Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

List of PCRs Used in India Payroll

Caricato da

sobharajDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

List of PCRs Used in India Payroll

Caricato da

sobharajCopyright:

Formati disponibili

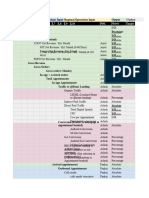

List of PCRs used in India payroll , Where it is used( related SCHEMA) and related

area in HR functionality

Listing of PCRs used in India Payroll , Where it is used ( related SCHEMA) and related

area in HR functionality

I believe I covered around 75%

Note : It is better not to change or modify standard SCHEMAs or PCRs. If you need any modification please copy standard one and do

modification to it

PCR TEXT Related Area SCHEMA TEXT

Gross to Net Calculation -

Cumulations for COA/CLA

IN76 Housing INN1 India

Basis

Gross to Net Calculation -

Create COA/CLA monthly

INCA Housing INN1 India

basis

Gross to Net Calculation -

Long term

INHF Hard furnishing recovery INN1 India

reimbursement

Gross to Net Calculation -

Actual Expenditure for Car &

INCC INN1 India

COCS into car perk /3C1 Conveyance

Gross to Net Calculation -

HR-IN: Create WPBP splits Child education

INCS INN1 India

in wage types exemption

Gross to Net Calculation -

Employee Eligibility for NE North east state

INNT INN1 India

Tax Exemption tax

Gross to Net Calculation -

North east state

INNE NE TAX Exemption INN1 India

tax

Gross to Net Calculation -

INVR Determine VRS Eligibility VRS INN1 India

Gross to Net Calculation -

INLN HR IN : Last nominal basis VRS INN1 India

Gross to Net Calculation -

Determine Gratuity

ING0 Gratuity INN1 India

eligibility

Removing split other than

INS0

WPBP

Gross to Net Calculation -

INPT Cumulation of PTax basis Ptax INN1 India

Gross to Net Calculation -

PCR IN89 Extrnal data for

IN89 Section 89 INN1 India

section 89(1) Relief

IN90 Capture Sec 89 Relief Section 89 INN1 Gross to Net Calculation -

outside SAP Payroll in /451

India

Gross to Net Calculation -

INN0 Setup of Projection Factor Projection INN1 India

Gross to Net Calculation -

HR-IN: Voluntary tax

INVT Income Tax INN1 India

deduction

Gross to Net Calculation -

HR-IN:Rounding off

INTR Income Tax INN1 India

monthly tax amounts

Removal of splits for

INRM

relevant wage types

Gross to Net Calculation -

Transfer of income Tax to

INBT Payment INN1 India

BT Table

Gross to Net Calculation -

Read balances carried

IN44 Retro INN1 India

forward (differences)

Gross to Net Calculation -

Read balances carried

IN45 Retro INN1 India

forward (differences)

B/F Termination related Gross to Net Calculation -

INTT exemptions for Payroll after Termination INN1 India

termination

Gross to Net Calculation -

INPB Cumulation of PTax basis Ptax INN1 India

HR-IN: India Payroll

Recovery of rounded

INRR Rounding Off IN00 Schema

amount

Cumulate net amount and

IN30 Cumulation of net amount Net pay INA9 form payment amount

Cumulate net amount and

Payment amount before

IN40 Net pay INA9 form payment amount

transfer(NET PAY)

Cumulate net amount and

Transfer advance wage types

XADV Net pay INA9 form payment amount

from LRT to RT

Cumulate net amount and

Import claim from previous

X04A Net pay INA9 form payment amount

period

Monthly factoring and

Partial factors for India - / Partial Period

INP1 801(CD), /802(WD), / Factor INAL storage (cumul.of gross

803(WH),/804(Nom) Calculations amount)

XVAL Valuate payroll elements Factoring INAL Monthly factoring and

using partial period factors storage (cumul.of gross

amount)

Monthly factoring and

Nominal Cumulation for 1 One day salary storage (cumul.of gross

IN77 INAL

day salary deduction deduction amount)

