Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Depreciation Rates Companies Act PDF

Caricato da

Gaurav PatangeDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Depreciation Rates Companies Act PDF

Caricato da

Gaurav PatangeCopyright:

Formati disponibili

www.taxprintindia.

com

Depreciation Chart: Income Tax

Assessment Year 2011-12

Block Nature of Asset Rate of

Depreciation

Building

Block-1 Residential building other than hotels and boarding houses 5

Block-2 Office, factory, godowns or building - not mainly residential purpose 10

Block-3 Temporary erections such as wooden structures 100

Furniture

Block-4 Furniture - Any furniture / fittings including electricals fittings 10

Plant and Machinery

Block-5 Any plant or machinery (not covered by block 6,7,8,9,10,11 or 12)

and motors cars (other than those used in a business of running

them on hire) acquired or put to use on or after April 1, 1990 15

Block-6 Ocean-going ships, vessels ordinary operating on inland waters

including speed boats 20

Block-7 Buses, lorries and taxies used in business of running them on hire,

machinery used in semi-conductor industry, moulds used in rubber

and plastic goods factories 30

Block-8 Aeroplanes, life saving medical equipment 40

Block-9 Containers made of glass or plastic used as refills, new commercial

vehicle which is acquired during Jan 1, 2009 and Sept 30, 2009 and is

put to use before Oct 1, 2009 for the purpose of business / profession 50

Block-10 Computers including computer software. Books (other than annual

publication) owned by a professional. 60

Block-11 Energy saving devices; renewal energy devices; rollers in flour mills,

sugar works and steel industry 80

Block-12 Air pollution control equipments; water pollution control equipments;

solid waste control equipments, recycling and resource recovery

systems; (being annual publications) owned by assessees

carrying on a profession or books (may or may not be annual

publications) carrying on business in running lending libraries 100

Intangible Assets

Block-13 Intangible assets (acquired after march 31, 1998) - Know-how,

patents, copyrights, trademarks, licences, franchises and any other

business or commercial rights of similar nature 25

dowload from www.simpletaxindia.org

www.taxprintindia.com

Interest Accrual: Kisan Vikas Patras

Period from the date Purchased from Purchased from Purchased from

of certificate to the 1-3-2001 to 28-2-2002 1-3-2002 to 28-2-2003 1-3-2003

date of its encashment Rate of Maturity Rate of Maturity Rate of Maturity

Interest Value Rs. Interest Value Rs. Interest Value Rs.

1 Year 7.75 1079.00 7.25 1074.00 6.40 1065.02

2 Years 7.75 1164.00 7.25 1153.00 6.40 1134.28

2 Years and 6 Months 7.75 1209.00 7.25 1195.00 6.40 1170.51

3 Years 8.25 1274.00 7.75 1256.00 6.40 1207.95

3 Year and 6 Months 8.25 1327.00 7.75 1305.00 6.88 1267.19

4 Years 8.75 1409.00 8.25 1382.00 6.88 1310.80

4 Year and 6 Months 8.75 1470.00 8.25 1439.00 6.88 1355.90

5 Years 9.25 1572.00 8.75 1534.00 7.36 1435.63

5 Year and 6 Months 9.25 1644.00 8.75 1602.00 7.36 1488.49

6 Years 9.75 1770.00 8.75 1672.00 7.36 1543.30

6 Year and 6 Months 9.75 1857.00 9.25 1800.00 7.85 1649.13

7 Years NA NA 9.25 1883.00 7.85 1713.82

7 Year and 6 Months - 2000.00* - 2000.00** 7.85 1781.06

8 Years NA NA NA NA 7.85 1850.93

8 Year and 7 Months NA NA NA NA - 2000.00

* 7 Years 3 Months ** 7 Years 8 Months

Gold - Silver Rates of Last 10 Years

Assessment Relevant Std. Gold Rate Silver Rate

Year Valuation (24 Carrat for 10 gms (9960 touch for 1 kg.

