Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Teuer Furniture Case

Caricato da

Arindam Malakar0%(3)Il 0% ha trovato utile questo documento (3 voti)

2K visualizzazioni5 pagineThis document summarizes a case study about Teuer Furniture, a seller of high-quality designer furniture. It discusses the company's plans to open 6 new showrooms in three years while targeting upper-income customers in second-tier cities. It also notes that Teuer Furniture has high inventory levels, leases its showroom space, and has 187 shareholders looking to potentially exit through an investor buyout using either cash from operations or new equity. The document concludes by providing financial assumptions and the results of a valuation model, estimating Teuer Furniture's enterprise value at $328 million and per share value at $32.99.

Descrizione originale:

teur fur valuation

Titolo originale

Teuer Furniture Case Pptx

Copyright

© © All Rights Reserved

Formati disponibili

PPTX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document summarizes a case study about Teuer Furniture, a seller of high-quality designer furniture. It discusses the company's plans to open 6 new showrooms in three years while targeting upper-income customers in second-tier cities. It also notes that Teuer Furniture has high inventory levels, leases its showroom space, and has 187 shareholders looking to potentially exit through an investor buyout using either cash from operations or new equity. The document concludes by providing financial assumptions and the results of a valuation model, estimating Teuer Furniture's enterprise value at $328 million and per share value at $32.99.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

0%(3)Il 0% ha trovato utile questo documento (3 voti)

2K visualizzazioni5 pagineTeuer Furniture Case

Caricato da

Arindam MalakarThis document summarizes a case study about Teuer Furniture, a seller of high-quality designer furniture. It discusses the company's plans to open 6 new showrooms in three years while targeting upper-income customers in second-tier cities. It also notes that Teuer Furniture has high inventory levels, leases its showroom space, and has 187 shareholders looking to potentially exit through an investor buyout using either cash from operations or new equity. The document concludes by providing financial assumptions and the results of a valuation model, estimating Teuer Furniture's enterprise value at $328 million and per share value at $32.99.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PPTX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 5

Teuer Furniture (A)

Group 5

Rajesh PGP/19/037

Sakshi PGP/19/166

Arun PGP/19/193

Novi PGP/19/212

Case facts

Seller of high quality designer furniture

Concentrated on second-tier cities

Plan to open 6 showrooms in three years

Target market is upper-income individuals

High inventory holding (48% of COGS)

Showrooms were leased

Majority of capital expenditure was on building interiors

No. of shareholders 187, shares outstanding 9,945,000

Long-term investors looking for an exit

Decision pending on whether investor buyout should be by cash from

operations or through equity

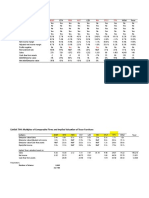

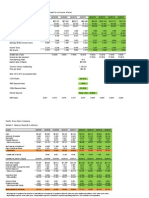

Assumptions

Sales growth for ages 7 and beyond are combined into one

average

COGS, SG&A and advertising as a percentage of sales

A/R as a percentage of sales of that year

Inventory, A/P as a percentage of COGS of next year

Depreciation was taken to be straight-line for 5 years

Lease increased at a rate of 2% per year

Corporate expenses was 5% of sales

Constant tax rate of 40%

WACC of 12.1%, long term growth rate is 3.5%

Excel output and results

Enterprise value = $328,126,000

Per share value = $32.99

Microsoft Excel

Worksheet

Thank You!

Potrebbero piacerti anche

- Teuer Furniture (A) Case Group 5 AnalysisDocumento5 pagineTeuer Furniture (A) Case Group 5 AnalysisRajesh PatidarNessuna valutazione finora

- Teuer FurnitureDocumento49 pagineTeuer FurnitureJuBee0% (2)

- Teuer Furniture Case A DCFDocumento28 pagineTeuer Furniture Case A DCFShilpi Jain100% (2)

- Teuer Furniture Case AnalysisDocumento3 pagineTeuer Furniture Case AnalysisPankaj KumarNessuna valutazione finora

- Teuer Furniture A Case Solution PPT (Group-04)Documento13 pagineTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- Teuer Furniture SecB Grp9Documento18 pagineTeuer Furniture SecB Grp9devilcaeser201033% (3)

- Teuer Furniture B Case SolutionDocumento43 pagineTeuer Furniture B Case SolutionShubham Gupta71% (7)

