Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

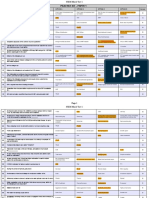

Nism 3 A - Compliance - Last Day Revision Test 2

Caricato da

Rohit SharmaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Nism 3 A - Compliance - Last Day Revision Test 2

Caricato da

Rohit SharmaCopyright:

Formati disponibili

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

About PASS4SURE.in

PASS4SURE is a professional online practice test bank for various NSE NCFM, NISM and BSE exams. The team behind

PASS4SURE has decades of experience in the financial and stock markets and have succeeded in preparing practice

question bank which will help not only to pass the exams easily but also get good knowledge of the subject.

Our online mock exams contain questions which are carefully analysed by the experts and have a high probability of being

asked in the exams. Thus all PASS4SURE questions are highly valued and contribute to an almost 100% success rate.

We do not believe in offering you thousands of questions but most important 400 500 practice questions and answers.

PASS4SURE understands that time and money is valuable for our students, so we regularly update all our exams. The old

questions are deleted and new important questions are added. Our LAST DAY REVISION test are on the spot. This is done

to ensure that the students learns what is most important and pass the exams. You do not have to try again and again

wasting time and money.

Our simple aim is to simplify the NCFM, NISM and BSE exams. ALL THE BEST.

IMPORTANT The viewing rights for this downloaded Question Bank will automatically

expire after 60 days from the date of purchase.

TEST DETAILS The SECURITIES INTERMEDIARIES COMPLIANCE ( NON FUND ) CERTIFICATION EXAM is a 100 mark

exam with 60% as passing marks. In all 100 questions will be asked with 0.25% negative marking for Wrong

Answers. The time duration is 2 hours.

All Rights Reserved. No Part of this documents may be reproduced, stored in a retrieval system, or transmitted, in any

form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior written permission

from PASS4SURE.in. For any clarification regarding this document or if you feel there are errors in the question bank,

please write us at info@pass4sure.in

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

LAST DAY REVISION EXAM 2

Question 1

(a)

(b)

(c)

(d)

Question 2

Department of Financial Services administers government policies relating

to ____________.

Public sector banks

Term-lending financial institutions

Life insurance and general insurance

All of the above

As per SEBI (Issue of Capital and Disclosure Requirements - ICDR)

Regulations, a copy of the resolution passed by the board of directors of

the issuer for allotting specified securities to promoters towards amount

received against promoters contribution, before opening of the issue

has to be submitted to _______ .

(a)

(b)

(c)

(d)

SEBI

Stock Exchange

Merchant Banker

AMFI

Correct Answer 1

All of the above

Correct Answer 2

SEBI

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 3

(a)

(b)

Question 4

(a)

(b)

(c)

(d)

Correct Answer 3

Answer

Explanation

Correct Answer 4

Can SEBI prohibit any company from issuing prospectus, any offer

document, or advertisement soliciting money from the public for the issue

of securities?

Yes

No

As per the SEBI (Prohibition of Fraudulent and Unfair Trade Practices

relating to Securities Market) Regulations, dealing in a security which is

not intended to effect a transfer of beneficial ownership but to serve only

as a device to ________ in the price of such security for wrongful gain or

avoidance of loss.

inflate

depress

cause fluctuations

all of the above

Yes

The Section 11A of the SEBI Act states that without any prejudice to the

provisions of the Companies Act 1956, SEBI may for the protection of

investors prohibit any company from issuing prospectus, any offer document,

or advertisement soliciting money from the public for the issue of securities.

all of the above

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 5

(a)

(b)

(c)

(d)

Question 6

(a)

(b)

(c)

(d)

As per the SEBI (Custodian of Securities) Regulations, an applicant for

the Custodian of Securities should have a networth of minimum of

Rs 50 lakhs

Rs 5 crores

Rs 25 crores

Rs 50 crores

As per the SEBI (Custodian of Securities) Regulations - every certificate

granted to the applicant as a Custodian of Securities shall be valid for a

period of ______ years from the date of registration or its renewal.

3

5

7

10

Correct Answer 5

Rs 50 crores

Correct Answer 6

Answer

Explanation

Every certificate grated to the applicant as a Custodian of Securities shall be

valid for a period of 3 years from the date of registration or its renewal.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 7

(a)

(b)

(c)

(d)

Question 8

(a)

(b)

To effectively implement the KYC guidelines, SEBI notified the ________.

SEBI (KYC Registration Agency) Regulations, 2011

SEBI (Self Regulatory Organization) Regulations, 2004

PMLA, 2002

None of the above

According to the SEBI (Stock Brokers and Sub Brokers) Regulations, the

compliance officer shall immediately and independently report to SEBI

any non-compliance observed by him. True or False ?

TRUE

FALSE

Correct Answer 7

SEBI (KYC Registration Agency) Regulations, 2011

Correct Answer 8

TRUE

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 9

(a)

(b)

(c)

(d)

Question 10

(a)

(b)

(c)

(d)

As per the SEBI (Prohibition of Fraudulent and Unfair Trade Prac-tices

relating to securities Market) Regulations, in case of fraud, SEBI can

________ the proceeds or securities in respect of any transaction which is

in violation of the SEBI regulations.

Impound

Retain

Both 1 and 2

SEBI does not have any such authority.

As per SEBI (Intermediaries) Regulations, 2008, what is the next step after

receiving the recommendations of the designated authority who is

appointed to enquire and recommend action in case of violation of rules of

the securities market ?

