Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Project Cost Report

Caricato da

Lahiru LakmalDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Project Cost Report

Caricato da

Lahiru LakmalCopyright:

Formati disponibili

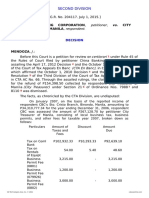

FINANCIAL SERVICES DIVISION

SALES TAX ADMINISTRATION

200 Oak Street, Suite 4000

P.O. Box 1190

Fort Collins, CO 80522-1190

(970) 498-5930

PROJECT COST REPORT FAX (970) 498-5942

Building Permit #:

Contractor’s Name:

Address:

City, State, & Zip: Phone:

Project Location:

For projects under $400,000 and not requesting a refund, complete this section:

By signing, I understand and agree to the following:

-the completed project is valued under $400,000

-the cost of the building material used in the project is materially the same as the estimated costs.

-no refund is due

-an audit may be requested by Larimer County up to three years after the completion of the project.

Signature Title Date

For Projects over $400,000, requesting a refund, or submitting additional taxes, complete this section:

1. Use Tax paid on Building Permit plus any additional County taxes paid on receipts:

+ $ 0.00

2. Actual material costs X .0080 $ 0.00

If line 2 is greater than line 1, proceed to Line 3 - If line 2 is less than line 1, proceed to Line 4

3. UNDERPAYMENT OF TAX:

Line 2 $ 0.00

Line 1 $ 0.00

Difference – Additional Tax Due $ 0.00

4. OVERPAYMENT OF TAX:

Line 1 $ 0.00

Line 2 $ 0.00

Difference – Refund Due $ 0.00

Return this completed form along with a copy of the building permit, final job cost summary and copies of any

documentation support claims for additional County sales tax paid or a different breakdown on subcontractor’s

billings. Please read Contractor’s letter and instructions for examples of back up documentation. All Project Cost

Project Cost Reports are due 60 after the issuance of the CO or letter of Completion. Any Project Cost Report

submitted after the 60 days is subject to penalty and interest. Reports are subject to audit.

I, hereby certify, under penalty of perjury, that the statements made herein are to the best of my knowledge true and

correct.

Signature Title Date

Potrebbero piacerti anche

- 2018 Davis-Stirling Common Interest DevelopmentDa Everand2018 Davis-Stirling Common Interest DevelopmentNessuna valutazione finora

- Solicitation ITB Welded-Aluminum Landing-CraftDocumento17 pagineSolicitation ITB Welded-Aluminum Landing-CraftJohn GuerreroNessuna valutazione finora

- 1040 Exam Prep Module V: Adjustments to Income or DeductionsDa Everand1040 Exam Prep Module V: Adjustments to Income or DeductionsNessuna valutazione finora

- IC Contractor Progress Payment Template 8531 Update v2Documento4 pagineIC Contractor Progress Payment Template 8531 Update v2Naveen BansalNessuna valutazione finora

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNessuna valutazione finora

- Petroleum Gross Receipts Tax Return - Quarterly: Delaware Division of Revenue 368 WHL - PetrolDocumento1 paginaPetroleum Gross Receipts Tax Return - Quarterly: Delaware Division of Revenue 368 WHL - PetrolGlendaNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Architect Invoice Instructions - 0Documento2 pagineArchitect Invoice Instructions - 0Joseph Mwangi WambuguNessuna valutazione finora

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionDa EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNessuna valutazione finora

- 27 Tds Calculator Rate ChartDocumento5 pagine27 Tds Calculator Rate ChartasareereNessuna valutazione finora

- 7) Progress PaymentDocumento5 pagine7) Progress Paymentkerwin jayNessuna valutazione finora

- Spectrum BillDocumento8 pagineSpectrum BillHARISH KUMARNessuna valutazione finora

- SICOM P2 Defect64 CanadaInvoice 16mar20Documento1 paginaSICOM P2 Defect64 CanadaInvoice 16mar20Prem KumarNessuna valutazione finora

