Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Maximize Profits for Hospital Supply Inc

Caricato da

made38Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Maximize Profits for Hospital Supply Inc

Caricato da

made38Copyright:

Formati disponibili

Hospital Supply, Inc http://www.bignerds.

com/print/Hospital-Supply-Inc/38435

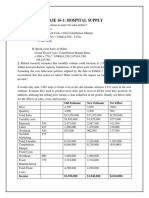

Case 6-1: Hospital Supply, Inc.

A. Introduction

This case consists examining various options of behavioral of costs in order to maximize profits. Hospital

Supply, Inc. manufactures hydraulic hoists and has a normal volume of 3,000 units per month. A

break-even analysis is used to determine the sales volume and prices at which the company would

profitably sell its product. Also, a number of scenarios are given in order to determine which options to

take to maximize profit or at least minimize loss.

B. Analysis

Question 1: According to exhibit 1 on page 500 in textbook variable costs per unit = $550 + $825 + $420

+ $275 = $ 2,070 and fixed costs per unit = $660 + $770 = $1,430.

Normal volume = 3,000 units and regular selling price = $4,350

Total fixed cost = 3,000 units *$1,430/unit = $4,290,000

Unit contribution = price/unit – variable cost/unit = $4,350 - $2,070 = $2,280

Contribution percent = $2,280/$4,350 = 0.524138

Question 2:

| |Regular price |With price reduction |Difference |

| | | |After - before |

|Quantity (units) |3,000 |3,500 |500 |

|Price ($) |4,350 |3,850 |-500 |

|Revenue $ (P x Q) |13,050,000 |13,475,000 |425,000 |

|Fixed costs |4,290,000 |4,290,000 |0 |

|Variable costs |6,210,000 |7,245,000 |1,035,000 |

|Total costs (FC+VC) |10,500,000 |11,535,000 | |

Income (with regular price) = Revenues –Total costs = $13,050,000 - $10,500,000 = $2,550,000

After price reduction, income = $13,475,000-$11,535,000 = $1,940,000

Question 3:

If government contract is accepted: income from government = 500 x unit contribution

= 500units x $2,280/unit = $1,140,000

Profit from fixed fee = $275,000

Fixed manufacturing cost prorated = ($660/unit) x 3000 units x 500units / 4000 units = 990,000,000/4000

= $247,500

Differential income = income – profit fixed fee – prorated fixed manufacturing costs

= 1,140,000 - $275,000 - $247,500 = -$615,500

Question 6:

Variable manufacturing costs per unit = $550 + $825 +$420 = $1,795

Variable marketing prospect per unit = $275 – $220 = $55

Fixed manufacturing prospect per unit = ($1,980,000 - $1,386,000)/1000 = 594,000/1,000 = $594

Total in-house cost = $1,795 + $55 + $594 = $2,444

Question 7:

| |Regular hoists |Regular hoists |Modified |Regular

|Total |

| |Without out |in-house |in-house |outsourced |With

out |

|Quantity (units) |3,000 |2,000 |800 |1,000 |

|

|Revenue R = (P x Q) |13,050,000 |8,700,000 |3,960,000 |4,350,000

|17,010,000 |

1 von 3 01.01.2011 16:02

Hospital Supply, Inc http://www.bignerds.com/print/Hospital-Supply-Inc/38435

|Variable costs |6,210,000 |4,140,000 |2,860,000 |220,000

|7,220,000 |

Income with outsourcing = $17,010,000 – ($4,290,000 + $7,220,000) – payment to outsourcing company.

Therefore, income = $5,550,000 – pmt to outsourcing co.

C. Solutions

1. - Break-even volume in units = fixed cost/unit contribution = $4,290,000/$2,280 = 1,882 units

- Break-even volume in sales = fixed cost/ contribution percent = $4,290,000/$0.524138 = $8,184,867

There is a slight difference using break-even volume x regular sales price.

