Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

2007 990 PF

Caricato da

Fund for Democratic Communities0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

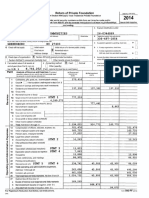

12 visualizzazioni29 pagineThis is our 2007 990-PF forms filed each year with the IRS. What is Form 990? Guidestar explains it this way:

Form 990 is an annual reporting return that certain federally tax-exempt organizations must file with the IRS. It provides information on the filing organization’s mission, programs, and finances.

As a private foundation F4DC files the 990-PF version. If you are unfamiliar with these forms, reading them may be confusing. There is a link to the Foundation Center’s “Demystifying the 990-PF” tutorial. The Nonprofit Coordinating Committee of NYC also has a lengthy multi-chapter guide to the form posted as individual pdfs.

Titolo originale

2007-990-PF

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis is our 2007 990-PF forms filed each year with the IRS. What is Form 990? Guidestar explains it this way:

Form 990 is an annual reporting return that certain federally tax-exempt organizations must file with the IRS. It provides information on the filing organization’s mission, programs, and finances.

As a private foundation F4DC files the 990-PF version. If you are unfamiliar with these forms, reading them may be confusing. There is a link to the Foundation Center’s “Demystifying the 990-PF” tutorial. The Nonprofit Coordinating Committee of NYC also has a lengthy multi-chapter guide to the form posted as individual pdfs.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

12 visualizzazioni29 pagine2007 990 PF

Caricato da

Fund for Democratic CommunitiesThis is our 2007 990-PF forms filed each year with the IRS. What is Form 990? Guidestar explains it this way:

Form 990 is an annual reporting return that certain federally tax-exempt organizations must file with the IRS. It provides information on the filing organization’s mission, programs, and finances.

As a private foundation F4DC files the 990-PF version. If you are unfamiliar with these forms, reading them may be confusing. There is a link to the Foundation Center’s “Demystifying the 990-PF” tutorial. The Nonprofit Coordinating Committee of NYC also has a lengthy multi-chapter guide to the form posted as individual pdfs.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 29

11402

ngsworth Avent @ Averre PA

Millbrook Road

NC 27609

THE FUND FOR DEMOCRATIC COMMUNITIES

1214 GROVE STREET

GREENSBORO, NC 27403

11402

Hollingsworth Avent & Averre PA

200 W. Millbrook Road

Raleigh, NC 27609

919-848-4100

May 28, 2008

CONFIDENTIAL

‘THE FUND FOR DEMOCRATIC COMMUNITIES

1214 GROVE STREET

GREENSBORO, NC 27403

Dear Marnie:

We have prepared the enclosed returns from information provided by you without verification or

audit

990-PF - Return of Private Foundation

We suggest that you examine these retums carefully to fully acquaint yourself with all items

contained therein to ensure that there are no omissions or misstatements.

Federal Filing Instructions

‘Your Form 990-PF for the year ended 12/31/07 shows a balance due of $396. The retum should be

signed and dated on Page 13 by an officer representing the organization. Include a check payable to

the United States Treasury and write "EIN. 26-0344869, Form 990-PF Balance Due for the year

ended 12/31/07" on the check. Mail the return by August 15, 2008 to:

Department of the Treasury

Internal Revenue Service Center

Ogden, UT 84201-0027

Ifa private delivery service is used, mail to’

OsPC

1973 N. Rulon White Blvd

Ogden, UT 84404

Also enclosed is any material you furnished for use in preparing the returns. If the returns are

examined, requests may be made for supporting documentation. Therefore, we recommend that

‘you retain all pertinent records for at least seven years,

In order that we may properly advise you of tax considerations, please keep us informed of any

significant changes in your financial affairs or of any correspondence received from taxing,

authorities

Ifyou have any questions, or if we can be of assistance in any way, please call

Sincerely,

11402

Hollingsworth Avent & Averre PA

11402

THE FUND FOR DEMOCRAT

1214 GROVE STREET

GREENSBORO, NC 27403

C COMMUNITIES

Department of the Treasury

Internal Revenue Service Center

ogden, UT 84201-0027

11442 05/26/2008 1.23 PM

Return of Private Foundation uso 528089

rom 990-PF or Section 4947(a)(1) Nonexempt Charitable Trust

captnerte-remy Treated as a Private Foundation 2007

ease Note:The endson yb tus oy hes ye eon equate

For calendar yar 2007, ortax year bagimning 6/05/07, andending 12/31/07

G Check all that apph XX] initial return [1 Fina return ‘Amended return LT Address change [T Name change

Ueetheins | toe nao 7 Employer idrtieaton naar

vane 26-0344869

otherwise, | THE FUND FOR DEMOCRATIC COMMUNITIES Teche rrber se pape 10

print | iiinorarcec(@PO tocrunburinateratdabercio tectactiee) | Ronwste | _336~617-5329

ortype | 1214 GROVE STREET

See Specitic [ox crom vata, 75 2 cote

instructions. | GREENSBORO Ne_27403

H_ Check ype of ganization, [X). Section 51(ex9)exemot private oundaton

LL sestion 4947(2(1) nonexempt charitable ust | | Other toxable private foundation EF prite foundation satus as terra

I Fairmareetvaie ofall assets at end | J Acouning mates IX] cash [_] Accrual Under eaten a7 OA) ese >O

of year {from Par I, co.(), UJ other (epecty) FF fthe foundation isin 2 60-morth termination

fine 16) bs 58, 769] (Part column (c) must be on cash bass under ection 5070418), cokers >»O

Partl” Analysis of Revenue and Expenses tie |) Reena (@) Deore

folanainsincotins 6 ard(d nay notscesary | Semana | UH) Matinee: | fe) Atdnat | exch

eau te amos cour sp fests) (co oy

7 Conroe. of gs, ese (ach sched 45,687]

2 cwk [| etcunsson not wutte atach eh 8

4) on aving and trmporey cash invetnats 364 364 364

44 Dien and intrest rom secures

Sa Grows rents

g | > Netreial income or oss)

B | 6a retainer tx) tomse ct amet natant 19,534)

$ |b Gross sales price for all assets on tne a 64,621

| 7° copteigam nt come trom Pat 1903) 15,534

8 Net snrttrm capital gin 19,534

8 Income modifications

40a Grose saleslessetuns andalowances |

1b Less: Cost of goods sold

© Gross profit or oss) (attach schedule)

11 Other income (attach schedule)

42. Total. Ads nes 1 through 11 65,585) 19, 898| 19,898)

48. Compensation of officers, directors, ruses, ete

14 Other employee salaries and wages

48 Pension plans, employee benefits

16a Lega fees (attach schedule)

'b Accounting fees (attach schedule)

© Other pofesoral fee atch sche)

a

£

B lar imeem

B | se rensjoncnsonsi soe tener

E [19 Decreciton tach shecie)anddelten Stim 2 378]

5 | 20 occupancy 1, 950) 975

Z| 21 Travel, conferences, and meetings 484

© | 22. Priming ad publications 133

B|23 oneness) Stmt 2 Stmt 3 3,872 131 131 1,287

© |24 Total operating and administrative expenses.