- Teuer Furniture (A) : Group 9 Aman Amit Jain - Shivram - Satvik - KamaljeetDocumento7 pagineTeuer Furniture (A) : Group 9 Aman Amit Jain - Shivram - Satvik - KamaljeetKuldeep BarwalNessuna valutazione finora

- Teuer B DataDocumento41 pagineTeuer B DataAishwary Gupta100% (1)

- Teur CaseDocumento7 pagineTeur Casewriter topNessuna valutazione finora

- Teuer Sheet (B) - Navam Gupta - 033 (828302)Documento48 pagineTeuer Sheet (B) - Navam Gupta - 033 (828302)devilcaeser20100% (1)

- Company financial data comparison and valuation metricsDocumento4 pagineCompany financial data comparison and valuation metricsChiranshu KumarNessuna valutazione finora

- The Teuer Furniture CaseDocumento7 pagineThe Teuer Furniture CaseKshitish100% (9)

- Teuer Furniture (A)Documento14 pagineTeuer Furniture (A)Abhinandan SinghNessuna valutazione finora

- Assignment Schumpeter Finanzberatung DEC-5-21Documento2 pagineAssignment Schumpeter Finanzberatung DEC-5-21RaphaelNessuna valutazione finora

- Caso TeuerDocumento46 pagineCaso Teuerjoaquin bullNessuna valutazione finora

- Case TeuerDocumento1 paginaCase Teuergorkemkebir0% (1)

- CV - Assignment - Group 8 - Teuer - Case BDocumento6 pagineCV - Assignment - Group 8 - Teuer - Case BKhushbooNessuna valutazione finora

- Flow Valuation, Case #KEL778Documento20 pagineFlow Valuation, Case #KEL778SreeHarshaKazaNessuna valutazione finora

- Flash MemoryDocumento9 pagineFlash MemoryJeffery KaoNessuna valutazione finora

- Teuer Furniture Case AnalysisDocumento3 pagineTeuer Furniture Case AnalysisPankaj Kumar0% (1)

- AirThreads Valuation Case Study - Excel FileDocumento18 pagineAirThreads Valuation Case Study - Excel FileRom Aure81% (16)

- Teuer Furniture - Student Supplementary SheetDocumento20 pagineTeuer Furniture - Student Supplementary Sheetsergio songuiNessuna valutazione finora

- (Shared) Day5 Harmonic Hearing Co. - 4271Documento17 pagine(Shared) Day5 Harmonic Hearing Co. - 4271DamTokyo0% (2)

- Pacific Grove Spice CompanyDocumento3 paginePacific Grove Spice CompanyLaura JavelaNessuna valutazione finora

- Case 45 American GreetingsDocumento8 pagineCase 45 American GreetingsMustafa Ali100% (5)

- TN33 California Pizza KitchenDocumento8 pagineTN33 California Pizza KitchenChittisa CharoenpanichNessuna valutazione finora

- Merrill Lynch CaseDocumento2 pagineMerrill Lynch CaseHailey Judkins100% (2)

- Pacific Grove Spice Company SpreadsheetDocumento7 paginePacific Grove Spice Company SpreadsheetAnonymous 8ooQmMoNs10% (1)

- Assignment Schumpeter CaseDocumento1 paginaAssignment Schumpeter CaseValentin Is0% (1)

- Ameritrade Case SolutionDocumento34 pagineAmeritrade Case SolutionAbhishek GargNessuna valutazione finora

- Ameritrade Case SolutionDocumento31 pagineAmeritrade Case Solutionsanz0840% (5)

- Caso HertzDocumento32 pagineCaso HertzJORGE PUENTESNessuna valutazione finora

- 128,000 forecasted sales in 2012Documento8 pagine128,000 forecasted sales in 2012chopra98harsh3311100% (4)

- Yell A Cross Border Acquisition 7 1024Documento4 pagineYell A Cross Border Acquisition 7 1024Yusuf SeyhanNessuna valutazione finora

- GR-II-Team 11-2018Documento4 pagineGR-II-Team 11-2018Gautam PatilNessuna valutazione finora

- Analysis of AirThread Connection Acquisition Cash Flows and ProjectionsDocumento66 pagineAnalysis of AirThread Connection Acquisition Cash Flows and Projectionsbachandas75% (4)

- Tottenham Case HBS Financials ValuationDocumento14 pagineTottenham Case HBS Financials ValuationPaco Colín0% (2)

- Valuation of AirThreadConnectionsDocumento3 pagineValuation of AirThreadConnectionsmksscribd100% (1)

