Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Inventory Management in India's Commercial Vehicle Industry

Caricato da

RD SinghTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Inventory Management in India's Commercial Vehicle Industry

Caricato da

RD SinghCopyright:

Formati disponibili

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

INVENTORY MANAGEMENT OF COMMERCIAL VEHICLE INDUSTRY

IN INDIA

*N. VELMATHI ** Dr. R. GANESAN

*Asst. Professor, Dept of Management, Muthayammal Engineering College, Rasipuram.

**Principal, Sri Venkateshwara College of Management, Coimbatore.

Introduction

Inventory constitutes a major component of working capital. To a large

extent, the success or failure of a business depends upon its inventory management

performances. Proper management and control of inventory not only solve the

problem of liquidity but also increase profitability. Inventory establishes a link

between production and sales.

Every business undertaking needs inventory in

adequate quantity for efficient processing and in-transit handling. Since, inventory

itself is an idle asset and involves holding cost; it is always desirable that investment

in this asset should be kept at the minimum possible level. Inventory should be

available in proper quantity at all times, neither more nor less than what is required.

Inadequate inventory adversely affects smooth running of business, whereas excess

of it involves extra cost, thus reducing profits. The primary objective of inventory

management is to avoid too much and too little of it so that uninterrupted production

and sales with minimum holding costs and better customers services may be

possible.

The term inventory refers to the stockpile of the products a firm is offering

for sale and various components that make up these products. As per accounting

terminology, inventory means the aggregate of these items of tangible property

which i) are held for sale in the ordinary course of business, ii) are in the process of

production for such sale, and iii) are to be available for sale. Thus, inventory

includes the stock of raw materials, goods-in-process, finished goods and stores and

spares. James H. Greene states that inventory comprises the movable articles of the

business which are eventually expected to go into the flow of trade. In commercial

Vehicle Industry, which is the subject matter of the present study, inventory involves

raw materials, work-in progress, spares and stores, finished goods, goods in transit

and other inventory.

To evaluate the practices and performances in inventory management in the

Commercial Vehicle Industry in India, the present paper attempt has been made to

analyse size, composition, circulation and growth of the inventory in the selected

companies during the period under study.

Review of literature

Niranjan Mandal and Dutta Smriti Mahavidyalaya, (2010) in their study

makes an attempt to provide an insight into the conceptual side of working capital

and to assess the impact of working capital management on liquidity, profitability

and non-insurable risk of ONGC, a leading public sector enterprise in India over a 9

year period (i.e. from 1998-99 to 2006-07). It also makes an endeavor to observe

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

and test the liquidity and profitability position of the enterprise and to study the

correlation between liquidity and profitability as well as between profitability and

risk. They may be concluded that working capital management is very much useful

to ensure better productive capacity, good profitability and sound liquidity of an

enterprise, specifically the PSE in India, for managerial decision making regarding

the creation of sufficient surplus for its growth and survival stability in the present

competitive and complex environment.

Koti Reddy and Raghav Baheti (2010) in their study seeks to examine

current policies and practices of working capital management at Saregama India

Limited and tries to identify the strengths and weaknesses of the company; the

opportunities it has and the threats it faces. It contains a detailed analysis of the

various factors affecting the working capital requirements of the company and the

impact they have on its profitability. The study concludes by suggesting solutions to

address the concern areas that have been identified. The company is recommended

to focus on digital sales, incentivize cash sales, follow a forecasting model that

captures the tastes and preferences of consumers and strictly implement its credit

policy.

Jasmine Kaur (2010) his study is concerned with the problems that arise in

attempting to manage the Current Assets, Current Liabilities and the interrelation

that exists between them. This is a two-dimensional study which examined the

policy and practices of cash management, evaluate the principles, procedures and

techniques of Investment Management, Receivable and Payable Management dealt

with analyzing the trend of working capital management and also to suggested an

audit program to facilitate proper working capital management in Indian Tyre

Industry. He revealed that there is a standoff between liquidity and profitability and

the selected corporate has been achieving a trade off between risk and return.

Efficient management of working Capital and its components have a direct effect on

the profitability levels of tyre industry.

Ranjith Appuhami (2008) the purpose of his research is to investigate the

impact of firms' capital expenditure on their working capital management. The

study used Shulman and Cox's (1985) Net Liquidity Balance and Working Capital

Requirement as a proxy for working capital measurement and developed multiple

regression models. The empirical research found that firms' capital expenditure has a

significant impact on working capital management. The study also found that the

firms' operating cash flow, which was recognized as a control variable, has a

significant relationship with working capital management, which is consistent with

findings of previous similar researches. The findings enhance the knowledge base of

working capital management and will help companies manage working capital

efficiently in growing situations associated with capital expenditure.

Pradeep Singh (2008) in his study made an attempt to examine the

inventory and working capital management of Indian Farmers Fertilizer Cooperative Limited (IFFCO) and National Fertilizer Limited (NFL). He concluded

that the overall position of the working capital of IFFCO and NFL is satisfactory.

But there is a need for improvement in inventory in case of IFFCO. However

inventory was not properly utilized and maintained by IFFCO during study period.

The management of NFL must try to properly utilize the inventory and try to

maintain the inventory as per the requirements, so that liquidity will not interrupt.

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

Present status of the Indian Automobile Industry

Indian automobile industry is nearly six decades old. The Indian Automobile

industry is the seventh largest in the world with an annual production of over 2.6

million units in 2009. In 2009, India emerged as Asias fourth largest exporter of

automobiles, behind Japan, South Korea and Thailand. The industry encompasses

commercial vehicles, multi-utility vehicles, passenger cars, two wheelers, three

wheelers, tractors and auto components. Out of 262 total number of companies,

220 Auto ancillaries, 7 commercial vehicle companies, 5 motor cycles / moped

companies, 8 passenger car manufacturers 12 scooter and three wheeler companies

and 10 tractor manufacturing companies. It employs 4, 50,000 people directly and

100, 00,000 people indirectly and is now inhabited by global majors in keen

contention.

