistrue:asignificantARCHeffectidentifiesatimevaryingconditionalvolatility,volatility

clustering(ormeanreversion),and,asaresult,thepresenceofafattaileddistribution(i.e.excess

kurtosis>0).

Thecorrelogram(i.e.ACF/PACFanalysis)canbeusedtoidentifytheorderoftheAR&MAcomponents

intheGARCHtypemodel.

Finally,noticethatforfinancialtimeseries,thenegativereturnsdeviatemorefromnormalitythan

positiveones.

Potrebbero piacerti anche

- SPPID QuestionsDocumento2 pagineSPPID Questionsvivek83% (12)

- SARIMA Modeling & Forecast in ExcelDocumento2 pagineSARIMA Modeling & Forecast in ExcelNumXL ProNessuna valutazione finora

- Kernel Density Estimation (KDE) in Excel TutorialDocumento8 pagineKernel Density Estimation (KDE) in Excel TutorialNumXL ProNessuna valutazione finora

- MetesDocumento26 pagineMetesPegah JanipourNessuna valutazione finora

- Stationary and Related Stochastic Processes: Sample Function Properties and Their ApplicationsDa EverandStationary and Related Stochastic Processes: Sample Function Properties and Their ApplicationsValutazione: 4 su 5 stelle4/5 (2)

- Applications of Variational Inequalities in Stochastic ControlDa EverandApplications of Variational Inequalities in Stochastic ControlValutazione: 2 su 5 stelle2/5 (1)

- ARIMA Modeling & Forecast in ExcelDocumento2 pagineARIMA Modeling & Forecast in ExcelNumXL ProNessuna valutazione finora

- Modeling S&P 500 STOCK INDEX Using ARMA-ASYMMETRIC POWER ARCH ModelsDocumento28 pagineModeling S&P 500 STOCK INDEX Using ARMA-ASYMMETRIC POWER ARCH Modelsdervisis1Nessuna valutazione finora

- Chapter 3Documento25 pagineChapter 3Jose C Beraun TapiaNessuna valutazione finora

- ARCH1Documento6 pagineARCH1Dimitrios KolomvasNessuna valutazione finora

- Estimation and Testing For Arch and GarchDocumento9 pagineEstimation and Testing For Arch and GarchKhalid LatifNessuna valutazione finora

- Arch Models and Conditional Volatility: 1, Write The Series As 1)Documento8 pagineArch Models and Conditional Volatility: 1, Write The Series As 1)Yusheel RamruthenNessuna valutazione finora

- Econometría Bollerslev GARCH 1986Documento21 pagineEconometría Bollerslev GARCH 1986Alejandro LopezNessuna valutazione finora

- Statistics and Probability Letters: S.Y. Hwang, J.S. Baek, J.A. Park, M.S. ChoiDocumento8 pagineStatistics and Probability Letters: S.Y. Hwang, J.S. Baek, J.A. Park, M.S. ChoiNurhayati -Nessuna valutazione finora

- Garch+deep LearningDocumento25 pagineGarch+deep Learningnjumath18184Nessuna valutazione finora

- Autoregressive Conditional HeteroskedasticityDocumento9 pagineAutoregressive Conditional HeteroskedasticityjuliusNessuna valutazione finora

- Arch Garch Models StatDocumento4 pagineArch Garch Models StatAyush choudharyNessuna valutazione finora

- All Garch Models and LikelihoodDocumento20 pagineAll Garch Models and LikelihoodManuNessuna valutazione finora

- WurtzEtAlGarch PDFDocumento41 pagineWurtzEtAlGarch PDFmarcoNessuna valutazione finora

- Moments of The ARMA-EGARCH ModelDocumento21 pagineMoments of The ARMA-EGARCH ModelBan-Hong TehNessuna valutazione finora

- 1 ARCH and Generalizations.: 1.1 Engle's ARCH ModelDocumento4 pagine1 ARCH and Generalizations.: 1.1 Engle's ARCH ModelWisse PrabawatiNessuna valutazione finora

- ARCH and MGARCH Models: EC 823: Applied EconometricsDocumento38 pagineARCH and MGARCH Models: EC 823: Applied EconometricsSlice LeNessuna valutazione finora

