Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2011 Publication Ballot

Caricato da

vaildailyDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

2011 Publication Ballot

Caricato da

vaildailyCopyright:

Formati disponibili

Vote Both Sides

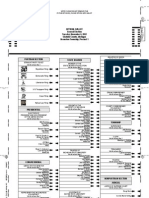

OFFICIAL BALLOT Eagle County, Colorado November 01, 2011

Instruction Text: To vote, completely fill in the rectangle to the left of your choice using only a dark blue or black ballpoint pen. If you tear, deface, or wrongly mark this ballot, return it to the Election Official and receive a replacement ballot. WARNING: Do not put an X or a checkmark in the rectangles next to your choices as they may not count properly as votes.

COORDINATED ELECTION Precinct 29 Uninc-38

COLORADO MOUNTAIN JUNIOR COLLEGE DISTRICT FOR BOARD OF TRUSTEES DIRECTOR DISTRICT NO. 2 (Four Year Term of Office) Vote for One Kathy Goudy Stan D. Orr FOR BOARD OF TRUSTEES DIRECTOR DISTRICT NO. 4 (Four Year Term of Office) Vote for One Richard E. Hague Robert C. Taylor FOR BOARD OF TRUSTEES DIRECTOR DISTRICT NO. 5 (Four Year Term of Office) Vote for One Ken Brenner John Fielding FOR BOARD OF TRUSTEES DIRECTOR DISTRICT NO. 6 (Four Year Term of Office) Vote for One ROARING FORK SCHOOL DISTRICT RE-1 Director District B 4 year term Vote for One Matthew Hamilton Director District C 4 year term Vote for One Phil Weir Terry Lott Richardson Director District D 4 year term Vote for One Myles Rovig Daniel Biggs WEST GRAND SCHOOL DISTRICT NO. 1-JT School Board Director At Large (4 year term) Vote for Three Dean Billington Michele DeSanti Michael "Mitch" Lockhart Jon Ewert Brett Davidson

11000310100012

Eagle County Clerk and Recorder

WARNING: Any person who, by use of force or other means, unduly influences an eligible elector to vote in any particular manner or to refrain from voting, or who falsely makes, alters, forges, or counterfeits any mail ballot before or after it has been cast, or who destroys, defaces, mutilates, or tampers with a ballot is subject, upon conviction, to imprisonment, or to a fine, or both.

Pat Chlouber Wes Duran EAGLE COUNTY SCHOOL DISTRICT RE50J For Board of Education, District A (For Four Years) Vote for One Tessa M. Kirchner For Board of Education, District B (For Two Years) Vote for One Kate Cocchiarella For Board of Education, District C (For Four Years) Vote for One Carrie Neill Benway For Board of Education, District D (For Four Years) Vote for One

Test Ballot

000000001102

Jeanne McQueeney For Board of Education, District G (For Two Years) Vote for One Thomas H. Johnson

Vote Both Sides

1993031162

Test Ballot

Vote Both Sides

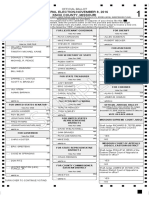

OFFICIAL BALLOT Eagle County, Colorado November 01, 2011

STATE OF COLORADO Ballot issues referred by the general assembly or any political subdivision are listed by letter, and ballot issues initiated by the people are listed numerically. A ballot issue listed as an "amendment" proposes a change to the Colorado constitution, and a ballot issue listed as a "proposition" proposes a change to the Colorado Revised Statutes. A "yes" vote on any ballot issue is a vote in favor of changing current law or existing circumstances, and a "no" vote on any ballot issue is a vote against changing current law or existing circumstances. TOWN OF EAGLE Ballot Issue 2A