Date i.e. 0.87 tola.) i.e. 85.734 tola)

2001-2002 31/03/2001 4190 7215

2002-2003 31/03/2002 5010 7875

2003-2004 31/03/2003 5310 7695

2004-2005 31/03/2004 6065 11770

2005-2006 31/03/2005 6180 10675

2006-2007 31/03/2006 8490 17405

2007-2008 31/03/2007 9395 19520

2008-2009 31/03/2008 12125 23625

2009-2010 31/03/2009 15105 22165

2010-2011 31/03/2010 16320 27255

dowload from www.simpletaxindia.org

www.taxprintindia.com

TDS Rates under DTAA Treaties

l

t ty ica

Dividend

teres oyal ec hn ce

i

In R T erv

S

Sr. Country Special Share Rate Rate Rate Rate Remarks if any

No. Rate 1 Holdg.2

1 2 3 4 5 6 7 8 9

1 Australia 15% 15% Note 1 Note 1

2 Bangladesh 10% 10% 15% 10% 10% Note 3

3 Belarus 10% 25% 15% 10% 15% 15%

4 Belgium 15% 10% 10% 10% 10% tax on interest if loan granted

15% by bank, in other cases 15%

5 Botswana 7.50% 25% 10% 10% 10% 10%

6 Brazil 15% 15% 25% Note 3 Royalty arising from use or right

15% to use trade marks taxable @ 25%

in other case @ 15%

7 Bulgaria 15% 15% 15% 20% Royalty relating to copyright etc

20% taxable @ 15% , in other cases 20%

8 Canada 15% 10% 25% 15% Note 1 Note 1

9 Cyprus 10% 10% 15% 10% 15% 15%/

10%

10 Denmark 15% 25% 20% 10% 20% 20% 10% tax on interest if loan granted by

15% bank, in other cases 15%

11 Finland 15% 10% 10%/ 15% / For 1997-2001, rate for

15% 10% royalty & technical service 15% ifGovt/

Specified org is payer and 20% for

other payers. For subsequent yr - 15%

12 Greece Note 4 Note 4 Note 4 Note 3

13 Indonesia 10% 25% 15% 10% 15% Note 3

14 Italy 15% 10% 20% 15% 20% 20%

15 Jordan 10% 10% 20% 20%

16 Kenya 15% 15% 20% 17.5%

17 Korea 15% 20% 20% 10% 15% 15% 10% if recipient is a bank - in other

15% cases 15%

18 Kyrgyz Rep. 10% 10% 15% 15%

19 Libyan Arab Note 4 Note 4 Note 4 Note 3

Jamahiriya

20 Malta 10% 25% 15% 10% 15% 15% /

10%

21 Mauritius 5% 10% 15% 20% 15% Note 3 Tax on interest in Nil in some cases

22 Mongolia 15% 15% 15% 25%

dowload from www.simpletaxindia.org

www.taxprintindia.com

TDS Rates under DTAA Treaties

l

t ty ica

Dividend

teres oyal ec hn ce

i

In R T erv

S

Sr. Country Special Share Rate Rate Rate Rate Remarks if any

No. Rate 1 Holdg.2

1 2 3 4 5 6 7 8 9

23 Montenegro 5% 25% 15% 10% 10% 10%

24 Myanmar 5% 10% 10% Note 3

25 Nepal 10% 10% 20% 10% 15% Note 3 10% if recipient is a bank-in

15% other cases 15%

26 New Zealand 15% 10% 10% 10%

27 Norway 15% 25% 20% 15% 10% 10%

28 Oman 10% 10% 12.5% 10% 15% 15%

29 Philippines 15% 10% 20% 10% 15% Note 3 Tax on interest @ 10% in

15% hands of financial institutions, insurance

companies, public issue of bonds/

debenture etc, in other cases 15%

30 Poland 15% 15% 22.5% 22.5%

31 Portuguese 10% 25% 10% 10% 10% 10%

Republic

32 Qatar 5% 10% 10% 10% 10% 10%

33 Romania 15% 25% 20% 15% 22.5% 22.5%

34 Saudi Arabia 5% 10% 10% Note 3

