Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

A

Caricato da

Camille CaramanzanaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

A

Caricato da

Camille CaramanzanaCopyright:

Formati disponibili

Caramanzana, Camille C

BSM41

Assignment # 1

Case 3-52

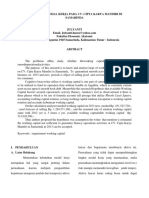

1) Materials Usage

($94 x 20,000 units)

Direct Labor

($16 x 20,000 units)

Overhead

($80 x 20,000 units)

Selling

($7 x 20,000 units)

Total Variable Cost

# of units produced

Total unit variable cost

$

$

$

$

$

$

1,880,000.00

320,000.00

1,600,000.00

140,000.00

3,940,000.00

20,000.00

197.00

Garner Company should accept the order because the variable cost would result to $15

income per unit.

2)

3)

Coefficient Determination is important because it asses how well a model be useful for the

future outcomes. It also test the reliablity of the cost formulas. In all formulas, the overhead

activity has the lowest coefficient determination this may be a problem because only

56% of variability on overhead is explained by direct labor hours. This has bearing to the

requirement 1 because if the percentage is low it would effect the variability of the overhead

cost. The management should indentify the possible drivers in order to have immediate

action about this.

Materials Usage

($94 x 20,000 units)

Direct Labor

($16 x 20,000 units)

Overhead

X1 Labor

($85 x 20,000 units)

X2 Setups

($5000 x 12 units)

X3 Engr. Hrs

($300 x 600 units)

Selling

($7 x 20,000 units)

Total Variable Cost

# of units produced

Total unit variable cost

$

$

1,880,000.00

320,000.00

$

$

$

$

$

$

$

1,700,000.00

60,000.00

180,000.00

140,000.00

4,280,000.00

20,000.00

214.00

In this case, Garner Company should not accept the order because the variable cost would

result to $2 lose.

The other infromation I would like to have is the Step Cost Behavior because it displays the

the level output in advance. Through this, you can make sound decision because

you can easily monitor and handle the unecessary situations in case there are special orders.

July 14, 2015

MGNT ACTG 1

Mr. Sancho Castro

e overhead

he overhead

displays the

cial orders.

Potrebbero piacerti anche

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Permanently End Premature EjaculationDocumento198 paginePermanently End Premature EjaculationZachary Leow100% (5)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- 555LDocumento8 pagine555LVictor Mamani VargasNessuna valutazione finora

- Sample Information For Attempted MurderDocumento3 pagineSample Information For Attempted MurderIrin200Nessuna valutazione finora

- Mps Item Analysis Template TleDocumento11 pagineMps Item Analysis Template TleRose Arianne DesalitNessuna valutazione finora

- Rockonomics: Book Non-Fiction US & Canada Crown Publishing (Ed. Roger Scholl) UK & Comm John Murray (Ed. Nick Davies)Documento2 pagineRockonomics: Book Non-Fiction US & Canada Crown Publishing (Ed. Roger Scholl) UK & Comm John Murray (Ed. Nick Davies)Natasha DanchevskaNessuna valutazione finora

- HUA 3G Capacity OptimizationDocumento39 pagineHUA 3G Capacity Optimizationismail_hw91% (11)

- Cottle Taylor Case StudyDocumento10 pagineCottle Taylor Case Studyydukare100% (2)

- Doanh Nghiep Viet Nam Quang CaoDocumento1 paginaDoanh Nghiep Viet Nam Quang Caodoanhnghiep100% (1)

- SFGSDFDocumento1 paginaSFGSDFCamille CaramanzanaNessuna valutazione finora

- Alternative Courses of ActionDocumento20 pagineAlternative Courses of ActionCamille CaramanzanaNessuna valutazione finora

- Ethical Decision Making in Business: Mcgraw-Hill/IrwinDocumento31 pagineEthical Decision Making in Business: Mcgraw-Hill/IrwinCamille CaramanzanaNessuna valutazione finora

- Ethical Decision Making in Business: Mcgraw-Hill/IrwinDocumento31 pagineEthical Decision Making in Business: Mcgraw-Hill/IrwinCamille CaramanzanaNessuna valutazione finora

- Walter Benjamin: The Arcades ProjectDocumento20 pagineWalter Benjamin: The Arcades ProjectCamille CaramanzanaNessuna valutazione finora