COORDINATED ELECTION Precinct 29 Uninc-38

TOWN OF AVON Ballot Issue 2B

SHALL THE TOWN OF EAGLE'S TAXES BE INCREASED BY $130,000.00 ANNUALLY (FIRST FULL FISCAL YEAR INCREASE) AND BY WHATEVER AMOUNTS ARE RAISED ANNUALLY THEREAFTER THROUGH THE ADOPTION OF AN INCREASE IN THE TOWN'S OCCUPATION TAX ON THE SHORT TERM RENTAL (LESS THAN 30 CONSECUTIVE DAYS) OF ANY HOTEL ROOM, MOTEL ROOM, LODGING ROOM, MOTOR HOTEL ROOM, GUEST HOUSE Proposition 103 (STATUTORY) ROOM, BED AND BREAKFAST ROOM, OR OTHER SIMILAR ACCOMMODATION LOCATED IN THE TOWN FROM TWO SHALL STATE TAXES BE INCREASED $536.1 DOLLARS ($2.00) PER DAY TO FOUR MILLION ANNUALLY IN THE FIRST FULL DOLLARS ($4.00) PER DAY EFFECTIVE FISCAL YEAR AND BY SUCH AMOUNTS AS JANUARY 1, 2012; AND SHALL ALL ARE RAISED ANNUALLY THEREAFTER BY REVENUES DERIVED FROM SUCH AMENDMENTS TO THE COLORADO INCREASE IN THE OCCUPATION TAX BE REVISED STATUTES CONCERNING A USED EXCLUSIVELY FOR THE GENERAL TEMPORARY INCREASE IN CERTAIN STATE MARKETING AND PROMOTION OF THE TAXES FOR ADDITIONAL PUBLIC TOWN OF EAGLE AND THE MARKETING EDUCATION FUNDING, AND, IN AND PROMOTION OF EAGLE EVENTS FOR CONNECTION THEREWITH, INCREASING THE PURPOSE OF GENERATING THE RATE OF THE STATE INCOME TAX ADDITIONAL REVENUE FOR EXISTING AND IMPOSED ON ALL TAXPAYERS FROM 4.63% FUTURE LODGING AND OTHER TOWN OF TO 5% FOR THE 2012 THROUGH 2016 EAGLE BUSINESSES, SUCH REVENUES TO INCOME TAX YEARS; INCREASING THE BE COLLECTED AND SPENT AS A VOTER RATE OF THE STATE SALES AND USE TAX APPROVED REVENUE CHANGE, FROM 2.9% TO 3% FOR A PERIOD OF FIVE NOTWITHSTANDING ANY REVENUE OR YEARS COMMENCING ON JANUARY 1, 2012; EXPENDITURE LIIMITATIONS CONTAINED IN REQUIRING THAT THE ADDITIONAL ARTICLE X, SECTION 20 OF THE COLORADO REVENUES RESULTING FROM THESE CONSTITUTION? INCREASED TAX RATES BE SPENT ONLY TO FUND PUBLIC EDUCATION FROM PRESCHOOL THROUGH TWELFTH GRADE AND PUBLIC POSTSECONDARY EDUCATION; SPECIFYING THAT THE Yes APPROPRIATION OF THE ADDITIONAL TAX REVENUES BE IN ADDITION TO AND NOT No SUBSTITUTED FOR MONEYS OTHERWISE APPROPRIATED FOR PUBLIC EDUCATION FROM PRESCHOOL THROUGH TWELFTH GRADE AND PUBLIC POSTSECONDARY EDUCATION FOR THE 2011-12 FISCAL YEAR; AND ALLOWING THE ADDITIONAL TAX REVENUES TO BE COLLECTED, KEPT, AND SPENT NOTWITHSTANDING ANY LIMITATIONS PROVIDED BY LAW?

