Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Revised Withholding Tax Tables 1601C

Caricato da

Chard San Buenaventura PerveraCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Revised Withholding Tax Tables 1601C

Caricato da

Chard San Buenaventura PerveraCopyright:

Formati disponibili

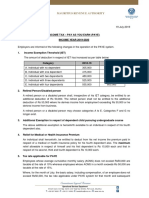

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

REVISED WITHHOLDING TAX TABLES

Effective JANUARY 1, 2009

DAILY

1

EXEMPTION

Status

0.00

('000P) + 0% over + 5%

0.00

1.65

8.25

over + 10%

over + 15%

over + 20%

6

28.05

7

74.26

over + 25%

over + 30%

165.02

A. Table for employees without qualified dependent

1. Z

2. S/ME

0.0

33

99

231

462

50.0

165

198

264

396

627

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

75.0

248

281

347

479

710

1. ME2 / S2

100.0

330

363

429

561

792

1. ME3 / S3

125.0

413

446

512

644

875

1. ME4 / S4

150.0

495

528

594

726

WEEKLY

1

EXEMPTION

0.00

Status

+ 0% over + 5%

0.00

9.62

over + 10%

over + 15%

5

48.08

957

6

163.46

over + 20%

7

432.69

over + 25%

961.54

over + 30%

A. Table for employees without qualified dependent

1. Z

2. S/ME

0.0

192

577

1,346

2,692

4,808

50.0

962

1,154

1,538

2,308

3,654

5,769

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

75.0

1,442

1,635

2,019

2,788

4,135

1. ME2 / S2

100.0

1,923

2,115

2,500

3,269

4,615

1. ME3 / S3

125.0

2,404

2,596

2,981

3,750

5,096

1. ME4 / S4

150.0

2,885

3,077

3,462

4,231

5,577

SEMI-MONTHLY

EXEMPTION

0.00

Status

0.00

+ 0% over + 5%

4

20.83

over + 10%

5

104.17

over + 15%

6

354.17

over + 20%

7

937.50

over + 25%

2,083.33

over + 30%

A. Table for employees without qualified dependent

1. Z

2. S/ME

0.0

417

1,250

2,917

5,833

10,417

50.0

2,083

2,500

3,333

5,000

7,917

12,500

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

75.0

3,125

3,542

4,375

6,042

8,958

1. ME2 / S2

100.0

4,167

4,583

5,417

7,083

10,000

1. ME3 / S3

125.0

5,208

5,625

6,458

8,125

11,042

1. ME4 / S4

150.0

6,250

6,667

7,500

9,167

12,083

MONTHLY

1

EXEMPTION

0.00

Status

0.00

+ 0% over + 5%

over + 10%

4

41.67

over + 15%

5

208.33

over + 20%

6

708.33

over + 25%

1,875.00

4,166.67

over + 30%

A. Table for employees without qualified dependent

1. Z

2. S/ME

0.0

833

2,500

5,833

11,667

20,833

50.0

4,167

5,000

6,667

10,000

15,833

25,000

B. Table for single/married employee with qualified dependent child(ren)

1. ME1 / S1

75.0

6,250

7,083

8,750

12,083

17,917

1. ME2 / S2

100.0

8,333

9,167

10,833

14,167

20,000

1. ME3 / S3

125.0

10,417

11,250

12,917

16,250

22,083

1. ME4 / S4

150.0

12,500

13,333

15,000

18,333

24,167

Legend: Z-Zero exemption

S-Single

ME-Married Employee

1;2;3;4-Number of qualified dependent children

S/ME = P50,000 EACH WORKING EMPLOYEE

Qualified Dependent Child = P25,000 each but not exceeding four (4) children

USE TABLE A FOR SINGLE/MARRIED EMPLOYEE WITH NO QUALIFIED DEPENDENT

1. Married Employee (Husband or Wife) whose spouse is unemployed.

2. Married Employee (Husband or Wife) whose spouse is a non-resident citizen receiving income from foreign sources.

3. Married Employee (Husband or Wife) whose spouse is engaged in business.

4. Single with dependent father/mother/brother/sister/senior citizen.

5. Single.

6. Zero Exemption for Employee with multiple employers for their 2nd, 3rd. . . Employers (main employer clains personal & additional exemption).

7. Zero Exemption for those who failed to file Application for Registration.

USE TABLE B FOR SINGLE/MARRIED EMPLOYEE WITH NO QUALIFIED DEPENDENT

1. Employed husband and husband clains exemptions of children

2. Employed wife whose husband is also employed or engaged in business; husband waived claim for dependent children in favor of employed wife.

