Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Jute Industry Analysis - Declining Industry

Caricato da

chouhan.bharat849124Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Jute Industry Analysis - Declining Industry

Caricato da

chouhan.bharat849124Copyright:

Formati disponibili

PROJECT REPORT SUBMITTED IN PARTIAL FULFILMENT OF

THE REQUIREMENTS OF THE COURSE ON

INDUSTRY & COMPETETIVE ANALYSIS

Jute Industry Analysis

(Declining Industry)

SUBMITTED TO

Prof. Ranjan Das

BY

Anindita Sampath (120/39)

Anita Kumar (124/39)

Archana Jagannathan (134/39)

Bhavya Nandkishore (148/39)

P.Sinna Krishnan (FP/08/02)

Jute Industry Analysis

Table of Contents

1. Introduction

2. Jute Industry Definition

3. Industry Structure

4. Geographical location of the mills

5. Jute – Why a declining industry

6. Jute Value Chain

7. Steps in Jute production

8. Jute products

9. Exports of jute goods during 2001 – 2002

10. Research & Development

11. Porter’s Five-Force Analysis

12. Competition analysis

13. Strategic Groups and Mobility Barriers

14. Diversification

15. Jute in Bangladesh

16. Future Strategy

Appendix A – Facts at a glance

Appendix B – Geographical distribution of Jute mills in India

Appendix C – Company Evaluation

IIM Calcutta Page 2 of 32

Jute Industry Analysis

1. Introduction

Jute: The Golden Fiber

Jute, the 'Golden Fiber' as it is called, is a plant that yields a fiber used for sacking and cordage.

Known as the raw material for sacks the world over, jute is truly one of the most versatile fibers

gifted to man by nature that finds various uses in the form of Handicrafts. Next to cotton, jute is the

cheapest and most important of all textile fibers.

2. Jute Industry Definition

The jute industry includes both raw jute as well as jute products- included in the entire value chain

are processes starting right from harvesting of jute for yarn preparation to processing of raw jute for

preparation of gunny bags, jute handicrafts and other diversified jute products.

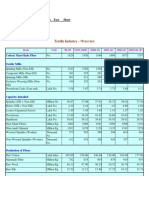

3. Industry Structure

The jute industry in India is fragmented and comprises of around 75 mills.

Table 1 bring out the following characteristics of the industry:

The largest jute mill i.e. Dalhousie accounts for approximately 49% of the capital employed in

the industry. However the remaining 50 of the industry is fragmented.

The second biggest firm in the industry accounts for only 9% of the capital employed.

The top5 firms in the industry account for 81% of the capital employed, of which 60% belongs

to Dalhousie alone.

Hence we conclude that apart from one firm, which is dominant in the industry, the industry is

fragmented. This one firm is likely to have a powerful influence on the Indian jute industry as

a whole.

IIM Calcutta Page 3 of 32

Jute Industry Analysis

4. Geographical location of the mills

Small jute mills – around 75 mills in India, out of which 59 are in West Bengal alone. It has been

the dominant jute producing state in the country primarily because of the easy availability of raw

material.

State Dec-99 Jun-00 Dec-00 Jun-01 Dec-02 Jun-02

West Bengal 59 59 59 59 59 59

Andhra Pradesh 7 7 7 7 7 7

U.P. 3 3 3 3 3 3

Bihar 3 3 10 3 3 3

Tripura 1 1 1 1 1 1

Orissa 1 1 1 1 1 1

M.P. 1 1 1 1 1 1

Assam 1 1 1 1 1 1

5. Jute - A declining industry

Production

At a first glance, it appears that the production of jute has remained stable over the past 5 years.

However, the following table shows the breakup of the total production, which further helps us in

understanding the pattern of production within the jute industry.

A continuously declining trend has been observed in Hessian, CBC and others. The only area, which

has shown an improvement, is sacking. This, we believe is due to the Jute Packaging Materials

(Compulsory use of packing Commodities) Act, 1987. Under the purview of this act, major

industrial users, like the cement, fertilizer, food grains and sugar industry- were required to use jute

IIM Calcutta Page 4 of 32

Jute Industry Analysis

as a packaging material in certain specified ratios. However, this Act will be removed in 2004 and

hence, we expect this segment too to decline after this period.

(APRIL / MARCH) HESSIAN SACKING CBC OTHERS TOTAL

1995 - 96 413.9 676.3 30.5 312.3 1433.0

1996 - 97 368.7 666.6 25.2 340.4 1400.9

1997 - 98 392.4 864.6 19.8 401.6 1678.4

1998 - 99 344.1 903.3 18.5 330.3 1596.2

1999 - 00 344.5 909.2 8.0 328.5 1590.2

2000 - 01 337.9 952.9 6.6 327.5 1624.9

2001 - 02 275.0 1033.7 5.0 286.7 1600.4

Consumption

The consumption patterns too show a similar trend. Consumption of hessain, CBC and others is

reducing gradually. Also, as mentioned earlier the increasing demand for sacking may be due to the

government regulations governing the use of packing material. Decreasing demand combined with

continuing production of jute is resulting in high inventory build-up.

(APRIL / MARCH) HESSIAN SACKING CBC OTHERS TOTAL

1995 – 96 266.9 665.5 2.3 226.6 1161.3

1996 – 97 259.8 652.0 1.7 222.5 1336.0

1997 – 98 285.8 842.4 1.5 257.5 1387.2

1998 – 99 286.2 886.3 1.3 230.5 1404.3

1999 – 00 287.0 907.4 1.4 230.9 1426.7

IIM Calcutta Page 5 of 32

Jute Industry Analysis

2000 – 01 269.7 935.2 0.8 229.4 1435.1

2001 – 02 243.0 1021.4 0.9 195.5 1460.8

Exports

Export statistics for the period 1997-98 to 2001-02 are as in the following table (Value: Rs. Million)

Year

Items 1997-98 1998-99 1999-2000 2000-01 2001-02

Value Value Value Value Value

Carpet Backing Cloth 406.98 468.76 206 140.2 98.64

Decorative Fabrics 56.68 49.45 27.96 33.2 25.19

Floor Coverings 345.88 542.31 487.03 652.82 766.26

Food Grade Jute

- - 83.79 251.8 179.56

Products

Gift Articles 34.85 86.89 78.74 102.16 92.41

Hand And Shopping

161.24 190.84 286.19 466.44 399.71

Bags

Hessian 2942.42 1993.86 1920.07 2058.4 1873.59

Jute Geo-textiles 38.18 40.18 62.49 59.7 61.14

Sacking 405.79 204.49 92.4 90.4 73.55

Wall Hangings 38.95 55.79 73.59 55.58 63.84

Yarn 2319.68 1854 1917.13 2651.8 2212.36

Jute Diversified

637.6 925.28 953.51 1310.2 1347.41

Products

Total 6750.65 5486.57 5235.39 6562.5 5846.25

Imports

Import of jute from various countries are given for the period 2001-02 in the following table:

(Value: Rs. Million)

Country Value

USA 1236.03

Belgium 818.71

UK 418.69

Egypt A RP 326.08

Turkey 239.68

Saudi Arab 230.45

Japan 202.41

Italy 141.67

German F Rep 123.81

IIM Calcutta Page 6 of 32

Jute Industry Analysis

Australia 116.78

United Arab Emirates 89.02

France 84.24

Spain 61.39

Canada 58.88

Netherlands 51.31

A further observation to support the fact that jute is a declining industry is that in the past decade,

only one mill was shut down in 1998. This is in sharp contrast to the fact that the year 2002 saw the

shutting down of 3 jute mills.

