Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Fm-Module 3

Caricato da

Rajesh MgDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Fm-Module 3

Caricato da

Rajesh MgCopyright:

Formati disponibili

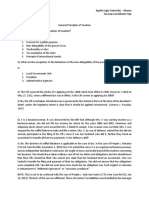

Module 3 Financing decisions.

COST OF CAPITAL The cost of capital of a firm is the minimum rate of return expected by its investors. It is the weighted average cost of various sources of finance used by a firm. The capital used by a firm may be in the form of debt, preference capital, retained earnings and equity shares. The concept of cost of capital is very important in the financial management. A decision to invest in a particular project depends upon the cost of capital of the firm or the cut off rate which is the minimum rate of return expected by the investors. In case a firm is not able to achieve even the cut off rate, the market value of its shares will fall. In fact, cost of capital is the minimum rate of return expected by its investors which will maintain the market value of shares at its present level. Hence, to achieve the objective of wealth maximisation, a firm must earn a rate of return more than its cost of capital. Further, optimal capital structure maximises the value of a firm and hence the wealth of its owners and minimises the firm's cost of capital. The cost of capital of a firm or the minimum rate of return expected by its investors has a direct relation with the risk involved in the firm. Generally, higher the risk involved in a firm, higher is the cost of capital. Cost of capital for a firm may be defined as the cost of obtaining funds, i.e., the average rate of return that the investors in a firm would expect for supplying funds to the firm. In the words of Hunt, William and Donaldson, "Cost of capital may be defined as the rate that must be earned on the net proceeds lo provide the cost elements of the burden at the time they are due". James C. Van Home defines cost of capital as, "a cut-off rate for the allocation of capital to investments of projects. It is the rate of return on a project that will leave unchanged the market price of the stock." Hampton, John J. defines cost of capital as, "the rate of return the firm requires from its investments, in order to increase the value of the firm in the market place". Thus, we can say that cost of capital is that minimum rate of return which a firm, must and, is expected to earn on its investments so as to maintain the market value of its shares. SIGNIFICANCE OF THE COST OF CAPITAL The concept of cost of capital is very important in the financial management. It plays a crucial role in both capital budgeting as well as decisions relating to planning of capital structure. Cost of capital concept can 1

also be used as a basis for evaluating the performance of a firm and it further helps management in taking so many other financial decisions. 1. As an Acceptance Criterion in Capital budgeting. In the words of James T.S. Posterfield 'the concept of cost of capital has assumed growing importance largely because of the need to devise a rational mechanism for making the investment decisions of the firm'. Capital budgeting decisions can be made by considering the cost of capital. According to the present value method of capital budgeting, if the present value of expected returns from investment is greater than or equal to the cost of investment, the project may be accepted; otherwise; the project may be rejected. The present value of expected returns is calculated by discounting the expected cash inflows at cut-off rate (which is the cost of capital). Hence, the concept of cost of capital is very useful in capital budgeting decision. 2. As a Determinant of Capital Mix in Capital Structure Decisions. Financing the firm's assets is a very crucial problem in every business and as a general rule there should be a proper mix of debt and equity capital in financing a firm's assets. While designing an optimal capital structure, the management has to keep in mind the objective of maximising the value of the firm and minimising the cost of capital. Measurement of cost of capital from various sources is very essential in planning the capital structure of any firm. 3. As a Basis for Evaluating the Financial Performance. In the words of S .K. Bhattachary the concept of cost of capital can be used to 'evaluate the financial performance of top management'. The actual profitability of the project is compared to the projected overall cost of capital; and the actual cost of capital of funds raised to finance the project. If the actual profitability of the project is more than the projected and the actual cost of capital, the performance may be said to be satisfactory. 4. As a Basis for taking other Financial Decisions. The cost of capital is also used in making other financial decisions such as dividend policy, capitalisation of profits, making the rights issue and working capital. Weighted Average Cost of Capital. After calculating the cost of each component of capital, the average cost of capital is generally calculated on the basis of weighted average method. This may also be termed as overall cost of capital. Weighted average cost of capital is the average cost of the costs of various sources of financing. Weighted average cost of capital is