35 Serbia 5% 25% 15% 10% 10% 10%

36 Singapore 10% 25% 15% 10% 10% 10% Tax on interest @ 10% if loan granted

15% by bank/similar institution/ insurance

company, in other cases 15%

37 Slovenia 5% 10% 15% 10% 10% 10%

38 Spain 15% 15% Note 2 Note 2

39 Srilanka 15% 10% 10% 10%

40 Sudan 10% 10% 10% Note 3

41 Syria 5% 10% 10% 10% 10% Note 3

42 Tajikistan 5% 25% 10% 10% 10% Note 3

43 Tanzania 10% 10% 15% 12.5% 20% Note 3

44 Thailand 15% 10% 20% 10% 15% Note 3 Interest taxable @

25% 10% if recipient is financial institution /

insurance company, in other cases 25%

45 Turkey 15% 10% / 15% 15% Interest taxable @ 10% if recipient is

15% fin. institution/bank, in other cases 15%

10

dowload from www.simpletaxindia.org

www.taxprintindia.com

TDS Rates under DTAA Treaties

l

t ty ica

Dividend

teres oyal ec hn ce

i

In R T erv

S

Sr. Country Special Share Rate Rate Rate Rate Remarks if any

No. Rate 1 Holdg.2

1 2 3 4 5 6 7 8 9

46 Ukraine 10% 25% 15% 10% 10% 10%

47 United 5% 10% 15% 5% 10% Note 3 Interest taxable @ 5% if loan is

Arab Emirates 12.5% granted by a bank / similar institute, in

other cases 12.5%

48 United Arab Note 4 Note 4 Note 4 Note 3

Republic

(Egypt)

49 United 15% 10% Note 1 Note 1 Interest taxable @ 10% if recipient is a

Kingdom 15% resident bank , in other cases 15%

50 United States 15% 10% 20% 10% Note 1 Note 1 Interest taxable @ 10% if loan is

15% granted by a bank / similar institute, in

other cases 15%

51 Uzbekistan 15% 15% 15% 15%

52 Zambia 5% 25% 15% 10% 10% Note 3

53 * 10% 10% 10% 10%

* Armenia, Austria, China, Czeck Republic, France, Germany, Hungary, Iceland, Ireland, Israel, Japan,

Kazakstan, Kuwait, Luxembourg, Malaysia, Morocco, Namibia, Netherlands, Russian Federation,

South Africa, Sweden, Swiss, Trinidad and Tobago, Turkmenistan, Uganda, Vietnam,

Note 1: Tax on royalties and fees for technical services will be levied in the country of source as follows

A. 10% in case of rental of equipments and services provided alongwith know-how and technical services

B. In any other cases

- During first 5 years of agreement - 15% if payer is Govt/ Specified Organisation - 20% in other cases

- Subsequent Years - 15% in all cases

Income of Govt/ certain institutions exempt from taxation in the country of source

Note 2: Tax on royalties and fees for technical services will be levied in the country of source as follows

A. 10% in case of royalties relating to payments for the use of industrial, commercial or scientific equipments

B. 20% in all other case

Note 3: No separate provision

Note 4: As per Domestic Law

1 2

- Rate of tax for majority share holders. - Percentage of share holding for Majority stake holders

11

dowload from www.simpletaxindia.org

www.taxprintindia.com

Depreciation Chart: Companies Act

Nature of Assets W.D.V(%) S.L.M(%)

