Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hca 600 Kingvsburwell

Caricato da

api-307874398Descrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hca 600 Kingvsburwell

Caricato da

api-307874398Copyright:

Formati disponibili

KING VS.

BURWELL

King vs. Burwell and Implications

Ashley Winans

HCA 600

3/28/2015

Professor Tracy Yee

KING VS. BURWELL

2

King vs. Burwell and Implications

Th King vs. Burwell case asserts that the text of the ACA only allows for subsidies on

state-run exchanges, and that the regulation as implemented by the IRS, providing for subsidies

on state-run exchanges as well as federal exchanges, exceeded the authority Congress granted to

it (Somnin, 2015, P.1). This case has the potential to cost 13 million Americans over $25 billion

as well as cost them their health insurance as they cannot afford this insurance without certain

tax breaks.

When the ACA was being written, the (unwritten) assumption was that all states would

take part in the Healthcare Marketplace; however, 37 states operate under a form of the federally

run or supported exchanges. Most of those 37 states also have governors or legislators who tend

to be more conservative and also opposed the Affordable Care Act as well as refused to

implement a state exchange. If these states has instead decided to created a state run exchange,

the citizens of these states would not have had their tax breaks affected by this particular case.

This is partially due to the ambiguous language used in drafting the ACA regarding the

exchange established by the State.

In the King vs. Burwell case, the plaintiffs contended that the IRSs interpretation is

contrary to the language of the statute It is asserted that the language of the statue

authorizes tax credits only for individuals who purchase insurance on state-run Exchanges.

However, the statutory language remains ambiguous and has been subjected to multiple

interpretations.

ACA opponents have brought this particular suit in order to deny tax support which

would essentially be used to offset the costs of medical coverage for many low and middle

income families. If this suit is successful, the aforementioned individuals will no longer have tax

KING VS. BURWELL

support and will be left without coverage. Additionally, it can potentially put an end to federally

run competitive state-based health insurance exchanges. The outcome of the King vs. Burwell

case has the potential to determine whether millions of people continue to have access to

affordable, comprehensive health insurance.

One possible solution is for Congress to amend this law with the three words or federal

government and instead say: Exchange established by the state or federal government when

they are defining the tax credit eligibility. Congress perspective is that state government

officials never understood the tax credits to be limited to state-run Exchanges, whereas member

of Congress understood that tax credits would be available to purchasers on all of the

Exchanges (Constitutional Accountability Center, 2015).

KING VS. BURWELL

References

King v. Burwell, U.S. Supreme Court. (n.d.). Constitutional Accountability Center:King v.

Burwell. Retrieved from: http://theusconstitution.org/cases/king-v-burwell.

Shi, L., & Signh, D. (2012). Delivering health care in America: A systems approach (5th ed.).

Burlington, MA: Jones & Bartlett Learning.

Somnin, Ilya. (2015). Federalism Arguments in King vs. Burwell. Retrieved March 27, 2015,

from http://www.washingtonpost.com/news/volokhconspiracy/wp/2015/03/07/federalism-arguments-in-king-v-burwell/

KING VS. BURWELL

APPENDIX A

Attach your appendix item here. If no appendices are needed, then omit this page. If more than

one appendix is needed, continue to the following page, place APPENDIX B (in all caps)

centered at the top of the page, and then attach the applicable item (e.g., table, figure, graph,

illustration, etc.). Continue the same process as necessary for all subsequent appendices.

Potrebbero piacerti anche

- Key States On The Front Line of Stopping ObamaCareDocumento5 pagineKey States On The Front Line of Stopping ObamaCareIllinois PolicyNessuna valutazione finora

- Policy Implications of King v. BurwellDocumento2 paginePolicy Implications of King v. BurwellNicole Castillo TarrielaNessuna valutazione finora

- The Affordable Care ActDocumento25 pagineThe Affordable Care ActTania Ballard100% (3)

- UP Law Review, Commerce Clause Challenges To Health Care ReformDocumento23 pagineUP Law Review, Commerce Clause Challenges To Health Care ReformProfessor NoBullNessuna valutazione finora

- King v. BurwellDocumento47 pagineKing v. BurwellPaigeLavenderNessuna valutazione finora

- Affordable Care “Tax”: A Guide to Obama Care (The Aca) for the Individual Tax PayerDa EverandAffordable Care “Tax”: A Guide to Obama Care (The Aca) for the Individual Tax PayerNessuna valutazione finora

- 50 Vetoes: How States Can Stop the Obama Health Care LawDa Everand50 Vetoes: How States Can Stop the Obama Health Care LawNessuna valutazione finora

