Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Clark Patrick A 00019939 449283 000 2009

Caricato da

Texas WatchdogDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Clark Patrick A 00019939 449283 000 2009

Caricato da

Texas WatchdogCopyright:

Formati disponibili

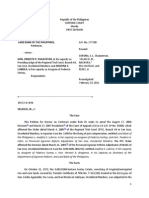

Texas Ethics Commission

PO Box 12070

Austin Texas 78711-2070

(512) 463-5800

1-800-325-8506

PERSONAL FINANCIAL STATEMENT FORM PFS

COVER SHEET

TOTAL NUMBER OF PAGES FILED:

Filed in accordance with chapter 572 of the Government Code. 25

Forfilings required in 2010, covering calendar year ending December 31,2009./ ACCOUNT # 00019939

Use FORM PFS--INSTRUCTION GUIDE when completing this form.

1 NAME TITLE; FIRST; MI OFFICE USE ONLY

JUDGE PATRICK A. Date Received

....... . . . . . . . . .................... RECEIVED

NICKNAME; LAST; SUFFIX

"PAT" CLARK APR 1 92010

2 ADDRESS ADDRESS 1 PO BOX; APT 1 SUITE #; CITY; STATE; ZIP CODE ~§i ithiCl Commission

ORANGE, TEXAS 77630

Receipl #

~ (CHECK IF FILER'S HOME ADDRESS) HDt® .1 Amount

}."LJ L-.- In

3 TELEPHONE AREA CODE PHONE NUMBER; EXTENSION II Art( ., ::t ZUlU

NUMBER ( 409 ) 882-7085 (OFFICE) Date Imaged

4 REASON

FOR FILING D CANDIDATE (INDICATE OFFICE)

STATEMENT

Q[) ELECTED OFFICER JUDGE - 128TH DISTRICT COURT (INDICATE OFFICE)

D APPOINTED OFFICER (INDICATE AGENCY)

D EXECUTIVE HEAD (INDICATE AGENCY)

D FORMER OR RETIRED JUDGE SITIING BY ASSIGNMENT

D STATE PARTY CHAIR (INDICATE PARTY)

D OTHER (INDICATE POSITION)

5 Family members whose financial activity you are reporting (filer must report information about the financial activity of the filer's spouse or

dependent children if the filer had actual control over that activity):

SPOUSE ROSALIE T. CLARK

DEPENDENT CHILD 1.

2.

3.

In Parts 1 through 18, you will disclose your financial activity during the preceding calendar year. In Parts 1 through 14, you are

required to disclose not only your own financial activity, but also that of your spouse or a dependent child if you had actual control

over that person's financial activity.

d.5 COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY"R. l4l{C\;}~3 Revised 10101/2009

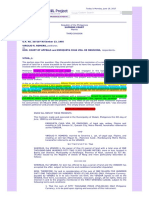

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

SOURCES OF OCCUPATIONAL INCOME

D NOT APPLICABLE

PART 1A

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under which the child is listed on the Cover Sheet.

1 INFORMATION RELATES TO

QFILER

D SPOUSE

D DEPENDENT CHILD _

2

EMPLOYMENT

IXI EMPLOYED BY ANOTHER

D SELF-EMPLOYED

NAME AND ADDRESS OF EMPLOYER 1 POSITION HELD D (Check If Filer's Home Address)

STATE OF TEXAS COUNTY OF ORANGE

NATURE OF OCCUPATION

INFORMATION RELATES TO

D FILER

D SPOUSE

D DEPENDENT CHILD _

EMPLOYMENT

D EMPLOYED BY ANOTHER

D SELF-EMPLOYED

NAME AND ADDRESS OF EMPLOYER 1 POSITION HELD D (Check If Filers Home Address)

NATURE OF OCCUPATION

INFORMATION RELATES TO

D FILER

D SPOUSE

D DEPENDENT CHILD _

EMPLOYMENT

D EMPLOYED BY ANOTHER

D SELF-EMPLOYED

NAME AND ADDRESS OF EMPLOYER 1 POSITION HELD D (Check If Filer's Home Address)

NATURE OF OCCUPATION

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY

Revised 10/01/2009

Texas Ethics Commission

PO Box 12070

Austin Texas 78711-2070

(512) 463-5800

1-800-325-8506

RETAINERS PART 18

g NOT APPLICABLE

This section concerns fees received as a retainer by you, your spouse, or a dependent child (or by a business in which you,

your spouse, or a dependent child have a "substantial interest") for a claim on future services in case of need, rather than for

services on a matter specified at the time of contracting for or receiving the fee. Report information here only if the value of

the work actually performed during the calendar year did not equal or exceed the value of the retainer. For more information,

see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 NAME AND ADDRESS

FEE RECEIVED FROM

2 NAME OF BUSINESS

FEE RECEIVED BY

o FILER

OR FILER'S BUSINESS

o SPOUSE

OR SPOUSE'S BUSINESS

o DEPENDENT CHILD

OR CHILD'S BUSINESS

3

FEE AMOUNT o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24.999 o $25,000--OR MORE

NAME AND ADDRESS

FEE RECEIVED FROM

NAME OF BUSINESS

FEE RECEIVED BY

o FILER

OR FILER'S BUSINESS

o SPOUSE

OR SPOUSE'S BUSINESS

o DEPENDENT CHILD

OR CHILD'S BUSINESS

FEE AMOUNT o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,OOO--OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