MILLS DATE OF SUSPENSION OF WORK

J K KANPUR (U.P.) 13 / 4 / 1987

GOURIPORE 4 / 9 / 1998

NEW CENTRAL 29 / 12 / 2000

UNION (NJMC) 15 / 1 / 2002

EASTERN 9 / 5 / 2002

ALEXANDRIA 1 / 9 / 2002

Installed Capacity

Installed capacity

Prod. of jute Domestic

Year apart fm 100%

goods Demand

EOU

Dec-99 1901 1622 1406

Jun-00 1901 1622 1406

Dec-00 1901 1622 1406

Jun-01 1887 1625 1435

Dec-01 1940 1605 1422

Jun-02 2080 1601 1461

The installed capacity (excluding 100% EOU) far exceeds the production of jute goods.

This is because

a. This is a declining industry

b. It is a commodity industry.

IIM Calcutta Page 7 of 32

Jute Industry Analysis

6. Jute Value Chain

Flow of raw jute

Various players in the Jute industry are Jute growers, Village Collection points, intermediaries,

dealers, co-operatives and mills. The flow of raw jute among these players is depicted in the

following figure.

Possible players who come into play after the raw jute reaches the terminal markets are given in the

following figure:

IIM Calcutta Page 8 of 32

Jute Industry Analysis

IIM Calcutta Page 9 of 32

Jute Industry Analysis

7. Steps in Jute production

Plantation: Jute seeds are sown anytime between March – May. The crop prefers a hot & humid

climate. It is low laying and takes about 5 to 6 months to grow.

Harvesting: Trees are cut from the bottom; leaves are stripped off from the top and accumulated in

bundles.

Retting: Retting is the process of extraction of the fibre. Bundles are then submerged in water for 7

to 10 days. Retting takes place due to joint action of water, aquatic and plant surface organisms,

mostly bacteria and the cambium and the cortex gets decomposed.

Stripping: The labourer holds the stem in one bunch and taps the rood end lightly with a mallet. This

frees the fibre at the foot of the stalk. The fibre is then grasped & by lashing & jerking the stem in

the water the rest of the fibre loosens and comes off.

Drying: Jute fibers are kept hanging on makeshift hangers for drying. This process takes about 2 to 3

days. Now the fibre is ready to be marketed. Here Grading becomes imperative depending on the

fineness, color, density, clearness etc, they are all score. Higher the score the better the pr for a

higher price. This is done at the buyers (like JCI) The crop new process to the hands of buyer

Grading: Jute is then brought to JCI godowns. The bundles are scanned and jute fibres are

categorized as per grades (TD1 to TD7). Gradewise these are stocked at separate locations

Pressing: Gradewise bundles are subjected to machine press to convert them in Bales. Even the

ropes used to tie the bales are prepared from the jute wastes. The bales are finally stored in the

warehouse as per their grades for sale.

IIM Calcutta Page 10 of 32

Jute Industry Analysis

8. Jute Products

The conventional jute products includes:

Jute yarn - of various counts

Jute twine - made by winding two or more yarn strings

Jute cloth - of different variety and for different applications like

Carpet backing cloth

General packaging purpose

Converting into sacks for carrying foodgrain, vegetable, sugar, fertilizer, cement etc.

Another area where jute has been put to use of late is the diversified sector where a wide

range of technologies has been developed. Jute has an infinite range of applications viz.

o Fine quality of yarn, which is used in weaving finer quality of fabric. Blended fabric

where even better quality of fabric is woven blending jute yarn with other superior

yarn.

o Jute fabric could be chemically processed, dyed and printed to produce colorful

fabric for manufacturing shopping bags, designer bags, brief cases and suitcases.

o Jute pulp for applications like making paper. Moulds etc.

o Jute particles boards or boards made of jute sticks. This in now being used in house

hold interior applications and knockdown furniture.

o Jute non-woven products, for industrial applications like automobile industry,

underground cable encasings etc.

o Jute geo-textile, which finds applications in holding soil erosion, making rural roads,

embankment building, landslide prevention, landscaping etc.

o Handicraft products, decorative and utility products of ethnic nature. This has an

infinite range such as Floor coverings, mats and under-layings etc.

Some characteristic qualities of the finished product which make them specially suited for their end

needs:

IIM Calcutta Page 11 of 32

Jute Industry Analysis

Yarn

Jute twine in varying weights and thickness is, however, used extensively both in India and abroad

for sewing, tying, and for a variety of industrial applications such as packing pipe joints, cable

binding, etc

Hessian bags

Totally biodegradable and easily blend with the environment. Jute Hessian bags are used for packing

of a variety of commodities viz. Food & Grains, Potatoes, Onions, Sugar, Tobacco, Coffee, Cocoa,

Peanut, Sand, Cement etc. These bags are tailored so as to hold goods up to 100 kgs of weight.

Sacking bags

Sacking bags, woven wholly from jute fabrics, are available as plain and twill bags. Jute bags, the

other name for sacking bags are mainly used to pack cement, sugar and other bulky articles, which

are packed in weight range from 50 to 100 kgs

Jute Hydrocarbon free cloth

Sacking bags treated with vegetable oil making it free from the harmful effects of hydrocarbons.

This renders it 100 % bio degradable and very safe to store edibles in.

Both Hessian bags and sacking bags are exported to Australia and New Zealand

Jute geotextiles and Hessian

Jute Geo-textiles are flexible, foldable, not very biodegradable, and water-resistant in nature,

particularly suitable for rain-fed, flood-prone climatic conditions. They can be used as geo-technical

engineering products like fibre drains, separators, filters and reinforcing materials.

Jute Hessian (Burlap) matting is extensively used in controlling soil erosion and usually laid along

the river embankments, sides, canal banks and hill slopes -

• Helps stop erosion damage

• Act as an aid to good vegetation growth on difficult terrain

• Easy to lay and to reposition

IIM Calcutta Page 12 of 32

Jute Industry Analysis

They are also called Erosion Control Matting. They are supplied in large quantities, throughout the

world.

