Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Caricato da

Shyam SunderDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)

Caricato da

Shyam SunderCopyright:

Formati disponibili

INTERACTIVE FINANCIAL SERVICES LIMITED

Date: May 30, 2016.

To,

BSE

To,

Limited

Ahmedabad Stock Exchange Limited

Phirozef eejeebhoy Towers,

Dalal Street,

Mumbai - 400 001.

Kamdhenu Complex,

Opp. Sahajanand College,

Panjrapole Ahmedabad - 380 015.

Dear Sir,

Sub:Submission of Audited Financial Result of the Company for the quarter and

year ended on March3l,2OL6 along with Audit Report and Form A.

Ref: Interactive Financial Services Limited(Security ld/Code: IFINSER/S39692)

In reference to captioned subject and pursuant to Regulation 33(3)(d) of the SEBI

(Listing Obligations and Disclosure Requirements) Regulations, 20!5, we are hereby

submitting the followings:

1. Audited Financial Results for the quarter and year ended on March 3L,20L6.

2. Audit Report on the Audited Financial Results.

3. Form A (For Audit Report with unmodified opinion).

Kindly take the same on your record and disseminate the same on your website and

oblige us.

Kindly take the same on your record and oblige us.

Thanking You,

Yours faithfully,

For, Interactive Financial Services Limited

f .M.Stn^A

Paresh Shah

Company Secretary

liance Officer

4, Saujanya Row House, Nr. Darpan Six Roads, Navrangpura, Ahmedabad-L4,Tel. No.079-26427428

Cl N No. 165910GJ 1994P1C023393, Email:ashokvithlani@polad.net

INTERACTIVE FINANCIAL SERVICES LIMITED

CIN: 1659 1 0G1199 4PLC023393

Registered Office: 4, Saujanya Raw Houses, Near Darpan Six Roads, Navrangpura, Ahmedabad - 380 009, Gujarat

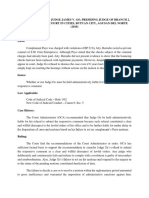

Jfitfement or Jf,anoalone AUqrf,eO rrnanclal KeSUIIS tof Ine quamef ano Yeaf ended On lUarch 31.,2016

IUARTER ENDEI

Particulars

Defe ofstrrf

Date ofend

A

B

ofrenortino nrrarfor

ofrenortina ouarter

Whether results are audited or unaudited

Nature ofreport standalone or consolidated

YEAR ENDED

3r/03/20ts

ott04t20t4

3tl03/201s

3L/03/201.6

3U12l2O1S

3L/03l2O1,S

31/O3/2016

ortortz0t6

oLtl0t20rs

3ttL2t20ts

ottoLt20rs

ott04t20ts

3110312015

Audited

3t/0312016

Audited

Audited

Standalone

Standalone

Standalone

3ll03l2t1(r

Audited

Unaudited

Standalone

Standalone

Part I

Revenue From Ooerations

Net sales or Revenue from Operations

Other operating revenues

Total Revenue from oDerations

(netl

27892LL

563043

6665t

854

588041

3504

2855869

s63497

591545

4635771

2279479

6928t

4705062

2243429

435C

lrpenses

Ia Cost of materials consumed

fb' Purchases of stock-in-trade

Lnanges ln lnventones ot nntshed goocls, worl(-rn-progress and

(c

stock-in-trade

rd' Employee benefi t expense

(e Depreciation and amortisation expense

(f 0ther Exoenses

268492

237758

74t!

746C

L97604L

892262

t7BL4S9

2L3L

120095

96693(

29822

5005196

594264

2260949

20574tL

359984

6001954

L495047

594880

(L,493,5r4)

23lS6l

(L,296,A921

7aB7A2

594880

1854(

(1,493,514)

23tS6l

\296,A921

7AA7A2

47L74

L76369

290677

547271

71342(

(1,540,688)

55192

f1,587,5681

24t5tl

7t3426

f1,s40,688.|

55192

(1,587,5681

247511

Net profit Oossl from ordinarv activities after tax

Extraordinary items fnet oftax Rs. expense

Lakhs]

7t3426

t1,540,688.|

ssr92

(1,s87,568]

24tStl

Net Profit/Loss for the oeriod from Continuine Ooerations

Profit floss) from Discontinuing Operations before tax

Iax Expenses of Discontinuins Operations

713426

(1,540,688.|

55192

(1,s87,568.]

