Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

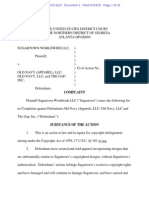

EcomNets Indictment Filed and Docketed

Caricato da

SouthsideCentralCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

EcomNets Indictment Filed and Docketed

Caricato da

SouthsideCentralCopyright:

Formati disponibili

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 1 of 27 PageID# 1

IN THE UNITED STATES DISTRICT COURT FOR THE

EASTERN DISTRICT OF VIRGINIA

Alexandria Division

UNITED STATES OF AMERICA

UNDER SEAL

INOPFN r.niJRT

APR 2 6 2016

tUHK, U.S. DISTRICT COlJf?!

AIFXANDRIA, VIRGINIA

Criminal No. l:16-CR-43

V.

Count 1: Conspiracy to Commit Visa Fraud

(18U.S.C. 371)

RAJU KOSURI,

(Counts 1-4; 10-19)

SMRITI JHARIA,

(Counts 1; 16-20)

Counts 2-9: Visa Fraud

SANCHITA BHATTACHARYA,

(Counts 1; 8-9; 21)

Counts 10-12: Aggravated Identity Theft

(18U.S.C. 1028A(a)(l))

VIKRANT JHARIA,

(Counts 1; 5)

Counts 13-15: International Money Laundering

(18U.S.C. 1956(a)(2)(A))

RICHANARANG,

Count 16: Conspiracy to Make False Statements

(Counts 1; 6-7)

to the Small Business Administration

(18U.S.C. 1546(a))

(18U.S.C. 371)

RAIMONDO PILUSO,

(Counts 16-19)

Counts 17-19: False Statements to the

Small Business Administration

(18U.S.C. 1014)

Defendants.

Counts 20-21: Unlawful Procurement of

Naturalization

(18U.S.C. 1425(a))

Forfeiture Notice

INDICTMENT

April 2016 Term - at Alexandria, Virginia

THE GRAND JURY CHARGES THAT:

General Allegations

At all times relevant to this Indictment:

1.

EcomNets, Inc., Data Systems, Inc., United Software Solutions, Inc.,

Unified Systems, Inc., United Technologies, Inc., Citrix Software, Inc., Agility Software,

1

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 2 of 27 PageID# 2

Inc., American Eagle Software, Inc., Climetrics, Inc., Immigration, LLC, and EcomNets

Federal Solutions, LLC (also known as GovSecurity, LLC) were business entities owned

andcontrolled by RAJU KOSURI ("KOSURI") and SMRITI JHARIA ("JHARIA"), and

located in the Eastern District of Virginia. The above-listed business entities are

described elsewhere inthis as Indictment as"the Enterprise businesses." The Enterprise

businesses purported to provide information technology ("IT") staffing, enterprise

software, and electronic data storage for corporate and government contract clients.

2.

Defendant KOSURI was an Indian national and U.S. legal permanent

resident and was married to defendant JHARIA, an Indian national and naturalized U.S.

citizen. Defendant SANCHITA BHATTACHARYA ("BHATTACHARYA") was an

Indian national and naturalized U.S. citizen. Defendant VIKRANT JHARIA was an

Indian national who was admitted to the United States in 2014 on a non-immigrant visitor

visaand was thebrother of defendant JHARIA; he was latergranted temporary work and

residency authorization based on a petition for an L-1A visa (intra-company executive or

manager transferee). Defendant RICHA NARANG ("NARANG") was an Indian

national and naturalized U.S. citizen. Defendant RAIMONDO PILUSO ("PILUSO")

was a U.S. citizenbom in Germany who acquired citizenship from one or both parents.

3.

Celtic Bank and First National Bank of Pennsylvania were banks whose

deposits were insured by the Federal Deposit Insurance Corporation ("FDIC").

4.

The U.S. Small Business Administration ("SBA") was an independent

agency within the executive branch of the United States government. The Department of

Homeland Security ("DHS") and Department of Labor ("DOL") weredepartments within

the executive branch of the United States government.

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 3 of 27 PageID# 3

The H-IB Visa Program

5.

The H-1B visa program allowed American businesses to temporarily

employ foreign workers withspecialized or technical expertise in a particular field such

as accounting, engineering, or computer science. The U.S. government limited the

issuance of H-1 B visas to 65,000 visas nationwide for the year 2015; exemptions from

the cap allowed for approximately 90,000 total visas to be issued under the H-1B

program. Generally, the H-1B program was designed to allow American businesses to

employhighly educatedforeign workers, but only under strict conditions.

6.

Before hiring a foreign worker under the H-1B visaprogram, the employer

musthave obtained approval from DOL by filing a Labor Condition Application

("LCA"). In the LCA, the employer represented that as of the date of the filing, a job

vacancy or vacancies existed, and it intended to employ a specified number of foreign

workers forspecific positions, at specific geographical locations, for a particular period

of time. The employer was required by DOL to make truthful representations regarding

the foreign worker'srate of pay, work location, andwhether the position was full-time.

The employer musthave represented that it would pay the foreign worker (hereinafter

"beneficiary") for non-productive time^that is, an employer who sponsors a beneficiary

was required to pay wages and other benefits to the beneficiary, even if he was not

actively working for certain periods of time. Employers were prohibited by program

regulations from requiring thatbeneficiaries pay, directly or indirectly, anypartof the

LCA or petitionfiling fee, administrative fees, attorney fees or any other costs related to

the H-1B petition.

7.

Upon approval of the LCA by DOL, the employer must then have

obtained permission from DHS and its components (to include U.S. Citizenship and

Irrmiigration Services ("USCIS")) to hirea specific, named individual. Theemployer

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 4 of 27 PageID# 4

obtained this approval by filing a Form 1-129 Petition for a Nonimmigrant Worker and

paying a processing fee to DHS. Included with the 1-129 was backgroxmd information

about the beneficiary and the employment opportunity, to include: (1) request to change,

amend, or continue immigration status, (2) job title, (3) description of responsibilities, (4)

rate of pay, (5) location of intended employment, (6) expected hours to be worked, (7)

dates of intended employment, (8) CV of prospective beneficiary, and (9) university

transcript and/or proof of advanced degree. Once USCIS approved the petition, the

beneficiary applied for a visa at a U.S. consulate overseas, or, if already in the United

States, the beneficiary's status was changed and/or extended as requested in the petition.

8.

Once the beneficiary was granted H-IB status, she possessed lawful non

immigrant status until the expiration of the H-IB status (typically three years, with an

option for renewal) or the end of employment with the sponsoring employer. If the

employment ended, the employer was obligated to notify USCIS and pay for the

beneficiary to return to her native country. The employer must have begun payment of

salary to the beneficiary within 60 days of visa issuance, if she was already in the United

States or within 30 days of admission to the United States if the beneficiary lived abroad,

9.

Employers utilizing the H-IB visa program frequently retained

immigration lawyers and consultants to navigate the petition process. These lawyers

often prepared petitions on behalf of sponsoring employers and communicated with DOL

and USCIS regarding requests for additional information. Lawyers who represented

employers on petitions were required to file with the petition a Form G-28 Notice of

Entry of Appearance as Attorney or Accredited Representative. The Form G-28 included

identifying information about the lawyer and an attestation, made under penalty of

perjury, that all information provided by the lawyer in the Form G-28 was true and

correct.

