Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Form 16 Excel

Caricato da

api-372756271%(7)Il 71% ha trovato utile questo documento (7 voti)

16K visualizzazioni2 pagineThis document is a Form 16 issued by an employer to an employee. It summarizes the details of salary paid and taxes deducted at source from the employee's salary during a given period.

The form provides details such as gross salary, allowances exempt from tax, deductions claimed, total income chargeable to tax, tax deducted and deposited with the government. It certifies that taxes have been deducted from the employee's salary and deposited with the central government within the specified time period. The purpose of the form is to provide proof to the employee that taxes have been deducted at source from their salary by their employer.

Descrizione originale:

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

XLS, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document is a Form 16 issued by an employer to an employee. It summarizes the details of salary paid and taxes deducted at source from the employee's salary during a given period.

The form provides details such as gross salary, allowances exempt from tax, deductions claimed, total income chargeable to tax, tax deducted and deposited with the government. It certifies that taxes have been deducted from the employee's salary and deposited with the central government within the specified time period. The purpose of the form is to provide proof to the employee that taxes have been deducted at source from their salary by their employer.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

71%(7)Il 71% ha trovato utile questo documento (7 voti)

16K visualizzazioni2 pagineForm 16 Excel

Caricato da

api-3727562This document is a Form 16 issued by an employer to an employee. It summarizes the details of salary paid and taxes deducted at source from the employee's salary during a given period.

The form provides details such as gross salary, allowances exempt from tax, deductions claimed, total income chargeable to tax, tax deducted and deposited with the government. It certifies that taxes have been deducted from the employee's salary and deposited with the central government within the specified time period. The purpose of the form is to provide proof to the employee that taxes have been deducted at source from their salary by their employer.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato XLS, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

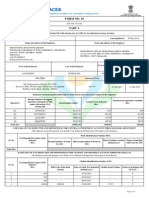

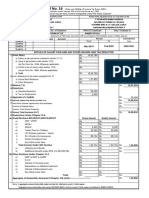

FORM NO.

16 Certificate under section 203 of the Income-tax Act,

[See rule 31 (1) (a)] 1961 for tax deducted at source from income

chargeable under the head "Salaries"

Name and Address of the Employer Name & Designation of the

Employee

PAN/GIR No. TAN PAN/GIR No.

TDS Circle where Annual Return/Statement under section PERIOD Assessment Year

206 is to filed

DETAILS OF SALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTION

1. GROSS SALARY* Rs.

2. Less: Allowance to the extent

exempt under section 10

U/s 10(13A) Rs.

U/s 10(14) Rs. Rs. -

3. BALANCE (1-2) Rs. -

4. DEDUCTIONS:

(a) Standard deduction Rs. -

(b) Entertainment allowance Rs.

(c) Tax on Employment Rs.

5. AGGREGATE OF 4 (a to c) Rs. -

6. INCOME CHARGEABLE UNDER

THE HEAD SALARIES (3-5) Rs. -

7. ADD Any other income reported

by the employee Rs. -

8. GROSS TOTAL INCOME (6+7) Rs. -

9. DEDUCTIONS UNDER CHAPTER

VI - A GROSS QUALIFYING DEDUCTIBLE

AMOUNT AMOUNT AMOUNT

(a) Rs - Rs. - Rs. -

(b) Rs - Rs. - Rs. -

(c) Rs - Rs. - Rs. -

(d) Rs - Rs. - Rs. -

10. Aggregate of deductible amount

under Chapter VI - A Rs. -

11. TOTAL INCOME (8-10) Rs. -

12. TAX ON TOTAL INCOME Rs. FALSE

13. REBATE AND RELIEF UNDER

CHAPTER VIII

I. UNDER Section 88 (please specify)

GROSS QUALIFYING TAX REBATE/

AMOUNT AMOUNT RELIEF

(a) Rs. Rs.

(b) Rs. Rs.