Break-even in sales = $8,184,867 AND 1,882 units x $4,350/unit = $8,186,700

2. With reference to analysis section about question 2, reducing the price would result in reduction of

income, since $1,940,000 - $2,550,000 = $610,000. Even though price reduction has its advantages such

as increasing demand, it reduces income considerably in this case, and can potentially reduce product

availability. Therefore, I wouldn’t recommend this measure to take effect.

3. If the government contract is accepted, the negative differential income (-$615,500) in question 3

analysis indicates a loss, suggesting a bad deal. Therefore, I would suggest turning down the government

offer.

4. The minimum price to be considered = variable manufacturing costs plus shipping costs plus marketing

cost. Marketing cost/unit = $22,000/1,000 = $22. Therefore, the minimum acceptable price equals ($550

+ $825 + $420) + $410 + $22 = $2,227/ unit. At this price, there will be no profits. There are definitely

advantages in selling in foreign market such as new market opportunity which could increase sales.

However, fluctuation in currencies should be closely watched as well as shipping costs that could change

from time to time.

5. Other than variable marketing costs, other costs related to the manufacture of these 200 units have been

consumed. Therefore, any selling price above the differential costs would be automatically considered as

an income. Because the 200 units have to be sold through regular channels at reduced prices, the

differential cost per unit = variable marketing cost = $275 per unit. This price corresponds to the

break-even price just for those 200 units.

6. In-house cost (as computed in analysis section of this case) equals $2,444. The proposal of $2,475 per

unit should not be accepted since it would reduce total income when there is no outsourcing.

7. As we see in analysis for question 7 above, with outsourcing, the income would be $5,500,000 – pmt to

outsourcing co., while income without outsourcing is $2,550,000. Therefore, the very maximum payment

to outsourcing company should be: $5,500,000 - $2,550,000 = $2,950,000, or $2,950/unit

This time, the proposed price of $2,475/unit is acceptable since it is below the maximum acceptable

payment, which is $2,950.

D. What Learned?

This case provides opportunity to determine alternative decisions in order to maximize profits taking in

account costs and entity total capacity. Important approaches and terms are also emphasized: break-even

analysis, fixed costs, variable costs, overhead costs, target profit, unit contribution, differential income and

contribution percent.

E. References

Anthony, Hawkins and Merchant. 2007 . Accounting Text & Cases. 12th edition. McGraw-Hill Irwin.

Accounting Cost Behavior – Online Accounting Lecture/Tutorial: http://simplestudies.com/accounting-

2 von 3 01.01.2011 16:02

Hospital Supply, Inc http://www.bignerds.com/print/Hospital-Supply-Inc/38435

cost-behavior.html

3 von 3 01.01.2011 16:02

Potrebbero piacerti anche

- Hospital SupplyDocumento3 pagineHospital SupplyJeanne Madrona100% (1)

- Case 16 Answers - Hospital Supply IncDocumento14 pagineCase 16 Answers - Hospital Supply IncRaul Carrera, Jr.100% (3)

- CAN Submission-Unilever in India: Hindustan Lever's Project Shakti - Marketing FMCG To The Rural ConsumerDocumento3 pagineCAN Submission-Unilever in India: Hindustan Lever's Project Shakti - Marketing FMCG To The Rural ConsumerRitik MaheshwariNessuna valutazione finora

- MAC Davey Brothers - AkshatDocumento4 pagineMAC Davey Brothers - AkshatPRIKSHIT SAINI IPM 2019-24 BatchNessuna valutazione finora

- Hospital Supply Inc.Documento4 pagineHospital Supply Inc.alomelo100% (2)

- Boston CreameryDocumento5 pagineBoston CreameryTheeraphog Phonchuai100% (1)

- Case Background: - Mrs. Santha - Owner Small Assembly Shop - Production Line ADocumento12 pagineCase Background: - Mrs. Santha - Owner Small Assembly Shop - Production Line AAbhishek KumarNessuna valutazione finora

- Northboro Machine Tools CorporationDocumento9 pagineNorthboro Machine Tools Corporationsheersha kkNessuna valutazione finora

