Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CH 3

Caricato da

Madyoka RaimbekDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CH 3

Caricato da

Madyoka RaimbekCopyright:

Formati disponibili

48 Brooks • Financial Management: Core Concepts

9. Is the present value always less than the future value?

Yes, as long as interest rates are positive—and interest rates are always positive—the present value of

a sum of money will always be less than its future value. One can get confused with this concept if

one thinks about the depreciation of an asset over time. Present value and future value in the TVM

equation refer identical cash flows at two different points in time.

10. When a lottery price is offered as $10,000,000 but will pay out a series of $250,000 payments

over forty years, is it really a $10,000,000 lottery prize?

The present value of the lottery is not worth $10,000,000. The total payments over time are

$10,000,000, but this is not the value of the lottery because these payments are at different points in

time and cash flows can only be added if they are at the same point in time.

Answers to End-of-Chapter Problems

1. Future Values. Fill in the future values for the following table,

a. using the future value formula, FV = PV × (1 + r) .

n

b. using the time value of money keys or function from a calculator or spreadsheet.

Present Value Interest Rate Number of Periods Future Value

$ 400.00 5.0% 5

$17,411.00 6.0% 30

$35,000.00 10% 20

$26,981.75 16% 15

Answer:

Present Value Interest Rate Number of Periods Future Value

$ 400.00 5.0% 5 $ 510.51

$17,411.00 6.0% 30 $ 99,999.92

$35,000.00 10% 20 $235,462.50

$26,981.75 16% 15 $249,999.97

a. With the TVM Formula (rounding to second decimal only for final answer),

FV = $400.00 × (1.05)5 = $400.00 × 1.2763 = $510.51

FV = $17,411.00 × (1.06)30 = $17,411.00 × 5.7435 = $99,999.92

FV = $35,000.00 × (1.10)20 = $35,000.00 × 6.7275 = $235,462.50

FV = $26,981.75 × (1.16)15 = $26,981.75 × 9.2655 = $249,999.97

©2010 Pearson Education, Inc. Publishing as Prentice Hall

Chapter 3 The Time Value of Money (Part 1) 49

b. Time Value of Money Keys or Spreadsheet

Input 5 5.0 −400 0

Variable N I/Y PV PMT FV

Compute 510.51

Input 30 6.0 −17,411 0

Variable N I/Y PV PMT FV

Compute 99,999.92

Input 20 10.0 −35,000 0

Variable N I/Y PV PMT FV

Compute 235,462.50

Input 15 16.0 −26,981.75 0

Variable N I/Y PV PMT FV

Compute 249,999.97

2. Future Value (with changing years). Dixie Bank offers a certificate of deposit with an option to

select your own investment period. Jonathan has $7,000 for his CD investment. If the bank is

offering a 6% interest rate, how much will the CD be worth at maturity if Jonathan picks a

a. two-year investment period?

b. five-year investment period?

c. eight-year investment period?

d. fifteen-year investment period?

a. FV = $7,000 × (1.06) = $7,000 × 1.1236 = $7,865.20

2

Answer:

b. FV = $7,000 × (1.06)5 = $7,000 × 1.3382 = $9,367.58

c. FV = $7,000 × (1.06) = $7,000 × 1.5938 = $11,156.94

8

d. FV = $7,000 × (1.06)15 = $7,000 × 2.3966 = $16,775.91

3. Future Value (with changing interest rates). Jose has $4,000 to invest for a two-year period. He is

looking at four different investment choices. What will be the value of his investment at the end

of two years for each of the following potential investments?

a. bank CD at 4%.

b. bond fund at 8%.

c. mutual stock fund at 12%.

d. new venture stock at 24%.

a. FV = $4,000 × (1.04) = $4,000 × 1.0816 = $4,326.40

2

Answer:

b. FV = $4,000 × (1.08)2 = $4,000 × 1.1664 = $4,665.60

c. FV = $4,000 × (1.12)2 = $4,000 × 1.2544 = $5,017.60

d. FV = $4,000 × (1.24)2 = $4,000 × 1.5376 = $6,150.40

©2010 Pearson Education, Inc. Publishing as Prentice Hall

50 Brooks • Financial Management: Core Concepts

4. Future Value. Grand Opening Bank is offering a one-time investment opportunity for its new

customers. A customer opening a new checking account can buy a special savings bond for $100

today, which the bank will compound at 7.5% for the next twenty years. The savings bond must

be held for at least five years but can then be cashed in at the end of any year starting with year

five. What is the value of the bond at each cash-in date up through twenty years? (Use an Excel

spreadsheet to solve this problem.)

Spreadsheet Solution:

In Cells A1 through A16 put in the Present Value of the savings bond, $100.00.

In Cells B1 through B16 put in the annual interest rate, 0.075, R.

In Cells C1 through C16 put in the waiting time in years, 5 through 20, N.

In Cell D1 put in the FV function using the row value in A1 for the PV, row value in B1 for

the interest rate, row value in C1 for n. Copy the formula for cells D2 through D16.

The displayed value will be the future value of the $100 savings bond at 7.5% annual interest.