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 5 of 27 PageID# 5

Count 1

(Conspiracy to Commit Visa Fraud)

10.

Paragraphs One through Nine of the general allegations are re-alleged and

incorporated by reference as if they were set forth herein.

11.

From in or about September 2001 through in or about January 2016, in the

Eastern District of Virginia and elsewhere, defendants KOSURI, JHARIA, VIKRANT

JHARIA, BHATTACHARYA, and NARANG did knowingly and intentionally combine,

conspire, confederate and agree with each other and others known and unknown to the

Grand Jury, to make under oath, and as permitted under penalty of perjury, knowingly to

subscribe as true, a false statement with respect to a material fact in an application,

affidavit, and other document prescribed by statute and regulation for entry into and as

evidence of authorized stay and employment in the United States, and to knowingly

present any such application, affidavit, and other document containing any false

statement and which fails to contain any reasonable basis in law or fact, in violation of

Section 1546(a) of Title 18, United States Code.

Purpose of the H-IB Visa Conspiracy

12.

The primary purpose of the conspiracy was to obtain money from visa

beneficiaries and end clients by means of securing H-IB visas through false and

fraudulent representations to DHS,DOL, and components of those departments.

Manner and Means of the H-IB Visa Conspiracy

13.

The named and unnamed co-conspirators employed various means in

furtherance of the conspiracy, including but not limited to means described in paragraphs

Fourteen through Twenty below.

14.

Defendant KOSURI organized EcomNets, Inc. in or about 2000, and

organized the remaining Enterprise businesses beginning in 2008 and continuing through

at least 2015. Defendants KOSURI and JHARIA acted as registered agents for some of

5

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 6 of 27 PageID# 6

the Enterprise businesses, while others were registered to nominees of KOSURI and

JHARIA, to include fictitious persons; in fact, defendants KOSURI and JHARIA owned

and controlled all of the Enterprise businesses. The Enterprise businesses purported to,

among other services, provide information technology ("IT") consultants to corporate

clients in need of IT supportthroughout the United States (the "staffingbusiness"). In

support of the staffing business, defendants KOSURI, VIKRANT JHARIA,

BHATTACHARYA, and NARANG, as well as other unnamed co-conspirators, recruited

beneficiaries, nearly all of whom were Indian nationals, to apply for H-IB visas,

15.

Beginning in 2001, when KOSURI caused an I-129 Petition for a

Nonimmigrant Workerto be filed by EcomNets, Inc. on behalf of his spouse, JHARIA,

for H-IB status, and continuing through at least 2015, KOSURI and other named and

unnamed co-conspirators submitted petitions for more than 800 individual immigration

benefits under the H-IB program.

16.

Defendant KOSURI and other named and unnamed co-conspirators filed

fraudulent and fictitious H-IB visa petitions and LCA's on behalfof the Enterprise

businesses. These H-IB visa petitions and LCA's contained material false statements

concerning: (1) the existence of a bona fide employment vacancy; (2) the end client who

would employthe beneficiary; (3) the place of intended employment of the beneficiary;

(4) the identity of the individual sponsoring the petition; (5) thejob responsibilities of the

beneficiary, and (6) the relationship between the beneficiary'semployer and the

purported end client. The co-conspirators claimed in numerous H-IB visa petitions and

LCA's submitted to DOL and DHS that the beneficiaries would work at a data center in

Danville, Virginia, when in fact the beneficiaries would work for end clients at locations

throughout the United States.

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 7 of 27 PageID# 7

17.

Defendants KOSURI, BHATTACHARYA, VIKRANT JHARIA, and

NARANG, as well as unnamed co-conspirators, represented to DOL, DHS, and USCIS

that the Enterprise businesses were wholly independent of one another, when in fact all of

the Enterprise businesses were owned and controlled by KOSURI and JHARIA. To

maintain the appearance of independence in federal government filings, the co-

conspirators used fictitious individuals to sign H-IB visa petitions and LCA's, and also

forged the signatures of real individuals who had no role in preparing or submitting visa

petitions or supporting documentation. The co-conspirators further set up dunmiyemail

accounts in the names of fictitious individuals to deceive DHS and DOL as to the true

author of various e-mail communications.

18.

Defendant KOSURI opened bank accounts in the names of the individual

Enterprise businesses, and regularly transferred funds between those accounts.

Defendant KOSURI used those accounts to receive payment from end clients and to pay

wages to the beneficiaries. Defendant KOSURI initiated wire transfers from these bank

accounts to bank accounts he controlled in India.

19.

Defendant KOSURI and other named and unnamed co-conspirators failed

to withhold employment taxes from some beneficiaries' wages and remit those taxes to

state and federal tax authorities. Beneficiaries were routinely denied access to forms W-2

and other individual tax reporting forms by defendant KOSURI.

20.

Defendant KOSURI and other named and unnamed co-conspirators

violated H-IB visa program rules by collecting visa processing and filing fees from

beneficiaries. Defendant KOSURI opened a bank account at Wells Fargo Bank in the

name of "Immigration, LLC," which account received not less than 400 payments for

visa processing fees firom individual beneficiaries between February 2014 and April

2015.

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 8 of 27 PageID# 8

Overt Acts in Furtherance of the H-IB Visa Conspiracy

21.

Infurtherance of the conspiracy, and to effect itsillegal objects, onor

about thedates listed below, inthe Eastern District of Virginia and elsewhere, defendants

KOSURI, JHARIA, VIKRANT JHARIA, BHATTACHARYA, NARANG, and their coconspirators committed the following overt acts, among others:

a.

On or about October 23, 2002, defendant JHARIA signed and caused to be

filed with the Immigration and Naturalization Service, a predecessor agency and

component of DHS, a fraudulent "Biographic Information" form on which she claimed

employment atCommerce One between February 2000 and September 2001, knowing

that claim to be false.

b.

On orabout April 30, 2011, defendant BHATTACHARYA, acting as

Operations Manager for Unified Systems, Inc., signed a Purchase Order falsely

representing that EcomNets, Inc. and Unified Systems, Inc. had entered into an

agreement to provide the services of U.S. to EcomNets, Inc. as a Computer Systems

Analyst.

c.

On orabout August.2,2011, defendant BHATTACHARYA, acting as

Operations Manager for Unified Systems, Inc., signed a Contractor Agreement falsely

representing that Unified Systems, Inc. had entered into anagreement to provide

technical or other specialized services to EcomNets, Inc.

d.

On or about June 8,2012, defendants KOSURI and BHATTACHARYA

caused the submission to USCIS ofan 1-129 Petition for a Nonimmigrant Worker and

supporting exhibits onbehalf ofA.G., which petition falsely represented that Unified

Systems, Inc. would employ A.G. as a Computer Systems Analyst in Danville, Virginia.

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 9 of 27 PageID# 9

e.

On or about December 7,2012, defendant KOSURI signed checks drawn

on a Wells Fargo bank account ending -6219 in the amounts of $1,225 and $2,325 to pay

the USCIS filing fees for an 1-129 Petition for a Nonimmigrant Worker on behalf of AJ.

f.

