Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Sen Sex

Caricato da

shamikCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Sen Sex

Caricato da

shamikCopyright:

Formati disponibili

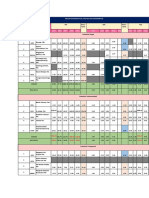

Co-efficient of Avg.

Daily Return

Scrip code Company Beta Values

Determination (R2) Volatility (%) year)

500325 RELIANCE 1.00 0.51 1.55 -

500209 INFOSYS TECH 0.79 0.42 1.36 2

532174 ICICI BANK L 1.47 0.61 2.09 1

500875 I T C LTD 0.73 0.30 1.49 3

500510 LARSEN & TOU 1.07 0.50 1.69

500010 HOUSING DEVE 1.11 0.50 1.73 2

500180 HDFC BANK LT 0.98 0.51 1.52 2

500112 STATE BANK O 1.15 0.45 1.91 3

532540 TCS LTD. 0.86 0.33 1.66 5

500312 ONG CORP LTD 0.66 0.21 1.58

532454 BHARTI ARTL 0.77 0.18 2.02 1

500470 TATA STL 1.30 0.51 2.03 -

500570 TATA MOTORS 1.47 0.47 2.39 6

500103 BHEL 0.82 0.41 1.43 -1

532555 NTPC LTD 0.66 0.33 1.27 -

500520 MAHINDRA & M 1.12 0.38 2.01 2

500440 HINDALCO IN 1.58 0.53 2.41 1

500696 HIND UNI LT 0.51 0.17 1.38 1

500900 STERLITE IN 1.49 0.47 2.43 -1

532286 JINDAL STEEL 1.03 0.46 1.68 -

507685 WIPRO LTD. 0.80 0.30 1.62 1

500400 TATA POWER 0.62 0.28 1.30 -

532977 BAJAJ AUTO 0.64 0.02 4.73 -2

532500 MARUTISUZUK 0.79 0.25 1.76 -1

500087 CIPLA LTD. 0.47 0.12 1.51 -

500182 HEROHONDA M 0.51 0.07 2.10 -1

500390 REL INFRA 1.24 0.24 2.79 -3

532532 JAIPRAK ASSO 1.66 0.48 2.66 -3

532868 DLF LIMITED 1.50 0.51 2.34 -1

532712 REL COM LTD 1.21 0.22 2.83 -3

SENSEX 1.00 1.11 1

Beta = Co-variance(SENSEX, Stock)/ Variance(SENSEX)

R2 = (Correlation)2

Average Daily Volatility = One standard deviation of daily returns of individual stock price for last one year

Returns = variation in the stock price over last one year

Potrebbero piacerti anche

- Strategic Analysis Report - Tesla MotorsDocumento8 pagineStrategic Analysis Report - Tesla MotorsahmedbaloNessuna valutazione finora

- The First Basic Plan For Immigration Policy, 2008-2012, Ministry of Justice, Republic of KoreaDocumento129 pagineThe First Basic Plan For Immigration Policy, 2008-2012, Ministry of Justice, Republic of KoreakhulawNessuna valutazione finora

- 32 - Indian ExportDocumento49 pagine32 - Indian Exportshawon azamNessuna valutazione finora

- Air Asia CompleteDocumento18 pagineAir Asia CompleteAmy CharmaineNessuna valutazione finora

- BetaDocumento1 paginaBetadipinchelseaNessuna valutazione finora

- Portfolio July 2005Documento10 paginePortfolio July 2005api-3716002Nessuna valutazione finora

- BOM (RTM) With China 08302021Documento17 pagineBOM (RTM) With China 08302021kumailNessuna valutazione finora

- Index Today (%) 1 Week (%) 1 Month (%) 6 Months (%) 1 Year (%) YTD (%)Documento11 pagineIndex Today (%) 1 Week (%) 1 Month (%) 6 Months (%) 1 Year (%) YTD (%)Violeta TaniNessuna valutazione finora

- Dowell Hal. BJ: Diacel LWL Halad-9 D-20 (GEL) HALAD-22A HALAD-413 R3 HALAD-344 GasstopDocumento9 pagineDowell Hal. BJ: Diacel LWL Halad-9 D-20 (GEL) HALAD-22A HALAD-413 R3 HALAD-344 GasstopRio DarianoNessuna valutazione finora

