Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Formula Sheet TVM

Caricato da

inchabogCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Formula Sheet TVM

Caricato da

inchabogCopyright:

Formati disponibili

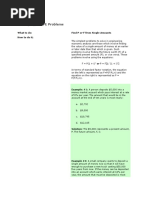

A.

Future Value and Present Value of a

Single Cash Stream or Several Unequal

Cash Streams

Future

Value

of

Annuity

Due

where:

FV

future

value

PV

present

value

n

periods

r

rate

B. Net Present Value of a Project

Solving for PMT, r, n of a Future Value of Annuity

C.

Annuities

Apply basic Algebra to solve for the missing item

Present Value of an Ordinary Annuity

Future

Value

of

Ordinary

Annuity

or

E. Future Values with Non-Annual

Periods

Present Value of an Annuity Due

Loan

Amortization

Annual

Payments

Note:

Solve

for

the

Annuity

Payments

first.

Loan

Amortization

Monthly

Payments

D.

Perpetuity

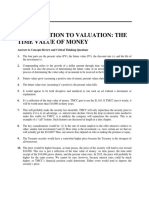

F. Finding n (years/period) of a future

value problem

Using the FV equation,

FVn

------ = (1+r)n

PV

Substitute the variables, FV and PV, with the

figures given in problem.

Your solution in dividing FVn/PV is your

basis in using the FV Table. For example,

you have 6.1051, and the rate given is 10%.

Since rate (r) is given in the problem, find

the 6.1051 in the 10% column, and check

the corresponding period to arrive at your

answer.

In this example, the answer is 5 years.

G. Finding r (rate) of a future value

problem

I.

Strategy

Map

You

may

write

problem

solving

tips

here.

FVn

------

=

(1+r)n

PV

Substitute

the

variables,

FV

and

PV,

with

the

figures

given

in

problem.

Your

solution

in

dividing

FVn/PV

is

your

basis

in

using

the

FV

Table.

For

example,

you

have

6.1051,

and

the

period

given

is

5

years.

Since

period

(n)

is

given

in

the

problem,

find

the

6.1051

in

the

5

years

column,

and

check

the

corresponding

rate

to

arrive

at

your

answer.

In

this

example,

the

answer

is

10%

years.

H.

Making

Interest

Rates

Comparable

Potrebbero piacerti anche

- TVM ProblemsDocumento7 pagineTVM ProblemsBala SudhakarNessuna valutazione finora

- PRE MBA Columbia Evaluating Cash FlowsDocumento65 paginePRE MBA Columbia Evaluating Cash FlowsRD A FernandezNessuna valutazione finora

- BCH-503-SM04time ValueDocumento67 pagineBCH-503-SM04time Valuesugandh bajaj100% (1)

- Engineering Economic Lecture 3Documento32 pagineEngineering Economic Lecture 3omar meroNessuna valutazione finora

- Time Value of Money (Part 2)Documento17 pagineTime Value of Money (Part 2)Claudine DuhapaNessuna valutazione finora

- 4 6 Spreadsheets Financial Calculators Solving For Cash FlowsDocumento6 pagine4 6 Spreadsheets Financial Calculators Solving For Cash Flowskarimotarike77Nessuna valutazione finora

- Manipulating Present Value FormulasDocumento2 pagineManipulating Present Value FormulasMaricarmen FloresNessuna valutazione finora

- Time Value of MoneyDocumento18 pagineTime Value of MoneyAlston PereiraNessuna valutazione finora

- Parrino4e ET 5-7Documento2 pagineParrino4e ET 5-7uccs1Nessuna valutazione finora

- Time ValueDocumento9 pagineTime Valuemohanraokp2279Nessuna valutazione finora

- Present Value of A Future SumDocumento9 paginePresent Value of A Future SumChabelita SantillanNessuna valutazione finora

- Unit 2 Lecture NotesDocumento3 pagineUnit 2 Lecture NotesHennrocksNessuna valutazione finora

- Chapter 5Documento33 pagineChapter 5GODNessuna valutazione finora

- Icfai FM Time Value of Money Ch. IiiDocumento13 pagineIcfai FM Time Value of Money Ch. Iiiapi-3757629100% (3)