Gives warning to the intermediary dismissing the recommendations

Issues the recommended action without hearing the noticee

issues a show cause notice to the intermediary as to why the recommended

action should not be taken

none of the above

Correct Answer 9

Both 1 and 2

Correct Answer 10

issues a show cause notice to the intermediary as to why the recommended

action should not be taken

Answer

Explanation

The designated authority shall, if there are reasonable grounds to do so, issue a

show-cause notice to the concerned person requiring it to show cause as to why

the certificate of registration granted to it, should not be suspended or cancelled

or why any other action provided in the regulations should not be taken.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 11

(a)

(b)

Question 12

(a)

(b)

(c)

(d)

As per SEBI (Prohibition of Fraudulent and Unfair Trade Practices

relating to securities Market) Regulations, SEBI can, both impound and

retain the proceeds or securities in respect of any transaction which is in

violation or prima facie in violation of these regulations - True or False ?

FALSE

TRUE

Every member of a recognized stock exchange has to maintain and

preserve the Counterfoils or duplicates of contract notes issued to clients

for a period of _____ years

2

5

7

10

Correct Answer 11

TRUE

Correct Answer 12

Answer

Explanation

Every member of a recognized stock exchange to maintain and preserve the

following documents for a period of 2 years:

Members contract books showing details of all contracts entered into by the

member with other members of the same exchange or counterfoils or duplicates

of memos of confirmation issued to such other members.

Counterfoils or duplicates of contract notes issued to clients.

Written consent of clients in respect of contracts entered into as principals.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 13

(a)

(b)

(c)

(d)

Question 14

(a)

(b)

Correct Answer 13

Answer

Explanation

Correct Answer 14

Answer

Explanation

A debenture trustee shall pay a sum of Rs. _______ as registration fees at

the time of the grant of certificate by SEBI.

Rs 25 lakhs

Rs 15 lakhs

Rs 10 lakhs

Rs 5 lakhs

As per the SEBI code of conduct for underwriters, an Underwriter is

responsible for the acts or omissions only of its employees and not of

agents in respect to the conduct of its business. State True or False ?

FALSE

TRUE

Rs 10 lakhs

Every debenture trustee shall pay a sum of Rs. 10 lakhs as registration fees at

the time of the grant of certificate by SEBI and shall pay renewal fee of Rs. 5

lakh every three years from the fourth year from the date of initial registration.

FALSE

The Underwriter is responsible for the acts or omissions of its employees and

agents in respect to the conduct of its business.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 15

(a)

(b)

(c)

(d)

Question 16

(a)

(b)

(c)

(d)

Correct Answer 15

Answer

Explanation

Correct Answer 16

Answer

Explanation

The annual fees to keep the registration in force as custodian under the

SEBI (Custodian of Securities) Regulations is ____________.

Rs. 10 lakh or 0.00025% of the assets under custody whichever is higher.

Rs 25 lakh or 0.00025% of the assets under custody whichever is higher.

Rs. 10 lakh or 0.00025% of the assets under custody whichever is lower.

Rs 25 lakh or 0.00025% of the assets under custody whichever is lower.

SEBI (Prohibition of Fraudulent and Unfair Trade Practices relating to

securities Market) Regulations have been made in exercise of the powers

conferred by __________.

Prevention of Money Laundering Act

Companies Act

Securities Contract ( Regulation ) Act

SEBI Act

Rs. 10 lakh or 0.00025% of the assets under custody whichever is higher.

On being granted the certificate of registration, the Custodian of securities need

to pay registra-tion fee of Rs. 15 lakh to SEBI, and an annual fee of Rs. 10 lakh

or 0.00025% of the assets under custody of the custodian of securities,

whichever is higher.

SEBI Act

The Securities and Exchange Board of India (Prohibition of Fraudulent and

Unfair Trade Practices relating to Securities Market) Regulations, 2003

prohibit fraudulent, unfair and manipulative trade practices in securities.

These regulations have been made in exercise of the powers conferred by

section 30 of the SEBI Act, 1992.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 17

(a)

(b)

Question 18

(a)

(b)

(c)

(d)

Fraud includes a willful misrepresentation of truth OR concealment of

material fact, in order that another person may act, to his detriment. State

whether True or False?

FALSE

TRUE

_____________ appoints the Registrar of Companies.

SEBI

Central Government

Company Law Board

RBI

Correct Answer 17

TRUE

Correct Answer 18

Central Government

Answer

Explanation

Pursuant to Section 609(1) of the Companies Act, 1956, the Central

Government has appointed Registrars at different places to discharge the

function of registration of companies.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 19

(a)

(b)

Question 20

(a)

(b)

(c)

(d)

Correct Answer 19

Answer

Explanation

Correct Answer 20

Answer

Explanation

SEBI in the interest of the securities market may direct an intermediary to

refund the money or securities collected from the investors, however no

interest will be paid on it - State True or False ?

TRUE

FALSE

______________ must be maintained by a Stock Broker while conducting

his business.

High level of profits

High level of Integrity

Prominence amongst his clients

All of the above

FALSE

The refund can be with or without interest as per the decision of SEBI.

High level of Integrity

As per the Code of Conduct for Brokers - A stock-broker, must maintain high

standards of integrity, promptitude and fairness in the conduct of all its

business.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 21

(a)

(b)

(c)

(d)

Question 22

(a)

(b)

(c)

(d)

Correct Answer 21

Answer

Explanation

Correct Answer 22

The certificate of registration granted as a Underwriter, and its renewal is

valid for a period of _____ from the date of its issue to the applicant.

2 years

3 years

5 years

7 years

For SEBI to consider the application of registration as a credit rating

agency of an entity promoted by a company, the promoter shall have a

continuous networth of minimum __________ for the previous five year.

Rs 1 crore

Rs 10 crores

Rs 50 crores

Rs 100 crores

3 years

The certificate of registration so granted and its renewal is valid for a period of

3 years from the date of its issue to the applicant.

An underwriter shall apply for renewal of registration three months prior to the

expiry of the period of the certificate along with the appropriate fees as

provided by in the regulations.

Rs 100 crores

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 23

(a)

(b)

(c)

(d)

Question 24

(a)

(b)

(c)

(d)

As per SEBI(Debenture Trustees) Regulations, debenture trustee shall

communicate to the debenture holders on _____basis regarding

compliance, defaults, etc. and the action taken regarding it.