A B C D

1 −100.00 0.075 5 FV (PV = A1, rate = B1, n = C1) = $143.56

2 −100.00 0.075 6 FV (PV = A2, rate = B2, n = C2) = $154.33

3 −100.00 0.075 7 FV (PV = A3, rate = B3, n = C3) = $165.90

4 −100.00 0.075 8 FV (PV = A4, rate = B4, n = C4) = $178.35

5 −100.00 0.075 9 FV (PV = A5, rate = B5, n = C5) = $191.72

6 −100.00 0.075 10 FV (PV = A6, rate = B6, n = C6) = $206.10

7 −100.00 0.075 11 FV (PV = A7, rate = B7, n = C7) = $221.56

8 −100.00 0.075 12 FV (PV = A8, rate = B8, n = C8) = $238.18

9 −100.00 0.075 13 FV (PV = A9, rate = B9, n = C9) = $256.04

10 −100.00 0.075 14 FV (PV = A10, rate = B10, n = C10) = $275.24

11 −100.00 0.075 15 FV (PV = A11, rate = B11, n = C11) = $295.89

12 −100.00 0.075 16 FV (PV = A12, rate = B12, n = C12) = $318.08

13 −100.00 0.075 17 FV (PV = A13, rate = B13, n = C13) = $341.94

14 −100.00 0.075 18 FV (PV = A14, rate = B14, n = C14) = $367.58

15 −100.00 0.075 19 FV (PV = A15, rate = B15, n = C15) = $395.15

16 −100.00 0.075 20 FV (PV = A16, rate = B16, n = C16) = $424.79

Note: The negative values in column A denote the cash outflow and produce a positive cash inflow

in column D.

5. Future Value. Jackson Enterprises has just purchased some land for $230,000. The land was

purchased for a future beach front property development project that will include rental

cabins, lodge, and recreational facilities. Jackson Enterprises has not committed to the

development project, but will decide in five years whether to go forward with it or sell off the

land. Real estate values increase annually at 4.5% for unimproved property in this area. For

how much can Jackson Enterprises expect to sell the property in five years if it chooses not to

proceed with the beach front development project? What if Jackson Enterprises holds the

property for ten years and then sells?

©2010 Pearson Education, Inc. Publishing as Prentice Hall

Chapter 3 The Time Value of Money (Part 1) 51

Answer: Holding Property Five Years:

FV = $230,000 × (1.045) = $230,000 × 1.2462 = $286,621.85

5

Holding Property Ten Years:

FV = $230,000 × (1.045) = $230,000 × 1.5530 = $357,182.97

10

6. Future Value. The Portland Stallions professional football team is looking at its future revenue

stream from ticket sales. Currently, a season package costs $325 per seat. The season ticket

holders have been promised this same rate for the next three years. Four years from now, the

organization will raise season ticket prices based on the estimated inflation rate of 3.25%. What

will the season tickets sell for in four years?

FV = $325 × (1.0325) = $325 × 1.136475928 = $369.35

4

Answer:

7. Future Value. Upstate University charges $16,000 a year in graduate tuition. Tuition rates are

growing at 4.5% each year. You plan on enrolling in graduate school in five years. What is your

expected graduate tuition in five years?

Answer: FV = $16,000 × (1.045)5 = $16,000 × 1.246181938 = $19,938.91

8. Present Values. Fill in the present values for the following table,

a. using the present value formula, PV = FV × (1/(1 + r ) ).

n

b. using the TVM keys or function from a calculator or spreadsheet.

Future Value Interest Rate Number of Periods Present Value

$ 900.00 5% 5 ?

$ 80,000.00 6% 30 ?

$350,000.00 10% 20 ?

$ 26,981.75 16% 15 ?

Answer:

Future Value Interest Rate Number of Periods Present Value

$ 900.00 5% 5 $ 705.17

$ 80,000.00 6.0% 30 $13,928.81

$350,000.00 10% 20 $52,025.27

$ 26,981.75 16% 15 $ 2,912.06

a. With TVM Formula (rounding to second decimal only for final answer),

PV = $900.00 × 1/(1.05) = $400.00 × 0.7835 = $705.17

5

PV = $80,000.00 × 1/(1.06) = $80,000.00 × 0.1741 = $13,928.81

30

PV = $350,000.00 × 1/(1.10)20 = $350,000.00 × 0.1486 = $52,025.27

PV = $26,981.75 × 1/(1.16)15 = $26,981.75 × 0.1079 = $2,912.06

©2010 Pearson Education, Inc. Publishing as Prentice Hall

52 Brooks • Financial Management: Core Concepts

b. Time Value of Money Keys or Spreadsheet

Input 5 5.0 0 −900

Variable N I/Y PV PMT FV

Compute 705.17

Input 30 6.0 0 −80,000

Variable N I/Y PV PMT FV

Compute 13,928.81

Input 20 10.0 0 −350,000

Variable N I/Y PV PMT FV

Compute 52,025.27

Input 15 6.0 0 −26,981.75

Variable N I/Y PV PMT FV

Compute 2,912.06

9. Present Value (with changing years). When they are first born, Grandma gives every grandchild

a $2,500 savings bond that matures in eighteen years. For each of the following grandchildren,

what is the present value of each savings bonds if the current discount rate is 4%?

a. Seth turned sixteen years old today.

b. Shawn turned thirteen years old today.

c. Sherry turned nine years old today.

d. Sheila turned four years old today.

e. Shane was just born.

a. PV = $2,500 × 1/(1.04) = $2,500 × 0.9246 = $2,311.39

2

Answer:

b. PV = $2,500 × 1/(1.04)5 = $2,500 × 0.8219 = $2,054.82

c. PV = $2,500 × 1/(1.04)9 = $2,500 × 0.7026 = $1,756.47

d. PV = $2,500 × 1/(1.04)14 = $2,500 × 0.5775 = $1,443.69

e. PV = $2,500 × 1/(1.04)18 = $2,500 × 0.4936 = $1,234.07

10. Present Value (with changing interest rates). Marty has been offered an injury settlement of

$10,000 payable in three years. He wants to know what the present value of the injury

settlement is if his opportunity cost is 5%. (The opportunity cost is the interest rate in this

problem.) What if the opportunity cost is 8%? What if it is 12%?