3. Single with qualified dependent children.

Visit my blog at

www.bendaggers.com

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

REVISED WITHHOLDING TAX TABLES

Annex "C"

Effective JANUARY 1, 2009

7

8

165.02

412.54

over + 32%

over

825

1,650

990

1,815

1,073

1,898

1,155

1,980

1,238

2,063

1,320

7

2,145

8

961.54

2,403.85

over + 32%

over

4,808

9,615

5,769

10,577

6,250

11,058

6,731

11,538

7,212

12,019

7,692

12,500

2,083.33

5,208.33

over + 32%

10,417

20,833

12,500

22,917

13,542

23,958

14,583

25,000

15,625

26,042

16,667

27,083

4,166.67

10,416.67

over + 32%

ed dependent children

nt Child = P25,000 each but not exceeding four (4) children

e from foreign sources.

mployer clains personal & additional exemption).

im for dependent children in favor of employed wife.

Visit my blog at

www.bendaggers.com

over

over

20,833

41,667

25,000

45,833

27,083

47,917

29,167

50,000

31,250

52,083

33,333

54,167

Potrebbero piacerti anche

- Revised Withholding Tax Tables2009Documento1 paginaRevised Withholding Tax Tables2009Emil A. MolinaNessuna valutazione finora

- FTP FTP - Bir.gov - PH Webadmin1 PDF 42126AnnexCDocumento1 paginaFTP FTP - Bir.gov - PH Webadmin1 PDF 42126AnnexCrupertville12Nessuna valutazione finora

- 2015 BIR Withholding Tax TableDocumento1 pagina2015 BIR Withholding Tax TableJonasAblangNessuna valutazione finora

- Philippines BIR Tax Rates 2009Documento0 paginePhilippines BIR Tax Rates 2009kamkamtoy100% (1)

- Payroll SystemDocumento21 paginePayroll SystemyuunissNessuna valutazione finora

- Witholding TaxDocumento41 pagineWitholding TaxEstudyante BluesNessuna valutazione finora

- Witholding TaxDocumento33 pagineWitholding TaxBfp Basud Camarines NorteNessuna valutazione finora

- Withholding Tax Table 1Documento1 paginaWithholding Tax Table 1Jhon Karl AndalNessuna valutazione finora

- Withholding Tax From BIR WebsiteDocumento37 pagineWithholding Tax From BIR Websitepeanut47Nessuna valutazione finora

- Effective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Documento1 paginaEffective JANUARY 1, 2009 Revised Withholding Tax Tables Annex "C"Vita DepanteNessuna valutazione finora

- Revised Withholding Tax TablesDocumento2 pagineRevised Withholding Tax TablesReylan San PascualNessuna valutazione finora

- Withholding TaxDocumento46 pagineWithholding TaxDura LexNessuna valutazione finora

- Revised Withholding Tax TablesDocumento2 pagineRevised Withholding Tax TablesShairaCerenoNessuna valutazione finora

- Withholding Tax RateDocumento1 paginaWithholding Tax RateJamie Jimenez CerreroNessuna valutazione finora

- Withholding Tax Table 1Documento1 paginaWithholding Tax Table 1Elton SUicoNessuna valutazione finora

- Employment Income TaxDocumento5 pagineEmployment Income TaxYehualashet MekonninNessuna valutazione finora

- Monthly: Old Taxation TablesDocumento2 pagineMonthly: Old Taxation TablesBai NiloNessuna valutazione finora

- Basic Philippine Labor Laws and Regulations: Compensation Regular CompensationDocumento13 pagineBasic Philippine Labor Laws and Regulations: Compensation Regular Compensationbro nawalibmatNessuna valutazione finora

- AbelDocumento12 pagineAbelErmi ManNessuna valutazione finora

- Exampaper OCT 2011Documento16 pagineExampaper OCT 2011Delmaree CoetzeeNessuna valutazione finora

- Employment Income TaxDocumento20 pagineEmployment Income TaxBizu AtnafuNessuna valutazione finora

- Audit Reconsideration Memorandum Baker SCRIBDDocumento7 pagineAudit Reconsideration Memorandum Baker SCRIBDMichael AlaoNessuna valutazione finora

- Noa 2020Documento5 pagineNoa 2020xiaolong.siboNessuna valutazione finora

- Identify and Discuss Direct TaxDocumento7 pagineIdentify and Discuss Direct Taxsamuel asefaNessuna valutazione finora

- TEST III-Question No. 3-Use The Table Below To Compute The Tax Due Tax Table If Taxable Income Is: Tax Due IsDocumento2 pagineTEST III-Question No. 3-Use The Table Below To Compute The Tax Due Tax Table If Taxable Income Is: Tax Due IsRen A EleponioNessuna valutazione finora

