Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

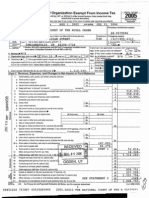

Atty MTG $51K 050401

Caricato da

api-3727794100%(3)Il 100% ha trovato utile questo documento (3 voti)

23 visualizzazioni10 pagineCopyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

100%(3)Il 100% ha trovato utile questo documento (3 voti)

23 visualizzazioni10 pagineAtty MTG $51K 050401

Caricato da

api-3727794Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 10

) = Wb EY

INSTR # 2001122856

--OR-BK 10746 PG 0683

worloaleales | (IF |

USAA FEDERAL SAVINGS BANK TOC TAL PDIF.S.201.08) 178,50

AFEDERALLY CHARTERED, nn ASSOCIATION INT. TAX PD(F.S.195) 108,00

HOME EQUITY LOAN SERVICING ieabiddeceeth deck cad

SAN ANTONIO, TX 78288-0558

5

‘This Mortgage prepared by:

Name Sonia J. Fuentes, Loan Closer

‘Company USA Federal Savings Bank

‘Address: 10750 McDermott Freeway, San Antonio, TX 78288

MORTGAGE

FOR USE WITH SECURED REVOLVING CREDIT AGREEMENT

MAXIMUM LIEN. The total amount of indebtedness secured by this Mortgage may decrease or increase

from time to time, but the maximum amount of principal indebtedness which may be outstanding at any one

time shall not exceed $51,000.00., plus interest, and amounts expended or advanced by Lender for the

payment of taxes, levies or insurance on the Property, and interest on such amounts.

THIS MORTGAGE dated Apni 5, 2001, is made and executed between Jay Fleleher, whose address Is 4810

Juno Street, Tampa, FL 33629 and Martha Ann Fleisher, his wife, whose address is 4810 Juno Street,

Tampa, FL. 33629 (referred ta below as "Grantor") and USAA FEDERAL SAVINGS BANK , whose address is

10750 McDERMOTT FREEWAY, HOME EQUITY LOAN SERVICING, SAN ANTONIO, TX. 78286-0558 (referred

to below as "Lender")

GRANT OF MORTGAGE For valuable consideration, Grantor morgages to Lorde a of Grantor's rg te, and nest and tothe

{otowng deserved real propery togetner wih al ening of avosequeniy erected or afted buldngs, mprovernents a fais, al semen,

12a al one nats ones and poi tsng loth fa propor nud watou latch a rrease ges, gear and Sa

trates, the *Real Properly’) located th Hillsborough County, State of Flond ee

See Exnlbit "A", which i attached to this Mortgage and made a part ofthis Morigage as if fully set forth

He bee or its address is commonly known as 4810 Juno Street, Tampa, FL 33629. The Real

ox Wendreation number i f2TBNrOo00. :

mevouwne LINE OF CREDIT Specifically, in addition to the amounts specitied In the Indebtedness definition, and without limitation,

{hls Mortgage secures @ revolving ine of cea under whlch upon request by Grantor, Lender, within twenty (20) years fom the date of

‘his Mortgage, may make future advances to Grantor Such future advances, togemer wiin Interest thereon, are secured by this

Morigage Such advances may be made, repaid, and remade fom time to time, subject to the tinifation that the totel outstanding

‘balance owing at any one time, not including finance charges on such balance ata fixed oF variable rate or sum as provided In the Credit

‘Agreement, any temporary overages, other charges, and any amounts expended or advanced as provided in elther the Indebledness

paragraph or this paragraph, shall nol exceed the Credit Limit as provided in the Credit Agreement It Is the Intention of Grentor and

Lender inat this Mortgage secures the balance outslanding under the Credit Agreement from lime to time from zero up to the Credit Lit

28 provided in this Mortgage and any Intermediate balance

Grantor presenty assigns to Lender sll of Grantor's nght, the, and nlerest in and to all present and future leases of the Propedy and all Rens