- Letter Notice of Payment VATDocumento2 pagineLetter Notice of Payment VATGgoudNessuna valutazione finora

- Project: Pramur Estonia Apartment at Adipampa Road, V.V.Mohalla, MysoreDocumento1 paginaProject: Pramur Estonia Apartment at Adipampa Road, V.V.Mohalla, MysorePoorni ShivaramNessuna valutazione finora

- Butler Pitch & Putt Disqualification LetterDocumento5 pagineButler Pitch & Putt Disqualification LetterAnonymous Pb39klJNessuna valutazione finora

- MyOrdersProductInvoice PDFDocumento1 paginaMyOrdersProductInvoice PDFFernando RosalesNessuna valutazione finora

- V3 Appe SWFT2020 001-098Documento98 pagineV3 Appe SWFT2020 001-098Hao CuiNessuna valutazione finora

- ABFT2020 Tutorial 12 Busines ExpenseDocumento6 pagineABFT2020 Tutorial 12 Busines ExpensePUI TUNG CHONGNessuna valutazione finora

- Bonifacio v. CIRDocumento3 pagineBonifacio v. CIRAntonio TopacioNessuna valutazione finora

- SOBC 2024 - January To June - Web EnglishDocumento29 pagineSOBC 2024 - January To June - Web EnglishMuhammad QasimNessuna valutazione finora

- Labour FormsDocumento59 pagineLabour FormsUnited Conservative Party CaucusNessuna valutazione finora

- Bac TXTN Final ExamDocumento1 paginaBac TXTN Final ExamMichael Angelo AmoresNessuna valutazione finora

- Bill-2low4u CorporationDocumento1 paginaBill-2low4u CorporationEdgar EnriquezNessuna valutazione finora

- 1 - TRAIN On Govt Agencies - NMT - 03.06.2018Documento26 pagine1 - TRAIN On Govt Agencies - NMT - 03.06.2018NISREEN WAYANessuna valutazione finora

- Commercial Proposal: Ref.: PR2002-0102Documento1 paginaCommercial Proposal: Ref.: PR2002-0102yassine aitlfakirNessuna valutazione finora

- NTN: 07862377 STRN: 0308854400219: Newage Cables Private LimitedDocumento2 pagineNTN: 07862377 STRN: 0308854400219: Newage Cables Private LimitedbilalNessuna valutazione finora

- 10.01.21 Heirs of Remigio M. Olveda 2021-07-02-04921Documento1 pagina10.01.21 Heirs of Remigio M. Olveda 2021-07-02-04921Teresita OlvedaNessuna valutazione finora

- Tax Deduction at SourceDocumento7 pagineTax Deduction at SourceEnvy NvNessuna valutazione finora

- Kimwa Compound, Baloy 04/01/2023 03/27/2023 LYL Development Corporation 006430292000Documento1 paginaKimwa Compound, Baloy 04/01/2023 03/27/2023 LYL Development Corporation 006430292000Maricel IpanagNessuna valutazione finora

- National Registration and Grading Scheme For Construction ContractorsDocumento4 pagineNational Registration and Grading Scheme For Construction ContractorsMadusanka WeebeddaNessuna valutazione finora

- 8225 Maximo Consulting Services RFPDocumento35 pagine8225 Maximo Consulting Services RFPteguhpratama12tkj1Nessuna valutazione finora

- Bill Tomboiz IncorporatedDocumento1 paginaBill Tomboiz IncorporatedEdgar EnriquezNessuna valutazione finora

- Work Sheet 4A2Documento1 paginaWork Sheet 4A2SohailAKramNessuna valutazione finora

- Sapwebsite Dzitalinfo QT 2020 10Documento2 pagineSapwebsite Dzitalinfo QT 2020 10ajay1989sNessuna valutazione finora

- Petitioner Respondent: China Banking Corporation, City Treasurer of ManilaDocumento14 paginePetitioner Respondent: China Banking Corporation, City Treasurer of ManilaENessuna valutazione finora

