Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Disbarment case against lawyer for negligence and damages claim against bank for unauthorized withdrawals

Caricato da

ynaymariaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Disbarment case against lawyer for negligence and damages claim against bank for unauthorized withdrawals

Caricato da

ynaymariaCopyright:

Formati disponibili

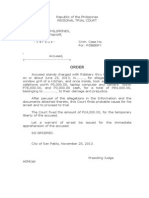

Jeanet S. Tabilog Torts & Damages Atty. Melvin C. Dequito A.C. No.

4955 September 12, 2011 Antonio Conlu Complainant vs. Atty. Ireneo Aredonia, Jr., - Respondent

FACTS: This case is a Disbarment case with prayer for damages against Atty. Ireneo Aredonia, Jr. on grounds of gross negligence filed by Antonio Conlu, his client in a case for Quieting of Title. The complainant secured the services of Atty. Aredonia to represent him. The Court rendered a Decision against the complainant. The Decision was appealed to the Court of Appeals, however the same was dismissed for failure of Atty. Aredonia to file the appeallants brief. The dismissal of the appeal learned only after the wife of the complainant verified the status of the appeal. Atty. Aredonia seek reconsideration on the resolution alleging that he did not received copy of the resolution, but the same was denied because of the late filing of the motion. The private complainant personally filed another motion for reconsideration but the same was denied for the reason that the belated filing of Atty. Aredonias first motion for reconsideration binds Antonio. Antonio then, appealed to the Supreme Court but said appeal was denied by the Court. Thereafter, Antonio filed the disbarment case before the Office of the Bar Confidant who rendered a Report/Recommendation to the Court. The Court in its resolution imposed among others the filing of an administrative case against Atty. Aredonia before the IBPCommission on Bar Discipline. ISSUES: 1. Whether or not there is gross negligence on the part of Atty. Aredonia. 2. Whether or not res ipsa loquitur applies in this case. 3. Whether or not complainant is entitled for damages. RULING: On the first issue, the Court ruled that the failure to file a brief resulting to the dismissal of an appeal constitutes inexcusable negligence. This default and his failure to inform his client of the status of the case translates to a violation of Canon 18 of the Code of Professional Responsibility, which states,

CANON 18 A LAWYER SHALL SERVE HIS CLIENT WITH COMPETENCE AND DILIGENCE. xxxx Rule 18.03 A lawyer shall not neglect a matter entrusted to him, and his negligence in connection therewith shall render him liable. Rule 18.04 A lawyer shall keep the client informed of the status of his case and shall respond within a reasonable time to the clients request for information. On the second issue, the Court held that the principle of res ipsa loquitur applies in this case as Atty. Aredonia had doubtlessly been languid in the performance of his duty as Antonios counsel. He neglect without reason to file the appellants brief before the CA. He failed, in short to exert his utmost ability and to give his full commitment to maintain and defend Antonios right. Antonio, by choosing Atty. Ireneo to represent him, relied upon and reposed his trust and confidence on the latter, as his counsel, to do whatsoever was legally necessary to protect Antonios interest, if not to secure a favorable judgment. Once they agree to take up the cause of a client, lawyers, regardless of the importance of the subject matter litigated or financial arrangements agreed upon, owe fidelity to such cause and should always be mindful of the trust and confidence reposed on them. On the third issue, the Court ruled that the complainant is not entitle to damages for failure to satisfactorily prove his claim for damages. WHEREFORE, respondent Atty. Ireneo Aredonia, Jr. is declared

GUILTY of inexcusable negligence, attempting to mislead the appellate court, misuse of Court processes, and willful disobedience to lawful orders of the Court. He is hereby SUSPENDED from the practice of law for a period of one (1) year effective upon his receipt of this Resolution, with WARNING that a repetition of the same or similar acts will be dealt with more severely.