- N12 Quantum Corr FN PDFDocumento15 pagineN12 Quantum Corr FN PDFmasab khanNessuna valutazione finora

- page_053Documento1 paginapage_053francis earlNessuna valutazione finora

- TN06 - Time Series Technical NoteDocumento8 pagineTN06 - Time Series Technical NoteRIDDHI SHETTYNessuna valutazione finora

- Econometrics Year 3 EcoDocumento185 pagineEconometrics Year 3 Ecoantoinette MWANAKASALANessuna valutazione finora

- ARCH and MGARCH Models: EC 823: Applied EconometricsDocumento38 pagineARCH and MGARCH Models: EC 823: Applied EconometricsTrinh ZitNessuna valutazione finora

- Innovations Algorithm for Periodically Stationary Time SeriesDocumento31 pagineInnovations Algorithm for Periodically Stationary Time SeriesBilly SmithenNessuna valutazione finora

- Unit 1 Probability DistributionsDocumento61 pagineUnit 1 Probability DistributionsSamNessuna valutazione finora

- GARCH TutorialDocumento12 pagineGARCH TutorialMuhammad MansoorNessuna valutazione finora

- Modelling Volatility in Financial Time Series: An Introduction To ArchDocumento16 pagineModelling Volatility in Financial Time Series: An Introduction To Archlars32madsenNessuna valutazione finora

- Tech Ah 2010 SepDocumento14 pagineTech Ah 2010 SepndokuchNessuna valutazione finora

- Arch and Garch ModelsDocumento33 pagineArch and Garch ModelstinybroNessuna valutazione finora

- Lamoureux 1990 Heteroskedascity GarchDocumento9 pagineLamoureux 1990 Heteroskedascity GarchnievesNessuna valutazione finora

- ECOM031 Financial Econometrics Lecture 4: Extending GARCH Models and Stochastic Volatility ModelsDocumento5 pagineECOM031 Financial Econometrics Lecture 4: Extending GARCH Models and Stochastic Volatility ModelsBelindennoluNessuna valutazione finora

- Asset Volatility Models LectureDocumento17 pagineAsset Volatility Models LecturejeffNessuna valutazione finora

- ScribdDocumento7 pagineScribdShlap LentilaNessuna valutazione finora

- ARCH ModelDocumento26 pagineARCH ModelAnish S.MenonNessuna valutazione finora

- Arch Model and Time-Varying VolatilityDocumento17 pagineArch Model and Time-Varying VolatilityJorge Vega RodríguezNessuna valutazione finora

- GARCHDocumento2 pagineGARCHAbhinay YagnamurthyNessuna valutazione finora

- Delineating UK Seafood MarketsDocumento29 pagineDelineating UK Seafood MarketsAbdulai FofanaNessuna valutazione finora

- Estimating stock volatility with Markov regime-switching GARCH modelsDocumento11 pagineEstimating stock volatility with Markov regime-switching GARCH modelseduardohortaNessuna valutazione finora

- Thresholdeffects.GARCH Models Allow for Asymmetriesin VolatilityDocumento25 pagineThresholdeffects.GARCH Models Allow for Asymmetriesin VolatilityLuis Bautista0% (1)

- 8503dufour RobustExactResSampleAutocorRandomness PDFDocumento17 pagine8503dufour RobustExactResSampleAutocorRandomness PDFProfitiserNessuna valutazione finora

- Arch ModelsDocumento13 pagineArch Modelsgarym28Nessuna valutazione finora

- The Conditional Autoregressive Geometric Process Model For Range DataDocumento35 pagineThe Conditional Autoregressive Geometric Process Model For Range Datajshew_jr_junkNessuna valutazione finora

- QF I Lecture4Documento13 pagineQF I Lecture4Nikolay KolarovNessuna valutazione finora

- Time Series: H T 2008 P - G RDocumento161 pagineTime Series: H T 2008 P - G RManoj Kumar ManishNessuna valutazione finora