Carpet Backing Cloth

CBC as it is commonly known as, commensurate to its name, is used as base material for carpets or

as the backing material of carpets. Manufacturers and exporters supply CBC in large quantities to

many carpet industries throughout the world. Carpet Backing Cloth is mainly used and is in great

demand in the carpet industry. CBC calls for export oriented market and jute mills in India are well

known in the export market for their produce

Home furnishings and textiles

Silky lustre, high tensile strength, low extensibility, considerable heat and fire resistance, long staple

length and inexpensive nature are the characteristics of jute that has immense designer potentials.

Manufacturers and exporters have discovered the high versatility of the fiber, which can be easily

combined with other materials. Finding a lot of usage in upholstery, the monotonous brown hue of

the fiber can be transformed to exotic colors, suited to a person's choice and style. Even the

coarseness of the fabric can be changed to a soft, silky fabric, which is environment friendly,

lightweight, durable, extremely fashionable and very easy-to-use. Jute is used for making covers and

stuffing etc. necessary for doing up furniture.

Industrial uses of jute

Jute felt - High quality jute felt is an excellent insulating material. Long lasting Jute felt is made to

serve the purpose effectively for a long time.

Jute Webbing

Jute webbing is used in many industries. It has the following usage:

• In the Cable industry

• As binding tapes for the carpets

• For upholstery

IIM Calcutta Page 13 of 32

Jute Industry Analysis

Main Products & Present Markets

Products Markets

Yarn Belgium, Turkey, Egypt

Lighter Packaging India, African & Latin American Countries

Food Grade Jute Products for packaging African & Latin American Countries), USA, Argentina,

Cocoa & Coffee Beans, Shelled & Pea nuts Turkey

Geo-textiles USA, West Europe

Shopping Bags USA, Japan, Saudi Arabia

Floor Covering USA, West Europe

Other Diversified Products USA, West Europe

9. EXPORTS OF JUTE GOODS DURING 2001 - 2002

OTHERS

8%

HESSIAN

JDPS 31%

22%

YARN SACKING

36% CBC 1%

2%

IIM Calcutta Page 14 of 32

Jute Industry Analysis

EXPORT OF 5 MAJOR JDPS FROM INDIA DURING 2001-02

Decorative

Fabrics

Wall

2%

Hangings Gift

5% Articles

7%

Hand & Floor

Shopping Coverings

Bags 56%

30%

10. Research & Development

Research and development by reputed organizations in India, have led to the strengthening of the

natural attributes of jute. With technological support coupled with government's developmental

efforts, the golden fiber, today, has entered into a varied range of applications generating

employment, contributing to sustainable human development and leading to a cleaner and healthier

environment.

Intensive R & D efforts through various research institutes mainly funded by Government of India

have resulted in remarkable breakthrough in product diversification. Prominent Products are:

• Hydro carbon-free Jute Products for packing food grade products like cocoa, coffee, shelled

nuts etc.

• Major R & D works in DREF Spinning System.

• Production of jute blended yarns with jute as the major component-using Jute/Viscose,

Jute/Acrylic, and Jute/Cotton--jute content varying from 60 to 70% by weight. Such yarns

suitable for blankets, shawls, pullovers and as also thick dress materials.

IIM Calcutta Page 15 of 32

Jute Industry Analysis

• Production of fine blended yarns using Jute/Cotton, Jute/Silk, Jute/Wool etc. for apparel use

Jute Content is 30-40%.

Jute based fabrics used particularly in areas of furnishing, upholstery, carpets, blankets and other

home textiles. R & D Institutions have developed Jute Reinforced Composites in the form of

flexible, semi rigid sheet and rigid board to substitute wood, timber, and plywood.

UNDP jute program has also facilitated diversification of jute sector by developing new technology,

promotion of employment opportunities by encouraging new entrepreneurs to set up production

units and development of indigenous machine manufacturing sector. Some of the on-going projects

are use of jute for paper production; jute based needle-punched carpets, development of multi-

component yarn from wool, jute and other fibers for floor coverings blankets and knitwear.

11. Porter’s Five-Force Analysis

Supplier Power

The major portion of the marketable surplus of jute is sold by the growers in the villages. This fact

has led to the establishment of a chain of middlemen between the growers and the manufacturing

mills. In addition to purchasing and selling the raw jute, these middlemen often perform such

essential functions as assembling and storing the crop, transporting it to the secondary market, and

financing the various transactions. While the power of the farmers cannot be said to be particularly

high, that of the middlemen is certainly high. Also, the jute farmers have the incentive to switch to

alternative crops like rice which is grown on the same land. This might altogether stop production of

jute; the main losers seem to be mill workers and not the farmers if jute declines further. Hence

supplier power seems to be reasonably medium to high.

Buyer Power

The buyers’ power is collectively significant as to mostly the price of jute is set depending on the

demand. The major buyers of jute as such are organizations like Food Corporation of India which

buys the jute sacking for foodgrains and the sugar, cement and fertilizer industries. This is mainly

due to the regulations issued by the government of India, leading therefore to forced buying. But

there are a number of political factions pushing for reducing these sanctions, due to the relatively

high price of jute packaging compared to other substitutes. Secondly, where jute sellers are

IIM Calcutta Page 16 of 32

Jute Industry Analysis

following a differentiating strategy is by trying to make jute more of a lifestyle product and therefore

establishing some kind of a fashion statement. Here, the buyers are big supermarkets like Shopper

Stop, which sell a whole range of products and Jute bags and accessories are just a miniscule part of

their total business. Hence it is not as important for them to buy the jute products as it is for the jute

industry to sell them. Of thirty major primary commodities traded internationally, only about six

have as much price and supply instability as jute. Demand is highly sensitive to price increases, but

not nearly as sensitive to decreases; once a portion of the market is lost to synthetics, it is very

difficult to win it back through price competition.

Apart from these, significant portions of buyers are foreign importers.

Overall, the buyer power seems significant.

Entry Barriers

Profitability – Low

Investment – Not too high, foreign investment available including joint venture options

Technology – Not a barrier, no specialized know how

Labour – skilled workers who are available in plenty or can be trained especially in India

Except for low profitability and the fact that jute industry as a whole is declining, there are no entry

barriers as such. All the major players in the jute industry are reported to have planned fresh

investments, which will not be restricted to West Bengal. However, according to a section of the

industry, the jute sector has not grown enough to absorb such huge production capacities. It is more

likely that the new units will only replace some of the older ones. Currently, the overall capacity of

the jute industry is about 100,000 tonnes per day. The annual turnover is Rs 4,000 crore and there

are altogether 73 integrated jute mills, of which 59 are in West Bengal. Fresh capacity to the tune of

25,000 tonnes per day is being currently implemented, creating job opportunities for more than

25,000 people, both skilled and unskilled.