PV = $10,000 × 1/(1.05) = $10,000 × 0.8638 = $8,638.38

3

Answer:

PV = $10,000 × 1/(1.08)3 = $10,000 × 0.7938 = $7,938.32

PV = $10,000 × 1/(1.12)3 = $10,000 × 0.7118 = $7,117.80

©2010 Pearson Education, Inc. Publishing as Prentice Hall

Chapter 3 The Time Value of Money (Part 1) 53

11. Present Value. The State of Confusion wants to change the current retirement policy for state

employees. To do so, however, the state must pay the current pension fund members the

present value of their promised future payments. There are 240,000 current employees in

the state pension fund. The average employee is twenty-two years away from retirement, and

the average promised future retirement benefit is $400,000 per employee. If the state has a

discount rate of 5% on all its funds, how much money will the state have to pay to the

employees before it can start a new pension plan?

Answer: Present Value of Retirement Payments of the Average Employee:

PV = $400,000 × 1/(1.05) = $400,000 × 0.3418 = $136,739.95

22

With 240,000 employees, the Total Obligations Are:

PV Obligation of Pension Fund = 240,000 × $136,739.95 = $32,817,590,000

Note, the PV was not rounded to nearest cent prior to multiplying it by the number of

employees.

12. Present Value. Two rival football fans have made the following wager: if one fan’s college

football team wins the conference title outright, the other fan will donate $1,000 to the winning

school. Both schools have had relatively unsuccessful teams but are improving each season. If

the two fans must put up their potential donation today and the discount rate is 8% for the

funds, what is the required upfront deposit if a team is expected to win the conference title in

five years? Ten years? Twenty years?

Answer: Present Value of Payoff in Five Years:

PV = $1,000 × 1/(1.08)5 = $1,000 × 0.6806 = $680.58

Present Value of Payoff in Ten Years:

PV = $1,000 × 1/(1.08)10 = $1,000 × 0.4632 = $463.19

Present Value of Payoff in Twenty Years:

PV = $1,000 × 1/(1.08)20 = $1,000 × 0.2145 = $214.55

13. Present Value. Prestigious University is offering a new admission and tuition payment plan

for all alumni. On the birth of a child, parents can guarantee admission to Prestigious if they

pay the first year’s tuition. The university will pay an annual rate of return of 4.5% on the

deposited tuition, and a full refund will be available if the child chooses another university. The

tuition is $12,000 a year at Prestigious and is frozen at that level for the next eighteen years.

What would parents pay today if they just gave birth to a new baby and the child will attend

college in eighteen years? How much is the required payment to secure admission for their

child if the interest rate falls to 2.5%?

PV = $12,000 × 1/(1.045) = $12,000 × 1/(2.2085) = $12,000 × 0.4528 = $5,433.60

18

Answer:

PV = $12,000 × 1/(1.025) = $12,000 × 1/(1.5597) = $12,000 × 0.6412 = $7,693.99

18

©2010 Pearson Education, Inc. Publishing as Prentice Hall

54 Brooks • Financial Management: Core Concepts

14. Present Value. Standard Insurance is developing a long-life insurance policy for people who

outlive their retirement nest egg. The policy will pay out $250,000 on your eighty-fifth birthday.

You must buy the policy on your sixty-fifth birthday. The insurance company can earn 7% on

the purchase price of your policy. What is the minimum purchase price the insurance company

should charge for this policy?

PV = $250,000 × 1/(1 + 0.07) = $250,000 × 0.258419 = $64,604.75

20

Answer:

15. Present Value. You are currently in the job market. Your dream is to earn a six-figure salary

($100,000). You hope to accomplish this goal within the next thirty years. In your field, salaries

grow at 3.75% per year. What starting salary do you need to reach this goal?

Answer: PV = $100,000 × 1/(1 + 0.0375)30 = $100,000 × 0.3314033 = $33,140.33

16. Interest Rate or Discount Rate. Fill in the interest rate for the following table

a. using the interest rate formula, r = (FV/PV) − 1.

1/ n

b. using the TVM keys or function from a calculator or spreadsheet.

Present Value Future Value Number of Periods Interest Rate

$ 500.00 $ 1,998.00 18 ?

$17,335.36 $230,000.00 30 ?

$35,000.00 $ 63,214.00 20 ?

$27,651.26 $225,000.00 15 ?

Answer:

Present Value Future Value Number of Periods Interest Rate

$ 500.00 $ 1,998.00 18 8.00%

$17,335.36 $230,000.00 30 9.00%

$35,000.00 $ 63,214.00 20 3.00%

$27,651.26 $225,000.00 15 15.00%

a. With the TVM Formula (rounding to second decimal only for final answer)

r = ($1998.00/$500.00) − 1 = 1.0800 − 1 = 8.00%

1/18

r = ($230,000/$17,335.36)1/30 − 1 = 1.0900 − 1 = 9.00%

r = ($63,214/$35,000) − 1 = 1.0300 − 1 = 3.00%

1/20

r = ($225,000/$27,651.26) − 1 = 1.1500 − 1 = 15.00%

1/15

©2010 Pearson Education, Inc. Publishing as Prentice Hall

Chapter 3 The Time Value of Money (Part 1) 55

b. Time Value of Money Keys or Spreadsheet

Input 18 500.00 0 −1,998.00

Variable N I/Y PV PMT FV

Compute 8.00

Input 30 17,335.36 0 −230,000

Variable N I/Y PV PMT FV

Compute 9.00

Input 20 35,000 0 −63,214

Variable N I/Y PV PMT FV

Compute 3.00

Input 15 27,651.26 0 −225,000

Variable N I/Y PV PMT FV

Compute 15.00

17. Interest rate (with changing years). Keiko is looking at the following investment choices and

wants to know what interest rate each choice produces.