SHALL TOWN OF AVON TAXES BE INCREASED $875,000 ANNUALLY BEGINNING IN 2012 AND BY WHATEVER ADDITIONAL AMOUNTS ARE RAISED ANNUALLY IN EACH SUBSEQUENT YEAR BY AN INCREASE IN THE TOWN SALES TAX RATE OF ZERO POINT THREE FIVE PERCENT (0.35%); AND SHALL THE PROCEEDS OF SUCH SALES TAX BE DEDICATED SPECIFICALLY TO THE AVON SUSTAINABLE TRANSIT PROJECT WHICH PROJECT SHALL BE DEFINED AS OPERATING PUBLIC TRANSIT SERVICES AND ACQUIRING, CONSTRUCTING, FINANCING AND MAINTAINING PUBLIC TRANSIT EQUIPMENT, FACILITIES AND RELATED CAPITAL IMPROVEMENTS; AND SHALL SUCH CHANGE BE IN EFFECT AS OF JANUARY 1, 2012; AND SHALL THE TOWN BE AUTHORIZED TO COLLECT, RETAIN AND SPEND ALL REVENUES FROM SUCH TAXES AND THE EARNINGS FROM THE INVESTMENT OF SUCH REVENUES AS A VOTER APPROVED REVENUE CHANGE UNDER ARTICLE X, SECTION 20 OF THE COLORADO CONSTITUTION OR ANY OTHER LAW?

Test Ballot

11000310200019

Yes No Ballot Question 2C

No EAGLE COUNTY Question 1A

Shall the maximum term of office for the District Attorney of the Fifth Judicial District be lengthened by one additional term so that the District Attorney may be elected for a maximum of three consecutive terms?

Yes No

Yes No

Vote Both Sides

1993031162

Yes

SHALL THE AMENDMENTS TO THE AVON HOME RULE CHARTER SET FORTH IN ORDINANCE NO. 11-13 BE ADOPTED AND TAKE EFFECT, which amendments include: permitting the Mayor to vote on all matters, defining the minimum quorum for a Council meeting as four members of Council, limiting business conducted at special Council meetings to those items stated in the meeting notice, requiring the adoption of a Town Code of Ethics, providing that ordinances shall not take effect until 30 days after final adoption, (excepting ordinances necessary for the immediate preservation of the public health and safety), authorizing the Town Council to determine the residency of the Town Manager, authorizing the Town Manager to hire the Town Clerk, providing that all Town employees shall serve at the will of the Town, requiring the concurring vote of 5 Council members to approve intergovernmental agreements with a duration longer than 10 years, and such other amendments as are set forth in Ordinance No. 11-13?

000000001205

Test Ballot

OFFICIAL BALLOT Eagle County, Colorado November 01, 2011

EAGLE COUNTY SCHOOL DISTRICT RE50J Ballot Issue 3B Ballot Issue 3E

COORDINATED ELECTION Precinct 29 Uninc-38

ROARING FORK SCHOOL DISTRICT RE-1 EAGLE RIVER FIRE PROTECTION DISTRICT Ballot Issue 5A

21000310300011

SHALL EAGLE COUNTY SCHOOL DISTRICT RE50J TAXES BE INCREASED NO MORE THAN $6,000,000 ANNUALLY (THE MAXIMUM ADDITIONAL AMOUNT WHICH MAY BE COLLECTED IN ANY YEAR BEGINNING IN TAX COLLECTION YEAR 2012) OR $1,000 MULTIPLIED TIMES THE FUNDED PUPIL COUNT (AS DEFINED IN 22-54-103, C.R.S.), WHICHEVER IS LESS; SHALL THE PROCEEDS OF THE TAX INCREASE BE USED FOR EDUCATIONAL PURPOSES: -MITIGATING STATE FUNDING CUTS

SHALL ROARING FORK SCHOOL DISTRICT NO. RE-1 TAXES BE INCREASED UP TO $4.8 MILLION ANNUALLY THROUGH A PROPERTY TAX OVERRIDE MILL LEVY IMPOSED AT A RATE SUFFICIENT TO PRODUCE THE AMOUNT SPECIFIED ABOVE, TO MITIGATE CURRENT AND FUTURE BUDGET CUTS FOR THE PURPOSE OF CONTINUING TO PROVIDE A HIGH QUALITY EDUCATION THAT HELPS PREPARE STUDENTS FOR LIFE AFTER HIGH SCHOOL BY, PRESERVING SMALL CLASS SIZES,

