Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

NFJPIA BLT Mock Board

Caricato da

Joshua Romeo VillarDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

NFJPIA BLT Mock Board

Caricato da

Joshua Romeo VillarCopyright:

Formati disponibili

po

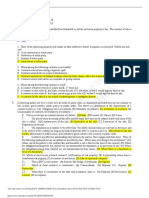

2011 NATIONAL CPA MOCK BOARD EXAMINATION

In partnership with the Professional Review & Training Center, Inc. and Isla Lipana & Co.

BUSINESS LAW & TAXATIO

N

INSTRUCTIONS: Select the best answer for each of the following questions. Mark

only one answer for each item on the answer sheet provided.

AVOID ERASURES.

Answers with erasures may render your examination answer sheet INVALID.

Use

PENCIL NO.2 only. GOODLUCK!

1.

2.

Which of these is not a conditional obligation?

a. D is to pay C P1,000,000 if he finishes his LL.B.

at the V.P. College of law.

b. D will pay C P500,000 as soon as his financial

means will permit him to do so.

c. D is to pay C P2,000,000 ten days after his

80th birthday.

d. D will pay C P1,000,000 twenty days after he

passes the C.P.A. exams for October 2008.

e. None of the above.

A, B, & C obligated themselves to deliver to X a

specific and determinate car valued at P600,000.

Due to the fault of A, the car was not delivered

to X causing the latter damages in the amount

of P9,000.

a. By specific performance. X can compel B & C to

deliver 1/3 each of the car and H to pay

damages.

b. The action of X is converted into one for

damages where he hold liable A, B & C

for P203,000 each.

c. The action of X is converted into one for

damages where he can hold B & C liable for

P200,000 each and A for P209,000.

d. The action being solidary and indivisible only

A

can be held liable by X for P609,000.

3.

Payment shall be made to, except:

a. Obligee

b. Creditors assignee

c. Obligor

d. Executor of the deceased obligee

4.

The delivery of a private document evidencing a

credit, made voluntarily by the creditor to the

debtor even before the debt is paid, extinguishes

the obligation by:

a. Express remission

c. Compensation

b. Implied remission

d. Novation

5.

Contracts are effective and binding only between

the parties, their assigns and their heirs. Three of

the following enumerations are exceptions as

provided by law. Which does not belong to

the exception?

a.

Where there is a stipulation in favor of a

third party

b. Where one of the parties to the contract dies

and thereafter a suit is filed on the basis of

the contract.

c. Where the obligations arising from contract

are not transmissible by their nature.

d.

Where the obligations arising from contract

are not transmissible by stipulation or by

provision of law.

6.

Statement 1: There is stipulation pour autrui

in case the stipulation states that one of the

parties to a contract is exempt from all previous

claims and damages sustained by the other party.

Statement 2: A stipulation pour autrui need not

be in any particular form, and may even be

inferred from the fact that the beneficiary has

enjoyed the same for a considerable period

a. Both statements are true

b. Both statements are false

c. Statement I is true but statement II is false

d. Statement I is false but statement II is true

7.

The following, except one, are the characteristics

of void or inexistent contract.

Which is the

exception?

a. They are not subject to ratification

b. The right to raise defense of illegality cannot

be waived.

c. The defense of illegality of the contract is

available to third persons whose interest is

not directly affected.

The action or defense for declaration of

the nullity or inexistence of the contract does

not prescribe.

8.

Boy Tigas entered into a contract of sale wherein

Boy Tigas will bought a knife with Jun for P3,000.

However Boy Tigas bought

the knife to kill

karding his mortal enemy. The contract between

Boy Tigas and Jun is:

a. Valid

d. Void

b. Rescissible

e. Unenforceable

c. Voidable

9.

A and B

are partners in

buying

and

selling automobiles.

A,

by

the partners

agreement, was authorized to buy automobiles

on a cash basis, never on the installment plan.

One day A bought on credit or on installment

plan a car from X, a client. X did not know of

As lack of authority. As purchase was made on

behalf and in the name of the partnership. Is the

partnership bound?

a. No because A was not really authorized to

bought on installment plan.

b. No because acquisition of automobiles requires

the consent of all partners.

c. Yes because although A was not really

authorized, still for apparently carrying on

in the

usual way the business of

the

partnership A is implicitly authorized and X

did not know of As lack of authority.

d. Yes

because all transaction

made by

any partners with third person is valid

provided the latter acted in good faith.

10. A, B and C are partners. Their contributions are as

follows: A, P60.000; B, P40.000 and C, services.

The partners agreed to divide profits and losses

in the following proportions: A, 35%; B, 25% and

C,

40%. If there is a loss of P10,000, how should

the said loss of P10,000 be shared by the

partners?

a. A, P6.000; 8, P4.000; C, nothing

b.

A, P3,000; B, P2,000; C,

P5.000 c. A, P3.500; B, P3.500; C,

P3.000 d.

A,P3.500;B,P2.500;C,

P4.000

11. Which of the following is not a requisite prescribed

by law in order that a partnership may be held

liable to a third patty for the acts of one of its

partners?