- ARIMA Estimation: Theory and Applications: 1 General Features of ARMA ModelsDocumento18 pagineARIMA Estimation: Theory and Applications: 1 General Features of ARMA ModelsCarmen RamírezNessuna valutazione finora

- Financial Time Series ModelsDocumento11 pagineFinancial Time Series ModelsAbdi HiirNessuna valutazione finora

- Time Series Analysis With Arima E28093 Arch013Documento19 pagineTime Series Analysis With Arima E28093 Arch013Jilani OsmaneNessuna valutazione finora

- Arch and GarchDocumento39 pagineArch and GarchJovan NjegićNessuna valutazione finora

- Northwestern University: BollerslevDocumento11 pagineNorthwestern University: BollerslevMuji GillNessuna valutazione finora

- ARCH and GARCH Estimation: Dr. Chen, Jo-HuiDocumento39 pagineARCH and GARCH Estimation: Dr. Chen, Jo-HuiSalman Zia100% (1)

- Arima Modeling With R ListendataDocumento12 pagineArima Modeling With R ListendataHarshalKolhatkarNessuna valutazione finora

- IJONAS 1 Volatility Modeling of Asset ReturnsDocumento10 pagineIJONAS 1 Volatility Modeling of Asset ReturnsBabayemi Afolabi WasiuNessuna valutazione finora

- Time-Frequency Analysis of Locally Stationary Hawkes ProcessesDocumento31 pagineTime-Frequency Analysis of Locally Stationary Hawkes ProcessesPerson PersonsNessuna valutazione finora

- Jordan Philips Dynamac StataDocumento30 pagineJordan Philips Dynamac StataThang LaNessuna valutazione finora

- Time-Dependent Hurst Exponent in Financial Time SeriesDocumento5 pagineTime-Dependent Hurst Exponent in Financial Time Seriesaldeni_filhoNessuna valutazione finora

- 1740 5300 1 PBDocumento5 pagine1740 5300 1 PBnavesib226 ngopycomNessuna valutazione finora

- Multi-Variate Stochastic Volatility Modelling Using Wishart Autoregressive ProcessesDocumento13 pagineMulti-Variate Stochastic Volatility Modelling Using Wishart Autoregressive ProcessesTommy AndersonNessuna valutazione finora

- Modelling Volatility and Correlation: Introductory Econometrics For Finance' © Chris Brooks 2008 1Documento52 pagineModelling Volatility and Correlation: Introductory Econometrics For Finance' © Chris Brooks 2008 1Ngọc HuyềnNessuna valutazione finora

- Wavelets in Time Series Analysis: (Submitted)Documento16 pagineWavelets in Time Series Analysis: (Submitted)fredsvNessuna valutazione finora

- KDE Optimization PrimerDocumento8 pagineKDE Optimization PrimerNumXL ProNessuna valutazione finora

- EWMA TutorialDocumento6 pagineEWMA TutorialNumXL ProNessuna valutazione finora

- KDE Optimization - Unbiased Cross-ValidationDocumento4 pagineKDE Optimization - Unbiased Cross-ValidationNumXL ProNessuna valutazione finora

- KDE - Direct Plug-In MethodDocumento5 pagineKDE - Direct Plug-In MethodNumXL ProNessuna valutazione finora

- NumXL VBA SDK - Getting StartedDocumento7 pagineNumXL VBA SDK - Getting StartedNumXL ProNessuna valutazione finora

- X13ARIMA-SEATS Modeling Part 2 - ForecastingDocumento7 pagineX13ARIMA-SEATS Modeling Part 2 - ForecastingNumXL ProNessuna valutazione finora

- Migration From X12ARIMA To X13ARIMA-SEATSDocumento8 pagineMigration From X12ARIMA To X13ARIMA-SEATSNumXL ProNessuna valutazione finora

- X13ARIMA-SEATS Modeling Part 3 - RegressionDocumento8 pagineX13ARIMA-SEATS Modeling Part 3 - RegressionNumXL ProNessuna valutazione finora

- Technical Note - MLR Forecast ErrorDocumento3 pagineTechnical Note - MLR Forecast ErrorNumXL ProNessuna valutazione finora

- Cointegration TestingDocumento8 pagineCointegration TestingNumXL ProNessuna valutazione finora