- 10-09-2022 RTM Copy of BOM (RTM) With RupaliDocumento16 pagine10-09-2022 RTM Copy of BOM (RTM) With RupalikumailNessuna valutazione finora

- AMTEL - Financials - I3investorDocumento3 pagineAMTEL - Financials - I3investorSham YusoffNessuna valutazione finora

- Sektor Infrastruktur, Utilitas, Dan TransportasiDocumento2 pagineSektor Infrastruktur, Utilitas, Dan TransportasiDiki DikiNessuna valutazione finora

- 8950P229 SampleDocumento5 pagine8950P229 SamplecarlosNessuna valutazione finora

- 5-Performance of Political PartiesDocumento1 pagina5-Performance of Political PartiesSatyapal ReddyNessuna valutazione finora

- Current ValueDocumento1 paginaCurrent Valuerawatamit1985Nessuna valutazione finora

- Intraday Setups BUY Trades: Watchlist and Trade Setups For Intraday Trading in Stocks (Based On 4H Timeframe)Documento11 pagineIntraday Setups BUY Trades: Watchlist and Trade Setups For Intraday Trading in Stocks (Based On 4H Timeframe)rajnNessuna valutazione finora

- Bcasvista 20190719Documento8 pagineBcasvista 20190719kezia yulinaNessuna valutazione finora

- Persen Target PTW 18 - 24 JAN 2023 UPDATE 16 JAN 2023Documento118 paginePersen Target PTW 18 - 24 JAN 2023 UPDATE 16 JAN 2023Rama DhaniNessuna valutazione finora

- 08-03-24bhagwati Enterprise Excel Sheet NewDocumento2 pagine08-03-24bhagwati Enterprise Excel Sheet Newmnj.shardaNessuna valutazione finora

- Stock StatementDocumento1 paginaStock StatementManish ChaubeyNessuna valutazione finora

- Research Hypothesis:: Dependent VariablesDocumento5 pagineResearch Hypothesis:: Dependent VariablesHafiz Saddique MalikNessuna valutazione finora

- Rukun Asri HortiDocumento8 pagineRukun Asri Hortihelenayu liziaNessuna valutazione finora

- Scripwise Price Movement in BANKEX: Bse Bankex 01 January, 2002 1000 23 June, 2003 Free-Float Market CapitalizationDocumento6 pagineScripwise Price Movement in BANKEX: Bse Bankex 01 January, 2002 1000 23 June, 2003 Free-Float Market CapitalizationChetan Ganesh RautNessuna valutazione finora

- Panel 1: Risk Parameters of The Investable Universe (Annualized)Documento27 paginePanel 1: Risk Parameters of The Investable Universe (Annualized)Ansab ArfanNessuna valutazione finora

- All Sectors - The Economic TimesDocumento4 pagineAll Sectors - The Economic Timesdvg6363238970Nessuna valutazione finora

- Data Analisis DiskriminanDocumento5 pagineData Analisis DiskriminandendytkNessuna valutazione finora

- Rasio IndustriDocumento4 pagineRasio IndustriAddini Dwi PuspitaNessuna valutazione finora

- Name Symbol Sector WT LOT Step LTP % ChangeDocumento4 pagineName Symbol Sector WT LOT Step LTP % ChangeRaypixel vfxNessuna valutazione finora

- q3 Iadc-Hse AsrkishDocumento2 pagineq3 Iadc-Hse AsrkishhshobeyriNessuna valutazione finora

- Assignment S1 2023 PDFDocumento13 pagineAssignment S1 2023 PDFDuy Trung BuiNessuna valutazione finora

- IndustryDocumento20 pagineIndustry121prashantNessuna valutazione finora

- Apcs Act 1964Documento11 pagineApcs Act 1964padmavathi srinivasNessuna valutazione finora

- Spreadsheet 8 1 SAMPLEDocumento48 pagineSpreadsheet 8 1 SAMPLEAnsab ArfanNessuna valutazione finora

- Escape From Tarkov Official and Actual Ammo TableDocumento4 pagineEscape From Tarkov Official and Actual Ammo TableAndy LeeNessuna valutazione finora

