Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

DTA Sale Duty Structure

Caricato da

Arun K Gupta0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

234 visualizzazioni1 paginaCopyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

DOC, PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato DOC, PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

234 visualizzazioni1 paginaDTA Sale Duty Structure

Caricato da

Arun K GuptaCopyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato DOC, PDF o leggi online su Scribd

Sei sulla pagina 1di 1

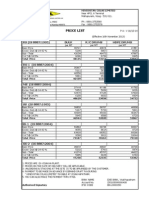

DTA SALE (DUTY STRUCTURE)

Example A B C D E F G H I J K L Assessable Value

Basic Duty ( 10% of A ) Assessable Value + Basic Duty CVD 10% ( of C ) Education Cess on CVD 2% ( of D ) S & H Education Cess on CVD 1% ( of E ) Duty for Custom Cess (B + D + E + F ) Education Cess on Customs 2% (of G) S&H Education Cess on Custom 1% (of G) Excise Duty Payable as per 3 CEA ( G + H+ I) Education Cess on Excise 2% (of J) S&H Education Cess on Excise 1% (of J)

1000 100 1100 110 2.2 1.1 213.3 4.266 2.133 219.699 4.39398 2.19699 226.29

Total Duty Payable

(J+K+L)

Potrebbero piacerti anche

- STPI Noida - Non STP Service Charges For SoftexDocumento1 paginaSTPI Noida - Non STP Service Charges For SoftexArun K GuptaNessuna valutazione finora

- Foreign Trade Policy, 27th August 2009 - 31st March 2014Documento105 pagineForeign Trade Policy, 27th August 2009 - 31st March 2014Deepak PareekNessuna valutazione finora

- Taj Mahal - Symbol of LoveDocumento7 pagineTaj Mahal - Symbol of LoveArun K GuptaNessuna valutazione finora

- Appointment LetterDocumento1 paginaAppointment LetterArun K GuptaNessuna valutazione finora

- STPI Fees Slab Export ValueDocumento1 paginaSTPI Fees Slab Export ValueArun K GuptaNessuna valutazione finora

- Ad Code Letter From The BankDocumento1 paginaAd Code Letter From The BankArun K Gupta100% (4)

- Application For Telephone SurrenderDocumento1 paginaApplication For Telephone SurrenderArun K Gupta60% (5)

- Import Gatt DeclarationDocumento2 pagineImport Gatt DeclarationVyankatesh AshtekarNessuna valutazione finora

- Bank Certificate FormatDocumento1 paginaBank Certificate FormatArun K GuptaNessuna valutazione finora

- Proximity Card Form For Advocate/ Bar Council MemberDocumento2 pagineProximity Card Form For Advocate/ Bar Council MemberArun K GuptaNessuna valutazione finora

- Independent Contractor AgreementDocumento4 pagineIndependent Contractor AgreementArun K Gupta0% (1)

- Resignation LetterDocumento1 paginaResignation LetterArun K GuptaNessuna valutazione finora

- Form 49 BDocumento5 pagineForm 49 Bkborah100% (9)

- Format of Vakalatnama in High CourtDocumento1 paginaFormat of Vakalatnama in High CourtArun K Gupta60% (5)

- Format of Affidavit For Filing Civil Writ Petition in High CourtDocumento1 paginaFormat of Affidavit For Filing Civil Writ Petition in High CourtArun K Gupta100% (4)

- Format - High Court Entry PassDocumento1 paginaFormat - High Court Entry PassArun K Gupta38% (8)

- The Teaching of IslamDocumento1 paginaThe Teaching of IslamArun K GuptaNessuna valutazione finora

- Gandhi Was Bisexual, Racist, Claims New BookDocumento1 paginaGandhi Was Bisexual, Racist, Claims New BookArun K GuptaNessuna valutazione finora

- Entry Pass For Supreme CourtDocumento2 pagineEntry Pass For Supreme CourtArun K Gupta50% (2)