POBox 12070

Austin Texas 78711-2070

(512) 463-5800

1-800-325-8506

STOCK MY WIFE HAS AN IRA PLACED WITH MERRILL LYNCH, THEREFORE SHE HAS STOCK 2

THROUGH THIS COMPANY'S INVESTMENTS. SHE ALSO HAS AN IRA P~D WITIrART

AMERICAN FUNDS, THEREFORE, SHE HAS STOCK THROUGH THIS CO.I' ALUE $25,000 OR

D NOTAPSf~~~LETWM(;HW¥H~S80~L.~RND~2~;oHo~~RO~Ai'i01~S, THEREFORE WE HAVE

List each business entity in which you, your spouse, or a dependent child held or acquired stock during the calendar year

and indicate the category of the number of shares held or acquired. If some or all of the stock was sold, also indicate the

category of the amount of the net gain or loss realized from the sale. For more information, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 BUSINESS ENTITY NAME

2 STOCK HELD OR ACQUIRED BY o FILER o SPOUSE o DEPENDENT CHILD

3 NUMBER OF SHARES o LESS THAN 100 o 100 TO 499 o 500 TO 999 o 1,000 TO 4,999

o 5,000 TO 9,999 o 10,000 OR MORE

4 IF SOLD o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

o NET LOSS

BUSINESS ENTITY NAME

STOCK HELD OR ACQUIRED BY o FILER o SPOUSE o DEPENDENT CHILD

NUMBER OF SHARES o LESS THAN 100 o 100 TO 499 0500 TO 999 o 1,000 TO 4,999

o 5,000 TO 9,999 o 10,000 OR MORE

IF SOLD o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

o NET LOSS

BUSINESS ENTITY NAME

STOCK HELD OR ACQUIRED BY o FILER o SPOUSE o DEPENDENT CHILD

NUMBER OF SHARES o LESS THAN 100 o 100 TO 499 0500 TO 999 o 1,000 TO 4,999

o 5,000 TO 9,999 o 10,000 OR MORE

IF SOLD o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

o NET LOSS

BUSINESS ENTITY NAME

STOCK HELD OR ACQUIRED BY o FILER o SPOUSE o DEPENDENT CHILD

NUMBER OF SHARES o LESS THAN 100 o 100 TO 499 0500 TO 999 o 1,000 TO 4,999

o 5,000 TO 9,999 o 10,000 OR MORE

IF SOLD o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

o NET LOSS

BUSINESS ENTITY NAME

STOCK HELD OR ACQUIRED BY o FILER o SPOUSE o DEPENDENT CHILD

NUMBER OF SHARES o LESS THAN 100 o 100 TO 499 o 500 TO 999 o 1,000 TO 4,999

o 5,000 TO 9,999 o 10,000 OR MORE

IF SOLD o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,OOO--OR MORE

o NET LOSS

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10/01/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

BONDS, NOTES & OTHER COMMERCIAL PAPER PART 3

~ NOT APPLICABLE

List all bonds, notes, and other commercial paper held or acquired by you, your spouse, or a dependent child during the

calendar year. If sold, indicate the category of the amount of the net gain or loss realized from the sale. For more

information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1

DESCRIPTION

OF INSTRUMENT

2 HELD OR ACQUIRED BY

D FILER D SPOUSE D DEPENDENT CHILD

3

IF SOLD

D NET GAIN D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,000--OR MORE

D NET LOSS

DESCRIPTION

OF INSTRUMENT

HELD OR ACQUIRED BY

D FILER D SPOUSE D DEPENDENT CHILD

IF SOLD

D NET GAIN D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,000--OR MORE

D NET LOSS

DESCRIPTION

OF INSTRUMENT

HELD OR ACQUIRED BY

D FILER D SPOUSE D DEPENDENT CHILD

IF SOLD

D NET GAIN D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,OOO--OR MORE

D NET LOSS

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10/01/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

MUTUAL FUNDS MY WIFE HAS AN IRA WITH AMERICAN FUNDS. (SEE PART 2) PART 4

WITH AN INHERITANCE FROM MY PAR~, WE BOTH HAVE AN

o NOT APPLICABLE INVESTMENT WITH AMERICAN FUNDS. VALUE $25,000 OR MORE.

List each mutual fund and the number of shares in that mutual fund that you, your spouse, or a dependent child held or

acquired during the calendar year and indicate the category of the number of shares of mutual funds held or acquired. If

some or all of the shares of a mutual fund were sold, also indicate the category of the amount of the net gain or loss realized

from the sale. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 MUTUAL FUND NAME

2 SHARES OF MUTUAL FUND o FILER o SPOUSE o DEPENDENT CHILD

HELD ORACQUIRED BY

3 NUMBER OF SHARES o LESS THAN 100 o 100 TO 499 o 500 TO 999 o 1,000 TO 4,999

OF MUTUAL FUND

o 5,000 TO 9,999 o 10,000 OR MORE

4 IF SOLD o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,OOO--OR MORE

o NET LOSS

MUTUAL FUND NAME

SHARES OF MUTUAL FUND o FILER o SPOUSE o DEPENDENT CHILD

HELD OR ACQUIRED BY

NUMBER OF SHARES o LESS THAN 100 o 100 TO 499 0500 TO 999 o 1,000 TO 4,999

OF MUTUAL FUND

05,000 TO 9,999 o 10,000 OR MORE

IF SOLD o NET GAIN

o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

o NET LOSS

MUTUAL FUND NAME

SHARES OF MUTUAL FUND o FILER o SPOUSE o DEPENDENT CHILD

HELD OR ACQUIRED BY

NUMBER OF SHARES o LESS THAN 100 o 100 TO 499 o 500 TO 999 o 1,000 TO 4,999

OF MUTUAL FUND

o 5,000 TO 9,999 o 10,000 OR MORE

IF SOLD o NET GAIN

o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

o NET LOSS

COPY AND ATIACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

INCOME FROM INTEREST, DIVIDENDS, ROYALTIES & RENTS PART 5

o NOT APPLICABLE

List each source of income you, your spouse, or a dependent child received in excess of $500 that was derived from

interest, dividends, royalties, and rents during the calendar year and indicate the category of the amount of the income. For

more information, see FORM PFS-INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 NAME AND ADDRESS

SOURCE OF INCOME INTEREST ON SAVINGS & CD'S AT ORANGE COUNTY CREDIT UNION.

