Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Model Answers Series 2 2010

Caricato da

Jack TsangDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Model Answers Series 2 2010

Caricato da

Jack TsangCopyright:

Formati disponibili

LCCI International Qualifications

Book-keeping and Accounts Level 2

Model Answers

Series 2 2010 (2007)

For further information contact us:

Tel. +44 (0) 8707 202909 Email. enquiries@ediplc.com www.lcci.org.uk

Book- Keeping and Accounts Level 2

Series 2 2010

How to use this booklet Model Answers have been developed by EDI to offer additional information and guidance to Centres, teachers and candidates as they prepare for LCCI International Qualifications. The contents of this booklet are divided into 3 elements: (1) (2) Questions Model Answers reproduced from the printed examination paper summary of the main points that the Chief Examiner expected to see in the answers to each question in the examination paper, plus a fully worked example or sample answer (where applicable) where appropriate, additional guidance relating to individual questions or to examination technique

(3)

Helpful Hints

Teachers and candidates should find this booklet an invaluable teaching tool and an aid to success. EDI provides Model Answers to help candidates gain a general understanding of the standard required. The general standard of model answers is one that would achieve a Distinction grade. EDI accepts that candidates may offer other answers that could be equally valid.

Education Development International plc 2010 All rights reserved; no part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording or otherwise without prior written permission of the Publisher. The book may not be lent, resold, hired out or otherwise disposed of by way of trade in any form of binding or cover, other than that in which it is published, without the prior consent of the Publisher.

Page 1 of 15

QUESTION 1 Bob and Anna are in partnership, sharing profits and losses in the ratio 4:1 respectively. The Balance Sheet of the partnership at 31 December 2009 was as follows: Bob and Anna Balance Sheet at 31 December 2009

Fixed Assets Goodwill Premises Motor vehicles Plant & machinery Fixtures & fittings

40,000 250,000 76,000 80,000 24,000 470,000

Current Assets Stock Debtors Bank Amounts falling due within 1 year Creditors Bank Loan (repayable June 2010) Net current Assets Financed by: Capital Accounts: Bob Anna Current Accounts: Bob Anna

25,000 38,000 15,000 78,000 30,000 12,000

(42,000) 36,000 506,000

320,000 180,000 2,000 4,000

500,000

6,000 506,000

Bob and Anna agreed that, from 1 January 2010, profits and losses would be shared in the ratio 3:1 respectively. It was also agreed that the following assets would be re-valued: Goodwill should no longer appear as an asset in the partnership books. 280,000 68,000 20,000 23,800 88,000

Premises Motor vehicles Fixture & fittings Stock Goodwill

REQUIRED Prepare the following at 1 January 2010: (a) (b) (c) (d) Revaluation Account Goodwill Account Capital Accounts of Bob and Anna Balance Sheet. (6 marks) (3 marks) (5 marks) (11 marks) (Total 25 marks)

2007/2/10MA

Page 2 of 15

MODEL ANSWER TO QUESTION 1 (a) 2010 Jan 1 Jan 1 Jan 1 Jan 1 Motor vehicles Fixtures and fittings Stocks Capital - 4:1 Bob Anna 8,000 4,000 1,200 Revaluation Account 2010 Jan 1 Jan 1

Premises Goodwill

30,000 48,000

51,840 12,960

64,800 78,000

. 78,000

(b) 2010 Jan 1 Jan 1 Balance b/d Revaluation 40,000 48,000 88,000

Goodwill Account 2010 Jan 1 Capital Bob Jan 1 Capital Anna

66,000 22,000 88,000

Capital Accounts (c) 2010 Jan 1 Jan 1 Goodwill Balance c/d Bob 66,000 305,840 371,840 Anna 22,000 170,960 192,960 2010 Jan 1 Jan 1 Bob 320,000 51,840 371,840 305,840 Anna 180,000 12,960 192,960 170,960