- Symphony Orchestra Case StudyDocumento3 pagineSymphony Orchestra Case StudyBrandon ElkinsNessuna valutazione finora

- Financial Accounting and Reporting: The Game of Financial RatiosDocumento8 pagineFinancial Accounting and Reporting: The Game of Financial RatiosANANTHA BHAIRAVI MNessuna valutazione finora

- SUBJECT: Analyses and Recommendations For The Different Cost AccountingDocumento4 pagineSUBJECT: Analyses and Recommendations For The Different Cost AccountinglddNessuna valutazione finora

- Don't Bother MeDocumento13 pagineDon't Bother MeMrinal KumarNessuna valutazione finora

- Operations Management-II End Term Paper 2020 IIM IndoreDocumento14 pagineOperations Management-II End Term Paper 2020 IIM IndoreRAMAJ BESHRA PGP 2020 Batch100% (2)

- Case Analysis Rosemont Hill Health Center V3 PDFDocumento8 pagineCase Analysis Rosemont Hill Health Center V3 PDFPoorvi SinghalNessuna valutazione finora

- Amaranth Disaster: How One Trader Lost $6B in 30 DaysDocumento15 pagineAmaranth Disaster: How One Trader Lost $6B in 30 DaysRani ZahrNessuna valutazione finora

- Solman 12 Second EdDocumento23 pagineSolman 12 Second Edferozesheriff50% (2)

- Alberta Gauge Company CaseDocumento2 pagineAlberta Gauge Company Casenidhu291Nessuna valutazione finora

- Samanya Building financialsDocumento5 pagineSamanya Building financialsShiladitya Swarnakar0% (1)

- Davey MukullDocumento6 pagineDavey MukullMukul Kumar SinghNessuna valutazione finora

- Atlantic Computers: A Bundle of Pricing OptionsDocumento4 pagineAtlantic Computers: A Bundle of Pricing OptionsFree GuyNessuna valutazione finora

- Davey Brothers Watch Co. SubmissionDocumento13 pagineDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchNessuna valutazione finora

- Rank Xerox CaseDocumento9 pagineRank Xerox CaseVarun KhannaNessuna valutazione finora

- Daud Engine Parts CompanyDocumento3 pagineDaud Engine Parts CompanyJawadNessuna valutazione finora

- Siemens CaseDocumento4 pagineSiemens Casespaw1108Nessuna valutazione finora

- Lipman Bottle CompanyDocumento20 pagineLipman Bottle CompanySaswata BanerjeeNessuna valutazione finora

- Catawba Industrial Company-Case QuestionsDocumento1 paginaCatawba Industrial Company-Case QuestionsSumit Kulkarni0% (3)

- Cci CaseDocumento3 pagineCci CaseDanielle Eller BurnettNessuna valutazione finora

- Color ScopeDocumento12 pagineColor Scopeprincemech2004100% (1)

- Balance Sheet Detective WorksheetDocumento2 pagineBalance Sheet Detective WorksheetAlina Zubair0% (1)

- Megacard CorporationDocumento16 pagineMegacard CorporationAntariksh ShahwalNessuna valutazione finora

- Buckeye Bank CaseDocumento7 pagineBuckeye Bank CasePulkit Mathur0% (2)

- Case Study 2 - ChandpurDocumento11 pagineCase Study 2 - Chandpurpriyaa03100% (3)

- 7-2 John Holtz (C) Case Study SolutionsDocumento14 pagine7-2 John Holtz (C) Case Study SolutionsAashima Grover100% (1)

- Lilac Flour Mills: Managerial Accounting and Control - IIDocumento9 pagineLilac Flour Mills: Managerial Accounting and Control - IISoni Kumari50% (4)

- PRICING EXERCISES ANALYSISDocumento14 paginePRICING EXERCISES ANALYSISvineel kumarNessuna valutazione finora

- Answer To VMD Medical Imaging CenterDocumento2 pagineAnswer To VMD Medical Imaging CenterPragathi SundarNessuna valutazione finora

