Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

401 (K) Planner: Growth of Investment

Caricato da

anon-13887Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

401 (K) Planner: Growth of Investment

Caricato da

anon-13887Copyright:

Formati disponibili

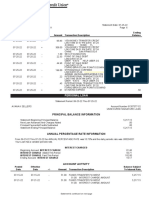

401(k) Planner [Name] [Date]

Assumptions

401(k) contribution per paycheck

401(k) employer contribution match per paycheck

Paychecks per year (12, 24, 26, or 52)

Expected annual rate of return

Age at of the end of this tax year

Anticipated retirement age

Current value of 401(k)

Date (the "as of" date for the current value)

The date of the year end

Marginal tax rate (federal plus state)

Tax Deferred 401(k) Plan Growth Taxable Savings Plan Growth

Age Estimated 401(k) Value Age Estimated Savings Value

Err:508 Err:508 Err:508 Err:508

Err:508 Err:508 Err:508 Err:508

Err:508 Err:508 Err:508 Err:508

Err:508 Err:508 Err:508 Err:508

Pre-tax retirement income (From retirement age to 90 years old)Pre-tax retirement income (From retirement age to 90 years old)

Monthly income Err:508 Monthly income Err:508

Growth of Investment

$1

$1

$1

$0

$0

$0 Column AG

0

Err:508 Column AF

Ages

Column AF Column AG

Days in pay period

Compounding periods in first yr

#DIV/0!

Err:508 0 Err:508 Err:508

Err:508 Err:508 Err:508 Err:508

Err:508

Err:508

0

Err:508

Err:508

Err:508

Potrebbero piacerti anche

- Alabama Court Form - Answer To Landlord's Claim (Eviction)Documento1 paginaAlabama Court Form - Answer To Landlord's Claim (Eviction)ForeclosureGate.org LibraryNessuna valutazione finora

- Tropicana LV LayoffsDocumento2 pagineTropicana LV LayoffsReno Gazette JournalNessuna valutazione finora

- Amanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Documento6 pagineAmanda K Scott 3535 W Cambridge AVE Fresno, CA 93722-6561Amanda Scott100% (1)

- Blank Personal Financial StatementDocumento1 paginaBlank Personal Financial StatementKiran P GunnamNessuna valutazione finora

- QwertyDocumento1 paginaQwertyqwew1eNessuna valutazione finora

- March 2021Documento3 pagineMarch 2021Calla HanNessuna valutazione finora

- (Sept 1, 2016) Schwab Wire Confirmation To Marek - Redacted PDFDocumento2 pagine(Sept 1, 2016) Schwab Wire Confirmation To Marek - Redacted PDFDavid HundeyinNessuna valutazione finora

- NYS-45-I: Instructions For Form NYS-45Documento5 pagineNYS-45-I: Instructions For Form NYS-45Christine ScheiblerNessuna valutazione finora

- Insurance Dec Page-DummyDocumento1 paginaInsurance Dec Page-DummyAjha DortchNessuna valutazione finora

- Cash FlowDocumento1 paginaCash Flowpawan_019Nessuna valutazione finora

- Invoice 189305 From Action Appliance ServiceDocumento1 paginaInvoice 189305 From Action Appliance ServiceAce MereriaNessuna valutazione finora

- ACH Reversal Request FormDocumento1 paginaACH Reversal Request FormRei HimuraNessuna valutazione finora

- 2019-H-294-01023 Acosta Bridge Decorative Lighting Permit - RedactedDocumento28 pagine2019-H-294-01023 Acosta Bridge Decorative Lighting Permit - RedactedAnne SchindlerNessuna valutazione finora

- Rent Ledger PDFDocumento1 paginaRent Ledger PDFJahziel KwonNessuna valutazione finora

- Account # 0302080036: Lifegreen SavingsDocumento2 pagineAccount # 0302080036: Lifegreen Savingsstorage mediaNessuna valutazione finora

- Bulldog Repair Order Electrical-2019Documento1 paginaBulldog Repair Order Electrical-2019abul hussainNessuna valutazione finora

- Transaction Summary: Contact UsDocumento1 paginaTransaction Summary: Contact UsJesseneNessuna valutazione finora

- Invoice 1127 From Reed Pools LLCDocumento1 paginaInvoice 1127 From Reed Pools LLCAce MereriaNessuna valutazione finora

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDocumento1 paginaSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445Nessuna valutazione finora

- Is in Kind 03-16-09Documento1 paginaIs in Kind 03-16-09Azi PaybarahNessuna valutazione finora

- 2017-10-18 Settlement Agreement - ARCH Resorts LLC V City of McKinney V Collin County - 17-8776Documento83 pagine2017-10-18 Settlement Agreement - ARCH Resorts LLC V City of McKinney V Collin County - 17-8776BridgetteNessuna valutazione finora

- Sample Profit and Loss StatementDocumento2 pagineSample Profit and Loss StatementElisabet Halida WahyarsiNessuna valutazione finora

- US1099Forms - Form 1099-NEC Copy BDocumento2 pagineUS1099Forms - Form 1099-NEC Copy BSaurabh ChandraNessuna valutazione finora

