Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

August Month Compliances

Caricato da

Nikhil Kasat0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni1 paginaAugust

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoAugust

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni1 paginaAugust Month Compliances

Caricato da

Nikhil KasatAugust

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

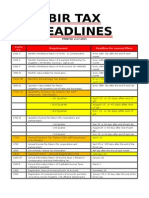

AUGUST MONTH COMPLIANCE

SN

Vertical

Due Dates

15.09.2015

1st Installment to Other Than company 30% of

Advance Tax liability

30.09.2015

Income tax Filing Tax Audit Under 44 AB for

the AY 2015-16 Corporate Assessee or NonCorporate Assessee reuqired to submit Return

of Income.

07.09.2015

Payment of TDS deducted for the month of

Aug,2015.

Interest @ 1.5% per month or part of month from the

date of deduction till the date of payment.

15.09.2015

TDS

2

COT

Professional Tax

Payment of COT(Monthly ) and filing of VAT 120

for Aug,2015.

Interest @ 1.5% per month or part of the month,

& Penalty @ 10% on the Tax payable.

Payment of VAT and filing of VAT 100 for

Aug,2015.

Interest @ 1.5% per month or part of the month,

& Penalty @ 10% on the Tax payable.

20.09.2015

E-Payment & filing of Form 5A for the month of Interest @ 1.50% per month or part of the month,

Aug,2015.

Penalty Rs. 250/-

06.09.2015

Monthly Payments for Copmanies

Excise

06.09.2015

GAR -7

E-Payment Mandatory For ED Paid >1000000 in

FY2014-15

10.09.2015

Monthly Return for production and removal of

goods ER-1

Monthly Return of Excisable Goods Manufactured

& Receipt of Inputs & Capital Goods By EOU,

STP,HTP ER-2

Monthly Return of Informations Relating to

Principal Inputs by Manufacturer for Specified

Duty paid>=Rs.One Crore in 2014-15

PLA/CENVAT/BOTH ER-6

EPF

15.09.2015

Consolidate Statements Due and Remittance

under EPF &EDLI Form 12A

Monthly Returns of Employee Joined /Left 5/10

ESI

Extent of Delay

Upto 6 Months

6Months to 1 Year

More Than 1 Year

Service Tax

Interest u/s 234C @1.5% per month or part of

the month

20.09.2015

VAT

Consequence of non compliance

Payment of 2nd Installment of Advance tax for

Companies At least 45% of Advance Tax liablility,

Income Tax

1

Particular

21.09.2015

ESI Deposit

Simple Int P.A

18%

24%

30%

Potrebbero piacerti anche

- SN Vertical Due Dates Particular Consequence of Non ComplianceDocumento1 paginaSN Vertical Due Dates Particular Consequence of Non ComplianceNikhil KasatNessuna valutazione finora

- Advance Payment of TaxDocumento8 pagineAdvance Payment of TaxdeeptiNessuna valutazione finora

- Pengesahan Penerimaan E-Be Bagi Tahun Taksiran 2015Documento1 paginaPengesahan Penerimaan E-Be Bagi Tahun Taksiran 2015Hafidz JamilNessuna valutazione finora

- TAX AND REGULATORY COMPLIANCE CALENDARDocumento6 pagineTAX AND REGULATORY COMPLIANCE CALENDARRohit KariwalaNessuna valutazione finora

- Important Indian tax and compliance due dates calendarDocumento4 pagineImportant Indian tax and compliance due dates calendarzydusNessuna valutazione finora

- Important Tax Calendar for Chirag Varaiya & CoDocumento13 pagineImportant Tax Calendar for Chirag Varaiya & CoAtul KawaleNessuna valutazione finora

- Updates On Financial Results For Sept 30, 2015 (Result)Documento5 pagineUpdates On Financial Results For Sept 30, 2015 (Result)Shyam SunderNessuna valutazione finora

- Financial Due Date ReminderDocumento16 pagineFinancial Due Date ReminderSureshArigelaNessuna valutazione finora

- Calculate your income tax in IndiaDocumento3 pagineCalculate your income tax in IndiaVasan GovindNessuna valutazione finora

- Tax 2015Documento12 pagineTax 2015Mohamad Nazmi Shamsul KamalNessuna valutazione finora

- June AugDocumento1 paginaJune Augfriendresh1708Nessuna valutazione finora

- How 2 Fillforn 280Documento6 pagineHow 2 Fillforn 280anon_639359071Nessuna valutazione finora

- Worked Example - I: Payment of Tax Before AssessmentDocumento2 pagineWorked Example - I: Payment of Tax Before AssessmentAnonymous 5Pub2IAbNessuna valutazione finora

- Statutory Due Date For F y 15 16Documento1 paginaStatutory Due Date For F y 15 16rajdeeppawarNessuna valutazione finora

- CitizenSafe Self Assessment Guide16Documento17 pagineCitizenSafe Self Assessment Guide16Ella DenizNessuna valutazione finora