Half Yearly

Yearly

Monthly

Every 3 months

The Banker to an issue has to submit the collection figures to the Registrar

to the Issue, the lead manager and the body corporate and such figures

should be submitted within ______ working days from the issue closure

date.

seven

three

six

fifteen

Correct Answer 23

Half Yearly

Correct Answer 24

seven

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 25

(a)

(b)

(c)

(d)

Question 26

(a)

(b)

(c)

(d)

Correct Answer 25

Answer

Explanation

Correct Answer 26

Answer

Explanation

The capital adequacy requirement to become a Debenture Trustee is

__________ .

Total Assets of Rs 1 crore

Total Assets of Rs 5 crores

Networth of Rs 5 crores

Networth of Rs 1 crore

As per the SEBI (Credit Rating Agencies) Regulations, a Credit Rating

Agency on being granted the registration certificate shall pay to SEBI the

registration fee of Rs. ______ lakhs

5

10

20

25

Networth of Rs 1 crore

As per SEBI (Debenture Trustees) Regulations, capital adequacy requirement

shall not be less than the networth of one crore rupees, provided that a

debenture trustee holding certificate of registration as on the date of

commence-ment of the SEBI (Debenture trustees) (Amendment) Regulations,

2003 shall fulfil the networth requirements within two years from the date of

such commencement.

20

The Credit Rating Agency on being granted the registration certificate shall pay

to SEBI the registra-tion fee of Rs. 20 lakh. Application for renewal can be

made to SEBI three months prior to the expiry of the certificate accompanied

with the renewal fees. The renewal fee is Rs. 10 lakh.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 27

(a)

(b)

Question 28

(a)

(b)

SEBI in the interest of the securities market may direct an intermediary to

refund the money or securities collected from the investors with or without

interest. State whether True or False?

TRUE

FALSE

Is it required to verify the source of funds as well as wealth of Politically

Exposed Persons ?

Yes

No

Correct Answer 27

TRUE

Correct Answer 28

Yes

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 29

(a)

(b)

(c)

(d)

Question 30

(a)

(b)

(c)

(d)

Correct Answer 29

Answer

Explanation

Correct Answer 30

If a Credit Rating Agency has to change the rating defination, it can be

done ____________.

only with the prior permission of SEBI

only with the approvals of its shareholders

only at certain periodic intervals

All of the above

A SEBI registered stock broker can become a depository participant

provided the stock broker has a minimum net worth of Rs._____ lakhs

10

25

50

100

only with the prior permission of SEBI

Rating definition, as well as the structure for a particular rating product, shall

not be changed by a credit rating agency, without prior information to SEBI.

50

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 31

(a)

(b)

Question 32

(a)

(b)

(c)

(d)

Correct Answer 31

Answer

Explanation

Correct Answer 32

Can SEBI prohibit any company from issuing prospectus, any offer

document, or advertisement soliciting money from the public for the issue

of securities? State Yes or No?

Yes

No

Which of the following is not a security as per Securities Contract

Regulation Act (SCRA) ?

Derivatives

Bonds

Bullion

Shares

Yes

The Section 11A of the SEBI Act states that without any prejudice to the

provisions of the Companies Act 1956, SEBI may for the protection of

investors prohibit any company from issuing prospectus, any offer document,

or advertisement soliciting money from the public for the issue of securities.

Bullion

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 33

(a)

(b)

(c)

(d)

Apart from SEBI Regulations, Bankers to an issue shall abide by the

relevant rules and regulations of _______ .

Indian Bank Association

Central Government

RBI

All of the above

Question 34

Post issue activities, generally co-ordinated by Lead Merchant Banker,

include which of the following?

(a)

(b)

(c)

(d)

Finalisation of the basis of allotment

Deciding on centres for holding conferences of stock brokers, investors, etc.

Processing rematerialisation requests

All of the above

Correct Answer 33

All of the above

Correct Answer 34

Finalisation of the basis of allotment

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 35

(a)

(b)

Question 36

(a)

(b)

(c)

(d)

Correct Answer 35

Answer

Explanation

Correct Answer 36

Answer

Explanation

As per SEBI (ICDR) Regulation, only audited and consolidated financial

statements need to be prepared in accordance to GAAP. State whether

True or False.

TRUE

FALSE

SEBI was set up under which act ?

Competition Act 2002

SEBI Act 1992

Securities Contract (Regulation) Act 1956

Securities Contract (Regulation) Rules 1957

FALSE

In accordance with requirements of the ICDR, the information required

includes audited consolidated or unconsolidated financial statements prepared

in accordance with Indian GAAP standards.

SEBI Act 1992

The SEBI Act of 1992 was enacted upon to provide for the establishment of a

Board to protect the interests of investors in securities and to promote the

development of, and to regulate, the securities market and for matters

connected therewith or incidental thereto.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 37

(a)

(b)

(c)

(d)

Question 38

(a)

(b)

Correct Answer 37

Answer

Explanation

Correct Answer 38

Answer

Explanation

To bring in uniformity in the KYC procedure across intermediaries, the In

Person Verification (IPV) has to be done by which of the foll

intermediaries Stock Brokers

KRAs & Depository Participants

Venture Capital Funds and Collective Investment Schemes

All of the above

Can a common order be passed in respect of a number of noticees where

the subject matter in question is substantially the same or similar in

nature?

Yes

No

All of the above

To bring in uniformity in the KYC procedure across intermediaries, the IPV

requirements for all the intermediaries have been streamlined by SEBI.

Intermediaries registered with SEBI as Stock Brokers, KRAs, Depository

Participants, Mutual Funds, Portfolio Managers, Venture Capital Funds and

Collective Investment Schemes need to mandatorily carry out IPV for all their

clients.