- Steel Frame FurnitureDocumento17 pagineSteel Frame FurnitureDev AnandNessuna valutazione finora

- QMDocumento87 pagineQMjyotisagar talukdarNessuna valutazione finora

- Amaranth Advisors: Burning Six Billion in Thirty DaysDocumento24 pagineAmaranth Advisors: Burning Six Billion in Thirty DaysRosalina MaharanaNessuna valutazione finora

- Problem Set 2Documento2 pagineProblem Set 2Rithesh KNessuna valutazione finora

- Classic Pen Case CMADocumento2 pagineClassic Pen Case CMARheaPradhanNessuna valutazione finora

- Sunair Boat BuildersDocumento9 pagineSunair Boat BuildersWei DaiNessuna valutazione finora

- Activity-Based Cost Systems: The Classic Pen Company A Case AnalysisDocumento14 pagineActivity-Based Cost Systems: The Classic Pen Company A Case AnalysisSarveshwar Sharma50% (2)

- Nonprofit Cost Allocation for Shelter PartnershipDocumento33 pagineNonprofit Cost Allocation for Shelter PartnershipFrancisco MarvinNessuna valutazione finora

- Bill FrenchDocumento6 pagineBill FrenchRohit AcharyaNessuna valutazione finora

- Solved The Dijon Company S Total Variable Cost Function Is TVC 50qDocumento1 paginaSolved The Dijon Company S Total Variable Cost Function Is TVC 50qM Bilal SaleemNessuna valutazione finora

- Case Analysis Chapter 3Documento4 pagineCase Analysis Chapter 3angelllNessuna valutazione finora

- Rosemont Health Center Rev01Documento7 pagineRosemont Health Center Rev01Amit VishwakarmaNessuna valutazione finora

- LP Formulation - Alpha Steels - Hiring Temp Workers To Minimise CostDocumento3 pagineLP Formulation - Alpha Steels - Hiring Temp Workers To Minimise CostGautham0% (1)

- Committee Recommends Mr. Gupta to Replace Mr. AshokDocumento8 pagineCommittee Recommends Mr. Gupta to Replace Mr. AshokdhinuramNessuna valutazione finora

- Baldwin Bicycle Company Case PresntationDocumento24 pagineBaldwin Bicycle Company Case Presntationrajwansh_aran100% (4)

- Landau CompanyDocumento4 pagineLandau Companyrond_2728Nessuna valutazione finora

- Software Associates Venky SolutionDocumento9 pagineSoftware Associates Venky SolutionabcdfNessuna valutazione finora

- Case Analysis of Colorscope, Inc.: Cost and Management AccountingDocumento14 pagineCase Analysis of Colorscope, Inc.: Cost and Management AccountingRaghav SNessuna valutazione finora

- Marginal CostingDocumento30 pagineMarginal Costinganon_3722476140% (1)

- Hospital Supply Inc Cost AnalysisDocumento5 pagineHospital Supply Inc Cost AnalysisMEERA JOSHY 192743633% (3)

- Case 16-1 (Alfi & Yessy)Documento4 pagineCase 16-1 (Alfi & Yessy)Ana KristianaNessuna valutazione finora

- Accounting Problems and SolutionsDocumento3 pagineAccounting Problems and SolutionsKavitha Ragupathy100% (1)

- Case 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Documento6 pagineCase 16-1: Hospital Supply: 1. What Is The Break-Even Volume in Units? in Sales Dollars?Lalit SapkaleNessuna valutazione finora

- Cost AccountingDocumento10 pagineCost AccountingDIANA IMADNessuna valutazione finora

- National Bank LTDDocumento10 pagineNational Bank LTDEhsAnul Kãbir SaifNessuna valutazione finora

- Barcap India - Capital - Goods 7 Dec 2011Documento159 pagineBarcap India - Capital - Goods 7 Dec 2011Sunayan PalNessuna valutazione finora

- Lind51640 ch15Documento23 pagineLind51640 ch15Subhasish GoswamiNessuna valutazione finora

- Working CapitalDocumento72 pagineWorking CapitalSyaapeNessuna valutazione finora