24tSLl

Total expenses

B52I

Profit (loss) from operations before other income, finance

costs and exceptional items

4

277533

Other income

Profit (loss) from ordinary activates before finance costs

and exceotional items

Finance costs

-1

Profit (loss) from ordinary activities after finance costs bul

before exceotional items

Prior period ltem before tax

ExceDtional items

10

Profit flossl from ordinarv activities before tax

l ax ExDense

12

13

t4

15

L6

17

Net Profit (Loss) from Discontinuins Operartions after tax

Net Profit flossl for neriod

18

22

Paid-up equiW share caDital

iace value ot eoulw snare caDltal I Der Snare

ileserves excluding revaluation reserve

Earnrngs per snare

24

2S

Part

ssLgz

(1,587,5681

24tS1l

30131000

I

[Not Annualized for the quarter ended)

Eaminss oer share before extraordinarv items

Jasic earnings per share before extraordinary items

Diluted earninss Der share before extraordinary items

tl Earninss ner share after extraordinarv items

Basic earnings per share after extraordinary items

trluteq earnrngs per snare aner extraorornary ltems

Rs.

10/-

30131000

Rs.

10/-

30r.3100c

Rs.

10/-

s013 1000

Rs.1.0/Rs.

(877,307

30 13 100C

10/7t0,277

0.24

0.24

t0.51

t0.51

0.02

0.02

(0.53.)

U.5J

0.08

0.08

0.24

0.24

t0.51

f0.51

0.02

0.02

0.53

0.53

0.08

0.08

ll

Public share holding labstractl

Number ofsharesofheld bv public

Percentage of shareholding held by public

(1,540,6881

Details ofeouitv share caDital

??

z6

713426

2,4L5,950

80.18

2,415,95C

80.18

1.607.500

53.35

Promoters and Dromoters srouD shareholdine labstractl

(al uetalls ol pledged or encumbereo snares Iabstxactl

Pledeed/Encumbered - Number of shares

Pleclged/Encumbered - Percentage ot shares (as a y0 ot the total

shareholdine of oromoter and oromoter sroupl

s$tt

2,415.950

80.18

1,607,500

53.35

Registered

INTERACTIVE FINANCIAL SERVICES LIMITED

CIN: L659 1 0G1799 4PLC023393

Office: 4, Saujanya Raw Houses, Near Darpan Six Roads, Navrangpura, Ahmedabad

JurEemenf, or Jranoarone Auorfeq rrnanclar Kesutf,s ror tne

Particulars

Dtte ofstert ofrenortins (|lertel

Date ofend ofreDortins ouartel

Whether results are audited or unaudited

Nature ofreoort standalone or consolidated

A

B

c

D

tbl

QUARTERENDED

2

3

51, 2o16

YEAR ENDED

31./03/201.6

3t/12l2o1s

3r/03lz0rs

3r/03/2OL6

3L/03l2OrS

otlot12016

ollrot20rs

ollorl20ts

otIo4t20ts

3tto3t20t6

3tt12t20rs

31t03t2015

3110312016

ott04t2014

37 tO"t20ts

Audited

Unaudited

Audited

Audited

Audited

Standalone

Standalone

Standalone

Standalone

Standalone

rteogeo/tsncumDereo - Hercentage oI snares (as a 7o oI tne tota

share capital ofthe company)

Details of non-encumbered shares labstractl

Non-encumbered - Number ofShares

Non-encumbered - Percentage of shares (as a o/o of the total

shareholding of oromoter and Dromoter srouD)

Non-encumbered - Percentage of shares (as a o/o of the total

share caoital of the comoanvl

B

lnvestor ComDlaints fFor the quarter ended on March 31, 2016)

Pencling at the beginning of the quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end ofthe quarter

Notes:1-

- 380 009, Gujarat

uuaner ano Year enoeo on Marcn

597150

597 150

1405600

597150

1405600

100.00

100.00

100.00

100.0c

1.00.00

t9.82

L9.82

46.65

L9.82

46.65

The above results were reviewed by the Audit commttee and subsequently taken on record by the Board of Directors of the company at its meetin!

held on Mav 30, 2016. The statutorv auditor ofthe companv have carried out Limited Review ofthe above Financial Results.

'l'he uomDanv has onlv one sesment ot activlw.

The prior fisures have been resrouped and reclassified wherever necessary,

Ine ngures or ra$ quaner are tne Darancrng ngures DeEween auolteo ngures rn respec or tne ruu nnancrat year ano me puDnsneo year to qat(

4

fisures uoto the Third Ouarter ofthe current Financial Year.