2

RECEIVED BY

IX] FILER IX! SPOUSE o DEPENDENT CHILD

3

AMOUNT o $500--$4,999 o $5,000--$9,999 o $10,000--$24,999 e $25,OOO--OR MORE

NAME AND ADDRESS

SOURCE OF INCOME BOTH PARENTS ARE NOW DECEASED. WE NOW HAVE CD'S AT

ORANGE SAVINGS BANK.

RECEIVED BY

~ FILER 4~ SPOUSE o DEPENDENT CHILD

AMOUNT o $500--$4,999 o $5,000--$9,999 o $10,000--$24,999 g:$25,OOO--OR MORE

NAME AND ADDRESS

SOURCE OF INCOME

RECEIVED BY

o FILER o SPOUSE o DEPENDENT CHILD

AMOUNT o $500--$4,999 o $5,000--$9,999 o $10,000--$24,999 o $25,OOO--OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10/01/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

PERSONAL NOTESAND LEASE AGREEMENTS PART 6

o NOT APPLICABLE

Identify each guarantor of a loan and each person or financial institution to whom you, your spouse, or

a dependent child had a total financial liability of more than $1,000 in the form of a personal note or notes or lease

agreement at any time during the calendar year and indicate the category of the amount of the liability. For more informa-

tion, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1

PERSON OR INSTITUTION PERSONAL LOAN TO DAUGHTER,

HOLDING NOTE OR FOR CAR AND HOME

LEASE AGREEMENT

2

LIABILITY OF

SFILER o SPOUSE o DEPENDENT CHILD

3

GUARANTOR

4

AMOUNT o $1,000--$4,999 o $5,000--$9,999 o $10,000--$24,999 XiI $25,000--OR MORE

PERSON OR INSTITUTION ORANGE COUNTY CREDIT UNION

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

~FILER o SPOUSE o DEPENDENT CHILD

GUARANTOR

AMOUNT o $1,000--$4,999 ~ $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

PERSON OR INSTITUTION

HOLDING NOTE OR

LEASE AGREEMENT

LIABILITY OF

o FILER o SPOUSE o DEPENDENT CHILD

GUARANTOR

AMOUNT o $1,000--$4,999 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

POBox 12070

Austin Texas 78711-2070

(512) 463-5800

1-800-325-8506

INTERESTS IN REAL PROPERTY PART 7A

(PAGE 1 OF 2 FOR 7A

o NOT APPLICABLE

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of "beneficial interest" and other specific directions for completing this section, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 o DEPENDENT CHILD

HELD OR ACQUIRED BY IX] FILER rn SPOUSE

2 STREET ADDRESS ' INCLUDING CITY, COUNTY, AND STATE

o NOT AVAILABLE 77630

IKl CHECK IF FILER'S HOME ADDRESS ORANGE, TEXAS

3 DESCRIPTION NUMBER OF LOTS OR ACRES AND NAME OF COUNTY WHERE LOCATED

o LOTS HOME, WITH APPROX. ONE ACRE-ORANGE COUNTY, TEXAS

o ACRES

4 NAMES OF PERSONS

RETAINING AN INTEREST

o NOT APPLICABLE

(SEVERED MINERAL INTEREST)

5 IF SOLD

o NETGAIN o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 !Xl $25,000--OR MORE

o NETLOSS

HELD OR ACQUIRED BY I!I FILER B SPOUSE &IN-LAWeJ DEPENDENT CHILD

STREET ADDRESS STREET ADDRESS, INCLUDING CITY, COUNTY, AND STATE

o NOT AVAILABLE

o CHECK IF FILER'S HOME ADDRESS

NUMBER OF LOTS OR ACRES AND NAME OF COUNTY WHERE LOCATED

DESCRIPTION

o LOTS 2 LOTS ON COW CREEK-NEWTON COUNTY, TEXAS

1 LOT BEHIND OUR HOME-ORANGE COUNTY, TEXAS

o ACRES

NAMES OF PERSONS

RETAINING AN INTEREST

o NOT APPLICABLE

(SEVERED MINERAL INTEREST)

IF SOLD

o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 [XI $10,000--$24,999 o $25,000--OR MORE

o NETLOSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

P.O. Box 12070

Austin Texas 78711-2070

(512) 463-5800

1-800-325-8506

INTERESTS IN REAL PROPERTY PART 7A

(PAGE 2 OF 2 FOE

D NOT APPLICABLE

Describe all beneficial interests in real property held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category of the amount of the net gain or loss realized from the sale.