-RETAINING QUALITY TEACHERS -CONTINUING NECESSARY CLASSROOM SUPPORT FOR ALL STUDENTS -MINIMIZING REDUCTIONS IN EXTRA CURRICULAR ACTIVITIES, ARTS AND ATHLETICS -REPLACING BUSES AND COMPUTERS THAT HAVE EXCEEDED THEIR USEFUL LIFESPAN -MAINTAINING BUILDINGS AND GROUNDS; AND ATTRACTING AND RETAINING QUALITY STAFF, PROVIDING QUALITY TEXTS, TECHNOLOGY FOR LEARNING, AND MATERIALS, AND PRESERVING SAFE LEARNING ENVIRONMENTS FOR KIDS, WHICH TAXES SHALL BE DEPOSITED INTO THE GENERAL FUND OF THE DISTRICT, SHALL BE IN ADDITION TO THE PROPERTY TAXES THAT OTHERWISE WOULD BE LEVIED FOR THE GENERAL FUND, AND SHALL CONSTITUTE A VOTER-APPROVED REVENUE CHANGE?

SHALL EAGLE RIVER FIRE PROTECTION DISTRICT'S TAXES BE INCREASED BY $1,830,000 IN 2012, AND BY SUCH AMOUNTS AS MAY BE COLLECTED ANNUALLY THEREAFTER THROUGH 2019 BY IMPOSITION OF AN ADDITIONAL MILL LEVY AT A RATE NOT GREATER THAN 1.95 MILLS WHICH TOGETHER WITH THE EXISTING MILL LEVY OF 5.55 MILLS IS SUFFICIENT TO GENERATE AN AMOUNT EQUAL TO THE 2011 TAX REVENUES TO PAY DISTRICT EXPENSES; AND SHALL SUCH REVENUES BE COLLECTED NOTWITHSTANDING ANY OTHER REVENUE LIMITS PROVIDED BY LAW?

Yes No

Test Ballot

SHALL SUCH TAX INCREASE BE IMPLEMENTED BY AN ADDITIONAL PROPERTY TAX MILL LEVY IN EXCESS OF THE LEVY AUTHORIZED FOR THE DISTRICT'S GENERAL FUND, PURSUANT TO Vote Yes or No AND IN ACCORDANCE WITH SECTION 22-54-108, C.R.S.; AND SHALL THE Yes DISTRICT BE AUTHORIZED TO COLLECT, No RETAIN AND SPEND ALL REVENUES FROM SUCH TAXES AND THE EARNINGS FROM THE INVESTMENT OF SUCH REVENUES AS A VOTER APPROVED REVENUE CHANGE AND AN EXCEPTION TO THE LIMITS WHICH WOULD OTHERWISE APPLY UNDER ARTICLE X, SECTION 20 OF THE COLORADO CONSTITUTION?

000000001102

Yes No

1993031162

Test Ballot

000000001393

Test Ballot

21000310400018

1993031162

Test Ballot

This page intentionally left blank

Potrebbero piacerti anche

- Donors Tax FAQs: Exemptions and ValuationDocumento4 pagineDonors Tax FAQs: Exemptions and ValuationBlesilda OracoyNessuna valutazione finora

- Sigmund Freud QuotesDocumento7 pagineSigmund Freud Quotesarbeta100% (2)

- Negotiating For SuccessDocumento11 pagineNegotiating For SuccessRoqaia AlwanNessuna valutazione finora

- ARARO v. COMELECDocumento14 pagineARARO v. COMELECIllia ManaligodNessuna valutazione finora

- Official General Election Sample Ballot Lake County, Florida November 2, 2010Documento2 pagineOfficial General Election Sample Ballot Lake County, Florida November 2, 2010Alvin Patrick PeñafloridaNessuna valutazione finora

- Sample Ballot with Selected Candidates for California ElectionDocumento4 pagineSample Ballot with Selected Candidates for California ElectionDarren BahamNessuna valutazione finora

- Glad Win Ballot Proofs 91912Documento48 pagineGlad Win Ballot Proofs 91912tfaber2933Nessuna valutazione finora

- Shelby County, MODocumento2 pagineShelby County, MOKHQA NewsNessuna valutazione finora

- 2014 Larimer County Sample BallotDocumento4 pagine2014 Larimer County Sample BallotColoradoanNessuna valutazione finora