G.R. No. 173259

July 25, 2011

Philippine National Bank, petitioner vs. F.F. CRUZ and CO., INC., respondent,

FACTS: This petition for review arose from a case for damages filed by FF Cruz against PNB. Plaintiff FF Cruz has open an account at PNBTimog Ave. Branch, wherein its president and its secretary-treasurer were the named signatories. Plaintiff FF Cruz, avers that PNB has been negligent to deduct the cashiers and managers checks amounting to Php9,950,000.00 and Php3,260,000.00, respectively, as the same were unauthorized and fraudulently made by the company accountant Aurea Caparas as both the president and the secretary were out of the country at that time. The plaintiff seeks to credit back and restore to its account the value of the checks, to which the defendant bank refused as the defendant bank alleged that it exercised due diligence in handling the account of FF Cruz, as the application of said checks have passed a through standard bank procedures and it was only after finding that it has no infirmity that the checks were given due course. The trial court rendered a Decision against defendant bank for not calling or personally verifying from the authorized signatories the legitimacy of the subject withdrawals considering that they were huge amounts. For this reason, defendant PNB had the last clear chance to prevent the unauthorized debits from the FF Cruz account. And thus, PNB should bear the whole loss. On appeal, the Court of Appeal, affirmed the Decision of the trial court with modification on the award for damages that PNB should only pay 60% of the actual damage and the Plaintiff FF Cruz should bear the remaining 40% for its contributory negligence by giving authority to its company accountant to transact with defendant bank PNB. Petitioner PNB appealed the Court of Appeals Decision.

ISSUES:

Whether or not the principle of last clear chance principle is applicable to held the defendant bank liable for damages.

RULING:

The Court ruled that the finding of the appellate court that PNB failed to make a proper verification as the managers check do not bear the signature of the bank verifier, thus casting doubt as whether the

signatures were indeed underwent the proper verification. In view of the foregoing, the Court ruled that PNB was negligent in handling the FF Cruz account specifically with respect to PNBs failure to detect the forgeries in subject application for managers check which could have prevented the loss. It further states, that PNB failed to meet the high standard of diligence required by the circumstances to prevent the fraud, where the banks negligence is the proximate cause of the loss and the depositor is guilty of contributory negligence, the damage between the bank and the depositor, a 60-40 ratio applies. Wherefore, the petition was denied and the CAs Decision is affirmed.

Potrebbero piacerti anche

- Bagatsing vs. RamirezDocumento2 pagineBagatsing vs. RamirezManuel Luis100% (1)

- Oyo State Civil Procedure RulesDocumento213 pagineOyo State Civil Procedure RulesMustapha SodiqNessuna valutazione finora

- Sample Meet and Confer Letter For United States District CourtDocumento2 pagineSample Meet and Confer Letter For United States District CourtStan Burman100% (3)

- 13 Paculdo Vs RegaladoDocumento12 pagine13 Paculdo Vs RegaladoEMNessuna valutazione finora

- 14 PACULDO V CADocumento2 pagine14 PACULDO V CAJulius ManaloNessuna valutazione finora

- Javier V CADocumento1 paginaJavier V CAranNessuna valutazione finora

- G.R. No. 230221 - Lechoncito, Trexia Mae DDocumento3 pagineG.R. No. 230221 - Lechoncito, Trexia Mae DTrexiaLechoncitoNessuna valutazione finora

- MILLA VS. PEOPLE Case Digest (Novation) 2012Documento2 pagineMILLA VS. PEOPLE Case Digest (Novation) 2012Sam LeynesNessuna valutazione finora

- Bayot Vs Sandigan Bayan G.R. No L 54645 76Documento8 pagineBayot Vs Sandigan Bayan G.R. No L 54645 76RaymondNessuna valutazione finora

- Supreme Court modifies interest computation in car accident caseDocumento4 pagineSupreme Court modifies interest computation in car accident casesupergarshaNessuna valutazione finora