Balance b/d Revaluation

Jan 1

Balance b/d

2007/2/10MA

Page 4 of 15

Alternative answer (a) 2010 Jan 1 Jan 1 Jan 1 Jan 1

Motor vehicles Fixtures and fittings Stocks Capital - 4:1 Bob Anna

8,000 4,000 1,200

Revaluation Account 2010 Jan 1

Premises

30,000

13,440 3,360

16,800 78,000

. 78,000

(b) 2010 Jan 1 Jan 1 Balance b/d Capital Bob Anna 40,000 38,400 9,600

Goodwill Account 2010 Jan 1

Capital Bob

66,000

48,000 88,000

Jan 1

Capital Anna

22,000 88,000

Capital Accounts (c) 2010 Jan 1 Jan 1 Goodwill Balance c/d Bob 66,000 305,840 ______ 371,840 Anna 22,000 170,960 ______ 192,960 2010 Jan 1 Jan 1 Jan 1 Bob 320,000 13,440 _38,400 371,840 305,840 Anna 180,000 3,360 __9,600 192,960 170,960

Balance b/d Revaluation Goodwill

Jan 1

Balance b/d

2007/2/10MA

Page 4 of 15

QUESTION 1 CONTINUED

(d)

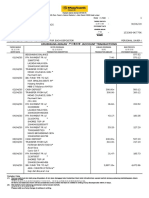

Bob and Anna Balance Sheet at 1 January 2010

Fixed Assets Premises Motor vehicles Plant & machinery Fixtures and fittings Current Assets Stocks Debtors Bank

280,000 68,000 80,000 20,000

448,000

23,800 38,000 15,000 76,800

Amounts falling due within 1 year Creditors Bank Loan Net current assets Financed by Capital Accounts: Bob Anna Current Accounts: Bob Anna 30,000 12,000

(42,000) 34,800 482,800

305,840 170,960

476,800

2,000 4,000

6,000 482,800

2007/2/10MA

Page 5 of 15

QUESTION 2 Bens year end is 30 September and his depreciation policy is as follows: Plant & machinery: 10% per annum straight line method on cost Motor vehicles: 25% per annum reducing balance method For both methods of depreciation, a full years depreciation is charged when an asset is purchased in the first six months of a financial year When an asset is purchased in the second six months of a financial year, a half years depreciation is charged No depreciation is charged in the year of sale.

The purchases and sales of fixed assets for the 3 years ended 30 September 2009 were as follows: Date of purchase Plant & machinery A Plant & machinery B Plant & machinery C Motor vehicle W Motor vehicle X Motor vehicle Y Motor vehicle Z 1 October 2006 1 March 2008 1 October 2008 1 October 2006 21 September 2007 31 January 2008 11 October 2008 Date of sale Motor vehicle W 11 October 2008 Cost 20,000 30,000 40,000 10,000 12,000 14,000 16,000 Sale proceeds 6,750 (cheque)

REQUIRED (a) Prepare the following accounts for the years ended 30 September 2007, 2008 and 2009: (i) (ii) (iii) (iv) (v) (b) (c) Plant & Machinery Provision for Depreciation Motor Vehicle Motor Vehicle Depreciation Motor Vehicle Provision for Depreciation Motor Vehicle Disposal. (4 marks) (5 marks) (3 marks) (5 marks) (4 marks) (2 marks) (2 marks) (Total 25 marks)

Define the term depreciation. Name one method of depreciation other than straight line or reducing balance.

2007/2/10MA

Page 6 of 15

MODEL ANSWER TO QUESTION 2 Plant & Machinery Provision for Depreciation Account (a) (i) 2007 2007 Sep 30 Balance c/d 2,000 Sep 30 Depreciation/P&L 2,000 2007 Oct 1 Balance b/d 2,000 2008 2008 Sep 30 Balance c/d 7,000 Sep 30 Depreciation/P&L 5,000 7,000 7,000 2008 Oct 1 Balance b/d 7,000 2009 2009 Sep 30 Balance c/d 16,000 Sep 30 Depreciation/P&L 9,000 16,000 16,000 2009 Oct 1 Balance b/d 16,000

(ii) 2006 Oct 1 2007 Sep 21 2007 Oct 1 2008 Jan 31 2008 Oct 1 Oct 11 Bank (W) Bank (X)