- 美国metabank账单Documento2 pagine美国metabank账单juliaechardhqa85Nessuna valutazione finora

- Invoice: Item Description Unit Price Quantity AmountDocumento1 paginaInvoice: Item Description Unit Price Quantity AmountAce MereriaNessuna valutazione finora

- Usabank Statement 1Documento3 pagineUsabank Statement 1Adnan HussainNessuna valutazione finora

- f133 PDFDocumento1 paginaf133 PDFfaresNessuna valutazione finora

- Confirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTDocumento1 paginaConfirmation: 1-888-205-8118 M-F 6:30am PST To 5:30pm PSTKarthik SheshadriNessuna valutazione finora

- UL PayStub 2019.01.15Documento1 paginaUL PayStub 2019.01.15Marcus GreenNessuna valutazione finora

- 7803 Stahelin - Performance ReportDocumento1 pagina7803 Stahelin - Performance ReportBay Area Equity Group, LLCNessuna valutazione finora

- Auto Repair InvoiceDocumento4 pagineAuto Repair Invoicedagz10131979Nessuna valutazione finora

- 1481546265426Documento3 pagine1481546265426api-370784582Nessuna valutazione finora

- Thank You For Your Payment!: Return To Home PrintDocumento1 paginaThank You For Your Payment!: Return To Home PrintAce MereriaNessuna valutazione finora

- Karen Henney 1120 Grove ST Apt 2 Downers Grove, Il 60515Documento1 paginaKaren Henney 1120 Grove ST Apt 2 Downers Grove, Il 60515Sharon JonesNessuna valutazione finora

- Description Rate Hours Earnings Year To Date Taxes Current Year To DateDocumento1 paginaDescription Rate Hours Earnings Year To Date Taxes Current Year To DateCody BryantNessuna valutazione finora

- CheckStub - 2021 08 27Documento1 paginaCheckStub - 2021 08 27Laila IbrahimNessuna valutazione finora

- Accounts Receivable AgingDocumento1 paginaAccounts Receivable Agingali reza0% (1)

- Tata Steel Financial Statement FY21Documento109 pagineTata Steel Financial Statement FY21Surya SuryaNessuna valutazione finora

- First Tech Credit Union Fees ScheduleDocumento3 pagineFirst Tech Credit Union Fees ScheduleNamtien UsNessuna valutazione finora

- C 4amrDocumento2 pagineC 4amrGreen TinaNessuna valutazione finora

- The 1003 Form by SushantDocumento31 pagineThe 1003 Form by Sushantapi-3825555100% (2)

- Spitfire Automotive Vehicle Repair OrderDocumento1 paginaSpitfire Automotive Vehicle Repair OrderSteven Crazed AZ PetersonNessuna valutazione finora

- Mohamed MahdiDocumento5 pagineMohamed Mahdimohamed khadarNessuna valutazione finora

- TDS VCI 984 & 985 Albar Fabric PDFDocumento4 pagineTDS VCI 984 & 985 Albar Fabric PDFmukulsareenNessuna valutazione finora

- Mar2017 PDFDocumento2 pagineMar2017 PDFShubham MahapatraNessuna valutazione finora

- Statement For Nov 22, 2021Documento1 paginaStatement For Nov 22, 2021Alexia BeckwithNessuna valutazione finora

- Your Reverse Mortgage Summary: You Could GetDocumento11 pagineYour Reverse Mortgage Summary: You Could GetPete Santilli100% (1)

- Principal Balance Information: Personal LoanDocumento1 paginaPrincipal Balance Information: Personal LoanAyanna SellersNessuna valutazione finora

- Branchless Account Opening FormDocumento2 pagineBranchless Account Opening FormCarmel DobleNessuna valutazione finora

- Form IL-941: 2020 Illinois Withholding Income Tax ReturnDocumento2 pagineForm IL-941: 2020 Illinois Withholding Income Tax ReturnArnawama LegawaNessuna valutazione finora

- 0692-5 - 2023-Edj-Statement 2Documento6 pagine0692-5 - 2023-Edj-Statement 2Bryan RuffNessuna valutazione finora

- Bank Statement Template 2Documento1 paginaBank Statement Template 2Zakaz SpainNessuna valutazione finora

- MorningStar ES0143416115Documento4 pagineMorningStar ES0143416115José J. Ruiz SorianoNessuna valutazione finora

- Income Statement Template V3Documento21 pagineIncome Statement Template V3Third WheelNessuna valutazione finora

- Profit & Loss StatementDocumento1 paginaProfit & Loss StatementNabila Ayuningtias100% (1)

- Reliance Jio Infocomm Limited Invoice: UnpaidDocumento1 paginaReliance Jio Infocomm Limited Invoice: UnpaidMadindian boyNessuna valutazione finora

- Documents PDFDocumento6 pagineDocuments PDFAngela NortonNessuna valutazione finora

