Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Section 609

Caricato da

Salazaer FideCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Section 609

Caricato da

Salazaer FideCopyright:

Formati disponibili

The Section 609

Credit Dispute

Do-It-Yourself

Letter Package

Restore Your Credit Score to 740+ Fast

Using a Clause in a Federal Law That the Credit Bureaus

Dont Want You To Know About!

The Section 609 Credit Dispute Do-It-Yourself Letter Package

The Section 609

Credit Dispute

Do-It-Yourself

Letter Package

INTRODUCTION:

Restoringyourbadcreditisnotadifficultjobifyouareready,willingandhavethe

patiencetodealwiththedelay&scaretacticsoftheCreditBureausandprovidedthatyouhave

theproperstepbystepinstructionsandtherighttoolstodoitwith.

TheattachedSection609LegalDisputeDoItYourselfLetters&Instructionsarethe

propertoolstouse.Dontletthesimplicityofthelettersandtheoftencalledoddball

instructionsfoolyou.Theywork,althoughthetimethatittakestogetpositiveresultswillvary

frompersontopersonconsideringthatsometimesitmaytake3or4roundsofsendingthe

variousletterswegiveyouinthepackagebuteventuallytheseletterswillforcethecreditbureaus

toremovethenegativeitemsthatyourequestthemto.

Inordertounderstandhowandwhythispackagewillenableyoutogetallofyournegative

itemsremovedfromyourcreditreportsyouneedtounderstandalittlebitaboutthecredit

reportingbusiness.TherearethreemainCreditReportingAgenciesreferredtoasCRAsand/or

creditbureaus.TheyareEquifax,ExperianandTransUnion.

Whenyouengageinacredittransaction(loan,mortgage,creditcardetc.)withabankor

anyothercreditortheinformationforeachoftheseaccountswillbereportedtooneormoreof

theseCRAs(creditbureaus)byeachcreditorandeachmontheachcredititemwillbereportedin

yourcreditfilewhichisindexedunderyoursocialsecuritynumber,physicaladdressandfull

name.

Page1.

2005-2015 All-Rights-Reserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

The Key To Your Success is the Fact That They Do Everything Electronically!

TheFairCreditReportingAct(copyincludedinthePackage)wasputintolawpriorto

theelectronicandcomputerage.Eventhoughthecreditindustryhasbeentryingtolobby

Congresstorewritethelawtomeetcurrenttechnologystandardsitisimportanttonotethat

thecurrentversionoftheFairCreditReportingAct(FCRA)requirestheCRAstohavephysical

copiesintheirfilesofdocumentationtosupporteachaccountbeingreportedon.

Itisalsoimportanttounderstandthatthecreditorsreportallofyourcredititemstothe

creditbureauselectronically.Theydontsendcopiesofanyphysicaldocumentswhatsoevertothe

creditbureaus.IMPORTANT:Whatthatmeansisthatthecreditbureausdonotreviewandor

verifyanycreditapplications,signedcontractsoranydocumentswhatsoeverbeforetheyreport

theitemonyourcreditreport.Theyacceptanyandallcredititemsthatacreditorsendstothem

electronically.Theyacceptthesecredititemsastrueandcorrectandbelongingtoyou.

Eachmonthyourbankorcreditorsendsanelectronicfilewiththedetailsofyouraccount

toeachoftheCRAs(creditbureaus)

o

account number

date opened

date of last activity

high credit

balance

payment term

status (borrower, co-borrower, joint)

historical status (as agreed, 30 days delinquent)

amount past due

payment amount

customer information secured from the credit application

andthecreditbureaussimplyplacethisinformationintoyourcreditfilewithNOVERIFICATION

doneastowhethertheaccountisvalid,theinformationiscorrectorwhetherthecreditoreven

hastherighttoreporttheitemonyourcreditreport.

Basicallythethreemaincreditbureausgivethecreditorthebenefitofthedoubtthatthey

arereportingaccurateinformation. Whywouldtheygivethecreditorsthebenefitofthedoubt

youask?

Themainanswertothatquestionisbecausethecreditorpaysthecreditbureautoreport

theitemandthecreditoralsopaysthecreditbureauseachtimetheypullyourcreditreport.The

Page2.

2005-2015 All-Rights-Reserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

creditbureausearnhundredsofmillionsofdollarsayearreportinganythingandeverythingon

yourcreditreportthatacreditorprovidesthemwith.

Creditbureausareaforprofitbusinessandtheygetpaidtoputitemsonyourcredit

reportandtheygetpaidwhenthesesamecreditorspullyourcreditreport.Creditorsareableto

chargeyouahigherinterestratethemorenegativeitemsthatareplacedonyourreport.The

problemwiththismethodofreportingisthatANYCREDITORcanessentiallyreportwhateverthey

wantaboutyouwhetheritiscorrectornot.Thereisamajorconflictofinterestgoingonhere

dontyouagree?

TheFederalGovernmentsawabigproblemwiththismethodofreportingsotheythought

thattheysolvedtheproblemwhentheypassedwhatisknownastheFairCreditReportingAct

(FCRA).ItwassupposedtoprotectyouandIandgoverntheactivitiesofCreditReportingAgencies

andregulatehowtheyreportinformationaboutyou.Itsoundsgoodintheorybutreadontofind

outwhyitisnotworking.

IfyoustudythisFederallawandalsostudythecaselawestablishedinvariouscourtcases

pertainingtovarioussectionsoftheFCRAyouwillseethattheFCRArequiresthatallCredit

ReportingAgenciesAreSupposedtoVERIFYALLINFORMATIONreceivedfromcreditorsBEFORE

thisinformationisaddedtoyourcreditfile.

Properverificationaccordingtoestablishedcaselawinvolvesthecreditbureauhaving

copiesoftheoriginalsignedcreditapplicationintheirfiles.Theyarerequiredtohaveacopyof

thecreditapplicationthatyousignedwhenyouopenedthecreditaccountwiththecreditorin

theirfiles.Theyaresupposedtohaveitintheirfilestoshowthattheyverifiedtheinformation

andaccountbelongstoyouandtoshowthattheyverifiedtheinformationbeforetheyplacediton

yourcreditreport.

Thetruthofthematteristhecreditbureausdontreviewanydocumentsletalone

keepacopyofyourcreditapplicationintheirfiles.TheyNEVERseeanydocuments.Theydont

wanttoseeanydocuments.

NOTE:ForthoseofyouwhohaveeverattemptedtoreadtheFCRA(FairCreditReporting

Act)toseewhereitstatesthatthecreditbureausaresupposedtohavedocumentsonfilethat

verifytheaccuracyofeveryaccountreportedinyourcreditfileIdonthavetotellyouthatthis

federallawlikemostlawscomingoutofourUnitedStatesCongressareclearasmud.They

areobviouslywrittenbygiftedattorneyspaidbylobbyistsworkingonbehalfofthebigbanks

andthecreditreportingagencies.Ourcongressmenandwomenwhositonthecommittees

thatdraftuptheselawsobviouslydontreadthelawsaftertheyarewrittenbytheseattorneys

toseeifthelawthattheydraftedarewrittenthewaytheydraftedthem.TheFCRAlawisabout

aseasytoreadasthetaxcode,dontyouagree?

Tohelpyoumaneuverthroughthemudwehaveoutlinedwheretolookinthe86page

documentcalledtheFairCreditReportingAct(acopyofwhichisincludedinthispackage).In

Page3.

2005-2015 All-Rights-Reserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

fact,wehavebrokenitdownto4paragraphs(alongwithourparaphrasingofthosepages)to

helpyouunderstandwhereitsaysinthelawthatthecreditbureausaresupposedtohave

writtendocumentsintheirfilesthatverifytheaccuracyoftheaccountsitreportsinyourcredit

files.AndFYIthereisalsoimportantcaselaw(CourtDecisions)thatwebaseourparaphrasing

on.