India manufactures about 38,00,000 two wheelers, 5,70,000 passenger cars,

1,25,000 Multi Utility Vehicle, 1,70,000 Commercial Vehicles and 2,60,000 tractors

annually. Today, the Indian automobile industry is ranked first in the world in the

production of three wheelers, second in the production of two wheelers, fourth in the

production of commercial vehicles and ninth in passenger vehicles.

Selection of Sample companies

There are 46 companies operating in the Indian Automobile Industry. The

companies under automobile industry are classified into five sectors namely;

Commercial vehicles, Motor cycles / mopeds, Passenger cars, Scooters and threewheelers and Tractors. Out of five sectors in the Indian Automobile Industry,

commercial vehicle sector has been selected for the purpose of the study. In order to

select the sample companies from the commercial vehicle sector for the study, only

those companies which were established before liberalization period (1990) only

selected. Thus, the number of companies selected under the study is restricted to five

out of seven companies viz., Ashok Leyland Ltd. (ALL), Tata Motors Ltd. (TML),

Force Motors Ltd. (FML), Eicher Motors Ltd.(EML) and SML Isuzu Ltd.(SML).

All the 27 manufacturing units of five companies are selected for the study based on

census method.

Other two commercial vehicle companies namely, Asian Motor Works Ltd.

and Tata Marcopolo Motors Ltd. were incorporated in the year 2002 and 2006

respectively, thus they have also been excluded for the study.

Objectives of the study

The present study attempts to achieve the following objectives.

1. To study the size of inventory of the selected units in Indian commercial

vehicle Industry.

2. To examine the composition of inventory in these units.

3. To know the circulation of inventory in these units.

4. To study the growth of inventory in these units.

Hypotheses of the study

The following hypotheses are helpful to achieve the above objectives.

1. There is no correlation between inventory and sales of Ashok Leyland Ltd.

2. There is no correlation between inventory and sales of Tata Motors Ltd.

3. There is no correlation between inventory and sales of Force Motors Ltd.

4. There is no correlation between inventory and sales of Eicher Motors Ltd.

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

5. There is no correlation between inventory and sales of SML Isuzu Ltd.

Period of the Study

The period of the study selected only ten years from 2000-01 to 2009-10.

Methodology

The study is analytical in nature. The data used for the study is secondary

data. The required data for the commercial vehicle companies were collected from

the compilation made by the Centre for Monitoring Indian Economy (CMIE) for the

period 2000-01 to 2009-10. Prowess database of CMIE is the most reliable and

empowered corporate database. It contains a highly normalized database built on a

sound understanding of disclosures on were over 7000 companies in India. Some of

the data collected from journals, websites, books etc. Editing, classification and

tabulation of the financial data, which will be collected from the above-mentioned

sources, will be done as per the requirements of the study.

Financial and Statistical Tools

For assessing the size, composition, circulation and growth of the inventory

position, Mean, Standard deviation and Co-efficient of variation is used. To find out

the relationship between sales and inventory linear regression analysis, Karl persons

co-efficient of correlation is used. To test the results of regression and correlation

co-efficient t test is applied.

Limitations of the Study

The data used in this study have been taken only from secondary sources and

as such it findings depends entirely on the accuracy of such data.

Findings of the study

Size of Inventory

The basic objective of inventory management is, to optimise the size of

inventory in a firm, so that, smooth performance of production and sales functions

may be possible at the minimum cost. The holding of surplus and slow moving

inventories extra costs, wherein, the inventory-carrying cost alone is estimated to be

between 10 and 20 percent in India while the interest payable on money borrowed

from banks for obtaining inventories is around 18 per cent. To what extent the

selected units have been successful in optimising their inventory holdings during the

period is evaluated in this paper.

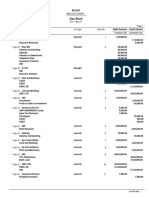

Table 1 portrays the size of inventories in the selected companies, during the

period of study. This table reveals that the size of inventory in the industry has

gradually increased from Rs.1880.99 crores in 2000-01 to Rs.4927.56 crores in

2009-10, i.e., more than double, except during the years 2001-02 and 2008-09 when

the investment in inventory has slightly come down. Among the firms, the increase

in inventory has been observed most in SML i.e., more than three times. The

inventory size of ALL has shot up from Rs. 517.67 crores in 2000-01 to Rs. 1638.24

crores in 2009-10 with slight falls in 2002-03, TML from Rs. 1105.1 crores to Rs.

2935.59 crores, and FML from Rs. 183.4 crores to Rs.193.73 crores during the

period of study. The size of inventory of EML has decreased from Rs. 30.56 crores

in 2000-01 to Rs. 22.03 crores in 2009-10. On the whole, it is evident that the size

of the inventory among the firms in the industry has been on the increase at a

slightly faster rate except EML.

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

Table 2 shows the values of mean and co-efficient of variation (C.V.) and t

values of the size of inventory. It reveals that the inventory has constituted a high

proportion of total investment in the industry. The mean value of inventory to

current assets ratio for the overall industry is 31.28 per cent, with it has been 51.97

per cent in FML, 36.71 per cent in ALL, 32.81 per cent in SML, 28.60 per cent in

TML and 27.26 per cent in EML. FML has relatively a high mean value among the

firms and its t value indicates that the mean value of this firm varies significantly

at 1 per cent level from industry mean value. In the case of FML, ALL and SML, the

mean value of inventory to CA ratio is more than the industry means value.

The percentage of inventory to total current assets of commercial vehicle

industry showed declining trend from 39.11% in 2000-01 to 29.59% in 2009-10.

Similarly, TML, EML and FMLs inventory to total current assets ratios were also

registered declining trend. This indicates that the lower shares of working capital

funds were tied up in inventories and TML, EML and FML had managed well their

inventory during the period of study.

