Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

November Reserve Bank of India Bulletin 2004

Caricato da

Steffie CarvalhoDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

November Reserve Bank of India Bulletin 2004

Caricato da

Steffie CarvalhoCopyright:

Formati disponibili

November Reserve Bank of India Bulletin 2004 I started with the core issue of risk in agriculture and how

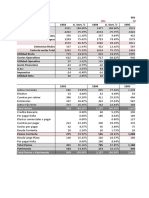

that is a key determinant of all the problems encountered in agricultural lending. I would, therefore, briefly like to examine the record of nonperforming assets (NPAs) in agriculture for commercial banks. Is the hesitation of banks to lend for agriculture really caused by the experience of a much higher level of NPAs? It is found that the proportion of NPAs is indeed higher for agriculture than they are for the no priority sector. However, they are not as high as those for small scale industries (SSI) and for other priority sectors. In fact, for private sector banks, agricultural NPAs are as low as 5 per cent of total outstanding advances to agriculture, and are lower than for the non priority sector (Table 9). In fact, it is likely that if public sector enterprises are excluded from the data for the non-priority sector, the performance of NPAs in agriculture may not be much higher than for lending to the non-priority sector private sector credit exposure as a whole. These data do suggest that agricultural lending may be more risky than nonpriority sectors, but the difference is probably not large enough to w a r r a n t e x c e s s i v e c a u t i o n i n b a n k l e n d i n g f o r agricultural purposes.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Non - Negotiable: Notification of DepositDocumento1 paginaNon - Negotiable: Notification of Depositေျပာမယ္ လက္တို႔ၿပီးေတာ့Nessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Doa TradeDocumento17 pagineDoa TradeEduardo WitonoNessuna valutazione finora

- Risk Management Options and DerivativesDocumento13 pagineRisk Management Options and DerivativesAbdu0% (1)

- WriteableDocumento9 pagineWriteableChinmay RaskarNessuna valutazione finora

- Insolvency LawDocumento14 pagineInsolvency LawShailesh KumarNessuna valutazione finora

- N26 StatementDocumento4 pagineN26 StatementCris TsauNessuna valutazione finora

- My - Invoice - 12 Jan 2023, 18 - 01 - 08Documento2 pagineMy - Invoice - 12 Jan 2023, 18 - 01 - 08Rohit Kumar DubeyNessuna valutazione finora

- The End of The Bretton Woods SystemDocumento2 pagineThe End of The Bretton Woods SystemSteffie CarvalhoNessuna valutazione finora

- SELLING and MarketingDocumento2 pagineSELLING and MarketingSteffie CarvalhoNessuna valutazione finora

- SynopsisDocumento2 pagineSynopsisSteffie CarvalhoNessuna valutazione finora

- BBI InvitationDocumento1 paginaBBI InvitationSteffie CarvalhoNessuna valutazione finora

- System AuditDocumento22 pagineSystem AuditSteffie CarvalhoNessuna valutazione finora

- Lesson 10 - Study MaterialDocumento15 pagineLesson 10 - Study Materialnadineventer99Nessuna valutazione finora

- Solution 1Documento5 pagineSolution 1frq qqrNessuna valutazione finora

- Functions of IDBI BankDocumento37 pagineFunctions of IDBI Bankangelia3101Nessuna valutazione finora

- Bajaj Auto Annual Report - Secc - grp6Documento11 pagineBajaj Auto Annual Report - Secc - grp6Varun KumarNessuna valutazione finora

- PUP Review Handout 3 OfficialDocumento2 paginePUP Review Handout 3 OfficialDonalyn CalipusNessuna valutazione finora

- UnileverDocumento5 pagineUnileverKevin PratamaNessuna valutazione finora

- Activities FXDocumento5 pagineActivities FXWaqar KhalidNessuna valutazione finora

- Renewal Premium Receipt - 00755988Documento1 paginaRenewal Premium Receipt - 00755988Tarun KushwahaNessuna valutazione finora

- Heineken 2004Documento50 pagineHeineken 2004k0yujinNessuna valutazione finora

- Default Profile Customer Level Account - FusionDocumento1 paginaDefault Profile Customer Level Account - FusionhuyhnNessuna valutazione finora

- Business Combi CH 6 de JesusDocumento9 pagineBusiness Combi CH 6 de JesusMerel Rose FloresNessuna valutazione finora

- FX Fluctuations, Intervention, and InterdependenceDocumento9 pagineFX Fluctuations, Intervention, and InterdependenceRamagurubaran VenkatNessuna valutazione finora

- ACCT203 LeaseDocumento4 pagineACCT203 LeaseSweet Emme100% (1)

- Analisis Foda AirbnbDocumento4 pagineAnalisis Foda AirbnbEliana MorilloNessuna valutazione finora

- MCTax GuideDocumento1 paginaMCTax Guidekhageshcode89Nessuna valutazione finora

- Rogoff (1985) ConservativeDocumento5 pagineRogoff (1985) Conservative92_883755689Nessuna valutazione finora

- StatementOfAccount 3092378518 Jul17 141113.csvDocumento49 pagineStatementOfAccount 3092378518 Jul17 141113.csvOur educational ServiceNessuna valutazione finora

- Excel Clarkson LumberDocumento9 pagineExcel Clarkson LumberCesareo2008Nessuna valutazione finora

- Mitsui OSK Lines Vs Orient Ship AgencyDocumento108 pagineMitsui OSK Lines Vs Orient Ship Agencyvallury chaitanya RaoNessuna valutazione finora

- Latihan 1 Rusamezananiff Bin RuselanDocumento46 pagineLatihan 1 Rusamezananiff Bin RuselanAnifNessuna valutazione finora

- Steel Swaps ExplainedDocumento29 pagineSteel Swaps Explainedinfo8493Nessuna valutazione finora

- Financial Times Europe - 25.11.2020Documento20 pagineFinancial Times Europe - 25.11.2020Muhammad AroojNessuna valutazione finora

- ForexDocumento2 pagineForexLyra Joy CalayanNessuna valutazione finora