Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Corporate Assignmentguide

Caricato da

Bedu DominicDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Corporate Assignmentguide

Caricato da

Bedu DominicCopyright:

Formati disponibili

DRAFT BALANCE SHEET 31st october 2010-11-10

£m 2011 2012 2013 2014

Net Assets 50 60 70 80 95

Financed by:

Long term Debt 20 24 28 32 38

Share Capital 15 15 15 15 15

Retained Profit 30 30+ 3.5=33.5 33.5+ 4.5=38 38+5=43 43+7=50

=50 =72.5 = 81 =90 =103

2010 2011 2012 2013 2014

Sales 100 120 140 160 190

Pbit 12.4 15.8 17.5 23.8

Nopat 8.7 11.1 12.3 16.7

Pat 6 7 9 10 14

Now answer how would you finance the plug in??

Any take by authorities ?look in text books tical

Using methods and articles you can find on financing the gap or plug in?

Task 2)critical

Will the business make a profit in the future? might want to comment on it?

Returns goes had in hand with risk?

Therefore what risk lies in this business of bankruptcy? explore using financial gearing?

Sensitivity analysis? What other theories lie in the risk analysis?

will the business survive long-tem(2010-2014).? Using these theories?

After having looked at the risk element we look at the shareholder wealth? Increasing

shareholder wealth? theories on adding value to shareholder wealth?

Theories on maximizing shareholder wealth?

Npv what does it assume in finding an appropriate cost of capital for the business and the

What do the authorities say?

What is on the ground current market scenarios?

What does our example illustration

Can we make shareholders wealthy in our example?Benchmarking very important?

current industry figures? Look at other businesses in the industry? Might even employ

CAPM?and see what the results look like? Read a few journals and add to support

arguments and decisions taken.

3)whether or not you would advise the m to go into the business?

Compare and contrast? What does the risk involved look like? Question if investors are

risk averse or not? How much profit could be made? If invested in other similare business

at present how much would they made? If invested in risk free investment how much

could they make?Conclude

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Answer KeysDocumento6 pagineAnswer Keyspolina2707562% (13)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- PepsiCo Changchun Joint Venture Helpful HintsDocumento2 paginePepsiCo Changchun Joint Venture Helpful HintsLeung Hiu Yeung50% (2)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- ch01 Introduction Acounting & BusinessDocumento37 paginech01 Introduction Acounting & Businesskuncoroooo100% (1)

- Accounting Changes and Error AnalysisDocumento39 pagineAccounting Changes and Error AnalysisIrwan Januar100% (1)

- Bir Form No. 1914Documento1 paginaBir Form No. 1914Mark Lord Morales BumagatNessuna valutazione finora

- James Montier WhatGoesUpDocumento8 pagineJames Montier WhatGoesUpdtpalfiniNessuna valutazione finora

- Monmouth Student Template UpdatedDocumento14 pagineMonmouth Student Template Updatedhao pengNessuna valutazione finora

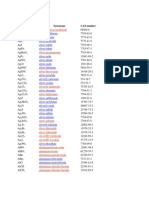

- FICO Configuration Transaction CodesDocumento3 pagineFICO Configuration Transaction CodesSoumitra MondalNessuna valutazione finora

- Return, Risk, and The Security Market LineDocumento45 pagineReturn, Risk, and The Security Market Lineotaku himeNessuna valutazione finora

- Data StructureDocumento6 pagineData Structuremohit1485Nessuna valutazione finora

- Employees PF Scheme 1952Documento100 pagineEmployees PF Scheme 1952P VenkatesanNessuna valutazione finora

- Hul Marketing Starategies Over The YearsDocumento11 pagineHul Marketing Starategies Over The YearsJay Karan Singh ChadhaNessuna valutazione finora

- REPORT - Economic and Steel Market Outlook - Quarter 4, 2018Documento24 pagineREPORT - Economic and Steel Market Outlook - Quarter 4, 2018Camelia ZlotaNessuna valutazione finora

- Ch7 HW AnswersDocumento31 pagineCh7 HW Answerscourtdubs78% (9)

- L Oréal Travel Retail Presentation SpeechDocumento6 pagineL Oréal Travel Retail Presentation Speechsaketh6790Nessuna valutazione finora

- ICICIdirect HDFCBank ReportDocumento21 pagineICICIdirect HDFCBank Reportishan_mNessuna valutazione finora

- CRM Case Study PresentationDocumento20 pagineCRM Case Study PresentationAnonymous QVBtzHYmxC100% (1)

- 1 Rural Indebtedness, Assets and Credit: Inter-State Variations in IndiaDocumento4 pagine1 Rural Indebtedness, Assets and Credit: Inter-State Variations in IndiaashwatinairNessuna valutazione finora

- Kingfisherairlines ORGANISATION CHARTDocumento5 pagineKingfisherairlines ORGANISATION CHARTAhmad Yani S NoorNessuna valutazione finora

- Charlotte Addendum 1Documento6 pagineCharlotte Addendum 1Danny InkleyNessuna valutazione finora

- Prospects and Challenges of The Emerging Oil and Gas Industry in GhanaDocumento8 pagineProspects and Challenges of The Emerging Oil and Gas Industry in GhanaEsther AdutwumwaaNessuna valutazione finora

- Unilever Case StudyDocumento17 pagineUnilever Case StudyRosas ErmitañoNessuna valutazione finora

- Our Friends at The Bank PDFDocumento1 paginaOur Friends at The Bank PDFAnnelise HermanNessuna valutazione finora

- SR05 - Amruth Pavan Davuluri - How Competitive Forces Shape StrategyDocumento14 pagineSR05 - Amruth Pavan Davuluri - How Competitive Forces Shape Strategyamruthpavan09Nessuna valutazione finora

- Chemical Formulas at A GlanceDocumento47 pagineChemical Formulas at A GlanceSubho BhattacharyaNessuna valutazione finora

- Resumo BTG Pactual PDFDocumento206 pagineResumo BTG Pactual PDFJulio Cesar Gusmão CarvalhoNessuna valutazione finora

- ATM BrochuresDocumento5 pagineATM Brochuresगुंजन सिन्हाNessuna valutazione finora

- For: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXDocumento2 pagineFor: Jyg Travel and Tours 2D1N Bohol Tour Itinerary MAY 23 - 25, 2018 Good For 3 Pax PHP 2,900/PAXLiza L. PadriquezNessuna valutazione finora

- CA PracticeDocumento2 pagineCA PracticeNatalia CalaNessuna valutazione finora

- Irfz 48 VDocumento8 pagineIrfz 48 VZoltán HalászNessuna valutazione finora