- X13ARIMA-SEATS Modeling Part 1 - Seasonal AdjustmentDocumento6 pagineX13ARIMA-SEATS Modeling Part 1 - Seasonal AdjustmentNumXL ProNessuna valutazione finora

- SARIMAX Modeling & Forecast in ExcelDocumento3 pagineSARIMAX Modeling & Forecast in ExcelNumXL ProNessuna valutazione finora

- Time Series Simulation Tutorial in ExcelDocumento5 pagineTime Series Simulation Tutorial in ExcelNumXL ProNessuna valutazione finora

- Technical Note - Autoregressive ModelDocumento12 pagineTechnical Note - Autoregressive ModelNumXL ProNessuna valutazione finora

- Data Preparation For Strategy ReturnsDocumento6 pagineData Preparation For Strategy ReturnsNumXL ProNessuna valutazione finora

- Technical Note - Moving Average ModelDocumento9 pagineTechnical Note - Moving Average ModelNumXL ProNessuna valutazione finora

- Discrete Fourier Transform in Excel TutorialDocumento10 pagineDiscrete Fourier Transform in Excel TutorialNumXL ProNessuna valutazione finora

- Case Study: Calculating CAPM Beta in ExcelDocumento18 pagineCase Study: Calculating CAPM Beta in ExcelNumXL Pro100% (1)

- WTI Futures Curve Analysis Using PCA (Part I)Documento7 pagineWTI Futures Curve Analysis Using PCA (Part I)NumXL ProNessuna valutazione finora

- X12 ARIMA in NumXL NotesDocumento14 pagineX12 ARIMA in NumXL NotesNumXL ProNessuna valutazione finora

- Data Preparation For Futures ReturnsDocumento6 pagineData Preparation For Futures ReturnsNumXL ProNessuna valutazione finora

- Empirical Distribution Function (EDF) in Excel TutorialDocumento6 pagineEmpirical Distribution Function (EDF) in Excel TutorialNumXL ProNessuna valutazione finora

- Case Study: Making Sense of Diesel PricesDocumento11 pagineCase Study: Making Sense of Diesel PricesNumXL ProNessuna valutazione finora

- Principal Component Analysis in Excel Tutorial 102Documento9 paginePrincipal Component Analysis in Excel Tutorial 102NumXL ProNessuna valutazione finora

- Regression Tutorial 202 With NumXLDocumento4 pagineRegression Tutorial 202 With NumXLNumXL ProNessuna valutazione finora

- Principal Component Analysis Tutorial 101 With NumXLDocumento10 paginePrincipal Component Analysis Tutorial 101 With NumXLNumXL ProNessuna valutazione finora

- Regression Tutorial 201 With NumXLDocumento12 pagineRegression Tutorial 201 With NumXLNumXL ProNessuna valutazione finora

- Introduction - Week 2Documento37 pagineIntroduction - Week 2Tayyab AhmedNessuna valutazione finora

- 1.11 CHEM FINAL Chapter 11 Sulfuric AcidDocumento21 pagine1.11 CHEM FINAL Chapter 11 Sulfuric AcidSudhanshuNessuna valutazione finora

- 0001981572-JAR Resources in JNLP File Are Not Signed by Same CertificateDocumento13 pagine0001981572-JAR Resources in JNLP File Are Not Signed by Same CertificateAnonymous AZGp1KNessuna valutazione finora

- SubNetting Practice LabDocumento3 pagineSubNetting Practice LabOdoch HerbertNessuna valutazione finora

- Login Form: User Name Password Remember MeDocumento8 pagineLogin Form: User Name Password Remember MeBridget Anne BenitezNessuna valutazione finora

- Bottazzini RiemannDocumento36 pagineBottazzini RiemanncedillaNessuna valutazione finora

- Astm D5501Documento3 pagineAstm D5501mhmdgalalNessuna valutazione finora

- Answers To Chemistry Homework 5.1 From Particles To Solutions P. 178 # 8,9,10Documento6 pagineAnswers To Chemistry Homework 5.1 From Particles To Solutions P. 178 # 8,9,10fantasy373Nessuna valutazione finora

