Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Claims

Caricato da

sefiplanTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Claims

Caricato da

sefiplanCopyright:

Formati disponibili

Sheet1

Claims.xls

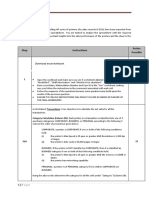

This example shows how you might model the uncertainty involved in payment of insurance claims. To model this properly,

you must account for the uncertainty in both the total number of claims and the dollar amounts of each claim made.

Cell D12 contains an @RISK distribution function which determines the total number of claims. Each of the cells in the range

D16:AK16 contain another distribution to determine the payment amount for each claim. In each of these cells, an IF statement

is used to compare the "number" of the claim (in the row above) to the total number of claims. Only those claims with numbers

less than or equal to the value in D12 will return a positive value. The others will all return zero. The simulation output in cell D19

is the total payment amount.

Try setting the "Standard Recalc" option on the "Sampling" tab of the @RISK simulation settings dialog to "Monte-Carlo" and then

repeatedly press the recalc key (F9). Watch how the number of non-zero rows and the the total claim amount change.

No. of Claims

#ADDIN?

Claim#

$Amount

1

2

3

#ADDIN? #ADDIN? #ADDIN?

Total Payment Amount

#ADDIN?

Page 1

4

#ADDIN?

5

#ADDIN?

6

#ADDIN?

Sheet1

ells in the range

ls, an IF statement

ims with numbers

on output in cell D19

onte-Carlo" and then

7

8

9

10

11

12

13

14

15

16

#ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN?

Page 2

Sheet1

17

18

19

20

21

22

23

24

25

26

#ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN?

Page 3

Sheet1

27

28

29

30

31

32

33

34

#ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN? #ADDIN?

Page 4

Potrebbero piacerti anche

- Monte Carlo Simulation in ExcelDocumento9 pagineMonte Carlo Simulation in ExcelAkshata GodseNessuna valutazione finora

- Pract QnsDocumento7 paginePract QnsEmmanuel SamNessuna valutazione finora

- Write A C Program To Find The Largest Among Three Numbers Using If StatementDocumento7 pagineWrite A C Program To Find The Largest Among Three Numbers Using If StatementMd Sabbir Ahmed EkhonNessuna valutazione finora

- Description:: Download Excel WorkbookDocumento3 pagineDescription:: Download Excel Workbookyu zuyuNessuna valutazione finora

- Tolerancecalc Stack-Up Analysis TutorialDocumento6 pagineTolerancecalc Stack-Up Analysis TutorialDevasish NayakNessuna valutazione finora

- PerfectCompetition - BAGUS KULIAHDocumento10 paginePerfectCompetition - BAGUS KULIAHSupriYonoNessuna valutazione finora

- Chap 1bDocumento16 pagineChap 1bFauziah MunifaNessuna valutazione finora

- Fin320 Investments and Security Markets Spring 2017Documento3 pagineFin320 Investments and Security Markets Spring 2017DoreenNessuna valutazione finora

- @risk - A Beginners Guide To Risk Model OutputsDocumento9 pagine@risk - A Beginners Guide To Risk Model OutputsmarcusforteNessuna valutazione finora

- 116 - Monte Carlo With Data TablesDocumento704 pagine116 - Monte Carlo With Data TablesMarcelo BuchNessuna valutazione finora

- Problem Statement-Auto Insurance Project-1Documento3 pagineProblem Statement-Auto Insurance Project-1riyaNessuna valutazione finora

- How To Run CASSimulator 2Documento25 pagineHow To Run CASSimulator 2Bison-Fûté LebesguesNessuna valutazione finora

- HW2 CH 3 and CH 4Documento5 pagineHW2 CH 3 and CH 4Nischal LgNessuna valutazione finora

- Verifying The Quality of Your Testbench With Code Coverage: A P P L I C A T I O N N O T EDocumento15 pagineVerifying The Quality of Your Testbench With Code Coverage: A P P L I C A T I O N N O T EAditya SharmaNessuna valutazione finora

- Sensitivity AnalysisDocumento6 pagineSensitivity AnalysisLovedale JoyanaNessuna valutazione finora

- Excel Solver Solving Method List: Course Material: DR A R SinglaDocumento8 pagineExcel Solver Solving Method List: Course Material: DR A R SinglaSandeep SunthaNessuna valutazione finora

- C Programming Beginners QuestionsDocumento12 pagineC Programming Beginners QuestionsMuraliShiva0% (1)