Composition of Inventory

In commercial vehicle industry, the major components of inventory include

raw materials, work-in progress, finished goods, stores and spares, goods in transit

and other inventory. Table 3 which contains the statistical values (mean and C.V.)

of proportionate shares of these components to total inventory, shows that raw

materials, work-in progress and finished goods constitute about 90 per cent of the

total inventory in the industry. Stores and spares rank at the fourth place with regard

to its share in total inventory in all the units; finished goods rank at the first place

regarding its share in total inventory in ALL, TML and SML whereas raw material

ranks at the first place in FML and EML.

It is evident from the table 3 that industry average for finished goods

proportion works out to 43.90 per cent; as against this, ALL has this share to the

tune of 45.47 per cent, TML 45.67 per cent and SML 42.77 per cent in the total

inventory.

This table further shows that mean values of the raw materials proportion to

total inventory have been higher in EML as well as FML than the industry. The Coefficient of Variation has been more in TML, (i.e., 0.26), than the industry coefficient of variation. Work-in-progress also occupies an important place in the

inventory in the industry, with 12.56 per cent mean value. This share has relatively

been less in EML, where the trend has been fluctuating in this ratio, and the

proportion of work-in progress has increased slightly in the firms during the period.

The C.V. has been relatively high in EML and ALL.

Goods-in-transit have

constituted a significant proportion of total inventory in TML and SML. Moreover,

the proportion of goods-in-transit has been nil in ALL, FML and EML.

Other materials have not constituted a significant proportion of total

inventory in this industry. Among the firms in the industry, the mean values of

other inventory proportionate to aggregate inventory, swings between 0.29 and

4.07, with relatively high variations.

Circulation of Inventory

Circulation of Inventory directly affects the profitability of a firm. Other

things remaining the same, the faster the circulation, the larger the profits. Each

turnover adds to the volume of profits. A high inventory turnover means that the

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

firm has conducted more business with less amount of inventory. In order to judge

the velocity with which inventory and its components have circulated in the selected

companies during the period of study, the following ratios have been computed:

1. Holding period of aggregate inventory

2. Holding period of raw materials

3. Holding period of work-in progress

4. Holding period of finished goods

The statistical values (mean, C.V. and t value) relating to these ratios, in

relation to the firms have been given in Table 4. The average inventory holding

period for the industry as a whole comes to 1.31 months. Among the companies in

the industry, FML (2.44 months) has the highest inventory holding period. TML has

the minimum holding period for inventory. And both these Mean values

significantly vary at 1 per cent level from the industry mean. The Co-efficient of

Variation values indicates that all the companies in the industry have experienced

less variation, than that of the industry. The Co-efficient of Variation values which

oscillate between 0.25 and 0.76 also confirm that, the variations in this ratio during

the period have been relatively high.

It has been observed from the table 4 that the average holding period for raw

material for the industry is 1.10 months. Among the firms in the industry, it ranged

between 0.79 months to 3.24 months. The holding period of raw material of FML is

higher than that of any other companies in the industry. The high C.V. values of

EML confirm that, variations in holding period of aggregate inventory during the

period have been relatively high. The holding period for raw material in ALL, TML

and FML vary significantly at 1 per cent level, similarly for EML and SML it varies

at 5 per cent level of significance, from that of the industry Mean value.

It is further observed from the table that the average holding period for workin progress in the industry is 1.52 months; among the firms in the industry, it ranged

between 0.12 months to 1.52 months. The mean values of all the companies vary

significantly at 5 per cent level, from the industry mean. The high Co-efficient of

Variation values of EML confirms that, variations in this ratio during the period

have been relatively high.

Growth Trends in Inventory and Sales

The sales of a concern directly affect its profit and the holding of inventory

involves cost. Every increase in the inventory is expected to be accompanied by an

adequate increase in sales so that the increased cost of inventory may be recovered

from the increased profits. In the commercial vehicle industry, there is an

emphasise to meet the production requirements without any interruption, by means

of holding enough level of inventory. For the purpose of comparing the growth in

sales with the growth in inventory during the period under review, progressive base

year growth rate and average growth rate have been computed.

Table 5 reveals that the average growth rate of sales has been more than the

growth rate of inventory in the industry. This trend is a healthy sign and indicates

that the industry, TML and FML has moved in the positive direction though the rate

is slow. TML and FMLs average growth rate in sales has been more than the

growth rate of inventory which indicates that very good administration of inventory

management in these two companies. ALL and EML, SMLs average growth rate in

inventory has been more than the growth rate of sales which indicates that the steps

to be taken to improve the growth rate of sales.

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

To have a look at the real growth that has taken place in inventory and sales

during the period under study, the average growth rates of inventory and sales at

constant prices have been shown in Table 6.

It is evident from the above table that the average growth rate of sales has

been more than the growth rate of inventory in all the companies selected for the

study; whereas in the case of sales, it is positive in all the companies except in EML.

The maximum average growth has been achieved by FML (i.e) 70.70 per cent),

while the growth is just marginal in the other companies. Hence, it is also said that,

as all the firms are already on the right track, results achieved so far are also

satisfactory.

Relationship between Inventory and Sales Regression Analysis

The achievement of the maximum possible profit is the goal of any

enterprise. This object can be achieved by accelerating sales to the extent possible.

In order to have uninterrupted flow of production and sales, inventories are to be

made available, whenever needed. Thus, the volume of sales and size of inventory

holdings are related to each other. For the purpose of having in depth insight into

the extent of relationship between inventory and sales, the values of co-efficient of

correlation (r), co-efficient of determination (R2), t value (to test the significance of

correlation) and linear regression equations have been computed in table 7.

The value of correlation co-efficient between sales and inventories is 0.98 in

the industry. The t values indicate that the relationship between inventory

(dependent variable) and sales (independent variable) have been significant at 1per

cent level in all units in the industry except FML. Among the firms in the

commercial vehicle industry all the units have significant relationship between

inventory and sales. The FML has to improve its inventory level as per the

operating requirements, because of the fact that there is moderate correlation

registered inventory and Sales. The correlation is stronger in TML and EML than in

any other firms in the industry. It reflects on the effectiveness of management in

controlling the inventory in relation to sales.

