Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

(A Division of Achievers Academy) Sub: - CB DATE: - 10/03/15 Time: - 2 Hrs MARKS: 75

Caricato da

sameer_kiniTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

(A Division of Achievers Academy) Sub: - CB DATE: - 10/03/15 Time: - 2 Hrs MARKS: 75

Caricato da

sameer_kiniCopyright:

Formati disponibili

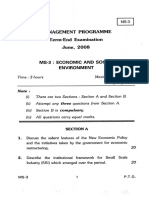

(A Division of Achievers Academy)

SUB: - CB

TIME: - 2 HRS

DATE: - 10/03/15

MARKS: 75

N.B. (1) Attempt all questions.

(2) Figures to right indicate marks allotted to each question.

Q.1. a) Explain the important functions of Central Bank.

(8)

b) Explain the changing role of monetary policy in an open economy.

(7)

OR

Q.1) Explain the transparency and accountability of central bank and explain RBIs conflicts

with fiscal policies.

(15)

Q.2. a) Explain the recent developments with reference to RBI.

(8)

b) Explain the important provisions of banking regulation act.

(7)

OR

Q.2. c) Explain the major organizational and functional developments of RBI

(8)

d) What are financial sector reforms?

(7)

Q.3. a) Explain the instruments of monetary policy.

(8)

b) Explain the process of multiple credit creation by commercial banks.

(7)

OR

Q.3. c) Why budgets are important for the government? Explain role of union budget in the

economic development of India.

(8)

d) What are the advantages and limitations of credit?

Q.4) Explain the constituents of Indian Financial Market.

(7)

(15)

OR

Q.4) What is financial stability? What are the reasons for financial instability in an

economy?

(15)

Q.5) Write short notes: (Any three)

a. Prudential Norms

b. Development of Financial Market

c. NABARD

d. Credit Authorization Scheme

e. Grant-in Aid

Prof. Agarwals Achievers Tutorial / TYBBI / CB.

(15)

Page 1

Potrebbero piacerti anche

- Econ1102 Macroeconomics 1 Sample Exam QuestionsDocumento2 pagineEcon1102 Macroeconomics 1 Sample Exam Questionschristine_liu0110100% (2)

- (A Division of Achievers Academy) SUB: - 01/04/15 TIME: - 2 Hrs 75Documento2 pagine(A Division of Achievers Academy) SUB: - 01/04/15 TIME: - 2 Hrs 75sameer_kiniNessuna valutazione finora

- Gujarat Technological University: InstructionsDocumento1 paginaGujarat Technological University: InstructionsFaisal Malek0% (1)

- The Money Market Is Fully Organized and Under The Control of The RBIDocumento2 pagineThe Money Market Is Fully Organized and Under The Control of The RBISunil RawatNessuna valutazione finora

- (A Division of Achievers Academy) Sub: - SM DATE: - 27/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) Sub: - SM DATE: - 27/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- Great Zimbabwe University Faculty of Commerce: Department of Accounting & FinanceDocumento2 pagineGreat Zimbabwe University Faculty of Commerce: Department of Accounting & FinanceARCHIBALDNessuna valutazione finora

- Commerce Bcom Banking and Insurance Semester 6 2023 April Central Banking CbcgsDocumento3 pagineCommerce Bcom Banking and Insurance Semester 6 2023 April Central Banking Cbcgsankityadav13heroNessuna valutazione finora

- BEC 3357 Monetary Theory PracticeDocumento2 pagineBEC 3357 Monetary Theory Practicekassimmakoy05Nessuna valutazione finora

- 2003 Anna University M.B.A Production Management Question PaperDocumento3 pagine2003 Anna University M.B.A Production Management Question PapervickysparkNessuna valutazione finora

- Third Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BDocumento18 pagineThird Semester Master of Business Administration (MBA) Examination Entrepernurial Development Paper II Section BTHE MANAGEMENT CONSORTIUM (TMC) ‘All for knowledge, and knowledge for all’Nessuna valutazione finora

- Jan 1006 AL61 MEDocumento1 paginaJan 1006 AL61 MESiddangouda PatilNessuna valutazione finora