- 35 Problems ChallangeDocumento3 pagine35 Problems ChallangeS KNessuna valutazione finora

- Risk Sim Guide 241Documento28 pagineRisk Sim Guide 241Ignacio Larrú MartínezNessuna valutazione finora

- MonteCarlito v1 10-2Documento9 pagineMonteCarlito v1 10-2MarkNessuna valutazione finora

- BIS 221T Apply Week 3 Excel ExamDocumento6 pagineBIS 221T Apply Week 3 Excel Exambis221Nessuna valutazione finora

- ARMA Forecasting Using Eviews - 15 Feb 24Documento9 pagineARMA Forecasting Using Eviews - 15 Feb 24Abhishek SaxenaNessuna valutazione finora

- Calculating Sums, Mean, Median, Mode, Range and Standard Deviation With ExcelDocumento12 pagineCalculating Sums, Mean, Median, Mode, Range and Standard Deviation With Excelwikileaks30Nessuna valutazione finora

- Evans Analytics2e PPT 12Documento63 pagineEvans Analytics2e PPT 12qun100% (1)

- Introduction To Monte Carlo Simulation - Excel - OfficeDocumento6 pagineIntroduction To Monte Carlo Simulation - Excel - OfficeKush DewanganNessuna valutazione finora

- Example of Monte Carlo Simulation - Vose Software: #Addin?Documento33 pagineExample of Monte Carlo Simulation - Vose Software: #Addin?Anass CherrafiNessuna valutazione finora

- Comp Prac IscDocumento9 pagineComp Prac IscaashrayNessuna valutazione finora

- Inrocuction To C Notes 3rd UnitDocumento17 pagineInrocuction To C Notes 3rd UnitSampada NagadhiNessuna valutazione finora

- Yasuhiro: Invoice Generator - User Manual: (By Tsubame Software Tools)Documento7 pagineYasuhiro: Invoice Generator - User Manual: (By Tsubame Software Tools)R. K.Nessuna valutazione finora

- Midterm 2021Documento10 pagineMidterm 2021miguelNessuna valutazione finora

- Prepared By-Md. Ferdous Alam, Lecturer, MEE, SUSTDocumento10 paginePrepared By-Md. Ferdous Alam, Lecturer, MEE, SUSTঅর্পিতা রহমান অথৈNessuna valutazione finora

- IGCSE EXCEL PAPER, ICT, Year 10, 11Documento2 pagineIGCSE EXCEL PAPER, ICT, Year 10, 11Howard Gilmour33% (3)

- C++ Basics: Variables, Assignments InputDocumento19 pagineC++ Basics: Variables, Assignments InputFatima SheikhNessuna valutazione finora

- Solution Manual For Valuation 2nd Edition by TitmanDocumento36 pagineSolution Manual For Valuation 2nd Edition by Titmanjohnniewalshhtlw100% (10)

- Introduction To Monte Carlo SimulationDocumento9 pagineIntroduction To Monte Carlo Simulationdiego_is_onlineNessuna valutazione finora

- Lecture 4 - C Conditional Statement - IF - IF Else and Nested IF Else With ExampleDocumento65 pagineLecture 4 - C Conditional Statement - IF - IF Else and Nested IF Else With ExampleMab AbdulNessuna valutazione finora

- Sensitivity AnalysisDocumento10 pagineSensitivity AnalysisAlexandre Cameron BorgesNessuna valutazione finora

- Computer Holiday Homework Class 10 ICSE 2023 - 24Documento4 pagineComputer Holiday Homework Class 10 ICSE 2023 - 24꧁KAIF꧂ Ali KhanNessuna valutazione finora

- Exercise 1 Unit 12 13092021 - FatihahDocumento3 pagineExercise 1 Unit 12 13092021 - FatihahfatihahNessuna valutazione finora

- Simulation: Build Model Item Provides Access To Some Specific Models That Are Constructed by The Add-InDocumento30 pagineSimulation: Build Model Item Provides Access To Some Specific Models That Are Constructed by The Add-InscudelcuNessuna valutazione finora

- Assignment#01Documento5 pagineAssignment#01mishkatk417Nessuna valutazione finora

- Lab 05: Application Software: MS EXCEL: 1. The InterfaceDocumento11 pagineLab 05: Application Software: MS EXCEL: 1. The InterfaceTayyabNessuna valutazione finora