‘tom the Proparty In additon, Grantor grants to Lender a Unform Commercial Code sacunty interest n the Personal Property and Rents

THIS MORTGAGE, INCLUDING THE ASSIGNMENT OF RENTS AND THE SECURITY INTEREST IN THE RENTS AND PERSONAL

_ PROPERTY, IS GIVEN TO SECURE (A) PAYMENT OF THE INDEBTEDNESS AND (®) PERFORMANCE OF EACH OF GRANTOR'S

JM

) BK\10746 PG 0684

TGAGE_

SE A ADV =

AGREEMENTS AND OBLIGATIONS UNDER THE CREDIT AGREEMENT, THE RELATED DOCUMENTS, AND THIS MORTGAGE THIS

MORTGAGE 18 GIVEN AND ACCEPTED ON THE FOLLOWING TERMS.

PAYMENT AND PERFORMANCE Excep! as otherwise provided in he Mortgage, Grantor shall py lo Londer al! amounts secured by ts

Motoag as they become due and shal sty pererm alot Grariars obigatone under is Mtgage

POSSESSION AND MAINTENANCE OF THE PROPERTY. Granlor agrees that Granlor’s possession and use of the Property shall be governed

by the felowing prowsions.

Possession and Use Uni Grantor’ interest m any or al of he Property is foracosed, Grantor may (1) remain in possession and contol

‘oF the Property, (2) uso, operate or manage the Property and (3) collec the Rents om the Property

Duly to Maintain. Grantor shall main the Property in good eondtion and promptly perform all repars, replacements, and mamtenance

necessary to preserve is value

Compliance With Environmental Laws Grantor represents and warrans to Lender that (1) Dunng the pened of Grantor's ownership of

{he Property, there has been no use, generaton, manulacture, storage, Weament, csposa,releaso or threatened rolease of any Hazardous

‘Substance by any person on, under, about or from the Property, (2) Grantor has no knowlodge of, or reason to beheve that there has been,

except as prewously disclosed lo and acknowedged by Lender in wriing, (g) ary breach or wolahon of any Envronmenal Lav, (0) any

se, generaton, manulactue, storage, treatment, disposal, release or thralened release of any Hazardous Substance on, under, about or

‘10m the Properly by any pir owners or occupants ofthe Property, of (c) any actual of threatened iigation or clams of any kind by any

Person relating fo such mater, and (3) Except as proviously asclosod fo and acknowledged by Lender m wring, (a) nellher Grantor nor

ny tenant, contractor, agent of other auhonzed user ofthe Property shall use, general, manufacture, sior, Wea, depose of or release any

Hazardous Substance on, under, about or from the Property, and (b) any such actly shal be conducted n.comphance wit al applicable

federal, sat, and local laws, regulatons and ordinances, including without hmtaton all Enwonmental Laws. Granlor aulhorzes Lander and

{ts agents to enter upon the Property to make such inspections and tesis, at Grantor's expers9, as Longer may doom appropnata to

determine complance of the Property with this section of the Morigage Any iepections or tests made by Lender shall be for Lender's

purposes ony and shall not be construed to creata any responsibity oF labilty on the part of Lender to Grantee of to any other person” The

Tepresentatons and warranties contained herain are based on Grantor's due cityence in investigating the Properly for Hazardous

Substanoas Grantor hereby (1) releases ang waves any ture clarms aganst Londer for idomaty or contnbution 1 the avent Grant

becomes ible for cleanup or olher costs under any such laws, and (2} agrees lo mdemaly and hod harmless Lender against any and ah

clams, lose, tabites, damages, penals, and expanses which Lendec may arecty or inaectly sustan or sulferreeullng Kom a breach

Of this section of the Mortgage or as a consequence of any use, generation, manulacture, storage, disposal, release or threatened release

‘curing pnor to Grantor’ ownership or interest nthe Property, whether or not the same was oF shoud have een known fo Grantor The