On or about December 13,2012, defendant KOSURI caused the

submission to USCIS of the 1-129 Petition for a Nonimmigrant Worker and supporting

exhibits on behalf of A.J., which petition falsely represented that Unified Systems, Inc.

would employ AJ. as a Computer Systems Analyst in Danville, Virginia.

g.

On or about February 22, 2013, defendant KOSURI obtained a Delaware

business license for United Software Solutions, Inc.

h.

On or about March 27,2013, defendant KOSURI signed checks drawn on

Wells Fargo bank account ending -0887 in the amounts of $1,225 and $1,575 to pay the

USCIS filing fees for an 1-129 Petition for a Nonimmigrant Worker on behalf of K.S.

i.

On or about April 11,2013, defendant KOSURI caused the submission to

USCIS of the 1-129 Petition for a Nonimmigrant Worker and supporting exhibits on

behalf of K.S., which falsely represented that United Software Solutions, Inc. would

employ K.S. as a Computer Systems Analyst in Danville, Virginia, and that K.S. would

be supervised by onsite manager T.F.J.

j.

On or about July 16, 2013, defendant KOSURI caused the transmission of

e-mail communications to beneficiary R.M. in connection with delayed payment of

wages, in which e-mail defendant KOSURI stated, inter alia, "You are an hourly

consultant NOT an employee - please understand your position with our company."

k.

On or about January 21, 2014, defendant NARANG caused the

transmission of e-mail communications to defendant KOSURI, in which she requested

that defendant KOSURI forge the signature of the synthetic persona "Sam Bose" on a

document to be submitted to USCIS.

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 10 of 27 PageID# 10

1.

On orabout January 18,2014, defendant VIKRANT JHARIA signed and

back-dated fraudulent offer letters from "Ecomnets Technologies India Pvt Ltd" with the

dates "January 9, 2013" and "December 31,2012."

m.

On or about April 8,2014, defendant NARANG caused the transmission

of e-mail communications to defendant KOSURI, m which she attacheda "Bench List"

of beneficiaries who were not currently employed by an end client.

n.

On or about April 12,2014, defendants KOSURI and VIKRANT JHARIA

caused the submission to USCIS ofa second 1-129 Petition for a Nonimmigrant Worker

and supporting exhibits on behalf ofdefendant VIICRANT JHARIA, which falsely

represented that defendant VIKRANT JHARIA hadbeen employed by EcomNets, Inc.'s

Indian subsidiary since January 2013 as General Manager. Included among the

supporting documents submitted with the petition were copies of fraudulent offer letters

signed by defendant VIKRANT JHARIA and a fraudulent resume for defendant

VIKRANT JHARIA.

o.

On or about April 16,2014, defendant KOSURI caused the submission to

USCIS of an1-129 Petition for a Nonimmigrant Worker and supporting exhibits on

behalf ofN.V., which petition falsely represented that Data Systems, Inc. would employ

N.V. as a Computer Systems Analyst in Danville, Virginia, and which included as

supporting documentation a fraudulent Deed of Lease purporting to show that Data

Systems, Inc. leased space at 107 Carpenter Drive, Suite 220, Sterling, Virginia.

p.

On or about on July25,2014, defendant NARANG signed a Consultant

Verification Letter falsely representing that Data Systems, Inc. had contracted with

EcomNets, Inc. to provide technical services for its ongoing project Enterprise Cloud

Implementation project, and that C.B. would beworking in Danville, Virginia as a

Computer Systems Analyst.

10

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 11 of 27 PageID# 11

q.

On or about June 27,2014, defendants KOSURI and NARANG, acting as

the synthetic persona "Sam Bose," caused the transmission of e-mail communications to

a representative of Princeton Information in connection with msurance coverage for

United Software Solutions, Inc.

r.

On or about August 15,2014, defendantNARANG signed a Consultant

Verification Letter falsely representing that United Technologies, Inc. had contracted

with EcomNets,Inc. to provide technical services for its ongoing Federal Cloud Solutions

project, and that G. S. would be working in Danville, Virginia as a Computer Systems

Analyst.

s.

On or about October 6,2014, defendant VIKRANT JHARIA caused the

transmission of e-mail communications to R.S., the beneficiary of a fraudulent United

Software Solutions, Inc. 1-129petition, in which defendant VIKRANT JHARIA wrote

that certain expenses would be reimbursed only after R.S. had spent six months on a

"billable project without bench period."

t.

On or about December 18,2014, defendant KOSURI obtained approval

for gross financing of $5,850,000 from First National Bank of Pennsylvania for the

business operations of EcomNets, Inc. and EcomNets Danville, LLC.

u.

On or about August 16, 2015, defendant KOSURI signed a 2014 Form

1120 U.S. Corporation Income Tax Return with the initials "VJ" as a "Director" of Data

Systems, Inc.

V.

On or about August 16,2015, defendant KOSURI signed a 2014 Form

1120 U.S. Corporation Income Tax Return with the initials "VJ" as a "Director" of

United Software Solutions, Inc.

(All in violation of Title 18, United States Code, Section 371).

11

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 12 of 27 PageID# 12

Counts 2 to 9

(Visa Fraud)

THE GRAND JURY FURTHER CHARGES THAT:

1.

Paragraphs One to Nine ofthe general allegations and Twelve to Twenty-

One of Count One are realleged and incorporated by reference as if fully set forth herein.

2.

On or about the dates set forth below, in the Eastern District ofVirginia

and elsewhere, the specified defendants did knowingly and intentionally make under

oath, and as permitted under penalty of peijury, knowingly to subscribe as true, a false

statementwith respect to a material fact in an application, affidavit, and other document

prescribed by statute and regulation for entry into and as evidence of authorized stay and

employment in the United States, and to knowingly present any such application,

affidavit, and other document containing any false statement and which fails to contain

any reasonable basis in law or fact, to wit: Forms 1-129 and supporting exhibits, to

include responses to Requests for Evidence, each statement constituting a separate count:

Date

iCount

Sponsoring

Pctition/RFE

Unified

December 28,

Systems, Inc.

2012

Unified

January 15,

Systems, Inc.

2013

KOSURI

KOSURI

KOSURI

United Software

Solutions, Inc.

VIKRANT

JHARIA

NARANG

EcomNets, Inc.

Data Inc.

Systems,

,, ^ ,

EcomNets, Inc.

United

NARANG

Technologies,

Inc.

BHATTACHARYA

IMf{ Visa

Defendant

BHATTACHARYA

Unified

Systems, Inc.

Unified

I Systems, Inc.

Inc.

^ Unified

Abhishek G.

Ashish J.

July 23,2013

Kumar S.

April 12, 2014

Defendant

VIKRANT JHARIA

August 28,

2014

September 5,

2014

November 15,

2011

December 19,

2012

(All in violation of Title 18, United

ted States Code, Section 1546(a)).

Chandra B.

Gautami S.

Usha S.

Vyas M.

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 13 of 27 PageID# 13

Counts 10 to 12

(Aggravated Identity Theft)

THE GRAND JURY FURTHER CHARGES THAT:

1.

Paragraphs One to Nine of the general allegations and Twelve to Twenty-

One of Count One are realleged and incorporated by reference as if fully set forth herein.

2.