- Why Obamacare Is Wrong for America: How the New Health Care Law Drives Up Costs, Puts Government in Charge of Your Decisions, and Threatens Your Constitutional RightsDa EverandWhy Obamacare Is Wrong for America: How the New Health Care Law Drives Up Costs, Puts Government in Charge of Your Decisions, and Threatens Your Constitutional RightsNessuna valutazione finora

- Summary: Landmark: Review and Analysis of The Washington Post's BookDa EverandSummary: Landmark: Review and Analysis of The Washington Post's BookNessuna valutazione finora

- National Federation of Independent Business v. SebeliusDocumento193 pagineNational Federation of Independent Business v. SebeliusCasey SeilerNessuna valutazione finora

- The Future of Healthcare Reform in the United StatesDa EverandThe Future of Healthcare Reform in the United StatesAnup MalaniNessuna valutazione finora

- Defend Yourself!: How to Protect Your Health, Your Money, And Your Rights in 10 Key Areas of Your LifeDa EverandDefend Yourself!: How to Protect Your Health, Your Money, And Your Rights in 10 Key Areas of Your LifeNessuna valutazione finora

- Healing American Healthcare: A Plan to Provide Quality Care for All, While Saving $1 Trillion a YearDa EverandHealing American Healthcare: A Plan to Provide Quality Care for All, While Saving $1 Trillion a YearNessuna valutazione finora

- TennCare, One State's Experiment with Medicaid ExpansionDa EverandTennCare, One State's Experiment with Medicaid ExpansionNessuna valutazione finora

- TennCare, One State's Experiment with Medicaid ExpansionDa EverandTennCare, One State's Experiment with Medicaid ExpansionNessuna valutazione finora

- The Pipes Plan: The Top Ten Ways to Dismantle ObamacareDa EverandThe Pipes Plan: The Top Ten Ways to Dismantle ObamacareNessuna valutazione finora

- The False Promise of Big Government: How Washington Helps the Rich and Hurts the PoorDa EverandThe False Promise of Big Government: How Washington Helps the Rich and Hurts the PoorNessuna valutazione finora

- Let's Fix Medicare, Replace Medicaid, and Repealthe Affordable Care Act: Here Is Why and How.Da EverandLet's Fix Medicare, Replace Medicaid, and Repealthe Affordable Care Act: Here Is Why and How.Nessuna valutazione finora

- Women vs. American Supreme Court: The History of Abortion LegislationDa EverandWomen vs. American Supreme Court: The History of Abortion LegislationNessuna valutazione finora

- The History of Abortion Legislation in the USA: Judicial History and Legislative ResponseDa EverandThe History of Abortion Legislation in the USA: Judicial History and Legislative ResponseNessuna valutazione finora

- Universal Medical Care from Conception to End of Life: The Case for A Single-Payer SystemDa EverandUniversal Medical Care from Conception to End of Life: The Case for A Single-Payer SystemNessuna valutazione finora

- Health Care for Some: Rights and Rationing in the United States since 1930Da EverandHealth Care for Some: Rights and Rationing in the United States since 1930Valutazione: 4.5 su 5 stelle4.5/5 (2)

- The Case Against Single Payer: How ‘Medicare for All' Will Wreck America's Health Care System—And Its EconomyDa EverandThe Case Against Single Payer: How ‘Medicare for All' Will Wreck America's Health Care System—And Its EconomyValutazione: 5 su 5 stelle5/5 (1)

- Abortion in the United States - Judicial History and Legislative BattleDa EverandAbortion in the United States - Judicial History and Legislative BattleNessuna valutazione finora

- Broken, Bankrupt, and Dying: How to Solve the Great American Healthcare Rip-offDa EverandBroken, Bankrupt, and Dying: How to Solve the Great American Healthcare Rip-offNessuna valutazione finora

- Overcharged: Why Americans Pay Too Much for Health CareDa EverandOvercharged: Why Americans Pay Too Much for Health CareNessuna valutazione finora

- Priceless: Curing the Healthcare CrisisDa EverandPriceless: Curing the Healthcare CrisisValutazione: 3.5 su 5 stelle3.5/5 (5)

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesDa EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNessuna valutazione finora

- American Healthcare & the Consumer Experience: Four ScenariosDa EverandAmerican Healthcare & the Consumer Experience: Four ScenariosNessuna valutazione finora

- This Time Get It Right: Good-Bye ObamaCare: Health Savings Accounts Open the Door to Universal Coverage and Lower CostsDa EverandThis Time Get It Right: Good-Bye ObamaCare: Health Savings Accounts Open the Door to Universal Coverage and Lower CostsNessuna valutazione finora

- Abortion Rights - Judicial History and Legislative Battle in the United StatesDa EverandAbortion Rights - Judicial History and Legislative Battle in the United StatesNessuna valutazione finora

