Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Factors Affecting Corporate Governance and Audit Committees - EXECUTIVE SUMMARY

Caricato da

dm2jkDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Factors Affecting Corporate Governance and Audit Committees - EXECUTIVE SUMMARY

Caricato da

dm2jkCopyright:

Formati disponibili

Factors Affecting Corporate Governance and Audit Committees in Selected Countries

©2005 The Institute of Internal Auditors Research Foundation

EXECUTIVE SUMMARY

In recent years the issue of corporate governance and committees related to it and their impacts on

corporate performance have continued to gain widespread prominence in the capital market economy.

The expectations of stakeholders with respect to the corporate governance process have never

been higher, and scrutiny by regulators and investors never more stringent. Attention has turned to

not only the effectiveness of corporate governance and the boards of directors, but also to those

committees to which responsibility and accountability have been delegated by the corporate decision-

making center as it fulfills its fiduciary obligations.

Corporate governance is the system by which organizations are governed and controlled. It is

concerned with the ways in which corporations are governed generally and in particular with the

relationship between the management of an organization and its shareholders. In this respect,

several control mechanisms, often in the form of committees, are implemented within the organization

in order to monitor its management activities and functioning. As a part of critical corporate

governance mechanisms, the audit committee has an oversight function dealing with different

managerial activities, corporate reporting, and auditing. This oversight includes ensuring the quality

of accounting policies, internal controls, and independent auditors to enhance control mechanisms,

anticipate financial risks, and promote accurate, transparent, and timely disclosure of corporate

information to various users of the organization’s financial information.

In most developed capital markets the debate about the improvement of corporate governance

structures has underlined the importance of an independent oversight board. The financial crisis of

recent years demonstrates the importance of this oversight board in the framework of the audit

committee. Following these events, regulatory and professional bodies pushed for the universal

adoption of audit committees on the basis of the assertions that these committees could be effective.

This requires that the necessary measures will be taken to assure their independence and objectivity.

The actions undertaken should respond to users’ criticisms of the lack of confidence in transparency

and quality of financial reporting as well as the inability of external auditors to provide the safeguards

expected.

However, the implementation of corporate governance framework and associated committees

varies from one country to another. While the general framework is partly set by law and partly by

the various agents within the organization, the environment and the regulatory bodies in each

country play a central role in this process. Corporate governance and the audit committee, like any

other organizational structure, are significantly affected by the legal, institutional, financial, cultural,

and political circumstances in each country.

The Institute of Internal Auditors Research Foundation

Factors Affecting Corporate Governance and Audit Committees in Selected Countries

©2005 The Institute of Internal Auditors Research Foundation

In contrast to corporate governance literature in the United States of America (USA) — and to

some extent the United Kingdom (UK) — relatively little is known about particular governance

practices in other countries. A country’s legal and economic institutions are essential for providing

good corporate governance, since they create a framework for forming contracts and enforcing

them. Besides that, currently there are some major differences within the European countries in

the field of governance. Therefore the research in international corporate governance could also

fruitfully examine individual mechanisms implemented in major capital markets.

Both in the USA and European Union, strong actions have been undertaken to enhance the public

confidence in the area of governance. This has provided the regulators the central oversight role in

capital markets. In recent years, several changes regarding the environmental factors have been

put in place. These consist of increasing legal protection of investor rights and foreign shareholdings

in capital markets. The latter can be related to facilities offered by market regulators for multiple

listings.

This study attempts to identify and understand the specific characteristics of the structure of

corporate governance and audit committee systems in general, and the audit committee and internal

and external audit functions as implemented in selected countries. In this respect, five countries

(France, Germany, the Netherlands, the United Kingdom, and the United States) among the most

developed nations have been selected. The study attempts to identify the significant differences in

corporate governance and their impacts on corporate structures in these countries. This has been

achieved with a detailed analysis of the current systems implemented in these countries, their

historical backgrounds, the changes made, and the reasons for them.

Chapter 1 provides an overview of corporate governance and audit committees. The chapter

discusses the importance of the theoretical foundations of this field with an emphasis on the economics

of corporate governance. The discussion on the audit committee and its relationship with other

control instruments demonstrates the outstanding place of this structure, particularly within publicly

listed companies. This explains why setting up audit committees within publicly traded companies,

despite there being only mitigated empirical evidence that they are effective in strengthening corporate

governance, has nonetheless become widespread. The discussion in the chapter also indicates

that, as expected, increased independent director experience and greater audit knowledge are

associated with audit committee member support for high audit quality.

Chapter 2 discusses the factors affecting the efficiency and effectiveness of corporate governance

and the audit committee. The study tries to identify the environmental (legal, institutional, financial,

economic, and social) as well as firm-specific factors affecting the current corporate governance

and the audit committee. It highlights the importance of such factors in selected countries.

The Institute of Internal Auditors Research Foundation

Factors Affecting Corporate Governance and Audit Committees in Selected Countries

©2005 The Institute of Internal Auditors Research Foundation

Chapter 3 reviews the major features of corporate governance and audit committees in France,

Germany, the Netherlands, the UK, and the USA. The choice of countries has been made on the

basis of their diversity and differences as well as their representative characteristics and positions

as developed capital markets. The study attempts to identify and understand the specific

characteristics of the structure of corporate governance and audit committees as implemented in

these countries.