a. Invest $400 and receive $786.86 in ten years.

b. Invest $3,000 and receive $10,927.45 in fifteen years.

c. Invest $31,180.47 and receive $100,000 in twenty years.

d. Invest $31,327.88 and receive $1,000,000 in forty-five years.

a. r = ($786.86/$400) − 1 = 1.07 − 1 = 7.00%

1/10

Answer:

b. r = ($10,927.45/$3,000)1/15 − 1 = 1.09 − 1 = 9.00%

c. r = ($100,000/$31,180.47)1/20 − 1 = 1.06 − 1 = 6.00%

d. r = ($1,000,000/$31,327.88)1/45 − 1 = 1.08 − 1 = 8.00%

18. Interest Rate. Two mutual fund managers, Martha and David, have been bragging that their

fund is the top performer. Martha states that investors bought shares in the mutual fund ten

years ago for $21.00 and those shares are now worth $65.00. David states that investors bought

shares in his mutual fund for only $3.00 six years ago and now they are worth $7.30. Which

mutual fund manager has had the highest growth rate for the management periods? Should

this comparison be made over different management periods? Why or why not?

Martha’s Rate, r = ($65.00/$21.00) − 1 = 1.1196 − 1 = 11.96%

1/10

Answer:

David’s Rate, r = ($7.30/$3.00)1/6 − 1 = 1.1598 − 1 = 15.98%

Fund Two has the higher annual return but for a shorter period of time. To be appropriate

for comparing performance, the funds should be evaluated over the same period of time.

The first fund may have had a higher return over the last six years than the second fund,

but low returns in the earlier years reduced the return below the 16% return rate of the

second fund.

©2010 Pearson Education, Inc. Publishing as Prentice Hall

56 Brooks • Financial Management: Core Concepts

19. Interest Rate. In 1972, Bob purchased a new Datsun 240Z for $3,000. Datsun later changed its

name to Nissan, and the 1972 240Z became a classic. Bob kept his car in excellent condition

and in 2002 could sell the car for six times what he originally paid. What was Bob’s return on

owning this car? What if he keeps the car for another thirty years and earns the same rate?

What could he sell the car for in 2032?

Answer: Thirty years’ return on car:

r = ($18,000/$3,000) − 1 = 1.0615 − 1 = 6.15%

1/30

Price thirty years from now:

FV = $18,000 × (1.0615) = $108,000

30

Or just increase the price six-fold again, $18,000 × 6 = $108,000.

20. Interest Rate. Upstate Bank is offering long-term certificates of deposit with a face value of

$100,000 (future value). Bank customers can buy these CDs today for $67,000 and will receive

the $100,000 in fifteen years. What interest rate is the bank paying on these CDs?

Answer: r = ($100,000/$67,000)1/15 − 1 = 1.027058 − 1 = 2.7058%

21. Discount rate. Future Bookstore sells books before they are published. Today, they are offering

the book Adventures in Finance for $14.20, but the book will not be published for another

two years. The retail price when the book is published will be $24. What is the discount rate

Future Bookstore is offering its customers for this book?

r = ($24/$14.20) − 1 = 1.30 − 1 = 30%

1/2

Answer:

22. Growth and Future Value. A famous disease control scientist is trying to determine the

potential infected population of the new West Columbia flu. Two weeks ago, the first patient

showed up with the disease. Four days later the disease control center in Atlanta had six

confirmed cases. The scientist estimates that it will be another two days before a cure will be

ready, a total of 16 days from the first confirmed case. How many patients will be infected

two days from now?

Answer: The disease is spreading at a growth rate of nearly 57% per day.

r = (6/1) − 1 = 1.3161 − 1 = 56.51%

1/4

Using the same growth rate for the 16-day period, (two weeks and two days), we

determine that the number of patients infected will be:

FV = 1 × (1.5156) = 1,296 or 1,296 patients

16

Or you could realize that every four days the number of people infected increases by

six times, and with four periods of four days you have

1 × 6 × 6 × 6 × 6 = 1 × (6)4 = 1,296.

©2010 Pearson Education, Inc. Publishing as Prentice Hall

Chapter 3 The Time Value of Money (Part 1) 57

23. Waiting Period. Fill in the number of periods for the following table.

a. using the waiting period formula, n = ln(FV/PV)/ln(1 + r).

b. using the TVM keys or function from a calculator or spreadsheet.

Present Value Future Value Interest Rate Number of Periods

$ 800.00 $ 1,609.76 6% ?

$17,843.09 $ 100,000.00 9% ?

$35,000.00 $3,256,783.97 12% ?

$25,410.99 $ 300,000.00 28% ?