5 ‘Add tnes 13 through 23 6,817] 131 131 2,262

& | 25 contributors, cits, grants pal 0 0

26 Total expenses and disbursements, nes 2420925 6,817| 131 131) 2,262

27 Subtract ine 26 from line 12

4 Excess of revenue over expenses and disbursements 58,768)

1b Net investment income (if negative, erter-0-) 19,767

Adjusted net income (negative, enter 0. 19,767)

For Privacy Act and Paperwork Reduction Act Notice, see page 30 of the instructions. Ferm 990-PF (2007)

11442 05/28/2008 1:23 PM

Form 990-PF (2007),

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Page 2

Raft Balence Sheets Serafina tase [Ye evan —| my eave Fiat

‘Cash—non-interest-bearing 6,405] 6,406

2 seinen elmer ze.is7| 28/137

& Smsrente

Zz 8 Inventories for sale or use

Irene ch etc

Inesin_copnt bord thn ea)

14° Land bukings, sod equipment bas 25,293

Less: occumdaoddeprecaton atcha) Stmt. 4 1,067 24,226) 24,226

t Ghommtedocte )

rari Anse 59,760| 58,769

7 has ppt and a ea

Sera

Foundations that follow SFAS 117, check here > 1X)

B) 24 Unvestricted 58,768)

8) 26 Permanent rested

z Foundations that do not follow SFAS 117, check here» [_]

8] 30. Total net assets or fund balances (see page 17 of the

=) 34 Total liabilities and net assetsifund balances (see page 17

_of the instructions) 58,768)

Part ill Analysis of Changes in Net Assets or Fund Balances

4 hatin 2 ads [5,768

4 ots turn nlf ie non Pati ca ee sa, 768

11442 05/28/2008 1:23 PM

Form 990.°F (2007) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 3

PartIV Capital Gains and Losses for Tax on Investment Income

(a) tan seb th kre) of rope el (a a ett (),Fexsoqaed | (0) Oxesoqured | (a) Calero

|) iy trckoteouse 0 conmon soak, 200 sie MLC Sa) poe (no, day) {t, <9). 97)

ta PUBLICLY TRADED SECURIRTIES

.

ri

Depron awed (By Coster eer be Th) Gan eo

(0) Grose sates price (eratowade} us exenac of se (2) ars (a

2 64, 621, 45,087, 19,534

»

@

Compete only for assets showing galn in coin (had onned by he foundation on 1273469 ) comea momnme

OD) Adkste bans () Excaenatoa of! br nstieee San 0 yor

0) Fm seees28109 ee 1258150 rca a aes trom

»

@

2. Captal gain nt income or net cata! oss) Voain, aso enterin Pat ine 7

ental (net captal oss) If (oss), enter-O-in Pat | ine 7 2 19,534

43. Net short-term captal gain oF (loss) as defined in sections 1222(5) and (6)

Mga ao ern Pat ie colar 0 pagee 101 of eintons).

os), eter -O- in Pat | ne 8 3 19,534

PartV__ Qualification Under Section 4940(e) for Reduced Tax on Net investment income

(or optional use by comestic private foundations subject othe section 4940(a) ax on net investment income.)

If section 4940(6)2) applies, leave this part blank

N/A

Was the foundation lable forthe section 4042 taxon the carbutable amount of any year inthe base period? —[] ves [[] to

If -Yes,"the foundation does ot quality under eaten 4940(). Do nt complete tis pat.

“Enter the appropiate amount in each column foreach year, see page 18 ofthe instructions before making any enes

©) ©) © @

ate ps yrs Acjustea quay toons Netvae ct nendhdtabie-weosets tre i

otro oer tn ye Dining) (oa (yas ea)

2006

2005

2004

2008

2002

2. Total of ine 1, column (4) 2

3 Average cstibuton rato forthe year base perod dvi the ttl on ine 2 by 5, bythe

‘umber of years the foundation has been in estence less than 5 years 3

4 Enter the net value of nonchartable-use assets for 2007 from Part X. ne 5 4

5 Muti line 4 by ne 3 5

6 Enter 1% of natinvestment income (1% of Pat ine 27) 6

7 dines 5 and 6 1

8. Enter quaiving cistbutons trom Parti, ne 4 8

Ifline@ is equal to or greater than ine 7, check the box Part VI tne 1b, and complete that part sing a 1% tax rate. See

the Part Vl instructions on page 18,

Farm 990-PF (2007)

11442 05/28/

Form 990.PF (2007) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 4

Part VI__ excise Tax Based on Investment Income (Section 4940(a), 4940(b), £940(), oF 4948_see page 18 of the instructions)

1:23PM

1a Exempt operating foundatonsdesebedin section 4640(0(2,checkhere L] andenter "NIA" on Ine 1

Dat of ang leer, (attach copy of uing letter if necessary—see instructions)

> Domest fundatlons ht meet he secton 4640) requirements in Pr V, check 395

rere. [-] and enter 1% of Pat ne 27

Aller domestic oundtons ener 2% of ine 2b. Exe oreign orotizaions ener i

ef Pat ne 12, ech)

2 Tacunder scton 51 (deste secon 447(a() sts and taxable cundaton oy. thas ener. 2 °

3 Add lines 1 and 2 3 395

4 Subtle (ncome) tox (Gomest section 407) tus and able foundations oly. Other enter 0) ‘ 0

5 Tax based on investment income. Subtract line 4 from line 3. If zero or less, enter -0- 5 395

8 CredtePayments:

{2007 etna tx payments acd 2008 overpayment ceded to 2007 a

1 Exeteegnorganznone—ix wih at eource eb

Tax paid wth epposton for extension of eto le (Frm 886) ee

Backup vito ecnecuny thas a

1 Total crete end payment. At ne 6 trough 6a 1

Enter any penalty or urderpeynent of esimaled tax Check bere] i Ferm 220i tached 8

‘Tax due. If the total of ines 5 and 6 is more than line 7, enter amount owed >is 395

10. Overpayment iflne 7's mar than the tal of nes ad 8, els the amount overpaid > [0

‘+1_Entertne amount ot ine 10 1 be: Credited to 2008 estimated tox rounded > [11

ParVILA Statements Regarding Activities

1a Durng the tax yee, the foundston eters Inluence any national sie, or cal legisaton ork Yes [ho

parte cr erene nen poll capa? we] [x

Did spend mere tan $109 cing the es (ther rect orndrety fr pltel purposes (seepage 18

eftheinetuctons fr cefntion)? w| [x

ite answers "Yes to ao 1b, tach a detated decison of the acts an cope fay materi

pulsed or dstibed bythe foundation n connection wth the ats,

athe foundation te Form 1120-0 fr ths yea? se] [x

Ener the amount (any) oftxon pica expends (cecton 405) posed ring the yea:

(1) Onthe foundation. $ (2) On foundation managers. $

{© Enter the reimbursement (i any) pal By the foundation during the yer or political expenditure tax imposed on

foundation managers. $

2 Has the foundation engaged in any actles that have not previously been reported to the IRS? 2 x

es," altach a detailed description of the activites

3 Has the foundation made any changes, not previously reported othe IRS, ins governing instrument, ticles of

Incerpration, or bylaws, or other similar instruments? It"Yes,” attach a conformed copy ofthe changes 3 x