This study considers corporate governance issues from an international perspective. The

internationalization and increasingly interlocked nature of global economies require a thorough

understanding of corporate structure at an international level, enabling multinational corporations

to function better. The major objective of the study is to contribute to a better comprehension of

environmental factors and the levels of risk with which multinational firms are faced. It has been

designed to provide up-to-date information about current and proposed corporate governance and

audit committee rules and practices, comparing and contrasting these in selected countries.

The Institute of Internal Auditors Research Foundation

Potrebbero piacerti anche

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Sample Income Tax FormDocumento8 pagineSample Income Tax FormSadav ImtiazNessuna valutazione finora

- Types of SamplingDocumento16 pagineTypes of SamplingNidhin NalinamNessuna valutazione finora

- Role of QA&QC in Manufacturing - PresentationDocumento32 pagineRole of QA&QC in Manufacturing - Presentationimran jamilNessuna valutazione finora

- Strategic Management Model ExamDocumento82 pagineStrategic Management Model ExamSidhu Asesino86% (7)

- Impact of Information Systems On Organizational Structure 1Documento4 pagineImpact of Information Systems On Organizational Structure 1kavees.20231704Nessuna valutazione finora

- Special Consideration For The Sole Practitioner Operating As A Management ConsultantDocumento3 pagineSpecial Consideration For The Sole Practitioner Operating As A Management ConsultantJessyNessuna valutazione finora

- BA5025-Logistics ManagementDocumento12 pagineBA5025-Logistics Managementjayasree.krishnan7785Nessuna valutazione finora

- DO-178B Compliance: Turn An Overhead Expense Into A Competitive AdvantageDocumento12 pagineDO-178B Compliance: Turn An Overhead Expense Into A Competitive Advantagedamianpri84Nessuna valutazione finora

- Invoice INV-0030Documento1 paginaInvoice INV-0030Threshing FlowNessuna valutazione finora

- 3 Creating Customer Value & Customer RelationshipsDocumento35 pagine3 Creating Customer Value & Customer RelationshipsFaryal MasoodNessuna valutazione finora

- Excel Exam 01Documento4 pagineExcel Exam 01redouane50% (2)

- BBA in Accounting 1Documento7 pagineBBA in Accounting 1NomanNessuna valutazione finora

- CB Consumer MovementDocumento11 pagineCB Consumer Movementbhavani33% (3)

- PAMM Guide PDFDocumento4 paginePAMM Guide PDFDiego MoraniNessuna valutazione finora

- MCS in Service OrganizationDocumento7 pagineMCS in Service OrganizationNEON29100% (1)

- Rutgers Newark Course Schedule Spring 2018Documento2 pagineRutgers Newark Course Schedule Spring 2018abdulrehman786Nessuna valutazione finora

- Quality ImprovementDocumento5 pagineQuality Improvementzul0867Nessuna valutazione finora

- Service Failure at Axis Bank (Case Study)Documento11 pagineService Failure at Axis Bank (Case Study)Snehil Mishra0% (1)

- Form I National Cadet Corps SENIOR DIVISION/WING ENROLMENT FORM (See Rules 7 and 11 of NCC Act 1948)Documento8 pagineForm I National Cadet Corps SENIOR DIVISION/WING ENROLMENT FORM (See Rules 7 and 11 of NCC Act 1948)Suresh Sankara NarayananNessuna valutazione finora

- Law of Contract: Prepared ByDocumento50 pagineLaw of Contract: Prepared Bymusbri mohamed98% (44)

- HR EssentialsDocumento7 pagineHR EssentialsAman BansalNessuna valutazione finora

- Learnforexsummary Trading Support ResistanceDocumento10 pagineLearnforexsummary Trading Support Resistancelewgraves33Nessuna valutazione finora

- Hall Mark ScamDocumento4 pagineHall Mark ScamSharika NahidNessuna valutazione finora

- Barclays Capital Global Outlook 122009Documento83 pagineBarclays Capital Global Outlook 122009Mohamed Saber MohamedNessuna valutazione finora

- Managing The Operation FunctionsDocumento13 pagineManaging The Operation FunctionsJoseph ObraNessuna valutazione finora

- Financial Management: Week 10Documento10 pagineFinancial Management: Week 10sanjeev parajuliNessuna valutazione finora

- Affidavit of NonliabilityDocumento3 pagineAffidavit of Nonliabilityzia_ghiasiNessuna valutazione finora

- Final Brand Building ProjectDocumento14 pagineFinal Brand Building ProjectSarah TantrayNessuna valutazione finora

- Tak Mungkin MencariDocumento3 pagineTak Mungkin Mencarishesqa_903684Nessuna valutazione finora

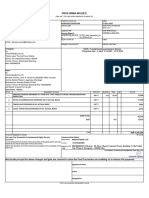

- Service Proforma Invoice - ACCEPTANCE Tata Projects-020Documento1 paginaService Proforma Invoice - ACCEPTANCE Tata Projects-020maneesh bhardwajNessuna valutazione finora