Yes

As per the SEBI (Intermediaries) Regulations - Action in case of default - The

Designated member may pass a common order in respect of a number of

notices where the subject matter in question is substantially the same or similar

in nature.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 39

(a)

(b)

(c)

(d)

Question 40

(a)

(b)

Correct Answer 39

Answer

Explanation

Correct Answer 40

Answer

Explanation

A Merchant Banker has to disclose its track record for a period of _______

from the date of listing for each public issue managed by the merchant

banker.

5 Financial Years

4 Calendar years

3 Financial Years

4 Financial Years

A member of a recognised stock exchange can enter into a contract as a

principal with another member who is also a member of a recognised

stock exchange after obtaining his consent - True or False ?

TRUE

FALSE

3 Financial Years

As per SEBI, the merchant bankers shall disclose the track record of the

performance of the public issues managed by them.

The track record shall be disclosed for a period of three financial years from

the date of listing for each public issue managed by the merchant banker. This

information should be made available on the website and a reference to the

same should be made in the offer document.

TRUE

Section 15 of SCRA provides that no member of a recognised stock exchange

shall in respect of any securities enter into any contract as a principal with any

person other than a member of a recognised stock exchange, unless he has

secured the consent or authority of such person and discloses in the note,

memorandum or agreement of sale or purchase that he is acting as a principal.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 41

(a)

(b)

(c)

(d)

Question 42

The certificate of registration as Underwriter is valid for a period of how

many years ?

2

3

5

10

As per Securities Contracts (Regulation) Rules - SCRR, the trading

members of the stock exchanges are required to maintain the counterfoils

or duplicates of contract notes issued to clients for how many years?

(a)

(b)

(c)

(d)

1

2

3

5

Correct Answer 41

Correct Answer 42

Answer

Explanation

Rule 15(2) od SCRR requires every member of a recognized stock exchange to

maintain and preserve the following documents for a period of 2 years:

Members contract books showing details of all contracts entered into by the

member with other members of the same exchange or counterfoils or duplicates

of memos of confirmation issued to such other members.

Counterfoils or duplicates of contract notes issued to clients.

Written consent of clients in respect of contracts entered into as principals.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 43

(a)

(b)

(c)

(d)

Question 44

(a)

(b)

As per the SEBI (Underwriters) Regulations - code of conduct, the

underwriters shall not be a party to or instrumental for ____________.

creation of false market

price rigging or manipulation

passing of unpublished price sensitive information in respect of securities

which are listed and proposed to be listed in any stock exchange to any person

or intermediary.

All of the above

Any person aggrieved by an order of the SEBI may prefer an appeal to the

Securities Appellate Tribunal within a period of 60 days from the date on

which a copy of the order made by SEBI has been received by such person.

True or False ?

TRUE

FALSE

Correct Answer 43

All of the above

Correct Answer 44

FALSE

Answer

Explanation

An appeal shall be filed within a period of 45 days and not 60 days.

(Any person aggrieved by any decision of the Securities Appellate Tribunal

may file an appeal to the Supreme Court within 60 days).

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 45

(a)

(b)

(c)

(d)

Question 46

(a)

(b)

(c)

(d)

__________of SEBI act relates to defaults by mutual funds(MFs) and

prescribes penalties.

Section 15A

Section 15B

Section 15C

Section 15D

In case of buy-back, the company shall ensure that all the securities

bought back are extinguished within ____ days of the last date of

completion of buy-back.

4

6

7

15

Correct Answer 45

Section 15D

Correct Answer 46

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 47

(a)

(b)

(c)

(d)

Question 48

(a)

(b)

(c)

(d)

Correct Answer 47

Answer

Explanation

Correct Answer 48

As per SEBI (Substantial Acquisition of Shares & Takeovers - SAST)

Regulations, within how many days a merchant banker has to make an

open offer before making the public announcement of entering into an

agreement for acquisition of shares or voting rights ?

4 working days

7 working days

15 working days

30 working days

Which of the following come under the scope of compliance ?

Checklists

Compliance's and redressing investor grievances

Minutes of Board Meeting

All of the above

4 working days

The acquirer company is required to appoint a SEBI registered Merchant

Banker, as a manager to the open offer before making the public

announcement.

The public announcement shall be made by the merchant banker not later than

4 working days of entering into an agreement for acquisition of shares or

voting rights or deciding to acquire shares or voting rights.

Compliance's and redressing investor grievances

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 49

(a)

(b)

Question 50

(a)

(b)

(c)

(d)

Correct Answer 49

Answer

Explanation

Correct Answer 50

State True or False - The SEBI Act vests SEBI with the power to issue the

certificate of registration to Securities MArket Intermediaries.

TRUE

FALSE

Any person aggrieved by any decision or order of the Securities Appellate

Tribunal may file an appeal to the Supreme Court within ______ days

from the date of communication of the decision or order of the SAT to

him.

30

60

75

90

TRUE

Section 12 of SEBI Act vests SEBI with the power to issue the certificate of

registration without which no stockbroker, sub-broker, share transfer agent,

banker to an issue, trustee of trust deed, registrar to an issue, merchant banker,

underwriter, portfolio manager, investment adviser or such other intermediary

who may be associated with the securities market shall buy, sell or deal in

securities.

60

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 51

(a)

(b)

(c)

(d)

Question 52

(a)

(b)

Correct Answer 51

Answer

Explanation

Correct Answer 52

Answer

Explanation

The guaranteeing of trades done on an registered securities market is done

by ____________.

Nationalised Banks

Clearing House

Merchant Bankers

The Stock Broker who executes the trade

An intermediary cannot sponsor or cause to be sponsored or carry on or

caused to be carried on any venture capital funds or collective investment

schemes including mutual funds if the same does not obtain a certificate of

registration from the SEBI - True or False ?

TRUE

FALSE

Clearing House

Clearing House is the intermediary which performs two important functions:

a) aggregating transactions over a trading period, netting the positions to

determine the liabilities of members and ensures movement of funds and

securities to meet respective liabilities; and

b) guarantee those trades, in the event of default by either buyer or seller.