- Nov-2019 CBDocumento3 pagineNov-2019 CBDeepika. BabuNessuna valutazione finora

- (A Division of Achievers Academy) SUB: - DATE: - 26/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) SUB: - DATE: - 26/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- Befa Important QuestionsDocumento5 pagineBefa Important Questionskruthi reddyNessuna valutazione finora

- Managerial Economics and Financial AnalysisDocumento4 pagineManagerial Economics and Financial Analysissrihari100% (1)

- APRIL 2012 M. Com. (Semester - IV) (Compulsory) Examination - 2012Documento3 pagineAPRIL 2012 M. Com. (Semester - IV) (Compulsory) Examination - 2012kavitachordiya86Nessuna valutazione finora

- Financial Management Important QuestionsDocumento3 pagineFinancial Management Important QuestionsSaba TaherNessuna valutazione finora

- R7210505 Managerial Economics and Financial AnalysisDocumento1 paginaR7210505 Managerial Economics and Financial AnalysissivabharathamurthyNessuna valutazione finora

- Mba Iv EdDocumento2 pagineMba Iv Edshirin29590Nessuna valutazione finora

- CE2451-Engineering Economics Cost AnalysisDocumento9 pagineCE2451-Engineering Economics Cost AnalysisAnban GunaNessuna valutazione finora

- IFS Suggested Questions by GKJDocumento5 pagineIFS Suggested Questions by GKJNayanNessuna valutazione finora

- BB0022 Capital and Money MarketDocumento2 pagineBB0022 Capital and Money MarketArvind KNessuna valutazione finora

- 2019-JAIBB PBE JulyDocumento1 pagina2019-JAIBB PBE Julyfarhadcse30Nessuna valutazione finora

- Ldce Questions 2001Documento73 pagineLdce Questions 2001Anurag KumarNessuna valutazione finora

- DBA7103 - Economics Ananlysis For BusinessDocumento20 pagineDBA7103 - Economics Ananlysis For BusinessThanigaivel KNessuna valutazione finora

- (A Division of Achievers Academy) Sub: - SM DATE: - 12/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) Sub: - SM DATE: - 12/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- The Story of A ME PaperDocumento1 paginaThe Story of A ME PaperputrastesuNessuna valutazione finora

- (Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDocumento8 pagine(Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalsaymtrNessuna valutazione finora

- Practice-Model Question Set I - Indian EconomyDocumento4 paginePractice-Model Question Set I - Indian EconomyLata BinaniNessuna valutazione finora

- IFS Suggestion GKJDocumento6 pagineIFS Suggestion GKJAN-DROID GAMER RATULNessuna valutazione finora

- SIWS Accounting of Banking Sector Modues 1 and 2Documento1 paginaSIWS Accounting of Banking Sector Modues 1 and 2ansarimukkarram2Nessuna valutazione finora

- Gujarat Technological University: InstructionsDocumento1 paginaGujarat Technological University: InstructionsVasim ShaikhNessuna valutazione finora

- BBK203Documento1 paginaBBK203abhishekgupta_limNessuna valutazione finora

- MEFA Important QuestionsDocumento14 pagineMEFA Important Questionstulasinad123Nessuna valutazione finora

- Economics Question BankDocumento39 pagineEconomics Question BankAnish KumarNessuna valutazione finora

- (Question Papers) RBrtI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDocumento10 pagine(Question Papers) RBrtI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) Mrunalguru1241987babuNessuna valutazione finora

- Economics: SECTION A (40 Marks)Documento3 pagineEconomics: SECTION A (40 Marks)Johnny MurrayNessuna valutazione finora

- Instructions: Attempt Any FIVE Questions. Each Question Carries Equal MarksDocumento1 paginaInstructions: Attempt Any FIVE Questions. Each Question Carries Equal MarksNajabat Ali RanaNessuna valutazione finora

- End Term E Mination: N: A e A L Est o S S e C Ceg VeDocumento1 paginaEnd Term E Mination: N: A e A L Est o S S e C Ceg VeSoumen PaulNessuna valutazione finora

- KASNEB - Aug 2009 To Nov 2010Documento13 pagineKASNEB - Aug 2009 To Nov 2010Josephe Mwinizi50% (2)