- Physical parameters shaping of Farwa Lagoon - LibyaDocumento7 paginePhysical parameters shaping of Farwa Lagoon - LibyaAsadeg ZaidNessuna valutazione finora

- 08 Candelaria Punta Del Cobre IOCG Deposits PDFDocumento27 pagine08 Candelaria Punta Del Cobre IOCG Deposits PDFDiego Morales DíazNessuna valutazione finora

- Javascript Api: Requirements Concepts Tutorial Api ReferenceDocumento88 pagineJavascript Api: Requirements Concepts Tutorial Api ReferenceAshish BansalNessuna valutazione finora

- Gallium Nitride Materials and Devices IV: Proceedings of SpieDocumento16 pagineGallium Nitride Materials and Devices IV: Proceedings of SpieBatiriMichaelNessuna valutazione finora

- Lecture 1: Encoding Language: LING 1330/2330: Introduction To Computational Linguistics Na-Rae HanDocumento18 pagineLecture 1: Encoding Language: LING 1330/2330: Introduction To Computational Linguistics Na-Rae HanLaura AmwayiNessuna valutazione finora

- Eurotech IoT Gateway Reliagate 10 12 ManualDocumento88 pagineEurotech IoT Gateway Reliagate 10 12 Manualfelix olguinNessuna valutazione finora

- Hydrocarbons NotesDocumento15 pagineHydrocarbons Notesarjunrkumar2024Nessuna valutazione finora

- WebControls - TabStripDocumento38 pagineWebControls - TabStripProkopis PrNessuna valutazione finora

- h6541 Drive Sparing Symmetrix Vmax WPDocumento19 pagineh6541 Drive Sparing Symmetrix Vmax WPsantoshNessuna valutazione finora

- Material Balance of Naphtha Hydrotreater and Reformer ReactorsDocumento22 pagineMaterial Balance of Naphtha Hydrotreater and Reformer ReactorsSukirtha GaneshanNessuna valutazione finora

- Excel Gantt Chart Template: Enter Your Project Details HereDocumento14 pagineExcel Gantt Chart Template: Enter Your Project Details HereBarselaNessuna valutazione finora

- Bab 8Documento29 pagineBab 8Nurul AmirahNessuna valutazione finora

- THKDocumento1.901 pagineTHKapi-26356646Nessuna valutazione finora

- Notifier Battery Calculations-ReadmeDocumento11 pagineNotifier Battery Calculations-ReadmeJeanCarlosRiveroNessuna valutazione finora

- GAS-INSULATED SWITCHGEAR MODELS 72kV ADVANCED ENVIRONMENTALLY FRIENDLYDocumento6 pagineGAS-INSULATED SWITCHGEAR MODELS 72kV ADVANCED ENVIRONMENTALLY FRIENDLYBudi SantonyNessuna valutazione finora

- 997-3 CIP Safety Adapter: Single Point Lesson (SPL) - Configure CIP Safety Adapter and A-B PLCDocumento18 pagine997-3 CIP Safety Adapter: Single Point Lesson (SPL) - Configure CIP Safety Adapter and A-B PLCTensaigaNessuna valutazione finora

- PDS - GulfSea Hydraulic AW Series-1Documento2 paginePDS - GulfSea Hydraulic AW Series-1Zaini YaakubNessuna valutazione finora

- 4495 10088 1 PBDocumento7 pagine4495 10088 1 PBGeorgius Kent DiantoroNessuna valutazione finora

- Probability Statistics and Random Processes Third Edition T Veerarajan PDFDocumento3 pagineProbability Statistics and Random Processes Third Edition T Veerarajan PDFbhavyamNessuna valutazione finora

- Unit 3: Databases & SQL: Developed By: Ms. Nita Arora Kulachi Hansraj Model School Ashok ViharDocumento18 pagineUnit 3: Databases & SQL: Developed By: Ms. Nita Arora Kulachi Hansraj Model School Ashok ViharAthira SomanNessuna valutazione finora

- Spesifikasi Produk SL-500Documento2 pagineSpesifikasi Produk SL-500tekmed koesnadiNessuna valutazione finora