Motor Vehicle Account 10,000 2007 12,000 Sep 30 Balance c/d 22,000 22,000 14,000 36,000 36,000 16,000 . 52,000 2008 Sep 30 2008 Oct 11 2009 Sep 30 Balance c/d

22,000 22,000

Balance b/d Bank (Y)

36,000 36,000 10,000

Balance b/d Bank (Z)

Disposal (W)

Balance c/d

42,000 52,000

2009 Oct 1 (iii) 2007 Sep 30 2008 Sep 30 2009 Sep 30

Balance b/d

42,000 Motor Vehicle Depreciation Account 2007 4,000 Sep 30 P&L A/c 2008 8,000 Sep 30 P&L A/c 2009 8,594 Sep 30 P&L A/c

4,000 8,000 8,594

PFD* PFD* PFD*

* PFD = Provision For Depreciation

2007/2/10

Page 7 of 15

QUESTION 2 CONTINUED (iv) 2007 Sep 30 Motor Vehicle Provision for Depreciation Account 2007 4,000 Sep 30 Depreciation 4,000 2007 Oct 1 Balance b/d 4,000 2008 Sep 30 Depreciation 12,000 8,000 12,000 12,000 2008 4,375 Oct 1 Balance b/d 12,000 2009 16,219 Sep 30 Depreciation 8,594 20,594 20,594 2009 Oct 1 Balance b/d 16,219

Balance c/d

2008 Sep 30 2008 Oct 11 2009 Sep 30

Balance c/d

Disposal Balance c/d

(v) 2008 Oct 11 2009 Sep 30

Motor vehicle P&L A/c

Motor Vehicle Disposal Account 2008 10,000 Oct 11 PFD Oct 11 Bank 1,125 11,125

4,375 6,750 _____ 11,125

(b)

Depreciation is an accounting adjustment that measures [the fall in value of a fixed asset] [over a period of time]. Revaluation Machine hours. Sum of digits Production unit method

(c)

2007/2/10/MA

Page 8 of 15

QUESTION 3 Sykes, a sole trader, started business on 1 January 2009. Full accounting records were not maintained during the first year. On 1 January 2009, Sykes opened a business bank account by depositing 20,000. He also transferred personal assets to the business at the following valuations: Motor vehicle 30,000 Fixture and fittings 5,000 On 1 July 2009, Sykes borrowed 12,000 for a twelve month period from Fagin, and this sum was deposited in the business account on that same date. Sykes agreed to pay 600 interest on 1 January 2010 in respect of the loan period from 1 July to 31 December 2009. The summary of the bank account for the year ended 31 December 2009 was as follows: Receipts Own deposit Loan from Fagin Receipts from customers Payments Staff wages Rent Purchases for resale Advertising Motor expenses Bank charges 20,000 12,000 122,000 35,300 8,000 62,000 1,900 8,200 500

During the year, Sykes did not pay all receipts from customers into the bank. He used the nonbanked receipts as follows: Drawings 22,000 Sundry expenses 1,752 Cash purchases 2,222 The following additional information is available at 31 December 2009: (1) (2) (3) (4) (5) (6) (7) Motor vehicle is to be depreciated at 20% per annum on cost Fixtures and fittings are to be depreciated at 10% per annum on cost Bad debts of 700 were written off during the year Closing stock 4,444 Creditors are owed 6,200 Debtors owe 12,200 Cash in hand 138.

REQUIRED Prepare the: (a) (b) Trading and Profit & Loss Account for the year ended 31 December 2009 Balance Sheet at 31 December 2009. (13 marks) (Total 25 marks) (12 marks)

2007/2/10/MA

Page 9 of 15

MODEL ANSWER TO QUESTION 3 (a) Sykes Trading and Profit & Loss Account for the year ended 31 December 2009 Sales Cost of sales Purchases Less closing stock Gross Profit Staff wages Rent Advertising Motor expenses Bank charges Sundry expenses Depreciation: motor vehicle Depreciation: fixtures and fittings Bad debt Loan interest Net Profit (b)