These 4 paragraphs noted below (along with our paraphrasing)

Revealwhytheseletterswork.

1.

Page35:609.Disclosurestoconsumers[15U.S.C.1681g](a)Informationon

file;sources;reportrecipients.Everyconsumerreportingagencyshall,uponrequest,andsubject

to610(a)(1)[1681h],clearlyandaccuratelydisclosetotheconsumer:

Paraphrase:Theinformationinthecreditbureausfiles(notthecreditorsfiles),mentioned

above,istheinformationthattheystoreintheircomputerbaseoneveryconsumer.Then

610(a)(1)[1681h]identifiestheproperidentificationrequired(driverlicenseandSScard)+a

writtenrequestbytheconsumer.Basicallyitsaysthatifaconsumerasksthecorrectway,in

writing,andhasproperlyidentifiedthemselves,the3bureausarerequiredtodisclosetothe

consumerexactlywhatdocumentsarestoredwithintheircomputerbasethatwereusedtoverify

theinformationthatisbeingreportedonthem.Theyrefusetoshowyouanythingbecausethey

donthaveanythingintheirfilestoshowyou.Insteadtheytellyoutorequestthesedocuments

fromtheoriginalcreditor.

2.

Page37(2)Summaryofrightsrequiredtobeincludedwithagencydisclosures.A

consumerreportingagencyshallprovidetoaconsumer,witheachwrittendisclosurebytheagency

totheconsumerunderthissectionParaphrase:Thissaysthesamethingasabovetheywill

disclosetheinformationrequestedtotheconsumer.

3.

Page37(2),(E),astatementthataconsumerreportingagencyisnotrequiredto

removeaccuratederogatoryinformationfromthefileofaconsumer,unlesstheinformationis

outdatedundersection605orcannotbeverified.

Paraphrase:Thereare2instancesrevealedinsubsection(2),(E),wherebyaccurate

derogatoryinformationcanberemoved.1.)IftheInformationisoutdatedinSection605.For

example,aBankruptcy7willstayonaconsumer'sbureaufor10years.Afterthe10years,this

creditfilewillexpireordropofffromtheircreditreport.Collections,Chargeoffs,Repossessionset

al,havealifespanof7yearsbeforefallingoff.2.)TheinformationCannotbeverified.

Verificationisthefocalpointofthedeletionprocess.Verificationisavaguetermbutisdefinedin

thetermssectionofthisdocumentonpage7.

4.

Page7(2)Verification(B)oftheinformationintheconsumer'sapplicationforthe

creditorinsurance,todeterminethattheconsumermeetsthespecificcriteriabearingoncredit

worthinessorinsurability.

Paraphrase:Thisisaboutasclearasmud.Itwasobviouslywrittenbyagiftedattorney.Although

Page4.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

(B)dealswithcreditandinsuranceforourpurposeshereweareonlyconcernedwiththecredit

portion.(2)(B)istheCREDITAPPLICATION!Ifyoulookclosely,itsaysthatitisthe"information"in

thecreditapplicationthatitusestodeterminewhethertheconsumermeetsthelending

guidelines.

HowItisSupposedtoWork:Forexample,let'sassumeyouaregoingtopurchaseacarandfinance

thatcar.WhentheCreditdepartmentofthatcardealershipfundadealwithalender,thedealer

surrendersthe2mostimportantfundingdocuments:thecontract+thecreditapplication.Once

thelenderissatisfiedwiththeseandthenecessarysupportingdocuments,thelenderfundsthe

loan.Thelendernowhastheresponsibilityofreportingthisconsumer'sfiletothe3credit

bureaus.

5.

Thelenderissupposedtosendthecreditapplicationtothe3creditbureausto

properlyverifythatthisisthecorrectcustomer.Thisverificationpieceisimportant.It'simportant

becausethedealershiphastocomplywiththePatriotActandotherimposedregulationsto

properlyverify,bysecuringacopyoftheconsumersDriverLicense,thatthepersonsigningthe

contract+thecreditapplicationisthepersonthatwasproperlyidentified.

Also,thelenderusedthiscreditapplicationasproofthattheconsumergavethecreditortheright

topulltheconsumerscreditfileandcheckontheperson'sjob,income,residence,references,and

thenapprovetheloan.Thecreditapplicationistheverificationpiece.

Thelenderthen,onamonthlybasis,sendsitsgiganticemailbatchfiletothe3creditbureausfor

everyoneoftheirloans.Inthisgiantfile,itcontainstheinformationoneveryconsumerthathasa

loanwiththem.Thelendersendsexactlywhatyouseeprintedonthecreditbureaureport.The

sentinfoincludes:

o

account number

date opened

date of last activity

high credit

balance

payment term

status (borrower, co-borrower, joint)

historical status (as agreed, 30 days delinquent)

amount past due

payment amount

customer information secured from the credit application

Page5.

2005-2015 AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

Theproblemis.Eventhoughthelawrequiresthecreditreportingagencytoverifyeveryaccount

itreportsonbeforereportingonitthefactisthelendernever,ever,ever,sendsthecredit

applicationtothe3creditbureaus!Nolenderseversendthecreditapplicationthereforethecredit

bureauNEVERverifiesanyofthisinformation.InsteadofsendingtheCRAacopyofthecredit

applicationtobeverified,thecreditorpullsthecreditfileoftheconsumerandthecreditorverifies

theinformationthattheconsumerputsonthecreditapplicationthemselves.Theverification

processwasdonebackwords.

Thelawrequiresthecreditreportingagencytoverifythecreditinformationnotthe

creditor.Thisbeingthecase,anythingthatisincludedinyourcreditbureaufilecanberemoved

ifyourequestthecreditreportingagenciesrighttoreporttheitembyforcingthemtoshowyou

theproofofverificationthatissupposedtobeintheirfiles.Youcaneffectivelyremoveboth

validnegativeitemsaswellasinvaliditemsthisway.

AccordingtotheFCRA,ifacreditfileisgoingtobereportedonaconsumer'sreportithasto

beproperlyverifiedbythecreditbureau.Eachitemincludedinacreditreporthasaverification

piecebut,thebureausneverhaveit.TheFCRAstatesthatthebureausaretheonesthathaveto

keepthisverificationonfileeventhoughthebureauswilltrytotellyoutogodirectlytothe

creditorandrequestthisinformationinsteadofaskingthecreditbureauforthedocumentation.

Thisisnotgoodconsideringthelender,anunscrupulouscourtemployee,oracollection

agencyordebtbuyercouldreportanythingtheylikeonyourcreditreportinanattempttogain

leverageagainstyoutocollectonanallegeddebtortojustifytoyouwhytheyarechargingyoua

higherinterestrate.TheSection609CreditDoItYourselfDisputelettersusedtodisputeyour

negativecredititemsaredirectedtowardsthe3bureausnotthecreditor.

Wedontcarewhatdocumentsthecreditorhasintheirfiles.Ourstanceisthataccording

toSection609oftheFCRAandbackedupbythevariousestablishedcaselawcreditbureausare

requiredtosendmeacopyofthedocumentsthattheyusedtoverifytheaccountIamdisputing.

Iftheydonothaveacopyofthedocument(s)usedtoverifymyaccountthenthatmeansthatthey

didnotverifytheaccountandtheFCRAstatesthattheyarerequiredtodeleteallunverified

items.

WhydontthecreditbureauskeepfilesiftheFCRArequiresthemto?Because

reviewingmillionsandmillionsofpaperdocumentsandthenkeepingtheminfilesontheirlocation

priortoreportingtheaccountinyourcreditfilewouldbeextremelydifficultandtimeconsuming

andwouldcostafortuneinmanpowertodoit.Soratherthangotothisgreatexpensethey

insteadsetupanelectronicreportingsystemandrelyonacreditortosubmitdocumentationto

youifyouchallengeanyoftheitemsonyourreport.Again,itallsoundsgoodintheoryBUTit

doingitthiswaydoesNOTcomplywiththecurrentlaw.