Page 1 of 6

a.

The partner

binds the partnership by

acquiescence

for

obligations

he

may

have contracted in good faith.

b. The partner must have the authority to bind

the partnership.

c. The contract must be in the partnership name

or for its account.

d. The partner must act on behalf of the

partnership.

12. Three of the following enumerations are rights of a

general .partner in a limited partnership that are

also enjoyed by a limited partner. Which among

them does a limited partner not enjoy?

a. To have the books of the partnership kept at

the principal place of business of the

partnership, and at a reasonable hour

to inspect and copy any of them;

b. To have on demand true and full information of

all things affecting the partnership and

a

formal

account of

partnership

affairs

whenever circumstances

render it

just

and reasonable;

c. To have dissolution and winding up by decree

of court;

d. To have all the rights and be subject to all

the

restrictions and liabilities of a partner in a

partnership without limited partners.

13. A partner whose liability for partnership debts is

limited to his capital contribution is called:

a. General partner

b. Limited partner

c. General-limited partner

d. Secret partner

14. Which of the following issuance of stocks is

not allowed

under

the

Corporation Code

of

the

Philippines (BP 68):

a. X Corp. issued preferred stock for P1 par

value.

b. Y Corp. issued a no par value share for P10 per

share.

c. Metro Bank Corp. issued a no par value

common shares for P5 per share.

d. Malayan Insurance Corp. issued a preferred

stock for P4 per share.

15. Which of the following cannot be included as a

valid provision under the By laws:

a.

The time, place and manner of calling

and conducting regular or special meetings of

the directors or trustees;

b. The time, place and manner of calling and

conducting regular or special meetings of

the stockholders or members;

c. The penalties for violation of the By laws

d. The time for holding the annual election of the

directors or trustees and the mode or manner

of giving notice thereof.

16. What is the voting proportion required for

the voluntary dissolution of the corporation?

a. Majority votes of the board of directors and 2/3

votes of the outstanding capital stock.

b. Majority votes of the board of directors

and

majority vote of the outstanding capital stock

c. Majority vote of the board of directors and 2/3

vote of the stockholders

d. Majority vote of the board of directors and

majority vote of the stockholders

17. A corporation commences its existence from the

issuance of the certificate of incorporation, which

one is the exception?

a. Close corporation

b. Widely-held corporation

c. Religious corporation

d. Non-stock corporation

e. Educational corporation

18. The right given to the stockholders to dissent and

demand payment of the fair value of their shares is

called:

a. Right of proxy

c. Pre-emptive right"

b. Appraisal right

d. Stock right

19. The promise or order is conditional, hence

non- negotiable?

a. "I promise to pay B or order P40.000". (Signed

Y)

b. "Pay B or order P40.000". (Addressed to Z

signed by Y)

c. "Pay B or order P40.000 and reimburse

yourself

out of

my

money in

your

possession". (Addressed to Z signed by Y)

d. "Pay B or order P40.000 out of my money in

your possession". (Addressed to Z signed by

Y)

20. A promissory note as distinguished from a bill of

exchange.

a. It contains an unconditional order

b. The one who issues it is primarily liable

c. The one who issues it is secondarily liable

d. There are three (3) parties, the drawer,

the payee and the drawee

21. Which of the following instrument is negotiable?

a. "Good to Jose Paz or order, P50,000" (signed

Pedro Cruz)

b. "I hereby authorize you to pay Jose Paz

or order P50.000" (signed Pedro Cruz)

c. "I promise to pay Jose Paz or order P50.000

worth in sugar" (signed Pedro Cruz)

d. "I promise to pay Jose Paz or order P50.000 on

October 25 (signed Pedro Cruz)

22. Marie makes a promissory note payable to bearer

and delivers the same to Polido, who negotiates

it to Arman by indorsing it without recourse. If

the note is dishonored in the hands of Arman

due to insolvency of Marie.

a.

Arman cannot recover from Polido because

the latter does not warrant Maries solvency.

b. Arman can recover from Polido because

the latter

is

secondary liable

on

the

instrument as indorser.

c. Arman can recover from Polido because of

breach of warranty.

d.

Arman cannot recover from Polido because

his indorsement is conditional.

23. Which is not correct? The acceptor by accepting a

negotiable instrument:

a. Admits the existence of the payee and

his capacity to endorse

b. Admits

the existence

of

the drawer,

the genuiness of his signature and his

authority to draw the instrument.

c. Admits the existence of the endorser, the

genuineness of his signature and his

authority to draw the instrument.

d. Admits that he will pay it according to the

tenor of his acceptance.

Page 2 of 6

24. A is maker of a promissory note for P100,000

payable to the order of B who negotiates the same

in favor of C. C loses the note and is found by

X who forges the signature of C and pretending to

be C negotiates the note to D, D to E, E to F and

F to G who is a holder in due course. Under

the circumstances which of these is not an

incorrect statement?

a. Being a holder in due course, G can recover

from maker A.

b. The signature

of

C being

forged, it

becomes inoperative and payment cannot be

enforced as against him.

c. E is not liable to F precisely because he was

not the one who forged the signature of C.

d. X is not liable to any party to the instrument

since his name does not appear thereon.