On or about the dates listed below, in the Eastern District of Virginia and

elsewhere, defendant KOSURI did knowingly transfer, possess, and use, without lawful

authority, a means of identification of another person, to wit: the names and signatures of

the individual victims listed below, during and in relation to felony violations enumerated

in 18 U.S.C. 1028A(c), that is, visa fraud, as alleged in Counts Two through Four of

this Indictment.

December 28,

Purchase order between Unified Systems, Inc.

2012

and EcomNets, Inc.

Master Service Agreement between Unified

Systems, Inc. and EcomNets, Inc.

12

July 23,2013

Task order between General Dynamics

Information Technology and EcomNets, Inc.

(All in violation of Title 18, United States Code, Section 1028A(a)(l))).

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 14 of 27 PageID# 14

Counts 13 to 15

(International Money Laundering)

THE GRAND JURY FURTHER CHARGES THAT:

1.

Paragraphs One to Nine of the general allegations and Twelve to Twenty-

One of Count One are realleged and incorporated by reference as if fully set forth herein.

2.

On or about the dates listed below, in the Eastern District of Virginia and

elsewhere, defendant KOSURI did unlawfully and knowingly transport, transmit, and

transfer funds to a place outside the United States from or through a place inside the

United States, with the intent to promote the carrying on of specified unlawful activity, to

wit: defendant KOSURI transferred funds in the amounts listed below from accounts he

controlled in the United States to accounts he controlled in India, with the intent to

promote visa fraud, in violation of Title 18, United States Code, Section 1546(a).

< OUlll

December 3,

2013

January 15,

2014

February 17,

2015 .

$55,000.00

$25,000.00

$36,600.00

Wire transfer from Wells Fargo Bank

account -6219 to Citibank

Wire transfer from Wells Fargo Bank

account -6219 to Citibank

Wire transfer from Wells Fargo Bank

account -2958 to Kotak Mahindra Bank

(All in violation of Title 18, United States Code, Section 1956(a)(2)(A)).

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 15 of 27 PageID# 15

Count 16

(Conspiracy to Make False Statements to the Small Business Administration)

THE GRAND JURY FURTHER CHARGES THAT:

1.

Paragraphs One to Four of the general allegations are realleged and

incorporated by reference as if fully set forth herein.

2.

From in or about May 2012 through in or about January 2016, in the

Eastern District of Virginia and elsewhere, defendants KOSURI, JHARIA, and PILUSO

did knowingly and intentionally combine, conspire, confederate and agree with each

other and others known and unknown to the Grand Jury, to make false statements and

reports for the purpose of influencing the actions of the SBA in connection with an

application for HUBZone certification and for the purpose of influencing FDIC-insured

banks in connection with loans guaranteed by the SBA, in violation of Title 18, United

States Code, Section 1014.

The SBA HUBZone and 7(a) Programs

3.

The Historically Underutilized Business Zones ("HUBZone") program

was a federal contracting preference program administeredby the SBA. The program

encouraged economic development and job creation in historically underutilized business

zones, known as HUBZones, through contract preferences. HUBZones were defined by

geographic boundaries, and one such HUBZone included the city of Danville, Virginia,

and the surrounding area.

4.

Small businesses operating in a HUBZone applied to the SBA for program

certification. To qualify, small businesses needed to meet the SBA definition of a "small

business," needed to be owned and controlled by a U.S. citizen, and needed to locate their

principal office in a HUBZone. Once certified, small businesses enjoyed a variety of

advantages when competing for federal contracts, to include sole-source contracts and a

15

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 16 of 27 PageID# 16

ten (10) percentprice advantage in open contractcompetitions when competing against

non-certified businesses.

5.

The SBA operated various loan guarantee programs, to include the 7(a)

program. The 7(a) program provided general purpose loans to small businesses via SBA-

approved lenders; the SEA guaranteedthe loans, providing an incentive to lenders to

underwrite loans to small businesses. In order to qualify for a loan under the 7(a)

program, a business needed to satisfy the following criteria, among others: (1) that it met

the SBA's definition of a "small business"; (2) that it was ownedby qualifying

principals; (3) that its operations did not fall withinprohibited categories; and (4) that the

loan proceeds were to be used for a sound business piupose.

Purposes of the HUBZone and 7(a) Conspiracy

6.

The primary purposes of the conspiracy were to obtain federal contract

preferences and SBA-guaranteed loans through false and fraudulent representations to the

SBA and FDIC-insuredbanks that participated in the SBA's 7(a) loan program.

Manner and Means of the HUBZone and 7(a) Conspiracy

7.

The named and unnamed co-conspirators employed various means in

furtherance of the conspiracy, including but not limited to the means described in

paragraphs Eight through Fifteen below.

8.

Defendant JHARIA submitted a HUBZone application to the SBA in

November 2012. In the application, JHARIA certified under penalty of peijury that she

was a U.S. citizen, was the sole owner of EcomNets Federal Solutions, LLC, and that the

principal business location and at least 35 percent of the firm's employees were

physically located in Danville, Virginia. With this initial HUBZone application, JHARIA

provided materially false state and federal tax records to the SBA, and made false

16

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 17 of 27 PageID# 17

representations to the SBA regarding the principal office of EcomNets Federal Solutions,

LLC and the residence of firm employees.

9.

After the initial and a second HUBZone application were denied by the

SBA, defendant JHARL\ submitted a third application to the SBA onor about May 29,

2014. In that application, defendant JHARIA concealed defendant KOSURI'S role as a

manager and owner of EcomNets Federal Solutions, LLC.

10.

Defendants KOSURI and JHARL\ concealed from the SBA in their initial

and subsequentHUBZone applications the true headquarters of EcomNets Federal

Solutions, LLC in Sterling, Virginia, and falsely represented to the SBAthat EcomNets

Federal Solutions, LLC was headquartered in anempty office suite in Danville, Virginia.

11.

Defendants KOSURI andJHARIA opened business checking accounts at

Wells Fargo Bank in the name of EcomNets Federal Solutions, LLC, on which accounts

both KOSURI and JHARIA were signatories.

12.

Defendant JHARIA represented to the SBA that she was a full-time

employee of EcomNets Federal Solutions, LLC in Danville, Virginia when in fact she

was employed as an IT contract employee for the U.S. Postal Service in Rossyln,

Virginia and at other locations (to include her residence) in Northern Virginia.

13.

Defendants JHARIA and KOSURI retained defendant PILUSO not later

than August 2013 to consulton JHARIA's HUBZone application to the SBA and to

prepare correspondence and other filings which were sent to the SBA on behalf of

EcomNets Federal Solutions, LLC.

14.

On or about July 21,2014, defendant JHARIA obtained a loan in the

amount of $150,000 from Celtic Bank, which loan was guaranteed by the SBA pursuant

to the 7(a) loan program. Defendant JHARIA represented to the SBA thatloan proceeds

17

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 18 of 27 PageID# 18

would be used for a sound business purpose, when in truth andfact the loan proceeds

were diverted to other Enterprise businesses and to defendant KOSURI individually.

15.

Subsequent to its certification by the SBA in or about September 2014,

EcomNets Federal Solutions, LLC, by andthrough defendants KOSURI and JHARIA,

applied for and received not less than $47,472 in federal government contracts.

Overt Acts in Furtherance of the HUBZone and 7(a) Conspiracy

16.

