Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Office Memorandum No - DGW/MAN/171 Issued by Authority of Director General of Works

Caricato da

Deep Prakash Yadav0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

41 visualizzazioni2 pagineJustification of tenders provisions as contained in para of 19.4.3. And 23. Of CPWD Works Manual-2007 are partially amended as under; para 4.1. Existing provision Preparation and forwarding of preliminary estimate the effect of building and other construction workers' welfare cess Act 1996, service tax including education cess as applicable at the time of submission of preliminary estimate is also to be added.

Descrizione originale:

Titolo originale

110

Copyright

© Attribution Non-Commercial (BY-NC)

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoJustification of tenders provisions as contained in para of 19.4.3. And 23. Of CPWD Works Manual-2007 are partially amended as under; para 4.1. Existing provision Preparation and forwarding of preliminary estimate the effect of building and other construction workers' welfare cess Act 1996, service tax including education cess as applicable at the time of submission of preliminary estimate is also to be added.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

41 visualizzazioni2 pagineOffice Memorandum No - DGW/MAN/171 Issued by Authority of Director General of Works

Caricato da

Deep Prakash YadavJustification of tenders provisions as contained in para of 19.4.3. And 23. Of CPWD Works Manual-2007 are partially amended as under; para 4.1. Existing provision Preparation and forwarding of preliminary estimate the effect of building and other construction workers' welfare cess Act 1996, service tax including education cess as applicable at the time of submission of preliminary estimate is also to be added.

Copyright:

Attribution Non-Commercial (BY-NC)

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

OFFICE MEMORANDUM

No.DGW/MAN/171

ISSUED BY AUTHORITY OF DIRECTOR GENERAL OF WORKS

NIRMAN BHAVAN, NEW DELHI DATED: 28.01.2009___________

Sub: Modifications in the provisions of CPWD Works Manual 2007

regarding justification of tenders

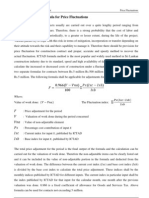

Provisions as contained in para of 19.4.3.1 and 23.3 of CPWD Works

Manual-2007 are partially amended as under;

Para Existing Provision Modified provision

Para Preparation and Preparation and forwarding of

4.1.4 forwarding of preliminary preliminary estimate

(7) estimate

The effect of building and The effect of building and other

other construction workers’ construction workers’ welfare cess

welfare cess Act 1996, Act 1996, service tax including

wherever applicable may education cess as applicable at the

also taken in the estimate. time of submission of preliminary

estimate is also to be added.

Para Justification of tenders Para 19.4.3.1 Justification of

19.4.3.1 tenders

The effect of building The effect of building material and

material and other other construction workers’ cess

construction workers’ cess Act 1996, VAT etc. wherever

Act 1996, service Tax, applicable and other factors which

VAT etc. wherever actually contributes towards the

applicable and other factors cost, but are not covered in

which actually contributes Analysis of Rates can also be added

towards the cost, but are not in arriving at the justified amount.

covered in Analysis of Rates But nothing shall be added in

can also be added in arriving analysis of rates for service Tax

at the justified amount. since being reimbursed to the

contractor separately.

23.3 (1) The rate of extra

items and deviation No change.

items beyond the

permissible limit will

be………………...th

e justification of

tender.

(2) For working out rates

under clause No change.

12………………...fo

r obtaining the

approval of the

competent authority.

(3) Nothing is to be added in the

analysis of rates on account of

service tax (which will be

reimbursed to the contractor by

the Engineer-in-Charge on

satisfying himself that the

contractor has actually and

genuinely has paid the tax) but

effect of other construction

workers’ cess Act 1996 as

applicable will also be added in

the analysis of rates for the

deviated/extra/substituted items.

- sd -

Superintending Engineer (C&M)

Issued vide file No. CSQ/CM/M/16(1)/2008

As per mailing list attached overleaf

Potrebbero piacerti anche

- II Annex B General Conditions Appendix 6 Contract Price AdjustmentDocumento4 pagineII Annex B General Conditions Appendix 6 Contract Price AdjustmentSandeep JoshiNessuna valutazione finora

- PreliminariesDocumento8 paginePreliminariesAfeeq RosliNessuna valutazione finora

- Service Tax On Works ContractDocumento4 pagineService Tax On Works Contractrajs27Nessuna valutazione finora

- Section 1 - PreliminariesDocumento284 pagineSection 1 - PreliminariesNor Nadhirah NadzreyNessuna valutazione finora

- Works Contract and Principle of AccretionDocumento5 pagineWorks Contract and Principle of AccretionNeeladri CNessuna valutazione finora

- Lumpsum ContractDocumento3 pagineLumpsum ContractjopuNessuna valutazione finora