Substitutes

Each category of jute products faces a number of substitutes. The threat of substitutes is very large

because jute is mainly used as a fiber in the production of the end product and there are a number of

man made ad natural fibres that can act as very close substitutes. It is true that jute has a number of

IIM Calcutta Page 17 of 32

Jute Industry Analysis

characteristics, which should prompt its usage but lack of knowledge of its qualities works in its

disfavour. Looking at substitutes in its main categories:

Packaging purposes: Jute is a flexible packaging material. It faces being substituted by

other flexible packaging materials like plastic; nylon and other man made fibres and also

form non-flexible packaging materials – boxes, cartons, and aluminium. Apart from which

latest innovations like modified atmosphere packaging cans, which seal in the air to retain

freshness, or smart materials that can “breathe” selective gases and keep food unspoilt are

being introduced which pose a big threat to using jute as agro product packaging.

Textiles: Cotton is the closest substitute having the same “natural” appeal, which is the main

marketing plank of jute textiles. Considering that currently all over the world, there is an

over capacity of cotton production and falling demand, downward trend of cotton prices will

tend to lower demand for jute textiles. Besides in this area Indian jute faces stiff competition

from Bangladeshi jute – known for its superior quality. The range of colours the dull brown

of natural jute can be dyed into – not faced by synthetic materials, which are regularly what

is used, restricts Jute usage for furnishings.

Jute bags: Here substitutes come from three areas: a) Plastic – either very low cost or comes

free with purchases since it is more economical for companies to use plastic bags for

promotional purposes. b) Cloth bags c) Leather bags – makes a stronger fashion statement

than jute! Again since the leather industry is going through a slump downward price makes it

a lot more difficult to replace. Cotton and Leather are more the more regular mediums of

expression as far as fashion goes. Demand for jute from both textiles and bags has depended

on fads rather than sustainable trends.

Competition

Major Players in the industry (India)

The entire jute industry, which is geographically concentrated in West Bengal is dominated by a few

key players, as can be easily seen from Table 1.1. A brief introduction of the operations and major

strategies followed by these players is given below.

IIM Calcutta Page 18 of 32

Jute Industry Analysis

Table 1.1 Major Players

Based on turnover:

Company Name Turnover

Champdany Industries Ltd. 177.56

Cheviot Company Ltd. 131.70

National Jute Manufacturers Corporation Ltd. 125.72

Aekta Ltd. 113.54

Gloster Jute Mills Ltd. 90.62

Based on Market Capitalisation:

Company Name Turnover

Cheviot Company Ltd. 46.38

Champdany Industries Ltd. 24.14

Howrah Mills Company Ltd. 8.08

Aekta Ltd. 4.32

Gloster Jute Mills Ltd. 3.60

Champandy Industries Ltd.

This company has the highest turnover and operates the maximum number of plants i.e 8 in West

Bengal and 2 in Orrisa. It is looking to further expand through takeovers and acquisitions.

Champandy has recently diversified from raw jute and sackings only to production of more non-

standard jute products.

This company seems to be concentrating too much on scale and seems to be concentrating on

becoming the biggest player turnoverwise. However, it has the second lowest profit margin among

the top 5 players. It’s capacity utilization is the lowest at 62.53% in the last financial year. It also

suffers from very poor industrial relations and had to close it’s factory for as long as 7 months due to

a strike in 1996-97.

Cheviot Company Ltd.

As compared Champandy, Cheviot’s capacity is lower, but it’s utilization is the highest in the

industry. Cheviot is into 100% manufacture of finished goods. Recently it was plagued by power

problems and hence is vertically integrating into power generation to meet it’s captive demand. In

IIM Calcutta Page 19 of 32

Jute Industry Analysis

order to meet the low, cyclical demand for jute, Cheviot also plans to diversify into non-jute

products. It has the highest net profit margin in the industry of 13.45%

Gloster Jute Mills Ltd.

Gloster operates only 1 jute mill in West Bengal and compared to the other companies, focuses less

on exports. It is a 100% jute products company and has recently more up the value chain onto more

value-added jute products. It has a major focus on technology and strives to achieve productivity

improvements through better technology.

Aekta

This company , which is majority- owned by the Kanoria group, is also a 100% jute products

company. An interesting fact about this company is that it operates a plant in Gurgaon for

manufacture of it’s diversified jute products. No other jute mill has any factories in northern India.

This gives a signal of it’s focus on exports of diversified goods to a great extent. Hence , it’s

strategic stake and focus in the diversified jute-product industry seems to be high.

Howrah Mills

Howrah Mills produces both raw jute as well as a variety of jute goods. It produces yarn for internal

use and for sale . This mill was under the BIFR , but is now on the road to recovery. It has

undertaken large-scale retrenchment under BIFR protection. It is targeting growth through

diversification within jute as well as modernization. It is targeting newer products such as soil

savers, sorim cloth, export yarn, shopping bags, bleached and dyed hessian. A noteworthy fact is that

it has an extremely high debt-equity ratio of 1.4 . This is suprising given the fact that most of the

small players in the jute –industry are non-dividend paying, privately owned companies. Howrah

mills has also applied for ISO 9002 certification for it’s products with a view to building it’s brand

identity.

IIM Calcutta Page 20 of 32

Jute Industry Analysis

12. Competition Analysis

A detailed analysis of the competition between the players is given below.

Financial performance:

Leverage /D/E 0.6 0.13 0.38 0.3 1.4

Profitability

0.94% 13.45% 3.06% 0.62% 5.5%

/net profit

Gross profit

5.38% 18.79% 5.65% 3.6% 6.8%

margin

Current Ratio 2 2.87 1.95 1.4 1.45

ROE 2.8% 24.2% 16.51% 8.62% 5.26%

Identifying Strategic Groups along the following dimensions:

IIM Calcutta Page 21 of 32

Jute Industry Analysis

Parameter Champdany Cheviot Gloster Aekta Howrah Mills

High- jute, jute Plans to diversify High – variety of

High – jute, yarn, Variety of jute

Focus yarn, jute into non jute jute products for

products products

products areas export

Presence Production of Production of yarn

Power Concentrating on Only production

across the yarn +finished for internal use and

generation final goods of final goods

value chain goods sale

Capacity

62.53% 84.53% 76.78% 70.46% 67.65%

utilization

Production

61576 mt 48070 mt N.A 36661 mt N.A.

Capacity

Promoters Promoters

Promoters 33%

71.97% 57.82%

Stakeholders, FIIs 17%

FIIs 0.37% FIIs 10.7%

participation Public 3% N.A. N.A.

Public 22.94% Public 27.93%

by FIIs NRI & Corp.

NRI & Corp. NRI & Corp.

bodies 47%

bodies 4.74% bodies 3.58%

Continuing

Industrial Poor – several No serious

problems - 81 Layoffs of workers Retrenchment

Relations strikes problems

day lockouts

4 100% EOUs 1 large export Moderate - 30% Moderate- 30% of

Export/ Import Low exports

78% of sales oriented plant of revenue revenues

Productivity

Growth through Exports of Diversification

Improvements in increase thru

Growth Plans expansion and diversified jute within jute,

productivity technology ; value-

takeovers goods modernisation

add final goods

Loan -9.63 cr. Loan of 5.84 cr.