In the above table, linear regression equation has been used for the purpose

of future projections. The values of parameter b indicate the sensitivity with which

inventory in a concern changes for a unit of increase / decrease in sales. Among the

firms, the sales elasticity of inventory varies from 0.07 units to 0.21 units. TML is

less sensitive than other firms in the industry for the change in inventory as a result

of change in sales. It is also inferred from the table that one unit increase in sales

volume shows 0.07 units increase in inventory levels in TML. Moreover, SML is

more sensitive than other firms in the industry for change in inventory as a result of

change in sales. It is also inferred from the table that one unit increase in sales

volume shows 0.21units in inventory levels in SML. The value of parameter b

further brings out that, the commercial vehicle industry can easily overcome the

problem of overstocking by increasing the level of operating activity, because its

growth in inventory is much less than the growth in sales.

Results of the Hypotheses

The following results were obtained from the above study:

1. There is correlation between inventory and sales of Ashok Leyland Ltd.

2. There is correlation between inventory and sales of Tata Motors Ltd.

3. There is correlation between inventory and sales of Force Motors Ltd.

4. There is correlation between inventory and sales of Eicher Motors Ltd.

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

5. There is correlation between inventory and sales of SML Isuzu Ltd.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

It has been observed from that all the units in the commercial vehicle industry have

significant relationship between inventory and sales.

Conclusion

While managing the inventory position of the company we have to

concentrate the four aspects of inventory management viz., size, composition,

circulation and growth of inventory. In this, overall analysis of inventory of all units

in the Indian commercial vehicle industry is very good in their management of

inventory. Among the firms in the commercial vehicle industry TML occupies the

first place in the management of inventory. It is evidently proved through strong

correlation between inventory and sales. FMLs average growth rate of sales has

been more than the growth rate of inventory which indicates that very good

administration of inventory, but the moderate correlation registered between sales

and inventory. It indicated that FML has to improve its inventory level as per the

operating requirements. Inventory is the largest asset among current assets in

manufacturing concerns. Thus, proper management of inventory is important to

maintain and improve the health of an organisation. Efficient management of

inventories will improve the profitability of the organisation.

References:

Bhattacharya, H. Working capital Management Strategies & Techniques, Prentice

Hall of India Pvt. Ltd.., New Delhi , 2001.

Bolten S.E.1976, Managerial finance. Boston: Houghton Mifflin Co., p.446.

James H. Greene, production and Inventory Control-systems and Decisions,

published by D.B. Taraporewale sons & Co. (P) Ltd., Bombay, 1983, p.203.

Pandey, I.M., Financial Management Vikas publishing House Pvt. Ltd. New

Delhi, 1999.pp.807-937

Rao, K.V., Management of working capital in Public Enterprises, Deep& Deep

publication, New Delhi, 1990.

Vijay Kumar, A., Working capital Management A comparative study, Northern

Book Centre, New Delhi, 2001.

Accounting Research and Terminology Bulletin, published by the American

Institute of Certified Public Accountants, New York, 1961, p.28.

Jasmine Kaur (2010), Working Capital Management in Indian Tyre Industry,

International Research Journal of Finance and Economics, Issue 46, Euro Journals

Publishing, Inc. Issue 46.

Koti Reddy and Raghav Haheti,T. (2010),Working capital management: pol

icies and practices at saregama India limited, International Journal of research in

commerce and Managemen, vo no. 1,ssue no. 8.

Niranjan Mandal, Dr. B. N. Dutta Smriti (2010), Impact Of working Capital

management On Liquidity,Profitabilityand Non-Insurable Risk And Uncertainty

Bearing:A Case Study Of Oiland Natural Gas Commission (ONGC), University of

Burdwan, Great Lakes Herald Vol 4, No 2.

Pradeep Singh (2008), Inventory and Working Capital Management: An

Empirical Analysis, The Icfai Journal of Accounting Research, Vol.VII, No.2, April,

pp.53-73.

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

12.

Ranjith Appuhami, B.A. (2009), The Impact of Firms' Capital Expenditure

on Working Capital Management: An Empirical Study across Industries in Thailand,

International Management Review, Vol. 4, Iss. 1, p. 8-21 (14 pp.)

Appendix

Year

ALL

Table 1

Size of Inventory

TML

FML

EML

(Rs. in Crores)

SML

Industry

2000-01

517.67

1105.10

183.40

30.56

44.26

1880.99

2001-02

595.34

987.51

132.29

29.33

46.52

1791.26

2002-03

410.46

1159.29

148.15

36.05

59.83

1818.06

2003-04

506.94

1147.44

152.26

126.25

60.35

1993.24

2004-05

568.08

1601.36

185.06

161.25

88.55

2604.3

2005-06

902.56

2012.24

213.84

161.23

91.14

3386.6

2006-07

1070.32

2500.95

203.92

168.91

87.33

4222.07

2007-08

1223.91

2421.83

240.67

210.38

123.50

4376.81

2008-09

1330.02

2229.81

196.03

19.37

149.29

3927.18

2009-10

1638.24

2935.59

193.73

22.03

160.00

4927.56

Source: computed from annual reports of the respective companies

Table 2

Statistical Values of Ratios Relating to Inventory Size

Year

ALL

TML

FML

EML

SML

Inventory to current assets ratio

Mean

36.71

28.60

51.97

27.26

32.81

C.V.

0.15

0.26

0.14

0.41

0.25

t

2.10***

-3.30*

11.39*

-1.09

0.59

Inventory to total assets ratio

Mean

31.78

19.68

60.74

25.03

85.19

C.V.