25. Sale is distinguished from dation in payment

in that in sale:

a. There is a pre-existing obligation or

credit, b. The cause is the price.

c. It is a mode of extinguishing an obligation in

the form of payment.

d. All of the above.

26. Anton sold a piece of land to Rene binding himself

not to sell the same to another person. On the

following day, Anton sold the land to Carlos who

immediately took possession in good faith. In the

case at bar, the proper remedy of Rene is to:

a. Institute an action for the annulment of

the sale to Carlos

b. Institute an action for the recovery of the land

c. Institute an action for damages against Anton

d. Institute an action for a criminal case against

Anton

27. Xenon stole a fountain pen from Olden and sold

it to a Bazaar who pays for it in good faith,

not knowing it was stolen. The Bazaar then sold

it to Bert, a student.

a. The Bazaar having bought it in good faith

becomes legal owners, and as such, he can

transfer ownership to Bert.

b. Ownership passed to Bert because he bought

it

in a merchant store.

c. Olden may recover the fountain pen from Bert

without reimbursement because he is the legal

owner.

d.

Bert cannot become the owner because

Xenon, the original seller, is not the owner.

28. Which of the following statements is false?

a.

In contract

to sell, ownership is not

transferred to the buyer upon delivery.

b. The unpaid seller can exercise stoppage in

transitu if the buyer is insolvent and the

vendor has not yet parted with the thing sold.

c. The price is considered certain if it is

in

reference to another thing certain.

d.

Dock warrant is

an example

of

a

negotiable document of title.

29. If movable property should have been sold to

different vendees, the ownership shall be

transferred to the person

a. Who have paid in good faith the purchase

price in full.

b. Who in good faith first recorded it in the

Registry of Property.

c. Who present the oldest title in good faith.

d. Who had first taken possession in good faith.

30. Min Co. wrote a circular letter to its customers

introducing a certain Arco as its duly authorized

agent. Cruz, a customer, dealt or transacted

business with Arco. Later, Arco's authority was

revoked and was published in a newspaper

of general circulation. Not withstanding his

knowledge of such revocation, Cruz continues

to transact business with Min Co. thru Arco. Is

Min Co. still liable for the agent's act even after

revocation?

a. Yes, because the revocation was not given in

the same way the power was granted.

b. No more, because the third person (Cruz) is

in bad faith.

c. No more, because the transaction that will be

entered after revocation will be void.

d. All of the above.

31. Ado appoints Bozo as his agent to sell his land.

Which of the following is valid?

a.

The authority of Bozo is in writing but

Bozo mortgages it also in writing.

b. The authority of Bozo from Ado is by way of

letter and Bozo sells the land to Cero in

writing.

c. The authority of Bozo is oral and Bozo sells

the land to Cero for P50,000 in a written

contract of sale.

d. The authority of Bozo is in writing but the sale

of the land in writing was made beyond the

period expressly set forth by Ado.

32. Phil appointed Aldo as his agent orally to sell his

parcel of land for P100,000. Five days after,

Aldo sold to Bert the parcel of

land for

P80,000 by means of public instrument executed

between Aldo and Bert. What is the effect and the

status of sale between Aldo and Bert?

a. The sale is valid because it was executed in a

public instrument.

b. The sale is

unenforceable because the

agent acted beyond the

scope of

his

authority for selling the land less than the

price instructed.

c. The sale is void because the appointment of

the agent is oral.

d. The sale can be ratified although the

appointment of Aldo is oral, because the sale

by Aldo to Bert is in a public instrument.

33. Effect of sale on the thing pledged if it is less

than the principal obligation.

a. Creditor cannot recover the deficiency.

b. Creditor can recover the deficiency.

c. Creditor cannot recover the deficiency even if

there is stipulation.

d. Creditor can recover the deficiency if there is

stipulation.

st

34. 1 Statement - If after the second auction sale, the

thing pledged is not sold, the pledgee can

appropriate the thing pledged.

2nd Statement - If the thing pledged is sold, but

the proceeds of the sale is less than the principal

obligation, the pledgee can collect the deficiency

from the pledger.

st

nd

a. Both are True

c. 1 is True; 2 is False

b. Both are False

d. 1st is False; 2nd is True

35. 1st Statement: In all cases of extra judicial

foreclosure, the right of redemption can be

exercised by the mortgagor within one year from

and after the juridical registration of the sale.

2nd Statement:

In judicial foreclosure, the

mortgagor may still exercise his equity of

redemption after the confirmation of the sale by

the court.

Page 3 of 6

a. Both statements are wrong.

st

b. 1 statement correct, 2nd statement wrong

c. Both statements are correct.

d. 1st statement wrong, 2nd statement correct.

36. Which is an inherent limitationl limitation?

a. Equality in Taxation

b. Uniformity of taxation

c. Territoriality rule

d. Non-infringement of religious freedom in

taxation

37. Which is incorrect?

a. Collection of taxes is an administrative act

b.