also known as composite cost of capital, overall cost of capital or average cost of capital. Once the specific cost of individual sources of finance is determined, we can compute the weighted average cost of capital by putting weights to the specific costs of capital in proportion of the various sources of funds to the total. The computation of the weighted average cost of capital involves the following steps. 1. Calculation of the cost of each specific source of funds. - This involves the determination of the cost of debt, equity capital, preference capital etc. This can be done either on before tax basis or after tax basis. 2. Assigning weights to specific costs.- This involves determination of the proportion of each source of funds in the total capital structure of the company. This may be done according to marginal weight method, or Historical weights method. 3. Adding of the weighted cost of all sources of funds to get an over all weighted average cost of capital. CAPITAL SRTUCTURE. In order to run and manage a company, funds are needed. Right from the promotional stage up to end, finances play an important role in a company's life. If funds are inadequate, or not properly managed, the entire organisation suffers. It is, therefore, necessary that correct estimate of the current and future need of capital be made to have an optimum capital structure which shall help the organisation to run its work smoothly and without any stress. Capital structure of a company refers to the make up of its capitalisation. A company procures funds by issuing various types of securities i.e. ordinary shares, preference shares, bonds and debentures. According to Gerestenbeg, "Capital structure of a company refers to the composition or make-up of its capitalisation and it includes all long-term capital resources viz : loans, reserves, shares and bonds." The capital structure is made up of debt and equity securities and refers to permanent financing of a firm. It is composed of longterm debt, preference share capital and shareholder's funds.For example, a company has equity shares of Rs. 1,00,000, debentures Rs. 1,00,000, preference shares of Rs. 1,00,000 and retained earnings of Rs. 50,000. The term capitalisation is used for total longterm funds. In this case it is of Rs. 3,50,000. The term capital structure is used for the mix of capitalisation. In this case it will be said that the capital structure of the company consists of Rs. 1,00,000 in equity shares, Rs. 1,00,000 in 2

preference shares, Rs. 1,00,000 in debentures and Rs. 50,000 in retained earnings. Before issuing any of these securities, a company should decide about the kinds of securities to be issued. In what proportion will the various kinds of securities be issued, should also be considered. CAPITALISATION, CAPITAL STRUCTURE AND FINANCIAL STRUCTURE. The terms, capitalisation, capital structure and financial structure, do not mean the same. Capitalisation refers to the total amount of securities issued by a company while capital structure refers to the kinds of securities and the proportionate amounts that make up capitalisation. For raising long-term finances, a company can issue three types of securities viz. Equity shares, Preference Shares and Debentures. A decision about the proportion among these types of securities refers to the capital structure of an enterprise. Some authors on financial management define capital structure in a broad sense so as to include even the proportion of short-term debt. In fact, they refer to capital structure as financial structure. Financial structure means the entire liabilities side of the balance sheet. The capital structure for a business should be planned. The debt-equity proposition, mix of equity sources, mix of debt sources and the like need to be planned. To plan capital structure, therefore, means determining the debtequity proportion and mix of individual components of equity (paid equity and earned equity, that is ratio of paid up equity capital to retained earnings) and mix of debt capital types (bank loan, debentures, public deposits, etc.,) so that the firm is optimally capitalized. OPTIMUM CAPITAL STRUCTURE The optimum or balanced capital structure means an ideal combination of borrowed and owned capital that may attain the marginal goal, ie maximizing of market value per share or minimization of cost of capital. The market value will be maximised or the cost of capital will be minimised when the real cost of each source of fund is the same. The optimum capital structure is obtained with the market value per share is most favourable. The capital structure of a company is to be determined initially at the time the company is floated. Great caution is required at this stage, since the initial capital structure will have long-term implications. Of course, it is not possible to have an ideal capital structure but the management should set a target capital structure and the initial capital structure should be framed and