TheCreditReportingAgenciessimplyhavechosenNOTtoverifytheaccountsinthe

mannerthatthelawwaswritten.Theyhavenevercompliedwiththelawandhavegottenaway

withitandtheirattitudeisthatwehavemanagedtogetthelawwrittenusingconfusinglegalese

Page6.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

andwehavelobbyistswhokeeptheFTC&CFPBfromhavingtoprovideconsumerswith

interpretationsofvariousclausesintheFCRAsoweareOK.Theirattitudeisifthereareafew

peoplewhofiledisputesandrequestproofofverificationandwhocontinuetochallengeus

afterweuseourscaretacticsanddelaytacticswellsimplyadheretotheirrequests.

Noexchangeoforiginalsignedapplicationdocumentsevertakesplacebetweenthe

creditorandtheCreditBureau(CRA). TheCRAjustreportstheinformationprovidedbyyour

creditorandfalselyassumesthatitisvalidandcorrectsimplybecauseitisbeingreportedto

them.AndwhenaskedtoVERIFYtheinformationtheCRAwillsimplysendanelectronic

communicationtothecreditoraskingisthisinformationcorrectandthecreditorwillusually

respondyesthisinformationiscorrect.ThentheCRAwillsendyoualetteroracopyofyour

creditreportwithanotationthatwillsay,Wehaveresearchedthecreditaccount.Theresults

are:wehaveverifiedthatthisitembelongstoyou.

The Truth is, NO ONE AT THE CREDIT BUREAU EVER ACTUALLY VERIFIES

THE ACTUAL CREDIT APPLICATION OR ANY OTHER DOCUMENTATION.

Thisisthedirtylittlesecretthatthecreditbureausdontwantyoutoknowabout.

Howdoweknowthatthisisthewaytheydealwithdisputes?Weknowthisbecausewe

havereadthetranscriptswhereemployeesforvariouscreditbureaushaveadmittedunderoath

thatthisishowitisdonewhentheytestifiedunderoathinvariouslawsuitspertainingtothe

FCRA.(NOTE:Acopyofoneofthetranscriptstestimonyfromonecourtcaseisincludedinthis

package.)

Wereyouawareofthis?Ifyouansweredno,dontfeelbad.MostconsumersHAVENO

IDEAthatthisishowcredititemsareverified.TheCreditReportingAgenciesareinviolationof

FederalLawwhentheydothisandtheyknowtheyarebutsince99.9%ofconsumersdonotknow

theirrightstheydontdoanythingaboutit.Whyshouldtheygotoallthatexpensewhenthey

donthaveto.

Notonlythat,tomakemattersworsetheFTC(FederalTradeCommission),whichis

supposedtoregulatetheCreditBureausandenforcetheFairCreditReportingAct,refusestostep

inwhenyoufileacomplaintwiththemorcomplainthatthecreditbureaurefusestosendyou

copiesoftheverification.

Today,ifyoufileacomplaintwiththeFTCtheywillsendyouaformletterthatstates,

Wecannotactasyourlawyerorinterveneinadisputebetweenaconsumerandacreditbureau

orbetweenaconsumerandacreditororfurnisherofinformation.Theprivateenforcement

provisionsoftheFCRApermittheconsumertobringacivillawsuitforwillfulnoncompliancewith

theAct.

TheywillgoontoinformyouthatifyouchoosetosueacreditbureauthattheFCRAallows

youmayreceiveactualdamagesand/orpunitivedamagesupto$1,000peroccurrenceforthe

Page7.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

creditbureauswillfulnoncompliancewiththeAct(Section616)aswellasfornegligent

noncomplianceandyouwillbeabletorecoveractualdamagessustainedbyyou(Section617)and

thatattorneyfeeswillbeallowedforbothformsofyourcivilactionifyouwinthelawsuit.Even

thoughtheFTCissupposedtoexisttoprotecttheconsumerandtoenforcetheFCRAtheywilltell

youthattheycantforcethecreditbureaustocomplywiththelawbutinsteadsuggestthatyou

consultwithaprivateattorneyifyoufeelthecreditbureauisnotcomplyingwiththelaw.

Onthesurfacethisisverydisturbinganddiscouragingdontyouagree?Wellitisandit

isnt.Letmeexplain.ThetruthofthematteristhatthecreditbureausareBIGforprofit

corporationsthathavesetuptheirownwayofdoingbusinessandhaveindoctrinatedthemasses

andlobbiedthevariousgovernmentofficialsintobelievingthattheyaredoingeverythingcorrect

andaboveandbeyondwhatthelawrequiresthemtodo.

Whydotheygetawaywithit?Theygetawaywithitbecausehardlyanybodyever

challengesthem.Butguesswhat,thecreditbureausbackoffwhensomebodychallengesthemthe

rightway.Theydontwanttogetsuedandhavetogototrialthereforetheyveryseldomforce

youtosuethembeforetakingthenegativeitemsoff.Notbecauseitwillcostalotofmoney.Heck

moneyisnotaproblemforthem.Theyhavethemoneyandresourcestodragalawsuitthrough

thecourtsystemforyears.

Theydontwanttoriskthepublicityandhavethemassesfindoutaboutthisespecially

duringthebankingandmortgagecrisiswearegongthroughnow.Theyknowthatiftheygetsued

andthecasegoestotrialtheywillloseandthentherewillbecaselawontherecordthatcouldget

theattentionofhordesofattorneysacrossthecountryandthentheirentirebusinessmodelwould

beinjeopardy.

Thegoodnewsis,ifyouchallengethecreditbureausrighttoreportanaccountandshow

themthatyouknowyourrightstheywillcomplywithyourrequestsassumingyoucangetyour

lettersthroughtoarealhumanbeing.(Moreonthatlater.)Afterall,thenumberofpeoplewho

knowhowtodoaproperdisputebasedonsection609therightwayarefewandfarbetweenso

whentheyreceiveavaliddisputebasedonsection609theyquietlycomply.

Itsnotabigdealtothemconsideringyouareagrainofsandonthebeach.Aslongasyou

servethemwithavaliddisputeinwritingandyoudontgiveupafterreceivingtheirstandard

delayorintimidationreplythattheyhaveverifiedtheitemasbeingvalidyouwillbeoneina

millionsoyouarenothreattotheirbusinessmodelsotheywillquietlyremovetheitemsthatyou

requestthemto.

Valid Negative Credit Items vs Invalid Items:

Thecreditbureauspropagandamachinehasindoctrinatedthemassesintobelievingthatit

isimpossibletogetaccuratecredititemsremovedfromyourcreditreportbutthetruthofthe

matteris,thatisfalse.Aswediscussedearlier,thelawisasclearasmudbut,Page37(2),(E),a

statementthataconsumerreportingagencyisnotrequiredtoremoveaccuratederogatory

Page8.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

informationfromthefileofaconsumer,unlesstheinformationisoutdatedundersection605or

cannotbeverified.thisclauseintheFCRAclearlystatesthattheyarerequiredtoremove

accurateinformationifitcannotbeverified.MostpeoplefalselybelievethereisNOHOPEin

removingvalidderogatoryinformationfromtheircreditreportandessentiallygiveup.But

nothingcouldbefurtherfromthetruth.

WithThe Section 609 Credit Dispute Do-It-Yourself Letter Packageandourstepbystep

setofinstructions,itdoesntmatterwhetherthenegativeaccountisvalidornot.Theletters

workbecauseitdisputestheCREDITREPORTINGAGENCIESRIGHTTOREPORTTHENEGATIVE

andNOTwhethertheaccountisvalidornot.