In furtherance of the conspiracy, andto effect its illegal objects, on or

about the dates listed below, in the Eastern District of Virginia and elsewhere, defendants

KOSURI, JHARIA, and PILUSO and their co-conspirators committed the following

overt acts, among others:

a.

On or about August 20,2013, defendant PILUSO deposited a check

signed by defendant KOSURI in the amount of $2,500 to an account in the name of

QualBlazer LLC, drawn on a Wells Fargo account ending -0200 in the name of

EcomNets Federal Solutions, LLC.

b.

On or about December 6,2013, defendant PILUSO deposited a check

signed by defendant KOSURI in the amount of $3,505 to an account in the name of

QualBlazer LLC, drawn on a Wells Fargo accountending -6654 in the name of

EcomNets, Inc.

c.

On or about May 29,2014, defendant JHARIA submitted to the SBA a

HUBZone application and supporting materials on behalf of EcomNets Federal

Solutions, LLC, and which application contained material false statements regarding the

location, ownership, and management of EcomNets Federal Solutions, LLC.

d.

On or about August 19,2013, defendant PILUSO caused the transmission

of e-mail communications to defendant KOSURI in connection witha request that

18

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 19 of 27 PageID# 19

defendant KOSURI sign a "Work Order" on behalf of EcomNets Federal Solutions, LLC

and defendant JHARIA.

e.

On or about September 11,2013, defendant PILUSO caused the

transmission of e-mail commimications to defendant KOSURI in connection with an

"Economic Disadvantage" letter to be submitted to the SBA in connection with the SBA

8(a) program.

f.

On or about August 23,2014, defendant PILUSO caused the transmission

of e-mail communications in connectionwith a request for information sent by the SBA

to EcomNets Federal Solutions, LLC.

g.

On or about August 25, 2014, defendant JHARIA caused the transmission

of a letter and supporting exhibits by facsimile to the SBA in connection with her

pending HUBZone application.

h.

On or about August 25,2014, defendant JHARIA caused the transmission

of e-mail communications to the SBA in connection with her pending HUBZone

application.

i.

On or about March 20,2015, defendant JHARIA caused the transmission

of wire communications to the SBA in connection with her HUBZone profile and the

business GovSecurity, LLC (formerly known as EcomNets Federal Solutions, LLC).

j.

On or about May 8,2012, defendants KOSURI and JHARIA opened a

business checking account ending -0200 at Wells Fargo Bank in the name of EcomNets

Federal Solutions, LLC.

k.

On or about May 28, 2013, defendants KOSURI and JHARIA submitted a

"Addendum to Certificate of Authority" to Wells Fargo Bank in connection with the

business checking account ending -0200 and added defendant KOSURI as an authorized

signer on the account.

19

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 20 of 27 PageID# 20

1.

On orabout July 16,2014, defendant JHARIA signed, under penalty of

peijury, SBA "Borrower Information Form" in connection with her application for a

SBA-guaranteed loan from Celtic Bank under the SBA 7(a) loan program.

m.

On or about July 21, 2014, defendants KOSURI and JHARIA caused the

wire transfer of$143,635 from Celtic Bank, representing the proceeds ofSBA-

guaranteed loan ending -0413, to Wells Fargo Bank business checking account ending 0200.

n.

On or about August 6,2014, defendant KOSURI deposited a check inthe

amount of$50,000 to Wells Fargo Bank business checking account ending -2884, drawn

on Wells Fargo Bank business checking account ending -0200, and made payable to

"EcomNets, Inc."

(All inviolation ofTitle 18, United States Code, Section 371).

20

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 21 of 27 PageID# 21

Counts 17 to 19

(False Statements to the Small Business Administration)

THE GRAND JURY FURTHER CHARGES THAT:

1.

Paragraphs One to Four of the general allegations and Paragraphs Three to

Sixteen of Count Sixteen are realleged and incorporated by reference as if fully setforth

herein.

2.

On or about the dates set forth below, in the Eastern District of Virginia

and elsewhere, defendants KOSURI, JHARIA, and PILUSO willfully and knowingly

made and caused to be made to the SBA false statements for thepurpose of influencing

the actions of the SBA in connection with the HUBZone application and continued

HUBZone certification of EcomNets Federal Solutions, LLC, each statement constituting

a separate count:

Oescription

Count

.J

miin ii iiuiiiifi^imiji-

17

18

19

August 5,

E-mail from JHARIA to SBA responding to request for

2014

information

August 25,

E-mail from JHARIA to the SBA containing letter and exhibits in

2014

support of HUBZone application

March 20,

HUBZone recertification changing name of enterprise from

EcomNets Federal Solutions, LLC to Govsecurity, LLC

2015

(All in violationof Title 18,United States Code, Section 1014).

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 22 of 27 PageID# 22

Count 20

(Procurement of Citizenship or Naturalization Unlawfully)

THE GRAND JURY FURTHER CHARGES THAT:

1.

Paragraphs One toNine ofthe general allegations and Twelve to Twenty-

One of Count One and Paragraphs Three to Sixteen of Count Sixteen are realleged and

incorporated by reference as if fully set forth herein.

2.

On or about the 23rd day ofMay, 2012, in the Eastern District ofVirginia,

defendant JHARIA, knowingly procured andattempted to procure her naturalization,

contrary to law.

(All in violation of Title 18,United States Code, Section 1425(a)).

22

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 23 of 27 PageID# 23

Count 21

(Procurement of Citizenship or Naturalization Unlawfully)

THE GRAND JURY FURTHER CHARGES THAT:

1.

Paragraphs One to Nine of the general allegations and Twelve to Twenty-

One of Count One are realleged and incorporated by reference as if fully set forth herein.

2.

On or about the 14th day of February, 2014, in the Eastern District of

Virginia, defendantBHATTACHARYA, knowingly procuredand attemptedto procure

her naturalization, contrary to law.

(All in violation of Title 18, United States Code, Section 1425(a)).

23

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 24 of 27 PageID# 24

Forfeiture Notice

Pursuant to Rule 32.2(a), defendants KOSURI, JHARIA, NARANG, VIKRANT

JHARIA, and BHATTACHARYA are hereby notified that, if convicted of any ofthe

offenses alleged inCounts One through Nine and Counts Twenty and Twenty-One,

above, they shall forfeit tothe United States, pursuant to 18 U.S.C. 982(a)(6)(A), all

right, title, and interest in any andall property, real or personal, which constitutes or is

derived from proceeds traceable toa violation of 18 U.S.C. 1546(a) orconspiracy to

commit the same orto a violation of 18 U.S.C. 1425. Defendant KOSURI is hereby

notified that, if convicted of any of the offenses alleged in Counts Thirteen through

Fifteen above, he shall forfeit to the United States, pursuant to 18 U.S.C. 982(a)(1), all

right, title, and interest in anyand all property, real or personal, which constitutes or is

derived from proceeds traceable to a violation of 18 U.S.C. 1956. The grand jury finds

probable cause to believe thatat a minimum, thefollowing assets are proceeds of the

offenses charged here or property involved in the offenses charged herein and are

therefore subject to forfeiture:

Sum of money equal to at least $20,700,000.00 in United States currency,

representing the amount of proceeds obtained as a result of a violation of 18

U.S.C. 1546(a) and a conspiracy to commit the same pursuant to 18 U.S.C.