- Ballot Stub: Official Questions and Issues Ballot Primary Election Hamilton County, Ohio May 07, 2013 PrecinctDocumento2 pagineBallot Stub: Official Questions and Issues Ballot Primary Election Hamilton County, Ohio May 07, 2013 PrecinctElizabeth BarberNessuna valutazione finora

- City Council: RESOLUTION No. 30100 C.M.SDocumento2 pagineCity Council: RESOLUTION No. 30100 C.M.SRecordTrac - City of OaklandNessuna valutazione finora

- Colorad Supreme Cout OpinionDocumento64 pagineColorad Supreme Cout OpinionThe ForumNessuna valutazione finora

- Mock Election BallotDocumento6 pagineMock Election BallotStatesman JournalNessuna valutazione finora

- Ny Gov + BPDocumento14 pagineNy Gov + BPJon CampbellNessuna valutazione finora

- Staff Memo - Item 9 - Ordinance O-2021-15 - Special Tax On Cigarettes - 8Documento2 pagineStaff Memo - Item 9 - Ordinance O-2021-15 - Special Tax On Cigarettes - 8Simply SherrieNessuna valutazione finora

- Property Tax Reform PresentationDocumento29 pagineProperty Tax Reform PresentationStatesman JournalNessuna valutazione finora

- Sample Detroit BallotDocumento4 pagineSample Detroit BallotCharlesPughNessuna valutazione finora

- Jefferson 2016 SampleDocumento364 pagineJefferson 2016 SampleAnonymous NjRIfLbNessuna valutazione finora

- FY 13-14 Fiscal HighlightsDocumento144 pagineFY 13-14 Fiscal HighlightsRepNLandryNessuna valutazione finora

- MN 2013 ScorecardDocumento15 pagineMN 2013 ScorecardAfp HqNessuna valutazione finora

- NFIB RecordDocumento4 pagineNFIB RecordVoteBusbyNessuna valutazione finora

- Chris Fick League of Oregon Cities Mayors Open Forum September 27, 2012Documento20 pagineChris Fick League of Oregon Cities Mayors Open Forum September 27, 2012Statesman JournalNessuna valutazione finora

- 1 1 PDFDocumento7 pagine1 1 PDFTalia RayNessuna valutazione finora

- District Council 1707-Redacted File HWMDocumento28 pagineDistrict Council 1707-Redacted File HWMAnonymous kprzCiZNessuna valutazione finora

- Mentor Initiative PetitionDocumento2 pagineMentor Initiative PetitionThe News-HeraldNessuna valutazione finora

- The Community Preservation Act in Northampton Summary, 11-3-11Documento5 pagineThe Community Preservation Act in Northampton Summary, 11-3-11Adam Rabb CohenNessuna valutazione finora

- Ballot 1Documento5 pagineBallot 1garivasNessuna valutazione finora

- Allen Park Proof 9-14-2012Documento84 pagineAllen Park Proof 9-14-2012David HerndonNessuna valutazione finora

- Be It Enacted by The General Assembly of The State of ColoradoDocumento8 pagineBe It Enacted by The General Assembly of The State of ColoradoKennady NickellNessuna valutazione finora

- Qeourt: L/epublic of Tbe IlbilippinesDocumento25 pagineQeourt: L/epublic of Tbe IlbilippinesThe Supreme Court Public Information OfficeNessuna valutazione finora

- And and And: AiftionDocumento14 pagineAnd and And: AiftionBerkeleySchools2010Nessuna valutazione finora

- Supreme Court: Today Is Saturday, June 20, 2015Documento12 pagineSupreme Court: Today Is Saturday, June 20, 2015Ian InandanNessuna valutazione finora

- CCMFY2012 Adopted Budget Analysis 06022011RDocumento12 pagineCCMFY2012 Adopted Budget Analysis 06022011RHelen BennettNessuna valutazione finora

- Print Preview - Full Application: Project DescriptionDocumento27 paginePrint Preview - Full Application: Project DescriptionRyan SloanNessuna valutazione finora

- Completed Parkland SAMPLE BallotDocumento4 pagineCompleted Parkland SAMPLE BallotNicholas TheodoreNessuna valutazione finora