For an explanation of "beneficial interest" and other specific directions for completing this section, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1

HELD OR ACQUIRED BY [XJ FILER o SPOUSE o DEPENDENT CHILD

2 STREET ADDRESS STREET ADDRESS. INCLUDING CITY. COUNTY. AND STATE

o NOT AVAILABLE 413 CAMELLIA

D CHECK IF FILER'S HOME ADDRESS ORANGE, TEXAS

3 DESCRIPTION NUMBER OF LOTS OR ACRES AND NAME OF COUNTY WHERE LOCATED

o LOTS HOME AND LOT- ORANGE COUNTY (INHERITED)

o ACRES

4 NAMES OF PERSONS

RETAINING AN INTEREST

o NOT APPLICABLE

(SEVERED MINERAL INTEREST)

5 IF SOLD

o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 0$10,000--$24,999 I!J $25,000--OR MORE

o NETLOSS

HELD OR ACQUIRED BY o FILER o SPOUSE o DEPENDENT CHILD

STREET ADDRESS STREET ADDRESS. INCLUDING CITY. COUNTY. AND STATE

o NOT AVAILABLE

o CHECK IF FILER'S HOME ADDRESS

NUMBER OF LOTS OR ACRES AND NAME OF COUNTY WHERE LOCATED

DESCRIPTION

o LOTS

o ACRES

NAMES OF PERSONS

RETAINING AN INTEREST

o NOT APPLICABLE

(SEVERED MINERAL INTEREST)

IF SOLD

o NET GAIN o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

o NETLOSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

7A)

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

INTERESTS IN BUSINESS ENTITIES PART 7B

~ NOT APPLICABLE

Describe all beneficial interests in business entities held or acquired by you, your spouse, or a dependent child during the

calendar year. If the interest was sold, also indicate the category ofthe amount of the net gain or loss realized from the sale.

For an explanation of "beneficial interest" and other specific directions for completing this section, see FORM PFS--

INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1

HELD OR ACQUIRED BY D FILER D SPOUSE D DEPENDENT CHILD

2 NAMEANDADDRESS

DESCRIPTION D (Check If Filer's Home Address)

3 IF SOLD

D NET GAIN D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,OOO--OR MORE

D NET LOSS

HELD OR ACQUIRED BY D FILER D SPOUSE D DEPENDENT CHILD

NAME AND ADDRESS

DESCRIPTION D (Check If Filer's Home Address)

IF SOLD

D NET GAIN D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,OOO--OR MORE

D NET LOSS

HELD OR ACQUIRED BY D FILER D SPOUSE D DEPENDENT CHILD

NAME AND ADDRESS

DESCRIPTION D (Check If Filer's Home Address)

IF SOLD

D NET GAIN D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,OOO--OR MORE

D NET LOSS

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10/01/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

GIFTS PART 8

~ NOT APPLICABLE

Identify any person or organization that has given a gift worth more than $250 to you, your spouse, or a dependent child, and

describe the gift. The description of a gift of cash or a cash equivalent, such as a negotiable instrument or gift certificate, must

include a statement of the value of the gift. Do not include: 1) expenditures required to be reported by a person required to be

registered as a lobbyist under chapter 305 of the Government Code; 2) political contributions reported as required by law; or

3) gifts given by a person related to the recipient within the second degree by consanguinity or affinity. For more information,

see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 NAME AND ADDRESS

DONOR

2 D FILER D SPOUSE D DEPENDENT CHILD

RECIPIENT

3

DESCRIPTION OF GIFT

NAME AND ADDRESS

DONOR

RECIPIENT D FILER D SPOUSE D DEPENDENT CHILD

DESCRIPTION OF GIFT

NAME AND ADDRESS

DONOR

RECIPIENT D FILER D SPOUSE D DEPENDENT CHILD

DESCRIPTION OF GIFT

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

TRUST INCOME PART 9

~ NOT APPLICABLE

Identify each source of income received by you, your spouse, or a dependent child as beneficiary of a trust and indicate the

category of the amount of income received. Also identify each asset of the trust from which the beneficiary received more

than $500 in income, if the identity of the asset is known. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 NAME OF TRUST

SOURCE

2 D FILER D SPOUSE D DEPENDENT CHILD

BENEFICIARY

3

INCOME D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,000--OR MORE

4 ASSETS FROM WHICH

OVER $500 WAS RECEIVED

D UNKNOWN

NAME OF TRUST

SOURCE

BENEFICIARY D FILER D SPOUSE D DEPENDENT CHILD

INCOME D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,000--OR MORE

ASSETS FROM WHICH

OVER $500 WAS RECEIVED

D UNKNOWN

NAME OF TRUST

SOURCE

BENEFICIARY D FILER D SPOUSE D DEPENDENT CHILD

INCOME D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,000--OR MORE

ASSETS FROM WHICH

OVER $500 WAS RECEIVED

D UNKNOWN

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10/01/2009

Texas Ethics Com mission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

BLIND TRUSTS PART 10A

~ NOT APPLICABLE

Identify each blind trust that complies with section 572.023(c) of the Government Code. See FORM PFS--INSTRUCTION

GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 NAME OF TRUST

2 NAME AND ADDRESS

TRUSTEE

3 BENEFICIARY D FILER D SPOUSE D DEPENDENT CHILD

4 FAIR MARKETVALUE D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,000--OR MORE

5

DATE CREATED

NAME OF TRUST

NAME AND ADDRESS

TRUSTEE

BENEFICIARY D FILER D SPOUSE D DEPENDENT CHILD

FAIR MARKET VALUE D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,OOO--OR MORE

DATE CREATED

NAME OF TRUST

NAME AND ADDRESS

TRUSTEE

BENEFICIARY D FILER D SPOUSE D DEPENDENT CHILD

FAIR MARKET VALUE D LESS THAN $5,000 D $5,000--$9,999 D $10,000--$24,999 D $25,OOO--OR MORE

DATE CREATED

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

(512) 463-5800

1-800-325-8506

P.O. Box 12070

Austin, Texas 78711-2070

TRUSTEE STATEMENT

PART 108

~ NOT APPLICABLE

An individual who is required to identify a blind trust on Part 10A of the Personal Financial Statement must submit a statement signed by the trustee of each blind trust listed on Part 10A. The portions of section 572.023 of the Government Code that relate to blind trusts are listed below.