- (WWW - Entrance-Exam - Net) - Mumbai University B.com Sample Paper 5Documento1 pagina(WWW - Entrance-Exam - Net) - Mumbai University B.com Sample Paper 5RebeccaNandaNessuna valutazione finora

- Management Programme Term-End Examination June, 2OO8Documento4 pagineManagement Programme Term-End Examination June, 2OO8skandamjNessuna valutazione finora

- Financial Awareness by Das Sir, Kolkata (09038870684)Documento23 pagineFinancial Awareness by Das Sir, Kolkata (09038870684)Tamal Kumar DasNessuna valutazione finora

- (Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalDocumento4 pagine(Question Papers) RBI Grade "B" Officers - Finance and Management Papers of Last 8 Exams (Phase 2) MrunalakurilNessuna valutazione finora

- BEC 3303 Economics of MoneyDocumento2 pagineBEC 3303 Economics of MoneyKelvin MagiriNessuna valutazione finora

- WWW - Manares U L Ts - Co.InDocumento5 pagineWWW - Manares U L Ts - Co.InRashmi SharmaNessuna valutazione finora

- Maharana Pratap College of Professional Studies Pre University Examination BBA (Sem. 4) Production ManagementDocumento5 pagineMaharana Pratap College of Professional Studies Pre University Examination BBA (Sem. 4) Production ManagementJyoti SinghNessuna valutazione finora

- Question Bank Subject Name: Macro Economics Subject Code: CML5104 Attempt All Questions. Section A 1. Define The FollowingDocumento2 pagineQuestion Bank Subject Name: Macro Economics Subject Code: CML5104 Attempt All Questions. Section A 1. Define The FollowingAlisha SharmaNessuna valutazione finora

- RBI Grade B Descriptive Paper Previous Year BankpoDocumento3 pagineRBI Grade B Descriptive Paper Previous Year BankpoVijay KumarNessuna valutazione finora

- Q. A. Credit Rating Agencies Over The Last Two Decades Have Gained Popularity. Explain The Nature and Role of The Credit Rating Agencies. Q. B. State Any TWO Types of Credit Ratings That ExistDocumento2 pagineQ. A. Credit Rating Agencies Over The Last Two Decades Have Gained Popularity. Explain The Nature and Role of The Credit Rating Agencies. Q. B. State Any TWO Types of Credit Ratings That ExistIhtisham UL HaqNessuna valutazione finora

- (4870) - 3005 M.B.A - Ii Marketing Spl. 306 - MKT: Consumer Behaviour (2013 Pattern) (Semester-III)Documento2 pagine(4870) - 3005 M.B.A - Ii Marketing Spl. 306 - MKT: Consumer Behaviour (2013 Pattern) (Semester-III)Pritesh Padamkumar GandhiNessuna valutazione finora

- P. G. D. B. M. (Semester - I) Examination - 2010: InstructionsDocumento77 pagineP. G. D. B. M. (Semester - I) Examination - 2010: InstructionsyaminididiNessuna valutazione finora

- Gujarat Technological UniversityDocumento1 paginaGujarat Technological UniversityFaisal MalekNessuna valutazione finora

- BBB 2406 Money and Banking Year Iv Semester IIDocumento1 paginaBBB 2406 Money and Banking Year Iv Semester IIprittycarol8Nessuna valutazione finora

- 0102 Managerial Economics and Financial AnalysisDocumento7 pagine0102 Managerial Economics and Financial AnalysisFozia PanhwerNessuna valutazione finora

- Managerial Economics and Financial AnalysisDocumento1 paginaManagerial Economics and Financial AnalysisLakshman ReddyNessuna valutazione finora

- CFI 5115 QuestionsDocumento9 pagineCFI 5115 QuestionsFungai Mukundiwa0% (1)

- PDC Question PapersDocumento56 paginePDC Question Paperssatyakar_vvkNessuna valutazione finora

- Financial Soundness Indicators for Financial Sector Stability in Viet NamDa EverandFinancial Soundness Indicators for Financial Sector Stability in Viet NamNessuna valutazione finora

- Harmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportDa EverandHarmonization and Standardization of Bond Market Infrastructures in ASEAN+3: ASEAN+3 Bond Market Forum Sub-Forum 2 Phase 3 ReportNessuna valutazione finora

- Prelim TimetableDocumento2 paginePrelim Timetablesameer_kiniNessuna valutazione finora

- Chapter 6Documento52 pagineChapter 6sameer_kiniNessuna valutazione finora

- Sub: Detailed Bifurcation of The Fees Paid For 2014-15Documento1 paginaSub: Detailed Bifurcation of The Fees Paid For 2014-15sameer_kiniNessuna valutazione finora

- Module 7: Object-Oriented ProgrammingDocumento27 pagineModule 7: Object-Oriented Programmingsameer_kiniNessuna valutazione finora

- IBF Q'sDocumento2 pagineIBF Q'ssameer_kiniNessuna valutazione finora

- Session1 TP1Documento19 pagineSession1 TP1sameer_kiniNessuna valutazione finora

- (A Division of Achievers Academy) SUB: - DATE: - 26/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) SUB: - DATE: - 26/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- (A Division of Achievers Academy) Sub: - Ib DATE: - 11/03/15 Time: - 2 Hrs MARKS: 75Documento2 pagine(A Division of Achievers Academy) Sub: - Ib DATE: - 11/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- Fgs Classes - Notice - Prelim Exam (Bcom, Bbi, Baf, BMS)Documento3 pagineFgs Classes - Notice - Prelim Exam (Bcom, Bbi, Baf, BMS)sameer_kiniNessuna valutazione finora

- (A Division of Achievers Academy) SUB: - DATE: - 13/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) SUB: - DATE: - 13/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- (A Division of Achievers Academy) Sub: - SM DATE: - 12/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) Sub: - SM DATE: - 12/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- Test Series Timetable 2014 - 2015Documento14 pagineTest Series Timetable 2014 - 2015sameer_kiniNessuna valutazione finora

- P1 - HRM - 75Documento1 paginaP1 - HRM - 75sameer_kiniNessuna valutazione finora

- (A Division of Achievers Academy) SUB: - DATE: - 14/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) SUB: - DATE: - 14/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- Prelim TimetableDocumento2 paginePrelim Timetablesameer_kiniNessuna valutazione finora

- P2 - HRM - 75Documento1 paginaP2 - HRM - 75sameer_kiniNessuna valutazione finora

- Bcom - 11032015 - P1 - HRMDocumento2 pagineBcom - 11032015 - P1 - HRMsameer_kiniNessuna valutazione finora

- (A Division of Achievers Academy) Sub: - Ib DATE: - 31/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) Sub: - Ib DATE: - 31/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- Euro Credit V.S Euro BondsDocumento1 paginaEuro Credit V.S Euro Bondssameer_kiniNessuna valutazione finora

- Sybbi Test Series Timetable 2014 - 2015Documento4 pagineSybbi Test Series Timetable 2014 - 2015sameer_kiniNessuna valutazione finora

- Rs 01 - Sapm - Time Value MoneyDocumento1 paginaRs 01 - Sapm - Time Value Moneysameer_kiniNessuna valutazione finora

- (A Division of Achievers Academy) SUB: - DATE: - 30/03/15 Time: - 2 Hrs MARKS: 75Documento1 pagina(A Division of Achievers Academy) SUB: - DATE: - 30/03/15 Time: - 2 Hrs MARKS: 75sameer_kiniNessuna valutazione finora

- Tybcom Test Series Timetable 2014 - 2015Documento4 pagineTybcom Test Series Timetable 2014 - 2015sameer_kiniNessuna valutazione finora

- Tybbi Test Series Timetable 2014Documento9 pagineTybbi Test Series Timetable 2014sameer_kiniNessuna valutazione finora

- SYBBI - Fin. MKT - P1 - 75Documento1 paginaSYBBI - Fin. MKT - P1 - 75sameer_kiniNessuna valutazione finora

- MKT - 75Documento2 pagineMKT - 75sameer_kiniNessuna valutazione finora

- HRM - 75Documento2 pagineHRM - 75sameer_kiniNessuna valutazione finora