- Supreme Court: The CaseDocumento4 pagineSupreme Court: The CaseLOUISE ELIJAH GACUANNessuna valutazione finora

- Digest 2Documento3 pagineDigest 2xx_stripped52Nessuna valutazione finora

- Statcon Term PaperDocumento9 pagineStatcon Term PaperJean Claude100% (1)

- G.R. No. 130654. July 28, 1999. PEOPLE OF THE PHILIPPINES, Plaintiff Appellee, vs. EDUARDO BASIN JAVIER, Accused AppellantDocumento10 pagineG.R. No. 130654. July 28, 1999. PEOPLE OF THE PHILIPPINES, Plaintiff Appellee, vs. EDUARDO BASIN JAVIER, Accused AppellantMichael RentozaNessuna valutazione finora

- Cases Rule 110Documento136 pagineCases Rule 110Grachelle AnnNessuna valutazione finora

- Criminal Law Cases - MidtermsDocumento4 pagineCriminal Law Cases - MidtermsAntonette NavarroNessuna valutazione finora

- Aurelio V Aurelio G R No 175367 June 6 2011Documento2 pagineAurelio V Aurelio G R No 175367 June 6 2011JoeyBoyCruzNessuna valutazione finora

- Cui V Arellano UnivDocumento2 pagineCui V Arellano UnivRenesmé100% (1)

- Statutory Construction GuideDocumento18 pagineStatutory Construction GuideTelle MarieNessuna valutazione finora

- Eugalca Vs Lao Adm. Matter No OCA No. 05-2177-D, April 5, 2006Documento4 pagineEugalca Vs Lao Adm. Matter No OCA No. 05-2177-D, April 5, 2006Lianne Gaille Relova PayteNessuna valutazione finora

- Jurisdiction of General Court-Martial over Oakwood Mutiny Case QuestionedDocumento37 pagineJurisdiction of General Court-Martial over Oakwood Mutiny Case QuestionedChrys Barcena0% (1)

- Ascencion DigestDocumento25 pagineAscencion Digestjohn vidadNessuna valutazione finora

- Case Digest - Barrientos vs. Libiran-Meteoro Adm. Case No. 6408Documento2 pagineCase Digest - Barrientos vs. Libiran-Meteoro Adm. Case No. 6408Angela Mericci G. MejiaNessuna valutazione finora

- Exempting Circumstances Gude QuestionsDocumento14 pagineExempting Circumstances Gude QuestionsKE NTNessuna valutazione finora

- X. SERAFIN v. LINDAYAG (Non-Imprisonment For Debt and Involuntary Servitude) PDFDocumento5 pagineX. SERAFIN v. LINDAYAG (Non-Imprisonment For Debt and Involuntary Servitude) PDFKaloi GarciaNessuna valutazione finora

- Artemio Villareal v. People of The Philippines, G.R. No. 151258Documento25 pagineArtemio Villareal v. People of The Philippines, G.R. No. 151258Ryan Balladares0% (1)

- 19 Casino JR V CaDocumento11 pagine19 Casino JR V CaPeachChioNessuna valutazione finora

- Catungal Vs RodriguezDocumento2 pagineCatungal Vs RodriguezRommel Mancenido LagumenNessuna valutazione finora

- Bernabe v. Alejo, GR 140500, Jan. 21, 2002 DigestedDocumento3 pagineBernabe v. Alejo, GR 140500, Jan. 21, 2002 DigestedJireh Rarama100% (1)

- Digest Pa MoreDocumento9 pagineDigest Pa Morelou navarroNessuna valutazione finora

- People Vs Ong Chiat LayDocumento6 paginePeople Vs Ong Chiat Layautumn moonNessuna valutazione finora

- Conlu vs. Aredonia, Jr.Documento14 pagineConlu vs. Aredonia, Jr.Gertrude Pillena100% (1)

- Organo Vs SandiganbayanDocumento10 pagineOrgano Vs SandiganbayanshezeharadeyahoocomNessuna valutazione finora