UndertheFCRA,CreditReportingAgencies(CreditBureaus)mustprovideacopyofthe

verifiableoriginalcreditordocumentationifitisrequestedproperlybyyoutheconsumer.Since

theycannotprovideproofofverificationtoyouintheformofaphysicalcontractdocumentper

yourwrittenrequesttodosotheaccountisclassifiedasUNVERIFIEDandundertheFCRAall

UNVERIFIEDaccountsMUSTBEDELETED.Whethertheaccountiscorrectornotmakesno

difference.IftheCRAcannotprovideyouphysicalverificationoftheaccountitisanUNVERIFIED

accountandMUSTBEDELETED.

ThisisWHYandHOWThe Section 609 Credit Dispute Do-It-Yourself Letter Packageworks.

Keepinmindthetimeittakestogetthemtoremovealloftheitemsthatyourequest

willvaryfrompersontoperson.Onepersonmaysendletter#1andgetvirtuallyallofthe

negativeitemsremovedinlessthan30days.Anotherpersonmaysendletter#1andonlygeta

fewaccountsremoved.Ora3rdpersonmaysendoutletter#1andgetthecreditbureausstandard

denialformletterortheirintimidationdenialletter(moreonthislater).

Regardlessoftheresultsyougetitisimportanttobediligentandpersistent.Ifafterthe

firstroundofletter#1sthereisstillderogatoryinformationremainingonyourcreditreportthen

yousimplysendthenextletterthatwegiveyouinyourpackageandemphasizingthatitisyour

2ndWrittenRequestforthemtosendyoucopiesoftheirverifiableproofthattheaccountin

questionorhavetheitemdeletedaspersection609.

Eventually,youwillfindthatallofyourderogatoryaccountswillbegintodisappear.For

somepeopleithappensquicklyandisquiteeasyandforothersitcanbeafightandtakemuch

longer.Why?

IMPORTANT:Thereasonwefoundthatthetimeittakestogetyourdisputeditems

removedvariesfrompersontopersonisbecausemostdisputelettersnevergetreadbyareal

human.Thetrickistogettheletterreadbyarealhumaninsteadofacomputer.Hereshowit

works:

Initiallyyourdisputelettergoestoahumanbuthe/shedoesntreadit.Theyonlyopen

theenvelopeandthenrunthepageorpagesthroughacomputerizedscanner.Thescanning

machinedoesanopticalrecognitionofthewordsinyourletter.Ifyourletteristypewrittenthen

Page9.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

thenameofthecreditorandtheaccountnumbersthatyouaredisputingcanbereadbythe

computerandtheyarecomparedtothecreditornameandtheaccountnumbersinyourcreditfile

andiftheymatchupthenthecomputerautomaticallysendsyouaformletterstatingthatthe

accountinformationhasbeenverified.Whambamcaseclosed.

Mostpeoplegiveupaftertheyreceiveareplyfromthecreditbureauthatstatesthatthey

haveverifiedtheaccounttobeaccurate.Thatiseasytodoright?Consideringthatyouknowthat

theaccountbelongstoyou.Mostpeopleareexpectingthiscreditdisputeprocessnottoworkso

theyquitassoonastheyreceivethisreplyfromthecreditbureau.Thatswhatthecreditbureaus

wantyoutodo.DontQuit!

Sothekeyistomakesurethatyourdisputelettergetsrejectedbythecomputerand

passedontoarealliveperson.Sohowdowedothat?

Wesimplyrecommendthatyouhandwriteinthecreditorsnameandaccountnumbers

ratherthantypetheminonyourletter.(Seesampleletterinyourpackagethatillustrateswhatwe

mean.)Nowhandwritingthisportionoftheletterdoesnotguaranteethatthehumanwhoisgoing

tolook(noticeIsaidlooknotread)atyourdisputeletterisgoingtoautomaticallydeletethe

itemsthatyouaredisputingbecauseheorsheseesthatyouaredisputingtheirrighttoreport

nottheaccuracyoftheitem.

Withoutgettingintoawholelotofdetailofthedutiesandrestrictionsputonemployeesat

thecreditbureausandtomakealongstoryshortitssufficetosaythatthesepeoplehavetodeal

withthousandsoffileseachdaywhichmeansthattheycanonlyspendafewminutesperfileif

theyaregoingtomaketheirquotaeachday.Soeventhoughyougotyourdisputeletterpastthe

computerandintothehandsofareallivepersonthesepeoplemaystillignoreyourletterand

automaticallygetthecomputertosendyouanothertypeofformletterwecalltheIntimidation

FormLetterRejection.Experian,EquifaxorTransUnionmaysendyouacommunicationsaying

somethinglikethis:

Wereceivedasuspiciouslookingrequestregardingyourpersonalcreditinformationthat

wehavedeterminedwasnotsentbyyou. Wehavenottakenanyactiononthisrequestandany

futurerequestsmadeinthismannerwillnotbeprocessedandwillnotreceivearesponse.

Oryoumayreceivealetterbackfromthemthatasksyouifyouaredoingbusinesswitha

creditrepaircompanyorwhetherornotyoupaidacompanytohelpyoudraftupyourdisputeletter

andtheymayaskyoutofilloutaquestionnaireandreturnittothembeforetheywillreviewyour

dispute.DONOTFILLOUTANYTHINGandreturnittothem.ONLYUsethelettersinthispackage.

Thesetypesofintimidatingresponsesaredesignedtodiscourageyouandorscareyouinto

believingthatyouaredoingsomethingwrongandgetyoutoabandonyourdispute.CreditBureaus

donotlikeitwhenconsumersfiledisputesbecauseitcoststhemtimeandmoneytodoitevenif

theyjustmailyoubackarejectionformletter.Theygettensofthousandsoflettersadaywhich

translatesintohundredsofthousandsofdollarstodealwiththem.Thesoonertheyscareyouaway

Page10.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

ordiscourageyouawaythebetteritisfortheirprofits.

Tofurtherscareyouintosubmission,theymayalsoincludesomethinglikethis:

Suspiciousrequestsaretakenseriouslyandreviewedbysecuritypersonnelwhowill

reportdeceptiveactivity,includingcopiesoflettersdeemedassuspicious,tolawenforcement

officialsandtostateorfederalregulatoryagencies.

DO NOT BE FOOLED or INTIMIDATED BY THIS!!!

These are nothing but scare tactics to intimidate you into giving up.

IfyounoticewitheachoftheSection609DoItYourselfCreditDisputeLettersyouare

includingacopyofyourDriversLicenseandorpictureIDcardandacopyofyourSocialSecurity

Card.Why?

Because,Section610(a)(1)[1681hoftheFCRAstipulatesthatacreditbureauisonly

requiredtorespondtoadisputefromaconsumerifitisinwritingandiftheconsumerproperly

verifiesthattheyarewhotheysaytheyareusingproperidentification.Acopyofavaliddriver

licenseshowinganaddressthatmatchesupwiththeaddressshowingonyourcreditreportanda

copyofyoursocialsecuritycardareconsideredvalididentification.Byprovidingallofthis

information,thereisnoquestionwhatsoeverthatYOUaretheonemakingthewrittenrequest.

IMPORTANT:Makesurethattheaddressshowingonyourdriverlicenseisthesame

addressthatshowsuponyourcreditreport.IfitdoesntthenIhighlyrecommendthatyougo

downtotheDMVandtellthemthatyoulostyourdriverslicenseandorderanewonewiththe

properaddressonit.Ifyoudonttellthemthatyoulostyouroldcardtheywillsimplyissueyoua

changeofaddresscardwhichthecreditbureausmaynotacceptthereforeitiswisetohaveyour

properaddressshowingonthecarditself.Sometimesiftheaddressonyourdriverslicense

doesntmatchupthentheywillacceptacopyoftwoutilitybillsthatshowyournameandaddress

thatmatchesupwiththenameandaddressshowingonyourcreditreport.

