Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

BRS Weekly Market Report - 22.01.2016

Caricato da

Jeewan WickramasooriyaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

BRS Weekly Market Report - 22.01.2016

Caricato da

Jeewan WickramasooriyaCopyright:

Formati disponibili

Weekly

Week III : 18th - 22th Jan 2016

BRS Weekly Market Report

BRS Market Report

Week III : 18th - 22nd Jan 2016

65, Braybrooke Place, Colombo 2, Sri Lanka research@bartleetreligare.com +94 11 5220200

Week III : 18th - 22th Jan 2016

BRS Weekly Market Report

The Week at a Glance

SL Market Indices

Current

Week

ASPI

Previous

Week

6,382.24

Change

(Points)

%

Change

-63.96

-0.99%

6,446.20

Current

Week

S&P SL20

Market closes 1% lower WoW

The market lost 185.02 points (-2.9%) during the first three days of trading,

continuing from last weeks downward trend. However, both indices started

to pick up during the latter part of the week and closed in green, mitigating

losses to a certain extent. On a WoW basis the benchmark ASPI lost 63.96

points (-1%) while the liquid S&P SL20 lost 24.77 points (-0.7%) to close at

6,382.24 and 3,315.36 respectively.

Previous

Week

3,315.36

3,340.13

Change

(Points)

%

Change

-24.77

-0.74%

Global Market Indices

Current

Week

15,882.68

16,151.41

-1.66%

NASDAQ

4,472.06

4,526.07

-1.19%

JKH continued as top turnover contributor

FTSE

5,894.94

5,873.95

0.36%

JKH contributed the highest to the weeks turnover amounting to LKR 791mn

largely aided by several negotiated deals on the stock. The market giant witnessed continuous drop in price during the week losing LKR 7.00 (-4.4%) WoW to

close at LKR 158.10. However, banking counter SAMP recovered LKR 5.70 (2.4%)

WoW to close at LKR 235.10 while most other banks closed lower and flat. The

BFI sector lost 1% overall WoW. Low valued counters in the likes of AAF, ALHP

and BIL too gained some attention during the week with their presence in the top

volume list.

DAX

9,771.11

9,802.04

-0.32%

NIFTY

7,420.45

7,566.45

-1.93%

HANG SENG

19,080.51

19,817.41

-3.72%

NIKKEI

16,958.53

17,240.95

-1.64%

Average daily turnover down 28% WoW

The week recorded a cumulative turnover of LKR 3.8bn resulting in an average daily turnover of LKR 760mn compared to LKR 973mn last week. A total

of 201mn shares changed hands via 31,632 trades while foreign volume constituted ~16% of total volume.

Foreign investors close as net sellers

Foreign participation was on a mixed note during the week, while total foreign purchases were recorded at LKR 985mn and total foreign sales at LKR

1.05bn. The week closed with net foreign outflow of LKR 64mn.

DOW JONES

Previous

%

Week Change

CSE Market Statistics

Current Week

Turnover LKR

3,802,452,378

Volume Shares

200,867,380

Foreign Purchases LKR

985,335,375

Foreign Sales LKR

1,048,903,983

Net In/Outflow LKR

(63,568,608)

All Share Price Index

6,500

6,450

6,400

6,349.71

6,350

6,300

6,324.61

SL FX Rates

6,283.24

6,382.24

6,250

6,261.18

6,200

6,150

Current

Value

Previous

Week

USD

146.02

145.89

0.09%

POUND

208.21

210.78

-1.22%

EURO

159.06

159.58

-0.33%

1.24

1.24

0.00%

YEN

6,100

18-Jan-16

19-Jan-16

20-Jan-16

21-Jan-16

22-Jan-16

%

Change

Week III : 18th - 22th Jan 2016

BRS Weekly Market Report

The Week at a Glance

Weekly Summary

MONDAY

TUESDAY

WEDNESDAY

THURSDAY

FRIDAY

All Share Index

6,324.61

6,283.24

6,261.18

6,349.71

6,382.24

S&P SL 20 Index

3,284.36

3,261.30

3,241.08

3,293.49

3,315.36

Equity Turnover (LKR)

812,727,144

765,325,926

606,949,438

986,893,510

630,556,360

Domestic Purchases (LKR)

705,221,711

568,107,131

561,756,427

497,714,372

484,317,364

Domestic Sales (LKR)