- Tuazon vs. Del Rosario-Suarez, 637 SCRA 728, G.R. No. 168325 December 13, 2010Documento7 pagineTuazon vs. Del Rosario-Suarez, 637 SCRA 728, G.R. No. 168325 December 13, 2010Daysel FateNessuna valutazione finora

- Criminal Law Review: (Course Outline/Syllabus)Documento11 pagineCriminal Law Review: (Course Outline/Syllabus)Van Irish VentilacionNessuna valutazione finora

- Supreme Court Reviews Mining Lease DisputeDocumento10 pagineSupreme Court Reviews Mining Lease DisputeReal Tabernero0% (2)

- Escamilla Guilty of Frustrated HomicideDocumento1 paginaEscamilla Guilty of Frustrated HomicideJemson Ivan WalcienNessuna valutazione finora

- 66 Santos, Sr. v. Beltran - A.C. No. 5858Documento10 pagine66 Santos, Sr. v. Beltran - A.C. No. 5858Amielle CanilloNessuna valutazione finora

- Criminal LawDocumento21 pagineCriminal LawDee WhyNessuna valutazione finora

- G.R. No. 179267Documento23 pagineG.R. No. 179267Aiyla AnonasNessuna valutazione finora

- Atty. Iris Bonifacio disbarment caseDocumento101 pagineAtty. Iris Bonifacio disbarment caseMichaela GarciaNessuna valutazione finora

- People V Ubina, 97 Phil 515Documento4 paginePeople V Ubina, 97 Phil 515Ryan ChristianNessuna valutazione finora

- Leges Legibus Est Optimus Interpretandi Modus or Every Statute Must Be SoDocumento4 pagineLeges Legibus Est Optimus Interpretandi Modus or Every Statute Must Be SoCofeelovesIronman JavierNessuna valutazione finora

- Benjamin G. Ting: Case 2 Title and PartiesDocumento13 pagineBenjamin G. Ting: Case 2 Title and PartiesFatzie Mendoza100% (1)

- Obligation and Contract Case DigestDocumento4 pagineObligation and Contract Case DigestPhlpost Legal DepartmentNessuna valutazione finora

- Atlas Consolidated Vs CADocumento9 pagineAtlas Consolidated Vs CAOwen BuenaventuraNessuna valutazione finora

- 178 Sermonia v. Court of Appeals, G.R. No. 109454, 14 June 1994Documento1 pagina178 Sermonia v. Court of Appeals, G.R. No. 109454, 14 June 1994Mario MorenoNessuna valutazione finora

- Cases Atty Arellano-MidtermsDocumento17 pagineCases Atty Arellano-MidtermsOna MaeNessuna valutazione finora

- Revised Penal Code Articles 1 20Documento5 pagineRevised Penal Code Articles 1 20Ricardo DelacruzNessuna valutazione finora

- People vs Ley: Child Abuse Case ExplainedDocumento6 paginePeople vs Ley: Child Abuse Case ExplainedRap BaguioNessuna valutazione finora

- Crim Reviewer Book 1 Revised 2007Documento126 pagineCrim Reviewer Book 1 Revised 2007Clint M. MaratasNessuna valutazione finora

- Association of Small Landowners in The Philippines, Inc. Vs Secretary of Agrarian ReformDocumento36 pagineAssociation of Small Landowners in The Philippines, Inc. Vs Secretary of Agrarian ReformSittie Rainnie BaudNessuna valutazione finora

- Malayan Realty v. Uy Han YongDocumento9 pagineMalayan Realty v. Uy Han YongAlexaNessuna valutazione finora

- Revised Ortega Lecture Notes On Criminal Law 2.1Documento83 pagineRevised Ortega Lecture Notes On Criminal Law 2.1Michael Rangielo Brion GuzmanNessuna valutazione finora