Answer: Solutions with Formula, TVM Keys, and Spreadsheet

Present Value Future Value Interest Rate Number of Periods

$ 800.00 $ 1,609.76 6% 12

$17,843.09 $ 100,000.00 9% 20

$35,000.00 $3,256,783.97 12% 40

$25,410.99 $ 300,000.00 28% 10

a. With the TVM Formula (rounding to second decimal only for final answer)

n = ln($1,609.76/$800.00)/ln(1.06) = 0.6992/0.0583 = 12

n = ln($100,000/$17,843.09)/ln(1.09) = 1.7236/0.0862 = 20

n = ln($3,256,783.97/$35,000)/ln(1.12) = 4.5331/0.1133 = 40

n = ln($300,000/$25,410.99)/ln(1.28) = 2.4686/0.2469 = 10

b. Time Value of Money Keys or Spreadsheet Inputs

Input 6.00 800.00 0 −1,609.76

Variable N I/Y PV PMT FV

Compute 12

Input 9.00 17,843.09 0 −100,000

Variable N I/Y PV PMT FV

Compute 20

Input 12.0 35,000 0 −3,256,783.97

Variable N I/Y PV PMT FV

Compute 40

Input 28.0 25,410.99 0 −300,000

Variable N I/Y PV PMT FV

Compute 10

©2010 Pearson Education, Inc. Publishing as Prentice Hall

58 Brooks • Financial Management: Core Concepts

24. Waiting period (with changing years). Jamal is waiting to be a millionaire. He wants to know

how long he must wait if

a. he invests $24,465.28 at 16% today?

b. he invests $47,101.95 at 13% today?

c. he invests $115,967.84 at 9% today?

d. he invests $295,302.77 at 5% today?

Answer: a. n = ln($1,000,000/$24,465.28)/ln(1.16) = 3.7105/0.1484 = 25

b. n = ln($1,000,000/$47,101.95)/ln(1.13) = 3.0554/0.1222 = 25

c. n = ln($1,000,000/$115,967.84)/ln(1.09) = 2.1544/0.0862 = 25

d. n = ln($1,000,000/$295,302.77)/ln(1.05) = 1.2198/0.0488 = 25

25. Waiting Period. Jeff, a local traffic engineer, has designed a new pedestrian footbridge. The

bridge has been designed to handle 200 pedestrians daily. Once the bridge reaches 1,000

pedestrians daily, however, it will require a new bracing system. Jeff has estimated that traffic

will increase annually at 5%. How long will the current bridge system work before a new

bracing system is required? What if the annual traffic rate increases at 8% annually? At what

traffic increase rate will the current system last only ten years?

Answer: For 5% growth rate in pedestrian traffic:

n = ln(1000/200)/ln(1.05) = 1.6904/0.0488 = 32.9869 years

For 8% growth rate in pedestrian traffic:

n = ln(1000/200)/ln(1.08) = 1.6904/0.0770 = 20.9124 years

Ten years maximum would require a growth rate of:

r = (1000/200) − 1 = 1.1746 − 1 = 17.46%

1/10

26. Waiting Period. Susan Norman seeks your financial advice. She wants to know how long it will

take for her to become a millionaire. She tells you that she has $1,330 today and wants to invest

it in an aggressive stock portfolio. The historical return on this type of investment is 18% per

year. How long will she have to wait if the $1,330 is the only amount she invests and she never

withdraws from the market until she reaches her million dollars? (Assume no taxes on the

earnings). What if the rate of return is only 14% annually? What if the rate of return is only

10% annually?

Answer: Waiting time if investment is earning 18%:

n = ln(1,000,000/1,330)/ln(1.18) = 6.6226/0.1655 = 40.0121 years

Waiting time if investment is earning 14%:

n = ln(1,000,000/1,330)/ln(1.14) = 6.6226/0.1310 = 50.5431 years

Waiting time if investment is earning 10%:

n = ln(1,000,000/1,330)/ln(1.10) = 6.6226/0.0953 = 69.4845 years

©2010 Pearson Education, Inc. Publishing as Prentice Hall

Chapter 3 The Time Value of Money (Part 1) 59

27. Waiting Period. Upstate University currently has a 6,000-car parking capacity for faculty, staff,

and students. This year, the university issued 4,356 parking passes. Parking passes have been

growing at a rate of 6% per year. How long will it be before the university will need to add

additional parking?

Answer: Waiting time if parking growth rate is 6%:

n = ln(6,000/4,356)/ln(1.06) = 0.320305264/0.058268908 = 5.4953 years

28. Double Your Money. Approximately how long will it take to double your money if you get

5.5%, 7.5%, or 9.5% annual return on your investment? Verify the approximate doubling

period with the time value of money equation.

Answer: Approximating the double period with the Rule of 72s:

At 5.5%, 72/5.5 = 13.09, or a little over 13 years

At 7.5%, 72/7.5 = 9.60, or a little over 9 1/2 years

At 9.5%, 72/9.5 = 7.5789, or a little over 7 1/2 years

Verification:

n = ln 2/ln 1.055 = 0.6931/0.0535 = 12.9462, or a little under 13 years

n = ln 2/ln 1.075 = 0.6931/0.0723 = 9.5844, or a little over 9 1/2 years

n = ln 2/ln 1.095 = 0.6931/0.0908 = 7.6376, or a little over 7 1/2 years

29. Double Your Wealth. Kant Miss Company is promising its investors that it will double their

money every three years. Is this promise too good to be true? What annual rate is Kant Miss

promising? If you invested $250 now and Kant Miss was able to deliver on its promise, how

long would it take before your investment reaches $32,000?

Answer: According to the rule of 72s, the approximate rate is: 72/3 = 24%

The actual rate is: r = 2 − 1 = 25.99%

1/3

To calculate how long it would take for $250 to turn into $32,000:

n = ln(32,000/250)/ln(1.2599) = 21 years

30. Challenge Question. In the text chapter, we dealt exclusively with a single lump sum, but often

we may be looking at several lump-sum values simultaneously. Let’s consider the retirement

plan of a couple. Currently, the couple has four different investments: a 401(k) plan, two

pension plans, and a personal portfolio. The couple is five years away from retirement. They

believe they have sufficient money in their plans today so that they do not have to contribute to

the plans over the next five years and will still meet their $2 million retirement goal. Here are

the current values and the growth rate of each plan:

401(k): $88,000 growing at 6.5%

Pension Plan 1: $304,000 growing at 7%

Pension Plan 2: $214,000 growing at 7.25%

Personal Portfolio: $149,000 growing at 8.5%

Does the couple have enough already invested to make their goal in five years?