There can be no tax if there is no law

providing for the said tax

c. No person can be imprisoned for non payment

of tax

d. A tax imposed outside the situs of taxation is

void

38. All are essential characteristics of a tax except:

a. Payment of the tax is

mandatory b. It is generally

payable in money

c. It is generally unlimited in amount

d. It is proportionate in character

39. One of the following is incorrect:

a. Donation of movable property worth P5,000

need not be in writing.

b. Donation of real property worth P5,000 must

be in a public instrument.

c. Tax exempt net gift for strangers is P100,000.

d.

A donation cannot be both a part of the

gross profit of the donor and a taxable income

to the donee.

40. Who is the taxpayer in estate tax:

a. The heirs or successors

b. The deceased persons estate

c. The heirs legal representatives

d. The executor or administrator of the state.

41. One of the following is not subject to 0-15%

first donors tax rates:

a. A donation to the illegitimate child of the

donors niece

b. A donation to the only brother of his paternal

uncle

c. A donation to the only sister of his maternal

aunt

d. A donation to the grandson of his fathers

brother

42. Emong donated P100,000 cash to his daughter

Baby on account of marriage, he is entitled to a

P10,000 deduction or exemption if he is a:

a. Non-resident alien

b. Resident alien

c. Both resident and non-resident

d. a or b above

43. All are incorrect except one:

a. Claims against insolvent person must be

notarized to be deductible

b. Losses must occur before decedents death to

be deductible

c. Allowable deduction for funeral expenses can

never be more than the actual expenses.

d. Onerous revocable transfers are includible in

the gross estate.

44. One of the following is VAT exempt.

a. Importation of goods for home consumption

b. Sale of drugs a supermarket

c. Sublease of personal property

d. Common carriers by land

45. Bova VAT registered operates a variety store, his

annual gross sales never exceeded the P1,500,000

limit. This years total cash receipts for the

first quarter was only P100,000 out of P250,000

gross sales, net of any tax. His tax due is:

a. P7,500 OPT

b.

3,500 OPT

c. 10,000 VAT

d. 30,000 VAT

46. Sarah inherited a residential lot in 1990 valued at

P200,000 at that time. On November 30,2009

she sold it for P400,000 when its fair market value

was P800,000 Sarah is subject to:

a. VAT

b. Donors Tax

c. OPT

d. Income Tax (CGT)

47. RUFFA purchased 10,000 shares of Dubidu Bidu in

200A for P30,000. The shares are listed in the LSE,

6 months later she sold them for P15,000.

She also bought in 200B 500 domestic shares

at P1,000/ share & sold them after 3 months

for P1,500/s directly thru a buyer, the capital

gains tax is:

a. P75

b. P3,750

c. P20,000

d. P1,250

48. Maximus died leaving the following:

Real Property located in Italy

(w/ P100,000 mortgage)

P840,000

Shares of stocks of foreign co.

Shares of stocks of domestic corp.

Life insurance proceeds Phil

Franchise, Phil

300,000

90,000

90,000

600,000

If he is non-resident Filipino citizen residing in

USA, the gross estate is

a. P780,000

c. P1,140,000

b. P1,920,000

d. P1,250,000

49. If he

is

non-resident

Romanian

in the

above problem,

the gross estate,

assuming

there is reciprocity law is:

a. P90,000

c. P180,000

b. P600,000

d. P 0

50. May-may, VAT registered made the following sales

nd

during the 2 quarter of 200A

Cash sales, exclusive of VAT

P200,000

Open account sales, invoice price

448,000

Installment sales, invoice price

896,000

Consignments: (with VAT)

June 1 (reported sold)

224,000

April 1

672,000

June 10

224,000

The total output tax is:

a. P168,000

b. P264,000

c. P240,000

d. P144,000

51. B. Tiu registered as a VAT taxpayer on June 1,

200A & became liable to VAT on that quarter. His

records showed the following:

Sales (invoice price)

Purchases (net of VAT)

P224,000

20,000

Page 4 of 6

Value of inventory as of May 31

purchased from VAT registered

person

VAT paid

Value of inventory as of May 31

purchase from:

Non VAT person

VAT Exempt persons whose

goods are VAT exempt

The VAT due is:

a. P14,800

b. P4,600

60,000

6,000

340,000

20,000

c. P6,600

d. P9,400

52. Mr. X made a gift on May 9, 2009 the last day of

filing the gift tax return is:

a. May 28, 2009

c. June 8, 2009

b. June 9, 2009

d. November 5, 2009

53. Dina Nakahinga, Filipino, married, died on

February 14,200B.

Assets

declared

and

deductions claimed by the estate are as follows:

Assets, conjugal

Family Home (house) Quezon City

Fishpond, Bulacan

Apartment, Manila

Shares of stock, Good Luck Co.,

domestic

Shares of stock, BX Inc., a foreign

Corporation 60% of the business

is in the Phil.