371 and as a result of a violation of 18 U.S.C. 1956(a)(2)(A).

Specified bank accoimts:

(a)

Account 530004879 in the name of Ecomnets Inc. at Acacia

Federal Savings Bank;

(b)

Account2123206768 in the names of Raju Kosuri and/or Smriti

(c)

Kosuri, all at Capital One Bank;

Accounts 0200132041,0200131902 and 0200132017 in the names

of Ecomnets Danville LLC, Ecomnets Inc., and Ecomnets Inc., all

(d)

at Eagle Bank;

Account Nos. Z135939 and Z135940 in the names of Smriti

Kosuri and Raj Kosuri, under the investment name United

(e)

Account 95072187 in the name of Ecomnets, Inc. at First National

(f)

Account 115031 in the name of Ecomnets, Inc. at John Marshall

Software Solutions, all at Equity TrustCompany;

Bank;

Bank;

24

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 25 of 27 PageID# 25

(g)

Accounts in thenames of Ecomnets, Inc., Smriti Kosuri and/or Raj

Kosuri, under ePlan Plan ID#69973, all at Sure 401 ePlan Services

Inc.;

(h)

Accounts 2834523215,3881325207, 5842068123, 5842072802,

6709250200, 6709250879, 6709250887, 8665062884,

7647363972, 7665252958, 7665252974, 7933476736,

8670393159, 8670393167, 8670338956, 8670374837,

2000025146219,2000051681175, and 2000005776654, in the

names of Ecomnets Federal Solutions, LLC, Ecomnets Federal

Solutions, LLC, Immigration, LLC, Ecomnets Danville, LLC,

Ecomnets Federal Solutions, LLC, Climetrics, Inc., United

Software Solutions,United Tech Corporation, United Tech

Corporation, Data Systems, Inc., Immigration, LLC,Data Systems,

Inc., Agility Software, Inc., Citrix Software, Inc., Resilience

Software Solutions, American Eagle Software, Inc., Unified

Systems, Inc., Unified Systems, Inc., and Ecomnets, Inc.,

respectively, all at Wells Fargo Bank;

Specified real property:

(i)

Real property located at 45615 Willow Pond Plaza, Sterling,

0)

Real property located at 45645 Willow PondPlaza, Sterling,

Virginia;

Real property located at 6C Cane CreekBlvd (consisting of 12.69

Virginia;

(k)

acres vacant land), Danville, Virginia.

Specified personal property:

(1)

A 2010 Mercedes Benz Model S400, black exterior color, fourdoor, bearing Vehicle Identification Number

WDDNG9FB6AA300660, last known to bear Virginia license tag

no. "999999S".

Pursuant to Title 21, United States Code, Section 853(p), defendants shall forfeit

the following substitute property to the United States of America, up to the value of the

currency above-described, if, by any act or omission of the defendant, the currency

above-described cannot be located uponthe exercise of due diligence; has been

transferred, soldto, or deposited with a thirdparty; has beenplacedbeyond the

jurisdiction of the Court; has been substantiallydiminished in value; or has been

commingled with other property which cannotbe divided without difficulty:

(m)

Real property located at 42916 Via Veneto Way, Ashbum,

(n)

Realproperty located at 22369 Maison Carree Square, Ashbum,

Virginia;

Virginia;

25

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 26 of 27 PageID# 26

(o)

Real property located at 3650 Morris Farm Drive, Unit 2A,

Greensboro, North Carolina; and

(p)

Safe deposit box numbers 226-3 and 556-3 in the name of Raju

Kosuri and/or Smriti Kosuri at Capital One Bank, located at 43931

Farmwell Hunt Plaza, Ashbum, Virginia.

(All in accordance with Title 18, United States Code, Sections 982(a)(6)(A) and

982(a)(1) and Title 21, United States Code, Section 853(p); and Rule 32.2(a), Federal

Rules of Criminal Procedure.)

Dated this

day of April 2016

A TRUE BILL

Pursuant tothe E-Govemment Act,,

The original ofthis page has been filed

undersea! In thaClftric's nffinn

Foreperson of the Grand Jury

Dana

Boente

Unit^ Atates A

%ul K. Nitze

Special Assistant

ed States Attorney (LT)

26

Case 1:16-cr-00043-LMB Document 1 Filed 04/26/16 Page 27 of 27 PageID# 27

c:!i al' Ai.'l

tv..; ;iC-^ -i olI '?ysq 3irij to

&w'.-iC

diii il] i32 i3.-J^U

:;.iT

Potrebbero piacerti anche

- Xpert Infotech Training ProposalDocumento8 pagineXpert Infotech Training ProposalUjjawal MathurNessuna valutazione finora

- Information Technology PolicyDocumento11 pagineInformation Technology PolicyMekh Raj PoudelNessuna valutazione finora

- ResumeDocumento3 pagineResumemike millNessuna valutazione finora

- RamKumar - Ganesh - SAP PI (XI) Developer - E11TULCSRCEG001 - ResumeDocumento6 pagineRamKumar - Ganesh - SAP PI (XI) Developer - E11TULCSRCEG001 - ResumeBala KrishnanNessuna valutazione finora

- Daily Bench Sales ReportDocumento23 pagineDaily Bench Sales ReportShan iosNessuna valutazione finora

- Computer Jobs & System Software ExplainedDocumento24 pagineComputer Jobs & System Software ExplainedParameswar RaoNessuna valutazione finora

- GEO ExitManagementSystemDocumento7 pagineGEO ExitManagementSystemgvspavanNessuna valutazione finora

- Summary of Experience: Chalakanth ReddyDocumento12 pagineSummary of Experience: Chalakanth ReddychalakanthNessuna valutazione finora

- Aligning Staffing Needs With Business StrategiesDocumento6 pagineAligning Staffing Needs With Business StrategiesVidhyaRIyengarNessuna valutazione finora

- SIA 2012 VMS MSP Landscape ReportDocumento154 pagineSIA 2012 VMS MSP Landscape Reportashwanibharadwaj1Nessuna valutazione finora

- Onward Healthcare: Company ProfileDocumento9 pagineOnward Healthcare: Company Profilechhavi420Nessuna valutazione finora

- Global Comprehensive Privacy Law MappingDocumento6 pagineGlobal Comprehensive Privacy Law MappingSridhaar DaraNessuna valutazione finora

- Experienced Systems Engineer Seeking New OpportunityDocumento2 pagineExperienced Systems Engineer Seeking New OpportunityRaghavendraNunemunthalaNessuna valutazione finora

- 2016 Cleaner Buyers GuideDocumento52 pagine2016 Cleaner Buyers GuideCleaner MagazineNessuna valutazione finora

- Lockheed SearchPros Staffing Agency Agreeement 2019 GDKN CorporationDocumento40 pagineLockheed SearchPros Staffing Agency Agreeement 2019 GDKN CorporationZentek InfosoftNessuna valutazione finora

- Contract Proposal For Recruitment of New Paso Robles Police ChiefDocumento11 pagineContract Proposal For Recruitment of New Paso Robles Police ChiefThe TribuneNessuna valutazione finora

- GO Jek ContactsDocumento5 pagineGO Jek ContactsNaveen KaranamNessuna valutazione finora

- WRX WhitepaperDocumento22 pagineWRX WhitepaperJoyel DsouzaNessuna valutazione finora