0.23

0.33

0.24

0.47

0.53

t

3.36*

-10.63*

8.37*

0.60

4.56*

Source: Computed from Annual reports of the respective companies

Industry

31.28

0.16

23.68

0.27

Table 3

Statistical values of Composition of Inventory (in Percentage)

Particulars

ALL

TML

FML

EML

SML

Industry

Raw Material

Mean

35.96 30.65

49.02

49.47 40.97

34.44

C.V

0.10

0.26

0.13

0.15

0.12

0.16

Work-in-progress

Mean

13.27 12.65

15.45

7.01

7.46

12.56

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

C.V

0.32

0.16

0.09

0.34

0.22

Finished goods

Mean

45.47 45.67

24.97

36.81 42.77

C.V

0.14

0.18

0.24

0.24

0.11

Stores and Spares

Mean

3.26

7.05

6.49

2.77

0.54

C.V

0.22

0.35

0.27

0.17

0.28

Goods-in-transit

Mean

3.01

7.97

C.V

0.69

0.52

Other Inventory

Mean

2.05

0.97

4.07

3.95

0.29

C.V

0.32

0.41

0.44

1.56

0.25

Source: Computed from Annual reports of the respective companies

0.16

43.90

0.13

5.56

0.29

1.98

0.57

1.56

0.39

Table 4

Statistical Values of Ratios Relating to Movements of Inventory

Particulars

ALL

TML

FML

EML

SML

Industry

Holding period of aggregate inventory

Mean

1.81

1.04

2.44

0.83

1.74

1.31

C.V.

0.25

0.26

0.67

0.62

0.64

0.76

t

4.58*

-3.41*

8.62*

-8.53*

3.64*

Holding period of Raw Material

Mean

1.62

0.79

3.24

1.09

1.49

1.10

C.V.

0.33

0.12

0.35

0.50

0.27

0.19

t

4.61*

-6.07*

7.14*

-0.01**

3.17**

Holding period of work-in-progress

Mean

0.45

0.26

0.69

0.12

0.25

1.52

C.V.

0.28

0.22

0.21

0.51

0.44

0.23

t

-13.37* -13.47*

-10.40*

-11.73*

-9.97*

Holding period of Finished goods

Mean

1.51

0.93

1.22

0.65

1.25

1.04

C.V.

0.28

0.40

0.35

0.85

0.23

0.31

t

4.64*

-3.31*

1.81

-1.78

1.70

Source: Computed from Annual reports of the respective companies

Table 5

Progressive Base year Percentage Growth of inventory and sales

from 2000-01 to 2009-10

Particulars

2000-01

Inventory

Sales

2001-02

ALL

-

TML

FML

EML

SML

http://www.exclusivemba.com/ijemr

Industry

-

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

Inventory

15.00

-10.64

-27.87

-4.02

5.11

Sales

0.54

9.83

0.72

22.27

26.65

2002-03

Inventory

-31.05

17.40

11.99

22.91

28.61

Sales

18.47

21.32

34.60

30.56

24.70

2003-04

Inventory

23.51

-1.02

2.77

250.21

0.87

Sales

24.78

45.85

34.89

117.88

28.74

2004-05

Inventory

12.06

39.56

21.54

27.72

46.73

Sales

23.46

32.52

-9.35

45.37

23.44

2005-06

Inventory

58.88

25.66

15.55

-0.01

2.92

Sales

25.48

18.75

9.06

-17.39

3.85

2006-07

Inventory

18.59

24.29

-4.64

4.76

-4.18

Sales

37.35

33.96

4.53

19.30

-1.70

2007-08

Inventory

14.35

-3.16

18.02

24.55

41.42

Sales

8.40

4.97

-7.24

12.51

10.87

2008-09

Inventory

8.67

-7.93

-18.55

-90.79

20.88

Sales

-23.15

-10.42

-17.12

-68.58

-18.68

2009-10

Inventory

23.17

31.65

-1.17

13.73

7.17

Sales

2.15

3.92

2.74

-4.57

3.25

Avg. Inventory 15.91

12.87

1.96

27.67

16.61

Avg. Sales

13.05

17.86

5.87

17.48

11.24

Source: Computed from Annual reports of the respective companies

-4.77

8.12

1.50

21.98

9.64

43.64

30.66

29.51

30.04

16.34

24.67

32.44

3.67

1.86

-10.27

-14.24

25.47

3.40

12.29

15.89

Table 6

Average Growth Rates in Inventory and sales (at constant prices)

from 2000-01 to 2009-10

Name of the Company

Inventory

Net Sales

ALL

13.64

13.76

TML

11.44

20.51

FML

0.54

70.70

EML

-3.58

-0.57

http://www.exclusivemba.com/ijemr

IJEMR January 2012-Vol 2 Issue 1 - Online - ISSN 2249 2585 - Print - ISSN 2249 - 8672

SML

15.33

13.23

Industry

11.25

17.95

Source: Computed from Annual reports of the respective companies

Table 7

Linear Regression Results (for Inventory to Sales Ratio)

Name of the

company

Linear Regression Equation

Y = a+bX

ALL

Y = 40.73 + 0.17X

0.88

TML

Y = 506.95 + 0.07X

0.98

FML

Y = 104.00 + 0.10X

0.54

EML

Y = -22.02 + 0.10X

0.98

SML

Y = -14.17 + 0.21X

0.81

Industry

Y = 595.83 + 0.09X

0.98

* indicates significant at 1% level.

Here, Y = Inventory; X = Sales

Source: Computed from annual reports of the respective units.

http://www.exclusivemba.com/ijemr

R2

t- value

0.78

0.97

0.29

0.96

0.65

0.96

5.37*

16.85*

1.81

14.41*

3.88*

14.74*

Potrebbero piacerti anche

- An Analytical Study On Inventory Managem PDFDocumento6 pagineAn Analytical Study On Inventory Managem PDFPOOJA CHAUDHARINessuna valutazione finora

- Research Paper On "Efficient Management of Working Capital: A Study of Automobile Industry in India"Documento8 pagineResearch Paper On "Efficient Management of Working Capital: A Study of Automobile Industry in India"yash sultaniaNessuna valutazione finora

- Impact of Working Capital Management On Profitability of The Select Car Manufacturing Companies in IndiaDocumento10 pagineImpact of Working Capital Management On Profitability of The Select Car Manufacturing Companies in IndiaHargobind CoachNessuna valutazione finora