TRUE

As per the rules of registration of Intermediaries, SEBI can suspend or cancel a

certificate of registration after giving the person concerned a reasonable

opportunity of presenting his case if he sponsors any venture capital funds or

collective investment schemes including mutual funds if the same does not

obtain a certificate of registration from the SEBI.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 53

(a)

(b)

Question 54

(a)

(b)

(c)

(d)

All the employees, directors etc of the intermediary need to strictly adhere

to the Code of Conduct as prescribed in the SEBI Regulations. State

Whether True or False?

TRUE

FALSE

___________ carries out the inspection and investigation of the books and

accounts maintained by the members of the Stock Exchange.

the respective Stock Exchange

Economic Offence Wing

Ministry of Finance

None of the above

Correct Answer 53

TRUE

Correct Answer 54

None of the above

Answer

Explanation

Regulation 19 of the SEBI (Stock Brokers and Sub-Brokers) Regulations gives

the SEBI Board the right to inspect.

SEBI may appoint inspecting authority to undertake inspection of the books of

account, other records and documents of the stock brokers, with or without

notice.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 55

(a)

(b)

(c)

(d)

Question 56

(a)

(b)

(c)

(d)

As per the Code of Conduct for the Debenture Trustees, a Debenture

Trustee is responsible for the acts or omissions of its __________ in respect

to the conduct of its business.

Employees

Agents

Both 1 and 2

None of the above

Whenever there is a violation of any regulations, the designated authority

issues a show cause notice. The show-cause notice shall specify the period

,not exceeding _________, within which reply should be submitted in

written representation along with documentary evidence, if any, in

support of the representation to the designated authority.

7 days

15 days

21 days

30 days

Correct Answer 55

Both 1 and 2

Correct Answer 56

21 days

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 57

(a)

(b)

(c)

(d)

Question 58

(a)

(b)

(c)

(d)

Correct Answer 57

Answer

Explanation

Correct Answer 58

Answer

Explanation

The Department of Disinvestment is concerned with which of the following

options?

Pension Regulation and Reforms

Direct Taxes

Disinvestment of Public Sector units

All of the above

_______ is the central nodal agency responsible for receiving, processing,

analyzing and disseminating information regarding suspicious financial

transactions in order to support anti-money laundering efforts.

Financial Intelligence Unit - India (FIU-I)

Economic Offence Wing (EOW)

SEBI

RBI

Disinvestment of Public Sector units

Department of Disinvestment oversees, among other things, all matters relating

to the disinvestment of Central Government equity from Central Public Sector

undertakings.

The department is also concerned with the financial policy relating to the

utilization of proceeds of disinvestment.

Financial Intelligence Unit - India (FIU-I)

FIU-I is an independent body reporting directly to the Economic Intelligence

Council headed by the Finance Minister and is the central nodal agency

responsible for receiving, processing, analyzing and disseminating information

regarding suspicious financial transactions in order to support anti-money

laundering efforts

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 59

(a)

(b)

(c)

(d)

Question 60

(a)

(b)

(c)

(d)

Which of the following is/are considered critical reporting for a

Compliance Officer ?

Money Laundering Activities

Submission of books of accounts

Submission of sauda books

All of the above

The objective of the SEBI (Prohibition of Insider Trading) Regulation is to

prohibit insider from ___________ on matters relating to insider trading?

Dealing

Counselling

Communicating

All of the above

Correct Answer 59

Money Laundering Activities

Correct Answer 60

All of the above

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 61

(a)

(b)

Question 62

Self Regulatory Organisations need to conform to the conditions as laid

down under SEBI (Intermediaries) Regulations, 2008 - State True or False

?

FALSE

TRUE

A KYC Registering Agency (KRA) need not have a electronic connectivity

in order to establish interoperability with KRA's - State True or False ?

(a)

(b)

TRUE

FALSE

Correct Answer 61

FALSE

Answer

Explanation

Correct Answer 62

Answer

Explanation

For recognition as an SRO, certain conditions have to be met as prescribed

under the SEBI (Self Regulatory Organizations) Regulations, 2004.

FALSE

KRA has to have a electronic connectivity in order to establish interoperability

with other KRA's.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 63

(a)

(b)

(c)

(d)

Question 64

(a)

(b)

(c)

(d)

Correct Answer 63

Answer

Explanation

Correct Answer 64

Answer

Explanation

Which of these organisations are not covered under PLMA ?

Mutual Funds

Manufacturing Firms taking Fixed Deposits for business expansion

Stock Brokers

Sub Brokers

As per SEBI (Depositories and Participants) Regulations code of conduct,

a Depository Participant shall not make untrue statements or suppress any

material fact in any __________ furnished to SEBI.

Information

Reports

Documents

All of the above

Manufacturing Firms taking Fixed Deposits for business expansion

The PMLA ie. Prevention of Money Laundering Act covers all Financial

Intermediaries, and this includes Mutual Funds, Stock and Sub Brokers.

All of the above

A Participant shall not make any untrue statement or suppress any material fact

in any documents, reports, papers or information furnished to SEBI.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 65

(a)

(b)

(c)

(d)

The functions of SEBI as per the SEBI Act includes __________.

Promoting and regulating self-regulatory organisations

Regulating substantial acquisition of shares and take-over of companies

Regulating the business in stock exchanges and any other securities markets

All of the above

Question 66

Dealing in securities shall be deemed to be a fraudulent or an unfair trade

practice if it involves fraud and may include an intermediary promising a

certain price in respect of buying or selling of a security to a client and

___________.

(a)

waiting till a discrepancy arises in the price of such security and retaining the

difference in prices as profit for himself.

promising an opposite transaction at a different price to another client

promising an opposite transaction at a different price at a later date to same

client

all of the above

(b)

(c)

(d)

Correct Answer 65

All of the above

Correct Answer 66

waiting till a discrepancy arises in the price of such security and retaining the

difference in prices as profit for himself.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 67

(a)

(b)

(c)

(d)

Question 68

(a)

(b)

(c)

(d)

Correct Answer 67

Answer

Explanation

Correct Answer 68

Answer

Explanation

As per Section 19A of the Depositories Act, the penalty for delay in

dematerialization or issue of certificate of securities is Rs. _____ per day or

Rs 1 crore which ever is less.