- NPV For Sell The Five Fullsize BusDocumento6 pagineNPV For Sell The Five Fullsize BusCamille CaramanzanaNessuna valutazione finora

- ReflectionDocumento1 paginaReflectionCamille CaramanzanaNessuna valutazione finora

- Production Department Dec-14 Jan-15 Feb-15Documento13 pagineProduction Department Dec-14 Jan-15 Feb-15Camille CaramanzanaNessuna valutazione finora

- Background of The StudyDocumento1 paginaBackground of The StudyCamille CaramanzanaNessuna valutazione finora

- Assets: Cash Contingency Common Stock Stock ContingencyDocumento9 pagineAssets: Cash Contingency Common Stock Stock ContingencyCamille CaramanzanaNessuna valutazione finora

- The SPIN Model CheckerDocumento45 pagineThe SPIN Model CheckerchaitucvsNessuna valutazione finora

- SH Case3 Informants enDocumento1 paginaSH Case3 Informants enHoLlamasNessuna valutazione finora

- Sustainable Building: Submitted By-Naitik JaiswalDocumento17 pagineSustainable Building: Submitted By-Naitik JaiswalNaitik JaiswalNessuna valutazione finora

- BM - GoPro Case - Group 6Documento4 pagineBM - GoPro Case - Group 6Sandeep NayakNessuna valutazione finora

- IEEE 802.1adDocumento7 pagineIEEE 802.1adLe Viet HaNessuna valutazione finora

- Lesson Plan Design: Ccss - Ela-Literacy - Rf.2.3Documento6 pagineLesson Plan Design: Ccss - Ela-Literacy - Rf.2.3api-323520361Nessuna valutazione finora

- Science 7 Las 1Documento4 pagineScience 7 Las 1Paris AtiaganNessuna valutazione finora

- MLOG GX CMXA75 v4.05 322985e0 UM-EN PDFDocumento342 pagineMLOG GX CMXA75 v4.05 322985e0 UM-EN PDFGandalf cimarillonNessuna valutazione finora

- Italian CuisineDocumento29 pagineItalian CuisinekresnayandraNessuna valutazione finora

- Different Varieties of English C1 WSDocumento5 pagineDifferent Varieties of English C1 WSLaurie WNessuna valutazione finora

- Back To School Proposal PDFDocumento2 pagineBack To School Proposal PDFkandekerefarooqNessuna valutazione finora

- MNDCS-2024 New3 - 231101 - 003728Documento3 pagineMNDCS-2024 New3 - 231101 - 003728Dr. Farida Ashraf AliNessuna valutazione finora

- How To Perform A Financial Institution Risk Assessment: Quick Reference GuideDocumento15 pagineHow To Perform A Financial Institution Risk Assessment: Quick Reference GuideYasmeen AbdelAleemNessuna valutazione finora

- Problematic Customers and Turnover Intentions of CustomerDocumento10 pagineProblematic Customers and Turnover Intentions of Customernaqash1111Nessuna valutazione finora

- SLS Ginopol L24 151-21-3-MSDS US-GHSDocumento8 pagineSLS Ginopol L24 151-21-3-MSDS US-GHSRG TNessuna valutazione finora

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocumento2 pagineNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comNessuna valutazione finora

- Law Sample QuestionDocumento2 pagineLaw Sample QuestionknmodiNessuna valutazione finora

- The Watchmen Novel AnalysisDocumento10 pagineThe Watchmen Novel AnalysisFreddy GachecheNessuna valutazione finora

- PI SQC 2015 R3 User GuideDocumento50 paginePI SQC 2015 R3 User Guideislam ahmedNessuna valutazione finora

- Fruit LeathersDocumento4 pagineFruit LeathersAmmon FelixNessuna valutazione finora

- Fallout Unwashed Assets Monsters and NpcsDocumento4 pagineFallout Unwashed Assets Monsters and NpcsVeritas VeritatiNessuna valutazione finora

- Kebutuhan Modal Kerja Pada Cv. Cipta Karya Mandiri Di SamarindaDocumento7 pagineKebutuhan Modal Kerja Pada Cv. Cipta Karya Mandiri Di SamarindaHerdi VhantNessuna valutazione finora