Cash in Bank

P800,000

1,000,000

1,600,000

600,000

400,000

100,000

Assets, Exclusive of Decedent

Family Home (lot), Quezon City

P500,000

Deductions claimed

Funeral expenses

Family home deduction

Loss (Decedent has a receivable

from Mr. MAX, a solvent

debtor

who absconded)

Liability (This represents unpaid

subscription to 200B shares of

Tililing Co. acquired on

February 10,200A)

Standard deduction (Unitemized &

undocumented)

Death benefits under RA 4917

P300,000

1,300,000

40,000

deductions

1,000,000

300,000

from the gross

c. P2,100,000

d. P2,600,000

55. All are sources of income except:

a. Capital

b. Labor

c. Sale or exchange of assets

d. Life insurance proceeds

56. Bernadette, married with a 2 year old child, has

the following transactions in 2009

Salaries received as employee

P200,000

Sales

1,440,000

Cost of goods sold

660,000

Deductions:

Operating expenses

Loss due to fire (property reported)

12,000

42,000

Other income:

Rent

36,000

Capital gain from sale of TV

held for 3 years

96,000

The taxpayer will report a taxable net income of:

a. P472,000

c. P320,400

b. P445,400

d. P500,400

The Rainbow Corp. provided the following data

for calendar year ending December 31, 2009:

($1 P50)

PHILIPPINES

ABROAD

GROSS INCOME

P 4,000,000

$40,000

DEDUCTIONS

P 2,500,000

$15,000

INCOME PAID

3,000

57. If it is a domestic corporation, its income tax after

credit is:

a. P812,500

c. P880,000

b. P832,000

d. P675,000

58. If it is a resident corporation, its income tax is:

a. P525,000

c. P880,000

b. P1,280,000

d. P450,000

59. If it is a non-resident alien corporation,

income tax is:

a. P1,200,000

c. P880,000

b. P128,000

d. P730,000

its

60. If it is a private educational institution , its income

tax after tax credit is:

a. P675,000

c. P275,000

b. P832,000

d. P150,000

61. If it is a resident corporation and it remitted 60%

of its net profit to its head office abroad, its total

tax liability is (ORIGINAL DATA)

a. P544,500

c. P196,000

b. P571,800

d. P612,750

200,000

The gross estate of Dina Nakahinga is:

a. P5,000,000

c. P2,620,000

b. P4,600,000

d. P5,540,000

54. The total allowable

estate is:

a. P1,100,000

b. P2,300,000

Contributions:

To a government priority project

in education

To Quiapo church

440,000

60,000

62. If it is a private educational institution but P3.5M of

its total gross income is from lease and

restaurant business, its income tax still due is:

a. P675,000

c. P150,000

b. P275,000

d. P812,500

63. Which shall not form part of the gross estate of a

decedent:

a. Life insurance where the executor is the

beneficiary and it is irrevocable

b. Transfer passing special power of appointment.

c. Revocable transfer

d. Intangible personal property of non-resident

alien decedent without reciprocity law

64. Ding Dong Corporation, a domestic corporation

now on its 5th year of operation provided the

following data:

Gross sales

P1,100,000

Sales returns and allowances

200,000

Cost of goods sold

300,000

Gain on sale of capital assets held

for 11 months

10,000

Loss on sale of capital assets held for

20 months

5,000

Royalty income

Allowable business expenses

50,000

580,000

Page 5 of 6

Income tax due is:

a. P9,625

b. P8,800

c. P10,500

d. P12,000

65. Purobuto, non-resident Japanese, died leaving the

following:

Exclusive properties, Philippines

P 560,000

Conjugal properties, Philippines

420,000

Conjugal properties, Abroad

1,820,000

Deductions claimed:

Funeral expenses

100,000

Judicial expenses

100,500

Unpaid expenses

150,500

Losses: occurring 3 mos. After death

due to fire

120,000

Donation mortis causa to Makati City

Hall

180,000

Family Home (inc. above)

1,000,000

Standard deduction

1,000,000

The taxable net estate is:

a. P210,000

b. P516,500

c. P1,900,000

d. P2,100,000

66. One of the following is subject to tax benefit rule:

a. Income from illegal transactions

b. Income from bad debts recovery:

c. Income from expropriation of property

d. Income from gambling

67. All

a.

b.

c.

are non taxable fringe benefits except?

Benefits given to a clerk of the company

De minimis benefits

Contribution of the employer for employees

benefit to retirement, insurance and vacation.

d. Fringe benefits for the convenience of the

employer.

68. One of the following is exempt from MCIT

a. Banks

b. Mining companies

c. Publicly held corporations

d. Educational institutions

69. Lady Bova, single, Filipino, provided the following

data for 200A:

Compensation income

(net of P25,000 w/tax,

but gross of P10,000

SSS, Pag-IBIG and Union dues)

13th Month pay

Gross Business Income

Interest Income,BPI

Royalty Income

Bad debt expense

(10% written off)

Interest Expense

Transportation expense

(50% business trips)

Health Insurance

Premiums for Family

Her taxable income is:

a. P654,500

c.

b. P589,500

d.