25000

50000

1 lakh

3 lakhs

Which following is/are deemed to be price sensitive information ?

Issue of securities or buy back of securities

Amalgamation, mergers or takeovers

Periodic financial results of the company

All of the above

1 lakh

Penalties for delay in dematerialization or issue of certificate of securities is Rs.

1 crore or Rs.1 lakh for each day of default, whichever is less.

All of the above

Price sensitive information is any information which if published, is likely to

materially affect the price of securities of that company.

The following are deemed to be price sensitive information:

- Periodic financial results of the company.

- Intended declaration of dividends (both interim and final).

-Issue of securities or buy back of securities.

-Any major expansion plans or execution of new projects.

-Amalgamation, mergers or takeovers.

- Disposal of the whole or substantial part of the undertaking.

-Any significant changes in policies, plans or operations of the company.

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Question 69

(a)

(b)

(c)

(d)

Question 70

(a)

(b)

Correct Answer 69

Answer

Explanation

Correct Answer 70

Interest rate futures can have the underlying as ___________.

Government Securities

T Bills

Both 1 and 2

None of the above

As an integral part of Client Due Diligence, an intermediary has to verify

the customer identity using reliable, independent source documents, data

or in-formation - True or False ?

TRUE

FALSE

Both 1 and 2

Interest-rate Futures are contracts in which the underlying asset is a debt

security, like futures on Treasury Bills (T-Bills), Commercial Paper (CP) or

Government Securities.

TRUE

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Practice Question Banks also available for :

NISM

NISM Series I: Currency Derivatives Certification Exam

NISM Series V A: Mutual Fund Distributors Certification Exam

NISM Series VI: NISM Series VI - Depository Operations Certification Exam

NISM Series VII: Securities Operations and Risk Management

NISM Series VII: Equity Derivatives Certification Exam

NISM Series III A: Securities Intermediaries Compliance certification Exam

NISM Series X A : Investment Adviser (Level 1) Certification Exam

NISM Series X B: Investment Adviser (Level 2) Certification Exam

NCFM

NCFM Financial Markets: A Beginners Module

NCFM Capital Market (Dealers) Module

NCFM Derivative Market (Dealers) Module

BSE

Certificate on Security Market (BCSM)

NISM SERIES III A SECURITIES INTERMEDIARIES

COMPLIANCE ( NON FUND ) CERTIFICATION V.IMP LAST DAY REVISION EXAM 2

Potrebbero piacerti anche

- Practical Visual Inspection of WeldsDocumento40 paginePractical Visual Inspection of WeldsAmit Sharma100% (1)

- High Containment Labs and Other Facilities of The US Bio Defense ProgramDocumento1 paginaHigh Containment Labs and Other Facilities of The US Bio Defense ProgramHRCNessuna valutazione finora

- NISM VII - SORM Short NotesDocumento25 pagineNISM VII - SORM Short Notescomplaints.tradeNessuna valutazione finora

- Grade 8 Science Activity 1 Quarter 4Documento8 pagineGrade 8 Science Activity 1 Quarter 4yoshirabul100% (2)

- Infants and ToddlersDocumento14 pagineInfants and ToddlersJosias Smith100% (1)

- Nism - 6Documento29 pagineNism - 6vjeshnani100% (1)

- My Study Plan Guide For AmcDocumento7 pagineMy Study Plan Guide For Amc0d&H 8Nessuna valutazione finora

- Capital Market Dealer Module Practice Book SampleDocumento36 pagineCapital Market Dealer Module Practice Book SampleMeenakshi86% (7)

- Wheel Horse by YearDocumento14 pagineWheel Horse by YearNeil SmallwoodNessuna valutazione finora

- NISM VA Revision - Test 3 PDFDocumento40 pagineNISM VA Revision - Test 3 PDFNila DhasNessuna valutazione finora

- Nism ViiDocumento33 pagineNism ViiRavi BhartiNessuna valutazione finora

- NISM Currency Derivatives Mock Test at WWW - MODELEXAM.INDocumento2 pagineNISM Currency Derivatives Mock Test at WWW - MODELEXAM.INSRINIVASAN0% (3)

- One Stop English - Cornish Village - Pre-IntermediateDocumento5 pagineOne Stop English - Cornish Village - Pre-Intermediatec_a_tabetNessuna valutazione finora

- Nism Series XV - Research Analyst Certification ExamDocumento17 pagineNism Series XV - Research Analyst Certification ExamRohit ShetNessuna valutazione finora

- Mutual Funds Distributor Exam NotesDocumento40 pagineMutual Funds Distributor Exam Notesprakash nagaNessuna valutazione finora

- Nism 3 A - Compliance - Last Day Revision Test 1Documento39 pagineNism 3 A - Compliance - Last Day Revision Test 1Rohit Sharma50% (2)

- Nism Mutual Fund Study Notes PDFDocumento28 pagineNism Mutual Fund Study Notes PDFArijitGhoshNessuna valutazione finora

- NISM Paper 1 To 5 MOCK Test - Vry ImpDocumento26 pagineNISM Paper 1 To 5 MOCK Test - Vry ImpKumarGaurav50% (2)

- Nism Series XV - Research Analyst Certification ExamDocumento17 pagineNism Series XV - Research Analyst Certification ExamRohit ShetNessuna valutazione finora

- Boge Screw UsaDocumento40 pagineBoge Screw UsaAir Repair, LLC100% (1)

- Peaditrician All IndiaDocumento66 paginePeaditrician All IndiaGIRISH JOSHINessuna valutazione finora

- Cooling & Heating: ShellmaxDocumento3 pagineCooling & Heating: Shellmaxvijaysirsat2007Nessuna valutazione finora