- Communique: Information To EmployersDocumento1 paginaCommunique: Information To EmployersVassen MootooNessuna valutazione finora

- Financial Calendar 2011-12Documento3 pagineFinancial Calendar 2011-12Delma SebastianNessuna valutazione finora

- 15 15ceDocumento1 pagina15 15ceYash TiwariNessuna valutazione finora

- GSISDocumento96 pagineGSISHoven MacasinagNessuna valutazione finora

- Siddiqsons Limited Accounts Department KPI SummaryDocumento9 pagineSiddiqsons Limited Accounts Department KPI SummaryArman MuhammadNessuna valutazione finora

- Interest 234abc CalculatorDocumento8 pagineInterest 234abc CalculatorcraszysaurabhNessuna valutazione finora

- Advance TaxDocumento9 pagineAdvance TaxManvi JainNessuna valutazione finora

- Peza ReportDocumento2 paginePeza ReportDiana FernandezNessuna valutazione finora

- Calender 09 Service TaxDocumento4 pagineCalender 09 Service TaxkingindiaNessuna valutazione finora

- Calculate Late Filing Interest U/s 234A, 234B, 234CDocumento3 pagineCalculate Late Filing Interest U/s 234A, 234B, 234CAbhishekNessuna valutazione finora

- Advance Payment of TaxDocumento7 pagineAdvance Payment of TaxKruti Mehta Gopi MehtaNessuna valutazione finora

- QC 16159Documento18 pagineQC 16159Reza KühnNessuna valutazione finora

- Filing Late Tax Returns: Penalties, Implications and ExceptionsDocumento7 pagineFiling Late Tax Returns: Penalties, Implications and ExceptionsBhupendra SharmaNessuna valutazione finora

- Income Slabs Income Tax RateDocumento4 pagineIncome Slabs Income Tax RateSavoir PenNessuna valutazione finora

- GENSANDocumento73 pagineGENSANraffyNessuna valutazione finora

- PAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Documento1 paginaPAYG Payment Summary - Individual Non-Business: Muhammad Danish 22/324 Woodstock Avenue Mount Druitt NSW 2770Danish MuhammadNessuna valutazione finora

- 12 Compliance ChartDocumento19 pagine12 Compliance CharttabrezullakhanNessuna valutazione finora

- Income Tax HandbookDocumento26 pagineIncome Tax HandbooknisarNessuna valutazione finora

- Tax Deducted at SourceDocumento5 pagineTax Deducted at SourceRajinder KaurNessuna valutazione finora

- Eyagendafiscala2015 150127002314 Conversion Gate01 PDFDocumento136 pagineEyagendafiscala2015 150127002314 Conversion Gate01 PDFEuglena VerdeNessuna valutazione finora

- Malaysia Taxpayer ResponsibilitiesDocumento3 pagineMalaysia Taxpayer ResponsibilitiesNurul AmiraNessuna valutazione finora

- Reminders - Due DatesDocumento7 pagineReminders - Due Datesdhuno teeNessuna valutazione finora

- Corporate - News Letter - August 2015-16Documento4 pagineCorporate - News Letter - August 2015-16Divesh GoyalNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento3 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Advance Payment of TaxDocumento9 pagineAdvance Payment of TaxParth P. DasNessuna valutazione finora

- Tax Planning and Managerial DecisionDocumento188 pagineTax Planning and Managerial Decisionkomal_nath2375% (4)

- Bir Tax Deadlines 2015Documento2 pagineBir Tax Deadlines 2015Mary Grace BanezNessuna valutazione finora

- Financial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Documento5 pagineFinancial Results & Limited Review Report For Aug 31, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Corporate Tax ConceptsDocumento20 pagineCorporate Tax ConceptsVandana ChambyalNessuna valutazione finora

- Session 5 TDSDocumento67 pagineSession 5 TDSsinthiakarim17Nessuna valutazione finora

- Advance Payment of TaxDocumento3 pagineAdvance Payment of TaxSalman AnsariNessuna valutazione finora

- PdataDocumento6 paginePdataRazor11111Nessuna valutazione finora

- Amount Credit Credits Items: 41580 Tax Payable Without Marginal ReliefDocumento4 pagineAmount Credit Credits Items: 41580 Tax Payable Without Marginal Reliefaqeelahmed1978Nessuna valutazione finora

- Advance Tax Payment GuideDocumento4 pagineAdvance Tax Payment GuideJaneesNessuna valutazione finora

- Relevant Dates: 15-Apr QuarterlyDocumento6 pagineRelevant Dates: 15-Apr Quarterlysanyu1208Nessuna valutazione finora

- Briefing MADE EASY-LUCILLEDocumento51 pagineBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezNessuna valutazione finora

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Documento5 pagineFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNessuna valutazione finora

- Financial Calendar 2010-2011 Due DatesDocumento3 pagineFinancial Calendar 2010-2011 Due Datesrichard_paradise7625Nessuna valutazione finora