553,961,396

573,613,259

550,429,244

748,949,871

326,594,627

Foreign Purchases (LKR)

107,505,433

197,218,796

45,193,011

489,179,138

146,238,997

Foreign Sales (LKR)

258,765,748

191,712,668

56,520,194

237,943,639

303,961,734

Vol of Turnover

27,954,107

39,804,670

27,408,492

32,254,951

73,445,160

% Vol of Foreign Turnover

9.0%

5.8%

2.6%

24.4%

25.2%

Total no. of Trades

6,510

7,693

4,591

6,809

6,029

% of Foreign Trades

6.3%

5.0%

6.1%

4.9%

4.7%

2,699,675,491,065

2,682,019,927,154

2,672,604,226,785

2,710,391,657,600

2,724,277,641,242

Market Capitalization (LKR)

Foreign Purchases vs Sales

Net Position on Foreign Holdings

LKR mn

LKR mn

600

300

500

200

400

100

300

0

200

-100

100

-200

0

18-Jan-16

19-Jan-16

20-Jan-16

Foreign Purchases

21-Jan-16

22-Jan-16

18-Jan-16

Foreign Sales

WEEKLY CSE ANNOUNCEMENTS

NONE

19-Jan-16

20-Jan-16

21-Jan-16

22-Jan-16

Week III : 18th - 22th Jan 2016

BRS Weekly Market Report

The Week at a Glance

Top 5 Sector Gainers & Losers

3.4%

2.4%

Oil Palm sector

emerged as the top

sector loser during

the week

1.9%

0.8%

IT

SRV

F&T

PLT

OIL

C&P

MTR

TRD

-2.5%

-2.4%

-2.3%

C&E

-2.1%

-4.5%

Sector Multiples

SECTOR

BFI

BEV

C&P

C&E

DIV

F&T

HLT

PER (x)

10.1 19.9

16.2

19.8 17.7

N/A

28.7 131.1 10.1 N/A

9.7

18.4

9.7 125.1 30.0

9.3

56.2

14.1

14.9

8.7

PBV (x)

1.3

1.4

1.2

1.2

2.7

0.9

2.6

1.0

1.3

1.9

1.3

1.3

1.0

4.7

1.6

H&T

4.5

INV

0.9

IT

1.2

L&P MFG MTR

OIL

2.8

PLT

0.6

P&E SERV S&S TELCO TRD

Weekly Crossings

Code

No of Crossings

Total Shares

Price (LKR)

Monday

JKH

800,000

164.00 - 165.00

Tuesday

JKH

128,714

158.80

DIST

500,000

215.00

CHOT

10,515,875

30.00

DIAL

9,363,140

10.40

JKH

1,600,000

156.90 - 157.00

COMB

202,970

126.00

JKH

200,000

159.50

RAL

34,755,555

4.00

CTC

77,490

967.00

ALHP

5,714,400

3.50

Wednesday

Thursday

Friday

DIST gave the

highest

contribution to

Tuesdays turnover

supported by a

block deal

Abbreviations

B A NK S FINA NCE & I NSURANCE

B FI

CHE M I CA LS & P HA RM A

C&P

DIV E RSIFI E D

DIV

HE A LT HCA RE

HLT

INV E ST M E NT T RUST

B E V E RA GE FOOD & T OB A CCO

B FT

CONST RUCT ION & E NG

C&E

FOOT WE A R & T E X T ILE S

F&T

HOT E LS A ND T RA V E L

H&T

IT

IT

LA ND A ND P ROP E RT Y

L&P

M OT ORS

MTR

P LA NT A T I ONS

P LT

SERV I CE S

SRV

T E LE CO

T EL

M A NUFA CT URI NG

M FG

OI L P A LM S

OIL

P OWE R A ND E NE RGY

P &E

ST ORE S A ND SUP P LIE S

S&S

T RA DING

T RD

I NV

Week III : 18th - 22th Jan 2016

BRS Weekly Market Report

BRS Stocks in Focus

MPS

MTD

YTD

Historical

Trailing

Forecasted

Forward

DPS

Dividend

NAV

PBV

(LKR)

change %

Change %

EPS (LKR)

PER (x)

EPS (LKR)

PER (x)

(LKR)

Yield (%)

(LKR)

(x)