- Invoice NinjaDocumento104 pagineInvoice NinjaOrlandoUtreraNessuna valutazione finora

- Sriram MDocumento5 pagineSriram MpaulNessuna valutazione finora

- Background Check Request FormDocumento3 pagineBackground Check Request FormBalachandra GollaNessuna valutazione finora

- Staffing ServicesDocumento4 pagineStaffing ServicesEmonics LLCNessuna valutazione finora

- Us Staffing - HandbookDocumento51 pagineUs Staffing - Handbookgudi.jayanthiNessuna valutazione finora

- Background Verification Form-SLK Laterals) - May 2010Documento6 pagineBackground Verification Form-SLK Laterals) - May 2010Syed TahaNessuna valutazione finora

- Google Group - 1Documento20 pagineGoogle Group - 1Amit PandeyNessuna valutazione finora

- Leadership Skills of Kishore Biyani The Retail KingDocumento22 pagineLeadership Skills of Kishore Biyani The Retail Kingakki1989akki100% (1)

- SLK SoftwareDocumento11 pagineSLK SoftwareSaimadhav MamidalaNessuna valutazione finora

- Top 10 Email Verification and Validation Services in 2021yojzmkcpwiDocumento2 pagineTop 10 Email Verification and Validation Services in 2021yojzmkcpwitincouch61Nessuna valutazione finora

- Appendix NJX Regular Employees v5Documento2 pagineAppendix NJX Regular Employees v5TokTok PHNessuna valutazione finora

- Recruiter List For Website 07-06-16Documento20 pagineRecruiter List For Website 07-06-16Stephen Emmanuel0% (1)

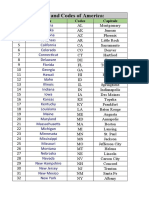

- USA (States and Codes)Documento8 pagineUSA (States and Codes)qwertyNessuna valutazione finora

- (Koirala and Sheikh) Software Testing Interview Qu (B-Ok - Xyz)Documento235 pagine(Koirala and Sheikh) Software Testing Interview Qu (B-Ok - Xyz)mamtaNessuna valutazione finora

- Julianne Kennard HR Change Manager ResumeDocumento3 pagineJulianne Kennard HR Change Manager ResumeproductivejmgNessuna valutazione finora

- Top tech client implementation partners and prime vendorsDocumento1 paginaTop tech client implementation partners and prime vendorsAkhil BharadwajNessuna valutazione finora

- Baird Staffing Research - March 2012.Documento65 pagineBaird Staffing Research - March 2012.cojones321Nessuna valutazione finora

- TechnologiesDocumento8 pagineTechnologiesnagababukoduruNessuna valutazione finora

- White Vendors ListDocumento65 pagineWhite Vendors ListTed JackNessuna valutazione finora

- Complaint Sugartown Worldwide LLC v. Old Navy (Apparel), LLC Et Al, 1:15-cv-02633Documento18 pagineComplaint Sugartown Worldwide LLC v. Old Navy (Apparel), LLC Et Al, 1:15-cv-02633croissantauchocolatNessuna valutazione finora

- RPAS Configuration GuideDocumento272 pagineRPAS Configuration Guidevarachartered283Nessuna valutazione finora

- Data Protection Procedure Aug 2020 (Aug 2022)Documento19 pagineData Protection Procedure Aug 2020 (Aug 2022)HassanNessuna valutazione finora

- Work Spreadsheet PDFDocumento39 pagineWork Spreadsheet PDFMohan MNessuna valutazione finora

- CEAG Products Chapter 6: Ex-Control and Distribution SystemsDocumento130 pagineCEAG Products Chapter 6: Ex-Control and Distribution SystemsHoangNessuna valutazione finora

- Rashal International LLC GDPR Compliance Extract (International)Documento5 pagineRashal International LLC GDPR Compliance Extract (International)Rashal International LLCNessuna valutazione finora

- Tech Aspect For Recruiters - Usitrecruit - Arun Kumar BethiDocumento26 pagineTech Aspect For Recruiters - Usitrecruit - Arun Kumar BethiPragy SharmaNessuna valutazione finora

- UntitledDocumento25 pagineUntitledDion AdalaNessuna valutazione finora

- Nouman Shabbir: Curriculum VitaeDocumento2 pagineNouman Shabbir: Curriculum VitaeNoumanShabbirNessuna valutazione finora

- Internship Excellence - GoCrackIt - 2020 DeckDocumento30 pagineInternship Excellence - GoCrackIt - 2020 DeckSubhadip SamantaNessuna valutazione finora

- Win Business: Proposal Writing GuideDocumento30 pagineWin Business: Proposal Writing GuideLipika haldarNessuna valutazione finora

- IT Sector and Its CompaniesDocumento11 pagineIT Sector and Its Companiespriyanka_joshi_31Nessuna valutazione finora

- Professional Summery: Role & ResponsibilitiesDocumento3 pagineProfessional Summery: Role & Responsibilitiesshikhar mehrotraNessuna valutazione finora

- Comsys Staffing Solutions OverviewDocumento21 pagineComsys Staffing Solutions OverviewVidhyaRIyengarNessuna valutazione finora

- Fortune 100 Companies ListDocumento46 pagineFortune 100 Companies Listsayeedkhan007Nessuna valutazione finora

- Template For Organisations: Your Company NameDocumento23 pagineTemplate For Organisations: Your Company NameLaeth HarebNessuna valutazione finora

- Electrical Engineer Resume SummaryDocumento2 pagineElectrical Engineer Resume SummaryGanta Venkata RajeshNessuna valutazione finora

- TrialDocumento468 pagineTrialkavilankuttyNessuna valutazione finora

- UAE HR Address File For Job SeekersDocumento26 pagineUAE HR Address File For Job SeekersNiyas DeenNessuna valutazione finora

- Read Me - I Am ImportantDocumento56 pagineRead Me - I Am ImportantarciblueNessuna valutazione finora

- United States v. Sylvia Anita Ryan-Webster, 353 F.3d 353, 4th Cir. (2003)Documento19 pagineUnited States v. Sylvia Anita Ryan-Webster, 353 F.3d 353, 4th Cir. (2003)Scribd Government DocsNessuna valutazione finora

- United States v. Ryan-Webster, 4th Cir. (2003)Documento21 pagineUnited States v. Ryan-Webster, 4th Cir. (2003)Scribd Government DocsNessuna valutazione finora

- GW Police ReportDocumento3 pagineGW Police ReportSouthsideCentralNessuna valutazione finora

- Sutherlin Mansion Expenses-February 2016Documento1 paginaSutherlin Mansion Expenses-February 2016SouthsideCentralNessuna valutazione finora

- RDF2015 Entertainment PosterDocumento1 paginaRDF2015 Entertainment PosterSouthsideCentralNessuna valutazione finora

- Public Safety LetterDocumento3 paginePublic Safety LetterSouthsideCentralNessuna valutazione finora

- Superintendent Employment Agreement (Signed)Documento15 pagineSuperintendent Employment Agreement (Signed)SouthsideCentralNessuna valutazione finora

- RDF2015 General PosterDocumento1 paginaRDF2015 General PosterSouthsideCentralNessuna valutazione finora