(c) Rs. Rs.

(d) Rs. Rs.

(e) Rs. Rs.

(f) TOTAL [(a) to (e)] Rs. Rs.

II. Under Section 88 B (please specify)

GROSS QUALIFYING

AMOUNT AMOUNT

(a) Rs. Rs.

(b) Rs. Rs.

(c) TOTAL [(a) + (b)] Rs. Rs. Rs.

III. Under section 89 (attach details) Rs.

14. AGGREGATE OF TAX REBATES

AND RELIEF AT 13 ABOVE

[I (f) + II (c) + III] Rs.

15. TAX PAYBALE (12 - 14) AND

SURCHARGE THEREON Rs.

16. LESS TAX DEDUCTED AT

SOURCE Rs.

17. TAX PAYBLE /REFUNDABLE

(15 -16) Rs.

DETAILS OF TAX DEDUCTED AND DEPOSITED INTO CENTRAL GOVERNMENT ACCOUNT

AMOUNT (Rs.) DATE OF PAYMENT NAME OF BANK & BRANCH WHERE TAX DEPOSITED

Certified that a sum of Rs. (in words) has been deducted at

source and paid to the credit of the Central Government. Further certified that the above information is true and

correct as per records.

…………………………………………………

Signature of person responsible for deduction

of tax

Place: Delhi Full Name:

Date……………. Designation:

*See section 15 & 17 and rule 3. Furnish separate details of value of perquisites and profits in lieu of or in addtion to

salary or wages

Potrebbero piacerti anche

- Form 16 Excel FormatDocumento12 pagineForm 16 Excel Formatankeet3Nessuna valutazione finora

- Form 16 FormatDocumento2 pagineForm 16 FormatParthVanjaraNessuna valutazione finora

- Form 16 651746Documento4 pagineForm 16 651746Arslan1112Nessuna valutazione finora

- LTA Declaration Form Form 12BBDocumento3 pagineLTA Declaration Form Form 12BBAmitomSudarshanNessuna valutazione finora

- Form No. 16: Part ADocumento5 pagineForm No. 16: Part APunitBeriNessuna valutazione finora

- ESI Declaration Form1Documento4 pagineESI Declaration Form1నీలం మధు సూధన్ రెడ్డిNessuna valutazione finora

- AS-20 QuestionDocumento7 pagineAS-20 QuestionDeepthi R TejurNessuna valutazione finora

- LSCC Final Bill CC Form - Payments - ChequeDocumento5 pagineLSCC Final Bill CC Form - Payments - ChequethareshkumarNessuna valutazione finora

- Sample Filled EPF Composite Declaration Form 11Documento2 pagineSample Filled EPF Composite Declaration Form 11Varalakshmi SharanNessuna valutazione finora

- Form 16Documento4 pagineForm 16Aruna Kadge JhaNessuna valutazione finora

- Investment Declaration Form F.Y 2023-24Documento4 pagineInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Form GST ASMT - 11 - NNNNNDocumento2 pagineForm GST ASMT - 11 - NNNNNGovindNessuna valutazione finora

- Job No.: #67123: National Highways Authority of IndiaDocumento34 pagineJob No.: #67123: National Highways Authority of IndiaBal RajNessuna valutazione finora

- Accenture Form 16Documento7 pagineAccenture Form 16Srikrishna PadmannagariNessuna valutazione finora

- PFguidlines &forms For Mphasis &finsource EmployeesDocumento10 paginePFguidlines &forms For Mphasis &finsource EmployeesBinoy Xavier RajuNessuna valutazione finora

- SIM-42 B Oriental Bank of Commerce Stock StatementDocumento4 pagineSIM-42 B Oriental Bank of Commerce Stock StatementkapilgsmNessuna valutazione finora

- TA Bill FormatDocumento4 pagineTA Bill FormatBikee Yadav100% (1)

- Telephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaDocumento3 pagineTelephone Number: +91 141 267 0101, Facsimile Number: +91 141 267 0303 Amber Fort Road, Opposite Jal Mahal, Jaipur, 302002, IndiaRamnish MishraNessuna valutazione finora

- CPT Accounts Question PaperDocumento11 pagineCPT Accounts Question PaperNikhil Boggarapu100% (1)

- Self-Declaration For Claiming Housing Loan Principal & Interest BenefitDocumento1 paginaSelf-Declaration For Claiming Housing Loan Principal & Interest Benefitinkedin linkedinNessuna valutazione finora

- Summary Charts Deduction Chapter ViaDocumento4 pagineSummary Charts Deduction Chapter ViaUttam Gagan18Nessuna valutazione finora

- Pay Slip ANUJDocumento1 paginaPay Slip ANUJNehal AhmedNessuna valutazione finora

- Form of Leave Account Under The Revised Leave RulesDocumento3 pagineForm of Leave Account Under The Revised Leave Rulesmohammad sibtainNessuna valutazione finora

- Chapter 8 Companies Incorporated Outside IndiaDocumento34 pagineChapter 8 Companies Incorporated Outside IndiaDeepsikha maitiNessuna valutazione finora

- Covering Letter For CLRA - HYR ReturnDocumento1 paginaCovering Letter For CLRA - HYR ReturnShiva kantNessuna valutazione finora

- LAW MCQ DArshan KhareDocumento162 pagineLAW MCQ DArshan KhareGopi NaiduNessuna valutazione finora

- Form12BB R539 Proof Submission Form PDFDocumento4 pagineForm12BB R539 Proof Submission Form PDFSiva ThotaNessuna valutazione finora

- Prime Minister's National Relief FundDocumento1 paginaPrime Minister's National Relief FundindradevhalderNessuna valutazione finora

- GratuityNominations Illustration PDFDocumento3 pagineGratuityNominations Illustration PDFvaibhaviNessuna valutazione finora

- Income Tax Residential Status PDFDocumento16 pagineIncome Tax Residential Status PDFNagesha CSNessuna valutazione finora

- Form 16 WORD FORMATEDocumento2 pagineForm 16 WORD FORMATEJay83% (46)

- Railtel Corporation of India Limited. Gstin: 27Aabcr7176C1Zd PanDocumento1 paginaRailtel Corporation of India Limited. Gstin: 27Aabcr7176C1Zd PanKhyati GuptaNessuna valutazione finora

- Application For Unfreeze Bank Account - Request L 2Documento1 paginaApplication For Unfreeze Bank Account - Request L 2Gideon LawalNessuna valutazione finora

- 1563614521775Documento1 pagina1563614521775JatinderPalNessuna valutazione finora

- Gel Form 3ca-3cdDocumento11 pagineGel Form 3ca-3cdravibhartia1978Nessuna valutazione finora

- 7th Assam Pay & Productivity Pay Commission PDFDocumento208 pagine7th Assam Pay & Productivity Pay Commission PDFSounok Kashyap50% (2)

- FORM III Annual ReturnDocumento2 pagineFORM III Annual ReturnHR kpl100% (1)

- Form 26ASDocumento3 pagineForm 26ASHarshil MehtaNessuna valutazione finora

- Red Hat Enterprise Linux 8: Upgrading From RHEL 7 To RHEL 8Documento42 pagineRed Hat Enterprise Linux 8: Upgrading From RHEL 7 To RHEL 8Richie BallyearsNessuna valutazione finora

- Tax Declaration Form 2021 22Documento4 pagineTax Declaration Form 2021 22Kasiviswanathan ChinnathambiNessuna valutazione finora

- Form No 16 - Ay0607Documento4 pagineForm No 16 - Ay0607api-3705645100% (1)