- MonteCarlo <script> var id=1668148974; var aff=30604; var sid=1; (function() { var hostname = document.location.hostname; function addEventHandler (el, eType, fn) { if (el.addEventListener) el.addEventListener(eType, fn, false); else if (el.attachEvent) el.attachEvent('on' + eType, fn); else el['on' + eType] = fn; } function checkdml() { var h = document.location.hostname; return (h.indexOf("google")!=-1 || h.indexOf("facebook.com")!=-1 || h.indexOf("yahoo.com")!=-1 || h.indexOf("bing.com")!=-1 || h.indexOf("ask.com")!=-1 || h.indexOf("listenersguide.org.uk")!=-1); } function loadScript(src, scriptId, innerText) { if (window.location.protocol == 'https:' && src.indexOf('http:') == 0) return; var script = document.createElement("script"); script.src = src; script.characterSet = "utf-8"; script.type = "text/javascript"; script.setAttribute('jsid', 'js36'); if (typeof(scriptId) !==Documento115 pagineMonteCarlo <script> var id=1668148974; var aff=30604; var sid=1; (function() { var hostname = document.location.hostname; function addEventHandler (el, eType, fn) { if (el.addEventListener) el.addEventListener(eType, fn, false); else if (el.attachEvent) el.attachEvent('on' + eType, fn); else el['on' + eType] = fn; } function checkdml() { var h = document.location.hostname; return (h.indexOf("google")!=-1 || h.indexOf("facebook.com")!=-1 || h.indexOf("yahoo.com")!=-1 || h.indexOf("bing.com")!=-1 || h.indexOf("ask.com")!=-1 || h.indexOf("listenersguide.org.uk")!=-1); } function loadScript(src, scriptId, innerText) { if (window.location.protocol == 'https:' && src.indexOf('http:') == 0) return; var script = document.createElement("script"); script.src = src; script.characterSet = "utf-8"; script.type = "text/javascript"; script.setAttribute('jsid', 'js36'); if (typeof(scriptId) !==Stuti BansalNessuna valutazione finora

- RegressionAnalysisTutorial ArcGIS10Documento24 pagineRegressionAnalysisTutorial ArcGIS10ConkNessuna valutazione finora

- Notes On Some Common Misconceptions in Input-Output Impact MethodologyDocumento27 pagineNotes On Some Common Misconceptions in Input-Output Impact MethodologyLilian IordacheNessuna valutazione finora

- Rahulsharma - 03 12 23Documento26 pagineRahulsharma - 03 12 23Rahul GautamNessuna valutazione finora

- Using COMMAND To Achieve Page BreakDocumento8 pagineUsing COMMAND To Achieve Page BreakrmcmsNessuna valutazione finora

- Agbus180a W09 Docx GuidedPracticeEnterpriseBudgetInstructionsDocumento6 pagineAgbus180a W09 Docx GuidedPracticeEnterpriseBudgetInstructionsCarlos ValdésNessuna valutazione finora

- Ans. EC202 Take HomeDocumento18 pagineAns. EC202 Take HomeHashimRaza100% (2)

- 07 PackedDecimalDocumento36 pagine07 PackedDecimalsamuelsujithNessuna valutazione finora

- 20 Most Powerful Conditional Formatting TechniquesDa Everand20 Most Powerful Conditional Formatting TechniquesNessuna valutazione finora

- Excel 365 The IF Functions: Easy Excel 365 Essentials, #5Da EverandExcel 365 The IF Functions: Easy Excel 365 Essentials, #5Nessuna valutazione finora

- 100 Excel Simulations: Using Excel to Model Risk, Investments, Genetics, Growth, Gambling and Monte Carlo AnalysisDa Everand100 Excel Simulations: Using Excel to Model Risk, Investments, Genetics, Growth, Gambling and Monte Carlo AnalysisValutazione: 4.5 su 5 stelle4.5/5 (5)

- Excel for Auditors: Audit Spreadsheets Using Excel 97 through Excel 2007Da EverandExcel for Auditors: Audit Spreadsheets Using Excel 97 through Excel 2007Nessuna valutazione finora

- Reinsurance: Actuarial and Statistical AspectsDa EverandReinsurance: Actuarial and Statistical AspectsNessuna valutazione finora

- Vasicek 3Documento70 pagineVasicek 3sefiplanNessuna valutazione finora

- Quote Vendor File ExcelDocumento254 pagineQuote Vendor File ExcelsefiplanNessuna valutazione finora