Monthly factoring and

INWT Create wage type /12N Projection INAL storage (cumul.of gross

amount)

Monthly factoring and

Store the last split of /12N storage (cumul.of gross

IN2N Projection INAL

in RT. amount)

Monthly factoring and

Supply Cost Accounting storage (cumul.of gross

XCH0 INAL

(CO) with number of hours amount)

Monthly factoring and

Monthly lump sums for Cost storage (cumul.of gross

XCM0 INAL

Accounting amount)

Monthly factoring and

IN72 Nominal Cumulations INAL storage (cumul.of gross

amount)

Monthly factoring and

INEX Monthly Nominal values INAL storage (cumul.of gross

amount)

Monthly factoring and

Gross input and

X023 storage(Cumulation of Net pay INAL storage (cumul.of gross

payment WT) amount)

Monthly factoring and

INNP HR-IN: Rule for Notice Pay Termination INAL storage (cumul.of gross

amount)

Import additional

Recurring

IN11 payments/deductions and Payment INAP payments/deductions Off

supplementary payments Cycle

Import additional

Process Third Party payments/deductions Off

INTP Membership fee INAP

Deductions (IT 0057) Cycle

Gross Input and Deductions, benefits and

X024 Storage(Cumulation of Net pay INDD storage

deduction WT)

Deductions, benefits and

Cumulation of gross amount,

X025 INDD storage

cost distribution

Retroactive accounting

PCR IN91 Updation of DT

IN91 Section 89 INNR INDIA

with latest Section 89 Result

Retroactive accounting

Read balances carried

IN41 Net pay INNR INDIA

forward (differences)

Retroactive accounting

Cumulation of payment

X047 Net pay INNR INDIA

amount

Retroactive accounting

Storage of new payment

IN42 Retro INNR INDIA

amount according to DT

Retroactive accounting

Store the differences in DT

IN43 Retro INNR INDIA

(India)

Retroactive accounting

Store PF bring forward wage

IN54 Retro INNR INDIA

types to RT

Retroactive accounting

HR-IN: Delete tax wage

IN55 Retro INNR INDIA

types from RT

Retroactive accounting

HR-IN: Import tax wage

IN56 Retro INNR INDIA

types from ORT

Passing wage types from HR-IN: PORT wage types

IN51 ORT to IT for Gratuity Gratuity INPO during Retro

Retro

Passing wage types from HR-IN: PORT wage types

IN52 ORT to IT for Superannuation INPO during Retro

Superannuation Retro

HR-IN: PORT wage types

HR-IN: Check LWF wage

INLW LWF INPO during Retro

type in case of retro

HR-IN: Passing LWF wage HR-IN: PORT wage types

IN53 types from ORT to IT for LWF INPO during Retro

retro

HR-IN: PORT wage types

Passing wage types from

IN49 Rounding Off INPO during Retro

ORT to IT for 1DSD Retro

HR-IN: PORT wage types

Delete calculated tax in the

INT1 Retro INPO during Retro

retro period

HR-IN: Importing net tax HR-IN: PORT wage types

INTX wage type from ORT for Retro INPO during Retro

retro period

XDPM Transfer deduction balances Totals and XDP0 Processing of deductions,

and totals Balances

balances and totals

Processing of deductions,

Save balances for further Totals and

XDPI XDP0 balances and totals

processing Balances

Processing of deductions,

Calculate balance of Totals and

XDPR XDP0 balances and totals

deductions Balances

Processing of deductions,

Determine deduction totals Totals and

XDPT XDP0 balances and totals

and transfer balance Balances

Import relevant wage types

X006 to LRT (Round Off Rounding Off XLRO Read last payroll results

ammount)

External bank transfers - Net payments/deductions

X055 International (read infotype Net pay XNN0 and transfers

0011)

Net payments/deductions

Import payments/deductions

X045 Net pay XNN0 and transfers

into RT

Net payments/deductions

Check bank transfers

X046 Net pay XNN0 and transfers

(advance payments)