- DRF 2014 GrantsDocumento1 paginaDRF 2014 GrantsSouthsideCentralNessuna valutazione finora

- June RIFA Agenda - Page 11-13Documento3 pagineJune RIFA Agenda - Page 11-13SouthsideCentralNessuna valutazione finora

- Dps 2015 StatsDocumento1 paginaDps 2015 StatsSouthsideCentralNessuna valutazione finora

- Norhurst RepaymentDocumento6 pagineNorhurst RepaymentSouthsideCentralNessuna valutazione finora

- Final School Board BudgetDocumento1 paginaFinal School Board BudgetSouthsideCentralNessuna valutazione finora

- 2014-2015 RetireesDocumento1 pagina2014-2015 RetireesSouthsideCentralNessuna valutazione finora

- Discipline Data Comparison ReportDocumento1 paginaDiscipline Data Comparison ReportSouthsideCentralNessuna valutazione finora

- Superintendent Employment Agreement (Signed)Documento15 pagineSuperintendent Employment Agreement (Signed)SouthsideCentralNessuna valutazione finora

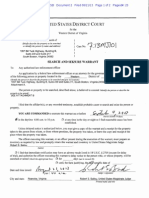

- Search Warrant - August 2013Documento24 pagineSearch Warrant - August 2013SouthsideCentralNessuna valutazione finora

- Nascar TripDocumento1 paginaNascar TripSouthsideCentralNessuna valutazione finora

- SSED GrantsDocumento1 paginaSSED GrantsSouthsideCentralNessuna valutazione finora

- Seizure WarrantDocumento2 pagineSeizure WarrantSouthsideCentralNessuna valutazione finora

- Danville-Pittsylvania Regional Industrial Facility AuthorityDocumento26 pagineDanville-Pittsylvania Regional Industrial Facility AuthoritySouthsideCentralNessuna valutazione finora

- Discipline Data Comparison ReportDocumento1 paginaDiscipline Data Comparison ReportSouthsideCentralNessuna valutazione finora

- RIFA FinancialsDocumento9 pagineRIFA FinancialsSouthsideCentralNessuna valutazione finora

- DPSMeningitis LetterDocumento1 paginaDPSMeningitis LetterSouthsideCentralNessuna valutazione finora

- Search Warrant - GrantedDocumento2 pagineSearch Warrant - GrantedSouthsideCentralNessuna valutazione finora

- School Discipline Report - August 11-29, 2014Documento1 paginaSchool Discipline Report - August 11-29, 2014SouthsideCentralNessuna valutazione finora

- Ed Newsome's DPS ContractDocumento6 pagineEd Newsome's DPS ContractSouthsideCentralNessuna valutazione finora

- Danville - General FundDocumento3 pagineDanville - General FundSouthsideCentralNessuna valutazione finora

- Merle Rutledge Gets Enjoined.Documento18 pagineMerle Rutledge Gets Enjoined.SouthsideCentralNessuna valutazione finora

- HCPS Pay ScalesDocumento1 paginaHCPS Pay ScalesSouthsideCentralNessuna valutazione finora

- PersonalEditionInstallation6 XDocumento15 paginePersonalEditionInstallation6 XarulmozhivarmanNessuna valutazione finora

- Noli Me TangereDocumento26 pagineNoli Me TangereJocelyn GrandezNessuna valutazione finora

- Revised Y-Axis Beams PDFDocumento28 pagineRevised Y-Axis Beams PDFPetreya UdtatNessuna valutazione finora

- Dismantling My Career-Alec Soth PDFDocumento21 pagineDismantling My Career-Alec Soth PDFArturo MGNessuna valutazione finora

- Man and Cannabis in Africa: A Study of Diffusion - Journal of African Economic History (1976)Documento20 pagineMan and Cannabis in Africa: A Study of Diffusion - Journal of African Economic History (1976)AbuAbdur-RazzaqAl-MisriNessuna valutazione finora

- CUBihar Dec12 ChallanDocumento1 paginaCUBihar Dec12 Challannareshjangra397Nessuna valutazione finora

- American Bible Society Vs City of Manila 101 Phil 386Documento13 pagineAmerican Bible Society Vs City of Manila 101 Phil 386Leomar Despi LadongaNessuna valutazione finora

- PNP Operations & Patrol GuidelinesDocumento8 paginePNP Operations & Patrol GuidelinesPrince Joshua Bumanglag BSCRIMNessuna valutazione finora

- 2022 ICT Mentorship 5Documento50 pagine2022 ICT Mentorship 5dcratns dcratns100% (21)

- Final Project Taxation Law IDocumento28 pagineFinal Project Taxation Law IKhushil ShahNessuna valutazione finora

- Human Rights Violations in North KoreaDocumento340 pagineHuman Rights Violations in North KoreaKorea Pscore100% (3)

- Phone, PTCs, Pots, and Delay LinesDocumento1 paginaPhone, PTCs, Pots, and Delay LinesamjadalisyedNessuna valutazione finora

- 5b Parking StudyDocumento2 pagine5b Parking StudyWDIV/ClickOnDetroitNessuna valutazione finora

- Class 3-C Has A SecretttttDocumento397 pagineClass 3-C Has A SecretttttTangaka boboNessuna valutazione finora

- Oath of Protection Paladin OathDocumento3 pagineOath of Protection Paladin OathJoseph OsheenNessuna valutazione finora

- Montaner Vs Sharia District Court - G.R. No. 174975. January 20, 2009Documento6 pagineMontaner Vs Sharia District Court - G.R. No. 174975. January 20, 2009Ebbe DyNessuna valutazione finora

- Restrictions on Hunting under Wildlife Protection ActDocumento14 pagineRestrictions on Hunting under Wildlife Protection ActDashang DoshiNessuna valutazione finora

- Uttara ClubDocumento16 pagineUttara ClubAccounts Dhaka Office75% (4)

- The War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFDocumento50 pagineThe War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFJosh Didgeridoo0% (1)

- Civil Unrest in Eswatini. Commission On Human Rights 2021Documento15 pagineCivil Unrest in Eswatini. Commission On Human Rights 2021Richard RooneyNessuna valutazione finora

- ThesisDocumento310 pagineThesisricobana dimaraNessuna valutazione finora

- Volume 42, Issue 52 - December 30, 2011Documento44 pagineVolume 42, Issue 52 - December 30, 2011BladeNessuna valutazione finora

- MSA BeijingSyllabus For Whitman DizDocumento6 pagineMSA BeijingSyllabus For Whitman DizcbuhksmkNessuna valutazione finora

- Meaning and Purpose of LawsDocumento12 pagineMeaning and Purpose of LawsChuphyl MatreNessuna valutazione finora

- Easy soil preparation tipsDocumento3 pagineEasy soil preparation tipsMichael GiftNessuna valutazione finora

- Understanding Cultural Awareness Ebook PDFDocumento63 pagineUnderstanding Cultural Awareness Ebook PDFLaros Yudha100% (1)

- Qualities of Officiating OfficialsDocumento3 pagineQualities of Officiating OfficialsMark Anthony Estoque Dusal75% (4)

- The Books of The Bible-ModuleDocumento38 pagineThe Books of The Bible-Modulejillene catapang67% (3)

- UGC Project FormatDocumento19 pagineUGC Project FormatAmit GautamNessuna valutazione finora