Land and Building

• Buildings (other than factory buildings) 5 1.63

• Factory Buildings 10 3.34

• Purely Temporary Erections such as wooden structures 100 100

Plant and Machinery

• plant and machinery (not being a ship) other than SS 13.91 4.75

continuous process plant for which no special rate has DS 20.87 7.42

been prescribed TS 27.82 10.34

• Electrical Machinery, X-ray and electrotherapeutic apparatus

and accessories thereto, medical diagnostic equipments,

namely, Catscan, Ultrasound Machine, ECG Monitors, SS 20 7.07

• Motor-cars, motor cycles, scooters and other mopeds SS 25.89 9.5

• Electrically operated vehicles including battery powered or

fuel cell powered vehicles SS 20 7.07

• Machinery used in the manufacture of electronic goods or SS 15.62 5.38

components DS 23.42 8.46

TS 31.23 11.87

• Earth-moving machinery employed in heavy construction SS 30 11.31

works, such as dams, tunnels, canals, etc.

• Motor buses and motor lorries other than used in a SS 30 11.31

business of running them on hire

• Motor buses, motor lorries and motor taxies used in a

business or running them on hire

• Rubber and plastic goods factories Moulds

• Data Processing Machines including computers

• Gas cylinders including valves and regulators SS 40 16.21

Furniture and Fittings

• General rates 18.1 6.33

• Rate for furniture and fittings used in hotels, restaurants

and boarding houses, schools, colleges and other

educational institutions, libraries, welfare centres, meeting

halls, cinema houses, theatres and circus, and for furniture

and fittings let out on hire for use on the occasion of

marriages and similar functions 25.88 9.5

SS : Single Shift DS : Double Shift TS : Triple Shift

12

dowload from www.simpletaxindia.org

Potrebbero piacerti anche

- Ban GaloreDocumento11 pagineBan Galorehuchha98Nessuna valutazione finora

- Alex ProcessingDocumento11 pagineAlex Processingsaniyag_1Nessuna valutazione finora

- AlexProcessingDocumento10 pagineAlexProcessingStephanie AnitaNessuna valutazione finora

- Pencil Factory. How To Start Polymer Pencil Manufacturing Business.-889953 PDFDocumento67 paginePencil Factory. How To Start Polymer Pencil Manufacturing Business.-889953 PDFMuhammad SulmanNessuna valutazione finora

- Air Bubble PackingDocumento9 pagineAir Bubble PackingSneha Sagar SharmaNessuna valutazione finora

- Pdfanddoc 339053 PDFDocumento81 paginePdfanddoc 339053 PDFArmin MerjaNessuna valutazione finora

- Project of Industrial Traning 'Documento17 pagineProject of Industrial Traning 'Ritesh shuklaNessuna valutazione finora

- Canvas Shoes (With Rubber Sole)Documento9 pagineCanvas Shoes (With Rubber Sole)PRAKASH SUBRAMANIYANNessuna valutazione finora

- Dprbidar Solar Power PVT LTD - Project Information MemorandumDocumento4 pagineDprbidar Solar Power PVT LTD - Project Information MemorandumCh YedukondaluNessuna valutazione finora

- Amul Industries PVT LTDDocumento5 pagineAmul Industries PVT LTDDhaval SolankiNessuna valutazione finora

- 02 Major Test - 03 November 2020Documento14 pagine02 Major Test - 03 November 2020Tlotliso MorethiNessuna valutazione finora

- Automobile GasketsDocumento17 pagineAutomobile GasketsGAMING WITH RVKNessuna valutazione finora

- Renova Bioenergy Rej Ing 24 06 019Documento6 pagineRenova Bioenergy Rej Ing 24 06 019neftali alvarezNessuna valutazione finora

- Financials of PAFDocumento26 pagineFinancials of PAFAbhishek PandaNessuna valutazione finora

- Occ 47-2070Documento2 pagineOcc 47-2070madhulathabingiNessuna valutazione finora

- Fundamental Analysis of ACCDocumento10 pagineFundamental Analysis of ACCmandeep_hs7698100% (2)

- Capmas Statistical Yearbook 2017 Industry and EnergyDocumento52 pagineCapmas Statistical Yearbook 2017 Industry and EnergyMariam M. WilliamNessuna valutazione finora