Bank transfers - Net payments/deductions

X050 International (Read banking Net pay XNN0 and transfers

details P0009)

Net payments/deductions

X060 Storage of payment amount Net pay XNN0 and transfers

Potrebbero piacerti anche

- Sap hr1Documento4 pagineSap hr1zafer nadeemNessuna valutazione finora

- PCRDocumento2 paginePCRSujithNambiar100% (1)

- Madhupayroll - Sap HR - HCM Indian Payroll Schemas and PCRDocumento7 pagineMadhupayroll - Sap HR - HCM Indian Payroll Schemas and PCRMurali MohanNessuna valutazione finora

- PCRs Used in India Payroll & Related Areas in HRDocumento3 paginePCRs Used in India Payroll & Related Areas in HRPriyanka SinhaNessuna valutazione finora

- PCRs Used in India Payroll FunctionsDocumento5 paginePCRs Used in India Payroll FunctionseurofighterNessuna valutazione finora

- @home ScorecardDocumento13 pagine@home ScorecardAkshat JainNessuna valutazione finora

- Instructions To Use Tax CalculatorDocumento5 pagineInstructions To Use Tax Calculatormadhuri priyankaNessuna valutazione finora

- B2C business financial metrics over timeDocumento4 pagineB2C business financial metrics over timeAnoushkaBanavarNessuna valutazione finora

- Prop. Solution For India Asset and Tax DepreciationDocumento8 pagineProp. Solution For India Asset and Tax DepreciationJit Ghosh100% (1)

- CH 1 - Determination of National IncomeDocumento13 pagineCH 1 - Determination of National IncomePrathmesh BhansaliNessuna valutazione finora

- Novartis NPS Employee Awareness Presentation PDFDocumento33 pagineNovartis NPS Employee Awareness Presentation PDFMohan CNessuna valutazione finora

- Novartis NPS Employee Awareness Presentation PDFDocumento33 pagineNovartis NPS Employee Awareness Presentation PDFMohan CNessuna valutazione finora

- Base File - P&L + MarginsDocumento38 pagineBase File - P&L + MarginsAnoushkaBanavarNessuna valutazione finora

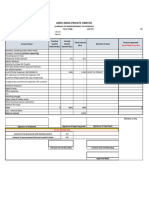

- Bhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0Documento4 pagineBhagwati Traders - (From 1-Apr-2011) : Participating in Return Tables 161 No Direct Implication in Return Tables 0mukesh singhal537Nessuna valutazione finora

- Salary Break-Up Cost To CompanyDocumento2 pagineSalary Break-Up Cost To Companyshanmukha2007Nessuna valutazione finora

- UntitledDocumento1 paginaUntitledJevanie CastroverdeNessuna valutazione finora

- FAMA OldDocumento4 pagineFAMA OldVarun RNessuna valutazione finora

- Tcs Ind As AdoptionDocumento12 pagineTcs Ind As AdoptionCA Darshan AjmeraNessuna valutazione finora

- Message From Gopal VittalDocumento2 pagineMessage From Gopal VittalMishra AnandNessuna valutazione finora

- Container Corporation of India (CCRI IN, Buy) - 1QFY20 Result - NomuraDocumento7 pagineContainer Corporation of India (CCRI IN, Buy) - 1QFY20 Result - NomuradarshanmaldeNessuna valutazione finora

- Chapter 1 Economis For FinanceDocumento6 pagineChapter 1 Economis For FinancePratham AgarwalNessuna valutazione finora

- EPC Power BU KPIs (April-18)Documento1 paginaEPC Power BU KPIs (April-18)syedfahadraza627Nessuna valutazione finora

- Summer internship project at KPIT TechnologiesDocumento8 pagineSummer internship project at KPIT TechnologiesRAHUL DAMNessuna valutazione finora

- Gma Network, Inc. Statements of Financial PositionDocumento5 pagineGma Network, Inc. Statements of Financial PositionMark Angelo BustosNessuna valutazione finora

- Icp CompendiumDocumento3 pagineIcp Compendiumak4784449Nessuna valutazione finora