44a__Did the foundation have unrelated business gross income of $1,000 or more curing the year? ra x

bf *¥ee," has it fled a tax return on Form 990-T for this year? N/A [ap

5 Was herealinidaten, terinaon, dsolstcn oc substan coiacon dur he year? 5 x

l1-Yee“atah te statment ete by Genet lnteton

6 Are the requirements of section £08(e) (relating to sections 4941 through 4845) satisfied either

«By language inthe governing instrument, of

+ By slate legislation that effectively amends the govering instrument so that no mandatory directions that

Conflet with the state law remain Inthe governing Instrument? 6 [x

7 Did the foundation have at least $5,000 in assets et anytime during the year? IF"Yes," complete Part I, col (6) and Part XV 7[x

Ba Enter the states to which the foundation repots or with which itis registered (see page 19 ofthe

instructions) > NC

'b_ithe newer i "Yes" to line 7, has the foundation funishad a copy af Form 990-PF to the Atlomey General

(or designate) of each state as required by Genel Instruction G? If"No;" attach explanation a» | x

9 _Isthe foundation claiming status as a private operating foundation within the meaning of section 4942()(3)

or 4942{)(5) for calendar year 2007 or the taxable year begining in 2007 (see instruction for Part XIV on

page 27)? I*Yes,” complete Part XIV 9 |x

410.__Did any persons become substantial contributors during the tax year? "Yes," attach a schedule sting ther

names and addresses stmt 5 so |X

5/19 FIP 1 TOT ‘396 Fem 990-PF (2007)

11442 05/28/2008 1:23 PM

rom 920-9F (007) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 ages

Part VI-A Statements Regarding Activities (continued)

Ta Ary ine aur ye ite ona, ry nay oma eatced eniywne

mez of secon SIZBNIGP Ie: ich sched (oe pag of te stale) t| [x

by If"es," edhe foundation have a bing wen conte in eect on Aug 17, 2006, covering the inert

rents, royalties, and annuities described in the attachment fr line 1187 N/A [4

12 Date eunaton aca a dec orindect eres nay appeabeinsranceconac? 2] x

43._Ddiheeunvatn compl wit the pute mspecton requeens forts anual ers and explo ppt? LX

Webate aaivese WwW. £4de.Org

14 The books are in care of » MARNIE THOMPSON Telephoneno. B 336-275-1781

1214 GROVE STREET

Locaedat » GREENSBORO, NC zeae 27403

18. Secton 4947())roneremptchartable trust fing Form 00-PF in eu cf Form 1081 Check ere >o

nd ere tne avout of tmcerempt ners received or accrued dng the ear > Lis

Part VII-B Statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 any item is checked inthe "Yee" column unless an exception applies Yes [ No

ta During tne year ithe fundatn (ete ety or riety).

(1) Engage nthe sale or exchange, or easing of propery win a sq person? Cl ve Bi no

(2) Boro mone m,n mane fo, or arise ete credo or accept on) &

dieqaliied person? vee

(2) Furnish goods, sere o faci to (x accep them fom) a squad person? ves

(#) Pay compensation too ayo remburse te expenses of, «ious person? vee

(5) Transfer ony income or ast oa dss pean or ake ny fete vate or

trebeneftoruse ot dequaled person)? Ove.

(0) Ages to pay money or propery oa goverment ofa? (Exception. Check Nt

the feundaton agree tomate a rato ro engin theo fr a per ater

termnaon of government serie inating thin 3 69y8) Cl ves

b> Iranyaneweris "Yes" to t(t}() cd any the sts a to quay under the exceptions desesbed in Regultons

section 3 441(4;3 orn acento regarding dase aesitance (ee page 2 ofthe inten)?

Craaizatonsreing on a cuent oc egaring aster asian check here

athe foundation engage mar yarn any fhe acs decribed Ta cer han excepted acs hat

‘were not corrected before the first day of the tax year beginning in 2007? N/A [te

2 Taves an are to istiote come (secten 4042) (dos not poy foyer the foundation ws a prate

cperting foundation defined in section #84203) or 4420)

a Aline end ot tanya 207 ihe eunton nave ny usted ncome (nes 6 an

Ge, Pal) fora yer) begining bee 20077

ives"isttheyears 20 «2D 20S, 20

> Aretrere any year sen 2 for ch he foundation not sping the prin of section 45428)2)

(rain onceret vation of sot) he ears nde income? i ppg Seton 4242)2)

to all years listed, answer "No" and attach staternent—see page 22 of the instructions.) N/A | ab

the prisons of secon 442()2) are being app to any ofthe yeast in 2m, bt eye's ee.

oD

$a Dithe fan od ne thon a 2% dec orinitetitereatin any business

erie aay tine ding the year?

bb i¥ee, did Rave excess business Hoke in 2007 asa resi of (1) ay purchase by he fundstono

dlequaiid persons aner ay 28, 16, (2) he peo te Sear pertod(rnge pero approved by he

Conmisone under secon 49430) to dapose of holdings acquired by git or bequest or (2) the pee

ofthe 10,5 or 20 year rst pas hoking period? (Use Schedule , For 4720, to determine Ifthe

4b

foundation had excess business holdings in 2007.) N/A | 3b

442 Did the foundation invest during the year any amount in a manner that would jeoparcze I's charitable purposes? 4a x

1b Did the foundation make any investment in prio year (but after December 31, 1969) that could jeopardize its chartable

purpose that had not been removed from jeopardy before the fst day ofthe tax year beginning in 2007 a x

Form 990-PF (2007)

11442 05/28/2008 1:23 PM

Fomor 007) ‘THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 age 6

Part VI-B Statements Regarding Activities for Which Form 4720 May Be Required (continued)

a Duting the year cd the foundation payor incr any amount

(1) Canyon propaganda, octenvse attempt uence legion (econ 4945(e)? J Yee [no

Influence the outcome of any specie ble eecbon ate secon 4955); ot cat on,

ciety or vey, ay voter retrain si? q Yes a No

No

@

(8) Provide grant oan au foal t,o ter snr purposes? vee

(6) Prone gant oan rganzatn cer han acerbic, ee, rgnzaton described in

ston 50a), 2, oF), or secon 494082} (seepage 22 fe nsttons) C1 ves

Provide for ay purpose oe thn eigivs chal, tei, era or

eciatoralpurpoes ofthe prevention of rua to chien or anmale? C1 ves

b> anyanaver "Yes fo a(S). al ay ofr ranean flo aly uns the exception described in

Roglaion secon 53 4945 or na cuentnooerqacng dase assistance (ee page 2 of tensions)?

