Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Selection 26 144

Caricato da

Anonymous fu1jUQDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Selection 26 144

Caricato da

Anonymous fu1jUQCopyright:

Formati disponibili

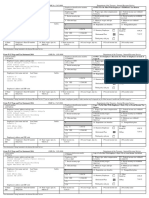

2015 W-2 and EARNINGS SUMMARY

Employee Reference Copy

Wage and Tax

Statement

OMB No.

W-2

2015

Copy C for employeesrecords.

Dept.

d Control number

Corp.

Employer

122681 NCN2/EMQ 296700

c

This blue Earnings Summary section is included with your W-2 to help describe portions in more detail.

The reverse side includes general information that you may also find helpful.

1. The following

1545-0008

use only

information

Gross Pay

EIC 1943

reflects your final 2015 pay stub plus any adjustments

Social Security

Tax Withheld

1304.10

80.85

Box 17 of W-2

Box 4 of W-2

Employers name, address, and ZIP code

EXAMINATION

MANAGEMENT

SERVICES INC

3050REGENT

BOULEVARD

100

IRVING TX 75063

Fed. Income

Tax Withheld

Medicare Tax

Withheld

Box 2 of W-2

Box 6 of W-2

submitted by your employer.

TX. State Income Tax

SUI/SDI

Box 14 of W-2

18.91

2. Your Gross Pay was adjusted as follows to produce your W-2 Statement.

Batch

#02844

Wages, Tips, other

Compensation

Box 1 of W-2

e/f Employees name, address, and ZIP code

TERESA R SPEIGHT

1100 NORTH 6TH STREET

WACO TX 76707

b

Employers FED ID number

Wages, tips, other comp.

Social security wages

APT#E5

Gross Pay

Reported W-2 Wages

Employees SSA number

Federal income tax withheld

Social security tax withheld

Medicare tax withheld

75-1444139

Social Security

Wages

Box 3 of W-2

Medicare

Wages

Box 5 of W-2

TX. State Wages,

Tips, Etc.

Box 16 of W-2

1,304.10

1,304.10

1,304.10

1,304.10

1,304.10

1,304.10

629-40-1782

1304.10

1304.10

5

Medicare wages and tips

Social security tips

80.85

1304.10

18.91

8 Allocated tips

Verification Code

3. Employee W-4 Profile.

10 Dependent care benefits

12a See instructionsfor box 12

11 Nonqualified plans

TERESA R SPEIGHT

1100 NORTH 6TH STREET APT#E5

WACO TX 76707

12b

12c

12d

13 Stat emp. Ret. plan 3rd party sick pay

14 Other

To change your Employee W-4 Profile Information,

file a new W-4 with your payroll dept.

Social Security Number: 629-40-1782

Taxable Marital Status: SINGLE

Exemptions/Allowances:

____________________

FEDERAL:

STATE:

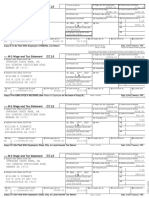

15 State Employers state ID no. 16 State wages, tips, etc.

7

No State Income Tax

TX

17 State income tax

18 Local wages, tips, etc.

19 Local income tax

20 Locality name

Wages, tips, other comp.

2015

Federal income tax withheld

ADP,

Wages, tips, other comp.

1304.10

3

Social security wages

Social security tax withheld

Medicare wages and tips

Control number

Medicare tax withheld

Dept.

Corp.

Employer

use only

EIC 1943

Control number

Employers FED ID number

a Employees SSA number

75-1444139

7

Social security tips

Verification Code

Dept.

Social security wages

80.85

Medicare tax withheld

1304.10

18.91

Corp.

Employer

122681 NCN2/EMQ 296700

c

Employers name, address, and ZIP code

Social security tax withheld

Medicare wages and tips

use only

EIC 1943

Medicare wages and tips

Control number

1304.10

Employers FED ID number

a Employees SSA number

75-1444139

8 Allocated tips

Social security tips

Federal income tax withheld

Social security tax withheld

Medicare tax withheld

80.85

Dept.

18.91

Corp.

Employer

122681 NCN2/EMQ 296700

use only

EIC 1943

Employers name, address, and ZIP code

EXAMINATION

MANAGEMENT

SERVICES INC

3050REGENT

BOULEVARD

100

IRVING TX 75063

629-40-1782

1304.10

Employers name, address, and ZIP code

EXAMINATION

MANAGEMENT

SERVICES INC

3050REGENT

BOULEVARD

100

IRVING TX 75063

Wages, tips, other comp.