- TDIFDocumento12 pagineTDIFptus nayakNessuna valutazione finora

- Acct Exam Y2l34yvaDocumento2 pagineAcct Exam Y2l34yvaAyushi SinghalNessuna valutazione finora

- THK Project Reimbursement-FebruaryDocumento3 pagineTHK Project Reimbursement-Februarytony immanuelNessuna valutazione finora

- Regulate local services with investment analysisDocumento79 pagineRegulate local services with investment analysisShivanshu RajputNessuna valutazione finora

- Indian Accounting Standards (IndAS): Practical Aspects, Case Studies and Recent DevelopmentsDocumento46 pagineIndian Accounting Standards (IndAS): Practical Aspects, Case Studies and Recent DevelopmentsKANADARPARNessuna valutazione finora

- Iris Onyx E-Invoicing Solution: How To Get Ready For The Mandate?Documento28 pagineIris Onyx E-Invoicing Solution: How To Get Ready For The Mandate?private completelyNessuna valutazione finora

- Component # Output Calculation Input Fixed Number/logic Calculation? NoteDocumento1 paginaComponent # Output Calculation Input Fixed Number/logic Calculation? NoteVu Nguyen AnhNessuna valutazione finora

- 02 Monster CO ConfigDocumento17 pagine02 Monster CO ConfigsumankumarperamNessuna valutazione finora

- Magister Akuntansi - Lampiran 1 Matriks Penelitian TerdahuluDocumento18 pagineMagister Akuntansi - Lampiran 1 Matriks Penelitian TerdahuluKojiro FuumaNessuna valutazione finora

- The Institute of Chartered Accountants of IndiaDocumento42 pagineThe Institute of Chartered Accountants of IndiaXpacNessuna valutazione finora

- EInvoice Webinar Jan2020Documento21 pagineEInvoice Webinar Jan2020Pankaj KhatoniarNessuna valutazione finora

- 2019 11 30 Acc222 Exercises01Documento1 pagina2019 11 30 Acc222 Exercises01Primitivo Suasin Bangahon Jr.Nessuna valutazione finora

- PDFDocumento2 paginePDFRidzwan SayyedNessuna valutazione finora

- KFS Full Freelancer ConventionalDocumento1 paginaKFS Full Freelancer Conventionalshaistarasheed9622Nessuna valutazione finora

- Understanding National IncomeDocumento23 pagineUnderstanding National IncomeJAYNessuna valutazione finora

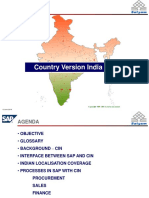

- Cin2 FullDocumento75 pagineCin2 FullGanesh KumarNessuna valutazione finora

- GST in India - Objectives, Concerns and ChallengesDocumento44 pagineGST in India - Objectives, Concerns and Challengesakhilca87% (15)

- Panasonic AVC Network Co. India Ltd. Oracle EBS - GST ImplementationDocumento33 paginePanasonic AVC Network Co. India Ltd. Oracle EBS - GST Implementationss5252Nessuna valutazione finora

- Bharti Airtel Faces Unabated Competition, Forecast LossesDocumento16 pagineBharti Airtel Faces Unabated Competition, Forecast Lossesishu919Nessuna valutazione finora

- CA Intermediate (IPC) Course Paper 4B Indirect Taxes Chapter 1 CA. Arun K. Agarwal, ACSDocumento37 pagineCA Intermediate (IPC) Course Paper 4B Indirect Taxes Chapter 1 CA. Arun K. Agarwal, ACSYash SinghaniaNessuna valutazione finora

- Capsule It PDFDocumento25 pagineCapsule It PDFGiri SukumarNessuna valutazione finora

- International Taxation: A Capsule For Quick RecapDocumento16 pagineInternational Taxation: A Capsule For Quick RecapShubham jindalNessuna valutazione finora

- Private Car Calculator (Incl Pay As You Drive)Documento2 paginePrivate Car Calculator (Incl Pay As You Drive)NangaiNessuna valutazione finora