- Present Value Annuity Tables: What Is An Annuity Table?Documento8 paginePresent Value Annuity Tables: What Is An Annuity Table?Sharmin ReulaNessuna valutazione finora

- Lecture 8Documento37 pagineLecture 8Muhammad UsmanNessuna valutazione finora

- Foundations of Financial Management 17Th Edition Block Solutions Manual Full Chapter PDFDocumento42 pagineFoundations of Financial Management 17Th Edition Block Solutions Manual Full Chapter PDFjavierwarrenqswgiefjyn100% (11)

- Chapter 13 SolutionsDocumento16 pagineChapter 13 SolutionsEdmond ZNessuna valutazione finora

- Cfi2101-Time Value of MoneyDocumento39 pagineCfi2101-Time Value of MoneyTakudzwa BenjaminNessuna valutazione finora

- Economics (Simple and Compound Interest#2)Documento17 pagineEconomics (Simple and Compound Interest#2)api-2636776733% (3)

- Solving Typical FE ProblemsDocumento30 pagineSolving Typical FE ProblemsCarlo Mabini Bayo50% (2)

- Lecture 3,4,5Documento85 pagineLecture 3,4,5EuielNessuna valutazione finora

- GEN331 - Lecture 04 - 232Documento38 pagineGEN331 - Lecture 04 - 232Omar ShrefNessuna valutazione finora

- Module 2 AnnuitiesDocumento20 pagineModule 2 AnnuitiesCatherine CambayaNessuna valutazione finora

- Time Value of Money: Suggested Readings: Chapter 3, Van Horne / DhamijaDocumento18 pagineTime Value of Money: Suggested Readings: Chapter 3, Van Horne / DhamijaSaurabh ChawlaNessuna valutazione finora

- Time Value of Money Formula Sheet: Financial ManagementDocumento3 pagineTime Value of Money Formula Sheet: Financial ManagementTechbotix AppsNessuna valutazione finora

- Engineering Econ Factor TablesDocumento7 pagineEngineering Econ Factor TablesZeJun ZhaoNessuna valutazione finora

- DISCOUNTINGDocumento8 pagineDISCOUNTINGNg'ang'a WanjiruNessuna valutazione finora

- Regular Payment of An AnnuityDocumento11 pagineRegular Payment of An AnnuityKarla BangFerNessuna valutazione finora

- TVMDocumento28 pagineTVMafnantahirNessuna valutazione finora

- To Calculate The Maturity Value of The AccountDocumento4 pagineTo Calculate The Maturity Value of The AccountDANIEL WELDAYNessuna valutazione finora

- Investment Appraisal Using DCF MethodsDocumento47 pagineInvestment Appraisal Using DCF MethodsMohit GolechaNessuna valutazione finora

- ADM 2350A Formula SheetDocumento12 pagineADM 2350A Formula SheetJoeNessuna valutazione finora

- StudyGuide Chapter3Documento28 pagineStudyGuide Chapter3Adil AnwarNessuna valutazione finora

- Time Value of MoneDocumento31 pagineTime Value of MoneRICANessuna valutazione finora

- Recursion Finance TeacherDocumento5 pagineRecursion Finance Teacherpawandalmia14Nessuna valutazione finora

- Solutions Paper - TVMDocumento4 pagineSolutions Paper - TVMsanchita mukherjeeNessuna valutazione finora

- Introduction To Valuation: The Time Value of MoneyDocumento12 pagineIntroduction To Valuation: The Time Value of Moneyzahida pervaizNessuna valutazione finora

- Compound Interest Formula DerivationsDocumento13 pagineCompound Interest Formula DerivationsDanishkoolNessuna valutazione finora

- Time Value of MoneyDocumento24 pagineTime Value of MoneyCharu Modi100% (1)

- MEC210 - Lecture 06 - 241Documento28 pagineMEC210 - Lecture 06 - 241Mina NasserNessuna valutazione finora