- Mathematical Literacy Grade 12 Term 3Documento24 pagineMathematical Literacy Grade 12 Term 3Thato Moratuwa MoloantoaNessuna valutazione finora

- Ten Tax Mistakes - Part 1Documento17 pagineTen Tax Mistakes - Part 1bomseriesNessuna valutazione finora

- Cme Staff Forum On Continous Medical EducationDocumento20 pagineCme Staff Forum On Continous Medical EducationolaniyanNessuna valutazione finora

- Chapter 8 Income TaxationDocumento7 pagineChapter 8 Income TaxationChristine Joy Rapi MarsoNessuna valutazione finora

- Provident FundDocumento18 pagineProvident FundShiv RamNessuna valutazione finora

- 3.1 Employment Income Tax Edited March 2021Documento22 pagine3.1 Employment Income Tax Edited March 2021Bimmer MemerNessuna valutazione finora

- Tax AssignmentDocumento13 pagineTax AssignmentYitera SisayNessuna valutazione finora

- General Information Regarding UIF Maternity BenefitsDocumento5 pagineGeneral Information Regarding UIF Maternity BenefitsJa DabNessuna valutazione finora

- Witholding TaxDocumento68 pagineWitholding TaxReynante GungonNessuna valutazione finora

- General Information Regarding UIF Maternity BenefitsDocumento4 pagineGeneral Information Regarding UIF Maternity Benefitsdiane terolNessuna valutazione finora

- Borang BE 2013 (Cukai)Documento2 pagineBorang BE 2013 (Cukai)nabilah hussinNessuna valutazione finora

- Public Chapter 4Documento19 paginePublic Chapter 4samuel debebeNessuna valutazione finora

- Tax Data Card 30 June 2014Documento9 pagineTax Data Card 30 June 2014api-300877373Nessuna valutazione finora

- Fortnightly Tax Table AuDocumento12 pagineFortnightly Tax Table AujaeadaNessuna valutazione finora

- AW8 (V32) Employee SectionDocumento13 pagineAW8 (V32) Employee Sectionmrwvpn8rqhNessuna valutazione finora

- FORM W-4 (2016) Questionnaire: Exceptions. An Employee May Be Able To Claim Exemption FromDocumento1 paginaFORM W-4 (2016) Questionnaire: Exceptions. An Employee May Be Able To Claim Exemption FromPavan Kumar VadlamaniNessuna valutazione finora

- Instruction NotesDocumento148 pagineInstruction NotesMusiime AlvinNessuna valutazione finora

- Attendance and Leave PolicyDocumento4 pagineAttendance and Leave Policyapi-1729404192% (37)

- US Internal Revenue Service: I1040as3 - 2004Documento4 pagineUS Internal Revenue Service: I1040as3 - 2004IRSNessuna valutazione finora

- Mauritius Revenue Authority: T: - F: - E: - WDocumento2 pagineMauritius Revenue Authority: T: - F: - E: - WAmrit ChutoorgoonNessuna valutazione finora

- Fundamental CH 4Documento8 pagineFundamental CH 4Tasfa ZarihunNessuna valutazione finora

- Sunward IPA - ZhangYuPengDocumento11 pagineSunward IPA - ZhangYuPengShawn RaSk RaSk100% (1)

- Salary Structure CalculatorDocumento7 pagineSalary Structure CalculatorSwati ModoNessuna valutazione finora

- Payroll Setup ChecklistDocumento4 paginePayroll Setup ChecklistcaliechNessuna valutazione finora

- Accounting For The Payroll System in An Ethiopian ContextDocumento11 pagineAccounting For The Payroll System in An Ethiopian ContextalemayehuNessuna valutazione finora

- Income Tax 2008circluar06Documento8 pagineIncome Tax 2008circluar06Qamar TanauliNessuna valutazione finora

- US Internal Revenue Service: I1040as3 - 2006Documento4 pagineUS Internal Revenue Service: I1040as3 - 2006IRSNessuna valutazione finora

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionDa EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionNessuna valutazione finora

- ONS Tax Benefit Model Tables April 2009Documento138 pagineONS Tax Benefit Model Tables April 20091nn1tNessuna valutazione finora

- 2021 Gr12 Maths Literacy WKBKDocumento20 pagine2021 Gr12 Maths Literacy WKBKtinashe chirukaNessuna valutazione finora

- 101 Ways to Save Money on Your Tax - Legally! 2014 - 2015Da Everand101 Ways to Save Money on Your Tax - Legally! 2014 - 2015Nessuna valutazione finora