161,012

70,422 4,444

65,978 95,034

35,300 8,000 1,900 8,200 500 1,752 6,000 500 700 600

63,452 31,582

Fixed Assets Motor vehicle Fixture and fittings

Sykes Balance Sheet at 31 December 2009 Accumulated Cost Depreciation 30,000 6,000 5,000 500 35,000 6,500

NBV 24,000 4,500 28,500

Current Assets Stock Debtors Bank Cash

4,444 12,200 38,100 138 54,882

Creditors falling due within one year Creditors 6,200 Loan 12,000 Loan Interest 600 Net current assets/Working capital Capital Opening capital Add: Net profit Less: drawings

(18,800) 36,082 64,582 55,000 31,582 86,582 22,000 64,582

2007/2/10/MA

Page 10 of 15

QUESTION 4 The following extract has been taken from the Receipts and Payments Account of the Treeton Social Club for the year ended 31 December 2009: Receipts Annual subscriptions Life membership Additional information: (1) (2) The club keeps a separate Annual Subscriptions Account and Life Membership Account. At 1 January 2009, annual subscriptions received in advance amounted to 120. Subscriptions accrued and unpaid at that date totalled 70. At 31 December 2009, subscriptions received in advance for the year ending 31 December 2010 amounted to 200. Subscriptions accrued and unpaid at that date totalled 40. During the year ended 31 December 2009 subscriptions written off amounted to 60. At 1 January 2009, the balance on the life membership fund was 18,600. It is the clubs policy to transfer 10% of the total in the life membership fund, at the financial year-end, to the clubs income and expenditure account. 9,160 3,000

(3)

(4) (5) (6)

REQUIRED (a) Prepare the Annual Subscriptions Account clearly showing the amount to be transferred to the Income & Expenditure Account. (8 marks) State in which section of the Balance Sheet the subscriptions remaining accrued and unpaid at 31 December 2009 would be recorded. (1 mark) Calculate the amount to be entered for life membership in the clubs Income & Expenditure Account. (2 marks)

(b)

(c)

2007/2/10/MA

Page 11 of 15

QUESTION 4 CONTINUED

After preparing his Trial Balance on 30 June 2009, Joe Bell discovered the following errors: (1) The purchase of a computer for 1,500 on 1 January 2009 has been debited to the Office Expenses Account. The total of discount allowed of 240 has been credited to the Discount Received Account. Receipt of 198 from Ben Millward has been correctly entered in the Cash Book but has been debited to Ben Millwards Account as 189. A credit sale to Derek Gray of 73 has been debited to the account of Denis Grant. A payment for motor expenses of 190 has been posted to the bank account but the other entry has been omitted.

(2) (3)

(4) (5)

REQUIRED (d) Prepare Journal entries to correct the errors (1) to (5) above. Narratives are NOT required. (10 marks) Prepare the Suspense Account. (4 marks) (Total 25 marks)

(e)

2007/2/10/MA

Page 12 of 15

MODEL ANSWER TO QUESTION 4 (a) Balance/accrued b/d I & E A/c Balance/prepaid c/d Annual Subscriptions Account 70 9,110 200 _____ 9,380 40 Balance/prepaid b/d Bank/Cash Subs written off Balance/accrued c/d Balance/prepaid b/d 120 9,160 60 40 9,380 200

(b)

Balance/accrued b/d Under the heading of Current Assets

(c)

(18,600 + 3,000) x 1/10 = 2,160

(d) Computer / Office equipment Office expenses Discount allowed Discount received Suspense Suspense Ben Millward Alternatively Suspense Suspense Ben Millward Ben Millward Derek Gray Denis Grant Motor expenses Suspense (e) Balance b/d Ben Millward 283 387 ___ 670

DR 1,500

CR 1,500

240 240 480 387 387

198 189 198 189 73 73 190 190 Suspense Account Discount allowed Discount received Motor expenses 240 240 190 670

2007/2/10/MA

Page 13 of 15

QUESTION 5 Derson Ltd commenced a manufacturing business on 1 January 2009. The financial year ends on 31 December. Derson Ltd manufactures goods and also purchases finished goods from a supplier. The following balances were extracted from the Trial Balance of Derson Ltd at 31 December 2009: 000 Dr 3,184 960 22 130 28 9,526 184 924 1,848 000 Cr 36