AlsonotethatifyoudonothaveacopyofyourSSNcardmakeacopyofapaystuborW2

formthatshowsyournameandSSNonit.

BeforestartingthedisputeprocessyoushouldgodowntotheFedExStoreoryourlocal

copycenterandgetabout1215copiesmadeupwithbothyourdriverslicenseandSScardsothat

youhavethemavailablewhenitistimetostartmailingdisputelettersandorrespondingtotheir

delayorintimidationletters.

Remember,ifyoudohappentogetsomeresistancefromtheCreditBureausdontbe

alarmedandDONOTgiveup.Theydontplayfairandveryseldomdotheycomplyafteronly

receivingyourfirstletter.Iftheysendyouarejectionletteroranintimidationletteraswe

discussedearlierjustsendthenextletterinourpackageandremindthemitisyour2ndRequest!

Page11.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

IftheysendyouaformtofilloutandreturntothemDontfilloutanyformsandreturnit

tothem.Onlyusethelettersthatareinthispackage.KeepsendingthelettersDEMANDINGthe

CreditBureaueitherprovidetheverifiableprooforDELETEtheitem.Itmaytakeafewlettersand

determinedpersistencebutallunverifieditemsmustandwillbedeleted.

IntheextremecasewheretheCRAstrytoignoreyourmultiplewrittenrequests,youcan

filealawsuitandsuetheCRAfordamagesundertheFairCreditReportingAct(FCRA)and/orfilea

formalcomplaintwiththeFederalTradeCommission(www.ftc.gov)forviolationsoftheFCRA.You

canfileyourcomplainthere:

https://www.ftccomplaintassistant.gov

Ifyournegativecredititemsarenotremovedaftersendingthemall4ofthecreditdispute

lettersthatareincludedinthispackagepleasecontactusat:

info@creditandfundingsolutions.com

Wellreviewyourfilesandbasedonhowyouhavebeentreatedbythecreditbureaus

wellcustomizeafifth&finalletterforyoutosendthemandorwillrecommendonwhetheryou

shouldfilealawsuitinsmallclaimscourtandorinFederalCourt.Youcanaccessinformation

including,alistofconsumerrightsattorneys,samplelawsuitpleadingsandcopiesofcaselawat:

http://SueCreditBureau.com

Uptonowtheonlypeoplewhoreporttousthattheyarenotgettinganyoftheirnegatives

removedarepeoplewefindoutthatdidNOTmailouttheirletterscertifiedmail.Makesurethat

youmailoutallofyourletterscertifiedmail.

Onemorething.ItisrecommendedthatyouDoNotApplyForanyadditionalcreditduring

thedisputeprocessanddonotallowanybodytopullyourcreditduringthistimeeitherUNLESS

itisabsolutelynecessary.

Ifyouarepresentlyindebtandareunabletomakeallofyourmonthlypaymentstoanyor

allofyourcreditorsthenyouneedtoknowhowtodealwiththesecreditors.Thisiscriticalnot

onlytothecreditdisputeprocessbutitiscriticalthatyounotspeaktoanydebtcollectoroverthe

phone.Youmustonlycommunicatewiththeminwriting.

Ifyouonlycommunicatewiththeminwritingandyoudoitproperlythenthereisan

excellentchancethatyouwillbeabletowalkawayfromthatoutstandingdebtwithoutgetting

suedandwithouthavingtopayanyofthemoneyback.Ifyouareinthissituationthenyouneed

togetyourhandsonanothertoolthatwillprovideyouwiththeproperwrittenletterstodeal

withthedebtcollectors.Goto:

http://www.DebtEliminationTools.com/BillCollector.html

GotonextpageforStepbyStepInstructions.

Page12.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

Step-By-Step Instructions:

UnderFederalLaw,onceperyearyoucanreceiveaFREEcreditreportfromeachofthe

threemainCreditReportingAgencies.

Step 1:

Pull a Credit Report from Experian, Equifax & TransUnion.

Go to: http://www.annualcreditreport.com togetcopiesofyourFREEcreditreports.If

youareluckyyouwillbeabletoaccessallthreecreditreportsonlineimmediately.ButBeware.

Youronlinerequestmightgetdeniedbecausetheysaythattheycannotverifythatyouarewho

yousayyouare.Ifthatisthecase,dontgiveup.Simplyprintouttheformthatcomesuponyour

screenandfillitoutandmailittotheaddressthatisontheformandincludeacopyofyourdrivers

licenseandSScardasproofofidentification.Itwillonlytakeafewdaysandyouwilleitherreceive

acopyofyourcreditreportinthemailandortheywillemailyoualinktogotothatwillenableyou

todownloadacopyofyourreport.

(Note:ifyouhavealreadyusedyourfreereportfortheyearyoumayhavetopurchasea

newreport)

Step 2:

Review Each Credit Report & Identify All Of The NEGATIVE

Items That You Want To Be Removed. Make a List: (See sample below)

NameofAccount:

AccountNumber:

1. ChaseBank

533376304023

2. BofA

424492101261

3. PalisadesCollection

PAL3CHSARB8275

4. etc

NOTE:Thenegativeaccountsthatyouwanttohavedeletedareeasytofind.Usuallythere

willbeasectiononyourcreditreporttitled:TheFollowingAccountsthatmaybeconsidered

negative:

NOTE#2:Theaccountnumberslistedforeachaccountshownonyourcreditreportare

alwayspartialaccountnumbers.Dontworry.Thatisallyouneedtowriteontoyourdispute

letters.SimplywriteinthesamepartialaccountnumberbesidetheNameofAccountasperthe

illustrationabove.

AfteryoucompileyourlistyoullbeHandWritingboththeNameofAccountandthe

AccountNumberontotheletter.Remember,thatisimportantifyouwanttogetyourdispute

letterseenandreadbyareallivepersonwhichincreasesthechancesofgettingthenegativeitem

removedwiththefirstletteror2ndletter.

Page13.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

Afteryouhavecompiledyourlistofnegativesforeachcreditreportyouwillneedtoopen

theSection609CreditDisputeDoItYourselfLetter#1forthefirstcreditbureau.Dothisonecredit

bureauatime.

NOTE#3:BeforeyoustartIrecommendthatyoucreate3separatefoldersonyourcomputer:

1. Experian

2. Equifax

3. TransUnion

Thencopyeachoftheletters#1,2,3and4intoeachofthefolders.ThenletsstartwithExperian.Open

theExperianfolderandthenopenLetter#1Experianinsidethefolder.Pluginyourname,addressetc

andthenPrintouttheletterandthenhandwriteintheaccountsandthepartialaccountnumbersfor

eachaccountthatyouwantdeletedandalsoaddthewordUnverifiedAccount.Seeexamplebelow:

NameofAccount:

AccountNumber:

ProvidePhysicalProofofVerification

1. Chase Bank

#533376304023 Unverified Account

2. B of A

#34765287.

Unverified late payments

3. Judgment

# 789736

Unverified judgment

NOTE#4:IveusedahandwritingfontintheexampleaboveYoushouldactuallyhandwrite

thisontotheletterandslantthelineabitsoitisnotstraightincaseyouhaveneathandwriting

otherwisethescannerwillprobablybeabletoreadthehandwritingfontwhereasitisunlikelyitwillbe

abletoreadyourownhandwritingespeciallyifyouuseablueinkpenandthelinesareslantedabitor

crooked.

NOTE#5:Ifyouhavemorethan22negativeaccountsonyourcreditreportmakesurethatyou

Onlydisputeamaximumof22accountsatonetime.Attemptingtodisputemorethan22

accountsatonetimecouldcausetheCreditBureaustoclassifyyourdisputeasfrivolousanddo

nothing.Theyhavetherighttodothat.

Step 3: Attach a copy of your Social Security card & Drivers License to

each letter that you send them including letter #2 etc.