- Time Value of MoneyDocumento5 pagineTime Value of MoneyXytusNessuna valutazione finora

- Parrino4e ET 5-20Documento2 pagineParrino4e ET 5-20uccs1Nessuna valutazione finora

- Chapter 4Documento22 pagineChapter 4Ahmed walidNessuna valutazione finora

- MEC210 - Lecture 05 - 241Documento25 pagineMEC210 - Lecture 05 - 241Mina NasserNessuna valutazione finora

- Economics-For Breadth and Various Depth ExamsDocumento10 pagineEconomics-For Breadth and Various Depth ExamsVNessuna valutazione finora

- Lec 10Documento24 pagineLec 10SOUMYA BHATTNessuna valutazione finora

- Engineering Economy Module 3Documento16 pagineEngineering Economy Module 3pickyypotatoNessuna valutazione finora

- Eng'g Eco ReviewDocumento14 pagineEng'g Eco ReviewMoody MindNessuna valutazione finora

- NUt 6 SA9 SSN 65Documento38 pagineNUt 6 SA9 SSN 65Don RomantikoNessuna valutazione finora

- Pre Post TestDocumento3 paginePre Post Testbobbyforteza92Nessuna valutazione finora

- Problem Set 4 Solutions-2Documento3 pagineProblem Set 4 Solutions-2kamphrat.jNessuna valutazione finora

- CHPTR 3Documento33 pagineCHPTR 3KenDaniswaraNessuna valutazione finora

- Lec 18Documento22 pagineLec 18RomilNessuna valutazione finora

- Fundamentals of Corporate Finance 11th Edition Ross Solutions ManualDocumento11 pagineFundamentals of Corporate Finance 11th Edition Ross Solutions ManualElizabethFuentesrfaj100% (39)

- Financial Management 3Documento32 pagineFinancial Management 3Aniq AimanNessuna valutazione finora

- (2-2) Time Value of Money - Uniform SeriesDocumento11 pagine(2-2) Time Value of Money - Uniform Seriessaleemm_2Nessuna valutazione finora

- Time Value of MoneyDocumento9 pagineTime Value of MoneyreiNessuna valutazione finora

- 3 - The Time Value of MoneyDocumento26 pagine3 - The Time Value of Moneydewatharschinia19Nessuna valutazione finora

- IVDocumento3 pagineIVinchabogNessuna valutazione finora

- Art 266-DDocumento14 pagineArt 266-DinchabogNessuna valutazione finora

- SantosDocumento24 pagineSantosinchabogNessuna valutazione finora

- 8 Maceda v. VasquezDocumento7 pagine8 Maceda v. VasquezinchabogNessuna valutazione finora

- City of Manila vs. AlegarDocumento2 pagineCity of Manila vs. Alegarinchabog100% (1)

- Art 266-DDocumento14 pagineArt 266-DinchabogNessuna valutazione finora

- AIMS - Academic Institutions Management SystemDocumento1 paginaAIMS - Academic Institutions Management SysteminchabogNessuna valutazione finora

- Summary of Articles: Chapter 1. Jurisprudence. Is It Relevant?Documento10 pagineSummary of Articles: Chapter 1. Jurisprudence. Is It Relevant?inchabogNessuna valutazione finora

- Art. XII, Sec. 8 - Kapag Naging: ST ND RD TH THDocumento3 pagineArt. XII, Sec. 8 - Kapag Naging: ST ND RD TH THinchabogNessuna valutazione finora

- Prosource v. HorphagDocumento4 pagineProsource v. HorphaginchabogNessuna valutazione finora

- MAS2 BSAIS 2D Interest Rate and Return PPT 2Documento172 pagineMAS2 BSAIS 2D Interest Rate and Return PPT 2Henry RufinoNessuna valutazione finora

- Hint: I PRT F P+I F P (1+rt) : Direction: Write The Letter of The Correct Answer On Your Answer SheetDocumento3 pagineHint: I PRT F P+I F P (1+rt) : Direction: Write The Letter of The Correct Answer On Your Answer SheetNeah Neoh NeohnNessuna valutazione finora