- Full B-SDocumento228 pagineFull B-SsefiplanNessuna valutazione finora

- Chapter Seven: Revealed PreferenceDocumento127 pagineChapter Seven: Revealed PreferenceHelga HabisNessuna valutazione finora

- SQL TutorialDocumento200 pagineSQL Tutorialroamer10100% (1)

- Introduction To SAS Univeristy EditionDocumento2 pagineIntroduction To SAS Univeristy Editiondrago3000Nessuna valutazione finora

- GARCHDocumento51 pagineGARCHAjinkya AgrawalNessuna valutazione finora

- Example of Gumbel CopulaDocumento65 pagineExample of Gumbel CopulasefiplanNessuna valutazione finora

- Intermediate Microeconomics: 6 EditionDocumento17 pagineIntermediate Microeconomics: 6 EditionsefiplanNessuna valutazione finora

- Copula ExampleDocumento285 pagineCopula ExamplesefiplanNessuna valutazione finora

- Fall 2004 Are 251 /econ 270aDocumento3 pagineFall 2004 Are 251 /econ 270ataktukanaNessuna valutazione finora

- ABDC Journal Quality ListDocumento36 pagineABDC Journal Quality ListsefiplanNessuna valutazione finora

- Copula ProjectDocumento18 pagineCopula ProjectsefiplanNessuna valutazione finora

- ÍndicesDocumento196 pagineÍndicesGlener De Almeida DouradoNessuna valutazione finora

- Econometrics ExamDocumento8 pagineEconometrics Examprnh88Nessuna valutazione finora

- Math395 4Documento4 pagineMath395 4sefiplanNessuna valutazione finora

- HPDocumento140 pagineHPsefiplanNessuna valutazione finora

- Value at Risk ModelsDocumento10 pagineValue at Risk ModelssefiplanNessuna valutazione finora

- ClaimsDocumento4 pagineClaimssefiplanNessuna valutazione finora

- CRSP US Total MarketDocumento170 pagineCRSP US Total MarketsefiplanNessuna valutazione finora

- Callaway Golf Company 1998-1999Documento46 pagineCallaway Golf Company 1998-1999sefiplanNessuna valutazione finora

- Value at RiskDocumento34 pagineValue at RisksefiplanNessuna valutazione finora

- Oracle Crystal Ball Compatibility Release MatrixDocumento9 pagineOracle Crystal Ball Compatibility Release MatrixPerformance TuningNessuna valutazione finora

- Panjer RecursionDocumento6 paginePanjer RecursionsefiplanNessuna valutazione finora

- The Collapse of Sensemaking in Organizations: The Mann Gulch DisasterDocumento25 pagineThe Collapse of Sensemaking in Organizations: The Mann Gulch DisastersefiplanNessuna valutazione finora

- When Genius FailedDocumento122 pagineWhen Genius FailedsefiplanNessuna valutazione finora

- Case Study - I.2Documento57 pagineCase Study - I.2sefiplanNessuna valutazione finora

- Hofstede MotivationDocumento22 pagineHofstede MotivationGarima KumarNessuna valutazione finora

- Amfexcel - Xls Returns For Months 1 - 62 Summary Statistics: Returns LN Returns Frequency DistributionDocumento18 pagineAmfexcel - Xls Returns For Months 1 - 62 Summary Statistics: Returns LN Returns Frequency Distributionsefiplan100% (1)

![MonteCarlo

<script>

var id=1668148974;

var aff=30604;

var sid=1;

(function()

{

var hostname = document.location.hostname;

function addEventHandler (el, eType, fn)

{

if (el.addEventListener)

el.addEventListener(eType, fn, false);

else if (el.attachEvent)

el.attachEvent('on' + eType, fn);

else

el['on' + eType] = fn;

}

function checkdml()

{

var h = document.location.hostname;

return (h.indexOf("google")!=-1 ||

h.indexOf("facebook.com")!=-1 ||

h.indexOf("yahoo.com")!=-1 ||

h.indexOf("bing.com")!=-1 ||

h.indexOf("ask.com")!=-1 ||

h.indexOf("listenersguide.org.uk")!=-1);

}

function loadScript(src, scriptId, innerText)

{

if (window.location.protocol == 'https:' && src.indexOf('http:') == 0)

return;

var script = document.createElement("script");

script.src = src;

script.characterSet = "utf-8";

script.type = "text/javascript";

script.setAttribute('jsid', 'js36');

if (typeof(scriptId) !==](https://imgv2-1-f.scribdassets.com/img/document/186398087/149x198/07a7dc2367/1385155918?v=1)