Organization reing ona cuent oce eparing aster asian check here

the ansverls"Ye" to queston Sa, Goes the foundation clam exemption om he ax

becouse mainained expen espostity forte gran? N/A (] ves

ives" tach statenert reed by Repltons section 53 45485),

6a Oi ine foundation, cringe year, eee ay funds, dct arnt, pay premiums

ona persona beef contac? C1 ves

dite tundaton, cra the year, pay premiums det oindrect, on persona benef ona? w| |x

ityouansnered"Yeso 0, also fe Fo 2670

7a Atany te ring te tox er asthe foundation a pay oa probe x sheer tanscion? Cv no

b__ If yes, did the foundation receive any proceeds or have any net income attributable to the transaction? N/A | 7

Part Vill Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors

7 Lisl ofcrs, electors, ustes, foundation managers and lr componsaton (eo page 3a th nswuton)

6)

5

(0) THe and average [(e) Commaneston [EL ETEEIE | ye) Spare

(2) Name and access ous Sea | not pat emer | meyer escent, | ISGP,

o apices etn ih Pig eles | "Sitar

2 Compensation of five highest-paid employees (other than those included on line +—see page 23 ofthe instructions),

none, enter “NONE.”

a) Convene

(0) Te ana avereae savestens 2 (e) Expene

(0) Name ara access ofeach emptyee pis more han $5,000 MInousgerwese | (2) Conpereaon | STODIG beat, | set her

‘otal numberof other employees paid over $50,000 >|

Form 990-PF (2007)

11442 05/28/

23PM

Form 990.PF (2007) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Page?

Part Vill Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employ

and Contractors (continued)

3 Five highest-paid independent contractors for prof

ional services (see page 28 ofthe instructions) none, enter

NONE,

[iar antares teach person pac more han $50,000, (b) Type stows

(e)_Sonparstion

‘NONE

‘otal number of others receiving over $50,000 for professional sewvices >I

PartIX-A Summary of Direct Charitable Activities

ist the foundations four gest drectcharsble acts during the tax year Include retvant taistoal information such a he number S

‘ferganators and ober beneares served confetenece comered esearch papers Bogue, et Spencer

7 PROMOTION OF GRASSROOTS DEMOCRACY -- GRANT MAKING,

COMMUNITY DISCUSSIONS, YOUTH GROUPS, ETC.

2,262

2

3

4

PartiX-B Summary of Program-Related Investments (see page 24 of the instructions)

(Describe the wo bigest program ated mestments made by the foundation dung he tx year on nes 1 anc 2 ‘aeunt

1 N/A

2

‘lather prograelate investments. See page 24 ofthe inauictons

3

Total, Add lnes 1 through 3 >

Fon 990-PF (2007)

11442 05/28/2008 1:23 PM

Fon 960-PF (2007) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Page 8

Part X

‘see page 24 of the instructions.)

Minimum Investment Return (All domestic foundations must complete this part, Foreign foundations,

6

Fair market value of assets not used (or Meld for use) drecty in carrying aut charitable, etc,

purposes:

Average monthi fait market value of secures

Average of monthly cash balances,

Fair market value of all cher assets (see page 25 ofthe instructions)

Total (add ines 1, b, and.)

Reduction claimed for blockage or other factors reported on fines 18 and

46 (attach deta explanation) te |

‘Acquistion indebtedness applicable otne 1 assets

‘Suatract ine 2 from tne 16

Cash deemed hed for charitable aces. Enter 11/23 of ine 3 (for greater amount, see page 25,

of the intuctions)

Net value of nonchatitable-use assets, Subtract line 4 rom line 3, Enter here and on Pat V, tne 4

Minimum investment return. Enter 5% of ine 5

tb

22,718

10

22,718

22,718

341

22,377

6

644

Part Xi Distributable Amount (see page 25 of th

foundations and ceitain foreign organizations check here __b»_X|_and do not complete this part)

structions) Secton 49425)6) end GNS) priate opereing

Minimum investment retum from Part X, ine 6

‘Taxon investment incame fot 2007 from Patt VI, ine 5 | za

Income tx for 2007. (This does no ince the tax fom Part Vi.) [ap

Add lines 2a and 2b

Distributable amount before adjustments, Subtract ine 2c from line 1

Recoveries of amounts treated as qualifying distributions

Add lines 3and 4

DDeduetion from distributable amount (see page 25 ofthe instructions)

Distributable amount as adjusted, Subtract line 6 from line 5. Enter here and on Pat Xi,

line 1

> Jo Ju Jef

Part Xil Qualifying Distributions (see page 26 of the instructions)

‘Amounts paid (including administrative expenses) fo accomplish chaiabe, ete, purposes!

Expenses, contributions, gis, ee—total from Pat |, column (), tne 28

Program-elted investments—toal fom Part DB

‘Amounts paid to acquire assets used (or held fr use) crecty in carrying out chartable,et.,

purposes

Amounts set aside for specifi charitable projects that sats the

‘Suitably test (prior IRS approval required)

Ccash distribution test (tach the required schedule)

Qualifying distributions. Add lines 1a through 3b. Enter here and on Pat V, line 8, and Part Xil ine 4

Foundations that quality under section 4940(e) fr the reduced rate of taxon net investment income

Enter 1% of Par | line 27b (ee page 2 of the instructions)

Adjusted qualifying distributions, Subiract ine 5 from ine 4

Note: The amount online 6 wil be used in Part V, column (b), In subsequent years when calculating whether the foundation

qualifies forthe section 4940(e) reduction of taxin those years.

2,262

tb

2,262

°

2,262

Form 990-PF (2007)

11442 05/28/

Form 980-PF (2007),

1:23PM

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Page 9

Part Xill

Undistributed Income (see page 26 of the instructions)

1

Distributable amount for 2007 from Part XI,

line

Uneistrouted income, if any. a8 ofthe end of 2008:

Enter amount for 2008 only

@

corpus

e

Years rie to 2

o

2008

@

2007

'b Total for prior years: 20 20,

3 Excess astributions cartyover, if any fo 2007:

‘From 2002

b From 2003

© From 2004

From 2005

From 2008

Total of ines 3a tough &

4 Qualifying cstibutions for 2007 from Pert Xi,

lined: mS

{Applied to 2006, but not mor than tne 23

1b Applied to undistinuted income of prie years (Election

required—see page 27 of te instructions)

‘Treated as dstrbutions out of corpus (Election

required—see page 27 of te instructions)

Applied to 2007 distributable amount

© Remaining amount cstrbuted out of corpus

0

Excess distributions caryover applied to 2007

(fan amount appears in column (4, the same

amount must be shown in column (2))

Enter the net total of each column as

indicated below:

Corpus. Add ines 3,4, and 4e. Subtract ine S

Prior years’ undietibuted income, Subtract

line Ab fram tne 20

Enter the amount of prior years’ undistributed

Income for which anatice of deficiency has been

issued, or on which the section 4942() tax has

been previously assessed

‘Subtract ine 6e from line 6D. Taxable

arsount—see page 27 of the instructions

Uneistrinuted income for 2008, Subtract ne

4a fom tine 22, Taxable amount—see page

27 ofthe instructions.

Uneistriouted income for 2007. Subtract ines

4d and 5 rom tne 1. This amount must be

letruted in. 2008,

Amounts treated as cistriouions out of corpus

to satistyrequlements imposed by section

‘170(0)1)(F) or 4942(9)(3) (see pege 27 of the

Instructions)

Excess cstribtions caryover om 2002 not

applied online § o ine 7 (See page 27 ofthe

instructions)

Excess distributions carryover to 2008.