- CFA Before The ExamDocumento2 pagineCFA Before The Exampingu_513501Nessuna valutazione finora

- SAP Closing Cockpit PDFDocumento32 pagineSAP Closing Cockpit PDFviru2all100% (1)

- A Financial System Refers To A System Which Enables The Transfer of Money Between Investors and BorrowersDocumento8 pagineA Financial System Refers To A System Which Enables The Transfer of Money Between Investors and BorrowersAnu SingalNessuna valutazione finora

- JDE Enterprise Profitability SolutionDocumento244 pagineJDE Enterprise Profitability SolutionSanjay GuptaNessuna valutazione finora

- KeiretsuDocumento18 pagineKeiretsuPradeep Kannan100% (1)

- Corporation Law CasesDocumento10 pagineCorporation Law CasescaseskimmerNessuna valutazione finora

- Case Study2 - CinemexDocumento3 pagineCase Study2 - CinemexAnonymous gUySMcpSqNessuna valutazione finora

- Tataranu B (68393) PDFDocumento2 pagineTataranu B (68393) PDFesseesse76Nessuna valutazione finora

- International Financial Magement: Dr. Md. Hamid U BhuiyanDocumento40 pagineInternational Financial Magement: Dr. Md. Hamid U BhuiyanTawsif HasanNessuna valutazione finora

- #Test Bank - Adv Acctg 2 - PDocumento43 pagine#Test Bank - Adv Acctg 2 - PJames Louis BarcenasNessuna valutazione finora

- Bec Final 1Documento16 pagineBec Final 1yang1987Nessuna valutazione finora

- Kosha Investments LTD Vs Securities & Exchange BD of India & ... On 18 September, 2015Documento5 pagineKosha Investments LTD Vs Securities & Exchange BD of India & ... On 18 September, 2015sreevarshaNessuna valutazione finora

- MBG Corporation Business and Financial Analysis: I. Company BackgroundDocumento21 pagineMBG Corporation Business and Financial Analysis: I. Company BackgroundAnggoro PutroNessuna valutazione finora

- Summary of Pas 36Documento5 pagineSummary of Pas 36Elijah MontefalcoNessuna valutazione finora

- Chapter 10 - Vat On Goods 2013Documento10 pagineChapter 10 - Vat On Goods 2013roseljoyNessuna valutazione finora

- Evolution of Banking in IndiaDocumento7 pagineEvolution of Banking in IndiaShobhit ShuklaNessuna valutazione finora

- 12 Things Not To Do in M&ADocumento15 pagine12 Things Not To Do in M&Aflorinj72Nessuna valutazione finora

- MicroCap Review Winter/Spring 2016Documento96 pagineMicroCap Review Winter/Spring 2016Planet MicroCap Review MagazineNessuna valutazione finora

- Breads Bakery BattleDocumento15 pagineBreads Bakery BattleEaterNessuna valutazione finora

- Investment ProcessDocumento32 pagineInvestment ProcessBirat Sharma100% (1)

- Capital Gains in IndiaDocumento10 pagineCapital Gains in IndiaHimanshu ThakkarNessuna valutazione finora

- Prolexus 2011Documento82 pagineProlexus 2011Shakirah MazlanNessuna valutazione finora

- 21 (AIC-EIEF 2017) 371-384 Mohammad Mansoor EIEF-257Documento14 pagine21 (AIC-EIEF 2017) 371-384 Mohammad Mansoor EIEF-257Dr-Muhammad Mansoor BaigNessuna valutazione finora

- 16 Personal Finance Principles Every Investor Should Know - Network 18 2013 PDFDocumento192 pagine16 Personal Finance Principles Every Investor Should Know - Network 18 2013 PDFBhavana Gupta100% (2)

- Hotel AccountsDocumento374 pagineHotel AccountsBijo JacobNessuna valutazione finora

- Class 11 Business Chapter 2Documento14 pagineClass 11 Business Chapter 2Mahender RathorNessuna valutazione finora