Borrowing Loan -36.39 cr. Loan of 5.4 cr, Loan of 13.14 cr.

Int. coverage = Int. coverage =

Capacity D/E ratio of 0.6 Int.coverage = 4.17 Int. coverage =2.01

69.09 3.61

Geographical 8 in W.B, 2 in 2 plants in W. 1 plant in West 1 in W.B, 1 in 1 plant in West

presence Orissa Bengal Bengal Gurgaon Bengal

Sackings –

Presence 60% value-add Sacking - Low Sacking –Low Raw jute +

Moderate value-

across products + 40% Value-add goods Value –add goods sackings + Value

add products-

categories jute & sackings – High – high add products

High

Low, private

Government Low, private Low, private

Company Low Low

involvement Company company

IIM Calcutta Page 22 of 32

Jute Industry Analysis

Jute Gloster

Cheviot

goods Aekta

Company Strategy:

Diversification into value-added jute products like jute bags, footwear etc. seems to be the profit

pool in this industry. As observed in the diagram above, the companies with the highest profitability

Categories

are the ones who operate entirely in the diversified jute goods market. Since production of raw jute

Champandy

Howrah Mills

is a commodity industry and prices are regulated there is not much differentiation between players.

But, in the production of value-added jute products, the major players are trying to differentiate

themselves from the rest either through

Small proving superior quality (ISO9002) or through technological

fragmented

players

superiority.Raw

However,

jute according to us there are 2 main issues that will have to be addressed by these

companies in the future:

Low High

Capacity Utilisation

1. Profit based on the parameters mentioned above (capacity utilization and diversification)

does not lead to sustainable competitive advantage as these can easily be imitated. Capacity

utilization in fact deals with operational efficiency and not with strategic positioning of a

firm. As shown by the data, firms like Howrah Mills which are diversifying into high-end

product and at the same time bringing in efficiency through layoffs and technological

improvements an easily pose a threat to Cheviot in the future.

IIM Calcutta Page 23 of 32

Jute Industry Analysis

2. Cartelisation to increase the generic demand for jute products may be a good option for the

existing players. This can be done through exhibitions, fairs etc.

14. Diversification

In order to enable jute-based products to make successful inroad into the textiles sector, jute has

been largely experimented with. In view of challenge faced from cheaper prices of synthetic

substitutes, more thrust has been given on diversification of jute products.

Major thrust areas of value-added diversified jute products include Jute Handlooms and Handicrafts,

Non-woven and Industrial Application, Jute Rigid Packaging, Decorative products and Geo-Jute etc.

15. Jute in Bangladesh

This is the traditional source of export earnings as well as one of the most important sectors in terms

of employment. However, competition from other countries, consumption substitutions with

synthetic products, and public sector management of many of the mills have all led to financial

problems in this sector. With advice and help from donor agencies, half of the public sector jute

mills were privatized in 1982 (Bhaskar and Khan, 1995). The government still has equity in over

three-quarters of the sector. After privatization, more manual labor was hired but output fell

steadily. Much of the decline in output since the 1980s was because of falling world demand.

Although jute manufactures still account for three-fourths of total jute exports, the proportion of raw

jute and jute manufactures in total exports has fallen from 68.4% in 1980 to 11% in 1995 (Rahman,

1997). The appreciation of the Taka against Asian competitors in the world market also had adverse

effects on output. More recently, the allowance of zero duty on machinery imports has helped jute

industries to re-orient themselves to some degree. The government has participated in a sectoral

adjustment scheme with the World Bank to close down a third of the public mills, downsize two

large mills, and privatize the remaining mills, but labor union and political opposition has led to the

cancellation of this program (The World Bank, 1999).

16. Future Strategy

IIM Calcutta Page 24 of 32

Jute Industry Analysis

At the margin, any growth in the jute industry will stem from growing exports. The top ten jute

importing countries across the world are Belgium , USA, Egypt, Turkey ,UK, Japan, Saudi Arabia,

Australia, Italy, and Syria

Jute Geo-Textiles

Geotextiles have seen unrivalled growth with a forecast by the United Nations International Trade

Center (UNITC) of 1,400 million m2 produced by the new millennium. Europe and North American

markets each account for 40% with the remaining 20% attributed to Japan, Asia and Australia. The

main applications are separators in earth works, drainage and linings as well as controlling soil

erosion and establishing plant growth.

As jute accounts for such a small proportion of geotextile use in the West there is enormous scope

for increased usage. Most land managers in Europe are generally unaware of the relevance of jute

products, as they consider textiles as the main output of the industry. Jute accounts for less than 1%

of total geotextile use, despite the technical advantages and low cost of jute geotextiles, which has

been demonstrated by research and the results of full-scale use. A promotion program that aims to

provide product information in readily useable form has been initiated by UNITC, UNDP and

JMDC.

Whilst the cost of geotextiles (selling in Europe for £ 0.40 to £ 0.80 per m2 ) is lower than synthetic

geotextiles ( £ 1.10 to £ 1.35 per m2 approx) and other natural fibre geotextiles (£ 0.75 to £ 2.00 per

m2) their usage is very low. S.K.Bhattacharya of the Indian Jute Mills Association stressed jute was

competitive on price, and other delegates commented that technical characteristics were also

superior to other materials in particular applications. Jute degrades in over 2 to 4 years, but this is

usually a sufficiently long period for vegetation growth to become established, and trials have shown

that degraded by-products are beneficial plants. Work is progressing to produce treated jute which

has a longer life before degradation.

IIM Calcutta Page 25 of 32

Jute Industry Analysis

Growing the domestic demand

The demand for jute is highly concentrated in West Bengal and the north east states – around the

regions where they are produced. In other parts of the country there is an exclusivity associated with

jute on account of a) its price b) availability only in high class fashion shops like Shopper’s stop or

Lifestyle, where the markup is more due to brand name rather than cost of the product itself. To

drive home this point a shopping bag which costs around Rs 55 – 100 in Kolkata costs anywhere

upwards of Rs.200 in the lifestyle shops in Bangalore. Making jute bags more available to the

consumer at prices closer to the production price will increase its overall usage

Changing lifestyles - GO GREEN !

Increasing environment consciousness and a perceptible change towards eco friendly goods both by

the general public and the corporations will increase the demand for jute products as compared to its

strongest non bio degradable substitutes. Also government regulations all over the world lean

towards promoting more eco clean products – supplying money for R&D purposes. Innovative uses

like jute based paper will expand usage of jute. Recognition of jute’s superior qualities as fibre has

been accruing because of research efforts in universities in the UK and the Untied States. Also the

UN has been funding a number of programs to research further uses of jute lending credibility to jute

as a substitute natural fibre.