P250,000

80,000

500,000

50,000

25,000

20,000

100,000

50,000

3,000

P587,100

P469,500

70. Aishah Corporation, a domestic corporation, had

the following data for taxable year 200A:

Sales

P5,000,000

Cost of Goods Sold

2,000,000

General, Selling and

Administrative Expenses

500,000

Interest Income from

Phil. Bank Deposit

100,000

Rental Income

(net of 5% withholding tax)

190,000

Dividend Income:

From domestic corporation

60,000

From foreign corporation

50,000

Winnings from charity sweepstakes 1,000,000

Capital gains from sale of

domestic share of stocks

Sold directly to buyer

75,000

Dividend declared and paid

during the year

500,000

Retained earnings,

beg. of the year

(subjected to IAE tax last year)

1,000,000

Note:

The board of

directors

approved

a

resolution reserving P1,500,000 of its net profit

for the year for plant expansion.

The income tax due after credit if any is:

a. P815,000

c. P890,000

b. P862,000

d. P855,000

End of Examination

Thank you for participating in the 2011 National Mock CPA Board Examinations!

Page 6 of 6

Potrebbero piacerti anche

- CPA Review School Audit ProblemsDocumento10 pagineCPA Review School Audit Problemsxxxxxxxxx100% (1)

- Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetDocumento10 pagineMultiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetRhad Estoque0% (1)

- Business Combi TsetDocumento28 pagineBusiness Combi Tsetsamuel debebeNessuna valutazione finora

- Far Test BankDocumento37 pagineFar Test BankheyheyNessuna valutazione finora

- (Problems) - Audit of Prepayments and Intangible AssetsDocumento13 pagine(Problems) - Audit of Prepayments and Intangible Assetsapatos0% (1)

- AUDProb TEST BANKDocumento28 pagineAUDProb TEST BANKFrancine HollerNessuna valutazione finora

- Inventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialDocumento5 pagineInventories, Investments, Intangibles, & Property, Plant and Equipment - Quiz MaterialMimiNessuna valutazione finora

- Auditing Theory Test Banks ReviewDocumento2 pagineAuditing Theory Test Banks ReviewJea Balagtas100% (1)

- Government entity service concession arrangementDocumento7 pagineGovernment entity service concession arrangementAyesha RGNessuna valutazione finora

- Sde WRDocumento10 pagineSde WRNitinNessuna valutazione finora

- EXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsDocumento37 pagineEXCEL Professional Services Management Firm PTRC Open Final Preboard ProblemsAnonymous Lih1laaxNessuna valutazione finora

- PRTC OLYMPIAD REGION 12 ACCOUNTING AND BUSINESS LAW REVIEWDocumento14 paginePRTC OLYMPIAD REGION 12 ACCOUNTING AND BUSINESS LAW REVIEWVincent Larrie MoldezNessuna valutazione finora

- Process Costing ReviewerDocumento46 pagineProcess Costing ReviewerAko Si Cynthia100% (1)

- Nfjpia Nmbe Taxation 2017 AnsDocumento9 pagineNfjpia Nmbe Taxation 2017 AnsEstudyante100% (2)

- IAS38 - Accounting for Intangible AssetsDocumento13 pagineIAS38 - Accounting for Intangible AssetsJehPoyNessuna valutazione finora

- Orca Share Media1532355060231Documento18 pagineOrca Share Media1532355060231Let it beNessuna valutazione finora

- Practical Accounting Part 1Documento18 paginePractical Accounting Part 1Jonacress Callo CagatinNessuna valutazione finora

- Answer The Following With Speed and Accuracy. Solutions Must Be DisclosedDocumento4 pagineAnswer The Following With Speed and Accuracy. Solutions Must Be DisclosedUNKNOWNNNessuna valutazione finora

- ReviewerDocumento5 pagineReviewermaricielaNessuna valutazione finora

- Saint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Job Order Costing Prelim Exam-PART 2Documento10 pagineSaint Vincent College of Cabuyao Brgy. Mamatid, City of Cabuyao, Laguna Job Order Costing Prelim Exam-PART 2jovelyn labordoNessuna valutazione finora

- Property, Plant and Equipement: Prior To Expense AfterDocumento8 pagineProperty, Plant and Equipement: Prior To Expense AfterAvox EverdeenNessuna valutazione finora

- Practical Accounting 1Documento32 paginePractical Accounting 1EdenA.Mata100% (9)

- FAR-4105 INVENTORIES - Part 2Documento3 pagineFAR-4105 INVENTORIES - Part 2music niNessuna valutazione finora

- Auditing Quiz BeeDocumento9 pagineAuditing Quiz BeeWilsonNessuna valutazione finora

- Auditing Theory Code of EthicsDocumento13 pagineAuditing Theory Code of EthicsAlmira BesoniaNessuna valutazione finora

- Investment AccountingDocumento3 pagineInvestment AccountingMaxineNessuna valutazione finora

- Items 1Documento7 pagineItems 1RYANNessuna valutazione finora

- Receivables - Additional Concepts Credit Impaired Financial AssetsDocumento2 pagineReceivables - Additional Concepts Credit Impaired Financial Assetsfinn mertensNessuna valutazione finora

- CTDI Tax Formatting QuestionsDocumento13 pagineCTDI Tax Formatting QuestionsMaryane AngelaNessuna valutazione finora