- Blogs Sap Com 2014 04 16 Parallel Ledgers in Asset Accountin PDFDocumento81 pagineBlogs Sap Com 2014 04 16 Parallel Ledgers in Asset Accountin PDFvenki1986Nessuna valutazione finora

- Statement 122925Documento3 pagineStatement 122925Itsmevenki SmileNessuna valutazione finora

- Heineken NV IFRS Presentation 02 2018Documento9 pagineHeineken NV IFRS Presentation 02 2018Gibbson NialaNessuna valutazione finora

- Q1 Budget vs ActualsDocumento8 pagineQ1 Budget vs Actualsneha saifiNessuna valutazione finora

- Financial Process AutomationDocumento4 pagineFinancial Process AutomationAabee SyedNessuna valutazione finora

- Private Car Calculator (Incl Pay As You Drive)Documento2 paginePrivate Car Calculator (Incl Pay As You Drive)NangaiNessuna valutazione finora

- ICAI National Convention 2015 WIRC – Ahmedabad Branch ICDS – Practical Issues August 2015Documento43 pagineICAI National Convention 2015 WIRC – Ahmedabad Branch ICDS – Practical Issues August 2015Sushil KumarNessuna valutazione finora

- Bajaj Finserv Q2 FY19 highlightsDocumento34 pagineBajaj Finserv Q2 FY19 highlightsAmarNessuna valutazione finora

- Economics For Finance: A Capsule For Quick Recap: National IncomeDocumento62 pagineEconomics For Finance: A Capsule For Quick Recap: National IncomeIndhuja MNessuna valutazione finora

- Data CollectionDocumento1 paginaData CollectionKDumpNessuna valutazione finora

- Unit 4: Relative ValuationDocumento47 pagineUnit 4: Relative ValuationMadhvendra BhardwajNessuna valutazione finora

- Natural Science subject curriculumDocumento15 pagineNatural Science subject curriculum4porte3Nessuna valutazione finora

- Pharmacology of GingerDocumento24 paginePharmacology of GingerArkene LevyNessuna valutazione finora

- FACS113 MineralswebDocumento51 pagineFACS113 MineralswebMohammad Amjad KhanNessuna valutazione finora

- 52 Codes For Conscious Self EvolutionDocumento35 pagine52 Codes For Conscious Self EvolutionSorina LutasNessuna valutazione finora

- Building Materials Alia Bint Khalid 19091AA001: Q) What Are The Constituents of Paint? What AreDocumento22 pagineBuilding Materials Alia Bint Khalid 19091AA001: Q) What Are The Constituents of Paint? What Arealiyah khalidNessuna valutazione finora

- Krittika Takiar PDFDocumento2 pagineKrittika Takiar PDFSudhakar TomarNessuna valutazione finora

- Das Aufkommen Eines Neuen Pseudoephedrinprodukts Zur Bekämpfung Des MethamphetaminmissbrauchsDocumento17 pagineDas Aufkommen Eines Neuen Pseudoephedrinprodukts Zur Bekämpfung Des Methamphetaminmissbrauchszossel ringoNessuna valutazione finora

- How To Write A Cover Letter For A Training ProgramDocumento4 pagineHow To Write A Cover Letter For A Training Programgyv0vipinem3100% (2)

- Recommender Systems Research GuideDocumento28 pagineRecommender Systems Research GuideSube Singh InsanNessuna valutazione finora

- The Sweetheart Doctrine and Its InapplicabilityDocumento4 pagineThe Sweetheart Doctrine and Its InapplicabilityJosiah BalgosNessuna valutazione finora

- Financial Management-Capital BudgetingDocumento39 pagineFinancial Management-Capital BudgetingParamjit Sharma100% (53)

- Grade 4 Science Quiz Bee QuestionsDocumento3 pagineGrade 4 Science Quiz Bee QuestionsCecille Guillermo78% (9)