IIM Calcutta Page 26 of 32

Jute Industry Analysis

APPENDIX 1

Indian Jute Industry – Facts at a glance

The Organized Sector

No of Jute Mills : 76

Annual Production : 1.6 Million MT

Workers Employed : 266 Thousand (direct & indirect)

Families dependant : 4 million household(direct & indirect)

Main Products Manufactured : Sacking, Hessian, Carpet Backing Cloth, Yarn, Food Grade

Products, Geo-textiles

The Informal Sector

Number of registered units : around 700 units

Total Employment : around 63000

Main Products Manufactured : Jute Bags, Jute Blended Fabrics, Jute Blended Carpets,

Giftware, Handicrafts, Decorative Articles

IIM Calcutta Page 27 of 32

Jute Industry Analysis

APPENDIX 2

Geographical distribution of jute production

Following map shows the various regions in which jute is grown in India.

IIM Calcutta Page 28 of 32

Jute Industry Analysis

APPENDIX 3

Evaluation of Champandy and Cheviot

Assumptions for valuation

1. Net profits have been discounted at cost of capital to find present value of the firm, since

details of the income statement and balance sheets were not readily available to calculate the

cash flows.

2. Betas of both companies have been obtained from data on www.insight.asianerc.com

3. Perpetual growth rates of 3% (inflation) have been applied to calculate the terminal value of

both companies.

4. Based on our competition analysis using the strategic dimensions, our assumption is the

Champandy will be able to make a profit of 1.5% in the near future.

5. Similarly, we assume that Cheviot, which is currently earning a profit of 13% will earn profit

of only 8% in the near future. This is because it’s competitive advantage, based on

diversification into jute products and operational efficiency will soon be imitated by other

firms (As can be seen from the plans for growth of the other mills)

Conclusions

Champandy: The stock has been valued at Rs.31.75. It is currently trading on the BSE at 40.45 and

NSE at 30.45

Cheviot: Cheviot, according to our valuation is valued at Rs.372. it has been valued on the BSE at

Rs. 152.8. This is because we have made optimistic forecast of sales and profits for Cheviot, based

on our analysis which states that in the near future, technological improvements and moving up the

value chain of jute –products will lead to increased profitability for a firm.

IIM Calcutta Page 29 of 32

Jute Industry Analysis

Raw Jute scenario: India

India extended all-out government support to farmers in providing fruit of research - HYV seeds

development, seed multiplication, preservation and distribution.

Indian jute mill owners pay, on the average, Rupees 450 per maund to growers of jute which

contributes to upliftment of farmers' economic condition and encourages them to go for jute

cultivation with enthusiasm. That is how, India has been able to increase jute acreage from about

8 lakh acre producing about 16 lakh bales of jute in 1947 when India was divided, jute fields

falling in East Pakistan. Now in about 35 lakh acres she is producing about 80 lakh of bales jute,

becoming almost independent of jute supplies from Bangladesh.

Bangladesh Raw jute scenario: Result of research done in Bangladesh Jute Research Institute for

development of raw jute production, has remained confined in the laboratory.

Governments of Bangladesh has not done anything ever in assisting farmers with multiplication

and distribution of HYV seeds. , Bangladesh market is now flooded with Indian seeds lowering

quality of Bangladesh jute. Cost of production of jute in the field is very high for farmers in

Bangladesh. Had jute been purchased from farmers during the harvest season and had the gang of

jute purchase officer, manager and CBA leaders not indulged in corrupt practices, jute cost for

mills would, at the maximum, be Tk. 450 per maund and farmers would get remunerative price of

Tk. 400 or more per maund.

Resultant effects of jute purchasing pattern followed in nationalised jute mills:

(i) Jute farmers becoming poorer getting less and less for their produce and are being discouraged

to go for jute cultivation.

As a result, jute acreage has come down from maximum of about lakh acres producing over 70

lakh bales down to minimum of about 15 lakh acres producing minimum of about 35 lakh bales

of jute, with fluctuations from year to year. When farmers get good price in one year, they grow

more next year and vice-versa.

(ii) The wind-fall profit earners are the middle men, such as farias, beparis and stockists, at the

cost of farmers and mills, mainly because government banks invariably fail to provide funds to

mills in June/July. Paradoxically, however, same banks, at government instructions, ultimately

advance funds to same jute mills for jute purchase in September, when jute is no longer with

farmers, but is with stockists. This happens every year.

(iii) Tk. 100 per maund ill-gotten gain against jute purchase is shared by mill manager, jute

purchase officer and CBA leaders, and a part is also siphoned up.

(iv) Cost of production of jute goods produced by jute mill is increased by about Tk. 5,000 per

ton, only on account of raw jute, but for which jute mills would have gone into profit.

Maintenance: Indian private jute mill owners have been very careful in regularly maintaining

IIM Calcutta Page 30 of 32

Jute Industry Analysis

their jute mill machinery which has enabled them to secure high-productivity efficiency from

their machines and workers, at 62 man-hours-ton.

Their jute mills are over hundred years old, on the average, but due to regular maintenance the

efficiency of their machinery is about twice more than that of poorly-maintained Bangladeshi

jute mills machinery, which, on an average, are only forty years old.

Almost entire money shown on mills maintenance account as expenditures for spare parts, oil etc.

are neither actually purchased nor used, and no maintenance is done in nationalised jute mills

resulting in reduced productivity of machines and workers.

Sales: Sales of all nationalized jute mills are centralized at corporation. They conduct 5 to 10 per

cent as state-to-state and bulk sales, often at discounted price.

The test of sales are conducted through export brokers in which case also 'discounts' are allowed

for the sake of 'competition' with local private mills and with imaginary Indian competitors.

All these 'discounts' are nothing but under-invoicing the sales, for personal benefit of sales

officers. The net result is that nationalized jute mills get sale proceeds at least 5 per cent lower

than ruling world price, as obtained by private owners.

Cost of producing one ton World ruling price and sale Profit/Loss sacking (jute bags) proceeds

per ton of sacking per ton of sacking

Indian Private Mills

a) Average cost of one ton of raw jute pur chased from farmers right in market reason: 26.5 mds

X Rupees 475 = Rupees 12,590/=

b) Average cost of wage of workers on 62 man-hours-ton basis = Rupees 930/

c) Other costs : Oil, starch, transportation maintenance, power, financing, overhead, etc. Rupees

6,370/=

Total Cost : Rupees 19,890/= per ton

Nationalised Mills of Bangladesh

a) Average cost of one ton raw jute, purchased from stockists after market season is over, 26.5

mds X Tk. 650/= Tk. 17,225/

b) Average cost of wage of workers on 150 man-hours-ton basis = Tk. 2,250/=

c) Other costs: Oil, starch, power, transportation, financing , maintenance, overhead, etc.

Tk. 7,500/=

IIM Calcutta Page 31 of 32

Jute Industry Analysis

Total Cost: Tk. 26,975 /= per ton

World Ruling Price Rupees 22,000/=

Sale proceeds : Rupees 22,000/=

World ruling price : Tk. 26,000/=

Actual sales proceeds : Tk. 24,500/=

Profit per ton: Rupees 2,110

Loss per ton : Tk. 2,475/=

///articles

// pape cuttings to be filed

photographs ??