- Nism Series V B - Mutual Fund Foundation ExamDocumento29 pagineNism Series V B - Mutual Fund Foundation ExamRanganNessuna valutazione finora

- Nism 5 A - Mutual Fund Exam - Practice Test 1Documento24 pagineNism 5 A - Mutual Fund Exam - Practice Test 1Aditi Sawant100% (5)

- NISM DOCE Exam MCQsDocumento6 pagineNISM DOCE Exam MCQsAvibhav KumarNessuna valutazione finora

- Derivative Market Dealer Module Practice Book SampleDocumento35 pagineDerivative Market Dealer Module Practice Book SampleMeenakshi0% (1)

- Paper 3-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 3 - UnlockedDocumento19 paginePaper 3-NISM X A - INVESTMENT ADVISER LEVEL 1 - PRACTICE TEST 3 - UnlockedHirak Jyoti DasNessuna valutazione finora

- Answer The Following QuestionsDocumento23 pagineAnswer The Following QuestionsnirajdjainNessuna valutazione finora

- NISM SERIES V B MUTUAL FUND EXAM PRACTICE TESTDocumento17 pagineNISM SERIES V B MUTUAL FUND EXAM PRACTICE TESTnewbie1947Nessuna valutazione finora

- STUDY MATERIAL FOR NISM Depository Operations Exam (DOCE) - NISM MOCK TEST AT WWW - MODELEXAM.INDocumento28 pagineSTUDY MATERIAL FOR NISM Depository Operations Exam (DOCE) - NISM MOCK TEST AT WWW - MODELEXAM.INThiagarajan Srinivasan74% (19)

- Nism Vi - Depository Exam - Last Day Revision Test 3Documento42 pagineNism Vi - Depository Exam - Last Day Revision Test 3sandip kumar100% (2)

- PDF Nism 8 Equity Derivatives Last Day Revision Test 1 DDDocumento54 paginePDF Nism 8 Equity Derivatives Last Day Revision Test 1 DDShamayal Ahmad0% (1)

- SERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKDa EverandSERIES 24 EXAM STUDY GUIDE 2021 + TEST BANKNessuna valutazione finora

- NISM Series III-A: Securities Intermediaries Compliance (Non Fund) Certification ExaminationDocumento9 pagineNISM Series III-A: Securities Intermediaries Compliance (Non Fund) Certification ExaminationGarimendra VermaNessuna valutazione finora

- Nism Series III A Securities Intermediaries Compliance Non Fund Exam WorkbookDocumento214 pagineNism Series III A Securities Intermediaries Compliance Non Fund Exam Workbookpiyush_rathod_13Nessuna valutazione finora

- WWW - Modelexam.in: Study Notes For Nism - Investment Adviser Level 1 - Series Xa (10A)Documento29 pagineWWW - Modelexam.in: Study Notes For Nism - Investment Adviser Level 1 - Series Xa (10A)sharadNessuna valutazione finora

- Nism Series 1 Currency - Real Feel Mock Test 2Documento54 pagineNism Series 1 Currency - Real Feel Mock Test 2Neeraj Kumar100% (1)

- Mutual Fund-Question BankDocumento32 pagineMutual Fund-Question Bankapi-3706352Nessuna valutazione finora

- NISM Series IIIA Book SummaryDocumento44 pagineNISM Series IIIA Book Summarybhavani sankar areNessuna valutazione finora

- Correct Answers Are Shown in GreenDocumento20 pagineCorrect Answers Are Shown in Greenvineetsukhija67% (6)

- NISM SERIES 1 – CURRENCY DERIVATIVES CERTIFICATION EXAM – PRACTICE TEST 1Documento19 pagineNISM SERIES 1 – CURRENCY DERIVATIVES CERTIFICATION EXAM – PRACTICE TEST 1Neeraj KumarNessuna valutazione finora

- Nism 6Documento30 pagineNism 6Hema lathaNessuna valutazione finora

- Welcome to Pass4Sure Mock TestDocumento28 pagineWelcome to Pass4Sure Mock TestManan SharmaNessuna valutazione finora

- NISM Equity Derivatives Mock Test WWW - MODELEXAM.INDocumento1 paginaNISM Equity Derivatives Mock Test WWW - MODELEXAM.INSRINIVASAN50% (2)

- Nism Equity Derivatives Study NotesDocumento26 pagineNism Equity Derivatives Study NotesRam LalaNessuna valutazione finora

- Mock 1Documento10 pagineMock 1Manan SharmaNessuna valutazione finora

- Equity DerivativesDocumento5 pagineEquity Derivativessimplypaisa50% (2)

- NISM MF Distributors Exam Study NotesDocumento56 pagineNISM MF Distributors Exam Study Notesamita YadavNessuna valutazione finora

- NISM Investment Adviser Study MaterialDocumento28 pagineNISM Investment Adviser Study MaterialSRINIVASAN100% (1)

- Investment Adviser XB Level 2 Exam Study Material NotesDocumento20 pagineInvestment Adviser XB Level 2 Exam Study Material NotesSRINIVASAN100% (2)

- Online Model Exams for NISM, NCFM & BCFM Exams - Register NowDocumento24 pagineOnline Model Exams for NISM, NCFM & BCFM Exams - Register NowSATISH BHARADWAJNessuna valutazione finora

- Nism 9Documento19 pagineNism 9newbie1947Nessuna valutazione finora

- Practice Test Paper & Mock Test For NISM SeriesDocumento2 paginePractice Test Paper & Mock Test For NISM SeriesIntelivisto Consulting India Private LimitedNessuna valutazione finora

- NISM - VII Question BankDocumento56 pagineNISM - VII Question BankRupal Rohan DalalNessuna valutazione finora

- Currency (1) 222 PDFDocumento81 pagineCurrency (1) 222 PDFSoumitra NaiyaNessuna valutazione finora