1304.10

1304.10

18.91

122681 NCN2/EMQ 296700

c

Social security wages

80.85

1304.10

Federal income tax withheld

1304.10

1304.10

5

LLC

EXAMINATION

MANAGEMENT

SERVICES INC

3050REGENT

BOULEVARD

100

IRVING TX 75063

Employers FED ID number

629-40-1782

a Employees SSA number

75-1444139

8 Allocated tips

Social security tips

629-40-1782

8 Allocated tips

10 Dependent care benefits

10 Dependent care benefits

10 Dependent care benefits

11 Nonqualified plans

12a See instructions for box 12

11 Nonqualified plans

12a

12

11 Nonqualified plans

12a

14 Other

12b

14 Other

12b

14 Other

12b

12c

12c

12c

12d

12d

12d

13 Stat emp. Ret. plan 3rd party sick pay

13 Stat emp. Ret. plan 3rd party sick pay

13 Stat emp. Ret. plan 3rd party sick pay

e/f Employees name, address and ZIP code

e/f Employees name, address and ZIP code

e/f Employees name, address and ZIP code

TERESA R SPEIGHT

1100 NORTH 6TH STREET

WACO TX 76707

TERESA R SPEIGHT

1100 NORTH 6TH STREET

WACO TX 76707

TERESA R SPEIGHT

1100 NORTH 6TH STREET

WACO TX 76707

APT#E5

15 State Employers state ID no. 16 State wages, tips, etc.

TX

APT#E5

15 State Employers state ID no. 16 State wages, tips, etc.

TX

18 Local wages, tips, etc.

17 State income tax

19 Local income tax

20 Locality name

19

W-2

Copy B to be filed with employees

Local income tax

No. 1545-0008

18 Local wages, tips, etc.

17 State income tax

20 Locality name

19

TX.State Reference

Wage and Tax

Statement

2015 W-2

Federal IncomeTax Return.

15 State Employers state ID no. 16 State wages, tips, etc.

TX

17 State income tax

Federal Filing Copy

Wage and Tax

Statement

OMB

APT#E5

Copy

Local income tax

OMB

No. 1545-0008

20 Locality name

TX.State Filing Copy

Wage and Tax

Statement

OMB

2015 W-2

Copy 2 to be filed with employeesState IncomeTax Return.

18 Local wages, tips, etc.

2015

Copy 2 to be filed with employeesState IncomeTax Return.

No. 1545-0008

Potrebbero piacerti anche

- I Pay Statements ServncoDocumento2 pagineI Pay Statements ServncoPablito Padilla100% (2)

- Dan Simon 2016 W2 PDFDocumento2 pagineDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNessuna valutazione finora

- Evans W-2sDocumento2 pagineEvans W-2sAlmaNessuna valutazione finora

- MH0ihh081h6754910230616041100202 PDFDocumento2 pagineMH0ihh081h6754910230616041100202 PDFLogan GoadNessuna valutazione finora

- W 2Documento3 pagineW 2lysprr33% (3)

- StatementDocumento2 pagineStatementLuis HarrisonNessuna valutazione finora

- Javier A Valdez 2107 BAMBOO ST. Mesquite TX 75150Documento2 pagineJavier A Valdez 2107 BAMBOO ST. Mesquite TX 75150javiercreatesNessuna valutazione finora

- W2 2010Documento2 pagineW2 2010Rick Nunns100% (2)

- W-2 Preview ADPDocumento4 pagineW-2 Preview ADPRyan AllenNessuna valutazione finora

- PDF W2Documento1 paginaPDF W2John LittlefairNessuna valutazione finora

- Statement For 2021Documento2 pagineStatement For 2021seguins0% (1)

- Elina Shinkar w2 2014Documento2 pagineElina Shinkar w2 2014api-318948819Nessuna valutazione finora

- Selection-26 - 55 PDFDocumento1 paginaSelection-26 - 55 PDFAnonymous fu1jUQNessuna valutazione finora

- Ajax PDFDocumento2 pagineAjax PDFGeorge AndoneNessuna valutazione finora

- Ioana w2 PDFDocumento1 paginaIoana w2 PDFBlueberry13KissesNessuna valutazione finora

- TAXES w2 REGAL HospitalityDocumento2 pagineTAXES w2 REGAL Hospitalityoskar_herrera2012Nessuna valutazione finora

- AutoPay Output Documents PDFDocumento2 pagineAutoPay Output Documents PDFAnonymous QZuBG2IzsNessuna valutazione finora