Banks, Finance & Insurance

CFIN

235.00

-7.11%

-7.11%

34.64

6.78

N/A

N/A

3.50

1.49%

231.84

1.01

CINS

1,400.00

-5.76%

-5.76%

96.46

14.51

N/A

N/A

20.00

1.43%

666.72

2.10

CINS(X)

779.90

-2.51%

-2.51%

96.46

8.09

N/A

N/A

20.00

2.56%

666.72

1.17

COMB

130.00

-7.28%

-7.28%

13.01

9.99

N/A

N/A

6.50

5.00%

76.00

1.71

COMB(X)

116.00

-5.69%

-5.69%

13.01

8.92

N/A

N/A

6.50

5.60%

76.00

1.53

DFCC

150.20

-10.65%

-10.65%

16.46

9.13

N/A

N/A

6.00

3.99%

180.72

0.83

HASU

65.00

-12.87%

-12.87%

8.35

7.78

N/A

N/A

3.75

5.77%

42.99

1.51

HNB

197.10

-6.41%

-6.41%

24.50

8.04

N/A

N/A

8.50

4.31%

164.72

1.20

HNB(X)

175.00

-1.63%

-1.63%

24.50

7.14

N/A

N/A

8.50

4.86%

164.72

1.06

NTB

79.00

-8.46%

-8.46%

10.31

7.66

N/A

N/A

2.10

2.66%

63.78

1.24

NDB

170.10

-12.36%

-12.36%

20.72

8.21

N/A

N/A

11.00

6.47%

170.70

1.00

SAMP

235.10

-5.20%

-5.20%

31.35

7.50

35.33

6.65

11.00

4.68%

207.35

1.13

SEYB

85.00

-10.53%

-10.53%

9.21

9.23

N/A

N/A

2.50

2.94%

74.88

1.14

SEYB(X)

64.80

-11.23%

-11.23%

9.21

7.04

N/A

N/A

2.50

3.86%

74.88

0.87

JINS

16.10

-8.00%

-8.00%

2.92

5.51

N/A

N/A

1.00

6.21%

11.59

1.39

CTC

967.00

-2.57%

-2.57%

46.01

21.02

62.65

15.43

39.50

4.08%

39.57

24.44

DIST

220.50

-10.37%

-10.37%

24.58

8.97

22.20

9.93

3.25

1.47%

208.92

1.06

NEST

2,000.00

-2.42%

-2.42%

70.49

28.37

85.86*

23.29

68.50

3.43%

84.43

23.69

100.10

-0.20%

-0.20%

8.04

12.45

11.80*

8.48

3.00

3.00%

80.08

1.25

80.00

-1.48%

-1.48%

8.04

9.95

11.80*

6.78

3.00

3.75%

80.08

1.00

140.90

-6.13%

-6.13%

4.05

34.79

14.67

9.60

3.00

2.13%

156.65

0.90

CARS

349.00

0.84%

0.84%

15.77

22.13

0.72*

484.72

1.00

0.29%

209.49

1.67

HAYL

298.00

-3.06%

-3.06%

34.42

8.66

30.72*

9.70

6.00

2.01%

398.30

0.75

HHL

82.00

-11.73%

-11.73%

3.74

21.93

3.66*

22.40

1.10

1.34%

35.55

2.31

JKH

158.10

-11.23%

-11.23%

11.37

13.91

11.61

13.62

3.50

2.21%

126.29

1.25

SPEN

87.00

-10.03%

-10.03%

6.60

13.18

3.84*

22.66

1.50

1.72%

50.75

1.71

SUN

55.90

5.08%

5.08%

3.97

14.08

3.56

12.80

0.95

1.70%

40.78

1.37

SUN

55.90

5.08%

5.08%

3.97

14.08

2.91

12.80

0.95

1.70%

16.55

1.37

Beverage, Food & Tobacco

Chemicals & Pharmaceuticals

CIC

CIC(X)

Construction & Engineering

DOCK

Diversified

1 Please note that the historical EPS represents the EPS reported for the last financial year, adjusted for non-recurring items, share splits,

bonuses and share consolidations.