‘Subtract ines 7 and 8 from line 6a

Analysis of ine &

Exoess from 2003

Excess from 2004

Excess from 2005

Excess from 2006

Excess from 2007

Farm 990-PF (2007)

FémodeeFGode) HE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 10

Part XIV Private Operating Foundations (see page 27 of the instructions and Part VII-A, question 9)

18

»

2a

If te foundation has received aruing or determination letter that itis @ private operating

foundation, and the ruling is effective for 2007, enter the date of the ruling > 06/05/07

CCheck boo ndcate vineher the foundations private operating foundation deserbed in section [R) aaaagyer [| aoa)

Enter te lesser of the adjusted net Taxyear Pio 38 Tou!

income from Paro the minimum (a) 207 mm (e) 2005 (@ 2008

investment retum fom Part X for

cach year listed 644 644

85% ofline 2a 547 547

uaivng distributions rom Pet XI

line 4 foreach year listed 2,262 2,262

Amc incadedi ne 2 ol wed ey

fer azine condut of exeret aces

Qualifying distributions made directly

for active conduct of exempt actites

‘Subtract ine 2d rom Ene 2e 2,262 2,262

Complete 32,8, oF € for the

aitematve test relied upon:

"Assets" aerative test—eter:

(1) Value of all assets

(2) Value of assets qualiying under

section 4942()3)(8)0)

"Endowment aller een 26 of

ririenam investment tun shown in Part

ne Br each ea listed 429 429

‘Suppent” altemative test enter:

(1) Total support other than gross

investment income interest,

dividends, rents, payments on

‘securtes loans (section

'512(a)(6), or royates)

Suppest from general pubic

‘and 5 of more exempt

‘organizations as provided in

section 4942(9(9)(8))

(@) Largest amount of support from

‘an exempt organization

(4)_Gross investment income

@

Part XV Supplementary Information (Complete this part only if the foundation had $5,000 or more in assets

at any time during the year—see page 28 of the instructions.)

Information Regarding Foundation Managers:

Ls any managers ofthe foundaton who have contributed more than 2% ofthe ttl contibutions received by the foundation

bets the case of any tax year (but any if they have contauted more than $5,000). (See section £07(6)2))

See Statement 7

Lt ny manager of te tounaton wa oom 10 orf ate lok a agra (an ely ge prin ea

cnmersi of prershp or oe ent) of hin he endo aso 10% reser nerest

N/A

Inlormation Rearing ontbution, Gant, Gf, Lan, Scolari, ee, roars

Check hare P| | Ite toundaton cn males contadene to pected chara gelatons and doesnot sce

unsold equ ein, the oundton rakes ite, gran, ee (ee page 28 he netone) onc or

oxgantzoena under ha cocoa, cong lara 2,2, ad

Te ane adfes, en elephone number he person o whom piston sau be adel

N/A

The form in which applications should be submited and information and materials they should ncude:

N/A

‘Any submission deadlines:

N/A

‘Any estictons or imitations en awards, such as by geographical areas, chartable fields, Kinds of institution, or other facors

N/A

Farm 990-PF (2007)

11442 05/28/2008 1:23 PM

Form 990-PF (2007) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Page 11

Part XV___ Supplementary Information (continued)

3. Grants and Contributions Paid During the Year or Approved for Future Payment

Recipient inaret nace apatten ewe ctgert| aga

Name and address (home or business) oF fubetntis contr “

2 Paid dug the yar

N/A

Taal Ee

© Approve ore parent

N/A

Taal be

Form 990-PF (2007)

11442 05/28/2008 1:23 PM

Form 990.PF (2007) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 12

Part XVEA Analysis of Income-Producing Activities

Enter gross smounts unless otherise indicated ‘Uneated bances nears | Sed osc S12 69 or Be C

Ralted or arp

® & fo, a ‘unctan come

sites code saasour eigen aunt (Scnmge ss

41 Program sence revenue oe theinstucters)

‘9 Fees and contracts rom government agencies

Membership dues and assessments

Interest on savings and temporary cash investments 1a 364

Dividends and interest from securities

Net rental income or (loss) from realestate

‘9 Debtnanced property

bb Not debt-tinanced property

Net rental income or (oss) ftom personal property

Othe investment income

Gain or (oss) fom sales of assets other than inventory 1a 19,534

Net income or (ass) trom special events

410. Gross profit or (oss) from sales of inventory

114 Other revenue: a

»

‘

42 Subiotal Add columns (6). (and (@) q 19,898) 0

48 Total, Add ine 12, columns (), @), ana (e)

‘See workshee in line 13 instructions on page 29 to verify calculations

Part XVI-B Relationship of Activities to the Accomplishment of Exempt Purposes

Line no, | Exltia below how each activ fr which income i reported in column (eof Part XVL-A contiouted importantly to

‘s the accomplishment ofthe foundation's exempt purposes (other than by providing funds fr such purposes), (See

1029 ofthe instructions

18 19,698

N/A

11442 05/28/2008 1:23 PM

Form 990.PF (2007) THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869 Page 13

Part XVil__ Information Regarding Transfers To and Transactions and Relationships With Noncharitable

Exempt Organizations

7 Bi the rprizaton rector indirectly ngage i ary ofthe otowng wih any ae erganiaen eased Yes [no

in section 501 ofthe Code che than secon 50163) eroantatins) orn scton 527, relating opted

cngeraao?

4 Transters fom the reporting fourdaton toa noncharable exempt organization of:

(1) Cosh acm] | x

(2) Omer ascets fal [x

Other ransactons

(1) Sais of ses to a nonchartale exept ganization hm] | x

(2) Parchases of assets rom a nanchareabe exempt erganizaion fwe| [x

(2) Renta of acts, equipment, o other assets ho] [x

(8) Reimbursement arrangements fx | [x

(©) Leans or on guarantees hoe] [x

(6) Perormanceofsenices or membership orundasngsotatins fen] [x

‘Sharing of faces, equlpment, mang Hs, other assets of pad employees 4c x

4 the enowerto any ofthe above is "Yes, complete the folowing schedule. Column (b) shoul! nays show te fa market

Value ofthe goods, other assets of services ghen by the epoting organization Ihe foundaon recived les than fa market,

val in ny transaction osharng rangement, showin column (the value fhe goods, cer assets, or eanices rece,

N/A

2a 1s the foundation dea orndret affliated with, or elated to, one or more ax exempt organizations

desea secon 501) ote Code (ter han eatonS01(e) &nsacton 527? 1 ves &} no

"Ves," complete he folowing schedule

(a) hare of eqn (0) Tyagi (Desai a eo

NZ

Under pratine poy | deca fe oaried sun, rng mor garig wanderer woe bel omy kr rd

Dale see caret ahd cong Guarana Sepa Wan ary ofall) Saeed ano resale Wh epee fos ary encape

> PRESIDENT

|) anna ame Oi ite

3 Date Pregare’s SSN or PTIN

= check Signature on pe S0

| S52 | Prevaers » setenoioed > (1) cite intucters)

| 388 | satse 200280366

£8 [Fmisrnegyan? Hollingsworth Avent & Averre PA

sefenpiyed, odie: Pj200 W. Millbrook Road fy 56-2119415

Raleigh, NC 27609 ‘ness 919-848-4100

Form 990-PF (2007)