1 NAME OF TRUST

NAME

2 TRUSTEE NAME

3 FILER ON WHOSE BEHALF STATEMENT IS BEING FILED

4 TRUSTEESTATEMENT

I affirm, under penalty of perjury, that I have not revealed any information to the beneficiary of this trust except information that may be disclosed under section 572.023 (b)(8) of the Government Code and that to the best of my knowledge, the trust complies with section 572.023 of the Government Code.

Trustee Signature

§ 572.023. Contents of Financial Statement in General (b) The account offinancial activity consists of:

(8) identification of the source and the category of the amount of all income received as beneficiary of a trust, other than a blind trust that complies with Subsection (c), and identification of each trust asset, if known to the beneficiary, from which income was received by the beneficiary in excess of $500;

(14) identification of each blind trust that complies with Subsection (c), including: (A) the category of the fair market value of the trust;

(8) the date the trust was created;

(C) the name and address of the trustee; and

(D) a statement signed by the trustee, under penalty of perjury, stating that:

(i) the trustee has not revealed any information to the individual, except information that may be disclosed under Subdivision (8); and

(ii) to the best of the trustee's knowledge, the trust complies with this section. (c) For purposes of Subsections (b)(8) and (14), a blind trust is a trust as to which:

(1) the trustee:

(A) is a disinterested party; (8) is not the individual;

(C) is not required to register as a lobbyist under Chapter 305; (D) is not a public officer or public employee; and

(E) was not appointed to public office by the individual or by a public officer or public employee the individual supervises; and

(2) the trustee has complete discretion to manage the trust, including the power to dispose of and acquire trust assets without consulting or notifying the individual.

(d) If a blind trust under Subsection (c) is revoked while the individual is subject to this subchapter, the individual must file an amendment to the individual's most recent financial statement, disclosing the date of revocation and the previously unreported value by category of each asset and.the income derived from each asset.

Revised 10/01/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

ASSETS OF BUSINESS ASSOCIATIONS

~ NOT APPLICABLE

PART 11A

Describe all assets of each corporation, firm, partnership, limited partnership, limited liability partnership, professional corporation, professional association, joint venture, or other business association in which you, your spouse, or a dependent child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount of the assets. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under which the child is listed on the Cover Sheet.

2 BUSINESS TYPE

1 NAME AND ADDRESS

BUSINESS D (Check If Filer's Home Address)

ASSOCIATION

3 HELD,ACQUIRED, OR SOLD BY

D FILER

D SPOUSE

D DEPENDENT CHILD --_

4 ASSETS

DESCRIPTION

: D LESS THAN $5,:~:EGO~ $5,000--$9,999

I I

'1' I I I

·1· I I I

·1· I I I

I

I

I I

I

T

I I I

'1' I I I

·1· I

I

I

I

D $10,000--$24,999

D $25,OOO--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999

D $25,000--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999

D $25,OOO--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999

D $25,OOO--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999

D $25,OOO--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999

D $25,OOO--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999

D $25,OOO--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999

D $25,OOO--OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY

Revised 10101/2009

Texas Ethics Commission

1-800-325-8506

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

LIABILITIES OF BUSINESS ASSOCIATIONS

PART 11B

~ NOT APPLICABLE

Describe all liabilities of each corporation, firm, partnership, limited partnership, limited liability partnership, professional corporation, professional association, joint venture, or other business association in which you, your spouse, or a dependent child held, acquired, or sold 50 percent or more of the outstanding ownership and indicate the category of the amount of the assets. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by providing the number under which the child is listed on the Cover Sheet.

2 BUSINESS TYPE

D $10,000--$24,999 D $25,OOO--OR MORE

I

I D LESS THAN $5,000 D $5,000--$9,999

I D $10,000--$24,999 D $25,OOO--OR MORE

I

I

I D LESS THAN $5,000 D $5,000--$9,999

I D $10,000--$24,999 D $25,OOO--OR MORE

I

T

I D LESS THAN $5,000 D $5,000--$9,999

I

I D $10,000--$24,999 D $25,OOO--OR MORE

'1'

I D LESS THAN $5,000 D $5,000--$9,999

I

I D $10,000--$24,999 D $25,OOO--OR MORE

·1·

I

I D LESS THAN $5,000 D $5,000--$9,999

I D $10,000--$24,999 D $25,OOO--OR MORE

I 1 BUSINESS ASSOCIATION

NAME AND ADDRESS

D (Check If Filer's Home Address)

3 HELD,ACQUIRED, OR SOLD BY

D FILER D SPOUSE D DEPENDENT CHILD ---

4 LIABILITIES

DESCRIPTION I CATEGORY

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999

D $25,OOO--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

D $10,000--$24,999 D $25,OOO--OR MORE

D LESS THAN $5,000 D $5,000--$9,999

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY

Revised 10/01/2009

Texas Ethics Commission

P.O Box 12070

Austin Texas 78711-2070

(512) 463-5800

1-800-325-8506

BOARDS AND EXECUTIVE POSITIONS PART 12

o NOT APPLICABLE

List all boards of directors of which you, your spouse, or a dependent child are a member and all executive positions you,

your spouse, or a dependent child hold in corporations, firms, partnerships, limited partnerships, limited liability partner-

ships, professional corporations, professional associations, joint ventures, other business associations, or proprietorships,

stating the name of the organization and the position held. For more information, see FORM PFS--INSTRUCTION GUIDE.