subsequent changes in the capital structure should be done keeping in view the target capital structure. Thus, the capital structure decision is a continuous one and has to be taken whenever a firm needs additional finances. The following are the three most common models to decide about a firms optimum capital structure: I. Operating and financial leverage model for analyzing the impact of debt on EPS II. Cost of capital and valuation model for determining the impact of debt on the shareholders value. III. Cash flow models governing the capital structure decisions, many other factors such as control, flexibility, or marketability are also considered in practice. A sound or appropriate capital structure should have the following features . 1 Profitability: The capital structure of the company should be most advantageous. Within the constraints, maximum use of leverage at a minimum cost should be made. 2 Solvency: The use of excessive debt threatens the solvency of the company. To the point debt does not add significant risk it should be used, otherwise its use should be avoided. 3 Flexibility: The capital structure should be flexible to meet the changing conditions. It should be possible for a company to adapt its capital structure with a minimum cost and delay if warranted by a changed situation. It should also be possible for the company to provide funds whenever needed to finance its profitable activities. 4 Capacity: The capital structure should be determined within the debt capacity of the company, and this capacity should not be exceeded. The debt capacity of a company depends on its ability to generate future cash flows. It should have enough cash to pay creditors fixed changes and principal sum. 5 Control: The capital structure should involve minimum risk of loss of control of the company. The owners of closely-held companies are particularly concerned about dilution of control. Following are the factors which should be kept in view while determining the capital structure of a company: (1) Trading on Equity. A company may raise funds either by issue of shares or by debentures. Debentures carry a fixed rate of interest and this interest has to be paid irrespective of profits. Of course, preference shares are also entitled to a fixed rate of dividend but payment of dividend depends upon the profitability of the company. In case the rate of return (ROI) on the total capital employed (shareholders' funds 3

plus long-term borrowed funds) is more than the rate of interest on debentures or rate of dividend on preference shares, it is said that the company is trading on equity. For example, the total capital employed in a company is a sum of Rs. 2 lakhs. The capital employed consists of equity shares of Rs. 10 each. The company makes a profit of Rs. 30,000 every year. In such a case the company cannot pay a dividend of more than 15% on the equity share capital. However, if the funds are raised in the following manner, and other things remain the same, the company may be in a position to pay a higher rate of return on equity shareholders' funds: (2) Retaining Control. The capital structure of a company is also affected by the extent to which the promoter/existing management of the company desire to maintain control over the affairs of the company. The preference shareholders and debenture holders have not much say in the management of the company. It is the equity shareholders who select the team of managerial personnel. It is necessary, therefore, for the promoters to own majority of the equity share capital in order to exercise effective control over the affairs of the company. The promoters or the existing management are not interested in losing their grip over the affairs of the company and at the same time, they need extra funds. They will, therefore, prefer preference shares or debentures over equity shares so long they help them in retaining control over the company. (3) Nature of Enterprise The nature of enterprise also to a great extent affects the capital structure of the company. Business enterprises which have stability in their earnings or which enjoy monopoly regarding their products may go for debentures or preference shares since they will have adequate profits to meet the recurring cost of interest/fixed dividend. This is true in case of public utility concerns. On the other hand, companies which do not have this advantage should rely on equity share capital to a greater extent for raising their funds. This is, particularly, true in case of manufacturing enterprises. (4) Legal Requirements The promoters of the company have also to keep in view the legal requirements while deciding about the capital structure of the company. This is particularly true in case of banking companies which are not allowed to issue any other type of security for raising funds except equity share capital on account of the Banking Regulation Act. (5) Purpose of Financing

The purpose of financing also to some extent affects the capital structure of the company. In case funds are required for some directly productive purposes, for example, purchase of new machinery, the company can afford to raise the funds by issue of debentures. This is because the company will have the capacity to pay interest on debentures out of the profits so earned. On the other hand, if the funds are required for non-productive purposes, providing more welfare facilities to the employees such as construction of school or hospital building for company's employees, the company should raise the funds by issue of equity shares. (6) Period of Finance The period for which finance is required also affects the determination of capital structure of companies. In case, funds are required, say for 3 to 10 years, it will be appropriate to raise them by issue of debentures rather than by issue of shares. This is because in case the funds are raised by issue of shares, their repayment after 8 to 10 years (when they are not required) will be subject to legal complications. Even if such funds are raised by issue of redeemable preference shares, their redemption is also subject to certain legal restrictions. However, if the funds are required more or less permanently, it will be appropriate to raise them by issue of equity shares. (7) Market Sentiments The market sentiments also decide the capital structure of the company. There are periods when people want to have absolute safety. In such cases, it will be appropriate to raise funds by issue of debentures. At other periods, people may be interested in earning high speculative incomes; at such times, it will be appropriate to raise funds, by issue of equity shares. Thus, if a company wants to raise sufficient funds, it must take into account market sentiments; otherwise its issue may not be successful. (8) Requirement of Investors Different types of securities are to be issued for different classes of investors. Equity shares are best suited for bold or venturesome investors. Debentures are suited for investors who are very cautious while preference shares are suitable for investors who are not very cautious. In order to collect funds from different categories of investors, it will be appropriate for the companies to issue different categories of securities. This is particularly true when a company needs heavy funds. (9) Size of the Company