- Audit of Investments - Set BDocumento4 pagineAudit of Investments - Set BZyrah Mae Saez0% (1)

- This Study Resource Was: Contributor: Atty. Mendoza, B. Date Contributed: March 2011Documento7 pagineThis Study Resource Was: Contributor: Atty. Mendoza, B. Date Contributed: March 2011Jan Christopher CabadingNessuna valutazione finora

- Responsibility Accounting and Transfer PricingDocumento68 pagineResponsibility Accounting and Transfer PricingMari Louis Noriell MejiaNessuna valutazione finora

- TX12 - Estate TaxDocumento14 pagineTX12 - Estate TaxPatrick Kyle AgraviadorNessuna valutazione finora

- ExamDocumento7 pagineExamKristen WalshNessuna valutazione finora

- Cost Accounting Guerrero Franchises Chap06Documento17 pagineCost Accounting Guerrero Franchises Chap06AlexanNessuna valutazione finora

- Investment Income and GainsDocumento9 pagineInvestment Income and GainsRex AdarmeNessuna valutazione finora

- First Preboard FAR ReviewDocumento26 pagineFirst Preboard FAR Reviewlois martinNessuna valutazione finora

- STC Vat Test Bank 1Documento29 pagineSTC Vat Test Bank 1alden123Nessuna valutazione finora

- Audit ReviewDocumento6 pagineAudit ReviewArnel RemorinNessuna valutazione finora

- Ix - Completing The Audit and Audit of Financial Statements Presentation PROBLEM NO. 1 - Statement of Financial PositionDocumento12 pagineIx - Completing The Audit and Audit of Financial Statements Presentation PROBLEM NO. 1 - Statement of Financial PositionKirstine DelegenciaNessuna valutazione finora

- CPA Review School First Pre-Board ExamDocumento9 pagineCPA Review School First Pre-Board ExamJohn Philip Castro100% (1)

- BLT ReviewerDocumento8 pagineBLT ReviewerVon Wilson AjocNessuna valutazione finora

- Nfjpia Mockboard-2011 BLTDocumento6 pagineNfjpia Mockboard-2011 BLTBj CaridoNessuna valutazione finora

- Nfjpia Mockboard 2011 BLTDocumento6 pagineNfjpia Mockboard 2011 BLTjamesNessuna valutazione finora

- Nfjpia Mockboard 2011 BLTDocumento12 pagineNfjpia Mockboard 2011 BLTVon Wilson AjocNessuna valutazione finora

- May 2019 Diagnostic RFBTDocumento18 pagineMay 2019 Diagnostic RFBTThea BacsaNessuna valutazione finora

- RDC Review School of Accountancy Mock ExamDocumento18 pagineRDC Review School of Accountancy Mock ExamMichaelJayCuturaMatolNessuna valutazione finora

- RFBT Quizzer 1Documento5 pagineRFBT Quizzer 1Jenille VillanuevaNessuna valutazione finora

- 2nd Statement. Solutio Indebiti and Negotiorum Gestio Are Quasicontracts That GiveDocumento5 pagine2nd Statement. Solutio Indebiti and Negotiorum Gestio Are Quasicontracts That GiveJosephine MercadoNessuna valutazione finora

- ACC51114 (Sample Questions - Quiz 4)Documento9 pagineACC51114 (Sample Questions - Quiz 4)The Brain Dump PHNessuna valutazione finora

- Business Law Final PreboardDocumento3 pagineBusiness Law Final PreboardYaj CruzadaNessuna valutazione finora

- Business Law Exam QuestionsDocumento8 pagineBusiness Law Exam QuestionsNeil RiveraNessuna valutazione finora

- C. Warranty Against EvictionDocumento5 pagineC. Warranty Against EvictionMelissa Kayla ManiulitNessuna valutazione finora

- Partnership Managing Partner Powers and DutiesDocumento5 paginePartnership Managing Partner Powers and DutiesTakuriNessuna valutazione finora

- Sheesh I Be Like He A DudeDocumento34 pagineSheesh I Be Like He A DudeJohn DoeNessuna valutazione finora

- BL (1-2 W Answers)Documento9 pagineBL (1-2 W Answers)Melissa Kayla ManiulitNessuna valutazione finora

- Law 1st PB Oct 2012Documento7 pagineLaw 1st PB Oct 2012Ssan DunqueNessuna valutazione finora

- BL Questions With AnswersDocumento15 pagineBL Questions With AnswersPeter Daniel Cinco BugtasNessuna valutazione finora

- Business LawDocumento5 pagineBusiness LawMelissa Kayla ManiulitNessuna valutazione finora

- Diagnostic Examination Air Lev2 3 AccountingDocumento17 pagineDiagnostic Examination Air Lev2 3 AccountingRobert CastilloNessuna valutazione finora

- Management ReportDocumento2 pagineManagement ReportJoshua Romeo VillarNessuna valutazione finora

- Management ReportDocumento2 pagineManagement ReportJoshua Romeo VillarNessuna valutazione finora