- Resume of Msnetty42Documento2 pagineResume of Msnetty42api-25122959Nessuna valutazione finora

- 20 TR 08894502584200889450Documento2 pagine20 TR 08894502584200889450Josh JasperNessuna valutazione finora

- Filename PDFDocumento3 pagineFilename PDFIvette PizarroNessuna valutazione finora

- W21225760934 0 PDFDocumento2 pagineW21225760934 0 PDFAnonymous czHLQeLPB4Nessuna valutazione finora

- SC Tax ReturnDocumento12 pagineSC Tax ReturnCeleste KatzNessuna valutazione finora

- 2014 TaxReturnDocumento25 pagine2014 TaxReturnNguyen Vu CongNessuna valutazione finora

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Documento3 pagineAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNessuna valutazione finora

- Omb No. 1545-0008 Omb No. 1545-0008Documento2 pagineOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNessuna valutazione finora

- Federal Electronic Filing Instructions: Tax Year 2018Documento13 pagineFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielNessuna valutazione finora

- Adp 2019 02 12 PDFDocumento2 pagineAdp 2019 02 12 PDFAdam Olsen100% (1)

- Justin w2Documento2 pagineJustin w2jusditzNessuna valutazione finora

- Dennis w2Documento5 pagineDennis w2Dennis GieselmanNessuna valutazione finora

- Wage and Tax Statement: Page 1 / 4Documento4 pagineWage and Tax Statement: Page 1 / 4blon majorsNessuna valutazione finora

- Dependent Student SheetDocumento4 pagineDependent Student SheetMaria GomezNessuna valutazione finora

- form-w2-Ramona-Crawford 2Documento9 pagineform-w2-Ramona-Crawford 2Nicole CarutherNessuna valutazione finora

- F 1040Documento2 pagineF 1040Kevin RowanNessuna valutazione finora

- FTF1299519215531Documento3 pagineFTF1299519215531Leslie Washington100% (1)

- Marie Aladin 2019 Tax PDFDocumento60 pagineMarie Aladin 2019 Tax PDFPrint Copy100% (1)

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocumento2 pagineW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Psav Encore Global W-2Documento5 paginePsav Encore Global W-2Vincent NewsonNessuna valutazione finora

- Federal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramDocumento10 pagineFederal Direct Stafford/Ford Loan Federal Direct Unsubsidized Stafford/Ford Loan Master Promissory Note William D. Ford Federal Direct Loan ProgramBrittany LyNessuna valutazione finora

- StubsDocumento2 pagineStubsAnonymous 8C2bCutL0100% (2)

- Loan AppDocumento9 pagineLoan Appanon-209253Nessuna valutazione finora

- Filing Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)Documento2 pagineFiling Status U.S. Individual Income Tax Return: Married Filing Jointly Qualifying Widow (Er) (QW)eddie waites100% (2)

- Steven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Documento21 pagineSteven Booth 261-25-7668 Louise Booth 571-27-5430 5717 Roundup Bakersfield, 93306Thomas Horne100% (1)

- w-2 2019 Form - LOUISA - BOKACHEVADocumento1 paginaw-2 2019 Form - LOUISA - BOKACHEVAKeller Brown JnrNessuna valutazione finora

- Form W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordsDocumento1 paginaForm W-2 Wage and Tax Statement 2020 Copy C, For Employee's RecordssageNessuna valutazione finora

- Tax FormsDocumento2 pagineTax Formswilliam schwartz50% (2)

- 9YWwhh55h5384810244629010109102 PDFDocumento2 pagine9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- 2021 Turbo Tax ReturnDocumento10 pagine2021 Turbo Tax ReturnIvette Hoffman75% (4)

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Documento2 pagineSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNessuna valutazione finora

- Or Wcomp 0.72 or Wcomp 0.72Documento1 paginaOr Wcomp 0.72 or Wcomp 0.72aaronNessuna valutazione finora

- U.S. Individual Income Tax Return 1040A: Filing StatusDocumento3 pagineU.S. Individual Income Tax Return 1040A: Filing StatusYosbanyNessuna valutazione finora

- Kaisers 10Documento41 pagineKaisers 10camillealyssa100% (1)

- TaxForms PDFDocumento2 pagineTaxForms PDFLMN214100% (1)

- 2021 Tax Return: Prepared ByDocumento6 pagine2021 Tax Return: Prepared BySolomonNessuna valutazione finora

- E Name w2 2021 WithInstructionsDocumento3 pagineE Name w2 2021 WithInstructionsKandice ChandlerNessuna valutazione finora