Purchases of raw materials Returns of raw materials Purchases of finished goods Returns of finished goods Carriage on: Purchases of raw materials Purchases of finished goods Sales Sales returns Direct wages Production overheads

The following additional information was also available at 31 December 2009: (1) (2) (3) Stock of raw materials at cost Work-in-progress at cost Stock of finished manufactured goods Finished goods are transferred from the factory at production cost plus 10% and this stock is valued accordingly Stock of finished goods bought from supplier at cost Prepaid production overheads Accrued direct wages 000 244 154 890

(4) (5) (6)

114 16 24

REQUIRED (a) Prepare the following for Derson Ltd: (i) (ii) Manufacturing Account for the year ended 31 December 2009 Trading Account for the year ended 31 December 2009. (13 marks) (8 marks)

(b)

State two reasons why a manufacturing business may decide to transfer the production cost to the trading account at cost plus a profit. (4 marks) (Total 25 marks)

2007/2/10/MA

Page 14 of 15

MODEL ANSWER TO QUESTION 5 (a) (i) Derson Ltd Manufacturing Account for the year ended 31 December 2009 000 Raw materials Purchases Carriage Less: Returns Less: Closing stock Cost of raw materials used Direct wages Prime cost Production overheads 3,184 130 3,314 36 3,278 244 (924 + 24) (1,848 - 16) 3,034 948 3,982 1,832 5,814 154 5,660 566 6,226 000

Less: Work-in-progress Production cost Manufacturing profit (5,660 x 10%) Transfer to Trading Account

(ii)

Sales Less: returns Production Cost Purchases Carriage Less: returns

Derson Ltd Trading Account for the year ended 31 December 2009 000 000 000 9,526 184 9,342 6,226 960 28 988 22 966 7,192 (890 + 114) 1,004 6,188 3,154

Less: stock finished goods Cost of goods sold Gross profit

(b) 1. To provide the manufacturing part of the company with a notional profit. It allows the business to distinguish the profit made from trading activities (buying and selling finished goods), from the profit made by manufacturing. It allows the business to make a comparison between the cost of manufacturing the product or buying in the completed product from an external source.

2.

2007/2/10/MA

Page 15 of 15

Education Development International plc 2010

EDI International House Siskin Parkway East Middlemarch Business Park Coventry CV3 4PE UK Tel. +44 (0) 8707 202909 Fax. +44 (0) 2476 516505 Email. enquiries@ediplc.com www.ediplc.com

Potrebbero piacerti anche

- Code 2007 Accounting Level 2 2010 Series 4Documento15 pagineCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- Book-Keeping & Accounts/Series-2-2005 (Code2006)Documento14 pagineBook-Keeping & Accounts/Series-2-2005 (Code2006)Hein Linn Kyaw100% (2)

- 2010 LCCI Bookkeeping and Accounts Series 3Documento8 pagine2010 LCCI Bookkeeping and Accounts Series 3Fung Hui Ying75% (4)

- 2007 LCCI Level 2 Series 3 (HK) Model AnswersDocumento12 pagine2007 LCCI Level 2 Series 3 (HK) Model AnswersChoi Kin Yi Carmen67% (3)

- 2008 LCCI Level 2 (2507) Series 3 Model AnswersDocumento17 pagine2008 LCCI Level 2 (2507) Series 3 Model AnswersTracy Chan0% (1)

- Accounting Level 3: LCCI International QualificationsDocumento17 pagineAccounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (4)

- Accounting Level 3/series 4-2009Documento16 pagineAccounting Level 3/series 4-2009Hein Linn Kyaw100% (5)

- 2011 LCCI Accounting IAS Level-3 Series 2 (Code 3902)Documento17 pagine2011 LCCI Accounting IAS Level-3 Series 2 (Code 3902)Hon Loon Seum100% (6)

- Book Keeping & Accounts/Series-3-2007 (Code2006)Documento11 pagineBook Keeping & Accounts/Series-3-2007 (Code2006)Hein Linn Kyaw100% (3)