- Measure JDocumento7 pagineMeasure JKJ HiramotoNessuna valutazione finora

- FY14 BRA Draft Print (Final)Documento32 pagineFY14 BRA Draft Print (Final)Susie CambriaNessuna valutazione finora

- Flagler 2012 Sample BallotDocumento2 pagineFlagler 2012 Sample BallotFlagler County DECNessuna valutazione finora

- Knox County, MODocumento2 pagineKnox County, MOKHQA NewsNessuna valutazione finora

- District 25 News: Aloha NeighborDocumento4 pagineDistrict 25 News: Aloha NeighborDella Au BelattiNessuna valutazione finora

- City of Gainesville - The Joint Legislative Auditing CommitteeDocumento7 pagineCity of Gainesville - The Joint Legislative Auditing CommitteeKyle HarveyNessuna valutazione finora

- 10000004527Documento22 pagine10000004527Chapter 11 DocketsNessuna valutazione finora

- Willow RidgeDocumento26 pagineWillow RidgeRyan SloanNessuna valutazione finora

- D25News 03 Mar2010Documento6 pagineD25News 03 Mar2010Della Au BelattiNessuna valutazione finora

- 1 2 PDFDocumento7 pagine1 2 PDFTalia RayNessuna valutazione finora

- 2010 Public Campaign Financing Handbook: July 2009Documento21 pagine2010 Public Campaign Financing Handbook: July 2009Charisse EnglishNessuna valutazione finora

- Budget OpinionnaireDocumento22 pagineBudget OpinionnaireVivek JhaNessuna valutazione finora

- Williams CFE SeptDocumento7 pagineWilliams CFE SeptKenneth Ryan JamesNessuna valutazione finora

- Zip Code Detailed Profile: Were You Denied A Mortgage?Documento32 pagineZip Code Detailed Profile: Were You Denied A Mortgage?ashes_xNessuna valutazione finora

- Standard: HigherDocumento10 pagineStandard: HigherJan GarmanNessuna valutazione finora

- Town of Holden Beach: "Unofficial" Minutes & CommentsDocumento17 pagineTown of Holden Beach: "Unofficial" Minutes & Commentscutty54Nessuna valutazione finora

- PAVEL SAKURETS Notary Application 842 Cannon 651-235-8972Documento1 paginaPAVEL SAKURETS Notary Application 842 Cannon 651-235-8972CamdenCanaryNessuna valutazione finora

- U.S Immigration Newspaper Vol 5 No 64Documento32 pagineU.S Immigration Newspaper Vol 5 No 64David FamuyideNessuna valutazione finora

- State Deficit Districts 12.6.12Documento9 pagineState Deficit Districts 12.6.12Alan BurdziakNessuna valutazione finora

- 2004-1 CFDMinutes Formation 05192004.XxxpdfDocumento30 pagine2004-1 CFDMinutes Formation 05192004.XxxpdfBrian DaviesNessuna valutazione finora

- Boulder Ballot PetitionDocumento2 pagineBoulder Ballot PetitionMatt SebastianNessuna valutazione finora

- Public NoticeDocumento2 paginePublic Noticeapi-310267100Nessuna valutazione finora

- Tarrant County Sample BallotDocumento4 pagineTarrant County Sample BallotMadalyn ShircliffNessuna valutazione finora

- Appendix E: TABOR, Article X, Section 20, Colorado ConstitutionDocumento5 pagineAppendix E: TABOR, Article X, Section 20, Colorado ConstitutionIndependence InstituteNessuna valutazione finora

- Leaving Currency Behind: How We Transition from Human Labor for Survival Toward a Fully Automated EconomyDa EverandLeaving Currency Behind: How We Transition from Human Labor for Survival Toward a Fully Automated EconomyNessuna valutazione finora

- Union Pacific LetterDocumento2 pagineUnion Pacific LettervaildailyNessuna valutazione finora

- Water ImprovementsDocumento3 pagineWater ImprovementsvaildailyNessuna valutazione finora

- Chair Lift Study May 1988Documento25 pagineChair Lift Study May 1988vaildailyNessuna valutazione finora