- Commercial Invoice CompletedExportForm ShippingSolutions 12.14.2015Documento2 pagineCommercial Invoice CompletedExportForm ShippingSolutions 12.14.2015Gaurav RawatNessuna valutazione finora

- SOBC 2023 January To June - Web EnglishDocumento28 pagineSOBC 2023 January To June - Web EnglishMufaddal BadruddinNessuna valutazione finora

- Turn To Next Page PleaseDocumento15 pagineTurn To Next Page PleaseMewnEProwtNessuna valutazione finora

- Status Notification For Services Package-1 Application: Customer InformationDocumento2 pagineStatus Notification For Services Package-1 Application: Customer InformationAbdulhamit KAYYALINessuna valutazione finora

- Vibe BrochureDocumento6 pagineVibe BrochureScott MydanNessuna valutazione finora

- TD - APPENDIX C - Invoicing - Procedures - FINAL - 03 - 18Documento4 pagineTD - APPENDIX C - Invoicing - Procedures - FINAL - 03 - 18andiNessuna valutazione finora

- Amount Due: B127 Mahindra Iris CourtDocumento4 pagineAmount Due: B127 Mahindra Iris CourtVinod VentoNessuna valutazione finora

- Quotation: Adstone Technical Services LLCDocumento2 pagineQuotation: Adstone Technical Services LLCAzaan KhanNessuna valutazione finora

- Accounting 1 - PPEDocumento38 pagineAccounting 1 - PPEPortia TurianoNessuna valutazione finora

- Financial Statements of Banking Co Problem 5Documento3 pagineFinancial Statements of Banking Co Problem 5gowrirao496Nessuna valutazione finora

- March Bill PDFDocumento2 pagineMarch Bill PDFRaman kumarNessuna valutazione finora

- CS011Documento11 pagineCS011Dean LefebvreNessuna valutazione finora

- D2086 - RFQ - MS Office 2007 Software Skills Program (Port Elizabeth - Not CT)Documento33 pagineD2086 - RFQ - MS Office 2007 Software Skills Program (Port Elizabeth - Not CT)Hassan SleemNessuna valutazione finora

- PCS Phone Contract With MDOCDocumento103 paginePCS Phone Contract With MDOCTlecoz HuitzilNessuna valutazione finora

- 048Documento16 pagine048AmanNessuna valutazione finora

- Amount Due: Summary of Charges Current Bill Period RsDocumento1 paginaAmount Due: Summary of Charges Current Bill Period RsMohitNessuna valutazione finora

- PC Case # Text Amendment June 20, 2011: Applicant: Property Location: Requested Action: PurposeDocumento5 paginePC Case # Text Amendment June 20, 2011: Applicant: Property Location: Requested Action: PurposeThe News-HeraldNessuna valutazione finora

- PC Square2307Documento3 paginePC Square2307SirManny ReyesNessuna valutazione finora

- Tds Income Tax Rates Fy 2010-11Documento13 pagineTds Income Tax Rates Fy 2010-11Surender KumarNessuna valutazione finora

- How To Fill in The FormDocumento2 pagineHow To Fill in The FormsriniNessuna valutazione finora

- CGT Tomanda AntokDocumento1 paginaCGT Tomanda AntokNvision PresentNessuna valutazione finora

- TDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11Documento13 pagineTDS (Tax Deducted at Source) Rate Chart For Financial Year 2010-11av_meshramNessuna valutazione finora

- Draft MOA-Springwoods Phase 2Documento3 pagineDraft MOA-Springwoods Phase 2carlger0% (1)

- Industrial RelationsDocumento39 pagineIndustrial RelationsbijayNessuna valutazione finora

- Lina v. Pano DigestDocumento1 paginaLina v. Pano Digestmei_2208Nessuna valutazione finora

- Positive ChristianityDocumento7 paginePositive ChristianityJeanne J. Nunez100% (1)

- Unconditionally Approved To Take BarDocumento12 pagineUnconditionally Approved To Take BarMelvin PernezNessuna valutazione finora

- Shree CSR Policy Final PDFDocumento6 pagineShree CSR Policy Final PDFAniket kawadeNessuna valutazione finora