‘rowsions of ths section of the Mortgage, nciuding the obbgahon to indemnty, shall surwve the payment of the Indebledness and the

‘salsfacton and reconveyance ofthe hen of ths Morigage and shall nol be afeciad by Lender's acqusston of any iferest inthe Property,

whether by foreclosure or otherwse

\Nulsance, Waste Grantor shall not cause, conduct or pormt any nursance nor commit, perm, oF suffer any stapping of or Waste on or to

{he Property of any portion of the Properly Without liibng tha generaity ofthe foregang, Grantor wit not remove, oF grant fo any other

‘party the rght to remove, any tmber, minerals (miuding cl and gas), coal, cay, 2008, sot, gravel or rock products without Lender's pror

‘wnt consent

Removal of improvements Grantor shall not demoish oF remove any improvements fom the Real Propetty without Lendo’s pnor wniten

Consent” As a condition tothe removal of any Improvements, Lender may require Grantor to make arrangements satstactory to Lender 10

‘piace such Improvements vath Improvements of atleast equal value

‘Lender's Right to Eater Lender and Lender's agents and representatives may enter upon the Real Property at al reasonable tes to

tind fo Lancs mre an fe mepec tho Rl Property fr uraee of Granorsconplance wn he fr and sono of as

Subsequent Liens. Grantor shall not allow any subsequent hens or mortgages on all or any portion of the Property wahout the pnor wniten

‘consent of Lender

Compliance with Governmental Requirements. Grantor shall promptly comply wih all laws, ordinances, and regulations, now oF hereafter

im effet, ofall governmental authorttes applicable to the use or occupancy ofthe Property. Grantor may contest mn good fath ary such lav,

‘ordinance, or fegulahon and withhold comphance dunng any proceeding. indudg approprale appeals, so long as Grantor has noted

Lender in writng prior to doing £9 and 80 long as, in Lenders sole opinion, Lenders interes in ihe Property ae not jeopardized Lender

‘may requre Granter to post adequate securty ora surely bond, reasonably sabstactory to Lender, o prolect Lender's interest

Duly to Protect Grantor agrees nother fo abandon nor leave unationded the Property Grantor shal do all ther acs, n adton to those

‘a's et forth above in tis section, whieh from the charactor and use ofthe Property ae reasonably necessary lo protect and preserve the

Property

DUE ON SALE ~ CONSENT BY LENDER. Londer may, at Londo’s option, deciaro immediately due and payable al sums secured by ths

‘Merigage upon the sale or transfor, wihout Lenders prec weten consant, of al or any part of the Real Property, o ary iterest in the Real

Property "sale oc transfor" means the conveyance of Real Property or any night, tite or inirest in tha Real Property, whather legal, benef ial or

fequtable, whether voluntary or voluntary, whalher By ought sale, deed, ntalment sale Contac, land contract, conract fr deed, leasehold

‘nforst vith a tarm greater than three (3) Years, loase-opton contact, or by sale, assignmort, of transfer of any bonetioalinerest in of to ary

Jana trust holding tite lo the Real Property, or by any other method ef conveyance of an interest in the Real Properly However, ths option shal

‘nol be exereed by Lender if such exorese is profited by federal law or by Flonda law

‘TAXES AND LIENS. The follownng prousions relating tothe taxes and ens on the Property are part of ths Mortgage

Ss TSS ny Tt TS SS

Payment Grartor shal pay when due (and in all events por to dolnquoncy) al taxes, payrol taxes, special taxes, assessments, watr

charges and sewer serace charges lowed agar rn account ofthe Property ad shal pay wen deal came for work Gone oh oor

Servees rendered or malenalfumshed tothe Property” Grantor shal malrtan the Property fee of any ters hang priory Ove o eau f0

therrrast of Lender uncer ths Mortgage, excep forthe Besing Indeblednes rated Ton this Monga or howe fens special) reo

tom wntng by Lender, end excopt ov tn tn of taxes and ascessmants act de as futher spetiedn the Fah to Contest paragraph