Hint: View each payment as a separate problem and find the future value of each lump sum. Then

add up all the future values five years from now.

©2010 Pearson Education, Inc. Publishing as Prentice Hall

64 Brooks • Financial Management: Core Concepts

By accepting the offer, Jake avoids the risk that prices will fall due to market conditions. On the other

hand, if prices should be higher than expected, he loses out on the opportunity to sell at the higher

price. The biggest risk is that something will happen to his crop. If the crop should fail, he would

have to absorb all of his costs up to that point, and he would also be obliged to buy trees at the

market price, whatever that may be, to meet his commitment to deliver 10,000 trees. The discount

rate implies that funds could be reinvested at 10%, so another way to look at the problem is that the

3

$28,000 is worth $28,000(1.10) or $37,268 three years from now, which is slightly more than he

expects to receive from selling the trees then.

©2010 Pearson Education, Inc. Publishing as Prentice Hall

Potrebbero piacerti anche

- Making Sense of Data I: A Practical Guide to Exploratory Data Analysis and Data MiningDa EverandMaking Sense of Data I: A Practical Guide to Exploratory Data Analysis and Data MiningNessuna valutazione finora

- Chapter 9 - Responsibility AccountingDocumento44 pagineChapter 9 - Responsibility Accountingsathishiim1985Nessuna valutazione finora

- Real Estate Finance and Investments: William B. Brueggeman, PH.DDocumento8 pagineReal Estate Finance and Investments: William B. Brueggeman, PH.DPlay BoyNessuna valutazione finora

- Chopra scm5 Tif ch12Documento24 pagineChopra scm5 Tif ch12Madyoka Raimbek100% (1)

- Chopra scm5 Tif ch07Documento27 pagineChopra scm5 Tif ch07Madyoka Raimbek75% (4)

- NailsDocumento28 pagineNailsRohit P100% (1)

- Chopra scm5 Tif ch14Documento15 pagineChopra scm5 Tif ch14Madyoka Raimbek100% (2)

- Associated British FoodsDocumento16 pagineAssociated British FoodsMohd Shahbaz Husain100% (1)

- Numericals On Financial ManagementDocumento4 pagineNumericals On Financial ManagementDhruv100% (1)

- Chapter 2Documento17 pagineChapter 2jinny6061100% (1)

- Chopra scm5 Tif ch17Documento18 pagineChopra scm5 Tif ch17Madyoka Raimbek100% (1)

- Brealey. Myers. Allen Chapter 32 SolutionDocumento5 pagineBrealey. Myers. Allen Chapter 32 SolutionHassanSheikhNessuna valutazione finora

- Solutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelDa EverandSolutions Manual to Accompany Introduction to Quantitative Methods in Business: with Applications Using Microsoft Office ExcelNessuna valutazione finora

- Question Paper PDFDocumento17 pagineQuestion Paper PDFSaianish KommuchikkalaNessuna valutazione finora

- Chopra Scm5 Tif Ch08Documento20 pagineChopra Scm5 Tif Ch08Madyoka Raimbek75% (4)

- Chopra Scm5 Tif Ch09Documento26 pagineChopra Scm5 Tif Ch09Madyoka RaimbekNessuna valutazione finora

- Chopra Scm5 Tif Ch09Documento26 pagineChopra Scm5 Tif Ch09Madyoka RaimbekNessuna valutazione finora

- Documents - Tips Chopra Scm5 Tif Ch05Documento23 pagineDocuments - Tips Chopra Scm5 Tif Ch05shahad100% (2)

- Chopra scm5 Tif ch18Documento15 pagineChopra scm5 Tif ch18Madyoka Raimbek100% (2)

- Chopra scm5 Tif ch15Documento28 pagineChopra scm5 Tif ch15Madyoka RaimbekNessuna valutazione finora

- Time Value of MoneyDocumento64 pagineTime Value of MoneyYasir HussainNessuna valutazione finora

- Costing Prob FinalsDocumento52 pagineCosting Prob FinalsSiddhesh Khade100% (1)

- Chopra Scm5 Tif Ch13Documento23 pagineChopra Scm5 Tif Ch13Madyoka RaimbekNessuna valutazione finora

- Chopra scm5 Tif ch03Documento19 pagineChopra scm5 Tif ch03Madyoka Raimbek100% (2)

- Answers/loan Amortization Schedule Personal Finance Problem Joan Messineo Borrowed 20 000 9 Annual q51926905Documento7 pagineAnswers/loan Amortization Schedule Personal Finance Problem Joan Messineo Borrowed 20 000 9 Annual q51926905HasanAbdullahNessuna valutazione finora

- Chopra scm5 Tif ch16Documento22 pagineChopra scm5 Tif ch16Madyoka RaimbekNessuna valutazione finora

- Financial Ratio AnalysisDocumento53 pagineFinancial Ratio AnalysisLaurentia Nurak100% (4)

- BEPP250 Final TestbankDocumento189 pagineBEPP250 Final TestbankMichael Wen100% (2)

- 17 Answers To All ProblemsDocumento25 pagine17 Answers To All ProblemsRaşitÖnerNessuna valutazione finora

- Tutorial Problems - Capital BudgetingDocumento6 pagineTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- FOF Seminar Activities Topic 4 SolutionsDocumento7 pagineFOF Seminar Activities Topic 4 Solutionsmuller1234Nessuna valutazione finora