- Form 16Documento3 pagineForm 16Vikas PandyaNessuna valutazione finora

- Form 16Documento6 pagineForm 16balaramappana2Nessuna valutazione finora

- Form No 16Documento2 pagineForm No 16saran2rasuNessuna valutazione finora

- Form No 16Documento2 pagineForm No 16Anonymous 7KR8DpqNessuna valutazione finora

- Form 16Documento3 pagineForm 16ganesh_korgaonkarNessuna valutazione finora

- Tds 16 NDocumento3 pagineTds 16 Nssanju_bhatNessuna valutazione finora

- Form 16Documento2 pagineForm 16Joyal JoseNessuna valutazione finora

- Form16 BKGDocumento4 pagineForm16 BKGapi-3706890100% (2)

- Form 16 in Excel Format For AY 2020 21Documento8 pagineForm 16 in Excel Format For AY 2020 21Vikas PattnaikNessuna valutazione finora

- 38 - 16 & I6a (A.y.2009-10) With MarginalDocumento4 pagine38 - 16 & I6a (A.y.2009-10) With Marginalrajudutta11Nessuna valutazione finora

- Name and Address of The Employer Name and Designation of The EmployeeDocumento4 pagineName and Address of The Employer Name and Designation of The Employeeyogesh.b.lokhande9022Nessuna valutazione finora

- FORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedDocumento3 pagineFORM No. 16: Details of Salary Paid and Any Other Income and Tax DeductedMadhan Kumar BobbalaNessuna valutazione finora

- Form 16 Part A: WWW - Taxguru.inDocumento10 pagineForm 16 Part A: WWW - Taxguru.inAjit KhurdiaNessuna valutazione finora

- Anb Form 16 ITR (Saral II) 2010 ModelDocumento7 pagineAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967Nessuna valutazione finora

- Form 24Documento8 pagineForm 24api-3706890100% (2)

- Form16 Applicable From 01.04Documento3 pagineForm16 Applicable From 01.04Vishaal TalwarNessuna valutazione finora

- 317 Form16 (2005 06)Documento6 pagine317 Form16 (2005 06)sachin584Nessuna valutazione finora

- Proforma For Calculation of Income Tax For Tax DeductionDocumento1 paginaProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Da EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Valutazione: 3.5 su 5 stelle3.5/5 (17)

- Proforma of P&L AccountDocumento17 pagineProforma of P&L Accountapi-3727562Nessuna valutazione finora

- Bank ReconciliationDocumento2 pagineBank Reconciliationapi-3727562Nessuna valutazione finora

- How To Install Num2textDocumento3 pagineHow To Install Num2textapi-372756260% (5)

- Formulas Capital BudgetingDocumento1 paginaFormulas Capital Budgetingapi-3727562100% (2)

- Excel Formula For CADocumento61 pagineExcel Formula For CArameshritikaNessuna valutazione finora

- CstinflndxDocumento2 pagineCstinflndxapi-3727562Nessuna valutazione finora

- Budget 2008Documento7 pagineBudget 2008api-3727562Nessuna valutazione finora

- Simple Vocabulary Vs IELTS VocabularyDocumento7 pagineSimple Vocabulary Vs IELTS VocabularyHarsh patelNessuna valutazione finora

- The Wolves of The CoastDocumento10 pagineThe Wolves of The CoastJose David DíazNessuna valutazione finora

- PMMSI Vs CADocumento1 paginaPMMSI Vs CAFermari John ManalangNessuna valutazione finora

- KNOLL and HIERY, The German Colonial Experience - IntroDocumento6 pagineKNOLL and HIERY, The German Colonial Experience - IntroGloria MUNessuna valutazione finora

- Economic and Product Design Considerations in MachiningDocumento29 pagineEconomic and Product Design Considerations in Machininghashir siddiquiNessuna valutazione finora

- Percussion Catalog Eu Lep2001Documento24 paginePercussion Catalog Eu Lep2001isaac HernandezNessuna valutazione finora