- Project Report Submitted By: Roll NO. MCME-18-29 Class: Submitted To: Assignment On: Company Analysis Subject: Financial Statement AnalysisDocumento8 pagineProject Report Submitted By: Roll NO. MCME-18-29 Class: Submitted To: Assignment On: Company Analysis Subject: Financial Statement AnalysisihtashamNessuna valutazione finora

- Week 11 Tutorial AnsDocumento6 pagineWeek 11 Tutorial AnsDaniel Goh0% (1)

- MultiCrystallineDataSheet - EN - SilikenDocumento4 pagineMultiCrystallineDataSheet - EN - Silikensydneyaus2005Nessuna valutazione finora

- Payout Oct - Xls 105428Documento3 paginePayout Oct - Xls 105428Ayaan KhanNessuna valutazione finora

- Test EraseDocumento8 pagineTest ErasejustifythisNessuna valutazione finora

- Cs CsaDocumento16 pagineCs CsaTamer MohamedNessuna valutazione finora

- Rolex Rings LTD - IPO Note - July'2021Documento8 pagineRolex Rings LTD - IPO Note - July'2021chinna raoNessuna valutazione finora

- Analysis: Calculation of Total Sales of The ProjectDocumento7 pagineAnalysis: Calculation of Total Sales of The ProjectShailesh Kumar BaldodiaNessuna valutazione finora

- 21 Useful Charts For Service TaxDocumento24 pagine21 Useful Charts For Service Taxashish692Nessuna valutazione finora

- "Study of Fixed Assets Module and Its Integration in Erp": Kec International Ltd. !!Documento22 pagine"Study of Fixed Assets Module and Its Integration in Erp": Kec International Ltd. !!rohitfafatNessuna valutazione finora

- Book 112Documento32 pagineBook 112Aditi BhaniramkaNessuna valutazione finora

- Raw Materials Unit NeededDocumento20 pagineRaw Materials Unit NeededKyll MarcosNessuna valutazione finora

- Corrugated Boxes1Documento8 pagineCorrugated Boxes1abhi050191Nessuna valutazione finora

- Maxime Project ReportDocumento60 pagineMaxime Project ReportMOHD GULZARNessuna valutazione finora

- Feasibility of Co Working SpaceDocumento25 pagineFeasibility of Co Working SpaceAli Azeem Rajwani100% (1)

- Statement Showing TFC'S Issued by Various Companies During The Period 1995 To 2008 (Calender Yearwise)Documento5 pagineStatement Showing TFC'S Issued by Various Companies During The Period 1995 To 2008 (Calender Yearwise)asifahmadaliNessuna valutazione finora

- Top Glove Corporation BHD Corporate PresentationDocumento21 pagineTop Glove Corporation BHD Corporate Presentationalant_2280% (5)

- IFT-NST For AirDocumento4 pagineIFT-NST For Airwewogo8600Nessuna valutazione finora

- Personnel Expenses: Salaries and Wages: Yr of Operation 1 2 3 4Documento6 paginePersonnel Expenses: Salaries and Wages: Yr of Operation 1 2 3 4Mithilesh PamnaniNessuna valutazione finora

- Flip Flow ScreenDocumento6 pagineFlip Flow Screenani1985Nessuna valutazione finora

- The Forecasting Problem Name University DateDocumento14 pagineThe Forecasting Problem Name University DateEstela Luna ChivasNessuna valutazione finora

- Loan Maturity Interest RatesDocumento24 pagineLoan Maturity Interest RatesAditya SharmaNessuna valutazione finora

- Payout Sep - Xls 105329Documento3 paginePayout Sep - Xls 105329Ayaan KhanNessuna valutazione finora

- Data Analysis and Interpretation: CCL Project ADocumento17 pagineData Analysis and Interpretation: CCL Project ARahul BhagatNessuna valutazione finora

- Plastic CratesDocumento9 paginePlastic CratesfawwazNessuna valutazione finora

- Explicatii/Perioada L1 L2: Total Cheltuieli Directe (1+2)Documento18 pagineExplicatii/Perioada L1 L2: Total Cheltuieli Directe (1+2)Camelia BeketNessuna valutazione finora