- People vs Rodriguez illegal possession firearm absorbed rebellionDocumento1 paginaPeople vs Rodriguez illegal possession firearm absorbed rebellionDigesting FactsNessuna valutazione finora

- Canon 1-3 P2Documento104 pagineCanon 1-3 P2Glace OngcoyNessuna valutazione finora

- Cases Legal EthicsDocumento57 pagineCases Legal EthicsPipoy AmyNessuna valutazione finora

- Tondo Medical Center Employees Assoc. vs. CA, 527 SCRA 746 (2007)Documento18 pagineTondo Medical Center Employees Assoc. vs. CA, 527 SCRA 746 (2007)Christiaan CastilloNessuna valutazione finora

- Case Digest b2Documento1 paginaCase Digest b2Mavic MoralesNessuna valutazione finora

- 2015-2016 Criminal LawDocumento19 pagine2015-2016 Criminal LawKatherine DizonNessuna valutazione finora

- Basan V PeopleDocumento1 paginaBasan V PeopleLotsee ElauriaNessuna valutazione finora

- How to Optimize Your Website for Search EnginesDocumento10 pagineHow to Optimize Your Website for Search EnginesJamesAnthonyNessuna valutazione finora

- Tilted Justice: First Came the Flood, Then Came the Lawyers.Da EverandTilted Justice: First Came the Flood, Then Came the Lawyers.Nessuna valutazione finora

- Negotiable InstrumentsDocumento40 pagineNegotiable InstrumentsynaymariaNessuna valutazione finora

- Sample Initial OrderDocumento1 paginaSample Initial OrderynaymariaNessuna valutazione finora

- SampleDocumento6 pagineSampleynaymariaNessuna valutazione finora

- Correction of EntriesDocumento4 pagineCorrection of Entriesynaymaria100% (2)

- Sample RaffleDocumento1 paginaSample RaffleynaymariaNessuna valutazione finora

- Affidavit of Lost Cemetery Lot CertificateDocumento1 paginaAffidavit of Lost Cemetery Lot CertificateynaymariaNessuna valutazione finora

- Republic of The PhilippinesDocumento1 paginaRepublic of The PhilippinesynaymariaNessuna valutazione finora

- InformationDocumento6 pagineInformationynaymariaNessuna valutazione finora

- Affidavit of Lost Cemetery Lot CertificateDocumento1 paginaAffidavit of Lost Cemetery Lot CertificateynaymariaNessuna valutazione finora

- The Local Government Code of The Philippines Ra 7160Documento246 pagineThe Local Government Code of The Philippines Ra 7160ynaymariaNessuna valutazione finora

- Cases Evidence 2Documento5 pagineCases Evidence 2ynaymariaNessuna valutazione finora

- Rem NotesDocumento4 pagineRem NotesynaymariaNessuna valutazione finora

- Amended National Internal Revenue CodeDocumento108 pagineAmended National Internal Revenue CodeynaymariaNessuna valutazione finora

- Evidence - Judicial NoticeDocumento2 pagineEvidence - Judicial NoticeynaymariaNessuna valutazione finora

- Evidence Digest CasesDocumento2 pagineEvidence Digest CasesynaymariaNessuna valutazione finora

- Samplex Primer Remrev Booklet - 2017: QualifiedDocumento11 pagineSamplex Primer Remrev Booklet - 2017: QualifiedCzaraine DyNessuna valutazione finora

- Justice Puno's Seniority RankingDocumento2 pagineJustice Puno's Seniority RankingROSE CAMILLE O DE ASISNessuna valutazione finora

- Reviewer For Legal ProfessionDocumento7 pagineReviewer For Legal ProfessionSand FajutagNessuna valutazione finora

- Criminal LawDocumento58 pagineCriminal LawDanilo Pinto dela BajanNessuna valutazione finora

- Memorandum of Law For Breach of Fiduciary DutyDocumento49 pagineMemorandum of Law For Breach of Fiduciary DutyL03A06100% (1)