- Eskimo PieDocumento30 pagineEskimo PieMing Yang100% (1)

- Airthread ValuationDocumento19 pagineAirthread Valuation45ss28Nessuna valutazione finora

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDocumento12 pagineBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNessuna valutazione finora

- Case Background: Kaustav Dey B18088Documento9 pagineCase Background: Kaustav Dey B18088Kaustav DeyNessuna valutazione finora

- Paginas Amarelas Case Week 8 ID 23025255Documento4 paginePaginas Amarelas Case Week 8 ID 23025255Lesgitarmedit0% (1)

- Stone Container CorporationDocumento5 pagineStone Container Corporationalice123h21Nessuna valutazione finora

- TN-1 TN-2 Financials Cost CapitalDocumento9 pagineTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Flash Memory IncDocumento3 pagineFlash Memory IncAhsan IqbalNessuna valutazione finora

- RJR Nabisco ValuationDocumento33 pagineRJR Nabisco ValuationShivani Bhatia100% (4)

- PGSC Debt obj. income statement ratios 2006-2010Documento68 paginePGSC Debt obj. income statement ratios 2006-2010Jose Luis ContrerasNessuna valutazione finora

- Pacific Grove Spice CompanyDocumento7 paginePacific Grove Spice CompanySajjad Ahmad100% (1)

- S&P Morning Briefing 11.14.18Documento7 pagineS&P Morning Briefing 11.14.18Abdullah18Nessuna valutazione finora

- 3 Q 2014 PPG EarningsDocumento9 pagine3 Q 2014 PPG Earningsxxxzzz6200Nessuna valutazione finora

- Greenply Industries LTD: Result Beat On All Counts!!!Documento7 pagineGreenply Industries LTD: Result Beat On All Counts!!!Kiran KulkarniNessuna valutazione finora

- PPG Reports Record Second Quarter Net Sales and Earnings: MediaDocumento9 paginePPG Reports Record Second Quarter Net Sales and Earnings: MediaKasthala Mohan KumarNessuna valutazione finora

- Top 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The SameDocumento4 pagineTop 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The Sameapi-234474152Nessuna valutazione finora

- Stocks 2016 PDFDocumento1 paginaStocks 2016 PDFFakruddinNessuna valutazione finora

- Research Scorecard: December 2015Documento46 pagineResearch Scorecard: December 2015senkum812002Nessuna valutazione finora

- Tata Motors LTD: Q4FY19 Result UpdateDocumento4 pagineTata Motors LTD: Q4FY19 Result Updatekapil bahetiNessuna valutazione finora

- Capcom Annual Report 2015Documento118 pagineCapcom Annual Report 2015AllGamesDeltaNessuna valutazione finora

- Cash Flow-Latest ViewsDocumento44 pagineCash Flow-Latest ViewsSyed Sheraz AliNessuna valutazione finora

- Join PageGroup inDocumento12 pagineJoin PageGroup inArindam MalakarNessuna valutazione finora

- Case Interview FrameworksDocumento6 pagineCase Interview Frameworkserika KNessuna valutazione finora

- GlobalizationDocumento12 pagineGlobalizationArindam MalakarNessuna valutazione finora

- Session 2 Water - Regional and Transboundary IssueDocumento44 pagineSession 2 Water - Regional and Transboundary IssueArindam MalakarNessuna valutazione finora

- Scanned by CamscannerDocumento2 pagineScanned by CamscannerArindam MalakarNessuna valutazione finora

- Longchamp's Le Pliage Success & Product StrategyDocumento1 paginaLongchamp's Le Pliage Success & Product StrategyArindam Malakar0% (5)

- Session 1 Sustainable DevelopmentDocumento32 pagineSession 1 Sustainable DevelopmentArindam MalakarNessuna valutazione finora

- Session 1 Introduction To The CourseDocumento10 pagineSession 1 Introduction To The CourseArindam MalakarNessuna valutazione finora

- LeleDocumento1 paginaLeleArindam MalakarNessuna valutazione finora

- Prepared By:: Arindam Malakar Ishwarya Thirumalai Miranda Boro Shekhar Teny Sumanraj Elangowan Archana TammaliDocumento3 paginePrepared By:: Arindam Malakar Ishwarya Thirumalai Miranda Boro Shekhar Teny Sumanraj Elangowan Archana TammaliArindam MalakarNessuna valutazione finora