2 * Annualized EPS

3 ** Companies who have paid both cash and scrip dividends during the last FY. However, DPS here only represents cash dividend

4 DPS figures represent per share dividend paid during the last FY and are adjusted for splits, bonus issues and share repurchases

Week III : 18th - 22th Jan 2016

BRS Weekly Market Report

BRS Stocks in Focus

MPS

MTD

YTD

Historical

Trailing

Forecasted

Forward

DPS

Dividend

NAV

PBV

(LKR)

change %

Change %

EPS (LKR)

PER (x)

EPS (LKR)

PER (x)

(LKR)

Yield (%)

(LKR)

(x)

Healthcare

CHL

100.50

-0.69%

-0.69%

8.13

12.36

N/A

2.70

2.69%

96.28

1.04

75.00

0.00%

0.00%

8.13

9.23

N/A

N/A

2.70

3.60%

96.28

0.78

AHPL

54.00

-8.63%

-8.63%

3.74

14.44

2.87

18.82

4.00

7.41%

53.00

1.02

AHUN

59.60

-12.35%

-12.35%

5.68

10.49

N/A

N/A

1.50

2.52%

50.96

1.17

CONN

63.00

-5.55%

-5.55%

4.78

13.18

N/A

N/A

5.00

7.94%

64.67

0.97

EDEN

16.50

-5.71%

-5.71%

(5.04)

N/M

N/A

N/A

0.00%

40.23

0.41

KHL

14.50

-5.84%

-5.84%

1.28

N/M

1.22

11.89

1.72%

14.39

1.01

PALM

38.00

-0.26%

-0.26%

(14.63)

N/M

N/A

N/A

0.00%

74.66

0.51

SHOT

32.00

-3.32%

-3.32%

1.83

17.49

N/A

N/A

0.00%

18.87

1.70

STAF

52.50

0.00%

0.00%

5.28

9.94

N/A

N/A

1.00

1.90%

42.38

1.24

ACL

109.90

-9.10%

-9.10%

14.35

7.66

10.00

10.99

1.00

0.91%

123.39

0.89

KCAB

121.50

-5.23%

-5.23%

14.78

8.22

16.00*

7.59

1.50

1.23%

126.56

0.96

LLUB

310.00

-9.88%

-9.88%

22.85

13.57

25.68

12.07

20.00

6.45%

52.12

5.95

LWL

96.20

-12.39%

-12.39%

19.12

5.03

20.72

4.64

4.00

4.16%

125.32

0.77

TJL

32.50

-8.45%

-8.45%

2.03

16.01

2.09

15.55

1.30

4.00%

13.03

2.49

RCL

98.50

-11.42%

-11.42%

18.97

5.19

18.08

5.45

5.00

5.08%

67.21

1.47

TKYO

39.50

-19.39%

-19.39%

5.40

7.31

6.00

6.58

0.00%

30.81

1.28

TKYO(X)

35.00

-11.39%

-11.39%

5.40

6.48

6.00

5.83

0.00%

30.81

1.14

DIAL

10.00

-6.54%

-6.54%

0.74

13.51

0.96*

10.42

0.13

1.30%

5.93

1.69

SLTL

40.00

-14.89%

-14.89%

2.81

14.23

3.72*

10.75

0.89

2.23%

36.66

1.09

AGAL

17.90

-12.68%

-12.68%

(23.58)

N/M

N/A

N/A

0.00%

21.23

0.84

KGAL

59.00

-11.28%

-11.28%

7.89

7.48

N/A

N/A

3.39%

102.24

0.58

KOTA

15.00

-15.73%

-15.73%

(11.05) N/M

N/A

N/A

0.00%

50.94

0.29

KVAL

70.00

0.00%

0.00%

(1.91) N/M

N/A

N/A

1.00

1.43%

74.80

0.94

MAL

2.90

-14.71%

-14.71%

(0.77) N/M

N/A

N/A

0.03

0.86%

72.81

0.24

WATA

20.80

-14.40%

-14.40%

1.72

12.09

N/A

N/A

0.50

2.40%

18.75

1.11

TPL

32.00

1.27%

1.27%

7.62

4.20

N/A

N/A

3.00

9.38%

68.13

0.47

LIOC

32.60

-12.13%

-12.13%

(1.23)

N/M

N/A

N/A

1.00

3.07%

32.65

1.00

HPWR

23.50

-6.00%

-6.00%

1.76

13.35

2.00*

11.75

0.00%

15.52

1.51

CHL(X)

N/A

Hotels & Travels

0.25

Manufacturing

Telecommunications

Plantations

2.00

-

Power & Energy

1 Please note that the historical EPS represents the EPS reported for the last financial year, adjusted for non-recurring items, share splits,

bonuses and share consolidations.