- Tekchand & Grandsons: From 1-7-2022 To 31-7-2022 All ItemsDocumento9 pagineTekchand & Grandsons: From 1-7-2022 To 31-7-2022 All ItemsManjeet SinghNessuna valutazione finora

- Elektor 1984 12Documento55 pagineElektor 1984 12Cappelletto GianlucaNessuna valutazione finora

- Y RumeuDocumento1 paginaY RumeuLainoNessuna valutazione finora

- S η a β k k T T TDocumento76 pagineS η a β k k T T TSuad KubatNessuna valutazione finora

- Front Wheel Assy. DrumDocumento2 pagineFront Wheel Assy. DrumSoroj BiswasNessuna valutazione finora

- QC Score Card Report On May'2022Documento53 pagineQC Score Card Report On May'2022RS MANIKANDANNessuna valutazione finora

- HDFC Equity Fund Is An Open-Ended Growth Scheme, Which Aims To Generate Long-TermDocumento8 pagineHDFC Equity Fund Is An Open-Ended Growth Scheme, Which Aims To Generate Long-Termshreedhar mohtaNessuna valutazione finora

- 3.daily Active Gain May 2021Documento212 pagine3.daily Active Gain May 2021wan izzuddinNessuna valutazione finora

- Swadaya TP1Documento5 pagineSwadaya TP1jiwjwjywsywfNessuna valutazione finora

- 1.daily Active Gain MARCH 2021Documento336 pagine1.daily Active Gain MARCH 2021wan izzuddinNessuna valutazione finora

- Diodo Regulador de CorrienteDocumento6 pagineDiodo Regulador de CorrienteHector Jose Murillo CordobaNessuna valutazione finora

- Pi Synda Gi Fittings PriceDocumento1 paginaPi Synda Gi Fittings Priceadeh mascotNessuna valutazione finora

- PNL Summary N142943 2021-2022 ReligareDocumento6 paginePNL Summary N142943 2021-2022 ReligareIshika ManwaniNessuna valutazione finora

- Closingrates 202308junDocumento19 pagineClosingrates 202308junTabrez IrfanNessuna valutazione finora

- Bi C012 E-Side FullDocumento9 pagineBi C012 E-Side FullChe Amar Shafiq Che BaharumNessuna valutazione finora

- Appendix I: Mark-Houwink Parameters For HomopolymersDocumento33 pagineAppendix I: Mark-Houwink Parameters For Homopolymerskiwi27_87Nessuna valutazione finora

- Libro 1Documento2 pagineLibro 1Miguelito Pa Q MasNessuna valutazione finora

- Aceleraci (On Vs Masa: 0.35 F (X) - 0.172x + 0.573568 R 0.9964969011Documento2 pagineAceleraci (On Vs Masa: 0.35 F (X) - 0.172x + 0.573568 R 0.9964969011Miguelito Pa Q MasNessuna valutazione finora

- Conductoare Neizolate Din Al: Po (KW) PSCC (KW)Documento5 pagineConductoare Neizolate Din Al: Po (KW) PSCC (KW)Ciprian ApalaghițeiNessuna valutazione finora

- Market Sentiments: Indian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG YtdDocumento11 pagineMarket Sentiments: Indian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG Ytdvikalp123123Nessuna valutazione finora

- Laying Conditions: 40 ºC 30 ºC 1.5 K M/W 0.8 M. Annex EDocumento2 pagineLaying Conditions: 40 ºC 30 ºC 1.5 K M/W 0.8 M. Annex Elk RentalNessuna valutazione finora

- EIWA NES 2060 - Blowing Agent 1Documento2 pagineEIWA NES 2060 - Blowing Agent 1Manuel HerreraNessuna valutazione finora

- Nudo A B C D Tramo AB BA BC BF CB CD DCDocumento3 pagineNudo A B C D Tramo AB BA BC BF CB CD DCLizanaSantistebanAlfonsoNessuna valutazione finora

- 31 Oct Rebalance PortfolioDocumento1 pagina31 Oct Rebalance Portfolioindopak1971Nessuna valutazione finora

- Market AnalysisDocumento143 pagineMarket AnalysisArivalagan VeluNessuna valutazione finora

- Qty Bulanan KelDocumento7 pagineQty Bulanan Kelpratamaerich1109Nessuna valutazione finora