IIM Calcutta Page 32 of 32

Potrebbero piacerti anche

- Lecture Notes 3Documento6 pagineLecture Notes 3Deon DombasNessuna valutazione finora

- What Needs To Be Done To Make Agriculture Profitable For More Farmers in IndiaDocumento10 pagineWhat Needs To Be Done To Make Agriculture Profitable For More Farmers in IndiaBellwetherSataraNessuna valutazione finora

- How marketing transformed rare pink diamonds into a coveted luxury brandDocumento20 pagineHow marketing transformed rare pink diamonds into a coveted luxury brandYahyaNessuna valutazione finora

- Bank Name and Code ListingDocumento4 pagineBank Name and Code ListingTanmoy HasanNessuna valutazione finora

- Rural Indebtedness in India-1Documento8 pagineRural Indebtedness in India-1HASHMI SUTARIYANessuna valutazione finora

- Increasing credit flow for agri allied sectorsDocumento23 pagineIncreasing credit flow for agri allied sectorschandraiva9820Nessuna valutazione finora

- Inplant Training.Documento8 pagineInplant Training.KhasimNessuna valutazione finora

- Consumer Behavior - Test Bank SchiffmanDocumento33 pagineConsumer Behavior - Test Bank SchiffmanEnsoyNessuna valutazione finora

- Kivuva-Effects of Outsourcing On Organizational Performance of Oil Marketing Companies in KenyaDocumento101 pagineKivuva-Effects of Outsourcing On Organizational Performance of Oil Marketing Companies in KenyaAmos Makori MaengweNessuna valutazione finora

- Iip June 2010Documento9 pagineIip June 2010kdasNessuna valutazione finora

- Study On Financial Position and Cash Management of Malco LTDDocumento59 pagineStudy On Financial Position and Cash Management of Malco LTDSyed FarhanNessuna valutazione finora

- Press Information Bureau Government of India New DelhiDocumento10 paginePress Information Bureau Government of India New DelhiKaushal MandaliaNessuna valutazione finora

- Production of PlywoodDocumento18 pagineProduction of PlywoodRv Pilongo67% (3)

- 3.0 Agricultural SectorDocumento29 pagine3.0 Agricultural SectorPei YuNessuna valutazione finora

- Profile On Embroidery ThreadDocumento15 pagineProfile On Embroidery ThreadPro IengNessuna valutazione finora

- 5 Revised FoundryDocumento26 pagine5 Revised FoundryFekadie TesfaNessuna valutazione finora

- Silk IndustryDocumento8 pagineSilk IndustryshashimvijayNessuna valutazione finora

- Facts About The Cotton Textile Industry of IndiaDocumento5 pagineFacts About The Cotton Textile Industry of IndianakkipooranNessuna valutazione finora

- Pakistan's Leather Industry Hindrances and Critical FactorsDocumento5 paginePakistan's Leather Industry Hindrances and Critical FactorsJairo NavarroNessuna valutazione finora

- 5 Revised FoundryDocumento26 pagine5 Revised FoundryFirezegi TkelehaymanotNessuna valutazione finora

- Textile Industry......Documento3 pagineTextile Industry......Divya ChawhanNessuna valutazione finora

- Productivity ImprovementDocumento27 pagineProductivity Improvementsathish kumarNessuna valutazione finora

- Sugar IndustriesDocumento6 pagineSugar IndustriesdonitamaediosanoNessuna valutazione finora

- API Sports Sarosh Ifrah NaveraDocumento28 pagineAPI Sports Sarosh Ifrah NaveraQazi Muhammad Adnan HyeNessuna valutazione finora

- Data Analysis and Interpretation of Cotton Textile IndustriesDocumento69 pagineData Analysis and Interpretation of Cotton Textile Industriesrohini soniNessuna valutazione finora

- Irc Full Paper Final Aye Aye Khin Up MDocumento16 pagineIrc Full Paper Final Aye Aye Khin Up MLong ThăngNessuna valutazione finora

- Proposal On - LEATHER SOLDocumento13 pagineProposal On - LEATHER SOLfdmnymk5tdNessuna valutazione finora

- Profile On PlywoodDocumento15 pagineProfile On Plywoodfdmnymk5tdNessuna valutazione finora

- Proposal On HINGES ProductionDocumento14 pagineProposal On HINGES Productionfdmnymk5tdNessuna valutazione finora

- Textile Industry - Overview: Ministry of Textile Fact SheetDocumento7 pagineTextile Industry - Overview: Ministry of Textile Fact SheetSylvia GraceNessuna valutazione finora

- Growth and Prospects of Textile Industry in India: Dr. R. ElangovanDocumento6 pagineGrowth and Prospects of Textile Industry in India: Dr. R. ElangovanRitika KumariNessuna valutazione finora

- Indian GDP Sectoral Shares 1999-2019Documento1 paginaIndian GDP Sectoral Shares 1999-2019Syed Ashar ShahidNessuna valutazione finora

- Malaysia's Agricultural Sector: Growth, Production and Policy TrendsDocumento58 pagineMalaysia's Agricultural Sector: Growth, Production and Policy TrendsNURUL EZZAH BINTI ISMAILNessuna valutazione finora

- 1 Laddawan JEMES Checked by Issara 13 07 21Documento18 pagine1 Laddawan JEMES Checked by Issara 13 07 21trader123Nessuna valutazione finora

- India Textile Industry: A $115B Global Leader by 2012Documento3 pagineIndia Textile Industry: A $115B Global Leader by 2012Niladri SahaNessuna valutazione finora

- Saffron PPP 1Documento9 pagineSaffron PPP 1sam12900Nessuna valutazione finora

- Various Categories: Year Area in Lakh Hectares Production in Lakh Bales of 170 Kgs Yield Kgs Per HectareDocumento5 pagineVarious Categories: Year Area in Lakh Hectares Production in Lakh Bales of 170 Kgs Yield Kgs Per Hectareamninder69Nessuna valutazione finora

- Loans of The BFIs SectorwiseDocumento126 pagineLoans of The BFIs Sectorwisebiratgiri00Nessuna valutazione finora

- India Petroleum StatisticsDocumento10 pagineIndia Petroleum StatisticsAjay GuptaNessuna valutazione finora

- Coffee Export Data From Economic Survey of IndiaDocumento2 pagineCoffee Export Data From Economic Survey of IndiaPrem BhagwatNessuna valutazione finora

- Varieties of RiceDocumento19 pagineVarieties of Riceritesh225Nessuna valutazione finora

- Group No 1 MEE Term Report Section BDocumento15 pagineGroup No 1 MEE Term Report Section BPraveen KhannaNessuna valutazione finora

- Demand Forecast of Fertilizer in PakistanDocumento10 pagineDemand Forecast of Fertilizer in PakistanmadihashkhNessuna valutazione finora

- Profile On Small Scale Paper: MakingDocumento17 pagineProfile On Small Scale Paper: MakingSISAYNessuna valutazione finora