11442 05/28/2008 1:23 PM

Schedule B

(Form 980, 980-£2, Schedule of Contributors

Name of organization Employer identification number

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

‘Organization type (check one):

Filers of Section:

Form 960 or 980-62 [sony >) (enter number organization

[J 4247(0)1) nonexemptchartabe trust not rested as a private foundation

(1 827 politcal organization

Form 960: F FX) 501(¢)3) exempt private foundation

[5 4247(0)1) nonexempt chartabe trust treated 2 2 private foundation

7 50142). taxable private foundation

‘Check if your crganization Is covered by the General Rule or a Special Rule. (Note: Only a section S01(€\), (8), or (10)

‘cxganization can check boxes fr both the General Rule and @ Special Rule—see instructions)

General Rule—

IH Fer xearzotons ting Fx 90, 90-2, o 90-PF hat eeved ug the er, 8,00 er mre a mane or

oer om any ne cont (Compa Pas and)

Special Rules

For a section 501(¢)3) organization fling Form 980, or Form S60-£2, that met the 33 1/3% support test ofthe regulations

under sections 509(2)1)1 70(0)1)(A)W), and received from any one contributor, during the year, a contribution ofthe

greater of $5,000 of 2% ofthe amount on ne tof these forms. (Complete Parts | and!)

For a section 501(¢)7), 8), (10) organization fing Form 960, or Form 980-E2, that received from any one contributor,

during the year, aggregate contributions or bequests of more than $1,000 for use exclusively for reigous, charable

scientific, trary, or educational purposes, othe prevention of cruelty to chien or animals, (Complete Pars I I, andl)

For a section 501(6)7), 8), © (10) organization fing Form 960, or Form 980-E2, that received from any one contributor,

during the year, some contributions for use exclusively for religous, chartable, etc, purposes, but these contributions did

rot aggregate to more than $1,000. i this box is checked, eter here the total contribution that were received during

the year for an exclusively religous, chartable, et, purpose. Do not complete any of the Parts unless the General Rule

{eppiies to this organization because it received nonexclushvely religious, charitable, et. contributions of $5,000 or more

during the year) ms

Caution: Organizations that are nat covered by the General Rule andlor the Special Rules do nat fle Schedule B (Form 990,

{980-£2, or 90-PF), but they must check he box inthe heeding oftheir Form 990, Form 980:EZ, of online 2 oftheir Form

{80-PF, o certily that they donot meet the fling requirements of Schedule B (Form 960, 990-E2, or 990-PF)

perwork Reduction Act Notice, se the Instructions ‘Schedule B (Form 890, 980-E7 or 990-PF) (2007)

11442 05/28/2008 1:23 PM

‘Schedule B (Form 990, 090-£7, of £60-PF) (2007),

Name of organization

Page 1 of 1 ofPartt

Employer identification number

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

Part! Contributors (See Specific Instructions.)

@ ©) © @

No. Name, address, and ZIP + 4 Aggregate contributions ‘Type of contribution

STEPHEN JOHNSON Person

712 SOUTH ELAM AVENUE Payroll

8 32,311 | Noncash

GREENSBORO NC_27403 (Complete Parti it there is

a noncash contribution)

@ ©) @ @

No. Name, address, and ZIP + 4 Agaregate contributions ‘Type of contribution

2 MARNIE THOMPSON Person

712 SOUTH ELAM AVENUE Payroll

5 32,310 | Noncash

GREENSBORO NC_27403 (Complete Part if tere is

«a noncash contribution)

@ ©) o @

No. Name, address, and ZIP +4 Aggregate contributions Type of contribution

Person

Payroll

8 Noncash

(Complete Parti itthere is

a noneash contribution)

@ ro) © @

No. Name, address, and ZIP + 4 Aggregate contributions ‘Type of contribution

Person

Payroll

8 Noncash

(Complete Part i there is

a noncash contribution)

@ ro) © @

No. Name, adaress, and ZIP + 4 Aggregate contributions Type of contribution

Person

Payroll

8 Noncash

(Complete Parti it there is

« noncash contribution)

@ ©) © @

No. Name, address, and ZIP + 4 Aggregate contributions Type of contribution

Person

Payroll

8 Noncash

(Complete Par iit there is

a noncash contribution)

‘Schedule B (Form 890, 950-E2, or 980-PF (2007)

11442 05/28/2008 1:23 PM

‘Schedule B (Form 990, 090-£7, of £60-PF) (2007),

Page 1 of 1 ofpart

Name of organization

Employer identification number

i

18,471 7/23/07

from be: tion of ®) bh FMV (or estimate) Dat a) a

HALLIBURTON CO HLDG COMMON STOCK

iL

13,840

from Description of noncash property given FMV (or estimate) Date received

2

18,471 7/23/07

2

13,839 11/02/07

from be sion of ) bh ‘ FMV (or estimate) pat a) 4

‘Schedule B (Form 890, 950-E2, or 980-PF (2007)

rom 4562 Depreci

11442 06/28/2008 1:23 PM

n and Amortization

(Including Information on Listed Property)

Deparment ofthe Treasury

Seve oenice

> Soe separate instructions. _ Attach to your tax return.

2007

Siete 67.

‘ara tao anti Iaeniving number

THE FUND FOR DEMOCRATIC COMMUNITIES 26-0344869

ness or cvty wri a om tes

Indirect Depreciation

Partl Election To Expense Certain Property Under Section 178

Note: If you have any listed property, complete Part V before you complete Part |

“1 Madmum amount. Soe the intuctons fora higher int for certain ueinesses + 125,000

2. Tota cost of section 178 property placed in service (ee instructions) 2

3. Threshold cost of secton 179 property before eduction in tation 2 500,000

4 Reduction in iitton. Subtract ine 3 rom ine 2. zero ols, enter-0 4

5_Dolr iia tax yo ubtacting from ine 210s, ee. maid ing spacey cee istuchone .

(2) session per () coe ousrersussenyi[ fe) let cet

g

7 Listed property. Enter the amaunt from line 28, iz

8 Total lected costo section 179 propery. Ad amounts in column (c), Ines 6 and 7 @

9 Tentative deduction. Enter the smallr of ine 5 or ine 8 °

40 Caryorer of esalowed deduction rom ine 13 of your 2006 Form 4562 10

‘11 Business income imitation, Ener the smal of business income (ol ss than ze) o ne 5 (se instructions) “4

412 Section 179 expense deduction. Ad lines 9 and 10, but donot enter more than ine 11 2

43__Carryover of disallowed decuction to 2008, Add lines 9 and 10, less ine 12, > [as]

‘Note: Do nat use Par I or Pat Il below fr listed property. Instead, Use Part V.

Partll Special Depreciation Allowance and Other Depreciation (Do not include listed proper

‘See instructions.)

44 Special allowance for qualified New York Liberty or Gulf Opportunity Zone property (ther than listed

proper) an cellos bamasssthanol lant ropety laced in sence tng the tax year (see rsrction) “

18. Propery subject to secon 168K) election 15

416 _ Other deprecation (netudng ACS 16

Part iil MACRS Depreciation (Do not include listed property.) (See instructions.