- Model Test Paper Maths CBSE Class IX - IIIDocumento8 pagineModel Test Paper Maths CBSE Class IX - IIIAnanthakrishnan Tinneveli VNessuna valutazione finora

- Final Revised ResearchDocumento35 pagineFinal Revised ResearchRia Joy SanchezNessuna valutazione finora

- Callaghan Innovation Annual Report 2018Documento108 pagineCallaghan Innovation Annual Report 2018Kerjasama P2BiotekNessuna valutazione finora

- इंटरनेट मानक का उपयोगDocumento16 pagineइंटरनेट मानक का उपयोगUdit Kumar SarkarNessuna valutazione finora

- 2005 Australian Secondary Schools Rugby League ChampionshipsDocumento14 pagine2005 Australian Secondary Schools Rugby League ChampionshipsDaisy HuntlyNessuna valutazione finora

- Module 3 Cherry 110309Documento17 pagineModule 3 Cherry 110309Krislyn Dulay LagartoNessuna valutazione finora

- HED - PterygiumDocumento2 pagineHED - Pterygiumterry johnsonNessuna valutazione finora

- Master ListDocumento26 pagineMaster ListNikhil BansalNessuna valutazione finora

- Polystylism in The Context of Postmodern Music. Alfred Schnittke's Concerti GrossiDocumento17 paginePolystylism in The Context of Postmodern Music. Alfred Schnittke's Concerti Grossiwei wuNessuna valutazione finora

- Molly C. Dwyer Clerk of CourtDocumento3 pagineMolly C. Dwyer Clerk of CourtL. A. PatersonNessuna valutazione finora

- Entrepreneurship - Quarter 2 - Week 1-3 - 4 M's of Production and - Business ModelDocumento6 pagineEntrepreneurship - Quarter 2 - Week 1-3 - 4 M's of Production and - Business ModelJude Del RosarioNessuna valutazione finora

- Midnight HotelDocumento7 pagineMidnight HotelAkpevweOghene PeaceNessuna valutazione finora

- 2015 ACI Airport Economics Report - Preview - FINAL - WEB PDFDocumento12 pagine2015 ACI Airport Economics Report - Preview - FINAL - WEB PDFDoris Acheng0% (1)

- Community ResourcesDocumento30 pagineCommunity Resourcesapi-242881060Nessuna valutazione finora

- Ethanox 330 Antioxidant: Safety Data SheetDocumento7 pagineEthanox 330 Antioxidant: Safety Data Sheetafryan azhar kurniawanNessuna valutazione finora

- Q3 Week 7 Day 2Documento23 pagineQ3 Week 7 Day 2Ran MarNessuna valutazione finora

- PNP TELEPHONE DIRECTORY As of JUNE 2022Documento184 paginePNP TELEPHONE DIRECTORY As of JUNE 2022lalainecd0616Nessuna valutazione finora

- MCQ CH 5-Electricity and Magnetism SL Level: (30 Marks)Documento11 pagineMCQ CH 5-Electricity and Magnetism SL Level: (30 Marks)Hiya ShahNessuna valutazione finora

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDa EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyValutazione: 5 su 5 stelle5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomDa EverandProfit First for Therapists: A Simple Framework for Financial FreedomNessuna valutazione finora

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDa EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanValutazione: 4.5 su 5 stelle4.5/5 (79)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Da EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Valutazione: 5 su 5 stelle5/5 (1)

- Project Control Methods and Best Practices: Achieving Project SuccessDa EverandProject Control Methods and Best Practices: Achieving Project SuccessNessuna valutazione finora

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDa EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesValutazione: 4.5 su 5 stelle4.5/5 (30)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesDa EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNessuna valutazione finora

- Basic Accounting: Service Business Study GuideDa EverandBasic Accounting: Service Business Study GuideValutazione: 5 su 5 stelle5/5 (2)

- The CEO X factor: Secrets for Success from South Africa's Top Money MakersDa EverandThe CEO X factor: Secrets for Success from South Africa's Top Money MakersNessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungDa EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungValutazione: 4 su 5 stelle4/5 (1)