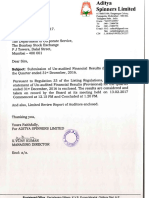

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Estimating Total Cost of Establishing The BusinessDocumento9 pagineEstimating Total Cost of Establishing The BusinessMr. DummyNessuna valutazione finora

- PVC Wire and Cable CoatingDocumento7 paginePVC Wire and Cable CoatingMeryL AngNessuna valutazione finora

- Profile For Coir Fiber or Dust Moulding UnitDocumento7 pagineProfile For Coir Fiber or Dust Moulding UnitAnandh SharavanNessuna valutazione finora

- Mashin TaxDocumento6 pagineMashin TaxSharavkhorol ErdenebayarNessuna valutazione finora

- TABLA I. Valores de La Función de Distribución EstándarDocumento7 pagineTABLA I. Valores de La Función de Distribución EstándarJorge P RNessuna valutazione finora

- Group BDocumento4 pagineGroup BBappy Kumar DasNessuna valutazione finora

- Areas of Assistance To MembersDocumento9 pagineAreas of Assistance To Memberskes7Nessuna valutazione finora

- Mutual FundDocumento2 pagineMutual Fundkum_praNessuna valutazione finora

- Practice Problems, CH 9 10 (MCQ)Documento5 paginePractice Problems, CH 9 10 (MCQ)scridNessuna valutazione finora

- Paper ConesDocumento8 paginePaper ConesEng.Abdalla Qassem50% (2)

- Pvcinsulation PDFDocumento9 paginePvcinsulation PDFjitendrajain1610Nessuna valutazione finora

- "Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiDocumento17 pagine"Engines For Growth & Employment": Presented By:-Prakash Sharma PGDM/ Mba, 2 Sem. IMM, New DelhiPrakash SharmaNessuna valutazione finora

- Mergers and Acquisition: Presented By, Vinay Kumar Kashyap AnanthramanDocumento9 pagineMergers and Acquisition: Presented By, Vinay Kumar Kashyap AnanthramanKashyap AnantharamanNessuna valutazione finora

- Clay Refractory Products World Summary: Market Sector Values & Financials by CountryDa EverandClay Refractory Products World Summary: Market Sector Values & Financials by CountryNessuna valutazione finora

- Glass & Glass Products World Summary: Market Values & Financials by CountryDa EverandGlass & Glass Products World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Accounting Test Bank 1Documento9 pagineAccounting Test Bank 1likes100% (1)

- Far410 Chapter 2 Conceptual Framework EditedDocumento60 pagineFar410 Chapter 2 Conceptual Framework EditedWAN AMIRUL MUHAIMIN WAN ZUKAMALNessuna valutazione finora

- Cost of Capital Study 2011-2012-KPMGDocumento52 pagineCost of Capital Study 2011-2012-KPMGanil14bits87Nessuna valutazione finora

- ZAU-84-104810-VA-5793-20001-0000-02-Scope of Work For CMMS and CCMSDocumento143 pagineZAU-84-104810-VA-5793-20001-0000-02-Scope of Work For CMMS and CCMSPazhamalai Rajan100% (1)

- TB21Documento33 pagineTB21Aiden Pats100% (1)

- Donations Eligible For 100% Deduction Without Qualifying LimitDocumento11 pagineDonations Eligible For 100% Deduction Without Qualifying LimitShravani ShravNessuna valutazione finora

- Divisionalized Performance and TPDocumento22 pagineDivisionalized Performance and TPNicole TaylorNessuna valutazione finora

- Annual-Report-13-14 AOP PDFDocumento38 pagineAnnual-Report-13-14 AOP PDFkhurram_66Nessuna valutazione finora

- Partnership Accounting With AnsDocumento22 paginePartnership Accounting With Ansjessica amorosoNessuna valutazione finora