- 101 Ways To Save Money on Your Tax - Legally! 2018-2019Da Everand101 Ways To Save Money on Your Tax - Legally! 2018-2019Nessuna valutazione finora

- 101 Ways to Save Money on Your Tax - Legally! 2017-2018Da Everand101 Ways to Save Money on Your Tax - Legally! 2017-2018Nessuna valutazione finora

- Servant Leadership and Job Satisfaction: The Moderating Roles of The Decision Making Process and Organizational StructureDocumento52 pagineServant Leadership and Job Satisfaction: The Moderating Roles of The Decision Making Process and Organizational StructureNathan EvaNessuna valutazione finora

- Aggregate Demand and Aggregate Supply (Chapter 20 of Mankiw)Documento28 pagineAggregate Demand and Aggregate Supply (Chapter 20 of Mankiw)bohuagario123Nessuna valutazione finora

- Supervising Work-Based TrainingDocumento132 pagineSupervising Work-Based TrainingPatricia MatiasNessuna valutazione finora

- HR MANAGMENT, HR ISSUES IN INDIAN MSMeDocumento11 pagineHR MANAGMENT, HR ISSUES IN INDIAN MSMeMayank PareekNessuna valutazione finora

- Unit 1 HRM 2021Documento70 pagineUnit 1 HRM 2021Shreya ChauhanNessuna valutazione finora

- SWOT Analysis of British American TobaccoDocumento7 pagineSWOT Analysis of British American TobaccoIbney Alam100% (2)

- ppt132 eDocumento2 pagineppt132 eLucasNessuna valutazione finora

- Christ Moot PDocumento10 pagineChrist Moot PBhavya VermaNessuna valutazione finora

- Complete Report of Honda HRMDocumento25 pagineComplete Report of Honda HRMAdnan Siddique50% (4)

- About Us: Is Not An Agent of Great North Immigration Inc. or ItsDocumento3 pagineAbout Us: Is Not An Agent of Great North Immigration Inc. or ItsDomingos AlbertoNessuna valutazione finora

- Jurnal Internasional 2Documento13 pagineJurnal Internasional 2Ilham Nur AziziNessuna valutazione finora

- Defenition of TrainingDocumento6 pagineDefenition of TrainingMia cahyatiNessuna valutazione finora

- HRA Module 1 - Lecture SlidesDocumento44 pagineHRA Module 1 - Lecture Slidesankit100% (1)

- International Human Resource ManagementDocumento21 pagineInternational Human Resource ManagementSuraj MauryaNessuna valutazione finora

- GSLISDocumento5 pagineGSLISburraganeshNessuna valutazione finora

- CV StylesDocumento2 pagineCV Stylesdazdaook daodaNessuna valutazione finora

- Samuel EwnetuDocumento87 pagineSamuel EwnetuMedi MarkNessuna valutazione finora

- Summary of OMB Circular A-122Documento3 pagineSummary of OMB Circular A-122NewDay2013Nessuna valutazione finora

- Business Ethics: Ratan Tata: Ethical LeadershipDocumento7 pagineBusiness Ethics: Ratan Tata: Ethical LeadershipDziipu znm100% (1)

- Non Financial Criteria and Factors Affecting Project SelectionDocumento18 pagineNon Financial Criteria and Factors Affecting Project SelectionreajithkumarNessuna valutazione finora

- Ais310-Chap 2Documento3 pagineAis310-Chap 2Izdihar ShuhaimiNessuna valutazione finora

- Swift Care Company Profile PDFDocumento27 pagineSwift Care Company Profile PDFMuthana JalladNessuna valutazione finora

- 1429751Documento42 pagine1429751Ariel BritoNessuna valutazione finora

- HRM KtuDocumento5 pagineHRM KtuPriyanka George100% (1)

- Job Design: Michael ArmstrongDocumento10 pagineJob Design: Michael ArmstrongRonald AlanzalonNessuna valutazione finora

- Carrier Decisions of Senior High School PDFDocumento94 pagineCarrier Decisions of Senior High School PDFNathalia LeonadoNessuna valutazione finora

- Human Resource Management (HRM or Simply HR) Is The Management of AnDocumento58 pagineHuman Resource Management (HRM or Simply HR) Is The Management of AnS Prabu RajNessuna valutazione finora

- 221 ExamsDocumento10 pagine221 ExamsElla Mae AgoniaNessuna valutazione finora

- Attitudes Towards Women ScaleDocumento4 pagineAttitudes Towards Women ScaleHemant KumarNessuna valutazione finora

- Job Satisfaction - IntroDocumento11 pagineJob Satisfaction - IntroKerrnaz Panthaki100% (1)