- Bulletin 55 Dec01Documento16 pagineBulletin 55 Dec01jjNessuna valutazione finora

- Frequently Asked Questions ON Scale of FeesDocumento2 pagineFrequently Asked Questions ON Scale of FeesrowatersNessuna valutazione finora

- DO - 046 - S2007 Dayworks and Provisional Sum PDFDocumento5 pagineDO - 046 - S2007 Dayworks and Provisional Sum PDFalterego1225Nessuna valutazione finora

- Go - Ms.no.227 - 2009 Price AdjustmentsDocumento5 pagineGo - Ms.no.227 - 2009 Price AdjustmentsMetro Division 1Nessuna valutazione finora

- 999989-UKD001-000-ZZ-TN-ZZ-000001 (R02) Penalties To Be Paid by Subcontractors To ContractorsDocumento11 pagine999989-UKD001-000-ZZ-TN-ZZ-000001 (R02) Penalties To Be Paid by Subcontractors To ContractorsTeus KoolNessuna valutazione finora

- Project Specific Preliminaries MWA 2018 05Documento13 pagineProject Specific Preliminaries MWA 2018 05kmgmasedi777Nessuna valutazione finora

- Impact of GST On Construction and Real EstateDocumento7 pagineImpact of GST On Construction and Real Estatesahilkaushik0% (1)

- Tender Estimation Lecture Note 05Documento2 pagineTender Estimation Lecture Note 05rachuNessuna valutazione finora

- Work Contracts in GSTDocumento4 pagineWork Contracts in GSTakshayjain93Nessuna valutazione finora

- Practical Illustrations On Indirect TaxationDocumento9 paginePractical Illustrations On Indirect Taxationsridharan1969Nessuna valutazione finora

- Dcw-Circular-07 10 2021Documento12 pagineDcw-Circular-07 10 2021Kombaiah PandianNessuna valutazione finora

- Adjustment To Contract SumDocumento8 pagineAdjustment To Contract SumNor Aniza100% (1)

- Supply of Ultrasonic Thickness Measurement Gauge As Per The Technical Specification Attached at Annexure IiiDocumento5 pagineSupply of Ultrasonic Thickness Measurement Gauge As Per The Technical Specification Attached at Annexure IiiAshish ChaurasiaNessuna valutazione finora

- Upto For In: CircularDocumento2 pagineUpto For In: CircularmanishjonwNessuna valutazione finora

- Model File Note in Respect of Change of Scope (COS) Cum Revised Cost Estimate ProposalsDocumento5 pagineModel File Note in Respect of Change of Scope (COS) Cum Revised Cost Estimate ProposalsromorthraipurNessuna valutazione finora

- Construction Contracts Works Contract From The Point of View of Value Added Tax Service TaxDocumento6 pagineConstruction Contracts Works Contract From The Point of View of Value Added Tax Service TaxjohnsonNessuna valutazione finora

- THIS CONTRACT Is Between: (Organization Name), (Name and Address of Consulting Firm)Documento21 pagineTHIS CONTRACT Is Between: (Organization Name), (Name and Address of Consulting Firm)aaronNessuna valutazione finora

- Adjustment of Contract & Final Accounts AsimentsDocumento24 pagineAdjustment of Contract & Final Accounts AsimentsRubbyRdNessuna valutazione finora

- APP157 CoP For Site Supervision 2009 202109Documento92 pagineAPP157 CoP For Site Supervision 2009 202109Alex LeungNessuna valutazione finora

- Schedu 2Documento13 pagineSchedu 2Anfal BarbhuiyaNessuna valutazione finora

- Adjustment of Contract & Final Accounts AsimentsDocumento23 pagineAdjustment of Contract & Final Accounts Asimentsrubbydean100% (9)

- C.5 Contract Force Account (June 2014)Documento6 pagineC.5 Contract Force Account (June 2014)Joland Afu RegaladoNessuna valutazione finora

- Mechanism For Determination of Prolongation CostsDocumento10 pagineMechanism For Determination of Prolongation CostswisnuNessuna valutazione finora

- 02 Library of Standard Amendments To NEC ECC V1.0 201610Documento17 pagine02 Library of Standard Amendments To NEC ECC V1.0 201610Bruce WongNessuna valutazione finora

- Mobilization PlanDocumento5 pagineMobilization PlanNatnael AbiyNessuna valutazione finora

- Ias 37 Onerous ContractDocumento8 pagineIas 37 Onerous ContractSchwi DolaNessuna valutazione finora

- Revision No. 12 (December 2012) 1of 12 App. 5.3Documento12 pagineRevision No. 12 (December 2012) 1of 12 App. 5.3Drift KingNessuna valutazione finora