- REVIEW OF LITERATURE DharaniDocumento5 pagineREVIEW OF LITERATURE Dharanigowrimahesh2003Nessuna valutazione finora

- Case Study Analyzes Goal Programming Model for Tire Company Working CapitalDocumento20 pagineCase Study Analyzes Goal Programming Model for Tire Company Working CapitalDay JimNessuna valutazione finora

- 153 523 2 PBDocumento7 pagine153 523 2 PBmoshrafNessuna valutazione finora

- Review of Literature GowriDocumento4 pagineReview of Literature Gowrigowrimahesh2003Nessuna valutazione finora

- Chapter-Ii Review of LiteratureDocumento26 pagineChapter-Ii Review of LiteraturekhayyumNessuna valutazione finora

- Literature Review on Financial Performance of Automobile CompaniesDocumento3 pagineLiterature Review on Financial Performance of Automobile CompaniesHarivenkatsai SaiNessuna valutazione finora

- Impact of working capital management on firmsDocumento8 pagineImpact of working capital management on firmsnational coursesNessuna valutazione finora

- TeruDocumento7 pagineTeruShakti Swarup-057Nessuna valutazione finora

- Financial Performance of Indian Automobile Companies: January 2018Documento7 pagineFinancial Performance of Indian Automobile Companies: January 2018DebitCredit Accounts LearningNessuna valutazione finora

- Financial Performance of Automobile Sector in IndiaDocumento10 pagineFinancial Performance of Automobile Sector in IndiaInternational Journal of Application or Innovation in Engineering & ManagementNessuna valutazione finora

- KSRM College of Management StudiesDocumento8 pagineKSRM College of Management StudiesRamakrishna UtukuruNessuna valutazione finora

- Working Capital Management of Asian Paints Ltd. and Nerolac Paints LTD PDFDocumento11 pagineWorking Capital Management of Asian Paints Ltd. and Nerolac Paints LTD PDFMerajud Din100% (4)

- International Journal of Management (Ijm) : ©iaemeDocumento9 pagineInternational Journal of Management (Ijm) : ©iaemeIAEME PublicationNessuna valutazione finora

- 2 9 40 367 PDFDocumento7 pagine2 9 40 367 PDFAnish BhatNessuna valutazione finora

- 13corporate Governance, Capital Structure and Financial Performance - AspDocumento13 pagine13corporate Governance, Capital Structure and Financial Performance - AspAhmed KasmiNessuna valutazione finora

- Ashapura MInechem Ltd.Documento83 pagineAshapura MInechem Ltd.Pravin chavdaNessuna valutazione finora

- IJRMEC Volume2, Issue 11 (November 2012) ISSN: 2250-057X Financial Performance of Textile Industry: A Study On Listed Companies of Tamil NaduDocumento13 pagineIJRMEC Volume2, Issue 11 (November 2012) ISSN: 2250-057X Financial Performance of Textile Industry: A Study On Listed Companies of Tamil NaduAmol MahajanNessuna valutazione finora

- A Study On Capital Structure: Roll No. - 2K191014Documento38 pagineA Study On Capital Structure: Roll No. - 2K191014Samrddhi GhatkarNessuna valutazione finora

- Determinants of Capital Structure in Select Indian IndustriesDocumento7 pagineDeterminants of Capital Structure in Select Indian IndustriesRamasamy VelmuruganNessuna valutazione finora

- Working Captial Management - Ashok LeylandDocumento31 pagineWorking Captial Management - Ashok LeylandRoyal Projects100% (1)

- The Impact of Cost and Sales Trend OverDocumento10 pagineThe Impact of Cost and Sales Trend OverNguyễn Tất QuíNessuna valutazione finora

- Nexus Between Working Capital Management and Sectoral PerformanceDocumento17 pagineNexus Between Working Capital Management and Sectoral Performancemohammad bilalNessuna valutazione finora

- Leverage Capital Structure and Dividend Policy Practices in Indian CorporateDocumento12 pagineLeverage Capital Structure and Dividend Policy Practices in Indian CorporateDevikaNessuna valutazione finora

- Project Report Sem 4 BbaDocumento43 pagineProject Report Sem 4 BbaTanya RajaniNessuna valutazione finora

- IJRPR8547Documento8 pagineIJRPR8547mspkselvam003Nessuna valutazione finora

- Working Capital Management: A Case Study of Hero Motocorp Pvt. LTDDocumento7 pagineWorking Capital Management: A Case Study of Hero Motocorp Pvt. LTDaloksingh420aloksigh420Nessuna valutazione finora

- Empirics On Working Capital Management A Case of Indian Cement IndustryDocumento5 pagineEmpirics On Working Capital Management A Case of Indian Cement IndustryMohitAgrawalNessuna valutazione finora

- 2 - Review of LietratureDocumento27 pagine2 - Review of LietratureBhagaban DasNessuna valutazione finora

- FINANCIAL HEALTH OF STEEL AUTHORITY OF INDIADocumento11 pagineFINANCIAL HEALTH OF STEEL AUTHORITY OF INDIAvamshivarkutiNessuna valutazione finora

- Inventory Turnover Optimization Criteria of Efficiency (With Special Reference To FMCG Sector in India)Documento5 pagineInventory Turnover Optimization Criteria of Efficiency (With Special Reference To FMCG Sector in India)Ayesha AtherNessuna valutazione finora

- Working Capital Management in Automobile PDFDocumento8 pagineWorking Capital Management in Automobile PDFSharon BennyNessuna valutazione finora

- Study On Automobile Industry of IndiaDocumento10 pagineStudy On Automobile Industry of Indiaradhaved.modelNessuna valutazione finora

- Goel 2015 Operating Liquidity and Financial Leverage Evidences From IndianDocumento7 pagineGoel 2015 Operating Liquidity and Financial Leverage Evidences From IndianGufranNessuna valutazione finora

- Research PaperDocumento10 pagineResearch PapervvpatelNessuna valutazione finora