- Battle Mountain FlyerDocumento2 pagineBattle Mountain FlyervaildailyNessuna valutazione finora

- Beaver Creek MOUDocumento5 pagineBeaver Creek MOUvaildailyNessuna valutazione finora

- Raptor Makes Its DebutDocumento47 pagineRaptor Makes Its DebutvaildailyNessuna valutazione finora

- VVMC FOVVMC Jan2017Documento29 pagineVVMC FOVVMC Jan2017vaildailyNessuna valutazione finora

- Proposed Fatal Flaws StudyDocumento3 pagineProposed Fatal Flaws StudyvaildailyNessuna valutazione finora

- Newsroom ScribdDocumento47 pagineNewsroom ScribdvaildailyNessuna valutazione finora

- Forest Service, Vail Resorts EmailsDocumento5 pagineForest Service, Vail Resorts EmailsvaildailyNessuna valutazione finora

- SeriesDocumento17 pagineSeriesvaildailyNessuna valutazione finora

- State of Colorado: Second Regular Session Seventieth General AssemblyDocumento6 pagineState of Colorado: Second Regular Session Seventieth General AssemblyvaildailyNessuna valutazione finora

- 2014 Sales Tax Tracking Bud and ActualDocumento1 pagina2014 Sales Tax Tracking Bud and ActualvaildailyNessuna valutazione finora

- Tcap Csap 2013 Exec SumDocumento265 pagineTcap Csap 2013 Exec SumvaildailyNessuna valutazione finora

- TCAP 2013 Growth Summary SheetDocumento5 pagineTCAP 2013 Growth Summary SheetvaildailyNessuna valutazione finora

- Tcap Csap 2013 Exec SumDocumento265 pagineTcap Csap 2013 Exec SumvaildailyNessuna valutazione finora

- Fourth of JulyDocumento40 pagineFourth of JulyvaildailyNessuna valutazione finora

- 2014 February Stax Collected MemoDocumento2 pagine2014 February Stax Collected MemovaildailyNessuna valutazione finora

- Ingalls Complaint Signed and DatedDocumento9 pagineIngalls Complaint Signed and DatedvaildailyNessuna valutazione finora

- Tcap Csap 2013 Exec SumDocumento265 pagineTcap Csap 2013 Exec SumvaildailyNessuna valutazione finora

- TCAP 2013 Growth Summary SheetDocumento5 pagineTCAP 2013 Growth Summary SheetvaildailyNessuna valutazione finora

- Letter of Last InstructionDocumento4 pagineLetter of Last InstructionvaildailyNessuna valutazione finora

- I70 PeisDocumento527 pagineI70 PeissummitdailyNessuna valutazione finora

- CMC-Jensen Separation Agreement Fully ExecutedDocumento10 pagineCMC-Jensen Separation Agreement Fully ExecutedvaildailyNessuna valutazione finora

- Vail Answer To Conlin ComplaintDocumento7 pagineVail Answer To Conlin ComplaintvaildailyNessuna valutazione finora

- Letter From David WilhelmDocumento1 paginaLetter From David WilhelmvaildailyNessuna valutazione finora

- Village (At Avon) Litigation Settlement Financial Questions and AnswersDocumento18 pagineVillage (At Avon) Litigation Settlement Financial Questions and AnswersvaildailyNessuna valutazione finora

- Annual Report 2011Documento32 pagineAnnual Report 2011vaildailyNessuna valutazione finora

- CSAP ScoresDocumento1 paginaCSAP ScoresvaildailyNessuna valutazione finora

- Konsep SRA (Sekolah Ramah Anak) Dalam Membentuk Budaya Islami Di Sekolah DasarDocumento10 pagineKonsep SRA (Sekolah Ramah Anak) Dalam Membentuk Budaya Islami Di Sekolah Dasarsupriyono hasanNessuna valutazione finora

- Biomass Characterization Course Provides Overview of Biomass Energy SourcesDocumento9 pagineBiomass Characterization Course Provides Overview of Biomass Energy SourcesAna Elisa AchilesNessuna valutazione finora