- Document: Docu:Manual:Revnofcmm&Mces: Revision Approved by Cil Bd.251StmeetDocumento8 pagineDocument: Docu:Manual:Revnofcmm&Mces: Revision Approved by Cil Bd.251StmeetArea Engineer CivilNessuna valutazione finora

- Exp NoteDocumento5 pagineExp NoteAbdullah AkbulutNessuna valutazione finora

- Price AdjustmentsPrice AdjustmentDocumento27 paginePrice AdjustmentsPrice Adjustmentvlatkoodgranit100% (4)

- PWD Accounts Theory-CompressedDocumento211 paginePWD Accounts Theory-Compressedabhishitewari75% (4)

- Practical Accounting 2 Topic: Long-Term Construction Contracts C. GonzagaDocumento10 paginePractical Accounting 2 Topic: Long-Term Construction Contracts C. GonzagaARISNessuna valutazione finora

- TH TH: Explanation.-For The Purposes of This ClauseDocumento4 pagineTH TH: Explanation.-For The Purposes of This ClauseAks SomvanshiNessuna valutazione finora

- JCT Clause 38Documento36 pagineJCT Clause 38PaulconroyNessuna valutazione finora

- Chapter X-Works Accounts.: A. General PrinciplesDocumento62 pagineChapter X-Works Accounts.: A. General PrinciplesExecutive Engineer R&BNessuna valutazione finora

- 4 Exhibit C - Compensation ScheduleDocumento13 pagine4 Exhibit C - Compensation SchedulestegenNessuna valutazione finora

- Service Tax ConclusionDocumento9 pagineService Tax ConclusionAbhas JaiswalNessuna valutazione finora

- Vol I RFPDocumento13 pagineVol I RFPTanmoy DasNessuna valutazione finora

- Practical Accounting 2 Topic: Long-Term Construction Contracts C. GonzagaDocumento10 paginePractical Accounting 2 Topic: Long-Term Construction Contracts C. GonzagaGuinevereNessuna valutazione finora

- Section - 2: Bangladesh, Matarbari 2 X 600MW Coal Fired Power Plant ProjectDocumento8 pagineSection - 2: Bangladesh, Matarbari 2 X 600MW Coal Fired Power Plant Projectruhul01Nessuna valutazione finora

- Mom & Boq Sewer English FinalDocumento33 pagineMom & Boq Sewer English FinalMohammed HanafiNessuna valutazione finora

- 01 Nec Ecc PN V1.1 201703Documento122 pagine01 Nec Ecc PN V1.1 201703sonnykinNessuna valutazione finora

- Commercial Amendment No. A307/1022/Ca-01 TO BIDDING DOCUMENT NO.: SM/A307-IUE-PC-TN-8005/1022Documento3 pagineCommercial Amendment No. A307/1022/Ca-01 TO BIDDING DOCUMENT NO.: SM/A307-IUE-PC-TN-8005/1022Vuong BuiNessuna valutazione finora

- Appendix I Contractor ' S Overhead CostsDocumento5 pagineAppendix I Contractor ' S Overhead CostsZoki JevtićNessuna valutazione finora

- 01 NEC ECC PN V2 20210811 Track Changes Final r1Documento126 pagine01 NEC ECC PN V2 20210811 Track Changes Final r1Fadi BoustanyNessuna valutazione finora

- BSR 2020 EN New - UnlockedDocumento189 pagineBSR 2020 EN New - Unlockedkavinda89Nessuna valutazione finora

- Construction Industry and Service Tax Amendments in Union Budget 2010Documento16 pagineConstruction Industry and Service Tax Amendments in Union Budget 2010coolchaserNessuna valutazione finora

- FIDIC & ICTAD Formula DifferencesDocumento5 pagineFIDIC & ICTAD Formula DifferencesTharaka Kodippily67% (3)

- ME-BENSON Apart Kontrak - Final-PerhitunganDocumento302 pagineME-BENSON Apart Kontrak - Final-PerhitunganTyo WayNessuna valutazione finora

- Evaluation of ClaimsDocumento6 pagineEvaluation of ClaimsGiora RozmarinNessuna valutazione finora

- Cover Project ContractDocumento4 pagineCover Project Contractdelvinceimpin796Nessuna valutazione finora

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Da EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703Nessuna valutazione finora

- .In Rdocs Notification PDFs CRB5100512KCDocumento12 pagine.In Rdocs Notification PDFs CRB5100512KCDeep Prakash YadavNessuna valutazione finora

- Sixthcpc 280113 UpdatedDocumento8 pagineSixthcpc 280113 Updatedkandhan_tNessuna valutazione finora

- Excel FormulaesDocumento30 pagineExcel Formulaesjiguparmar1516Nessuna valutazione finora