- AStudyon Working Capital Management Efficiencyof TCSIndias Top 1 CompanyDocumento13 pagineAStudyon Working Capital Management Efficiencyof TCSIndias Top 1 CompanySUNDAR PNessuna valutazione finora

- Trend Analysis Final Project by ArjitDocumento37 pagineTrend Analysis Final Project by Arjitsandeepkaur1131992Nessuna valutazione finora

- Comparative Ratio Analysis of Auto GiantsDocumento12 pagineComparative Ratio Analysis of Auto GiantsMohammad Ahtesham AvezNessuna valutazione finora

- Strategic Profit Model Measuring Indian Apparel RetailDocumento15 pagineStrategic Profit Model Measuring Indian Apparel RetailMutharasu A SelvarasuNessuna valutazione finora

- Analysis of The Effect of Working Capital Management On Profitability of The Firm: Evidence From Indian Steel IndustryDocumento8 pagineAnalysis of The Effect of Working Capital Management On Profitability of The Firm: Evidence From Indian Steel IndustryShikha MishraNessuna valutazione finora

- Sudeshnaa Final Yr ProjectDocumento15 pagineSudeshnaa Final Yr ProjectShri hariniNessuna valutazione finora

- Research Paper Ma PiyushDocumento15 pagineResearch Paper Ma Piyushpiyushpurva2005Nessuna valutazione finora

- Project ArticleDocumento12 pagineProject ArticleAkash SNessuna valutazione finora

- Working Capital Management in Tata Steel Limited: Advanced Studies, Pallavaram, Chennai - 600117Documento6 pagineWorking Capital Management in Tata Steel Limited: Advanced Studies, Pallavaram, Chennai - 60011747 Anubhav SinghNessuna valutazione finora

- Working Capital ManagementDocumento7 pagineWorking Capital ManagementZubair ArshadNessuna valutazione finora

- Review of LiteratureDocumento9 pagineReview of Literatureasir immanuvelNessuna valutazione finora

- Imapct of Working Capital Management On Profitability of The Select Commercial Vehicle Manufacturers in IndiaDocumento11 pagineImapct of Working Capital Management On Profitability of The Select Commercial Vehicle Manufacturers in IndiaHakimi AssadNessuna valutazione finora

- Fundamental Analysis For Investment Decisions On TWO AUTOMOBILE COMPANIES 25Documento14 pagineFundamental Analysis For Investment Decisions On TWO AUTOMOBILE COMPANIES 25Ramesh KumarNessuna valutazione finora

- FMCG - Analysis With Cover Page v2Documento9 pagineFMCG - Analysis With Cover Page v2Neha singhNessuna valutazione finora

- Introduction and Design of The StudyDocumento47 pagineIntroduction and Design of The StudyKarthika ArvindNessuna valutazione finora

- 1 s2.0 S221256711600037X Main PDFDocumento7 pagine1 s2.0 S221256711600037X Main PDFfiestaNessuna valutazione finora

- Working Capital Management in Mahindra & Mahindra LTD: January 2008Documento15 pagineWorking Capital Management in Mahindra & Mahindra LTD: January 2008Haris AnsariNessuna valutazione finora

- Information SystemDocumento15 pagineInformation SystemSudip BaruaNessuna valutazione finora

- Building Manufacturing Competitiveness: The TOC WayDa EverandBuilding Manufacturing Competitiveness: The TOC WayValutazione: 3 su 5 stelle3/5 (1)

- EXPLORING KEY FACTORS THAT INFLUENCE TALENT MANAGEMENTDa EverandEXPLORING KEY FACTORS THAT INFLUENCE TALENT MANAGEMENTNessuna valutazione finora

- A Study of the Supply Chain and Financial Parameters of a Small BusinessDa EverandA Study of the Supply Chain and Financial Parameters of a Small BusinessNessuna valutazione finora

- Corporate Governance, Firm Profitability, and Share Valuation in the PhilippinesDa EverandCorporate Governance, Firm Profitability, and Share Valuation in the PhilippinesNessuna valutazione finora

- ASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Da EverandASEAN Corporate Governance Scorecard Country Reports and Assessments 2019Nessuna valutazione finora

- Estimate Siddhi VinayakDocumento2 pagineEstimate Siddhi VinayakRD SinghNessuna valutazione finora

- (WWW - Entrance Exam - Net) B.F.a 1Documento20 pagine(WWW - Entrance Exam - Net) B.F.a 1RD SinghNessuna valutazione finora

- Business Proposal Letter Revise ChangeDocumento4 pagineBusiness Proposal Letter Revise ChangeRD SinghNessuna valutazione finora

- Certificate and Diploma Course in English SyllabusDocumento9 pagineCertificate and Diploma Course in English SyllabusRD SinghNessuna valutazione finora

- 01 SynopsisDocumento9 pagine01 SynopsisRebecca GodwinNessuna valutazione finora

- TPO Development ProgramDocumento3 pagineTPO Development ProgramRD SinghNessuna valutazione finora

- Recruitment Solutions by Lemon Fresh SolutionsDocumento14 pagineRecruitment Solutions by Lemon Fresh SolutionsRD SinghNessuna valutazione finora

- English For Business Level 1 April 2012 PDFDocumento17 pagineEnglish For Business Level 1 April 2012 PDFMichaela AquinoNessuna valutazione finora

- Imc Traning SolutionDocumento4 pagineImc Traning SolutionRD SinghNessuna valutazione finora

- Recruitment Solutions by Lemon Fresh SolutionsDocumento14 pagineRecruitment Solutions by Lemon Fresh SolutionsRD SinghNessuna valutazione finora

- Month by Month Calendar of College Counseling ActivitiesDocumento9 pagineMonth by Month Calendar of College Counseling ActivitiesRD SinghNessuna valutazione finora

- Paper 71Documento8 paginePaper 71RD SinghNessuna valutazione finora

- CRM Question BankDocumento2 pagineCRM Question BankRD SinghNessuna valutazione finora