- Book Keeping and Accounts Model Answer Series 3 2014Documento13 pagineBook Keeping and Accounts Model Answer Series 3 2014cheah_chinNessuna valutazione finora

- Book-Keeping & Accounts Level 2/series 3 2008 (Code 2007)Documento15 pagineBook-Keeping & Accounts Level 2/series 3 2008 (Code 2007)Hein Linn Kyaw100% (3)

- 2006 LCCI Level 2 Series 2Documento16 pagine2006 LCCI Level 2 Series 2mandyc_2650% (2)

- Book-Keeping & Accounts Level 2/series 2 2008 (Code 2007)Documento12 pagineBook-Keeping & Accounts Level 2/series 2 2008 (Code 2007)Hein Linn KyawNessuna valutazione finora

- 2010 LCCI Level 3 Series 2 Model Answers (Code 3012)Documento9 pagine2010 LCCI Level 3 Series 2 Model Answers (Code 3012)mappymappymappyNessuna valutazione finora

- Management Accounting Level 3/series 4 2008 (3024)Documento14 pagineManagement Accounting Level 3/series 4 2008 (3024)Hein Linn Kyaw50% (2)

- Accounting (IAS) Level 3/series 4-2009Documento14 pagineAccounting (IAS) Level 3/series 4-2009Hein Linn KyawNessuna valutazione finora

- Management Accounting/Series-4-2011 (Code3024)Documento18 pagineManagement Accounting/Series-4-2011 (Code3024)Hein Linn Kyaw100% (2)

- Certificate in Advanced Business Calculations Level 3/series 3-2009Documento18 pagineCertificate in Advanced Business Calculations Level 3/series 3-2009Hein Linn Kyaw100% (10)

- Management Accounting Level 3: LCCI International QualificationsDocumento14 pagineManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw50% (2)

- Accounting (IAS) Level 3/series 2 2008 (Code 3902)Documento17 pagineAccounting (IAS) Level 3/series 2 2008 (Code 3902)Hein Linn Kyaw100% (6)

- 2009 S3 Ase2007Documento15 pagine2009 S3 Ase2007May CcmNessuna valutazione finora

- ASE20104 Examiner Report - March 2018Documento20 pagineASE20104 Examiner Report - March 2018Aung Zaw HtweNessuna valutazione finora

- Book-Keeping and Accounts Level 2Documento16 pagineBook-Keeping and Accounts Level 2Hein Linn Kyaw87% (15)

- Management Accounting Level 3/series 4 2008 (3023)Documento14 pagineManagement Accounting Level 3/series 4 2008 (3023)Hein Linn KyawNessuna valutazione finora

- Management Accounting Level 3: LCCI International QualificationsDocumento17 pagineManagement Accounting Level 3: LCCI International QualificationsHein Linn Kyaw100% (2)

- Cost Accounting Level 3/series 4 2008 (3016)Documento20 pagineCost Accounting Level 3/series 4 2008 (3016)Hein Linn Kyaw0% (1)

- Certificate in Management Accounting Level 3/series 3-2009Documento15 pagineCertificate in Management Accounting Level 3/series 3-2009Hein Linn Kyaw100% (2)

- Accounting (IAS) /series 4 2007 (Code3901)Documento17 pagineAccounting (IAS) /series 4 2007 (Code3901)Hein Linn Kyaw0% (1)

- Code 2006 Accounting Level 2 2001 Series 2Documento22 pagineCode 2006 Accounting Level 2 2001 Series 2apple_syih100% (3)

- Book Keeping and Accounts Level 2 Model Answers Series 4 2013Documento11 pagineBook Keeping and Accounts Level 2 Model Answers Series 4 2013Angelina Papageorgiou100% (1)

- Management Accounting: Level 3Documento16 pagineManagement Accounting: Level 3Hein Linn Kyaw100% (1)

- Cost Accounting Level 3/series 2 2008 (Code 3016)Documento18 pagineCost Accounting Level 3/series 2 2008 (Code 3016)Hein Linn Kyaw67% (3)

- Cost Accounting Level 3/series 2-2009Documento17 pagineCost Accounting Level 3/series 2-2009Hein Linn Kyaw100% (5)