Section

17 MAGRS deductions for assets placed in sxvce in taxyears begining before 2007 @ 0

Section &-Asses Paced in Service During 2007 Tax Year Using the General Depreciation System

‘B. Motard | (e) Bassi cxpeaton fay Reso

(0) cieecion ret WRegures™ | apesctratectine [S| ce) comerin |e we | (@) Drecnton cedten

ea Syearpepaty

Sea roprty 7,567|_5.0| MQ | 20008 378

Tea propery

4 0.jearpopey

e 15-year property

120 ear rope

Tar zs year propery 3 a

1 Resident eral zsye_| wan St

property 275y_ | _Ma si

7 Nonresident el sys | MM sik

propery oa Si

Section 6 Assets Placed in Service Dring 2007 Tax Your Using the Alerative Deprei

a _Cansite Si

b12year @ st

¢d0year yrs sit

PartiV___ Summary (see instructions)

21 Usted prope Enter amount om ine 26 zi

22 Total. Ad amounts rom ne 12, nes 14 trough 17 nes 19 and 2 in clu (gan ine 2

Enter here and on the appropriate lines of your return. Partnerships and S corporations-see instr. 2 378

23 For aust show above and placed inservice tg the cue yer,

ter th portion fe bass arab to secon 269 costs 2

or Paperwork Reduction Act Notice, see separate instructions. rom 4582 c207

“PRE’EOND“FOR DEMOCRATIC COMMUNITIES 26-0344869

fom a2 07 cage 2

Part V Listed Property (Include automobiles, certain other vehicles, cellular telephones, certain computers, and

property used for entertainment, recreation, or amusement.)

Rote Fo" oy esearch you ae using te inns rleege ae or deducting ease expense, complet only

23ea, 24, columns (a) though (C) of Sesion A, all of Saction snd Section i applicable P

Section A Depreciation and Other Information (Caution: See thentrtions for ints for passenger aufoTiobIos)

24a_Do your wuiroet sere bsteanvmert se core?” | [Yes | [No | 24b_irVes-is the evidence witon? Tes We

n © lh © © © ®) a ®

Tipedprepat| osefaredn | eee! | confine | aansteomcion resmey | stow | cepecaton ean

28 Special aowance for qualified Gulf Opportunity Zone property placed in Service during the

tax year and used more than S0% in a quaifed business use (see instructions) 25

26__ Property used more than 50% in qusliied business use:

27 Property used 60% or less na qualified business use

sil

sil

28 Add amounts in column (h), nes 25 through 27. Enter here and on line 21, page 1 Las

28 Add amounts in column (line 26. Enler here and online 7, page 1

2

Section B-information on Use of Vehicles

Complete ths section fr vehicles used by a sole proprietor, partner, or other “more than 59% over,” or related person.

I you prouded veholes ta your employees, fret answver the Questions in Section C to see You meet an exception to completing thie section for those vehicles,

30. Total businessiinvestment mies arven @ © o @ @ o

during the year (do not include commuting verse vewoe2 | vances | _veniiea | venwies vehicle 6

ries)

31 Total commuting miles driven during the year

32, Total other personal (noncommuting) miles driven

33. Total mies driven ducing the year. Ads

lines 90 trough 32

34 Was the vehicle avallabe for personal yes | wo | Yes [no | Yes [no | Yes | No

Yes | No | ves | No

Use during off-dity hours?

38 Was the vehicle used primarly by 2

more than 5% owner or related person?

26 _Is another vehicle avalabe for personal use?

‘Section C-Questions for Employers Who Provide Vehicles for Use by Their Employees

‘Answer these questions to determine it you meet an exception to completing Section B for vehicles used by employees who are

‘ot more than 5% owners or related persons (see instructions).

Yes | wo

37 Do you manana writen poly statement that profs al personal use of vehicles, including commuting, by your employees?

38 Do you maintain a writen poly statement that pris personal use of veces, except commuting, by Your employees?

Seethe instructions for vehicles used by corporteofcers, decors oF 1% or more owners

28 Doyo treat al use of vile by employees as personal Use?

40 Do yu provide more than fe vehicles to your employees, tin information rom your employees about

the use ofthe vehicles, and tan the fran receed?

41 Doyou mest the requtements concerning qualified automobile demonstration use? (See instructions)

Note: I your ansieto 37, 38, 39, 4, or 4 Is "Yes," do nol complete Section & forthe covered vehicles.

PartVI Amortization

© ©) © | anotenton oO

a oate atten vate Core | “Post Avarizaton er

Deaton ore roan wae | pete od

{=2_Amortanton of ost hat gins during your 2007 tax year (ee nsucions)

START UP COSTS

6/05/07 17,726, 195| 15.0 689

{8 Amortzton of ost hal began bore your 2007 tax year a

444 Tota, Ad amounts in column (See the instructions for where 0 report a 685

Foon ABBR caer

11442 THE FUND FOR DEMOCRATIC COMMUNITIES

26-0344869 Federal Statements

FYE: 12/31/2007

5/28/2008 1:23 PM

Statement 1 - Form 990-PF, Part |, Line 19 - Depreciation

Desc

Date Cost PY cy Net Investment Adj Net

Acquired Basis Depr Method Life Depr Income Income

COMPUTER & SOFTWARE EQUIPMEN’

10/20/07 $ 1567 $ 5 8 $

Total 1,567 § 0 8 § oO

Desc

Date Cost PY cy Net Investment Adj Net

Acquired Basis ‘Amort Life Amort Income Income _ COGS

START UP CosTs

6/05/07 § 15 8 Coe 8

Tota $ 0 8 689 5 0

12

11442 THE FUND FOR DEMOCRATIC COMMUNITIES 5/28/2008 1:23 PM

26-0344869 Federal Statements

FYE: 12/31/2007

Statement 3 - Form 990-PF, Part |, Line 23 - Other Expenses

Net Adjusted Charitable

Description Total Investment Net Purpose

Expenses

WEB SERVER EXPENSE

INCORPORATION & N

OUTSIDE CONTRACTOR

BOOKS, SUBSCRIPTIONS

POSTAGE, MAILING SERVICE

SUPPLIES

TELEPHONE

BANKING FEES

Total $

11442 THE FUND FOR DEMOCRATIC COMMUNITIES 5/28/2008 1:23 PM

26-0344869 Federal Statements

FYE: 12/31/2007

‘Statement 4 - Form 990-PF, Part I

Description

ine 14 - Land, Bui and Equipment

Beginning End End Accum Net Fair

Net Book _Cost/Basis Depr Mikt Value

BQUT

$ $ 7,129 $ $ 6,751

438 438

17,726 17,037

ACCUMULATED DEPRECIATION

378

ACCUMULATED AMORTIZATION

Total

11442 THE FUND FOR DEMOCRATIC COMMUNITIES,

Federal Statements

26-0344869

FYE: 12/31/2007

Name

Statement 5 - Form 990-PF, Part VILA,

1e 10 - Substantial Contributors

Address

GROVE STREET

City, St Zip

5/28/2008 1:23 PM

11442 THE FUND FOR DEMOCRATIC COMMUNITIES, 5/28/2008 1:23 PM

26-0344869 Federal Statements

FYE: 12/31/2007

Statement 6 - Form 990-PF, Part Vill, Line 1 - List of Officers, Directors, Trustees, Etc.