Onceyoucompleteeachletter,simplysigntheletter,includeaphotocopyofyourSocial

SecuritycardandIDCard(DriversLicenseorPassport)asproofofyouridentityandmailtheletter

tothecreditbureauCERTIFIEDMAIL.(Thiswillenableyoutotrackdeliveryofyourletterand

provideproofthatitwasreceivedbytheCreditBureau)iftheyendupdoingnothing.Thatwould

beniceconsideringtheywouldhavetodeletealloftheitemsyourequestedonceyoushowed

Page14.

2005-2015 AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

themorthecourtyourproofofdelivery.

Step 4: Hand write the envelope, dont type.

HandwriteyourreturnaddressandtheCreditBureauaddressontheenvelopesothecredit

bureautreatsthedisputeletterasifitisfromanindividualwhichmeansthattheyaremorethan

likelytotakelongertoopenyourletterwhichmeansthattheywilltakelongertodealwithitand

thatbeingsaidthereisabetterchancethattheyllremovetheitemsquicker.

The3rdworldworkerswhodealwithdisputelettershavestrictquotarulestoabidebyif

theywanttokeeptheirjobsowhentheygetbehindtheyhavetwooptions.1)Sendoutthewe

haveverifiedformlettertothestackoflettersthattheyarebehindon.2)Or,deleteallofthe

disputeditemsonthestackoflettersthattheyarebehindon.Envelopesthatarehandwrittenare

takenaslettersfromindividualconsumersandaredealtwithlastwhichmeansthatwhentheyget

aroundtoopeningthemaweekalreadymighthavegoneby.Sincetheyhavetorespondtoyour

disputewithin30daystheyquiteoftendonthavetimetodealwithyourdisputesoyouhavea50

50chanceofgettingtheitemsremovedwiththefirstletter.

Step 5: Wait 4 Days then prepare and mail out Letter #1 to the 2nd Credit

Bureau and then 4 days later mail letter #1 to the 3rd credit bureau.

Dontsendoutyourdisputeletter#1toall3creditbureausonthesameday.Sendthem

outfourdaysapart.Doingitthiswayincreasestheoddsofgettingtheitemsremovedafteronly

usingthefirstletter.Thisrecommendationcomesdirectlyfromaretiredemployeeforoneofthe

creditbureaus.Wepromisednottorevealwhyherecommendedyoudoitthiswayasperhis

requestandthereisnoneedforyoutounderstandwhyyoushoulddoitthisway.Justdoit.

Afteryoumailoutyourletter#1toall3creditbureausoveran9dayperiodthenyoull

watchyourmailcloselyforresponsesfromthecreditbureaus.Itusuallytakesabout2130daysto

receiveyourfirstcorrespondencefromthecreditbureaus.Aswehavediscussedpreviously,they

willsendyouanythingfromacopyofyourcreditreporttoaintimidationletter.Ifyoureceivea

responseandsomenegativeitemswerenotremovedANDtheCreditBureauDIDNOTprovideyou

withacopyofthewrittenverifiableproofperyourwrittenrequestthensendthenextletterin

thepackage.

Itisrecommendedthatyouopen(3)filefoldersoneforEquifax,ExperianandTransUnion

andkeepverydetailedrecordsofthedatesofyourcommunicationswitheachCreditReporting

Agency.Itisimportantthatyouestablishapapertrailhistoryofyoureffortstoenforceyour

consumerrightsundertheFairCreditReportingAct.DOCUMENTEVERYTHINGINWRITING.Keep

copiesoflettersyousendthem,certifiedmailreceipts,responseletters,notesetc.

Page15.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

Iftheyfailtorespondtoyourletter#1within30daysofreceivingyourletterthenmail

themacopyoftheNoResponseLetterthatisincludedinthispackage.Also,mailacopyofthis

letterto:cc.ConsumerFinancialProtectionBureau(CFPB)POBox4503,IowaCity,IA52244

Overtime,ifyouhavetofileacomplaintwiththeFTCorCFPBandoryourStateAttorney

GeneralyouwillhaveaverystrongsupportedcaseagainsttheCreditBureauandthisevidencewill

beinvaluableshouldyoueverhavetogototheunusualextremeoffilingalawsuittoseek

damages.

IMPORTANT: Everytimeyousendoneoftheletterstothecreditbureaumakesurethat

youincludeacopyofyourdriverslicenseandSSNcard.Remember,wetoldyoutogotoyourcopy

centerandmake12or15copiessoyouhavethemhandytoattachtoeachletteryoumailout.If

youfailtoattachacopyofthesedocumentstoeachletteryouwillprobablygetareplyafter

waiting2130daysthatsimplytellsyouthattheyareunabletorespondtoyourrequestbecause

therewasnoproofofwhoyouareattachedtothedisputeletter.Itsanotherdelaytacticthat

theyusetodiscourageyouanditjustdelaysthingsforyou.

AftertheyreceiveyourfirstdisputelettertheCreditBureaushave30daystoinvestigate

yourdisputeandsendyouareply.Inmostcasestheywillsendyouanacknowledgmentletter

thatappeartostatethattheywillnotinvestigateyourdisputeand/ortheywilltellyouthatyouare

illegallytryingtodisputelegitimateitemsonyourcreditreportandtheymayaskyoutofillouta

formorquestionnaireandreturnittothem.DONOTFILLOUTANYFORMSandreturnittothem.

Simplyrespondtothemwiththenextletterthatwehaveforyouinthispackage.

NOTE:Sometimesthecreditbureauswillremoveonly2or3oftheitemsandleave4or5of

themstillonyourreportafteryourfirstorsecondletter.Ifthishappensjustcontinueonwiththe

nextletterthatyousendthembutmakesurethatyoudontlisttheremovedaccountsonthe

nextletter.

OK,thatbringstoaclosethebackgroundbehindtheSection609CreditDoItYourself

DisputeLetterPackageaswellasthesimpleStepbyStepInstructionsyouneedtofollowinorder

togetallofthenegativeitemsremovedfromeachofyourcreditreports.

Ifyouhaveanyquestionsconcerningthispackagepleasesendanemailto:

info@creditandfundingsolutions.com

Wewillsendyouaresponsewithin24hours.

Page16.

2005-2015AllRightsReserved

The Section 609 Credit Dispute Do-It-Yourself Letter Package

Copyright 2005-2015

All World Wide Rights Reserved

Nopartsofthispackagemaybereproducedortransmittedinanyformorbyanymeansincludingphotocopying,

scanning,recording,usinganinformationalstorageandretrievalsystemorduplicatingitinanyelectronicformat

whatsoeverwithoutwrittenpermissionfromtheCopyrightholderDebtEliminationTools.comLLC.

IfyouaregivenwrittenpermissiontodistributecopiesofthisreportfromtheCopyrightholderyoumustdistributethe

entirereportinitsentiretyandyouareNOTallowedtomakeanychangesand/oradditionsoralterationsinanyway

andthenameofthecopyrightholdermustremainunaltered.Anyviolatorswillbeprosecutedtothefullextentofthe

law.

Whileallattemptshavebeenmadetoverifyinformationprovidedinthispublication,theauthordoesnotassume

responsibilityforerrors,inaccuraciesoromissions.Anyslightsofpeople,companiesororganizationsareunintentional.

Ifwehaveoffendedanyoneinanywayweapologize.Whileeveryefforthasbeenmadetoensurethishelpfuland

informativemanualisaccurate,nowarrantiesofanykindaremadewithregardstoitscompletenessandaccuracy.

Thepublicationisdesignedtoprovidetheauthorsopinionsinrespecttothesubjectmattercovered.Itisnotintended

foruseasasourceoflegal,accountingortaxadvice.Theauthorstressesthattheinformationcontainedhereinmaybe

subjecttovaryingnational,stateand/orlocallawsand/orregulations.Allreadersareadvisedtoretaincompetent

counseltodeterminetheapplicablelawsthatapplytothem.