- Management Accounting: Level 3Documento16 pagineManagement Accounting: Level 3Hein Linn KyawNessuna valutazione finora

- Book Keeping and Accounts Past Paper Series 2 2011Documento6 pagineBook Keeping and Accounts Past Paper Series 2 2011Aggelos Ispirli0% (1)

- 025 Za 2010Documento13 pagine025 Za 2010gurpreet_mNessuna valutazione finora

- Accounting-2009 Resit ExamDocumento18 pagineAccounting-2009 Resit ExammasterURNessuna valutazione finora

- Solution Past Paper Higher-Series4-08hkDocumento16 pagineSolution Past Paper Higher-Series4-08hkJoyce LimNessuna valutazione finora

- Lcci Level3 Solution Past Paper Series 3-10Documento14 pagineLcci Level3 Solution Past Paper Series 3-10tracyduckk67% (3)

- ABE Dip 1 - Financial Accounting JUNE 2005Documento19 pagineABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- Accounting ApplicationsDocumento8 pagineAccounting Applicationsaumit0099Nessuna valutazione finora

- Accounting/Series 4 2007 (Code3001)Documento17 pagineAccounting/Series 4 2007 (Code3001)Hein Linn Kyaw100% (2)

- 9706 w10 QP 41Documento8 pagine9706 w10 QP 41Diksha KoossoolNessuna valutazione finora

- 2009-Financial Reporting Main EQP and CommentariesDocumento46 pagine2009-Financial Reporting Main EQP and CommentariesBryan SingNessuna valutazione finora

- Advanced AccountingDocumento13 pagineAdvanced AccountingprateekfreezerNessuna valutazione finora

- QuestionsDocumento7 pagineQuestionsMyra RidNessuna valutazione finora

- Ms 4Documento2 pagineMs 4Dickie SangmaNessuna valutazione finora

- Accounting/Series 3 2007 (Code3001)Documento18 pagineAccounting/Series 3 2007 (Code3001)Hein Linn KyawNessuna valutazione finora

- 001 1-1gbr 2002 Dec QDocumento14 pagine001 1-1gbr 2002 Dec QArun KarthikNessuna valutazione finora

- Financial Accounting December 2009 Exam PaperDocumento10 pagineFinancial Accounting December 2009 Exam Paperkarlr9Nessuna valutazione finora

- 2010 LCCI Level 3 Series 2 Question Paper (Code 3012)Documento8 pagine2010 LCCI Level 3 Series 2 Question Paper (Code 3012)mappymappymappyNessuna valutazione finora

- Insert Source Booklet Jan 09 6001Documento12 pagineInsert Source Booklet Jan 09 6001Yue Ying0% (1)

- 20jan2009 PDFDocumento16 pagine20jan2009 PDFAnonymous 08s0UFNessuna valutazione finora

- 9706 31 Insert M J 20Documento8 pagine9706 31 Insert M J 20chirag mehtaNessuna valutazione finora

- Accounting Dec 2007 Part1Documento13 pagineAccounting Dec 2007 Part1AR SikdarNessuna valutazione finora

- AC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and CommentariesDocumento59 pagineAC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and Commentaries전민건Nessuna valutazione finora

- Financial Accounting Fundamentals May 2011Documento6 pagineFinancial Accounting Fundamentals May 2011Kofi EwoenamNessuna valutazione finora

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocumento25 pagineCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNessuna valutazione finora

- Accounting Treatment of DepreciationDocumento5 pagineAccounting Treatment of Depreciationwebsurfer755100% (3)

- Source Booklet Jan 09 6001Documento12 pagineSource Booklet Jan 09 6001MashiatUddinNessuna valutazione finora

- Landed Costs in JDEDocumento21 pagineLanded Costs in JDERatish Kumar GuptaNessuna valutazione finora

- MBBsavings - 160149 237706 - 2022 10 31 PDFDocumento4 pagineMBBsavings - 160149 237706 - 2022 10 31 PDFbrendapriscilaNessuna valutazione finora

- CL Ka and SolutionsDocumento4 pagineCL Ka and SolutionsInvisible CionNessuna valutazione finora