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocumento2 pagineDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNessuna valutazione finora

- Adeccow 215Documento2 pagineAdeccow 215ier362Nessuna valutazione finora

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocumento15 pagineMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programdog dogNessuna valutazione finora

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Documento2 pagineJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- W 2Documento6 pagineW 2prads1259Nessuna valutazione finora

- Tax FormsDocumento2 pagineTax FormsBridget May Cruz100% (1)

- Treasury Bond ResultsDocumento4 pagineTreasury Bond ResultsDennis OndiekiNessuna valutazione finora

- David RockefellerDocumento4 pagineDavid RockefellerRonaldNessuna valutazione finora

- 1twe PDFDocumento360 pagine1twe PDFAsad SamadNessuna valutazione finora

- Us 1099 2022Documento4 pagineUs 1099 2022mks12Nessuna valutazione finora

- The Hirsch Report PDFDocumento91 pagineThe Hirsch Report PDFFirdaus TahirNessuna valutazione finora

- Professor Patricia Patty Pa Te Is Retired From The Palm Springs PDFDocumento1 paginaProfessor Patricia Patty Pa Te Is Retired From The Palm Springs PDFTaimour HassanNessuna valutazione finora

- Kaisers 10Documento41 pagineKaisers 10camillealyssa100% (1)

- Victoria Freitas - 1040-FormDocumento2 pagineVictoria Freitas - 1040-Formapi-537101018Nessuna valutazione finora

- Final Dataflow Diagram Payroll SystemDocumento1 paginaFinal Dataflow Diagram Payroll SystemRiRi ChanNessuna valutazione finora

- Guzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodDocumento2 pagineGuzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodGerald SantosNessuna valutazione finora

- BoschDocumento1 paginaBoschShakir HussainNessuna valutazione finora

- Paycheck 20211203 002360 Maurisha 202112231136Documento1 paginaPaycheck 20211203 002360 Maurisha 202112231136saraNessuna valutazione finora

- Full Report December 2011: U.S. Manufacturing Competitiveness InitiativeDocumento0 pagineFull Report December 2011: U.S. Manufacturing Competitiveness Initiativeapi-238443539Nessuna valutazione finora

- Updated Lender List - WEBDocumento2 pagineUpdated Lender List - WEBReynante CabalteraNessuna valutazione finora

- LMS1 FebruaryDocumento6 pagineLMS1 FebruaryAnitas LimmaumNessuna valutazione finora

- Tax Guide For Small BusinessDocumento54 pagineTax Guide For Small BusinessRaja PKNessuna valutazione finora

- Falling Short: The Coming Retirement ChallengesDocumento29 pagineFalling Short: The Coming Retirement ChallengesNational Press Foundation100% (1)

- USA CityDocumento320 pagineUSA Citymackintosh21Nessuna valutazione finora

- Urvi Dhala Paystub 2021 12 31Documento1 paginaUrvi Dhala Paystub 2021 12 31uNessuna valutazione finora

- Realtor%20 Excel%20 SpreadsheetDocumento93 pagineRealtor%20 Excel%20 SpreadsheetMuhammad Uzair PanhwarNessuna valutazione finora

- Adp Pay Stub TemplateDocumento1 paginaAdp Pay Stub TemplateJordan McKenna0% (1)

- Las Vegas Casino Slot Machines For SaleDocumento25 pagineLas Vegas Casino Slot Machines For SaleWorldwide Gaming IncNessuna valutazione finora

- Form PDFDocumento1 paginaForm PDFanby1Nessuna valutazione finora

- Assignment 5 45Documento5 pagineAssignment 5 45Michael TungNessuna valutazione finora

- UnassignedPending Civil Cases 9-15-05Documento540 pagineUnassignedPending Civil Cases 9-15-05Cairo AnubissNessuna valutazione finora

- 12 568bk PDFDocumento60 pagine12 568bk PDFAReliableSourceNessuna valutazione finora

- Falling Giant - A Case Study of AIG - InvestopediaDocumento4 pagineFalling Giant - A Case Study of AIG - InvestopediatanmriNessuna valutazione finora

- Chapter 4Documento6 pagineChapter 4Ashanti T Swan0% (1)

- Coin Collection PRICEDDocumento3 pagineCoin Collection PRICEDEric Doctore KrageNessuna valutazione finora

- Lerma E Claus 7087 Coventry Glenn Road Las Vegas, NV 89148Documento1 paginaLerma E Claus 7087 Coventry Glenn Road Las Vegas, NV 89148FRANKLYN TRONCONessuna valutazione finora