- Istvan Deak - Beyond Nationalism - A Social and Political History of The Habsburg Officer Corps, 1848-1918 (1990)Documento300 pagineIstvan Deak - Beyond Nationalism - A Social and Political History of The Habsburg Officer Corps, 1848-1918 (1990)CydLosekannNessuna valutazione finora

- Cover Letter For OrdinanceDocumento2 pagineCover Letter For OrdinanceGillian Alexis ColegadoNessuna valutazione finora

- Javellana vs. The Executive Secretary (Digest)Documento5 pagineJavellana vs. The Executive Secretary (Digest)Jessa F. Austria-CalderonNessuna valutazione finora

- Fidelity CEO William Foley Aware of Federal ViolationsDocumento2 pagineFidelity CEO William Foley Aware of Federal ViolationsAdrian LoftonNessuna valutazione finora

- 100 Legal GK Questions Part 1Documento12 pagine100 Legal GK Questions Part 1Sushobhan Sanyal100% (2)

- Cointelpro: FBI Domestic Intelligence Activities COINTELPRO Revisited - Spying & DisruptionDocumento6 pagineCointelpro: FBI Domestic Intelligence Activities COINTELPRO Revisited - Spying & DisruptionDarkk SunnNessuna valutazione finora

- Cases For Statcon 1Documento6 pagineCases For Statcon 1Phoebe SG FanciscoNessuna valutazione finora

- The Flag Code: This Independent Learning Material Is Not For SaleDocumento11 pagineThe Flag Code: This Independent Learning Material Is Not For SaleEmgelle JalbuenaNessuna valutazione finora

- 2021 Ordinance On Loud MusicDocumento3 pagine2021 Ordinance On Loud MusicClark Collin Lomocso TejadaNessuna valutazione finora

- Estructura de Redes de Computadores 60 To 90 PDFDocumento31 pagineEstructura de Redes de Computadores 60 To 90 PDFcarlosruiz111Nessuna valutazione finora

- Lu Do v. BinamiraDocumento2 pagineLu Do v. BinamiraquasideliksNessuna valutazione finora

- GradationList AAO of 18Documento90 pagineGradationList AAO of 18Kausik DattaNessuna valutazione finora

- Exxxotica RulingDocumento32 pagineExxxotica RulingRobert WilonskyNessuna valutazione finora

- RWPPT For Final Demo - ExDocumento33 pagineRWPPT For Final Demo - ExGuillermo AlvarezNessuna valutazione finora

- Cooperative Society ActDocumento9 pagineCooperative Society Actazaudeen100% (1)

- Regionalism in IndiaDocumento24 pagineRegionalism in IndiaAbhishekGargNessuna valutazione finora

- Dwnload Full Decoding The Ethics Code A Practical Guide For Psychologists 4th Edition Fisher Test Bank PDFDocumento35 pagineDwnload Full Decoding The Ethics Code A Practical Guide For Psychologists 4th Edition Fisher Test Bank PDFsparpoil.pian.dpxd100% (10)

- Silverio - Cagandahan CaseDocumento14 pagineSilverio - Cagandahan Case001nooneNessuna valutazione finora

- Childprotecta 99Documento378 pagineChildprotecta 99api-294360574Nessuna valutazione finora

- Ma. Aiza Santos Week 9 The Executive Branch 1Documento16 pagineMa. Aiza Santos Week 9 The Executive Branch 1Moises John Sangalang100% (1)

- SK Irr PDFDocumento44 pagineSK Irr PDFElizalde Teo BobbyNessuna valutazione finora

- All About IASDocumento6 pagineAll About IASAnant SharmaNessuna valutazione finora

- Anti-Violence Against Women and Children Act: CHR: Dignity of AllDocumento27 pagineAnti-Violence Against Women and Children Act: CHR: Dignity of AllNoemi vargasNessuna valutazione finora

- Opec Bulletin 08 2021Documento96 pagineOpec Bulletin 08 2021Andre KoichiNessuna valutazione finora