- Unit 5Documento5 pagineUnit 5RD SinghNessuna valutazione finora

- Physice 2016 Unsolved Paper Delhi Board PDFDocumento6 paginePhysice 2016 Unsolved Paper Delhi Board PDFRD SinghNessuna valutazione finora

- CB 1Documento180 pagineCB 1RD SinghNessuna valutazione finora

- Research Paper Writing SkillsDocumento114 pagineResearch Paper Writing SkillsRD SinghNessuna valutazione finora

- Advertising Management: Meaning, Nature and Scope of AdvertisingDocumento12 pagineAdvertising Management: Meaning, Nature and Scope of AdvertisingRD SinghNessuna valutazione finora

- Insurance SectorDocumento45 pagineInsurance SectorJkgi InstitutionsNessuna valutazione finora

- CRM-UNIT 5 EditDocumento6 pagineCRM-UNIT 5 EditRD SinghNessuna valutazione finora

- Finance Insurance Risk Management and Insurance BasicsDocumento44 pagineFinance Insurance Risk Management and Insurance BasicsRD SinghNessuna valutazione finora

- CRE Question Bank 1Documento21 pagineCRE Question Bank 1RD SinghNessuna valutazione finora

- CT-2 Be RDDocumento3 pagineCT-2 Be RDRD SinghNessuna valutazione finora

- Imt Ghaziabad - The A-TeamDocumento6 pagineImt Ghaziabad - The A-TeamAbhishek GuptaNessuna valutazione finora

- MemosDocumento42 pagineMemosRhod Bernaldez EstaNessuna valutazione finora

- Questionnaire: Mysore Sandal Soap Products With Reference To Bangalore Market". IDocumento4 pagineQuestionnaire: Mysore Sandal Soap Products With Reference To Bangalore Market". ISuraj Seshan100% (4)

- Netezza Vs TeradataDocumento16 pagineNetezza Vs Teradataad_iemNessuna valutazione finora

- Responsibilities ChitfundsDocumento11 pagineResponsibilities ChitfundsRanjith ARNessuna valutazione finora

- Phillip Morris Companies and Kraft, IncDocumento9 paginePhillip Morris Companies and Kraft, IncNishant Chauhan100% (4)

- Content ServerDocumento5 pagineContent ServerTrần Thị Thanh TràNessuna valutazione finora

- Senior Executive Title Operations Management in Tampa Bay FL Resume Mark WanichDocumento2 pagineSenior Executive Title Operations Management in Tampa Bay FL Resume Mark WanichMarkWanichNessuna valutazione finora

- Proforma For Calculation of Income Tax For Tax DeductionDocumento1 paginaProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- The Marketer's Guide To Travel Content: by Aaron TaubeDocumento18 pagineThe Marketer's Guide To Travel Content: by Aaron TaubeSike ThedeviantNessuna valutazione finora

- Tally 7.2Documento38 pagineTally 7.2sarthakmohanty697395Nessuna valutazione finora

- Solution Homework#7 Queuing Models BBADocumento5 pagineSolution Homework#7 Queuing Models BBAongnaze2Nessuna valutazione finora

- McKinsey Quarterly - Issue 1 2012 (A Resource Revolution)Documento136 pagineMcKinsey Quarterly - Issue 1 2012 (A Resource Revolution)DeividasBerNessuna valutazione finora

- Synopsis DhananjayDocumento15 pagineSynopsis DhananjayDevendra DhruwNessuna valutazione finora

- Netvault Backup Compatibility Guide For Hardware and Software TechnicalDocumento71 pagineNetvault Backup Compatibility Guide For Hardware and Software TechnicalArunmurNessuna valutazione finora

- About ATA CarnetDocumento4 pagineAbout ATA CarnetRohan NakasheNessuna valutazione finora

- BD - 2013 Netrc 011 Bi 009Documento144 pagineBD - 2013 Netrc 011 Bi 009Aryan LaudeNessuna valutazione finora

- Citizens CharterDocumento505 pagineCitizens CharterBilly DNessuna valutazione finora

- Transnational Crimes and Malaysia's Domestic LawsDocumento5 pagineTransnational Crimes and Malaysia's Domestic LawsGlorious El DomineNessuna valutazione finora

- Psa 210Documento3 paginePsa 210Medina PangilinanNessuna valutazione finora

- Scribd Robert KuokDocumento3 pagineScribd Robert KuokRavi Kumar Nadarashan0% (2)

- MBA Notes AdvertisingDocumento4 pagineMBA Notes AdvertisingBashir MureiNessuna valutazione finora

- Action Coach - Mathew AndersonDocumento1 paginaAction Coach - Mathew AndersonMathew AndersonNessuna valutazione finora

- Describe The Forms of Agency CompensationDocumento2 pagineDescribe The Forms of Agency CompensationFizza HassanNessuna valutazione finora

- A Study On Customer Relationship Management at Yamaha Srinivasa Motors PuducherryDocumento6 pagineA Study On Customer Relationship Management at Yamaha Srinivasa Motors PuducherryEditor IJTSRDNessuna valutazione finora

- Weeks PD 1 2 3 4 5 6 7 8 9 10 11 12: Gear BoxDocumento4 pagineWeeks PD 1 2 3 4 5 6 7 8 9 10 11 12: Gear BoxRavi PrakashNessuna valutazione finora

- Archon Umipig Resume 2018 CVDocumento7 pagineArchon Umipig Resume 2018 CVMaria Archon Dela Cruz UmipigNessuna valutazione finora

- Day Book 2Documento2 pagineDay Book 2The ShiningNessuna valutazione finora

- Financial Analysis of Wipro, Tech Mahindra, Mindtree and Oracle Financial Services SoftwareDocumento34 pagineFinancial Analysis of Wipro, Tech Mahindra, Mindtree and Oracle Financial Services SoftwareSankalp Saxena100% (1)

- Kap 09 - Bill of Quantities and Cost Estimates-2009-03-09 PDFDocumento43 pagineKap 09 - Bill of Quantities and Cost Estimates-2009-03-09 PDFLateera AbdiinkoNessuna valutazione finora