- Grafik Li & SuDocumento2 pagineGrafik Li & SuYusi SulastriNessuna valutazione finora

- KanuDocumento1 paginaKanumanna.dass76Nessuna valutazione finora

- Tugas Problem Set 5 Ekonomi ManajerialDocumento3 pagineTugas Problem Set 5 Ekonomi ManajerialRuth AdrianaNessuna valutazione finora

- Drivers of International BusinessDocumento38 pagineDrivers of International BusinessAKHIL reddyNessuna valutazione finora

- Abu Dhabi EstidamaDocumento63 pagineAbu Dhabi Estidamagolashdi100% (3)

- Project Feasibility Report: BBA 5th SemesterDocumento15 pagineProject Feasibility Report: BBA 5th SemesterChandan RaiNessuna valutazione finora

- Rates and ProportionalityDocumento23 pagineRates and ProportionalityJade EncarnacionNessuna valutazione finora

- Boat Bassheads 100 Wired Headset: Grand Total 439.00Documento1 paginaBoat Bassheads 100 Wired Headset: Grand Total 439.00Somsubhra GangulyNessuna valutazione finora

- Daftar Industrial EstatesDocumento2 pagineDaftar Industrial EstatesKepo DehNessuna valutazione finora

- Law University SynopsisDocumento3 pagineLaw University Synopsistinabhuvan50% (2)

- Answer Key Part 4Documento13 pagineAnswer Key Part 4Alfina TabitaNessuna valutazione finora

- Plan Contable EmpresarialDocumento432 paginePlan Contable EmpresarialJhamil Nirek PascasioNessuna valutazione finora

- Eldorado DredgeDocumento2 pagineEldorado DredgeNeenNessuna valutazione finora

- Waste Managment PlanDocumento56 pagineWaste Managment Planabrham astatikeNessuna valutazione finora

- Factors Responsible For The Location of Primary, Secondary, and Tertiary Sector Industries in Various Parts of The World (Including India)Documento53 pagineFactors Responsible For The Location of Primary, Secondary, and Tertiary Sector Industries in Various Parts of The World (Including India)Aditya KumarNessuna valutazione finora

- Grammar Vocabulary 1star Unit7 PDFDocumento1 paginaGrammar Vocabulary 1star Unit7 PDFLorenaAbreuNessuna valutazione finora

- Indian Economic Social History Review-1979-Henningham-53-75Documento24 pagineIndian Economic Social History Review-1979-Henningham-53-75Dipankar MishraNessuna valutazione finora

- Marketing Analysis of NestleDocumento40 pagineMarketing Analysis of NestleFaizanSheikh100% (3)

- © 2019 TOKOIN. All Rights ReservedDocumento47 pagine© 2019 TOKOIN. All Rights ReservedPutra KongkeksNessuna valutazione finora

- Datesheet For BallDocumento1 paginaDatesheet For BallWicked PhenomNessuna valutazione finora

- Assignment 2-3 ContempDocumento2 pagineAssignment 2-3 ContempMARK JAMES BAUTISTANessuna valutazione finora

- Arch Support - DesigningDocumento7 pagineArch Support - DesigningjasonjcNessuna valutazione finora

- Sbi Po QTN and AnsDocumento6 pagineSbi Po QTN and AnsMALOTH BABU RAONessuna valutazione finora

- Operation Flood White Revolution Muhammad Ali 2007-Va-378 Bs (Hons) Dairy TechnologyDocumento23 pagineOperation Flood White Revolution Muhammad Ali 2007-Va-378 Bs (Hons) Dairy TechnologyShawn MathiasNessuna valutazione finora

- Economic Engineering - Inflation - Lectures 1&2Documento66 pagineEconomic Engineering - Inflation - Lectures 1&21k subs with no videos challengeNessuna valutazione finora

- Technology TransferDocumento31 pagineTechnology TransferPrasanth KumarNessuna valutazione finora

- SCHOOLDocumento18 pagineSCHOOLStephani Cris Vallejos Bonite100% (1)

- Flight Booking Invoice MMTDocumento2 pagineFlight Booking Invoice MMTNanak JAYANTANessuna valutazione finora

- Maruti CaseDocumento5 pagineMaruti CaseBishwadeep Purkayastha100% (1)