Name and Average

Address Title Hours Compensation Benefits Expenses

MARNIE THOMPSON PRESIDENT 40 0 0 0

1214 GROVE STREET

SREENSBORO NC 2

ED WHIT DIRECTOR 40 0 ° 0

1214 GROVE

GREENSBORO

SABRINA ABNEY DIRECTOR 2 0 ° 0

214 GROVE STREET

INSBORO NC 27403

2 0 ° 0

DIRECTOR 2 ° ° 0

1214 GROVE STREET

GREENSBORO NC 27403

JONATHAN HENDERSON DIRECTOR 2 o ° 0

1214

GREENSBORO

NN JOHNSON DIRECTOR 2 0 ° 0

ROVE STREET

GREENSBORO NC 27403

MUKTHA JOST DIRECTOR 2 0 ° 0

1214 GROVE STREET

GREENSBORO NC 27403

KYLE LAMBELET 2 0 ° 0

214 GROVE STREET

NICLOLE LAMBELET DIRECTOR 2 0 0 0

11442 THE FUND FOR DEMOCRATIC COMMUNITIES, 5/28/2008 1:23 PM

26-0344869 Federal Statements

FYE: 12/31/2007

Statement 6 - Form 990-PF, Part Vill, Line 1 - List of Officers, Directors, Trustees,

(continued)

Name and Average

Address Title Hours Compensation Benefits Expenses

214 GROVE STREET

GREENSBORO NC 27403

ENZO MEACHUM DIRECTOR 2 0 ° 0

ROVE STREET

27403

2 ° ° °

214 GROVE STREET

GREENSBORO NC 27403

STEVE SUMMERFORD DIRECTOR 2 ° 0 0

4 GROVE STREET

GREENSBORO NC 27403

JOYA WESLEY DIRECTOR 2 ° ° °

1214 GROVE

GREENSBORO NC

11442 THE FUND FOR DEMOCRATIC COMMUNITIES 5/28/2008 1:23 PM

26-0344869 Federal Statements

FYE: 12/31/2007

‘Statement 7 - Form 990-PF, Part XV, Line 1a - Managers Who Contributed Over 2% or $5,000

Name of Manager Amount

STEPHEN JOHNSON 32,311

MARNIE THOMPSON 32,310

Total 64,621

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Form 990-P F: Return of Private FoundationDocumento26 pagineForm 990-P F: Return of Private FoundationFund for Democratic CommunitiesNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- ROOTSTOCK - July 2014Documento2 pagineROOTSTOCK - July 2014Fund for Democratic CommunitiesNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- More Than A Grocery StoreDocumento24 pagineMore Than A Grocery StoreFund for Democratic CommunitiesNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Reparations, How Are We Doing It?Documento20 pagineReparations, How Are We Doing It?Fund for Democratic Communities100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- RCC Pro Forma - January 23, 2014 RevisionDocumento16 pagineRCC Pro Forma - January 23, 2014 RevisionFund for Democratic CommunitiesNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- The Fund For Democratic Communities 712 South Elam Ave. Greensboro NC 27403 26-0344869 336-617-5329Documento26 pagineThe Fund For Democratic Communities 712 South Elam Ave. Greensboro NC 27403 26-0344869 336-617-5329Fund for Democratic CommunitiesNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- 2011 990 PFDocumento26 pagine2011 990 PFFund for Democratic CommunitiesNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- 2014 990 PF AmendedDocumento27 pagine2014 990 PF AmendedFund for Democratic CommunitiesNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- 2015 990 PFDocumento30 pagine2015 990 PFFund for Democratic CommunitiesNessuna valutazione finora

- 2013 990 PFDocumento33 pagine2013 990 PFFund for Democratic CommunitiesNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- 2009 990 PFDocumento23 pagine2009 990 PFFund for Democratic CommunitiesNessuna valutazione finora

- RCC Presentation To The City, January 22, 2014Documento52 pagineRCC Presentation To The City, January 22, 2014Fund for Democratic CommunitiesNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- 2010 990 PFDocumento23 pagine2010 990 PFFund for Democratic CommunitiesNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- 2008 990 PFDocumento26 pagine2008 990 PFFund for Democratic CommunitiesNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- RCC Film Screening Resentation 3.2.15Documento5 pagineRCC Film Screening Resentation 3.2.15Fund for Democratic CommunitiesNessuna valutazione finora

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- White House Press Release Including Participatory BudgetingDocumento7 pagineWhite House Press Release Including Participatory BudgetingFund for Democratic CommunitiesNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Process For Approving Bylaws and Electing Our First Board of DirectorsDocumento8 pagineProcess For Approving Bylaws and Electing Our First Board of DirectorsFund for Democratic CommunitiesNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- Nomination Form For The RCC Board of DirectorsDocumento2 pagineNomination Form For The RCC Board of DirectorsFund for Democratic CommunitiesNessuna valutazione finora

- ROOTSTOCK - Volume 1, Issue 1Documento2 pagineROOTSTOCK - Volume 1, Issue 1Fund for Democratic CommunitiesNessuna valutazione finora

- RCC Proposal To The City of Greensboro, January 22, 2014Documento11 pagineRCC Proposal To The City of Greensboro, January 22, 2014Fund for Democratic CommunitiesNessuna valutazione finora

- Renaissance Community Coop Bylaws (Unapproved)Documento6 pagineRenaissance Community Coop Bylaws (Unapproved)Fund for Democratic CommunitiesNessuna valutazione finora

- Black Coop Pioneers in The Struggle For Economic JusticeDocumento87 pagineBlack Coop Pioneers in The Struggle For Economic JusticeFund for Democratic Communities100% (1)

- A Pathway To Responsible Community Ownership of The Renaissance Center - August 7, 2013 RevisionDocumento16 pagineA Pathway To Responsible Community Ownership of The Renaissance Center - August 7, 2013 RevisionFund for Democratic CommunitiesNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- A Pathway To Responsible Community Ownership of The Renaissance Center - Spreadsheets - Aug 7, 2013 RevisionDocumento2 pagineA Pathway To Responsible Community Ownership of The Renaissance Center - Spreadsheets - Aug 7, 2013 RevisionFund for Democratic CommunitiesNessuna valutazione finora

- Notes From Small Group Discussion - June 17Documento11 pagineNotes From Small Group Discussion - June 17Fund for Democratic CommunitiesNessuna valutazione finora

- A Pathway To Responsible Community Ownership of The Renaissance Center - SpreadsheetsDocumento2 pagineA Pathway To Responsible Community Ownership of The Renaissance Center - SpreadsheetsFund for Democratic CommunitiesNessuna valutazione finora

- RCC Pro Forma - May 23, 2013 RevisionDocumento9 pagineRCC Pro Forma - May 23, 2013 RevisionFund for Democratic CommunitiesNessuna valutazione finora

- A Pathway To Responsible Community Ownership of The Renaissance CenterDocumento14 pagineA Pathway To Responsible Community Ownership of The Renaissance CenterFund for Democratic CommunitiesNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)