- Ican SyllabusDocumento82 pagineIcan SyllabusOlufunso EkundayoNessuna valutazione finora

- Deloitte-A Roadmap To Accounting For Income Taxes (Nov2011)Documento505 pagineDeloitte-A Roadmap To Accounting For Income Taxes (Nov2011)mistercobalt3511Nessuna valutazione finora

- Strategic Human Resource Management (MHRM 612-2) Strategic Human Resource Management (MHRM 612-2)Documento12 pagineStrategic Human Resource Management (MHRM 612-2) Strategic Human Resource Management (MHRM 612-2)endaleNessuna valutazione finora

- Apple FinancialDocumento8 pagineApple FinancialmeoboyNessuna valutazione finora

- Unit 1 Introduction To Income Tax Act 1961.: Dnyansagar Arts and Commerce College, Balewadi Pune.45Documento43 pagineUnit 1 Introduction To Income Tax Act 1961.: Dnyansagar Arts and Commerce College, Balewadi Pune.45SIDDHESHNessuna valutazione finora

- The Use of Assertions in Obtaining Audit EvidenceDocumento7 pagineThe Use of Assertions in Obtaining Audit EvidenceJesebel AmbalesNessuna valutazione finora

- Sip ReportDocumento64 pagineSip ReportShreyash ShahNessuna valutazione finora

- Knowledge Base Care Ifrs 17 (LRC)Documento33 pagineKnowledge Base Care Ifrs 17 (LRC)grace sijabatNessuna valutazione finora

- Solution Manual For Strategic Human Resource Management 5th Edition by MelloDocumento11 pagineSolution Manual For Strategic Human Resource Management 5th Edition by MelloBlanca Denton100% (36)

- Tutorial Letter 103/3/2016: Group Financial ReportingDocumento52 pagineTutorial Letter 103/3/2016: Group Financial ReportingTINOTENDA MUCHEMWANessuna valutazione finora

- Chapter 17Documento76 pagineChapter 17waleedtanvirNessuna valutazione finora

- GR Oup: 1: Mahnoor Naseer (6155129) Khadija Azeem (6155127) Fiza Alvi (6155111) Rabia Malik (615511)Documento7 pagineGR Oup: 1: Mahnoor Naseer (6155129) Khadija Azeem (6155127) Fiza Alvi (6155111) Rabia Malik (615511)fiza alviNessuna valutazione finora

- BR.030 B R M D: Financials-Fixed AssetsDocumento27 pagineBR.030 B R M D: Financials-Fixed Assetstyui876Nessuna valutazione finora

- DELL LBO Model Part 2 Completed (Excel)Documento9 pagineDELL LBO Model Part 2 Completed (Excel)Mohd IzwanNessuna valutazione finora

- C35 - MFRS 138 IntangiblesDocumento28 pagineC35 - MFRS 138 IntangibleskkNessuna valutazione finora

- Aztra Zeneca CaseDocumento10 pagineAztra Zeneca CaseMaica PeregrinNessuna valutazione finora

- Auditing and Assurance: Specialized Industries - Midterm ExaminationDocumento14 pagineAuditing and Assurance: Specialized Industries - Midterm ExaminationHannah SyNessuna valutazione finora

- Normalization of Balance Sheets and Income Statements: A Case Illustration of A Private Plumbing EnterpriseDocumento20 pagineNormalization of Balance Sheets and Income Statements: A Case Illustration of A Private Plumbing EnterpriseWolf BangsNessuna valutazione finora

- Financial Accounting Marathon PartnershipDocumento37 pagineFinancial Accounting Marathon PartnershipPriyvrat MamgainNessuna valutazione finora

- Accounting Theory Chapter 8 - GodfreyDocumento30 pagineAccounting Theory Chapter 8 - GodfreyRozanna AmaliaNessuna valutazione finora

- Datasets 523573 961112 Costco-DataDocumento4 pagineDatasets 523573 961112 Costco-DataAnish DalmiaNessuna valutazione finora