- CA upholds malicious mischief conviction but acquits on trespassDocumento6 pagineCA upholds malicious mischief conviction but acquits on trespassJennyMariedeLeonNessuna valutazione finora

- Proper execution of tax waiverDocumento2 pagineProper execution of tax waiversmtm06Nessuna valutazione finora

- Sony Agrees To $15M SettlementDocumento220 pagineSony Agrees To $15M Settlementcrecente7032100% (1)

- G R No L-16478 PEOPLE OF THE PHILIPPINES Vs MODESTO MALABANAN Y ARANDIADocumento4 pagineG R No L-16478 PEOPLE OF THE PHILIPPINES Vs MODESTO MALABANAN Y ARANDIARuel FernandezNessuna valutazione finora

- Adr Case Digest Soledad F BengsonDocumento1 paginaAdr Case Digest Soledad F BengsonCes BabaranNessuna valutazione finora

- Article III (3) RevisedDocumento107 pagineArticle III (3) Revisedconstitution100% (1)

- Appendix B Engagement LetterDocumento3 pagineAppendix B Engagement LetterJoHn CarLoNessuna valutazione finora

- Continental Illinois Bank & Trust Co. v. ClementDocumento2 pagineContinental Illinois Bank & Trust Co. v. ClementKathNessuna valutazione finora

- People vs. MoralesDocumento1 paginaPeople vs. MoralesIan RonquilloNessuna valutazione finora

- Ewa Kosior - The Notion of Codicil. Origins and Contemporary SolutionDocumento12 pagineEwa Kosior - The Notion of Codicil. Origins and Contemporary SolutionMoldovan RomeoNessuna valutazione finora

- Yao Ka Sin Trading v. CADocumento1 paginaYao Ka Sin Trading v. CADennis CastroNessuna valutazione finora

- Mejia V AmazonDocumento11 pagineMejia V AmazonGMG EditorialNessuna valutazione finora

- Distinction Between The 1935, 1973 and 1987 Phil. Constitution 1935 Constitution 1973 Constitution 1987 Constitution Framing of The ConstitutionDocumento1 paginaDistinction Between The 1935, 1973 and 1987 Phil. Constitution 1935 Constitution 1973 Constitution 1987 Constitution Framing of The ConstitutionAngelica GaliciaNessuna valutazione finora

- Torres Vs SatsatinDocumento3 pagineTorres Vs SatsatinRobert Vencint NavalesNessuna valutazione finora

- RTC Ruling on Concubinage Case Despite Pending Annulment PetitionDocumento3 pagineRTC Ruling on Concubinage Case Despite Pending Annulment PetitionbrahmsNessuna valutazione finora

- Project - Law of Torts 1: Topic - Novus Interveniens and Its ApplicationDocumento21 pagineProject - Law of Torts 1: Topic - Novus Interveniens and Its ApplicationRohan D'cruzNessuna valutazione finora

- G.R. No. 136100 Uy Vs LandbankDocumento2 pagineG.R. No. 136100 Uy Vs LandbankDean BenNessuna valutazione finora

- People Vs Quianzon 62 Phil 162Documento2 paginePeople Vs Quianzon 62 Phil 162Joyleen HebronNessuna valutazione finora

- Andamo vs IAC land dispute civil case dismissalDocumento2 pagineAndamo vs IAC land dispute civil case dismissalmelinda elnarNessuna valutazione finora

- Francisco Vs House of Representatives PDFDocumento8 pagineFrancisco Vs House of Representatives PDFAnna GuevarraNessuna valutazione finora

- Victorias Milling V CA - GR 117356 - 333 SCRA 663Documento8 pagineVictorias Milling V CA - GR 117356 - 333 SCRA 663Jeremiah ReynaldoNessuna valutazione finora

- Sandejas Vs Lina CaseDocumento24 pagineSandejas Vs Lina CaseKEMPNessuna valutazione finora