Date:- May 30,2016

Place:- Ahmedabad

For, Interactive Financial Services Limited

s$$$AshokVithalani

Managing Director

DIN:00023247

M.R.PANDHI & ASSOCIATES

CHARTERED ACCOUNTANTS

101, Panchdeep Complex, Mayur Colony, Nr. Mithakhali Six Roads, Navrangpura, Ahmedabad-38O 009

Phones: (079) 26565949 c 26420994 o e-mail: mrpandhi@gnail.com

Auditor's Report on Ouarterlv Financial Results and Year to Date Results of the Companv

Pursuant to the Resulation 33 of the SEBI (Listins Oblieations and Disclosure

Req

uirements) Resulations. 2015

To,

The Board of Directors

of

Interactive Financial Services Ltd.

We have audited the quarterly financial results of Interactive Financial Services Ltd. ("the

company") for the quarter ended 31" March, 2016 and the year to date results for the year ended

3l't March, 2016 attached herewith, being submitted by the company pursuant to the requirement

of Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations,

2015. These quarterly financial results as well as the year to date financial results have been

prepared on the basis of the related financial statements, which are the responsibility of the

company's management. Our responsibility is to express an opinion on these financial results

based on our audit of such financial statements, which have been prepared in accordance with the

recognition and measurement principles laid down in Accounting standard prescribed under

Section 133 of the Companies Act, 2013 as applicable read with relevant rules issued there

under; or by the Institute of Chartered Accountants of India, as applicable and other accounting

principles generally accepted in India.

We conducted our audit in accordance with the auditing standards generally accepted in India.

Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial results are free of material misstatement(s). An audit includes examining,

on a test basis, evidence supporting the amounts disclosed as financial results. An audit also

includes assessing the accounting principles used and significant estimates made by

management.

An audit involves performing procedures to obtain audit evidence about the amounts and the

disclosures in the statements. The procedures selected depend on the auditor's judgment,

including the assessment of the risks of the material misstatements of the Statement, whether due

to fraud or error. In making those risk assessments, the auditor considers internal control relevant

to the Company's preparation and fair presentation of the Statements in order to design audit

procedures that appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Company's internal control. An audit also includes evaluating

the appropriateness of the accounting policies used and the reasonableness of the accounting

estimates made by the Management, as well as evaluating the overall presentation of the

Statement.

nr-F\$

rRN-11?rt')\l|

i[otiintt

'lo-

t,'''',].,f,

lbt";z

,/

We believe that the audit evidence, we have obtained is sufficient and appropriate to provide a

basis for our audit opinion.

In our opinion and to the best of our information and according to the explanations given to us

well as the year to date results:

these quarterly financial results as

(i) are presented in accordance with the requirements of Regulation 33 of the SEBI (Listing

Obligations and Disclosure Requirements) Regulations,20l5 in this regard; and

(ii) give a true and fair view of the net profit and other financial information for the quarter

3l't March, 2016 as well as the year to date results for the year ended 3l't March, 2016

ended

For, M.R. Pandhi and Associates

Chartered Accountants

Firm Registration No. 112360W

Place: Ahmedabad

Date:

3010512016

:( :lll;ll,lli'lu

Nw

N.R Pandit

(Partner)

Membership No: 033436

INTERACTIVE FINANCIAT SERVICES

LIMITED

May 30,2016

FORM A

(For audit report with unmodified opinion)

[Pursuant to Regulation 33 of SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 20151

2.

Name of the company

lnteractive Financial Services Limited

Annual financial statements for the year

March 31.2016

ended

J.

Type of Audit observation

Un-modified

4.

Frequency of observation

Not Applicable

For, Interactive Financial Services Limited

For. Interactive Financial Services

Limited

\$$$"

Ashok Vithalani

Managing Director

DIN:00023247

For, Interactive Financial Services Limited

^w

Chairman - Audit Committde

DIN:02510845

Chief Financial Offrcer

For, M.R. Pandhi & Associates

Chartered Accountants

tr-P-Y-

N.R. Pandit

Partner

Membership No.033436

FRN No.l12360W

Roads,.Navranspura, nhmedabad_14,

l;,illl.l[ji]i?,ir,":,y^o^Tt:"_rix

cl N No. L5s910GJ 1994p1c023393, Emair:ashokvithrani@

poiad.net

rel. No.07e_264 27428

Potrebbero piacerti anche

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- PDF Processed With Cutepdf Evaluation EditionDocumento3 paginePDF Processed With Cutepdf Evaluation EditionShyam SunderNessuna valutazione finora

- Standalone Financial Results For March 31, 2016 (Result)Documento11 pagineStandalone Financial Results For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results For September 30, 2016 (Result)Documento3 pagineStandalone Financial Results For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Documento3 pagineStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNessuna valutazione finora

- Investor Presentation For December 31, 2016 (Company Update)Documento27 pagineInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderNessuna valutazione finora