2 * Annualized EPS

3 ** Companies who have paid both cash and scrip dividends during the last FY. However, DPS here only represents cash dividend

4 DPS figures represent per share dividend paid during the last FY and are adjusted for splits, bonus issues and share repurchases

Week III : 18th - 22th Jan 2016

BRS Weekly Market Report

Contact Us

HOTLINE

+94 (0) 115 220 200

FAX

+94 (0) 112 434 985

Or visit us @ www.bartleetreligare.com

INSTITUTIONAL SALES

RETAIL SALES

Murali

(011)5220201/212

murali@bartleetreligare.com

Vajira

(011)5220217

vajira@bartleetreligare.com

Angelo

(011)5220207/214

angelo@bartleetreligare.com

Yusri

(011)5220224

ymm@bartleetreligare.com

Sujeewa

(011)5220213

sujeewa@bartleetreligare.com

Dhanushka

(011)5220222

dhanushka@bartleetreligare.com

Yadhavan

(011)5220215

yadhavan@bartleetreligare.com

Muditha

(011)5220226

muditha@bartleetreligare.com

Ahmadeen

(011)5220218

ahamadeen@bartleetreligare.com

Asitha

(011)5220209

asitha@bartleetreligare.com

Dilusha

(011)5220219

dilusha@bartleetreligare.com

Hiral

(011)5220275

hiral@bartleetreligare.com

nikita@bartleetreligare.com

Iresh

(011)5220274

iresh@bartleetreligare.com

Waruna

(011)5220277

dewaraja@bartleetreligare.com

RESEARCH

Nikita

(011)5260204

Nusrath

(011)5260210

nusrath@bartleetreligare.com

Jennita

(011)5260207

jennita@bartleetreligare.com

Thilini

(011)5260208

thilini@bartleetreligare.com

BUSINESS DEVELOPMENT

Ishan

(011)5260206

ishan@bartleetreligare.com

Suren

Sonali

(011)5260211

sonali@bartleetreligare.com

Vajirapanie

(011)5260206

vajirapanie@bartleetreligare.com

Lasan

(011)5260205

lasan@bartleetreligare.com

(011)5220216

suren@bartleetreligare.com

BRANCHES

Bandarwela

(0575)675083

Batticalo

(065)5679525

gireesan @bartleetreligare.com

Galle

(091)5633512

milindu@bartleetreligare.com

(057)2225537

indrajith@bartleetreligare.com

Jaffna

(021)2221800

(021)2220145

(021)5671115

mohan@bartleetreligare.com

Kandy

(081)5622779

(081)5622781

(081)2203710

dayananda@bartleetreligare.com

Kiribathgoda

(011)5238065

(011)2916711

(041)5410006

heshan@bartleetreligare.com

Matara

(041)5410005

Negombo

(031)5677838

Panadura

(038)2239610

Polonnaruwa

(027)5678995

mahesh@bartleetreligare.com

Vauniya

(024)5679544

mohan@bartleetreligare.com

Wellawatta

(011)5633733

upul@bartleetreligare.com

(041)2232985 (041)2234926

thilina@bartleetreligare.com

samith@bartleetreligare.com

(038)5678617

duminda@bartleetreligare.com

DISCLAIMER: In compiling this report, Bartleet Religare Securities (Pvt) Ltd has made every endeavour to ensure its accuracy but cannot hold ourselves

responsible for any errors that may be found herein. We further disclaim all responsibility for any loss or damage which may be suffered by any person

relying upon such information or any options, conclusions or recommendations herein whether that loss or damage is caused by any fault or negligence

in the part of Bartleet Religare Securities (Pvt) Limited.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- 2023 QS World University Rankings V2.1 (For Qs - Com)Documento37 pagine2023 QS World University Rankings V2.1 (For Qs - Com)Simo NoussairNessuna valutazione finora

- PMI - Services, December 2014Documento8 paginePMI - Services, December 2014Swedbank AB (publ)Nessuna valutazione finora

- EQ-5D-5L User GuideDocumento36 pagineEQ-5D-5L User GuideBernardo Cielo IINessuna valutazione finora