- CASHDocumento1 paginaCASHنور روسلنNessuna valutazione finora

- Amort tableHLDocumento24 pagineAmort tableHLMylyn MendozaNessuna valutazione finora

- Loan Amortization Schedule1Documento9 pagineLoan Amortization Schedule1api-354658624Nessuna valutazione finora

- This Template Is Obtained From HTTP://WWW - Andypope.info Above Mentioned Website Has Great Worksheets Tutorials and Excellent SamplesDocumento5 pagineThis Template Is Obtained From HTTP://WWW - Andypope.info Above Mentioned Website Has Great Worksheets Tutorials and Excellent Samplesanon-13887Nessuna valutazione finora

- Swing Trading Calculator 97versionDocumento22 pagineSwing Trading Calculator 97versionanon-13887100% (2)

- Happy FaceDocumento1 paginaHappy Faceanon-13887100% (1)

- Mind ReaderDocumento1 paginaMind Readerapi-3835581Nessuna valutazione finora

- Can SlimDocumento20 pagineCan Slimanon-13887100% (1)

- Sandeep DhamijaDocumento15 pagineSandeep DhamijaSiddharthNessuna valutazione finora

- 83592481 (1)Documento3 pagine83592481 (1)MedhaNessuna valutazione finora

- SIMPLE and COMPOUND INTEREST 11Documento69 pagineSIMPLE and COMPOUND INTEREST 11Jay QuinesNessuna valutazione finora

- Auditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA ExamsDocumento38 pagineAuditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA Examsvenakata3722Nessuna valutazione finora

- Introduction On HDFC BankDocumento3 pagineIntroduction On HDFC BankAditya Batra50% (2)

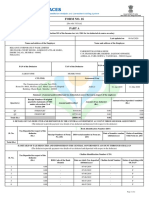

- Form No. 16: Part ADocumento8 pagineForm No. 16: Part AParikshit ModiNessuna valutazione finora

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocumento2 paginePT Astra Agro Lestari TBK.: Summary of Financial StatementIntan Maulida SuryaningsihNessuna valutazione finora

- CH 13Documento31 pagineCH 13Natasha GraciaNessuna valutazione finora

- Tutorial 1 PresentDocumento12 pagineTutorial 1 PresentLi NiniNessuna valutazione finora

- Producers Bank Vs CADocumento2 pagineProducers Bank Vs CA001nooneNessuna valutazione finora

- Anup TransactionsDocumento6 pagineAnup TransactionsNirupam DewanjiNessuna valutazione finora

- Factors Affecting Valuation of SharesDocumento6 pagineFactors Affecting Valuation of SharesSneha ChavanNessuna valutazione finora

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocumento156 pagineAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFJamille Rose PagulayanNessuna valutazione finora

- Marketing Strategy For IslamicDocumento16 pagineMarketing Strategy For IslamicTamim Arefi100% (1)

- AFS SolutionsDocumento19 pagineAFS SolutionsRolivhuwaNessuna valutazione finora

- Finance Master Thesis PDFDocumento7 pagineFinance Master Thesis PDFafkojbvmz100% (2)

- CH 08Documento51 pagineCH 08Daniel NababanNessuna valutazione finora

- Indian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianDocumento4 pagineIndian Income Tax Return Acknowledgement 2020-21: Esappo445Q Mohan Prathap PandianVignesh KanagarajNessuna valutazione finora

- Monetary Policy and Central Banking PDFDocumento2 pagineMonetary Policy and Central Banking PDFTrisia Corinne JaringNessuna valutazione finora

- Relevance of Questions From Past Level III Essay Exams: Use IFT Prep To Ace The Level III ExamDocumento3 pagineRelevance of Questions From Past Level III Essay Exams: Use IFT Prep To Ace The Level III ExamHasan KhanNessuna valutazione finora

- NEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsDocumento168 pagineNEW DT Bullet (MCQ'S) by CA Saumil Manglani - CS Exec June 22 & Dec 22 ExamsAkash MalikNessuna valutazione finora

- It Lab FileDocumento34 pagineIt Lab FileMannu BhardwajNessuna valutazione finora

- 5 Structured Products Forum 2007 Hong KongDocumento11 pagine5 Structured Products Forum 2007 Hong KongroversamNessuna valutazione finora

- Cityam 2010-10-29Documento52 pagineCityam 2010-10-29City A.M.Nessuna valutazione finora

- Learnings From DJ SirDocumento94 pagineLearnings From DJ SirHare KrishnaNessuna valutazione finora

- 1000 Assets: Account # Account NameDocumento24 pagine1000 Assets: Account # Account NameGomv ConsNessuna valutazione finora

- Sales Invoice: Customer InformationDocumento1 paginaSales Invoice: Customer InformationRaghavendra S DNessuna valutazione finora

- MouthfreshenerdprDocumento22 pagineMouthfreshenerdprSumit SharmaNessuna valutazione finora

- Application FormDocumento1 paginaApplication FormjvenatorNessuna valutazione finora

- Mirae Factsheet April2017Documento16 pagineMirae Factsheet April2017Dashang G. MakwanaNessuna valutazione finora