Companies which are of small size have to rely considerably upon the owners' funds for financing. Such companies find it difficult to obtain long-term debt. Large companies are generally considered to be less risky by the investors and, therefore, they can issue different types of securities and collect their funds from different sources. They are in a better bargaining position and can get funds form the sources of their choice. (10) Government Policy Government policy is also an important factor in planning the company's capital structure. For example, a change in the lending policy of financial institutions may mean a complete change in the financial pattern. Similarly, by virtue of the Securities & Exchange Board of India Act, 1992 and the Rules made there under, the Securities & Exchange Board of India can also considerably affect the capital issue policies of various companies. Besides this, the monetary and fiscal policies of the Government also affect the capital structure decision. (11) Provision for the Future While planning capital structure the provision for future should, also be kept in view. It will always be safe to keep the best security to be issued in the last instead of issuing all types of securities in one installment. In the words of Gerestenberg, "Manager of corporate financing operations must always think of rainy days or the emergencies. The general rule is to keep your best security or some of your best securities till the last".

Leverage.

The dictionary sense of the term leverage refers to an increased means of accomplishing some purpose. For example, leverage helps us in lifting heavy objects, which may not be otherwise feasible. Nevertheless, in the area of finance, the term leverage has a special connotation. It is used to describe the firms ability to use fixed cost assets or funds to blow up the return to its owners. James Van Horne has defined leverage as the employment of an asset or funds for which the firm pays a fixed cost or fixed return. Thus, according to him, leverage results as an outcome of the firm employing an asset or source of funds, which has a fixed charge (or return). The former may be termed as fixed operating cost, while the latter may be termed as fixed financial cost.

Types of Leverages Leverages are of three types: (i) Operating leverage, (ii) Financial leverage and (iii) Composite leverage. Operating Leverage The operating leverage may be defined as the tendency of the operating profit to vary disproportionately with sales. It is assumed to exist when a firm has to pay fixed cost regardless of level of output or sales. The firm is said to have a high degree of operating leverage if its employs a greater amount of fixed costs and a small amount of variable costs. On the other hand, a firm will have a low operating leverage when it employs a greater amount of variable costs and a smaller amount of fixed costs. Computation of Operating Leverage: The operating leverage can be calculated by the following formula: Contribution [C] Operating Leverage = Operating Profit [OP] Operating profit here means Earning Before Interest and Tax (EBIT).

firms earning per share. The financial leverage therefore indicates the percentage change in earning per share in relation to a percentage change in EBIT. Financial leverage helps considerably the financial manager while devising the capital structure of the company. A high financial leverage means high fixed financial costs and high financial risk. A financial manager must plan the capital composition in a way that the firm is in a position to meet its fixed financial costs. Increase in fixed financial costs requires indispensable increase in EBIT level. Composite Leverage Operating leverage measures percentage change in operating profit due to percentage change in sales. It explains the degree of operating risk. Financial leverage measures percentage change in taxable profit (or EPS) on account of percentage change in operating profit (i.e., EBIT). Thus, it explains the degree of financial risk. Both these leverages are closely fretful with the firms capacity to meet its fixed costs (both operating and financial). In case both the leverage are combined, the result obtained will unveil the effect of change in sales over change in taxable profit (or EPS). Composite leverage thus expresses the relationship between revenue on account of sales (i.e. contribution or sales less variable cost) and the taxable income. It helps in finding out the resulting percentage change in taxable income on account of percentage change in sales. This can be computed as follows: Composite leverage = Operating leverage x Financial leverage