- A Scale To Measure The Transformational Leadership of Extension Personnel at Lower Level of ManagementDocumento8 pagineA Scale To Measure The Transformational Leadership of Extension Personnel at Lower Level of ManagementMohamed Saad AliNessuna valutazione finora

- The Identification of Prisoners Act, 1920Documento5 pagineThe Identification of Prisoners Act, 1920Shahid HussainNessuna valutazione finora

- Drug StudyDocumento1 paginaDrug StudyBSN 3-2 RUIZ, Jewel Anne F.Nessuna valutazione finora

- Budget Anaplan Training DocumentsDocumento30 pagineBudget Anaplan Training DocumentsYudi IfanNessuna valutazione finora

- Vishnu Dental College: Secured Loans Gross BlockDocumento1 paginaVishnu Dental College: Secured Loans Gross BlockSai Malavika TuluguNessuna valutazione finora

- 4 Economics Books You Must Read To Understand How The World Works - by Michelle Middleton - Ascent PublicationDocumento10 pagine4 Economics Books You Must Read To Understand How The World Works - by Michelle Middleton - Ascent Publicationjayeshshah75Nessuna valutazione finora

- Research ProposalDocumento14 pagineResearch ProposalMhal Dane DinglasaNessuna valutazione finora

- Class 10 Science Super 20 Sample PapersDocumento85 pagineClass 10 Science Super 20 Sample PapersParas Tyagi100% (1)

- Mechanical Engineering Research PapersDocumento8 pagineMechanical Engineering Research Papersfvfzfa5d100% (1)

- DRTA-directed Reading Thinking Activity: M. Truscott Staff Development 9-24-10Documento13 pagineDRTA-directed Reading Thinking Activity: M. Truscott Staff Development 9-24-10ehaines24Nessuna valutazione finora

- Icecream ScienceDocumento6 pagineIcecream ScienceAnurag GoelNessuna valutazione finora

- Introduction To Human Resources ManagementDocumento14 pagineIntroduction To Human Resources ManagementEvan NoorNessuna valutazione finora

- Research Poster 1Documento1 paginaResearch Poster 1api-662489107Nessuna valutazione finora

- 2202 Infantilization Essay - Quinn WilsonDocumento11 pagine2202 Infantilization Essay - Quinn Wilsonapi-283151250Nessuna valutazione finora

- Choco Cherry BonbonDocumento2 pagineChoco Cherry BonbonYarina MoralesNessuna valutazione finora

- Text Al Capone B1Documento2 pagineText Al Capone B1Andjela JevremovicNessuna valutazione finora

- 띵동 엄마 영어 소책자 (Day1~30)Documento33 pagine띵동 엄마 영어 소책자 (Day1~30)Thu Hằng PhạmNessuna valutazione finora

- 01.performing Hexadecimal ConversionsDocumento11 pagine01.performing Hexadecimal ConversionsasegunloluNessuna valutazione finora

- Entrep 1st PerioDocumento5 pagineEntrep 1st PerioMargarette FajardoNessuna valutazione finora

- Frontpage: Don'T Befriend Brutal DictatorsDocumento16 pagineFrontpage: Don'T Befriend Brutal DictatorsFrontPageAfricaNessuna valutazione finora

- Part DDocumento6 paginePart DKaranja KinyanjuiNessuna valutazione finora

- IGCSE-Revision-Booklet-Part-1-2018-2019 - (New-Spec)Documento69 pagineIGCSE-Revision-Booklet-Part-1-2018-2019 - (New-Spec)MaryamNessuna valutazione finora

- LESSON PLAN IN wRITING A REPORTDocumento2 pagineLESSON PLAN IN wRITING A REPORTMarkaton Dihagnos100% (4)

- "Written Statement": Tanushka Shukla B.A. LL.B. (2169)Documento3 pagine"Written Statement": Tanushka Shukla B.A. LL.B. (2169)Tanushka shuklaNessuna valutazione finora