- One Sentence Health Care Reforms: 200 Alternatives and Steps Beyond the Affordable Care ActDa EverandOne Sentence Health Care Reforms: 200 Alternatives and Steps Beyond the Affordable Care ActNessuna valutazione finora

- Constitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxDa EverandConstitutional Tax Structure: Why Most Americans Pay Too Much Federal Income TaxNessuna valutazione finora

- Reforming America's Health Care System: The Flawed Vision of ObamaCareDa EverandReforming America's Health Care System: The Flawed Vision of ObamaCareValutazione: 5 su 5 stelle5/5 (2)

- Affordable Medicare for All: American Health Care Is the Problem and Medicare for All Americans Is the SolutionDa EverandAffordable Medicare for All: American Health Care Is the Problem and Medicare for All Americans Is the SolutionNessuna valutazione finora

- Gale Researcher Guide for: Federalists and Anti-Federalists: RatificationDa EverandGale Researcher Guide for: Federalists and Anti-Federalists: RatificationNessuna valutazione finora

- Restoring Quality Health Care: A Six-Point Plan for Comprehensive Reform at Lower CostDa EverandRestoring Quality Health Care: A Six-Point Plan for Comprehensive Reform at Lower CostNessuna valutazione finora

- National Health Policy: What Role for Government?Da EverandNational Health Policy: What Role for Government?Valutazione: 5 su 5 stelle5/5 (1)

- The Poverty of Welfare: Helping Others in the Civil SocietyDa EverandThe Poverty of Welfare: Helping Others in the Civil SocietyValutazione: 5 su 5 stelle5/5 (1)

- Summary: The Cure: Review and Analysis of David Gratzer's BookDa EverandSummary: The Cure: Review and Analysis of David Gratzer's BookNessuna valutazione finora

- Healthcare, Actually: A Brief Review of International Healthcare, America's Challenges, and Steps Towards Universal HealthcareDa EverandHealthcare, Actually: A Brief Review of International Healthcare, America's Challenges, and Steps Towards Universal HealthcareNessuna valutazione finora

- Healthy Competition: What's Holding Back Health Care and How to Free ItDa EverandHealthy Competition: What's Holding Back Health Care and How to Free ItNessuna valutazione finora

- Living Legislation: Durability, Change, and the Politics of American LawmakingDa EverandLiving Legislation: Durability, Change, and the Politics of American LawmakingNessuna valutazione finora

- Obamacare: What's in It for Me?: What Everyone Needs to Know About the Affordable Care ActDa EverandObamacare: What's in It for Me?: What Everyone Needs to Know About the Affordable Care ActValutazione: 4 su 5 stelle4/5 (1)

- The New Income Tax Scandal: How the Income Tax Cheats Workers out of Million$ Each Year and the Corrupt Reasons Why This HappensDa EverandThe New Income Tax Scandal: How the Income Tax Cheats Workers out of Million$ Each Year and the Corrupt Reasons Why This HappensNessuna valutazione finora

- HTM 680 Practice FusionDocumento9 pagineHTM 680 Practice Fusionapi-307874398Nessuna valutazione finora

- Ashleyelisawinansresume032116web Docx 1Documento1 paginaAshleyelisawinansresume032116web Docx 1api-307874398Nessuna valutazione finora

- Running Head: FINAL EXAMDocumento7 pagineRunning Head: FINAL EXAMapi-307874398Nessuna valutazione finora

- Running Head: Organizational Is Budgeting 1Documento12 pagineRunning Head: Organizational Is Budgeting 1api-307874398Nessuna valutazione finora

- Running Header: Ethical Issues in Health It 1Documento6 pagineRunning Header: Ethical Issues in Health It 1api-307874398Nessuna valutazione finora

- Hca 663 Group Presentation 1Documento14 pagineHca 663 Group Presentation 1api-307874398Nessuna valutazione finora

- Hca 622 LeadershipDocumento7 pagineHca 622 Leadershipapi-307874398Nessuna valutazione finora

- 1 Data Analysis: Smoking and DeathDocumento9 pagine1 Data Analysis: Smoking and Deathapi-307874398Nessuna valutazione finora

- Htm660casestudy17 1Documento6 pagineHtm660casestudy17 1api-307874398Nessuna valutazione finora

- Mercyhospitalpatientportalproposal1 1Documento36 pagineMercyhospitalpatientportalproposal1 1api-307874398Nessuna valutazione finora

- Running Header: Iom: Quality in Health Care 1Documento20 pagineRunning Header: Iom: Quality in Health Care 1api-307874398Nessuna valutazione finora

- HTM 660 Final PresentationDocumento27 pagineHTM 660 Final Presentationapi-307874398Nessuna valutazione finora