- Indian Contract Act, 1872Documento110 pagineIndian Contract Act, 1872viky@bcba50% (2)

- Account ManualDocumento146 pagineAccount ManualDeep Prakash YadavNessuna valutazione finora

- Law of ContractsDocumento102 pagineLaw of Contractsrajjuneja100% (5)

- FAQ On Cordros Money Market FundDocumento3 pagineFAQ On Cordros Money Market FundOnaderu Oluwagbenga EnochNessuna valutazione finora

- 16 PDFDocumento11 pagine16 PDFVijay KumarNessuna valutazione finora

- BitPay Payout PresentationDocumento8 pagineBitPay Payout PresentationLuana BlaNessuna valutazione finora

- PHM PCH EnglishDocumento9 paginePHM PCH Englishlalit823187Nessuna valutazione finora

- Business Economics PPT Chap 1Documento18 pagineBusiness Economics PPT Chap 1david sughapriyaNessuna valutazione finora

- Ceramic Tiles - Official Gazette 27 (10234)Documento16 pagineCeramic Tiles - Official Gazette 27 (10234)NajeebNessuna valutazione finora

- Japan CurrencyDocumento13 pagineJapan CurrencymelisaNessuna valutazione finora

- Paper 3 of JAIIB Is Legal and Regulatory Aspects of BankingDocumento3 paginePaper 3 of JAIIB Is Legal and Regulatory Aspects of BankingDhiraj PatreNessuna valutazione finora

- Bbob Current AffairsDocumento28 pagineBbob Current AffairsGangwar AnkitNessuna valutazione finora

- EV Infrastructure Solutions DEA-524Documento8 pagineEV Infrastructure Solutions DEA-524tommyctechNessuna valutazione finora

- TAC0002 Bank Statements SelfEmployed ReportDocumento78 pagineTAC0002 Bank Statements SelfEmployed ReportViren GalaNessuna valutazione finora

- Ethics DigestDocumento29 pagineEthics DigestTal Migallon100% (1)

- Jurnal Metana TPADocumento8 pagineJurnal Metana TPARiska Fauziah AsyariNessuna valutazione finora

- Indias Top 50 Best ItDocumento14 pagineIndias Top 50 Best ItAnonymous Nl41INVNessuna valutazione finora

- EntrepDocumento2 pagineEntrepJersey RamosNessuna valutazione finora

- Nama Peserta BPPDocumento53 pagineNama Peserta BPPInge Syahla KearyNessuna valutazione finora

- Rallis India AR 2014-15 Page 25Documento168 pagineRallis India AR 2014-15 Page 25bhomikjainNessuna valutazione finora

- Job Order Costing Seatwork - 2Documento2 pagineJob Order Costing Seatwork - 2Akira Marantal ValdezNessuna valutazione finora

- Business+plan+P MousslyonDocumento54 pagineBusiness+plan+P MousslyonYoussef ElhabtiNessuna valutazione finora

- Capacity Management in Service FirmsDocumento10 pagineCapacity Management in Service FirmsJussie BatistilNessuna valutazione finora

- Case Study 18 PresentationDocumento11 pagineCase Study 18 PresentationZara KhanNessuna valutazione finora

- Grade 11 Daily Lesson Log: ObjectivesDocumento2 pagineGrade 11 Daily Lesson Log: ObjectivesKarla BangFerNessuna valutazione finora

- Invitation To Bid: Dvertisement ArticularsDocumento2 pagineInvitation To Bid: Dvertisement ArticularsBDO3 3J SolutionsNessuna valutazione finora

- Gmail - Your Booking Confirmation PDFDocumento8 pagineGmail - Your Booking Confirmation PDFvillanuevamarkdNessuna valutazione finora

- Paul Buchanan - Traffic in Towns and Transport in CitiesDocumento20 paginePaul Buchanan - Traffic in Towns and Transport in CitiesRaffaeleNessuna valutazione finora

- Export Invoice: Item Description: Qty: UOM: Curr Unit PriceDocumento4 pagineExport Invoice: Item Description: Qty: UOM: Curr Unit PriceAdam GreenNessuna valutazione finora

- Chapter 6 MoodleDocumento36 pagineChapter 6 MoodleMichael TheodricNessuna valutazione finora

- Economy of BangladeshDocumento22 pagineEconomy of BangladeshRobert DunnNessuna valutazione finora

- Definition of Managerial EconomicsDocumento1 paginaDefinition of Managerial Economicsmukul1234Nessuna valutazione finora

- Progressive Housing in New York City: A Closer Look at Model Tenements and Finnish CooperativesDocumento154 pagineProgressive Housing in New York City: A Closer Look at Model Tenements and Finnish Cooperativescarly143100% (5)