- Transcript of The Investors / Analysts Con Call (Company Update)Documento15 pagineTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderNessuna valutazione finora

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Documento4 pagineStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Equitable PCI Bank v. NG Sheung NgorDocumento2 pagineEquitable PCI Bank v. NG Sheung Ngorcarmelafojas100% (3)

- Diesel Road RollerDocumento2 pagineDiesel Road Rollerinaka yepNessuna valutazione finora

- Anticipation GuideDocumento1 paginaAnticipation Guideapi-259906298Nessuna valutazione finora

- Standards of Auditing NotesDocumento101 pagineStandards of Auditing NotesRocky Rk100% (4)

- Quote Identification For To Kill A MockingbirdDocumento2 pagineQuote Identification For To Kill A MockingbirdJacjac BattsNessuna valutazione finora

- Chap 19Documento32 pagineChap 19api-240662953Nessuna valutazione finora

- Puyo vs. Judge Go (2018)Documento2 paginePuyo vs. Judge Go (2018)Mara VinluanNessuna valutazione finora

- Simla Deputation PDFDocumento2 pagineSimla Deputation PDFMirahmed MiraliNessuna valutazione finora

- Modern Hunter User ManualDocumento16 pagineModern Hunter User ManualJim GregsonNessuna valutazione finora

- QT HCL56260 1699261504Documento2 pagineQT HCL56260 1699261504mohit254714582369Nessuna valutazione finora

- SpecPro Round 5 DigestsDocumento13 pagineSpecPro Round 5 Digestscmv mendoza100% (1)

- Script For Client CounselDocumento2 pagineScript For Client CounseluminadzNessuna valutazione finora

- Homeroom Guidance: Quarter 1 - Module 3: I, You and We: Respecting Similarities and DifferencesDocumento10 pagineHomeroom Guidance: Quarter 1 - Module 3: I, You and We: Respecting Similarities and DifferencesCaryl Posadas63% (8)

- Rs-States Made Them Stateless-Bedouins Lebanon - 2010Documento10 pagineRs-States Made Them Stateless-Bedouins Lebanon - 2010frontiersruwadNessuna valutazione finora

- What Is Electricity?: Prepared By: Engr. Renzo M. JognoDocumento36 pagineWhat Is Electricity?: Prepared By: Engr. Renzo M. JognoRenzo M. JognoNessuna valutazione finora

- Electronics Projects VolDocumento1 paginaElectronics Projects Volmuthurajan_hNessuna valutazione finora

- Accountability Review in Tanzania: Fahamu, Ongea Sikilizwa / Informed, Speaking and Heard ProjectDocumento2 pagineAccountability Review in Tanzania: Fahamu, Ongea Sikilizwa / Informed, Speaking and Heard ProjectOxfamNessuna valutazione finora

- Federal Register / Vol. 70, No. 199 / Monday, October 17, 2005 / NoticesDocumento2 pagineFederal Register / Vol. 70, No. 199 / Monday, October 17, 2005 / NoticesJustia.comNessuna valutazione finora

- Unenforceable ContractsDocumento10 pagineUnenforceable ContractsGolaNessuna valutazione finora

- Topinhar Call CentreDocumento2 pagineTopinhar Call CentreMohit KumarNessuna valutazione finora

- Canada QuizDocumento6 pagineCanada Quizroxanavamos100% (1)

- Tertiary Education Subsidy Sharing AgreementDocumento2 pagineTertiary Education Subsidy Sharing AgreementPark Shin HyeNessuna valutazione finora

- Proof of PaymentDocumento2 pagineProof of PaymentMark Neil BolalinNessuna valutazione finora

- Archexteriors Vol 34Documento10 pagineArchexteriors Vol 34Thanh NguyenNessuna valutazione finora

- Driver CPC - Periodic Training LeafletDocumento8 pagineDriver CPC - Periodic Training Leafletkokuroku100% (1)

- Islamabad Housing SocitiesDocumento5 pagineIslamabad Housing SocitiesMUHAMMAD ADNANNessuna valutazione finora

- TSO C155bDocumento6 pagineTSO C155bHosein AlaviNessuna valutazione finora

- Final Examination: Criminal Law ReviewDocumento18 pagineFinal Examination: Criminal Law ReviewStephany PolinarNessuna valutazione finora

- Kanchi Seer Prayed and Pope DiedDocumento6 pagineKanchi Seer Prayed and Pope Diedripest100% (2)

- 0035 - People vs. Aspili 191 SCRA 530, November 21, 1990Documento11 pagine0035 - People vs. Aspili 191 SCRA 530, November 21, 1990Gra syaNessuna valutazione finora