When reporting information about a dependent child's activity, indicate the child about whom you are reporting by

providing the number under which the child is listed on the Cover Sheet.

1 ST. MARY'S SCHOOL

ORGANIZATION FOUNDATION

2

POSITION HELD MEMBER OF BOARD (PRESIDENT)

3 POSITION HELD BY ~FILER D SPOUSE D DEPENDENT CHILD

ORGANIZATION ORANGE COUNTY COMMUNITY PARTNERS- THE RAINBOW ROOM

POSITION HELD MEMBER

POSITION HELD BY D FILER g:SPOUSE D DEPENDENT CHILD

ORGANIZA TION ORANGE COUNTY CREDIT UNION

POSITION HELD MEMBER (CHAIRMAN)

POSITION HELD BY XiI FILER D SPOUSE D DEPENDENT CHILD

ORGANIZATION ST. MARY'S PARISH COUNCIL

POSITION HELD (MEMBER)

POSITION HELD BY ~ FILER D SPOUSE D DEPENDENT CHILD

ORGANIZATION

POSITION HELD

POSITION HELD BY D FILER D SPOUSE D DEPENDENT CHILD

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 1010112009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

EXPENSES ACCEPTED UNDER HONORARIUM EXCEPTION PART 13

~ NOT APPLICABLE

Identify any person who provided you with necessary transportation, meals, or lodging, as permitted under section 36.07(b)

of the Penal Code, in connection with a conference or similar event in which you rendered services, such as addressing an

audience or participating in a seminar, that were more than perfunctory. Also provide the amount of the expenditures on

transportation, meals, or lodging. You are not required to include items you have already reported as political contributions

on a campaign finance report, or expenditures required to be reported by a lobbyist under the lobby law (chapter 305 of the

Government Code). For more information, see FORM PFS--INSTRUCTION GUIDE.

1 NAME AND ADDRESS

PROVIDER

2 AMOUNT

NAME AND ADDRESS

PROVIDER

AMOUNT

NAME AND ADDRESS

PROVIDER

AMOUNT

NAME AND ADDRESS

PROVIDER

AMOUNT

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

P.O. Box 12070

Austin. Texas 78711-2070

(512) 463-5800

1-800-325-8506

INTEREST IN BUSINESS IN COMMON WITH LOBBYIST PART 14

~ NOT APPLICABLE

Identify each corporation, firm, partnership, limited partnership, limited liability partnership, professional corporation, profes-

sional association, joint venture, or other business association, other than a publicly-held corporation, in which you, your

spouse, or a dependent child, and a person registered as a lobbyist under chapter 305 of the Government Code that both have

an interest. For more information, see FORM PFS--INSTRUCTION GUIDE.

1 NAME ANO AODRESS

BUSINESS ENTITY

2 INTEREST HELD BY D FILER D SPOUSE D DEPENDENT CHILD

NAME AND ADDRESS

BUSINESS ENTITY

INTEREST HELD BY D FILER D SPOUSE D DEPENDENT CHILD

NAME AND ADDRESS

BUSINESS ENTITY

INTEREST HELD BY D FILER D SPOUSE D DEPENDENT CHILD

NAME AND ADDRESS

BUSINESS ENTITY

INTEREST HELD BY D FILER D SPOUSE D DEPENDENT CHILD

NAME AND ADDRESS

BUSINESS ENTITY

INTEREST HELD BY D FILER D SPOUSE D DEPENDENT CHILD

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Com mission

P.O. Box 12070

Austin Texas 78711-2070

(512) 463-5800

1-800-325-8506

FEES RECEIVED FOR SERVICES RENDERED PART 15

TO A LOBBYIST OR LOBBYIST'S EMPLOYER

~ NOT APPLICABLE

Report any fee you received for providing services to or on behalf of a person required to be registered as a lobbyist under

chapter 305 of the Government Code, or for providing services to or on behalf of a person you actually know directly compen-

sates or reimburses a person required to be registered as a lobbyist. Report the name of each person or entity for which the

services were provided, and indicate the category of the amount of each fee. For more information, see FORM PFS--

INSTRUCTION GUIDE.

1 PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

2

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

PERSON OR ENTITY

FOR WHOM SERVICES

WERE PROVIDED

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,000--OR MORE

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 1010112009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

REPRESENTATION BY LEGISLATOR BEFORE PART 16

STATE AGENCY

~ NOT APPLICABLE

This section applies only to members of the Texas Legislature. A member of the Texas Legislature who represents a person

for compensation before a state agency in the executive branch must provide the name of the agency, the

name of the person represented, and the category of the amount of the fee received for the representation. For more

information, see FORM PFS--INSTRUCTION GUIDE.

Note: Beginning September 1, 2003, legislators may not, for compensation, represent another person before a state

agency in the executive branch. The prohibition does not apply if: (1) the representation is pursuant to an attorney/client

relationship in a criminal law matter; (2) the representation involves the filing of documents that involve only ministerial acts

on the part of the agency; or (3) the representation is in regard to a matter for which the legislator was hired before

September 1, 2003.