- Corti Et Al., 2021Documento38 pagineCorti Et Al., 2021LunaNessuna valutazione finora

- Grade 1 English For KidsDocumento4 pagineGrade 1 English For Kidsvivian 119190156Nessuna valutazione finora

- Study Habits Guide for Busy StudentsDocumento18 pagineStudy Habits Guide for Busy StudentsJoel Alejandro Castro CasaresNessuna valutazione finora

- Intel It Aligning It With Business Goals PaperDocumento12 pagineIntel It Aligning It With Business Goals PaperwlewisfNessuna valutazione finora

- App Inventor + Iot: Setting Up Your Arduino: Can Close It Once You Open The Aim-For-Things-Arduino101 File.)Documento7 pagineApp Inventor + Iot: Setting Up Your Arduino: Can Close It Once You Open The Aim-For-Things-Arduino101 File.)Alex GuzNessuna valutazione finora

- Critiquing a Short Story About an Aged MotherDocumento2 pagineCritiquing a Short Story About an Aged MotherJohn Rey PacubasNessuna valutazione finora

- CV Finance GraduateDocumento3 pagineCV Finance GraduateKhalid SalimNessuna valutazione finora

- Senior Civil Structure Designer S3DDocumento7 pagineSenior Civil Structure Designer S3DMohammed ObaidullahNessuna valutazione finora

- Theories of LeadershipDocumento24 pagineTheories of Leadershipsija-ekNessuna valutazione finora

- PAASCU Lesson PlanDocumento2 paginePAASCU Lesson PlanAnonymous On831wJKlsNessuna valutazione finora

- 3 People v. Caritativo 256 SCRA 1 PDFDocumento6 pagine3 People v. Caritativo 256 SCRA 1 PDFChescaSeñeresNessuna valutazione finora

- Spelling Errors Worksheet 4 - EditableDocumento2 pagineSpelling Errors Worksheet 4 - EditableSGillespieNessuna valutazione finora

- Compund and Complex Sentences ExerciseDocumento3 pagineCompund and Complex Sentences ExerciseTimothyNessuna valutazione finora

- History of Philippine Sports PDFDocumento48 pagineHistory of Philippine Sports PDFGerlie SaripaNessuna valutazione finora

- AccentureDocumento11 pagineAccenturecentum1234Nessuna valutazione finora

- THE LEGEND OF SITU BAGENDIT by AIN 9CDocumento2 pagineTHE LEGEND OF SITU BAGENDIT by AIN 9CwahyubudionoNessuna valutazione finora

- Airforce Group Y: Previous Y Ear P AperDocumento14 pagineAirforce Group Y: Previous Y Ear P Aperajay16duni8Nessuna valutazione finora

- 02 Activity 1 (4) (STRA)Documento2 pagine02 Activity 1 (4) (STRA)Kathy RamosNessuna valutazione finora

- Brochure - Coming To Work in The Netherlands (2022)Documento16 pagineBrochure - Coming To Work in The Netherlands (2022)Tshifhiwa MathivhaNessuna valutazione finora

- First Time Login Guidelines in CRMDocumento23 pagineFirst Time Login Guidelines in CRMSumeet KotakNessuna valutazione finora

- Zsoka PDFDocumento13 pagineZsoka PDFMasliana SahadNessuna valutazione finora

- Brochure Financial Planning Banking & Investment Management 1Documento15 pagineBrochure Financial Planning Banking & Investment Management 1AF RajeshNessuna valutazione finora

- Lcolegario Chapter 5Documento15 pagineLcolegario Chapter 5Leezl Campoamor OlegarioNessuna valutazione finora

- Chengyang Li Archive Cra 23Documento32 pagineChengyang Li Archive Cra 23Li ChengyangNessuna valutazione finora

- Risc and Cisc: Computer ArchitectureDocumento17 pagineRisc and Cisc: Computer Architecturedress dressNessuna valutazione finora

- Written Test Unit 7 & 8 - Set ADocumento4 pagineWritten Test Unit 7 & 8 - Set ALaura FarinaNessuna valutazione finora