- HTM 680 Lakeland HealthcareDocumento11 pagineHTM 680 Lakeland Healthcareapi-307874398Nessuna valutazione finora

- HTM 680 OpendoorfamilymedicalcentercasestudyDocumento6 pagineHTM 680 Opendoorfamilymedicalcentercasestudyapi-307874398Nessuna valutazione finora

- Hca 626 Casestudy 3Documento7 pagineHca 626 Casestudy 3api-307874398Nessuna valutazione finora

- Carpio, Dissenting in Estrada V EscriturDocumento8 pagineCarpio, Dissenting in Estrada V Escriturcmv mendoza100% (1)

- Conflict of Laws Course Outline Atty GravadorDocumento3 pagineConflict of Laws Course Outline Atty GravadorCarmii HoNessuna valutazione finora

- Bernaldez Vs FranciaDocumento6 pagineBernaldez Vs Franciaaljohn pantaleonNessuna valutazione finora

- Notice Fraud Upon The CourtDocumento12 pagineNotice Fraud Upon The CourtSovereign_King_3095100% (3)

- Ho Chi Minh On Revolution - Selected Writings, 1920-66Documento356 pagineHo Chi Minh On Revolution - Selected Writings, 1920-66Harmony-JazmyneSamiraRodriguez100% (6)

- Functional SchoolDocumento28 pagineFunctional SchoolJennifer Marie Columna BorbonNessuna valutazione finora

- Patriotspenentry 2015Documento2 paginePatriotspenentry 2015api-207571429Nessuna valutazione finora

- Oglesby v. Sanders - Document No. 3Documento1 paginaOglesby v. Sanders - Document No. 3Justia.comNessuna valutazione finora

- Constitutional Law - II Notes (Module-2)Documento30 pagineConstitutional Law - II Notes (Module-2)HarshitaNessuna valutazione finora

- Rajiv Shah Is Documented@Davos TranscriptDocumento4 pagineRajiv Shah Is Documented@Davos TranscriptDocumented at Davos 2011 - Presented by ScribdNessuna valutazione finora

- Interpretive Theories - Dworkin Sunstein and ElyDocumento26 pagineInterpretive Theories - Dworkin Sunstein and ElyChristopher J. Lin100% (1)

- 2022-Election-Guidelines-fin (3) (Edited)Documento5 pagine2022-Election-Guidelines-fin (3) (Edited)lielNessuna valutazione finora

- Citizenship and Immigration Law ProjectDocumento12 pagineCitizenship and Immigration Law ProjectakankshaNessuna valutazione finora

- BELLFRANC - Crew Application Form-1Documento2 pagineBELLFRANC - Crew Application Form-1ajay tandelNessuna valutazione finora

- Narrative Report DoneDocumento53 pagineNarrative Report DoneElaine BanezNessuna valutazione finora

- Stewart Blackmore (Labour) ManifestoDocumento6 pagineStewart Blackmore (Labour) ManifestoIWCPOnlineNessuna valutazione finora

- Great Depression WorksheetsDocumento3 pagineGreat Depression Worksheetsmrkastl901Nessuna valutazione finora

- World Economic Depression by Raghuram RajanDocumento2 pagineWorld Economic Depression by Raghuram RajanPrashant BahirgondeNessuna valutazione finora

- Appointment of DirectorDocumento4 pagineAppointment of DirectorPrakash LfadNessuna valutazione finora

- Relevancy of AdrDocumento16 pagineRelevancy of AdrRaj Krishna100% (1)

- PASEI v. TorresDocumento1 paginaPASEI v. TorresPierre AlvizoNessuna valutazione finora

- Corruption in KenyaDocumento3 pagineCorruption in KenyaAugustine MuindiNessuna valutazione finora

- DPSPDocumento12 pagineDPSPSheetal ShindeNessuna valutazione finora

- CPWD Circular 270619 1Documento1 paginaCPWD Circular 270619 1JaslinrajsrNessuna valutazione finora

- An Open Letter To Teamster Local 377 MembersDocumento7 pagineAn Open Letter To Teamster Local 377 MembersRebecca SmithNessuna valutazione finora

- Barangay Development Council (BDC)Documento2 pagineBarangay Development Council (BDC)Abdul Rafi Lomondaya100% (3)

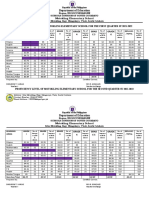

- Gwa 1st 2nd Quartersy2021 2022finalDocumento2 pagineGwa 1st 2nd Quartersy2021 2022finalJorell Jun de la PeñaNessuna valutazione finora

- Riph MidtermsDocumento11 pagineRiph Midtermskennpastor3Nessuna valutazione finora