- RBI Master Circular On RestructuringDocumento120 pagineRBI Master Circular On RestructuringHarish PuriNessuna valutazione finora

- AP QuizzerDocumento9 pagineAP QuizzerAngel TumamaoNessuna valutazione finora

- Sos - October 2018Documento26 pagineSos - October 2018Lilia Villarin DoradoNessuna valutazione finora

- Cash and Cash Equivalents (Problems)Documento9 pagineCash and Cash Equivalents (Problems)IAN PADAYOGDOGNessuna valutazione finora

- NCERT Solutions For Class 11 Accountancy Chapter 10 Financial Statements - 2Documento90 pagineNCERT Solutions For Class 11 Accountancy Chapter 10 Financial Statements - 2Badal singh ThakurNessuna valutazione finora

- Oartnership: AccouDocumento1 paginaOartnership: AccouShoyo HinataNessuna valutazione finora

- Perpetual Answer KeyDocumento15 paginePerpetual Answer KeyAngel AmbrosioNessuna valutazione finora

- Chapter 7 SolutionsDocumento33 pagineChapter 7 SolutionsDwightLidstrom100% (1)

- LN 10.5 Tfcmgug En-UsDocumento128 pagineLN 10.5 Tfcmgug En-UstomactinNessuna valutazione finora

- Fabm 2-4.PDF SceDocumento23 pagineFabm 2-4.PDF SceJerwinasmr TabujaraNessuna valutazione finora

- I - Identify The Following Accounts As A. Assets, Liabilities, Capital, Revenue, Expense, Other Income B. Debit or Credit C. Nominal or Real AccountDocumento2 pagineI - Identify The Following Accounts As A. Assets, Liabilities, Capital, Revenue, Expense, Other Income B. Debit or Credit C. Nominal or Real AccountAries KeiffNessuna valutazione finora

- Sap IcbDocumento9 pagineSap IcbBhupendra KumarNessuna valutazione finora

- Extra Questions - Financial Statements (Final Accounts) - Everonn - Class-11th CommerceDocumento26 pagineExtra Questions - Financial Statements (Final Accounts) - Everonn - Class-11th Commerceganesh86.1250% (4)

- Small Business Accounting GuideDocumento30 pagineSmall Business Accounting GuideKamlesh Singh100% (1)

- Ibs Jitra 1 30/06/20Documento9 pagineIbs Jitra 1 30/06/20Aizat Sera SuwandiNessuna valutazione finora

- GB DGNGDocumento26 pagineGB DGNGabhishek georgeNessuna valutazione finora

- Cost Accounting Prestest 2Documento19 pagineCost Accounting Prestest 2aiswiftNessuna valutazione finora

- MFI Audit Course Manual1Documento39 pagineMFI Audit Course Manual1Amandeep SinghNessuna valutazione finora

- Pacalna - Accounting Cycle ActivityDocumento35 paginePacalna - Accounting Cycle ActivityAnifahchannie PacalnaNessuna valutazione finora

- Money and Banking ProjectDocumento11 pagineMoney and Banking Projectshahroze ALINessuna valutazione finora

- Bir RR 12-2003Documento10 pagineBir RR 12-2003HjktdmhmNessuna valutazione finora

- Partnership Exam PaperDocumento9 paginePartnership Exam PaperZahid Hussain KhokharNessuna valutazione finora

- Bank Statement 4Documento4 pagineBank Statement 4Jardan Nelli86% (7)

- Auditing Problem For Shareholder's EquityDocumento14 pagineAuditing Problem For Shareholder's Equityblack hudieNessuna valutazione finora

- 2014 3016 Midterm Departmental ExamDocumento14 pagine2014 3016 Midterm Departmental ExamPatrick ArazoNessuna valutazione finora

- Balance of Payments: Chapter ThreeDocumento36 pagineBalance of Payments: Chapter ThreeHu Jia QuenNessuna valutazione finora

- Department of Veterinary &: A.H. Extension EducationDocumento21 pagineDepartment of Veterinary &: A.H. Extension Educationdahiphale1Nessuna valutazione finora