‘Right to Contest Grantor may witnhold payment of any tax, assessmont, or clam in connacton wth @ good fath depute over the

‘bigation to pay, so long as Lender's inloest nthe Property isnot jeopardized I! allen arses o's fled a8 a resul of nonpayment, Grant

‘hall within flen (18) days after the ten anses of @ Hen is ted, wihin teen (15) days after Grantor has nate of to flng,eecure the

‘ischargo ofthe bon, orf requested by Lender, depos with Lender cash or a suffoent corporate surely bond or other secunly saslactory

to Lender in an amount suffcent lo discharge ine len plus ary costs and Lender's reasonable atlomeye’ fovs, or other chargee thal coud

‘acerue a a resull ofa forectosure or sale under the ken In any cortesl, Grantor shall defend fell and Lender and shall salsfy any adverse

Judgment before enforcamnt against the Property Grantor shall name Lender as an additonal abigee under any surely Bond furnshed in

‘he conlest preoeoainge

Evidence of Payment Grantor shall upon demand turish to Lender satstactory evidence of paymant ofthe taxes oF assessments and shal

‘authonze the appropnate governmental oficial to dever to Lender at any be a witten slalement of the taxes and assessmenis agai! the

Notice of Construction Grantor shall noty Lender al leas! feen (15) days before any work ws commenced, any servoss are furnished, oF

any matenals are supplied to tho Property, i any mechani’ ban, matenalmen's lon, or other len could be asterted on aczount ef the work,

‘seraces, or matenalsGranlor wil yoon request of Lencer furnish to Lender advance assurances salistactry to Lender thal Grantor can and

‘il pay he cost of such improvements

PROPERTY DAMAGE INSURANCE The folowing provsions ceang lo wsunng the Property area part o ths Mortgage

Maintenance of insurance Grantor shall procure and mainten pobtes offre insurance with slandard extandad coverage endorsements

(on @ replacement basss for the full insurable value covenng all Improvements on the Real Property in an amount eufeant 10 avoid

application of any coinsurance clause, and wiih a standard mortgages clause n favor of Lender Polos shall be unten by such msurance

‘companes and in such form as may be reasonably aoceptable to Lender Grantor shal deliver to Lender cortoatos of coverage from each

{nsurer contaning a stpulabon that coverage wil aot be canceled or imunished wihout a manumum offen (10) days’ pnor writen notice (0

[Lender and not containng any csclamer of the insures habity for falure to gia such notce Each insurance poly also shal include an

‘endorsement providing thal coverage in favor of Lender wil not be impaired in any way by any act, omission oF default of Grantor or any

‘ther person |The Real Property iso willbe located in an area designeted by the Drrector of the Federal Emargeney Management Agency

‘a5 a specsl flood hazard area Grantor agrees to oblan and mairian Federal Flood Insurance, # availabe, forthe ful Unpad prnoipal

balance of the loan and any pnor tens on the property sacunng the loan, up to the maxim pokcy Wms cet under the National Flood

Insurance Program, or as otherwise requred by Lender, and to maintain such msurance forthe term of he loan

‘Appltcation of Proceeds Grantor shall promptty notty Lendar of any loss or damage to the Property Lender may make proot of loss #

Grantor fas to do'so witun fieen (15) days ofthe casually Whether or nol Lender's sectrty s mpared, Lender may, at Lender's electon,

‘eceve and relaia the proceeds ofan insurance and apply the proceeds tothe reduction of he Indebtedness, payment of any en afectng

the Property, or he restoration and repair of the Property If Lender elects to apply the proceeds to restoreton and repar, Grantor shal

‘epar oF replace he damages or destroyed Improvements na manner satelactory To Lender Lander shal, ypon salstactory proot ct such

‘expenditure, pay or rermburee Grantor kom the proceeds fr the reasonable cost of ropat of restoraon # Grantors not deta under tes