- Chapter 4-FinanceDocumento14 pagineChapter 4-Financesjenkins66Nessuna valutazione finora

- ARCHMLDocumento60 pagineARCHMLKhushboo Shah100% (1)

- Life Insurance Misc - Cases Awards 1-10-2014to31.3.2015Documento1.082 pagineLife Insurance Misc - Cases Awards 1-10-2014to31.3.2015Jinal SanghviNessuna valutazione finora

- Tutorial WorkbookDocumento23 pagineTutorial Workbookumobil 2726Nessuna valutazione finora

- Lesson 1 - Simple InterestDocumento13 pagineLesson 1 - Simple InterestMariel SibuloNessuna valutazione finora

- TVM Spring 2015Documento2 pagineTVM Spring 2015Kamran RaufNessuna valutazione finora

- Acknowledgement: Prof .J.K JainDocumento43 pagineAcknowledgement: Prof .J.K JainManish NaharNessuna valutazione finora

- EDS522 - Week 8Documento21 pagineEDS522 - Week 8William OketamiNessuna valutazione finora

- Lecture9 - ES301 Engineering EconomicsDocumento19 pagineLecture9 - ES301 Engineering EconomicsLory Liza Bulay-ogNessuna valutazione finora

- Zakat On Pension and AnnuityDocumento2 pagineZakat On Pension and AnnuityjamalaasrNessuna valutazione finora

- Regular Payment of An AnnuityDocumento11 pagineRegular Payment of An AnnuityKarla BangFerNessuna valutazione finora

- Module 2Documento60 pagineModule 2lizNessuna valutazione finora

- ch06 Time Value of MoneyDocumento44 paginech06 Time Value of MoneyMortarezNessuna valutazione finora

- MCQ in Engineering Economics Part 13 ECE Board ExamDocumento19 pagineMCQ in Engineering Economics Part 13 ECE Board ExamJosel J. LegaspiNessuna valutazione finora

- Fundamentals of Corporate Finance, SlideDocumento250 pagineFundamentals of Corporate Finance, SlideYIN SOKHENG100% (4)

- Syllabus Mathematics of InvestmentDocumento4 pagineSyllabus Mathematics of InvestmentAngel Omlas100% (1)

- Compound Interest and The Concept of Present Value: Appendix IiDocumento5 pagineCompound Interest and The Concept of Present Value: Appendix Iipalak32Nessuna valutazione finora

- Interest and Annuity Tables For Discrete CompoundingDocumento19 pagineInterest and Annuity Tables For Discrete CompoundingWan Muhd FaizNessuna valutazione finora

- Time Value of MoneyDocumento68 pagineTime Value of MoneyTimothy JonesNessuna valutazione finora

- Mock Exam For CFA Level 1Documento70 pagineMock Exam For CFA Level 1christyNessuna valutazione finora

- MODULE 3 Engineering EconomyDocumento34 pagineMODULE 3 Engineering EconomyJohn Carlo Bacalando IINessuna valutazione finora

- Hybrid Annuity Model For Highway Projects: Ministry of Road Transport & Highways Government of IndiaDocumento60 pagineHybrid Annuity Model For Highway Projects: Ministry of Road Transport & Highways Government of IndiaArunava Sengupta100% (1)

- GOSI Contribution CalculationDocumento10 pagineGOSI Contribution CalculationMohamed Shanab100% (1)

- Problem Set 6Documento2 pagineProblem Set 6Gisel Lopez FelixNessuna valutazione finora

- Summary: Accounting For Notes Payable Prepared By: Eden C. CabreraDocumento6 pagineSummary: Accounting For Notes Payable Prepared By: Eden C. CabreraambiNessuna valutazione finora

- The Time Value of Money: Learning ModuleDocumento31 pagineThe Time Value of Money: Learning ModulekattyperrysherryNessuna valutazione finora

- Corporate Finance LectureDocumento124 pagineCorporate Finance LectureMuhammad Kashif ZafarNessuna valutazione finora

- Chapter 11 ANPVDocumento2 pagineChapter 11 ANPVxuzhu5Nessuna valutazione finora