1

STATE AGENCY

2

PERSON REPRESENTED

3

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,OOO--OR MORE

STATE AGENCY

PERSON REPRESENTED

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,OOO--OR MORE

STATE AGENCY

PERSON REPRESENTED

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 o $25,OOO--OR MORE

STATE AGENCY

PERSON REPRESENTED

FEE CATEGORY o LESS THAN $5,000 o $5,000--$9,999 o $10,000--$24,999 D $25,OOO--OR MORE

COpy AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

BENEFITS DERIVED FROM FUNCTIONS HONORING PART 17

PUBLIC SERVANT

~ NOT APPLICABLE

Section 36.10 of the Penal Code provides that the gift prohibitions set out in section 36.08 of the Penal Code do not apply

to a benefit derived from a function in honor or appreciation of a public servant required to file a statement under chapter 572

of the Government Code or title 15 of the Election Code if the benefit and the source of any benefit over $50 in value are: 1)

reported in the statement and 2) the benefit is used solely to defray expenses that accrue in the performance of duties or

activities in connection with the office which are nonreimbursable by the state or a political subdivision. If such a benefit is

received and is not reported by the public servant under title 15 of the Election Code, the benefit is reportable here. For more

information, see FORM PFS--INSTRUCTION GUIDE.

1 NAME AND ADDRESS

SOURCE OF BENEFIT

2

BENEFIT

NAME AND ADDRESS

SOURCE OF BENEFIT

BENEFIT

NAME AND ADDRESS

SOURCE OF BENEFIT

BENEFIT

NAME AND ADDRESS

SOURCE OF BENEFIT

BENEFIT

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

P.O Box 12070

Austin Texas 78711-2070

(512) 463-5800

1-800-325-8506

LEGISLATIVE CONTINUANCES PART 18

~ NOT APPLICABLE

Identify any legislative continuance that you have applied for or obtained under section 30.003 of the Civil Practice

and Remedies Code, or under another law or rule that requires or permits a court to grant continuances on the

grounds that an attorney for a party is a member or member-elect of the legislature.

1

NAME OF PARTY

REPRESENTED

2

DATE RETAINED

3

STYLE, CAUSE NUMBER,

COURT & JURISDICTION

4

DATE OF CONTINUANCE

APPLICATION

5

WAS CONTINUANCE

GRANTED? DYES DNO

NAME OF PARTY

REPRESENTED

DATE RETAINED

STYLE, CAUSE NUMBER,

COURT, & JURISDICTION

DATE OF CONTINUANCE

APPLICATION

WAS CONTINUANCE

GRANTED? DYES DNO

COPY AND ATTACH ADDITIONAL PAGES AS NECESSARY Revised 10101/2009

Texas Ethics Commission

P.O. Box 12070

Austin, Texas 78711-2070

(512) 463-5800

1-800-325-8506

PERSONAL FINANCIAL STATEMENT AFFIDAVIT

The law requires the personal financial statement to be verified. The verification page must have the signature of the individual required to file the personal financial statement, as well as the signature and stamp or seal of office of a notary public or other person authorized by law to administer oaths and affirmations. Without proper verification, the statement is not considered filed.

I swear, or affirm, under penalty of perjury, that this financial statement covers calendar year ending December 31 , 2009, and is true and correct and includes all information required to be reported by me under chapter 572 of the Government Code.

Signature of Filer

SANDY KAUFMAN

MY COMMISSION EXPIRES February 25, 2013

AFFIX NOTARY STAMP I SEAL ABOVE

Sworn to and subscribed before me, by the said PATRICK A. CLARK , this the

APRIL ,20 10 , to certify which, witness my hand and seal of office.

14TH day of

SANDY KAUFMAN

Print name of officer administering oath

Title of officer administering oath

Revised 10101/2009

Potrebbero piacerti anche

- Coburn Safety at Any PriceDocumento55 pagineCoburn Safety at Any PriceAaron NobelNessuna valutazione finora

- Inspection ReportsDocumento63 pagineInspection ReportsTexas Watchdog100% (1)

- Your Money and Pension ObligationsDocumento24 pagineYour Money and Pension ObligationsTexas Comptroller of Public AccountsNessuna valutazione finora

- Homeland Security BudgetDocumento183 pagineHomeland Security BudgetTexas Watchdog100% (1)

- Alamo ReportDocumento38 pagineAlamo ReportTexas WatchdogNessuna valutazione finora

- Cityreferenda DownballotDocumento2 pagineCityreferenda DownballotTexas WatchdogNessuna valutazione finora

- Travisco DownballotDocumento3 pagineTravisco DownballotTexas WatchdogNessuna valutazione finora

- Stateemployees PercentDocumento1 paginaStateemployees PercentTexas WatchdogNessuna valutazione finora

- State Employees ChangeDocumento2 pagineState Employees ChangeTexas WatchdogNessuna valutazione finora

- Nov 2012 Sample BallotDocumento6 pagineNov 2012 Sample BallotMike MorrisNessuna valutazione finora

- State Employees ChangeDocumento2 pagineState Employees ChangeTexas WatchdogNessuna valutazione finora

- Full-Time Equivalent State Employees For The Quarter Ending August 31, 2012Documento36 pagineFull-Time Equivalent State Employees For The Quarter Ending August 31, 2012Texas WatchdogNessuna valutazione finora

- Office of Inspector General Report On FEMA Handling of Hurricane KatrinaDocumento218 pagineOffice of Inspector General Report On FEMA Handling of Hurricane KatrinaTexas WatchdogNessuna valutazione finora

- Texas Appleseed - Ticketing Booklet WebDocumento214 pagineTexas Appleseed - Ticketing Booklet WebTexas WatchdogNessuna valutazione finora