- The Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000Documento24 pagineThe Cost of Capital: HKD 100,000,000 HKD 250,000,000 HKD 150,000,000 HKD 250,000,000chandel08Nessuna valutazione finora

- PS3 ADocumento10 paginePS3 AShrey BudhirajaNessuna valutazione finora

- Mulyiple Choice Questions On EcnomicsDocumento4 pagineMulyiple Choice Questions On EcnomicssandeeproseNessuna valutazione finora

- Did United Technologies Overpay For Rockwell CollinsDocumento2 pagineDid United Technologies Overpay For Rockwell CollinsRadNessuna valutazione finora

- Ans. Corporate Finance Part 2Documento17 pagineAns. Corporate Finance Part 2HashimRazaNessuna valutazione finora

- frm指定教材 risk management & derivativesDocumento1.192 paginefrm指定教材 risk management & derivativeszeno490Nessuna valutazione finora

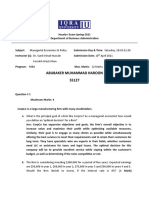

- Abubaker Muhammad Haroon 55127Documento4 pagineAbubaker Muhammad Haroon 55127Abubaker NathaniNessuna valutazione finora

- MGT 3332 Sample Test 1Documento3 pagineMGT 3332 Sample Test 1Ahmed0% (1)

- Quantitative TechniquesDocumento11 pagineQuantitative TechniquessanjayifmNessuna valutazione finora

- Revision Pack 4 May 2011Documento27 pagineRevision Pack 4 May 2011Lim Hui SinNessuna valutazione finora

- Chapter 12Documento25 pagineChapter 12Muhammad Umair KhalidNessuna valutazione finora

- Chapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Documento20 pagineChapter 14 Simulation Modeling: Quantitative Analysis For Management, 11e (Render)Jay BrockNessuna valutazione finora

- FIN323 Exam 2 SolutionsDocumento7 pagineFIN323 Exam 2 SolutionskatieNessuna valutazione finora

- CH 003Documento25 pagineCH 003bigbufftony100% (1)

- Question Pool Chapter03Documento35 pagineQuestion Pool Chapter03Petar N NeychevNessuna valutazione finora

- Solutions of Selected Problems in Chapter 4 - The Time Value of Money (Part 2)Documento10 pagineSolutions of Selected Problems in Chapter 4 - The Time Value of Money (Part 2)Sana Khan100% (1)

- BCBL Financial StatementDocumento2 pagineBCBL Financial StatementTanvirNessuna valutazione finora

- Linear Programming (LINDO Output) (Assignment Question 2 and 3)Documento8 pagineLinear Programming (LINDO Output) (Assignment Question 2 and 3)UTTAM KOIRALANessuna valutazione finora

- EPM7e Slides Ch07 How To Monitor and Control A TPM ProjectDocumento40 pagineEPM7e Slides Ch07 How To Monitor and Control A TPM ProjectGulzaibNessuna valutazione finora

- QP March2012 p1Documento20 pagineQP March2012 p1Dhanushka Rajapaksha100% (1)

- CH 8 - Competitive DynamicsDocumento24 pagineCH 8 - Competitive DynamicsMilindMalwade100% (1)

- Compound Interest, Present Value, Annuities and Finding The Interest RatesDocumento41 pagineCompound Interest, Present Value, Annuities and Finding The Interest RatesCher Na100% (1)

- CH 4 - End of Chapter Exercises SolutionsDocumento80 pagineCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseNessuna valutazione finora

- Chapter022 Solutions ManualDocumento47 pagineChapter022 Solutions Manualkanak100% (2)

- Ebit Eps AnalysisDocumento11 pagineEbit Eps Analysismanish9890Nessuna valutazione finora

- Capital Budgeting - 01Documento23 pagineCapital Budgeting - 01ru4angelNessuna valutazione finora

- ADMS 2510 Chapter 1 NotesDocumento3 pagineADMS 2510 Chapter 1 Notesemahal16Nessuna valutazione finora

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Documento4 paginePayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangNessuna valutazione finora

- Wallace Garden SupplyDocumento4 pagineWallace Garden SupplyestoniloannNessuna valutazione finora

- Appendix B Solutions To Concept ChecksDocumento31 pagineAppendix B Solutions To Concept Checkshellochinp100% (1)

- Estimating Demand: Regression AnalysisDocumento29 pagineEstimating Demand: Regression Analysissamer abou saadNessuna valutazione finora

- Mortgage Markets Practice Problems SolutionsDocumento8 pagineMortgage Markets Practice Problems Solutionsjam linganNessuna valutazione finora

- Financial Management Assignment 2Documento24 pagineFinancial Management Assignment 2Rohan AhujaNessuna valutazione finora

- Macsg12: Aggregate Demand in The Money Goods and Current MarketsDocumento30 pagineMacsg12: Aggregate Demand in The Money Goods and Current MarketsJudithNessuna valutazione finora

- Finance Assistant CV TemplateDocumento2 pagineFinance Assistant CV TemplateRizky WidiyantoNessuna valutazione finora

- AssignmentDocumento2 pagineAssignmentAbdul Moiz YousfaniNessuna valutazione finora

- DocxDocumento6 pagineDocxVịt HoàngNessuna valutazione finora

- Chapter 7 Notes Question Amp SolutionsDocumento7 pagineChapter 7 Notes Question Amp SolutionsPankhuri SinghalNessuna valutazione finora

- Chapter 9: The Capital Asset Pricing ModelDocumento6 pagineChapter 9: The Capital Asset Pricing ModelJohn FrandoligNessuna valutazione finora