- Spss Part 4 Kebolehpercayaan InstrumenDocumento11 pagineSpss Part 4 Kebolehpercayaan InstrumensalNessuna valutazione finora

- Labour Index Base Year-2016 100Documento6 pagineLabour Index Base Year-2016 100Vikrant DeshmukhNessuna valutazione finora

- Economy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddeDocumento1.553 pagineEconomy Results Due To Faulty Legal System and Unjust State of Georgia Convictions On All 5 Counts of Banks' Cases of Innocent Srinivas VaddesvvpassNessuna valutazione finora

- Index NumberDocumento12 pagineIndex NumberKaness MathzNessuna valutazione finora

- Spdji Equity Rebalance CurrentDocumento1.540 pagineSpdji Equity Rebalance CurrenttHe lOsErNessuna valutazione finora

- Market IndicatorsDocumento7 pagineMarket Indicatorssantosh kumar mauryaNessuna valutazione finora

- Daftar Pekerja Yang Belum Mengerjakan Self Learning Materi: Kebijakan Human Capital Health Care Tanggal 6 Agustus 2020 Jam 9.00 WibDocumento5 pagineDaftar Pekerja Yang Belum Mengerjakan Self Learning Materi: Kebijakan Human Capital Health Care Tanggal 6 Agustus 2020 Jam 9.00 WibAbditama RezaNessuna valutazione finora

- WM/Reuters: F11 Exchange RatesDocumento23 pagineWM/Reuters: F11 Exchange RatesObert Charmany Waharika AnandaNessuna valutazione finora

- Anexo 3. C2 - Carlos Marx PDFDocumento5 pagineAnexo 3. C2 - Carlos Marx PDFLaura EscobarNessuna valutazione finora

- 2024 QS World University Rankings 1.1 (For Qs - Com)Documento36 pagine2024 QS World University Rankings 1.1 (For Qs - Com)arunkorath100% (1)

- Ind Nifty AutoDocumento2 pagineInd Nifty AutoDharmendra Singh GondNessuna valutazione finora

- Asi1718-Vol IIDocumento318 pagineAsi1718-Vol IIMeghal SivanNessuna valutazione finora

- Analisis Karakteristik Dan Potensi Daerah Serta Kebutuhan DaerahDocumento38 pagineAnalisis Karakteristik Dan Potensi Daerah Serta Kebutuhan DaerahFairuz WardatyNessuna valutazione finora

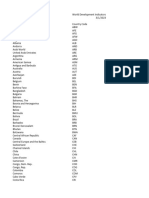

- Human Development IndexDocumento17 pagineHuman Development Indexritz meshNessuna valutazione finora

- PriceDocumento7 paginePriceVelmurugan ElumalaiNessuna valutazione finora

- API LP - Lpi.infr - XQ Ds2 en Excel v2 5269708Documento47 pagineAPI LP - Lpi.infr - XQ Ds2 en Excel v2 5269708Thúy HàNessuna valutazione finora

- Chapter 11IndexNo Tue09Documento8 pagineChapter 11IndexNo Tue09Bid HassanNessuna valutazione finora

- Transformers and Rectifiers IndiaDocumento26 pagineTransformers and Rectifiers IndiaPravesh RaoNessuna valutazione finora

- CPI2017 FullDataSetDocumento92 pagineCPI2017 FullDataSetEdmilson ValoiNessuna valutazione finora

- Excel Functions Live TestDocumento15 pagineExcel Functions Live TestAlex ButucaruNessuna valutazione finora

- Excel Work On HDIDocumento4 pagineExcel Work On HDISubhangi NandiNessuna valutazione finora

- Cpi FebDocumento34 pagineCpi FebSunetra DattaNessuna valutazione finora

- Stock Market IndicesDocumento13 pagineStock Market IndicesilyasNessuna valutazione finora

- Index NumbersDocumento16 pagineIndex NumbersMehdi HooshmandNessuna valutazione finora

- Consumer Price IndexDocumento3 pagineConsumer Price IndexRabeya KhanamNessuna valutazione finora

- Historical Cpi U 201806 PDFDocumento4 pagineHistorical Cpi U 201806 PDFslawiNessuna valutazione finora

- MIL CPI IW May 2021 EDocumento1 paginaMIL CPI IW May 2021 EAmit BharambeNessuna valutazione finora