- Texas State Auditor's Office Report On Emerging Technology FundDocumento81 pagineTexas State Auditor's Office Report On Emerging Technology FundThe Dallas Morning NewsNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Texas Class Action - RobinhoodDocumento23 pagineTexas Class Action - RobinhoodDaily Caller News FoundationNessuna valutazione finora

- Land Bank V PagayatanDocumento12 pagineLand Bank V PagayatanCpdo BagoNessuna valutazione finora

- TSA Response To GoodenDocumento6 pagineTSA Response To GoodenHayden SparksNessuna valutazione finora

- El Alamein - Operazione SuperchargeDocumento2 pagineEl Alamein - Operazione SuperchargeAndrea MatteuzziNessuna valutazione finora

- Serafin vs. Lindayag (A.M. No. 297-MJ, September 30, 1975)Documento5 pagineSerafin vs. Lindayag (A.M. No. 297-MJ, September 30, 1975)Marienyl Joan Lopez VergaraNessuna valutazione finora

- Ciceron P. Altarejos, Petitioner, vs. Commission On Elections, Jose ALMIÑE and VERNON VERSOZA, Respondents. G, R. 163256 FactsDocumento4 pagineCiceron P. Altarejos, Petitioner, vs. Commission On Elections, Jose ALMIÑE and VERNON VERSOZA, Respondents. G, R. 163256 FactsFernan ParagasNessuna valutazione finora

- End of BipolarityDocumento9 pagineEnd of Bipolarityekagrata100% (1)

- 1MDB SagaDocumento4 pagine1MDB SagaJingyi SaysHelloNessuna valutazione finora

- Popular Culture BuhleDocumento19 paginePopular Culture Buhlemongo_beti471Nessuna valutazione finora

- Speech On LifeDocumento2 pagineSpeech On LifeHenna May DisuNessuna valutazione finora

- Romero v. Court of Appeals 250 SCRA 223Documento5 pagineRomero v. Court of Appeals 250 SCRA 223Krisleen Abrenica0% (1)

- CVV 361 S82016008Documento7 pagineCVV 361 S82016008Minh Giang Hoang NguyenNessuna valutazione finora

- What Is A Memorandum or MemoDocumento23 pagineWhat Is A Memorandum or MemoJella BandalanNessuna valutazione finora

- RBI Form BDocumento1 paginaRBI Form BGerald Floro Funa100% (2)

- Angelo v. District of Columbia Reply To Opposition To Motion For Preliminary Injunction 2022-10-30Documento188 pagineAngelo v. District of Columbia Reply To Opposition To Motion For Preliminary Injunction 2022-10-30AmmoLand Shooting Sports NewsNessuna valutazione finora

- Ross Rica Sales Center v. Sps. Ong, GR. No. 132197, Aug. 16, 2005Documento2 pagineRoss Rica Sales Center v. Sps. Ong, GR. No. 132197, Aug. 16, 2005Miller Concernman Ebron Pajantoy Jr.100% (1)

- Ascending The Mountain of The LordDocumento9 pagineAscending The Mountain of The Lordjuan pozasNessuna valutazione finora

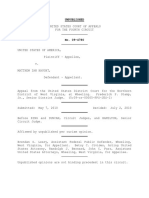

- United States v. Haught, 4th Cir. (2010)Documento5 pagineUnited States v. Haught, 4th Cir. (2010)Scribd Government DocsNessuna valutazione finora

- Research Paper CRPC 2018LLB124Documento28 pagineResearch Paper CRPC 2018LLB124SWETCHCHA MISKANessuna valutazione finora

- Kilosbayan V MoratoDocumento5 pagineKilosbayan V Moratolehsem20006985Nessuna valutazione finora

- Printing Press LettersDocumento4 paginePrinting Press LettersSyed Hazrath babaNessuna valutazione finora

- Nazi Police StateDocumento16 pagineNazi Police StateTheo ChingombeNessuna valutazione finora

- SLCo Council Letter On SB57Documento2 pagineSLCo Council Letter On SB57KUTV 2NewsNessuna valutazione finora

- NSTP Module 2Documento76 pagineNSTP Module 2Niña Baltazar100% (3)

- Acta de Nacimiento AUMD921222HDFGRN04. TraducciónDocumento1 paginaActa de Nacimiento AUMD921222HDFGRN04. TraducciónAlma I. RomoNessuna valutazione finora

- Why Anti-Racism Will Fail (Rev. Dr. Thandeka)Documento19 pagineWhy Anti-Racism Will Fail (Rev. Dr. Thandeka)RD100% (2)

- Broadcast Music, Inc. v. Columbia Broadcasting System, Inc. Analysis of The 1979 Supreme Court CaseDocumento19 pagineBroadcast Music, Inc. v. Columbia Broadcasting System, Inc. Analysis of The 1979 Supreme Court CaseCharles ChariyaNessuna valutazione finora

- Myanmar Ethnic ConflictDocumento12 pagineMyanmar Ethnic Conflictthinzar 313Nessuna valutazione finora

- Text Di Bawah Ini Digunakan Untuk Menjawab Nomor 1 Dan 2.: Rahmat and Wati JumintenDocumento3 pagineText Di Bawah Ini Digunakan Untuk Menjawab Nomor 1 Dan 2.: Rahmat and Wati JumintenKiddy Care TegalNessuna valutazione finora

- Year 12 English Invictus and Ransom Aarushi Kaul ADocumento3 pagineYear 12 English Invictus and Ransom Aarushi Kaul ALevi LiuNessuna valutazione finora