Financial Leverage

The financial leverage may be defined as the propensity of the residual net income to vary disproportionately with operating profit. It indicates the change that takes place in the taxable income as a result of change in the operating income. It signifies the survival of fixed interest/fixed dividend bearing securities in the total capital structure of the company. Thus, the use of fixed interest/dividend bearing securities such as debt and preference capital along with the owners equity in the total capital structure of the company is described as financial leverage. Trading on equity and financial leverage: Financial leverage is also sometimes termed as trading on equity. The company resorts to trading on equity with the objective of giving the equity shareholders a high rate of return. One of the objectives of planning an appropriate capital structure is to maximize the return on equity shareholders funds or maximize the earning per share (EPS). Some scholars have used the terms financial leverage in the context that it defines the relationship between EBIT and EPS. According to Gitman, financial leverage is the ability of a firm to use fixed financial charges to blow up the effects of changes in EBIT on the 5

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Human Right 3 BBA CBCS MAHATMA GANDHI UNIVERSITYDocumento9 pagineHuman Right 3 BBA CBCS MAHATMA GANDHI UNIVERSITYRajesh MgNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Green EntrepreneurshipDocumento34 pagineGreen EntrepreneurshipRajesh MgNessuna valutazione finora

- Brand Equity, Brand PositioningDocumento5 pagineBrand Equity, Brand PositioningRajesh MgNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Brand Extension - Meaning, Advantages. Brand Licensing - Meaning and Benefits. Co-branding-Meaning and Benefits.Documento6 pagineBrand Extension - Meaning, Advantages. Brand Licensing - Meaning and Benefits. Co-branding-Meaning and Benefits.Rajesh MgNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Financial ManagementDocumento16 pagineFinancial ManagementRajesh MgNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- NSS College RajakumariDocumento7 pagineNSS College RajakumariRajesh MgNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Working Paper No.123Documento23 pagineWorking Paper No.123Rajesh MgNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- AccountingDocumento1 paginaAccountingRajesh MgNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Human Right Mahatma Gandhi University BBA CBCS 5-1Documento19 pagineHuman Right Mahatma Gandhi University BBA CBCS 5-1Rajesh MgNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Short VersionDocumento6 pagineShort VersionthuskiNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- ModelDocumento17 pagineModelRajesh MgNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Financial Management - Module1Documento6 pagineFinancial Management - Module1Rajesh MgNessuna valutazione finora

- Advertising and Sales Promotion NotesDocumento58 pagineAdvertising and Sales Promotion NotesRajesh MgNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- A Study On Mobile Banking in IndiaDocumento8 pagineA Study On Mobile Banking in IndiaRajesh MgNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- FM - 2 & 3Documento22 pagineFM - 2 & 3Rajesh MgNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Ob Chapter Personaity FinalDocumento8 pagineOb Chapter Personaity FinalRajesh MgNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Ob - ExtraDocumento7 pagineOb - ExtraRajesh MgNessuna valutazione finora

- Global Business Environment: NSS College.Documento36 pagineGlobal Business Environment: NSS College.Rajesh MgNessuna valutazione finora

- Iii BbaDocumento6 pagineIii BbaRajesh MgNessuna valutazione finora

- Marketing Print2Documento31 pagineMarketing Print2Rajesh MgNessuna valutazione finora

- Financial Managment - DividendDocumento4 pagineFinancial Managment - DividendRajesh Mg100% (1)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Advertising and Publicity Management Lecture Notes BBADocumento22 pagineAdvertising and Publicity Management Lecture Notes BBARajesh Mg100% (1)

- Financial Management - Module1Documento6 pagineFinancial Management - Module1Rajesh MgNessuna valutazione finora

- Marketing ManagementDocumento18 pagineMarketing ManagementRajesh MgNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- FM - 2 & 3Documento22 pagineFM - 2 & 3Rajesh MgNessuna valutazione finora

- Fundamental ConceptsDocumento2 pagineFundamental ConceptsRajesh MgNessuna valutazione finora

- Advertising - 2 Salesmanship NotesDocumento21 pagineAdvertising - 2 Salesmanship NotesRajesh Mg100% (1)

- Principles of Management (Bcs361) : Short QuestionsDocumento14 paginePrinciples of Management (Bcs361) : Short Questionss.reeganNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (120)

- Marketing Print2Documento31 pagineMarketing Print2Rajesh MgNessuna valutazione finora

- Short Question Answers ManagementDocumento13 pagineShort Question Answers ManagementRajesh Mg100% (1)