Thispublicationisdistributedwiththeintentthattheauthorisnotengagedingivinganyprofessional,legal,

accounting,orinvestingservicesadvice.Nothinginthismanualcreatesanattorneyclientrelationshipbetweenthe

authororanyofhisassociatesandthereader.

Ifprofessionaladviceisneeded,pleaseseekouttheproperprofessional.Thecontentsofthisbookshouldnotbe

substitutedforpersonalizedlegaladvice.Thereaderofthispublicationassumestotalresponsibilityfortheuseof

thesematerials.Idisclaimanyloss,eitherdirectlyorindirectly,asaconsequenceofapplyingtheinformation

presentedherein.

LiabilityDisclaimer

Byreadingthisdocument,youassumeallrisksassociatedwithusingtheadvicegivenbelow,withafullunderstanding

thatyou,solely,areresponsibleforanythingthatmayoccurasaresultofputtingthisinformationintoactioninany

way,andregardlessofyourinterpretationoftheadvice.Youfurtheragreethatourcompanycannotbeheld

responsibleinanywayforthesuccessorfailureofyourbusinessasaresultoftheinformationpresentedbelow.Itis

yourresponsibilitytoconductyourownduediligenceregardingthesafeandsuccessfuloperationofyourbusinessif

youintendtoapplyanyofourinformationinanywaytoyourbusinessoperations.

TermsofUse

Youaregivenanontransferable,personaluseonlylicensetothispackageofproducts.Youcannotdistributeany

partofitorshareitwithotherindividuals.Also,therearenoresalerightsorprivatelabelrightsgrantedwhen

purchasingthisdocument.Inotherwords,it'sforyourownpersonaluseonly.ViolatorswillbesubjecttopayingONE

HUNDREDTHOUSANDDOLLARStothecopyrightholderifitisproventhatyouviolatedthenondisclosureagreement.

Contact us by Email:

info@creditandfundingsolutions.com

Page17.

2005 - 2015AllRightsReserved

Potrebbero piacerti anche

- Instant Credit RepairDocumento53 pagineInstant Credit RepairMenjetu98% (57)

- Expert Credit Sweeps - Cheat Sheet - Public ViewDocumento2 pagineExpert Credit Sweeps - Cheat Sheet - Public ViewCK in DC73% (11)

- Generic 609 Credit Dispute LetterDocumento2 pagineGeneric 609 Credit Dispute Letterrealtor.ashley100% (4)

- 609 Letter Templates: The Ultimate Guide to Repair Your Credit Score. Learn How to Use Credit Report Disputes, Improve Your Personal Finance and Raise Your Score to 100+.Da Everand609 Letter Templates: The Ultimate Guide to Repair Your Credit Score. Learn How to Use Credit Report Disputes, Improve Your Personal Finance and Raise Your Score to 100+.Nessuna valutazione finora

- Learn to Repair Credit | Get Approved for Business Loans: Loans, Tradelines and CreditDa EverandLearn to Repair Credit | Get Approved for Business Loans: Loans, Tradelines and CreditValutazione: 4.5 su 5 stelle4.5/5 (3)

- Credit Repair Guide: How to Fix Credit Score and Remove Negatives From Credit ReportDa EverandCredit Repair Guide: How to Fix Credit Score and Remove Negatives From Credit ReportValutazione: 5 su 5 stelle5/5 (5)

- Method of Verification (MOV) Dispute Steps GuideDocumento6 pagineMethod of Verification (MOV) Dispute Steps GuideKNOWLEDGE SOURCE92% (37)

- I Have Used These Techniques and Improved My Score by 100 Pts in Less Than 1 YearDocumento9 pagineI Have Used These Techniques and Improved My Score by 100 Pts in Less Than 1 YearKNOWLEDGE SOURCE96% (50)

- Inquiry Removal TemplateDocumento1 paginaInquiry Removal Templatesavedsoul2266448100% (10)

- How to Remove Negative Items from Your Credit Report in Less Than 40 DaysDocumento11 pagineHow to Remove Negative Items from Your Credit Report in Less Than 40 DaysNathan Ryan Woods94% (34)

- Things Credit Bureaus Do Not Want You To KnowDocumento5 pagineThings Credit Bureaus Do Not Want You To KnowFreedomofMind94% (47)

- Debt Validation Sample Letter DisputeDocumento15 pagineDebt Validation Sample Letter DisputeKNOWLEDGE SOURCE96% (51)

- Credit-Rebuilding Letters: Letter # Letter Should Be Sent To Reason To Send Letter (Letter Name)Documento29 pagineCredit-Rebuilding Letters: Letter # Letter Should Be Sent To Reason To Send Letter (Letter Name)FreedomofMind95% (39)

- Full Credit Sweep LetterDocumento2 pagineFull Credit Sweep LetterBrad85% (68)

- Section 609 of The Fair Credit Reporting Act LoopholeDocumento7 pagineSection 609 of The Fair Credit Reporting Act LoopholeFreedomofMind97% (39)

- Using Section 609 of The Fair CreditDocumento4 pagineUsing Section 609 of The Fair CreditFreedomofMind94% (16)

- 10 Great LettersDocumento11 pagine10 Great LettersKNOWLEDGE SOURCE100% (1)

- The Dispute Letters Templates PDFDocumento20 pagineThe Dispute Letters Templates PDFFreedomofMind96% (49)

- Delete ErrorsDocumento11 pagineDelete ErrorsKNOWLEDGE SOURCE100% (18)

- Dispute To Creditor For Charge OffDocumento4 pagineDispute To Creditor For Charge Offrodney75% (20)

- Guerrilla Tactics That Will Give You A Good Credit RatingDocumento10 pagineGuerrilla Tactics That Will Give You A Good Credit Ratinglvn_reviewer55% (11)

- Hidden Credit Repair SecretsDocumento19 pagineHidden Credit Repair SecretsDordiong89% (9)

- Chex Systems Dispute LettersDocumento15 pagineChex Systems Dispute LettersZIONCREDITGROUP93% (15)

- The Ultimate DIY Kit! (Instant Download)Documento27 pagineThe Ultimate DIY Kit! (Instant Download)Taiwo Adeleye100% (44)

- Credit Repair Letter!Documento8 pagineCredit Repair Letter!matt91% (35)

- Credit Repair Dispute Letters PDFDocumento13 pagineCredit Repair Dispute Letters PDFJaz CiceroSantana Boyce96% (24)

- Credit Repair Plan B 19 Day ResultsDocumento2 pagineCredit Repair Plan B 19 Day ResultsPlan B CRS30% (10)

- Dispute Letter Demanding Verification of AccountsDocumento2 pagineDispute Letter Demanding Verification of AccountsBonaparte Phil100% (9)

- 609 Credit Dispute Letter1Documento2 pagine609 Credit Dispute Letter1Juanita93% (15)

- Templates of Credit Rebuilding LettersDocumento27 pagineTemplates of Credit Rebuilding LettersLm Rappeport100% (4)

- Dispute Credit Report ErrorsDocumento6 pagineDispute Credit Report ErrorsKNOWLEDGE SOURCE100% (30)

- Templates of Credit Rebuilding LettersDocumento28 pagineTemplates of Credit Rebuilding LettersDonnell Jefferson100% (3)

- 37 Days To Clean CreditDocumento10 pagine37 Days To Clean Creditporcherab10% (10)

- DIY - CREDIT REPAIR EBOOK - Instructions - v1 PDFDocumento69 pagineDIY - CREDIT REPAIR EBOOK - Instructions - v1 PDFYawNyarko92% (24)

- Hard Inquiry Removal LetterDocumento1 paginaHard Inquiry Removal Lettercamwills283% (12)

- 40 Credit Repair SecretsDocumento8 pagine40 Credit Repair Secretswlingle11753% (19)