Morigage Any proceeds whsch have not been asbursed within 160 days afer ther receipt and which Lenaar has not committed o the

repar oF restoraton ofthe Property shall be used frst fo pay any amount owing fo Lender under Cys Mortgage, then to pay accrued infeaet,

and the remainder, f any, shall be appled fo the principal balance of the Indebtedness. If Lender holds any proceeds afer payment in Kil of

the Indebtedness, such proceeds shal be paid to Grantor as Grantor's merests may appear

‘Unexpired insurance at Sale. Any unexpred insurance shall nure to the beret ot, and pass to, the purehacer of he Property covered by

‘ths Mortgage al any rustee's sale or other sale eld under the provsions ofthis Mortgage, of at any foreclosure sale f such Property

Compliance with Existing Indebtedness Dunng the perod in which any Exstng Indebledness descnbed below 1s n effec, complance

with the msurance provsions contained in the instrument evidencing such Exsing Indebledness shall constivie complance wih the

insurance provisions under ths Mortgage, 1 tho extent compiance withthe terms of this Morigage Would corsiiuis @ dupteation of

‘surance requarement If any proceeds Fom the insurance become payable on loss, the provisions ints Morigage for dson of proceeds

‘shal apply only to that portion ofthe proceeds not payable tothe holder ofthe Exsbng Indabledness

LENDER'S EXPENDITURES. 1! Grantor fais (A) to hoop the Property tree of all tas, tars, secuny interests, enoumbrances, and other cams,

{®) 10 promde any requrad surance on the Property, (C) to make repars to the Property orto comply wih any obligation Yo maitzin Exstng

Indebtedness n good standing as requred below, in Lender may do's0_ If any action ar proceeding s Commencad thal would mater atect

Lender's inerests in the Property, Uien Lender on Grantors behalf may, butts not requred to, lake any acton that Lender betoves to be

propriate to protect Lender's ntrests

WARRANTY; DEFENSE OF TITLE” The flowing prowsions relating fo ownership ofthe Property are a part of ths Mortgage

“Title. Grantor warrants that (a) Grantor holds good and marketable tle af racard fo the Property in fee simple, foe and clear of al hans

land encumbrances otter than those set ferth inthe Real Property descnplion or in the Existing Indebledness section below or in any tile

‘surance polcy, ile report, or fina tile opinion issued in favor of, and acceplad by, Lender in cennecton wih ths Morgage, and (b)

‘Grantor has the full nght, power, and authonty te execute and dalver this Morigage fo Lender

Defense of Tite Subject o the excepbon in the paragraph above, Grantor warrants and wil forever defend the tile to the Property aganst

‘the lawl caims of ai persons In tha event any acton or proceeding = commenced thal questions Grantors We or tne inlorest of Lender

Potrebbero piacerti anche

- 2005 501c10 Jesters Court 113Documento6 pagine2005 501c10 Jesters Court 113api-3727794100% (3)

- Jesters 2006 501c10 Summerville Court 113Documento7 pagineJesters 2006 501c10 Summerville Court 113api-3727794100% (3)

- CEO $100K Sat 070203Documento1 paginaCEO $100K Sat 070203api-3727794100% (3)

- Ceo $100K 060802Documento7 pagineCeo $100K 060802api-3727794100% (3)

- Atty SAT $51K 071201Documento1 paginaAtty SAT $51K 071201api-3727794100% (4)

- 501c10 2003 990Documento12 pagine501c10 2003 990api-3727794Nessuna valutazione finora

- 501c3 2006 990Documento22 pagine501c3 2006 990api-3727794Nessuna valutazione finora

- 501c10 2004 990Documento11 pagine501c10 2004 990api-3727794Nessuna valutazione finora

- 2005 501 C 10Documento14 pagine2005 501 C 10api-3727794Nessuna valutazione finora

- 501c3 2005 990Documento19 pagine501c3 2005 990api-3727794Nessuna valutazione finora