- Demo - Nism 5 A - Mutual Fund ModuleDocumento7 pagineDemo - Nism 5 A - Mutual Fund ModuleDiwakarNessuna valutazione finora

- 50 Question Test Paper BanksDocumento8 pagine50 Question Test Paper BanksSalil NagvekarNessuna valutazione finora

- NCFM Derivatives Market (Dealers) Module Mock Test QuestionsDocumento19 pagineNCFM Derivatives Market (Dealers) Module Mock Test QuestionsPooja Khandelwal100% (1)

- Basics of Credit Ratings and AnalysisDocumento8 pagineBasics of Credit Ratings and AnalysisPavan ValishettyNessuna valutazione finora

- NCFM Nse Wealth Management Module BasicsDocumento49 pagineNCFM Nse Wealth Management Module BasicssunnyNessuna valutazione finora

- Nism Investment Adviser Level1 Study Notes PDFDocumento33 pagineNism Investment Adviser Level1 Study Notes PDFTumpa BoseNessuna valutazione finora

- Amfi Mock Test PaperDocumento48 pagineAmfi Mock Test PaperUmang Jain100% (7)

- Nism Sorm NotesDocumento25 pagineNism Sorm NotesdikpalakNessuna valutazione finora

- Nism VIII Test 3Documento12 pagineNism VIII Test 3Ashish Singh50% (2)

- Nism X B Caselet 7Documento8 pagineNism X B Caselet 7Finware 1Nessuna valutazione finora

- NISM Series-VIII Equity Derivatives Certification ExaminationDocumento2 pagineNISM Series-VIII Equity Derivatives Certification ExaminationIntelivisto Consulting India Private Limited50% (2)

- Financial Markets A Beginners ModuleDocumento16 pagineFinancial Markets A Beginners ModulePuneeta Gupta100% (1)

- Unit 7 Merchant BankingDocumento14 pagineUnit 7 Merchant BankingSravani RajuNessuna valutazione finora

- Chairman, SEBI vs. Shriram Mutual FundsDocumento11 pagineChairman, SEBI vs. Shriram Mutual FundsRohit Singh DhurveNessuna valutazione finora

- Practice Test No. 4-Converted PASS 4 SUREDocumento29 paginePractice Test No. 4-Converted PASS 4 SUREsanjar khokharNessuna valutazione finora

- Vodafone Idea Limited: PrintDocumento2 pagineVodafone Idea Limited: PrintPrakhar KapoorNessuna valutazione finora

- Evonik-BREAK THRU Brochure Microbials EN Asset 2214205Documento5 pagineEvonik-BREAK THRU Brochure Microbials EN Asset 2214205李雷Nessuna valutazione finora

- Forensic Science Project Group B5518Documento5 pagineForensic Science Project Group B5518Anchit JassalNessuna valutazione finora

- Time ManagementDocumento30 pagineTime ManagementVaibhav Vithoba NaikNessuna valutazione finora

- B Fire BehaviorDocumento39 pagineB Fire BehaviorDon VitoNessuna valutazione finora

- Hydrogen DryerDocumento2 pagineHydrogen Dryersanju_cgh5518Nessuna valutazione finora

- Chapter 2 ManojDocumento4 pagineChapter 2 ManojBro FistoNessuna valutazione finora

- (Tertiary Level Biology) R. J. Wootton (Auth.) - Fish Ecology-Springer Netherlands (1992)Documento218 pagine(Tertiary Level Biology) R. J. Wootton (Auth.) - Fish Ecology-Springer Netherlands (1992)John Davi JonesNessuna valutazione finora

- M Shivkumar PDFDocumento141 pagineM Shivkumar PDFPraveen KumarNessuna valutazione finora

- Integration of The Saprobic System Into The European Union Water Framework DirectiveDocumento14 pagineIntegration of The Saprobic System Into The European Union Water Framework DirectiveMihaela MirabelaNessuna valutazione finora

- Installation and Operating Instructions DPV and DPLHS PumpsDocumento36 pagineInstallation and Operating Instructions DPV and DPLHS PumpsSergeyNessuna valutazione finora

- Mini City Direct Heating SubstationDocumento4 pagineMini City Direct Heating SubstationPaul ButucNessuna valutazione finora

- (L-2) - Cell - Mar 03, 2020Documento52 pagine(L-2) - Cell - Mar 03, 2020puneetlokwani04Nessuna valutazione finora

- BG Nexus Storm 2G Twin WP22RCD IP66 Weatherproof Outdoor Switched Socket 13ADocumento4 pagineBG Nexus Storm 2G Twin WP22RCD IP66 Weatherproof Outdoor Switched Socket 13AAnonymous 8guZVX3ANessuna valutazione finora

- WILLIEEMS TIBLANI - NURS10 Student Copy Module 15 Part1Documento32 pagineWILLIEEMS TIBLANI - NURS10 Student Copy Module 15 Part1Toyour EternityNessuna valutazione finora

- CIVIL BILL OF QUANTITIESDocumento16 pagineCIVIL BILL OF QUANTITIESTomNessuna valutazione finora

- Spring Creek Sun August 27Documento24 pagineSpring Creek Sun August 27amoses88Nessuna valutazione finora

- NECC Sri Lanka May 2017 An Open Appeal To UN and International Community PDFDocumento18 pagineNECC Sri Lanka May 2017 An Open Appeal To UN and International Community PDFThavam RatnaNessuna valutazione finora

- Cyclopropane, Ethynyl - (Cas 6746-94-7) MSDS: CyclopropylacetyleneDocumento5 pagineCyclopropane, Ethynyl - (Cas 6746-94-7) MSDS: CyclopropylacetyleneMiMi JoyNessuna valutazione finora

- ESD Control Experts: Electrical Overstress (EOS) and Electrostatic Discharge (ESD) EventDocumento39 pagineESD Control Experts: Electrical Overstress (EOS) and Electrostatic Discharge (ESD) EventDaiana SilvaNessuna valutazione finora