- An Introduction To Pakistan's Sugar Industry: TH TH THDocumento12 pagineAn Introduction To Pakistan's Sugar Industry: TH TH THSennen DesouzaNessuna valutazione finora

- 24.1growth Performance of Manufacturing Sector: Industrial Sector in India and Economic LiberalizationDocumento5 pagine24.1growth Performance of Manufacturing Sector: Industrial Sector in India and Economic LiberalizationAadhityaNessuna valutazione finora

- Jin Shuren: 1. The Present Situation of Chinese Modified StarchDocumento13 pagineJin Shuren: 1. The Present Situation of Chinese Modified StarchTatiana AlvaradoNessuna valutazione finora

- Jute IndustryDocumento10 pagineJute IndustryMANJIT KALHANessuna valutazione finora

- Welding Machine Production PlantDocumento26 pagineWelding Machine Production PlantJohn100% (1)

- Project Profile On The Establishment of Nails Producing PlantDocumento28 pagineProject Profile On The Establishment of Nails Producing PlantAwetahegn HagosNessuna valutazione finora

- Previous Next: Agriculture and Consumer Protection More DetailsDocumento3 paginePrevious Next: Agriculture and Consumer Protection More DetailsRevappa YeddeNessuna valutazione finora

- Biscuit ProposalDocumento18 pagineBiscuit Proposalfdmnymk5tdNessuna valutazione finora

- APGENCO FlyashDocumento37 pagineAPGENCO Flyashlokesh0144Nessuna valutazione finora

- SITRAFocus ListDocumento4 pagineSITRAFocus ListAnonymous Pt7NHkat9Nessuna valutazione finora

- Modern Ginning and Pressing UnitDocumento8 pagineModern Ginning and Pressing UnitHiteshGondalia100% (3)

- Cotton YarnDocumento26 pagineCotton YarnAbebaw SirajNessuna valutazione finora

- Table 1aDocumento3 pagineTable 1aRohit GuptaNessuna valutazione finora

- Bahir Dar Textile Share CompanyDocumento5 pagineBahir Dar Textile Share CompanyBedilu Liul100% (1)

- Proposal On Wood ScrewDocumento15 pagineProposal On Wood Screwfdmnymk5tdNessuna valutazione finora

- Chap 73Documento2 pagineChap 73atrigaurav19885280Nessuna valutazione finora

- Project Report On Recruitment and Selection by PreetiDocumento85 pagineProject Report On Recruitment and Selection by Preetipritothegreat86% (7)

- Isuzu Libro 2 PDFDocumento802 pagineIsuzu Libro 2 PDFjulia_23_22100% (2)

- CMC Internship ReportDocumento62 pagineCMC Internship ReportDipendra Singh50% (2)

- BBEK4203 Principles of MacroeconomicsDocumento20 pagineBBEK4203 Principles of MacroeconomicskiranaomomNessuna valutazione finora

- BREAKING NEWS ROCKS SMALL TOWNDocumento119 pagineBREAKING NEWS ROCKS SMALL TOWNКостя НеклюдовNessuna valutazione finora

- Brightspot Training ManualDocumento97 pagineBrightspot Training ManualWCPO 9 NewsNessuna valutazione finora

- Crack Detection & RepairDocumento5 pagineCrack Detection & RepairHaftay100% (1)

- BAMBUDocumento401 pagineBAMBUputulNessuna valutazione finora

- Marguerite Musica, Mezzo Soprano - Upcoming Roles, Training & MoreDocumento1 paginaMarguerite Musica, Mezzo Soprano - Upcoming Roles, Training & MoreHaley CoxNessuna valutazione finora

- Service 31200800 11-13-13 CE-AUS English PDFDocumento262 pagineService 31200800 11-13-13 CE-AUS English PDFduongpn100% (1)

- Visual Design-Composition and Layout PrinciplesDocumento5 pagineVisual Design-Composition and Layout PrinciplesRadyNessuna valutazione finora

- DRS User ManualDocumento52 pagineDRS User Manualwmp8611024213100% (1)

- Segment Reporting NotesDocumento2 pagineSegment Reporting NotesAshis Kumar MuduliNessuna valutazione finora

- Pondicherry University: Examination Application FormDocumento2 paginePondicherry University: Examination Application FormrahulnkrNessuna valutazione finora

- Set Up A Mail Server On LinuxDocumento56 pagineSet Up A Mail Server On Linuxammurasikan6477Nessuna valutazione finora

- Catalogue: See Colour in A Whole New LightDocumento17 pagineCatalogue: See Colour in A Whole New LightManuel AguilarNessuna valutazione finora

- IIM Kozhikode Senior Management ProgrammeDocumento14 pagineIIM Kozhikode Senior Management ProgrammeGupta KanNessuna valutazione finora

- Brother Electric Sewing xr9550prwDocumento2 pagineBrother Electric Sewing xr9550prwVenkatNessuna valutazione finora

- Natural DyeDocumento21 pagineNatural Dyesanjay shettiNessuna valutazione finora

- Playlist ArchacDocumento30 paginePlaylist ArchacMartin JánošíkNessuna valutazione finora

- Web TPI MDF-TC-2016-084 Final ReportDocumento35 pagineWeb TPI MDF-TC-2016-084 Final ReportKrishnaNessuna valutazione finora

- Jameson 2000 The Journal of Prosthetic DentistryDocumento4 pagineJameson 2000 The Journal of Prosthetic DentistryKarthikmds ElangovanNessuna valutazione finora

- Form-Q - Application For Quarry PermitDocumento1 paginaForm-Q - Application For Quarry PermitDebasish PradhanNessuna valutazione finora

- Check List: For Processing of RA Bills @Documento9 pagineCheck List: For Processing of RA Bills @pvnNessuna valutazione finora

- Kantian vs Utilitarian Ethics in BusinessDocumento2 pagineKantian vs Utilitarian Ethics in BusinessChris Connors67% (3)

- Admissions To MUNDocumento2 pagineAdmissions To MUNImran KamalNessuna valutazione finora

- API Standard 520: Sizing, Selection, and Installation of Pressure-Relieving Devices, Part II-InstallationDocumento4 pagineAPI Standard 520: Sizing, Selection, and Installation of Pressure-Relieving Devices, Part II-InstallationThế Sự PhạmNessuna valutazione finora

- PAS Install Lab Guide - v11.2Documento145 paginePAS Install Lab Guide - v11.2Muhammad Irfan Efendi SinulinggaNessuna valutazione finora

- Difference Between Offer and Invitation To TreatDocumento5 pagineDifference Between Offer and Invitation To TreatBrian Okuku Owinoh100% (2)

- Mipspro™ Assembly Language Programmer'S Guide: Document Number 007-2418-001Documento129 pagineMipspro™ Assembly Language Programmer'S Guide: Document Number 007-2418-001mr_silencioNessuna valutazione finora