- PSA 120 Framework of Philippine Standards on AuditingDocumento9 paginePSA 120 Framework of Philippine Standards on AuditingMichael Vincent Buan SuicoNessuna valutazione finora

- BL 2 (Partnership)Documento8 pagineBL 2 (Partnership)Joshua Romeo VillarNessuna valutazione finora

- BLT PRTC Pre-BoardDocumento12 pagineBLT PRTC Pre-BoardJohanna CatahanNessuna valutazione finora

- Business Law and Taxation ReviewerDocumento5 pagineBusiness Law and Taxation ReviewerJeLo ReaNdelar100% (2)

- 21-29107 Schulz - Millsap AwardDocumento20 pagine21-29107 Schulz - Millsap AwardmikekvolpeNessuna valutazione finora

- Partnerships in KenyaDocumento13 paginePartnerships in KenyaMercy NamboNessuna valutazione finora

- PA Agreement Ownership & RolesDocumento4 paginePA Agreement Ownership & RolesSithmbiso100% (6)

- Delaney v. Fidelity Lease Limited ruling on limited partner liabilityDocumento1 paginaDelaney v. Fidelity Lease Limited ruling on limited partner liabilityMond Ramos100% (1)

- Professional Engineers Act 1991Documento79 pagineProfessional Engineers Act 1991WENLU ZHANGNessuna valutazione finora

- Organizing and Financing The Venture: EBW 2133 Entrepreneurial FinanceDocumento15 pagineOrganizing and Financing The Venture: EBW 2133 Entrepreneurial FinanceKato ChanNessuna valutazione finora

- Partnership (Chapters 1-3)Documento22 paginePartnership (Chapters 1-3)nicadagle1996Nessuna valutazione finora

- Chapter 3Documento9 pagineChapter 3graceNessuna valutazione finora

- Stage One Application Form and Guide: International Communities ProgrammeDocumento51 pagineStage One Application Form and Guide: International Communities ProgrammeRaj GildaNessuna valutazione finora

- Business Studies NotesDocumento55 pagineBusiness Studies NotesCyrus Ngugi100% (1)

- Capital Structure and Business FormsDocumento14 pagineCapital Structure and Business FormsPhương Anh HàNessuna valutazione finora

- Forms of Business OwnershipDocumento36 pagineForms of Business OwnershipFurqan AhmedNessuna valutazione finora

- Court Reverses Itself in Partnership DisputeDocumento5 pagineCourt Reverses Itself in Partnership DisputeFlorz GelarzNessuna valutazione finora

- Railway Electrification Project TenderDocumento120 pagineRailway Electrification Project TenderCore4 EngineersNessuna valutazione finora

- Walter Juda and Renee Juda v. Commissioner of Internal Revenue, 877 F.2d 1075, 1st Cir. (1989)Documento14 pagineWalter Juda and Renee Juda v. Commissioner of Internal Revenue, 877 F.2d 1075, 1st Cir. (1989)Scribd Government DocsNessuna valutazione finora

- Heirs of Jose Lim vs. LimDocumento12 pagineHeirs of Jose Lim vs. LimJerome ArañezNessuna valutazione finora

- Answers and Solutions To Exercises and ProblemsofpartnershipDocumento25 pagineAnswers and Solutions To Exercises and ProblemsofpartnershipDanicaEsponilla67% (6)

- Labor Recruitment RulesDocumento10 pagineLabor Recruitment RulesRuby ReyesNessuna valutazione finora

- Russell MethodologyDocumento40 pagineRussell MethodologyBilly SilvaNessuna valutazione finora

- Defining the Employer-Employee RelationshipDocumento560 pagineDefining the Employer-Employee Relationshipeka1992Nessuna valutazione finora

- Cross-Border Mergers & Acquisitions and the Role of HR IntegrationDocumento7 pagineCross-Border Mergers & Acquisitions and the Role of HR IntegrationJeremy Dao100% (1)

- Financial Accounting-Class 1Documento46 pagineFinancial Accounting-Class 1Karen JoyceNessuna valutazione finora

- Law On PartnershipDocumento42 pagineLaw On Partnershipblueviolet21Nessuna valutazione finora

- Corporation Law Midterms Quick NotesDocumento15 pagineCorporation Law Midterms Quick NotesMarieNessuna valutazione finora

- 12 Accounts Half YearlyDocumento5 pagine12 Accounts Half YearlyRahul MajumdarNessuna valutazione finora

- Accounting for Partnerships Chapter 12 SummaryDocumento49 pagineAccounting for Partnerships Chapter 12 SummaryKristian Paolo De LunaNessuna valutazione finora

- II PU Accountancy QPDocumento13 pagineII PU Accountancy QPLokesh RaoNessuna valutazione finora

- The Purpose and Use of Financial StatementsDocumento56 pagineThe Purpose and Use of Financial StatementsDang ThanhNessuna valutazione finora

- MGT101 Past Papers SolvedDocumento58 pagineMGT101 Past Papers SolvedSheraz PrinceNessuna valutazione finora

- Claint AssignmentDocumento13 pagineClaint AssignmentMuhammadWaseemNessuna valutazione finora