- Silabus-S2-MMT 2009-20141-MIDocumento35 pagineSilabus-S2-MMT 2009-20141-MIAdityaRahadianFachrurNessuna valutazione finora

- Ind As 101 - First Time Adoption of Indian Accounting StandardsDocumento5 pagineInd As 101 - First Time Adoption of Indian Accounting StandardsRaghavanNessuna valutazione finora

- Chapter 1 Financial MarketsDocumento32 pagineChapter 1 Financial Markets09 CHAN CHUI YAN S2ENessuna valutazione finora

- PG Valuation Analysis Project FinalDocumento20 paginePG Valuation Analysis Project FinalKaushal Raj GoelNessuna valutazione finora

- FinMan Module 3 FS, Cash Flow and TaxesDocumento10 pagineFinMan Module 3 FS, Cash Flow and Taxeserickson hernanNessuna valutazione finora

- 2014 IFRS Financial Statements Def CarrefourDocumento80 pagine2014 IFRS Financial Statements Def CarrefourawangNessuna valutazione finora

- Debt Capital Market in NigeriaDocumento19 pagineDebt Capital Market in NigeriaOyin AyoNessuna valutazione finora

- Quiz 2Documento5 pagineQuiz 2asaad5299Nessuna valutazione finora

- BSP Guideline On Registration-Of-Foreign-InvestmentsDocumento6 pagineBSP Guideline On Registration-Of-Foreign-InvestmentsmtscoNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Law MCQ RTPDocumento13 pagineLaw MCQ RTPSHIVSHANKER AGARWALNessuna valutazione finora

- Corporate Partnership Estate and Gift Taxation 2013 7th Edition Pratt Test BankDocumento26 pagineCorporate Partnership Estate and Gift Taxation 2013 7th Edition Pratt Test Bankdanielwilkinsonkzemqgtxda100% (33)

- BuwisDocumento23 pagineBuwisshineneigh00Nessuna valutazione finora

- Tax Law LMT Aquila Legis FraternityDocumento17 pagineTax Law LMT Aquila Legis FraternityWilbert ChongNessuna valutazione finora

- BAF 202 Corporate Finance and Financial ModellingDocumento62 pagineBAF 202 Corporate Finance and Financial ModellingRhinosmikeNessuna valutazione finora

- Week 7 NotesDocumento6 pagineWeek 7 NotescalebNessuna valutazione finora

- Accounting and Financial Analysis Lecture Notes Lectures 1 10 PDFDocumento57 pagineAccounting and Financial Analysis Lecture Notes Lectures 1 10 PDFNush Ahmd100% (1)

- Business Combination 4Documento2 pagineBusiness Combination 4Jamie RamosNessuna valutazione finora

- Rules of Capital Maintenance: Pranjal NeupaneDocumento11 pagineRules of Capital Maintenance: Pranjal NeupaneSamish DhakalNessuna valutazione finora

- Cost of CapitalDocumento31 pagineCost of CapitalAnamNessuna valutazione finora

- Redington 2016Documento78 pagineRedington 2016eepNessuna valutazione finora

- British American TobaccoDocumento30 pagineBritish American TobaccoFahim YusufNessuna valutazione finora

- Reviewer in Financial Management (Finals Examination)Documento10 pagineReviewer in Financial Management (Finals Examination)Maxine SantosNessuna valutazione finora

- Promoters Prospectus DDocumento26 paginePromoters Prospectus Dsiddhanthpandey17Nessuna valutazione finora

- FM02 Ch07 ShowDocumento86 pagineFM02 Ch07 ShowRumah Cantik BungaNessuna valutazione finora

- THPS-1 Spring 20110Documento4 pagineTHPS-1 Spring 20110bugzlyfeNessuna valutazione finora

- Audit of Financial Statement PresentationDocumento7 pagineAudit of Financial Statement PresentationHasmin Saripada Ampatua100% (1)

- Ae 211 Quiz 1Documento3 pagineAe 211 Quiz 1Joshua LokinoNessuna valutazione finora

- Real Lessons in Management Strategy From Coles AustraliaDocumento66 pagineReal Lessons in Management Strategy From Coles AustraliadheevettiNessuna valutazione finora

- BMO Annual Report 2020Documento218 pagineBMO Annual Report 2020Bilal MustafaNessuna valutazione finora

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)