- Recipes - MasterChef (Indian TV Show)Documento48 pagineRecipes - MasterChef (Indian TV Show)Arun K Gupta100% (1)

- Format of Affidavit For Filling Additional DocumentsDocumento1 paginaFormat of Affidavit For Filling Additional DocumentsArun K Gupta54% (13)

- Breads N Breakfast Treats Exciting Recipes 05Documento28 pagineBreads N Breakfast Treats Exciting Recipes 05Arun K GuptaNessuna valutazione finora

- Format of Affidavit For SLP (Civil/Criminal)Documento1 paginaFormat of Affidavit For SLP (Civil/Criminal)Arun K Gupta100% (3)

- Format of VakalatnamaDocumento1 paginaFormat of VakalatnamaArun K Gupta82% (11)

- Supreme Court of India - Proximity Card Form For ClerkDocumento1 paginaSupreme Court of India - Proximity Card Form For ClerkArun K Gupta100% (1)

- Waiting List DDA Housing Scheme 2010Documento15 pagineWaiting List DDA Housing Scheme 2010Arun K GuptaNessuna valutazione finora

- Candies & Other Treats Exciting Recipes 02Documento28 pagineCandies & Other Treats Exciting Recipes 02Arun K GuptaNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 1739898250marksheet June, 2016 For UploadingDocumento36 pagine1739898250marksheet June, 2016 For Uploadingdurgeshtiwary0% (1)

- Updated List of LocationsDocumento38 pagineUpdated List of LocationsSumanNessuna valutazione finora

- Customs, Excise Service Tax Appellate Tribunal West Block No.2, R.K. Puram, New Delhi-110066Documento3 pagineCustoms, Excise Service Tax Appellate Tribunal West Block No.2, R.K. Puram, New Delhi-110066AnonymousNessuna valutazione finora

- Gging TagDocumento14 pagineGging TagCaroline DonaldsonNessuna valutazione finora

- Yateen Vyas: Seeking Middle Level Career Opportunities in Logistics, Excise& Service Tax With An Organization of ReputeDocumento2 pagineYateen Vyas: Seeking Middle Level Career Opportunities in Logistics, Excise& Service Tax With An Organization of ReputeyateenvyasNessuna valutazione finora

- HScodes - TariffDocumento123 pagineHScodes - Tariff0716800012Nessuna valutazione finora

- East Godavari District Officers Phone Numbers-Mobile Numbers Andhra Pradesh StateDocumento7 pagineEast Godavari District Officers Phone Numbers-Mobile Numbers Andhra Pradesh StateSRINIVASARAO JONNALANessuna valutazione finora

- 12-Stock Valuation March-10 - FOR TAX AUDITDocumento352 pagine12-Stock Valuation March-10 - FOR TAX AUDITAnkur TailorNessuna valutazione finora

- Mumbai1 CX Qe Dec17 PDFDocumento12 pagineMumbai1 CX Qe Dec17 PDFRohan ShindeNessuna valutazione finora

- Mumbai1 CX Qe Dec17 PDFDocumento12 pagineMumbai1 CX Qe Dec17 PDFsachin golegaonkarNessuna valutazione finora

- Price List 2009 - MOSIL - MRP Only Rev 01 Issue 01Documento16 paginePrice List 2009 - MOSIL - MRP Only Rev 01 Issue 01pratikshah202100% (1)

- Certificate NACIN Jan-2024 72ndbatch (Revised)Documento2 pagineCertificate NACIN Jan-2024 72ndbatch (Revised)IAS MeenaNessuna valutazione finora

- Transfer Placement Policy of Central Excise Lucknow ZoneDocumento5 pagineTransfer Placement Policy of Central Excise Lucknow ZoneSUSHIL KUMARNessuna valutazione finora

- Eulsion Price List Wef 16-11-2013Documento2 pagineEulsion Price List Wef 16-11-2013P. Balaji Chakravarthy100% (1)

- Joining ReportDocumento5 pagineJoining ReportRam SewakNessuna valutazione finora