- Chapter 4Documento45 pagineChapter 4Yanjing Liu67% (3)

- Case StudyDocumento6 pagineCase Studyanhdu7Nessuna valutazione finora

- Heizer Chapter 4 - ForecastingDocumento31 pagineHeizer Chapter 4 - ForecastingANessuna valutazione finora

- Hillier Model 3Documento19 pagineHillier Model 3kavyaambekarNessuna valutazione finora

- ENG 111 Final SolutionsDocumento12 pagineENG 111 Final SolutionsDerek EstrellaNessuna valutazione finora

- Answwr of Quiz 5 (MBA)Documento2 pagineAnswwr of Quiz 5 (MBA)Wael_Barakat_3179Nessuna valutazione finora

- Corporate Financial Analysis with Microsoft ExcelDa EverandCorporate Financial Analysis with Microsoft ExcelValutazione: 5 su 5 stelle5/5 (1)

- Capital Budgeting Decisions A Clear and Concise ReferenceDa EverandCapital Budgeting Decisions A Clear and Concise ReferenceNessuna valutazione finora

- Value Chain Management Capability A Complete Guide - 2020 EditionDa EverandValue Chain Management Capability A Complete Guide - 2020 EditionNessuna valutazione finora

- Chopra scm5 Tif ch10Documento25 pagineChopra scm5 Tif ch10Madyoka RaimbekNessuna valutazione finora

- Chopra scm5 Tif ch10Documento25 pagineChopra scm5 Tif ch10Madyoka RaimbekNessuna valutazione finora

- Eng PDFDocumento359 pagineEng PDFMadyoka RaimbekNessuna valutazione finora

- Chapter 6 Designing Global Supply Chain NetworksDocumento22 pagineChapter 6 Designing Global Supply Chain NetworksRashadafaneh100% (1)

- Wheelen10 Ppt08 PJDDocumento27 pagineWheelen10 Ppt08 PJDMadyoka RaimbekNessuna valutazione finora

- Thinktheory ch01Documento4 pagineThinktheory ch01Snehil SinghNessuna valutazione finora

- Forecasting Stock Returns: What Signals Matter, and What Do They Say Now?Documento20 pagineForecasting Stock Returns: What Signals Matter, and What Do They Say Now?madcraft9832Nessuna valutazione finora

- 03 Portfolio Risk and Return - Part IIDocumento24 pagine03 Portfolio Risk and Return - Part IIAmol BagulNessuna valutazione finora

- Current Ratio: Interpretation and Evaluation of The Ratio Analysis of People's Insurance Company (PICL)Documento50 pagineCurrent Ratio: Interpretation and Evaluation of The Ratio Analysis of People's Insurance Company (PICL)HR CHRNessuna valutazione finora

- Anita PaperDocumento12 pagineAnita PaperAgusSafriTanjungNessuna valutazione finora

- Functions of National Saving OrganizationDocumento41 pagineFunctions of National Saving OrganizationAamir Khan83% (40)

- Chapter 6: Risk Aversion and Capital Allocation To Risky AssetsDocumento14 pagineChapter 6: Risk Aversion and Capital Allocation To Risky AssetsBiloni KadakiaNessuna valutazione finora

- Questions and ProblemsDocumento25 pagineQuestions and ProblemsLinh LinhNessuna valutazione finora

- Tong Hop Ham ExcelDocumento244 pagineTong Hop Ham ExcelImpossible MinosNessuna valutazione finora

- 24 EegDocumento27 pagine24 EegAashna ChaturvediNessuna valutazione finora

- Cost of Funds CalculatorDocumento2 pagineCost of Funds CalculatorcallmetarantulaNessuna valutazione finora

- Mutual Funds: Professionally Managed PortfoliosDocumento51 pagineMutual Funds: Professionally Managed PortfoliosIVYAYBSNessuna valutazione finora

- Nike Financial AnalysisDocumento4 pagineNike Financial AnalysisEmir Muminovic100% (1)

- 660 281proDocumento18 pagine660 281proFebri5awalsyahNessuna valutazione finora

- A Study of Marketing Mix Elements of Reliance Mutual FundDocumento22 pagineA Study of Marketing Mix Elements of Reliance Mutual Fundamitagrawal7100% (5)

- Construction of Free Cash Flows A Pedagogical Note. Part IDocumento23 pagineConstruction of Free Cash Flows A Pedagogical Note. Part IDwayne BranchNessuna valutazione finora

- Unit 3Documento18 pagineUnit 3anas khanNessuna valutazione finora

- Lums Cases Bibliography FinalDocumento142 pagineLums Cases Bibliography Finalsoni0033100% (2)

- Questions ACG, CCADocumento6 pagineQuestions ACG, CCAHamza El MissouabNessuna valutazione finora

- 5.1 Rates of Return: Holding-Period Return (HPR)Documento31 pagine5.1 Rates of Return: Holding-Period Return (HPR)irma makharoblidzeNessuna valutazione finora

- GRC FinMan Cost of Capital ModuleDocumento13 pagineGRC FinMan Cost of Capital ModuleJasmine FiguraNessuna valutazione finora

- Nism Exam For Mutual FundDocumento210 pagineNism Exam For Mutual FundarmailgmNessuna valutazione finora

- FIN 765 (2017 Fall) - SyllabusDocumento7 pagineFIN 765 (2017 Fall) - SyllabusAbhishek ChandnaNessuna valutazione finora

- Return On Investment - Indicator For Measuring The PDFDocumento8 pagineReturn On Investment - Indicator For Measuring The PDFKelly RamosNessuna valutazione finora