- Income Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxDocumento16 pagineIncome Tax Calculator For FY 2015-16: Shakeeb Khan AxxxxxxxxshikhaxohebkhanNessuna valutazione finora

- Tax Planning and ManagementDocumento12 pagineTax Planning and Managementayushi chandraNessuna valutazione finora

- Income Tax Slabs & Rates For Assessment Year 2013-14Documento37 pagineIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalNessuna valutazione finora

- Witholding TaxDocumento68 pagineWitholding TaxReynante GungonNessuna valutazione finora

- Adjusting the AccountsDocumento6 pagineAdjusting the AccountsJenelle RamosNessuna valutazione finora

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesDa EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNessuna valutazione finora

- Sale DeedDocumento5 pagineSale DeedNitin GoyalNessuna valutazione finora

- Income Declaration Scheme Rules, 2016: Form 1Documento9 pagineIncome Declaration Scheme Rules, 2016: Form 1Nikhil KasatNessuna valutazione finora

- Black Money BillDocumento30 pagineBlack Money BillNikhil KasatNessuna valutazione finora

- BLack Money RulesDocumento23 pagineBLack Money RulesLive LawNessuna valutazione finora

- Types of stamps and concepts of stamp dutyDocumento5 pagineTypes of stamps and concepts of stamp dutyNikhil Kasat100% (2)

- Delhi Dvat Registration InformationDocumento4 pagineDelhi Dvat Registration InformationNikhil KasatNessuna valutazione finora

- DTL Sec 10Documento14 pagineDTL Sec 10Nikhil KasatNessuna valutazione finora

- Derivatives Markets in Interest Rate & Foreign Exchange RateDocumento20 pagineDerivatives Markets in Interest Rate & Foreign Exchange RatehdjfhsjfhwjfNessuna valutazione finora

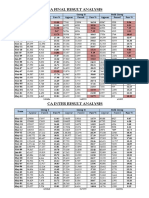

- CA Result AnalysisDocumento1 paginaCA Result AnalysisNikhil KasatNessuna valutazione finora

- Banca SuranceDocumento32 pagineBanca SuranceNikhil KasatNessuna valutazione finora

- Some Confusing & Debatable CSR Issues: Learning Series Vol.-I Issue - 2 2015-16Documento21 pagineSome Confusing & Debatable CSR Issues: Learning Series Vol.-I Issue - 2 2015-16Nikhil KasatNessuna valutazione finora

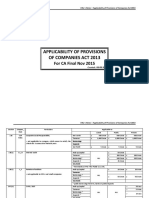

- ApplicabiliTY of ProvisionsDocumento3 pagineApplicabiliTY of ProvisionsNikhil KasatNessuna valutazione finora

- Hedging With Financial DerivativesDocumento30 pagineHedging With Financial DerivativesNikhil KasatNessuna valutazione finora

- Agricultural Income: Agricultural Income: - As Per Sec 10 (1) Agricultural Income Earned by TheDocumento9 pagineAgricultural Income: Agricultural Income: - As Per Sec 10 (1) Agricultural Income Earned by TheNikhil KasatNessuna valutazione finora

- How to score 12-14 marks on Professional Ethics exam questionsDocumento2 pagineHow to score 12-14 marks on Professional Ethics exam questionsNikhil KasatNessuna valutazione finora

- List of Indian As Convergence With IfrsDocumento1 paginaList of Indian As Convergence With IfrsNikhil KasatNessuna valutazione finora

- Calculate Fees and Stamp Duty for Increase in Authorised Share CapitalDocumento10 pagineCalculate Fees and Stamp Duty for Increase in Authorised Share CapitalNikhil KasatNessuna valutazione finora

- Directors Report As Per StatusDocumento5 pagineDirectors Report As Per StatusNikhil KasatNessuna valutazione finora

- Web Base Timesheet ApplicationDocumento4 pagineWeb Base Timesheet ApplicationNikhil KasatNessuna valutazione finora

- Curriculum VitaeDocumento13 pagineCurriculum VitaeNikhil KasatNessuna valutazione finora

- Valuation of InventoriesDocumento4 pagineValuation of InventoriesNikhil KasatNessuna valutazione finora

- Importance of ArticleshipDocumento6 pagineImportance of ArticleshipNikhil KasatNessuna valutazione finora

- Anf 4dDocumento3 pagineAnf 4dNikhil KasatNessuna valutazione finora

- Privileges To Small CompaniesDocumento2 paginePrivileges To Small CompaniesNikhil KasatNessuna valutazione finora

- C01Documento23 pagineC01Silvery DoeNessuna valutazione finora

- Tds On SalariesDocumento55 pagineTds On SalariespunitNessuna valutazione finora

- Ind As 2015Documento2 pagineInd As 2015Nikhil KasatNessuna valutazione finora

- CUSTOMS VALUATION COMPUTATIONDocumento8 pagineCUSTOMS VALUATION COMPUTATIONNikhil KasatNessuna valutazione finora