- 30 Day Removal FixDocumento1 pagina30 Day Removal FixKNOWLEDGE SOURCE83% (23)

- 03-2 - C - How To Remove Bankruptcy and Other Public RecordsDocumento10 pagine03-2 - C - How To Remove Bankruptcy and Other Public RecordsBRIAN RUDD100% (7)

- 37 Days To Clean Credit EbookDocumento80 pagine37 Days To Clean Credit EbookVenita Jefferson17% (6)

- What The Credit Bureaus Don't Want You To KnowDocumento16 pagineWhat The Credit Bureaus Don't Want You To KnowLarry McKinstry86% (7)

- Ultimate Credit Repair GuideDocumento38 pagineUltimate Credit Repair Guidewlingle11756% (9)

- CRC LLC BFC Equifax 7 of 15 Method SweepDocumento6 pagineCRC LLC BFC Equifax 7 of 15 Method Sweeprodney83% (12)

- Credit Repair Toolkit1Documento16 pagineCredit Repair Toolkit1rodney100% (7)

- Operation Clean SweepDocumento12 pagineOperation Clean SweepCreditScoreAide.com71% (7)

- Why Credit Restoration Works: Remove Items Using FCRA Section 609Documento3 pagineWhy Credit Restoration Works: Remove Items Using FCRA Section 609KNOWLEDGE SOURCE100% (3)

- Credit Repair Secrets ExposedDocumento69 pagineCredit Repair Secrets ExposedJulian Williams©™86% (14)

- Sample Non-Permissible Purpose LetterDocumento2 pagineSample Non-Permissible Purpose LetterFreedomofMind100% (7)

- Inquiry Removal: A Step-By-Step Guide On How To Remove Hard Inquiries From All Three Credit BureausDocumento17 pagineInquiry Removal: A Step-By-Step Guide On How To Remove Hard Inquiries From All Three Credit BureausMooreTrust100% (4)

- Late Payment Removal CreditDocumento15 pagineLate Payment Removal CreditKadir Wisdom75% (16)

- Erasing Bad Credit Manual 0402Documento91 pagineErasing Bad Credit Manual 0402nevayield80% (5)

- Fcra Section 609 and 605 LetterDocumento15 pagineFcra Section 609 and 605 LetterGary80% (5)

- G 325a PDFDocumento0 pagineG 325a PDFdodakadejaNessuna valutazione finora

- Section 609Documento18 pagineSection 609Salazaer Fide96% (95)

- New Employee Orientation: TO: From: SubjectDocumento1 paginaNew Employee Orientation: TO: From: SubjectSalazaer FideNessuna valutazione finora

- 2013 Full Exam PrepDocumento58 pagine2013 Full Exam PrepSalazaer FideNessuna valutazione finora

- RAIO Training March 2012Documento65 pagineRAIO Training March 2012SFLDNessuna valutazione finora

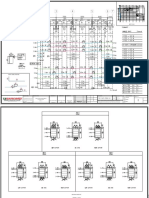

- Revised Y-Axis Beams PDFDocumento28 pagineRevised Y-Axis Beams PDFPetreya UdtatNessuna valutazione finora

- Chapter 2Documento16 pagineChapter 2golfwomann100% (1)

- Pratshirdi Shri Sai Mandir'ShirgaonDocumento15 paginePratshirdi Shri Sai Mandir'ShirgaonDeepa HNessuna valutazione finora

- Pennycook Plagiarims PresentationDocumento15 paginePennycook Plagiarims Presentationtsara90Nessuna valutazione finora

- Immersion-Reviewer - Docx 20240322 162919 0000Documento5 pagineImmersion-Reviewer - Docx 20240322 162919 0000mersiarawarawnasahealingstageNessuna valutazione finora

- ACCA F6 Taxation Solved Past PapersDocumento235 pagineACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- The Wisdom of Solomon by George Gainer Retyped 1nov16Documento47 pagineThe Wisdom of Solomon by George Gainer Retyped 1nov16kbsd3903Nessuna valutazione finora

- Davies Paints Philippines FINALDocumento5 pagineDavies Paints Philippines FINALAnonymous 0zrCNQNessuna valutazione finora

- New Earth Mining Iron Ore Project AnalysisDocumento2 pagineNew Earth Mining Iron Ore Project AnalysisRandhir Shah100% (1)

- Corporate Surety BondsDocumento9 pagineCorporate Surety BondsmissyaliNessuna valutazione finora

- Philippine LiteratureDocumento75 paginePhilippine LiteratureJoarlin BianesNessuna valutazione finora

- Elementary Present Continuous and Present Simple AnswersDocumento5 pagineElementary Present Continuous and Present Simple AnswersFabio SoaresNessuna valutazione finora

- Carnival Panorama Deck Plan PDFDocumento2 pagineCarnival Panorama Deck Plan PDFJuan Esteban Ordoñez LopezNessuna valutazione finora

- Man and Cannabis in Africa: A Study of Diffusion - Journal of African Economic History (1976)Documento20 pagineMan and Cannabis in Africa: A Study of Diffusion - Journal of African Economic History (1976)AbuAbdur-RazzaqAl-MisriNessuna valutazione finora

- Phone, PTCs, Pots, and Delay LinesDocumento1 paginaPhone, PTCs, Pots, and Delay LinesamjadalisyedNessuna valutazione finora

- Edit 610 Lesson Plan RedesignDocumento3 pagineEdit 610 Lesson Plan Redesignapi-644204248Nessuna valutazione finora

- Sto NinoDocumento3 pagineSto NinoSalve Christine RequinaNessuna valutazione finora

- MSA BeijingSyllabus For Whitman DizDocumento6 pagineMSA BeijingSyllabus For Whitman DizcbuhksmkNessuna valutazione finora

- Bid for Solar Power Plant under Institute for Plasma ResearchDocumento10 pagineBid for Solar Power Plant under Institute for Plasma ResearchDhanraj RaviNessuna valutazione finora

- The Wizards' Cabal: Metagaming Organization ReferenceDocumento3 pagineThe Wizards' Cabal: Metagaming Organization ReferenceDawn Herring ReedNessuna valutazione finora

- Montaner Vs Sharia District Court - G.R. No. 174975. January 20, 2009Documento6 pagineMontaner Vs Sharia District Court - G.R. No. 174975. January 20, 2009Ebbe DyNessuna valutazione finora

- Wires and Cables: Dobaindustrial@ethionet - EtDocumento2 pagineWires and Cables: Dobaindustrial@ethionet - EtCE CERTIFICATENessuna valutazione finora

- Installation and repair of fibre optic cable SWMSDocumento3 pagineInstallation and repair of fibre optic cable SWMSBento Box100% (1)

- Volume 42, Issue 52 - December 30, 2011Documento44 pagineVolume 42, Issue 52 - December 30, 2011BladeNessuna valutazione finora

- Yiseth Tatiana Sanchez Claros: Sistema Integrado de Gestión Procedimiento Ejecución de La Formación Profesional IntegralDocumento3 pagineYiseth Tatiana Sanchez Claros: Sistema Integrado de Gestión Procedimiento Ejecución de La Formación Profesional IntegralTATIANANessuna valutazione finora

- Civil Air Patrol News - Mar 2007Documento60 pagineCivil Air Patrol News - Mar 2007CAP History LibraryNessuna valutazione finora

- Simple Present: Positive SentencesDocumento16 pagineSimple Present: Positive SentencesPablo Chávez LópezNessuna valutazione finora

- Macroeconomics: International FinanceDocumento7 pagineMacroeconomics: International FinanceLuis Fernando Delgado RendonNessuna valutazione finora

- Measat 3 - 3a - 3b at 91.5°E - LyngSatDocumento8 pagineMeasat 3 - 3a - 3b at 91.5°E - LyngSatEchoz NhackalsNessuna valutazione finora